Market overview

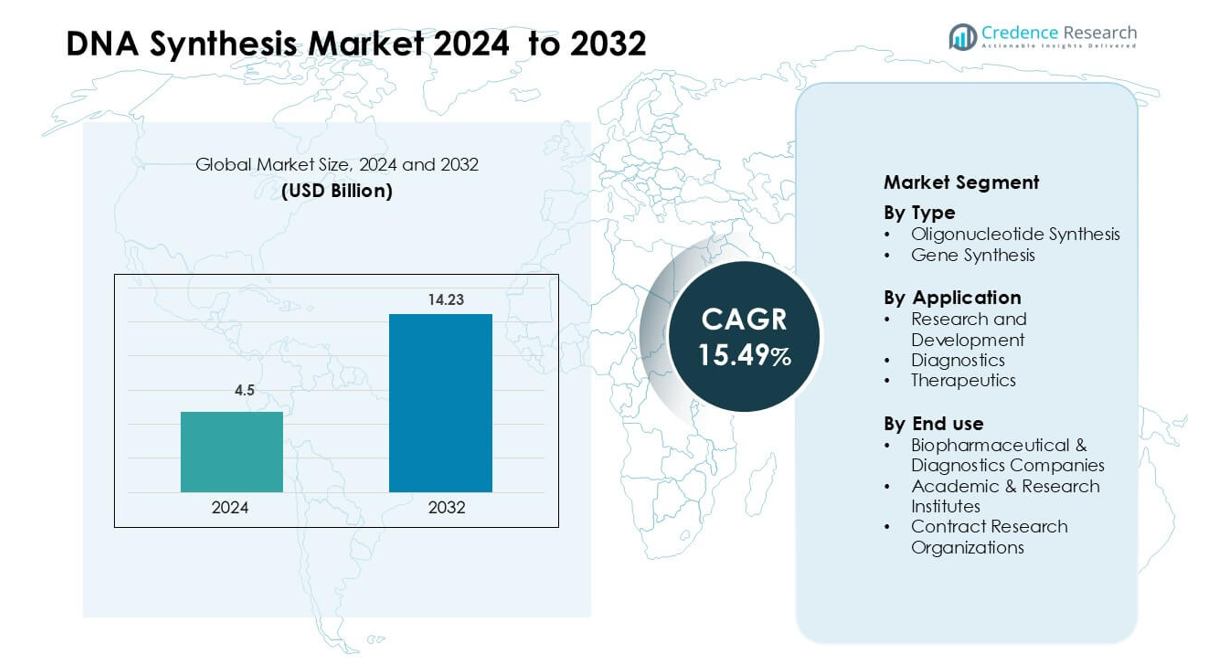

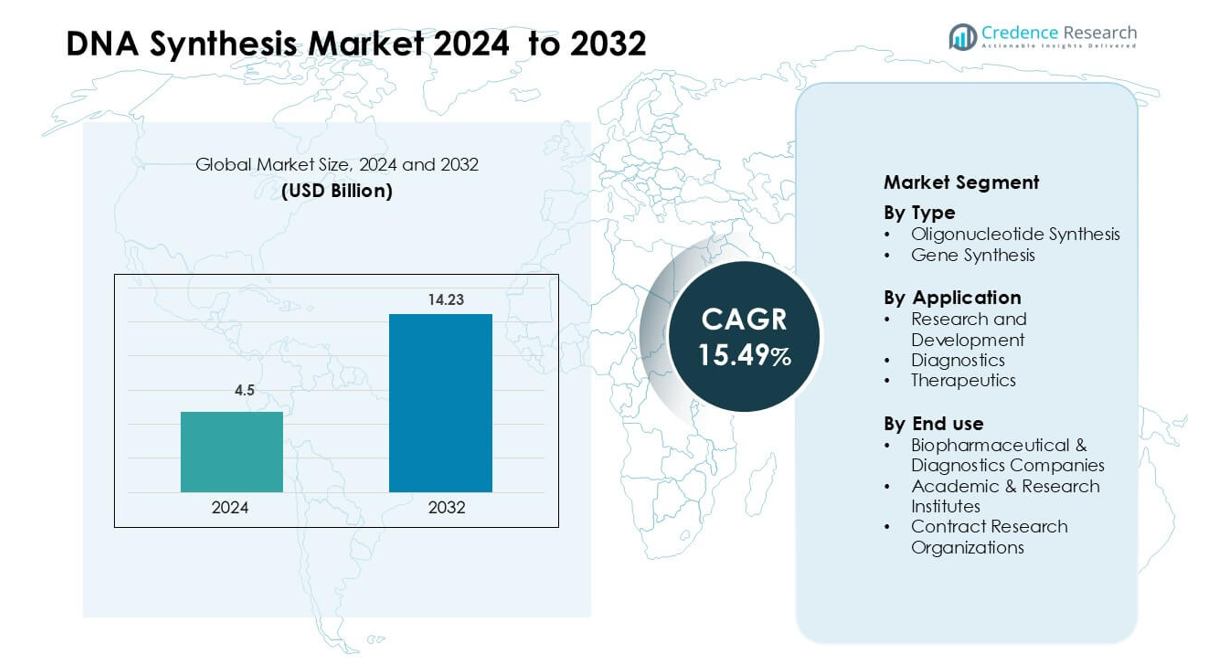

DNA Synthesis Market was valued at USD 4.5 billion in 2024 and is anticipated to reach USD 14.23 billion by 2032, growing at a CAGR of 15.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DNA Synthesis Market Size 2024 |

USD 4.5 billion |

| DNA Synthesis Market, CAGR |

15.49% |

| DNA Synthesis Market Size 2032 |

USD 14.23 billion |

The DNA synthesis market includes strong participants such as GenScript, Eton Bioscience, Quintara Biosciences, Eurofins Scientific, Twist Bioscience, Integrated DNA Technologies, IBA Lifesciences, Thermo Fisher Scientific, BIONEER Corporation, and LGC Biosearch Technologies, each competing through advanced platforms, improved accuracy, and faster turnaround. These companies focus on high-fidelity oligonucleotides, complex gene constructs, and scalable synthesis services that support diagnostics, therapeutics, and synthetic biology programs. They also expand global reach through partnerships with biotech firms and research institutes. North America leads the market with a 38% share, driven by strong R&D funding, genomic initiatives, and early adoption of automated DNA assembly technologies.

Market Insights

- The DNA synthesis market reached USD 4.5 billion in 2024 and is set to grow at a 15.49 % CAGR through 2032, supported by rising demand for high-fidelity oligos, genes, and synthetic constructs across research and clinical use.

- Strong growth stems from higher adoption of synthetic biology, expanded genomic research, and increasing use of DNA-based tools in diagnostics and therapy development, driving steady demand for oligonucleotide synthesis, which holds the largest segment share.

- Key trends include automation, high-throughput assembly, and AI-driven sequence optimization, which improve accuracy and reduce turnaround time while supporting large-scale design programs.

