Market Overview

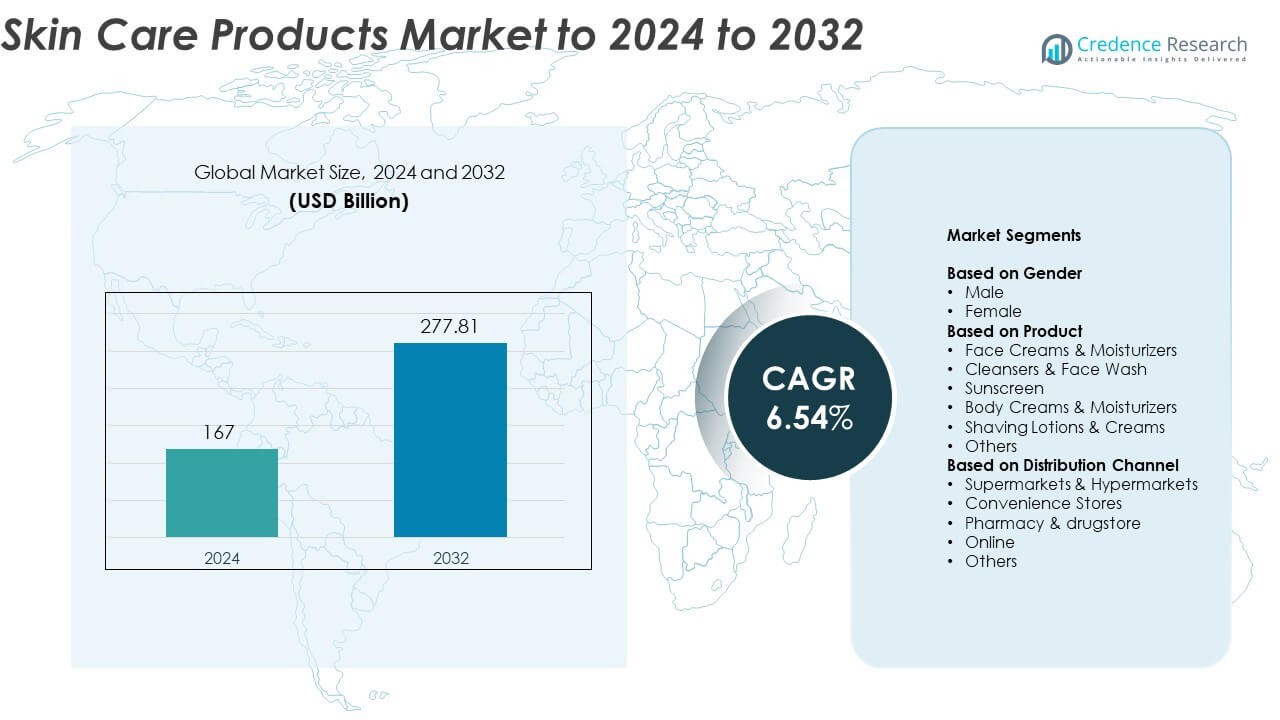

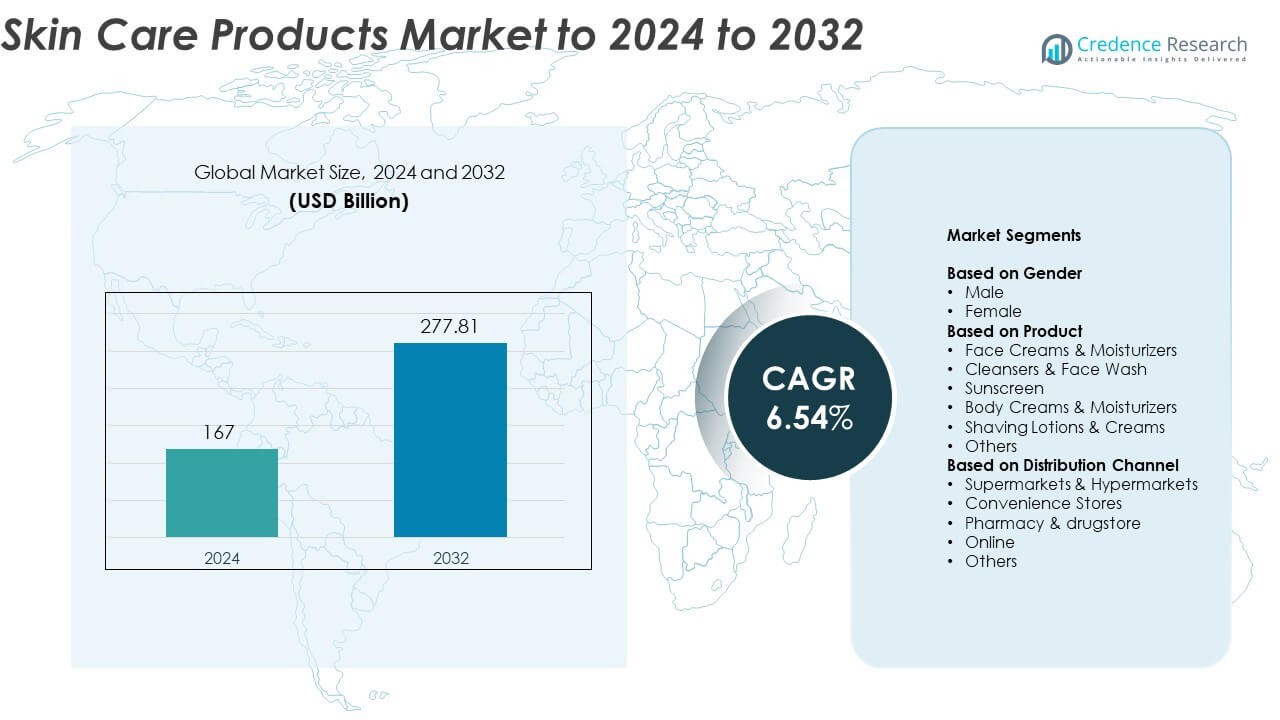

The Skin Care Products Market size was valued at USD 167 billion in 2024 and is anticipated to reach USD 277.81 billion by 2032, at a CAGR of 6.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skin Care Products Market Size 2024 |

USD 167 Billion |

| Skin Care Products Market, CAGR |

6.54% |

| Skin Care Products Market Size 2032 |

USD 277.81 Billion |

The skin care products market is led by major players such as Unilever, L’Oréal S.A., Procter & Gamble (P&G), Johnson & Johnson, Shiseido Co., Ltd., Beiersdorf AG, Coty Inc., Colgate-Palmolive Company, Revlon, and Avon Products, Inc. These companies dominate through extensive product portfolios, strong R&D capabilities, and robust global distribution networks. Asia Pacific leads the market with a 33.4% share in 2024, driven by high consumer spending and innovation-led beauty trends. North America follows with 28.6% share, supported by premium product demand, while Europe holds 25.8% share, reflecting its strong heritage in skincare innovation and sustainable beauty.

Market Insights

Market Insights

- The skin care products market was valued at USD 167 billion in 2024 and is projected to reach USD 277.81 billion by 2032, growing at a CAGR of 6.54%.

- Rising awareness of personal grooming, increased use of natural ingredients, and higher spending on premium beauty products are driving market expansion.

- Trends such as clean beauty, sustainable packaging, and AI-based product personalization are reshaping consumer preferences globally.

- The market is competitive, with leading companies focusing on innovation, digital marketing, and strategic acquisitions to strengthen their global presence.

