Market Overview:

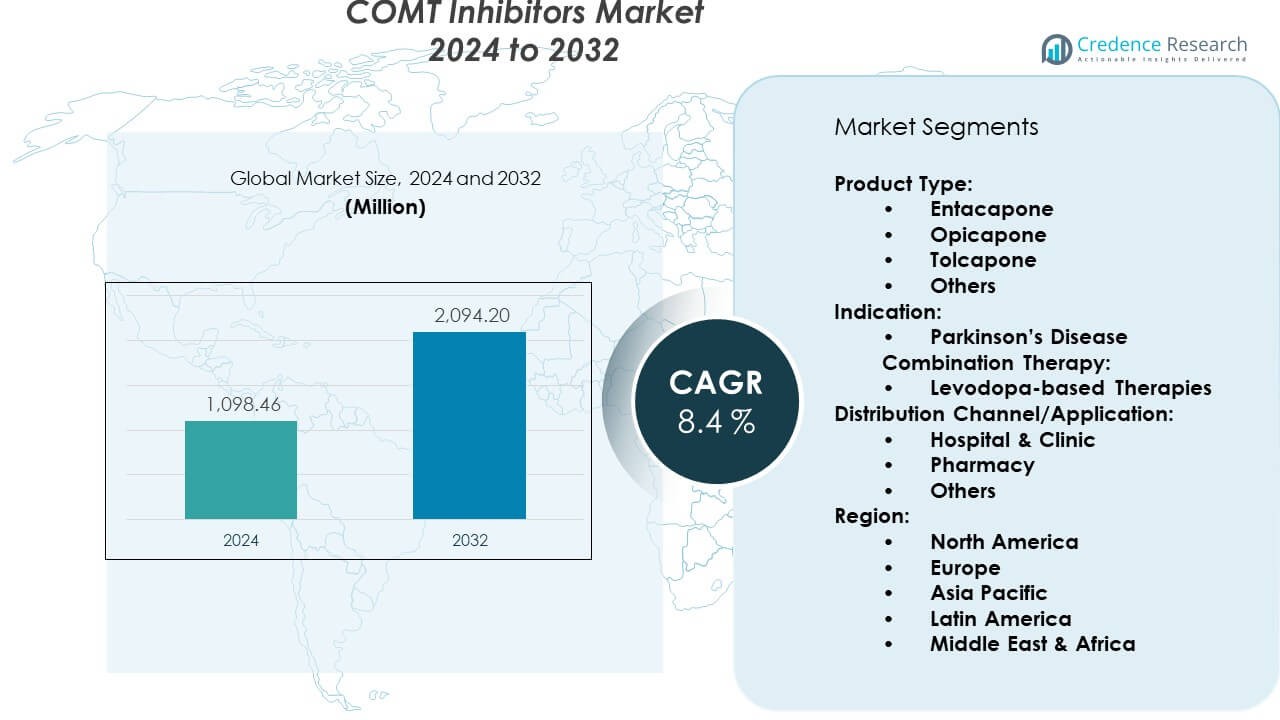

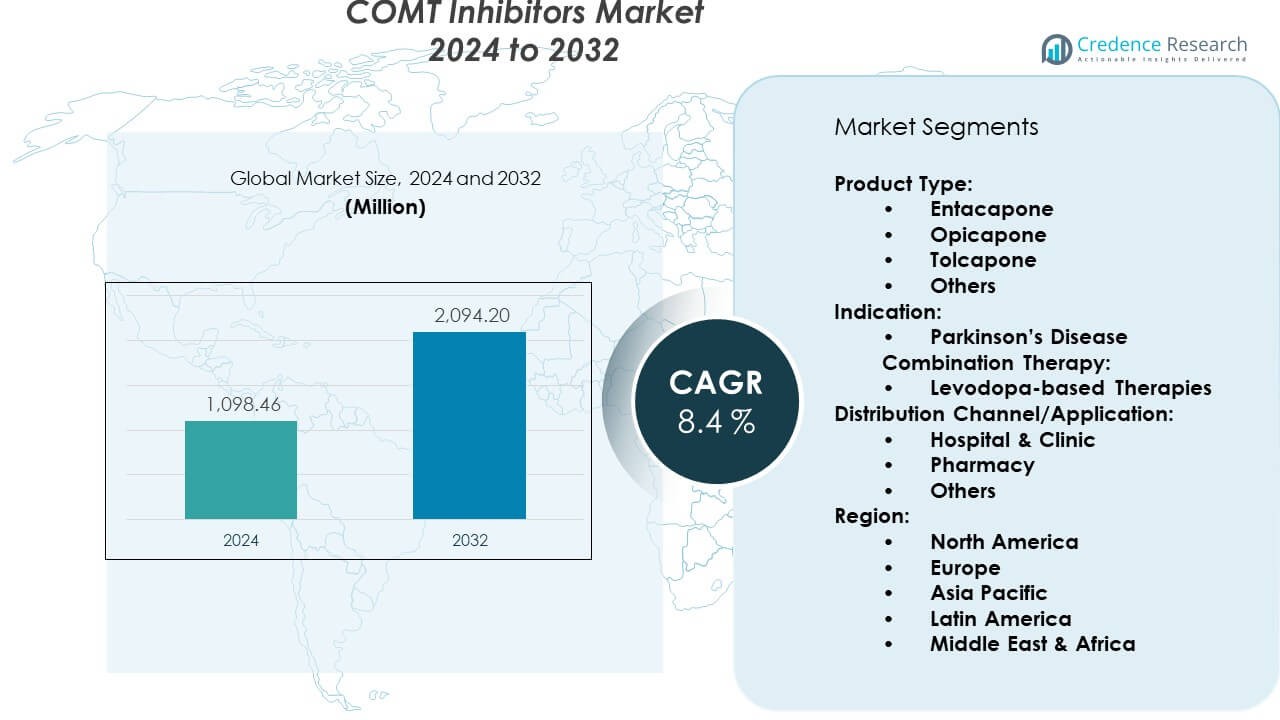

The COMT Inhibitors Market reached USD 1,098.46 million in 2024 and is expected to rise to USD 2,094.20 million by 2032, supported by a CAGR of 8.4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| COMT Inhibitors Market Size 2024 |

USD 1,098.46 Million |

| COMT Inhibitors Market, CAGR |

8.4% |

| COMT Inhibitors Market Size 2032 |

USD 2,094.20 Million |

Growing use of adjunct therapies drives strong demand for COMT inhibitors. Clinicians prioritize drugs that improve levodopa response and stabilize motor control. Patients seek treatment plans that lower “off-time” and support daily functioning. Research teams now develop options with fewer side effects to lift therapy adherence. Hospitals expand neurology units and integrate updated protocols for Parkinson’s care. Wider diagnostic access enables early treatment decisions, which supports market growth throughout many care settings.

North America leads due to strong neurological care networks and higher diagnosis rates. Europe follows with broad access to advanced Parkinson’s therapies and strong reimbursement support. Asia Pacific emerges as a fast-growing region as awareness programs expand and treatment capacity improves. Countries across Latin America and the Middle East show rising interest due to growing elderly populations and better specialty-care coverage. Global adoption strengthens as more nations invest in chronic disease management and long-term neurological treatment pathways.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The COMT Inhibitors Market reached USD 1,098.46 million in 2024 and is projected to hit USD 2,094.20 million by 2032, supported by a CAGR of 8.4% during the forecast period.

- North America (42%), Europe (31%), and Asia Pacific (18%) hold the highest regional shares due to strong neurology infrastructure, higher diagnosis rates, and established treatment pathways.

- Asia Pacific, holding 18%, remains the fastest-growing region, driven by rising Parkinson’s awareness, expanding hospital capacity, and broader access to combination therapies.

- Product Type share is led by Entacapone at 48%, followed by Opicapone at 32%, due to strong clinical use and favorable dosing profiles.

- Distribution Channel share is dominated by Hospitals & Clinics at 57%, with Pharmacies at 34%, supported by high patient flow and consistent prescription volume.

Market Drivers:

Growing Need For Advanced Adjunct Therapies In Parkinson’s Treatment

Demand rises due to wider adoption of combined treatment plans for motor-symptom control. Clinicians prescribe COMT inhibitors to stabilize levodopa response during long-term care. Patients look for therapies that reduce “off-time” and improve daily movement. Hospitals expand neurology units to support integrated care pathways. Drug makers refine formulations to limit side effects and lift patient adherence rates. Research supports stronger focus on multi-mechanism therapy plans. It strengthens clinical confidence through predictable outcomes. The COMT Inhibitors Market grows through consistent demand for adjunct support.