- Competition intensifies as global players invest in quality control, GMP-ready services, and advanced synthesis platforms to meet needs across pharma, biotech, and research institutes, while cost pressure and error limitations remain key restraints.

- North America leads with a 38% share, followed by Europe and Asia-Pacific, while R&D applications dominate due to heavy primer, probe, and gene construct consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Oligonucleotide Synthesis dominates the DNA synthesis market with 39.98% share in 2024. Demand stays strong because oligonucleotides support PCR primers, probes, sequencing, and gene editing workflows. High use in molecular diagnostics and routine research drives repeat orders and volume growth. Gene Synthesis forms the second key segment, serving custom constructs, gene fragments, and gene libraries. This segment benefits from synthetic biology programs, vaccine development, and engineered cell lines. Shorter turnaround times and higher accuracy further support adoption of complex gene constructs.

- For instance, Integrated DNA Technologies (IDT) was founded as a startup by Dr. Joseph A. Walder in 1987. The company experienced rapid growth, and within its first decade, it grew from 10 synthesizing machines to more than 500, shipping an average of 75,000 custom oligonucleotides per day to more than 82,000 customers worldwide.

By Application

Research and Development is the leading segment with 44.96% market share in 2024. This leadership reflects large genomics projects, functional studies, and early drug discovery programs. Laboratories order high volumes of primers, probes, and synthetic constructs for cloning and pathway work. Diagnostics represent a fast growing application as molecular tests and NGS panels expand. Demand rises especially across oncology, infectious disease, and reproductive health testing. Therapeutics use grows with gene and cell therapies, DNA vaccines, and oligonucleotide-based drugs.