- Asia Pacific leads with a 33.4% share, followed by North America at 28.6% and Europe at 25.8%, while the female segment dominates with a 64.7% share due to higher adoption of daily skincare routines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Gender

The female segment dominates the skin care products market, accounting for nearly 64.7% share in 2024. The strong preference for anti-aging, brightening, and hydration-based products drives this dominance. Increasing awareness of self-care, social media influence, and brand-led innovation in premium formulations further fuel demand. Meanwhile, the male segment is growing steadily with rising adoption of grooming essentials such as moisturizers, cleansers, and shaving creams. Expanding product lines targeting men’s skin concerns, including pollution and acne, are expected to accelerate this segment’s growth during the forecast period.

- For instance, Unilever’s Dove Self-Esteem Project has educated over 100 millionyoung people since 2004, with the goal of building body confidence and self-esteem through academically validated resources

By Product

Face creams and moisturizers lead the market, holding about 36.5% share in 2024. Their popularity stems from consistent use in daily skincare routines and the availability of specialized formulations for hydration, anti-aging, and protection. The segment benefits from growing consumer preference for multifunctional creams enriched with natural ingredients and SPF protection. Cleansers and face wash follow, driven by urban pollution and increased skin sensitivity. The introduction of dermatologist-tested and eco-friendly products continues to attract younger demographics and health-conscious consumers globally.

- For instance, La Roche-Posay is now recommended by over 100,000 dermatologists worldwide and is present in over 60 countries.