- For instance, Novartis’ Comtan (entacapone) demonstrated an average 2-hourreduction in daily “off-time” in controlled trials (ranging from approximately 1.0 to 1.5 hours across studies), supporting long-term levodopa response. Clinicians prescribe COMT inhibitors to stabilize levodopa response during extended care.

Rising Diagnosis Rates And Early Treatment Initiation Across Neurological Centers

Early detection helps more patients start structured therapy before severe symptom progression. Screening programs across hospitals improve the accuracy of Parkinson’s identification. Patients receive timely prescriptions that rely on COMT inhibitors to support long-term function. Neurology teams adopt updated protocols that emphasize continuous motor stability. Rapid testing tools make diagnosis easier in primary care environments. Drug makers support awareness programs that highlight early consultation benefits. Treatment adoption grows where clinical pathways remain well organized. It ensures higher therapy continuity across diverse patient groups.

- For instance, Orion Pharma’s Ongentys (opicapone) showed a placebo-adjusted 8-minutereduction in off-time in the Phase III BIPARK-I study. The implementation of standardized diagnostic criteria, such as those from the International Parkinson and Movement Disorder Society, within clinical practice helps to improve the accuracy of Parkinson’s identification by specialists.

High Demand For Therapies With Better Motor Stability And Lower Fluctuation Burden

Patients seek treatments that prevent irregular motor function during daily tasks. COMT inhibitors help reduce levodopa breakdown and lift movement consistency. Clinicians value predictable results that support long-term therapy comfort. Hospitals rely on structured regimens to lower patient distress. Drug developers invest in options with enhanced safety profiles. Strong clinical data supports wider acceptance among specialists. It encourages hospitals to maintain comprehensive neurological treatment stacks. The demand trend supports broader use throughout chronic care systems.

Expansion Of Generic Drug Availability And Wider Affordability Across Regions

Generic formulations widen access across cost-sensitive regions with rising patient loads. Hospitals procure generics to maintain consistent supply for long-term prescriptions. Patients gain reliable treatment options without heavy financial strain. Clinicians support generic use where therapeutic performance stays stable. Drug makers enhance production lines to meet global demand. Distribution networks expand to underserved markets. It supports treatment continuation even in remote centers. The presence of generics strengthens market participation across broader zones.

Market Trends:

Shift Toward Next-Generation COMT Inhibitors With Improved Safety And Tolerability

Drug developers introduce new molecules that target stronger safety and reduced adverse effects. Clinicians evaluate updated profiles that support better long-term outcomes. Patients respond positively to formulations that limit treatment discomfort. Hospitals integrate these options into chronic management programs. Research groups work on refining metabolic pathways for higher precision. It boosts confidence in extended therapy use. Regulatory agencies accelerate reviews where strong clinical evidence appears. The COMT Inhibitors Market observes steady traction for next-generation options.

- For instance, Ongentys (opicapone) achieved regulatory approval due to once-daily dosing with a favorable hepatic safety profile, improving tolerability over older molecules. Clinicians evaluate updated profiles that support better long-term outcomes.

Integration Of COMT Inhibitors Into Multimodal Neurological Care Pathways

Multimodal care gains attention across neurology units seeking stable outcomes. Treatment teams combine COMT inhibitors with behavioral and physical therapy plans. Hospitals introduce coordinated models that reduce patient complexity. Technology tools support monitoring of movement challenges. Patients value structured guidance during symptom variation phases. It enhances overall satisfaction with long-term therapy. Drug makers position their products as essential components in combined care. The trend strengthens clinical adoption across advanced centers.

- For instance, AbbVie markets advanced Parkinson’s therapies, such as the newly approved Vyalev/Produodopa, which has been initiated in over 4,200 patients worldwide. These treatments often incorporate COMT inhibitors as an adjunct to levodopa within a multimodal treatment plan. Treatment teams combine these pharmaceutical interventions with non-pharmacological methods like behavioral and physical therapy plans to manage symptoms effectively.

Growing Focus On Personalized Dosing Strategies And Long-Term Therapy Optimization

Clinicians refine dosing patterns to match individual symptom behavior. Patients benefit from tailored plans that reflect lifestyle and progression needs. Hospitals deploy digital tools to track fluctuations. Data insights guide more precise adjustments. Drug makers explore adaptive therapy models that improve adherence. It improves treatment continuity across diverse groups. Personalized methods gain support among neurologists seeking stable outcomes. The COMT Inhibitors Market aligns with broader healthcare moves toward precision care.