- For instance, Twist Bioscience’s silicon‑based DNA synthesis platform is capable of synthesizing 9,600 genes in a single run on one chip, enabling high‑throughput variant library generation for drug discovery.

By End use

Biopharmaceutical and Diagnostics Companies hold the largest share at 42.03% in 2024. These organizations drive demand through extensive therapeutic pipelines, biomarker research, and companion diagnostics. They require scalable, GMP grade synthesis, strong quality systems, and regulatory compliant documentation. Academic and Research Institutes form a substantial customer base for basic and translational research. These institutes support projects in genetics, synthetic biology, and novel therapeutic discovery. Contract Research Organizations grow quickly as sponsors outsource discovery programs, assays, and preclinical studies.

Key Growth Drivers

Growing Adoption of Synthetic Biology Programs

The rapid expansion of synthetic biology programs drives strong demand for DNA synthesis services. Research teams design custom genes, metabolic pathways, and regulatory elements to develop engineered microbes, advanced therapeutics, and bio-based materials. These projects require accurate, scalable, and rapid DNA construction, which boosts orders for oligonucleotides, long DNA fragments, and fully assembled genes. Many companies now integrate automated assembly platforms and high-throughput screening tools, which increases the volume of constructs needed each month. Wider use of CRISPR workflows also supports this growth because gene editing experiments depend on guide RNAs and donor templates produced through DNA synthesis. As global investment in synthetic biology grows, biotechnology companies, academic labs, and start-ups continue to adopt DNA synthesis as a core tool for innovation and product development across healthcare, agriculture, and industrial biotechnology.

- For instance, Synbio Technologies reports having synthesised over 10 billion bases and optimized more than 500 000 codons to support complex synthetic biology workflows.

Expansion of Precision Medicine and Genomic Research

Precision medicine efforts increase DNA synthesis demand as researchers target disease-specific mutations and patient-level biomarkers. Laboratories design custom primers, probes, and gene panels for next-generation sequencing workflows, which require constant replenishment of high-quality oligonucleotides. Pharma companies also use synthetic DNA to validate drug targets, model genetic variations, and study disease pathways. Growth in rare disease research accelerates demand further because personalized therapies often need custom gene constructs and optimized DNA sequences. Many hospitals and diagnostic labs expand genetic testing services, which pushes procurement of synthetic DNA for assay development. As governments fund genomic initiatives and sequencing costs continue to fall, healthcare systems adopt more DNA-based tools, increasing long-term use of DNA synthesis across both research and clinical settings.

- For instance, Integrated DNA Technologies offers synthetic genes from 25 bp to 5 kb delivered with 100% sequence verification and a guaranteed delivery turnaround of 8 business days for up to 500 bp and 12 days for 501‑5000 bps.

Rising Pipeline of Gene and Cell Therapy Candidates

The growing pipeline of gene and cell therapy candidates acts as a major driver of the DNA synthesis market. Developers need synthetic promoters, enhancers, coding sequences, and regulatory elements to construct therapeutic vectors. CAR-T, AAV-based therapies, and in vivo gene editing programs rely heavily on precise DNA synthesis to ensure safety and efficacy. Companies scale manufacturing and preclinical studies, which raises the need for GMP-compliant, error-free sequences. As more therapies enter clinical trials, demand rises for large-scale gene constructs, quality-controlled plasmids, and custom oligonucleotides used in vector engineering and analytical testing. Continued investment in advanced therapies ensures stable and long-term growth for DNA synthesis providers, especially those offering high-fidelity synthesis, rapid turnaround, and regulatory support for clinical-grade DNA.

Key Trend and Opportunity

Increasing Automation and High-Throughput DNA Assembly

Automation shapes the next phase of DNA synthesis by boosting speed, accuracy, and volume. Companies adopt robotic liquid handlers, microfluidic systems, and machine-learning-based error correction tools to assemble complex genes faster. High-throughput platforms now support parallel synthesis of hundreds to thousands of constructs, enabling faster screening for bioengineering, drug discovery, and metabolic pathway optimization. Miniaturized reaction formats also reduce reagent use and lower cost per base. As providers integrate cloud-based design tools and AI-driven sequence optimization, customers gain greater control over construct design and turnaround times. Automation helps scale synthetic biology programs, accelerates R&D cycles, and supports industrial-level DNA manufacturing.