By Distribution Channel

Supermarkets and hypermarkets dominate the distribution channel segment, capturing around 41.3% share in 2024. Their leadership is driven by wide product availability, attractive discounts, and in-store brand promotions. Consumers prefer these outlets for product authenticity and the ability to compare multiple brands at once. Online sales are rapidly expanding due to e-commerce growth, digital campaigns, and influencer marketing. Subscription-based models and virtual consultations further enhance accessibility, particularly among millennials and Gen Z consumers seeking personalized skincare solutions with doorstep delivery convenience.

Key Growth Drivers

Rising Awareness of Personal Grooming and Skin Health

Increasing consumer awareness about personal grooming and skin health is a primary growth driver. The expanding influence of social media, celebrity endorsements, and dermatological education has boosted demand for high-quality skincare solutions. Consumers are more informed about ingredients and formulations, encouraging adoption of products with proven efficacy and safety. This trend spans all age groups, with younger demographics showing strong interest in preventive skincare routines and natural products.

- For instance, Beiersdorf’s NIVEA brand (including Labello) grew organically by 9.0% globally in 2024, contributing significantly to the overall Consumer Business Segment’s organic sales growth of 7.5%, while the entire Beiersdorf Group achieved an organic sales growth of 6.5%

Innovation in Formulations and Product Customization

Manufacturers are focusing on innovation through advanced formulations and personalization. The integration of biotechnology, peptides, and plant-based actives enhances product effectiveness while addressing specific skin concerns such as acne, pigmentation, and aging. Customization through digital skin analysis tools and AI-based product recommendations is gaining traction. This approach enhances consumer satisfaction and brand loyalty, allowing companies to create tailored solutions for diverse skin types and regional preferences.

- For instance, Procter & Gamble secured US patent 11, (No. 12144882) on 19 Nov 2024 for a low-pH skin care composition combining hydroxycinnamic acid with a vitamin B3 compound.

Expansion of E-commerce and Direct-to-Consumer Models

The rapid growth of e-commerce platforms has transformed the skincare industry landscape. Direct-to-consumer brands leverage online channels for wider reach, data-driven marketing, and personalized engagement. Digital sales benefit from influencer partnerships, product tutorials, and subscription models offering convenience and consistency. Additionally, global consumers are increasingly trusting online purchases due to improved return policies, transparent reviews, and quick delivery, making e-commerce a crucial driver of sustained market expansion.

Key Trends & Opportunities

Shift Toward Clean and Sustainable Beauty

The global shift toward clean beauty presents a major opportunity for brands emphasizing sustainability. Consumers now favor eco-friendly packaging, cruelty-free testing, and vegan formulations. Companies adopting transparent ingredient sourcing and biodegradable packaging are witnessing higher brand loyalty. Regulatory support and the rise of ethical consumption further push brands to innovate with green chemistry, ensuring long-term relevance in an environmentally conscious market.

- For instance, The Body Shop had created 718 refill stations in 40 countries by December 2022 and aimed to have 850 stations open across the world by the end of 2023.

Technological Integration in Product Development

Advanced technologies such as AI, AR, and skin diagnostic tools are reshaping consumer interaction with skincare. Virtual consultations, digital shade-matching, and ingredient analysis enhance the shopping experience. Brands use machine learning to develop data-backed formulations, improving precision and performance. This tech-driven personalization enables businesses to connect directly with customers, enhance product efficacy, and reduce development time, offering significant opportunities for innovation and differentiation.

- For instance, L’Oréal filed 694 patents in 2024 and logged 110 million+ uses of its Beauty Tech services

Key Challenges

Rising Competition and Market Saturation

The skincare products market faces intense competition due to numerous brands offering similar formulations. Established players and emerging startups are competing for market share, leading to pricing pressures. Product duplication and low entry barriers make differentiation difficult, especially in the mass-market category. Companies are focusing on unique brand identities, clinical validation, and niche product positioning to sustain growth in this saturated landscape.

Regulatory Complexity and Ingredient Compliance

Strict regulations governing cosmetic formulations pose a major challenge for manufacturers. Differences in ingredient restrictions, labeling norms, and testing standards across countries complicate product launches. Non-compliance can result in recalls or delays, affecting brand reputation. Continuous updates in clean beauty and safety standards further increase compliance costs. To overcome these barriers, companies are investing in regulatory expertise and transparent supply chain management.

Regional Analysis

North America

North America held around 28.6% share of the skin care products market in 2024. The region’s growth is driven by strong consumer demand for anti-aging, organic, and dermatologist-tested formulations. High disposable income and brand awareness support premium product adoption. The U.S. leads with a robust presence of established brands and rising male grooming trends. Clean beauty and sustainable packaging are key focuses, while advanced digital marketing continues to enhance consumer engagement and online sales across major retailers and direct-to-consumer channels.