Expansion Of Clinical Research Toward Early-Stage And Non-Motor Symptom Management

Research teams explore the role of COMT inhibitors in earlier disease phases. Clinical trials study effects on broader neurological functions. Hospitals partner with research institutes to test new endpoints. Patients gain access to therapy insights beyond basic motor control. The focus includes mood, cognitive strain, and fatigue control. It creates new pathways for expanded treatment relevance. Regulators track trial results to support future approvals. The trend builds stronger interest in diversified clinical use.

Market Challenges Analysis:

Safety Concerns, Adverse Events, And Variability In Patient Response

Clinicians monitor side effects closely due to varied patient tolerance. Some patients experience gastrointestinal discomfort, which limits therapy continuation. Hospitals track cases of liver-related complications linked to certain formulations. Drug makers face scrutiny to maintain strict safety compliance. Regulatory agencies demand strong evidence for labeling improvements. It challenges broader acceptance across conservative clinical environments. Patients often shift treatment plans when variability becomes difficult to manage. The COMT Inhibitors Market must address safety gaps through better data and formulation innovation.

High Treatment Complexity, Access Barriers, And Limited Specialist Availability

Many regions lack enough neurologists to manage long-term therapy guidance. Patients in remote areas face difficulty receiving stable prescriptions. Hospitals in emerging regions struggle with limited diagnostic infrastructure. Drug makers face logistical challenges when supplying low-volume rural markets. Treatment plans require close dose monitoring, which increases workload. Technology gaps hinder remote follow-ups. It reduces long-term adherence among vulnerable patient groups. Better training and stronger care networks remain essential for improvement.

Market Opportunities:

Expansion Of Tele-Neurology Platforms And Remote Treatment Optimization Models

Tele-neurology improves access for patients who lack nearby specialists. Hospitals use remote platforms to monitor treatment response. Clinicians adjust doses based on real-time symptom feedback. Drug makers support digital tools that guide long-term therapy. Patients gain reliable support without frequent travel. It helps the COMT Inhibitors Market reach wider geographic regions. Remote networks create strong adoption in underserved zones. The opportunity strengthens overall therapy continuity.

Growth Of Research Programs Exploring Wider Therapeutic Roles And New Patient Groups

Research teams expand investigations into early-stage and advanced disease use. Hospitals test COMT inhibitors in combination with emerging neuro-therapeutics. Patients benefit from improved symptom-control potential. Drug developers invest in next-phase trials to widen indications. Regulatory agencies support studies backed by strong clinical results. It opens pathways for new commercial segments. Broader clinical relevance drives strategic investment. The opportunity ensures long-term growth momentum across global markets.

Market Segmentation Analysis:

Product Type

Entacapone leads due to widespread clinical acceptance and strong use in daily Parkinson’s management. Opicapone gains traction through once-daily dosing and better convenience. Tolcapone holds a limited share because of safety concerns that restrict broad adoption. Other options remain under evaluation across research centers that test new molecular profiles. Demand across these groups influences treatment strategies in the COMT Inhibitors Market and shapes long-term product positioning. It supports higher interest in next-generation formulations that reduce burden and improve adherence.

- For instance, Comtan (entacapone) is approved in over 40 countries, reinforcing its clinical reach. Opicapone gains traction through once-daily dosing and better convenience. Tolcapone holds a limited share because of safety concerns that restrict broad adoption.

Indication

Parkinson’s Disease remains the dominant indication due to strong reliance on COMT inhibitors for motor-symptom control. Clinicians prescribe these therapies to stabilize levodopa response and reduce “off-time.” Patients depend on consistent support that enhances movement and daily performance. Hospitals maintain structured neurological pathways that integrate these drugs. It strengthens therapy continuity across chronic care environments. Growing diagnosis rates across various regions increase treatment volume during early and advanced stages.

- For instance, UCB’s entire portfolio of medicines for severe immune system and central nervous system diseases touched the lives of over 3.2 million patients around the worldin 2023, reflecting a strong global reach across various therapeutic areas.

Combination Therapy

Levodopa-based therapies remain the central combination method in clinical practice. COMT inhibitors extend levodopa activity and support more stable motor function. Specialists rely on this method to reduce fluctuation cycles. Hospitals follow treatment protocols that prioritize combination plans for long-term care. It ensures predictable outcomes for patients managing progressive symptoms. Combination therapy continues to drive consistent market adoption.