- For instance, Twist Multiplexed Gene Fragments product supports pools of up to 500 base‑pairs in length, with variant pools starting at 1,000 sequences in parallel.

Growth of DNA-Based Vaccines and Immunotherapy

DNA-based vaccines and immunotherapies create strong opportunities for synthesis companies. Researchers require custom antigen sequences, codon-optimized genes, and plasmid backbones for preclinical and clinical studies. mRNA vaccine platforms also use synthetic DNA templates during transcription, which increases upstream demand. Many biotech firms now explore DNA vaccines for infectious diseases, oncology, and emerging pathogens. Regulatory momentum, combined with global investment in rapid-response vaccine platforms, increases orders for high-quality and GMP-ready DNA. This opportunity strengthens as countries invest in biodefense and pandemic preparedness programs, expanding the need for scalable DNA production.

- For instance, VGXI, Inc. has built a facility capable of manufacturing plasmid DNA at concentrations up to 10 mg/mL and supercoiling purity >95 % to support GMP‑grade vaccine production.

Rising Use of DNA Synthesis in Agriculture and Industrial Biotechnology

Agriculture and industrial biotech sectors adopt DNA synthesis for crop engineering, microbial strain enhancement, and metabolic pathway design. Synthetic DNA enables creation of stress-tolerant crops, improved nutrient profiles, and faster-growing plant varieties. Industrial players engineer microbes to produce biofuels, enzymes, bio-plastics, and specialty chemicals, all of which require optimized gene constructs and regulatory sequences. As companies shift from fossil-based to bio-based production, they rely more on synthetic genes and pathway rewiring. The agricultural sector also increases use of gene-editing tools, which boosts the need for primers, guides, and donor templates. These developments expand the application base for DNA synthesis beyond healthcare.

Key Challenge

High Cost of Complex and Large-Scale DNA Constructs

Despite strong demand, high synthesis costs limit adoption of complex and long DNA constructs. Long sequences require multiple assembly steps, error-correction cycles, and validation processes that increase production expenses. Many academic labs and smaller biotech firms struggle to afford large gene constructs or rapid-turnaround synthesis services. Price sensitivity slows uptake of industrial-scale or pathway-level projects where hundreds of sequences are required. Although automation lowers cost over time, the gap between demand and affordability remains a major obstacle. Cost burdens also impact early-stage research teams that rely on grant-based funding, making it difficult to scale experiments that require high-fidelity or customized DNA.

Technical Limitations in Error Rates and Sequence Complexity

DNA synthesis still faces challenges related to sequence accuracy, GC-rich regions, repeats, and secondary structures. Complex sequences often produce higher error rates, requiring additional screening and quality control. These limitations slow project timelines, increase production steps, and restrict the types of genes that can be synthesized at scale. Some therapeutic and industrial applications demand near-perfect accuracy and long, stable constructs, which current synthesis chemistry cannot always deliver. Providers work to reduce error frequency and expand sequence compatibility, but technical constraints continue to affect turnaround time and cost. These challenges reduce efficiency for researchers engineering new biological pathways or therapeutic constructs.

Regional Analysis

North America

North America leads the DNA synthesis market with an estimated 38% share, driven by strong investment in genomics, synthetic biology, and gene therapy programs. The region benefits from advanced research infrastructure, large pharmaceutical pipelines, and early adoption of automated DNA assembly systems. U.S. laboratories and biotech firms generate high demand for oligonucleotides, gene fragments, and clinical-grade constructs used in diagnostics and therapeutic development. Expanding precision medicine initiatives, growing sequencing output, and rising venture capital funding further strengthen regional growth. Canada supports additional demand through government-funded genomics projects and expanding academic research networks.

Europe

Europe holds about 27% market share, supported by active genomic research programs, strong regulatory frameworks, and advanced biotechnology clusters. Countries such as Germany, the U.K., and France drive regional demand with well-established pharmaceutical industries and growing investments in synthetic biology. Research centers use DNA synthesis for molecular diagnostics, vaccine development, and engineered cell lines. EU programs focused on bioeconomy expansion and precision medicine further increase adoption. The region also benefits from academic-industry partnerships that accelerate gene-editing research, metabolic engineering, and high-throughput DNA assembly.