Europe

Europe accounted for nearly 25.8% share of the market in 2024, supported by strong skincare traditions and premium brand heritage. Demand is driven by consumers’ focus on natural, vegan, and eco-certified formulations. France, Germany, and the U.K. lead in both production and consumption, with an emphasis on dermatological safety and innovation. Regulatory standards promoting product transparency strengthen consumer trust. The rise of multifunctional and anti-pollution creams further fuels market growth across key European markets.

Asia Pacific

Asia Pacific dominated the global skin care products market with approximately 33.4% share in 2024. The region’s leadership stems from high consumer spending in countries such as China, Japan, South Korea, and India. Rapid urbanization, beauty consciousness, and the popularity of K-beauty and J-beauty trends boost demand. Growing middle-class income levels and product diversification in both mass and premium segments drive regional expansion. Innovation in lightweight formulations and digital retail strategies continue to reshape market dynamics.

Latin America

Latin America captured around 7.1% share of the global market in 2024, supported by increasing awareness of skincare routines among younger consumers. Brazil and Mexico lead regional growth with rising interest in sun protection, hydration, and anti-aging products. Local and international brands are investing in affordable yet high-quality formulations to attract middle-income groups. The expansion of online beauty platforms and influencer marketing is further enhancing accessibility, promoting market development across urban centers.

Middle East and Africa

The Middle East and Africa region held about 5.1% share of the global market in 2024. Growth is driven by rising disposable incomes, expanding retail infrastructure, and increasing adoption of premium skincare products. Consumers are increasingly drawn to products that address climate-specific concerns such as dryness and sun exposure. The UAE and Saudi Arabia lead regional sales with strong demand for luxury and halal-certified products. Global brands are expanding distribution networks and localized offerings to capture emerging market opportunities.

Market Segmentations:

By Gender

By Product

- Face Creams & Moisturizers

- Cleansers & Face Wash

- Sunscreen

- Body Creams & Moisturizers

- Shaving Lotions & Creams

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacy & drugstore

- Online

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The skin care products market is highly competitive, with leading companies such as Unilever, Shiseido Co., Ltd., Revlon, Coty Inc., Johnson & Johnson, Inc., L’Oréal S.A., Colgate-Palmolive Company, Beiersdorf AG, Avon Products, Inc., and Procter & Gamble (P&G) dominating the landscape. The competition is driven by continuous innovation, product diversification, and expansion into emerging markets. Major players focus on research and development to introduce advanced formulations that cater to specific skin concerns, including aging, pigmentation, and hydration. Sustainability and clean beauty remain central strategies as consumers increasingly prefer eco-friendly and transparent brands. Digital marketing and influencer collaborations enhance brand visibility and consumer engagement, particularly among younger demographics. Companies are also strengthening their presence through mergers, acquisitions, and partnerships to expand regional reach and enhance distribution networks. Overall, the competitive environment is characterized by technological integration, premiumization trends, and rising investments in personalization and sustainability-focused product portfolios.

Key Player Analysis

- Unilever

- Shiseido Co., Ltd.

- Revlon

- Coty Inc.

- Johnson & Johnson, Inc.

- L’Oréal S.A.

- Colgate-Palmolive Company

- Beiersdorf AG

- Avon Products, Inc.

- Procter & Gamble (P&G)

Recent Developments

- In 2025, L’Oréal launched Cell BioPrint at CES, a device that provides detailed skin quality analysis in five minutes by measuring skin biomarkers, helping people better understand their skin longevity and aging.

- In 2025, Shiseido launched “Sengan Serum,” a washable beauty serum delivering hydration by merging with water, developed under its open innovation program fibona Lab.

- In 2025, Olay Body introduced the limited-edition Power Edit collection with Wantable, combining skincare and personalized styling to enhance confidence with products like the Olay Super Serum Body Wash, which offers hydration, firming, smoothing, and brightening benefits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Gender, Product, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean, vegan, and cruelty-free skincare will continue to accelerate globally.

- AI-driven skin diagnostics and personalized product recommendations will gain wider adoption.

- Male grooming and skincare will emerge as one of the fastest-growing consumer segments.

- Brands will increasingly focus on sustainable packaging and eco-friendly ingredient sourcing.

- Online and direct-to-consumer channels will drive a significant share of future sales.

- Hybrid multifunctional products combining skincare and makeup benefits will rise in popularity.

- Growth in anti-aging and sun protection categories will remain steady across demographics.

- Emerging markets in Asia and Latin America will offer strong expansion opportunities.

- Collaborations with dermatologists and clinical validation will strengthen consumer trust.

- Investments in biotechnology and natural actives will shape next-generation skincare innovations.

Market Insights

Market Insights