Asia-Pacific

Asia-Pacific captures nearly 24% market share, fueled by rapid growth in genomics, diagnostics, and biopharma manufacturing. China, Japan, South Korea, India, and Singapore expand DNA synthesis use across drug discovery, gene-editing research, and clinical testing laboratories. Government-led genome projects, expanding sequencing capacity, and rising investment in synthetic biology accelerate demand. Several regional companies invest in automation and high-throughput synthesis technologies, driving competitive pricing and faster turnaround. APAC’s growing biotechnology workforce and expanding CRO sector make the region a strong hub for outsourced DNA synthesis services.

Latin America

Latin America holds around 6% market share, driven by rising adoption of molecular diagnostics, infectious disease testing, and academic genomic research. Brazil, Mexico, and Argentina lead regional activity with growing investments in biotechnology infrastructure and research institutes. Expanding public health programs increase demand for synthetic primers and probes used in PCR and sequencing workflows. Partnerships with international suppliers support access to high-quality DNA constructs. Although investment levels remain lower than major markets, demand grows steadily as clinical testing expands and universities adopt more synthetic biology tools.

Middle East & Africa

The Middle East & Africa region accounts for nearly 5% market share, supported by expanding healthcare modernization and growing interest in genomic medicine. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption, focusing on precision diagnostics, infectious disease research, and academic genomics programs. Infrastructure development in clinical laboratories raises demand for basic oligonucleotides and sequencing-related constructs. Regional initiatives promoting biotechnology education and innovation also support gradual market expansion. Growth remains moderate due to limited manufacturing capabilities, but rising investment in healthcare research strengthens long-term potential.

Market Segmentations:

By Type

- Oligonucleotide Synthesis

- Gene Synthesis

By Application

- Research and Development

- Diagnostics

- Therapeutics

By End use

- Biopharmaceutical & Diagnostics Companies

- Academic & Research Institutes

- Contract Research Organizations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the DNA synthesis market features a mix of global biotechnology firms, specialized synthesis providers, and high-throughput technology innovators that focus on precision, scale, and turnaround speed. Companies compete by offering advanced oligonucleotide synthesis, large gene constructs, and GMP-grade materials that support diagnostics, therapeutics, and synthetic biology research. Many providers invest in automation, microfluidics, and enzyme-based synthesis platforms to improve accuracy and reduce cycle times. Partnerships with pharmaceutical companies, academic institutes, and contract research organizations strengthen service portfolios and expand geographic reach. Firms also enhance online ordering systems, sequence optimization tools, and custom design platforms to improve user experience. Growing demand for long DNA fragments, high-fidelity constructs, and error-corrected sequences drives continuous product upgrades. Competitors aim to differentiate through quality control strength, scalability, and regulatory compliance to support rising applications in gene therapy, vaccine development, and advanced genomic research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GenScript

- Eton Bioscience, Inc.

- Quintara Biosciences

- Eurofins Scientific

- Twist Bioscience

- Integrated DNA Technologies, Inc.

- IBA Lifesciences GmbH

- Thermo Fisher Scientific, Inc.

- BIONEER CORPORATION

- LGC Biosearch Technologies

Recent Developments

- In January 2025, Eton Bioscience expanded its sequencing portfolio with whole-plasmid nanopore sequencing. The service uses Oxford Nanopore MinION and EPI2ME workflows to deliver Q30+ assemblies for synthetic biology and DNA-writing projects.

- In June 2024, GenScript Biotech Corporation launched its FLASH Gene gene-synthesis service with flat-rate pricing. The service delivers sequence-verified plasmid constructs in four business days for advanced biologics R&D

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as synthetic biology research grows across healthcare and industrial biotech.

- Demand will rise for long, complex, and error-corrected DNA constructs that support advanced engineering.

- Automation will scale high-throughput synthesis and lower turnaround times for custom sequences.

- Enzyme-based DNA synthesis methods will gain wider adoption due to higher accuracy and fewer chemical steps.

- Clinical-grade DNA will see strong uptake as more gene and cell therapy programs enter trials.

- AI-driven design tools will improve sequence optimization and reduce failure rates in complex genes.

- DNA-based vaccines and immunotherapies will boost orders for codon-optimized constructs and plasmid templates.

- CROs will increase their share by supporting outsourced discovery and preclinical projects.

- Regional manufacturing hubs will expand to shorten supply chains and improve delivery speed.

- Cost reduction efforts will improve access for academic labs and early-stage biotech companies.