Distribution Channel/Application

Hospitals and clinics lead due to high patient flow and specialist access. Pharmacies maintain strong dispensation levels through branded and generic products. Other channels expand reach into remote areas where neurological care remains limited. It supports broader access for long-term treatment needs across diverse regions.

Segmentation:

Product Type:

- Entacapone

- Opicapone

- Tolcapone

- Others

Indication:

Combination Therapy:

Distribution Channel/Application:

- Hospital & Clinic

- Pharmacy

- Others

Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the COMT Inhibitors Market due to strong diagnostic capacity and advanced neurology care. Hospitals maintain structured treatment pathways that support stable therapy adoption. Patients gain early access to updated drugs through robust approval systems. Clinical specialists manage high treatment volumes supported by strong reimbursement models. Drug makers focus on the region to strengthen new product introduction. It benefits from strong awareness programs that improve early-stage consultation. The region retains a leading position through continuous investment in chronic disease management.

Europe

Europe secures the second-largest market share supported by wide clinical adoption and consistent regulatory alignment. Hospitals integrate COMT inhibitors into well-developed neurological care networks. Patients gain steady access to branded and generic options across many countries. Research centers across Germany, France, and the UK investigate long-term therapy outcomes. Treatment teams follow standardized guidelines that improve dosing continuity. It maintains strong demand due to a large elderly population facing movement-related disorders. The region strengthens its share through structured national Parkinson’s programs.

Asia Pacific

Asia Pacific holds a rising market share driven by expanding neurology units and growing diagnosis rates. Countries increase investment in hospital infrastructure to support Parkinson’s treatment capacity. Patients adopt COMT inhibitors as awareness spreads across urban centers. Clinicians emphasize combination therapy to manage higher patient loads. Drug makers target the region to widen access for new and generic formulations. It benefits from a large population transitioning toward specialized care. The region continues to emerge as a high-growth zone supported by improved healthcare access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Roche (F. Hoffmann-La Roche Ltd.)

- AbbVie Inc.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Lundbeck A/S

- Orion Corporation

- Acadia Pharmaceuticals

- Amneal Pharmaceuticals

- UCB

- Cardinal Health Inc.

Competitive Analysis:

The COMT Inhibitors Market reflects moderate competition driven by strong portfolios from global pharmaceutical companies. Key players focus on safety improvements, wider regulatory approvals, and broader distribution reach. Firms invest in better formulations to support long-term tolerance in chronic neurological care. Hospitals favor brands with strong clinical data and predictable outcomes. It pushes companies to refine manufacturing quality and expand geographic networks. Strategic alliances help firms strengthen supply stability and maintain product availability. Expanding generic penetration increases pressure on branded competitors across price-sensitive regions.

Recent Developments:

- In September 2025, Novartis AG signed a licensing agreement with Arrowhead Pharmaceuticals worth up to $2.2 billion for the exclusive worldwide rights to develop, manufacture, and commercialize ARO-SNCA, a preclinical siRNA therapy targeting alpha-synuclein in Parkinson’s disease and related synucleinopathies. Novartis paid $200 million up front with potential milestones of up to $2 billion, marking the company’s renewed push into Parkinson’s disease drug development using RNA interference technology after its previous alpha-synuclein program with UCB failed in clinical trials.

- In September 2025, Novartis secured a second siRNA deal with Argo Biopharma for heart disease treatments, paying $160 million upfront with potential milestone and option payments reaching $5.2 billion. This transaction, combined with the Arrowhead deal, demonstrated Novartis’s commitment to RNA-based therapeutic approaches across neurodegenerative and cardiovascular diseases.

- In August 2025, AbbVie completed its acquisition of Capstan Therapeutics for up to $2.1 billion in cash. The acquisition added CPTX2309, a potential first-in-class in vivo targeted lipid nanoparticle (tLNP) anti-CD19 CAR-T therapy candidate for B cell-mediated autoimmune diseases, along with Capstan’s proprietary tLNP platform designed to deliver RNA payloads capable of engineering specific cell types in vivo.

- In June 2025, Roche announced its decision to proceed with Phase III development of prasinezumab, an investigational anti-alpha-synuclein antibody, in early-stage Parkinson’s disease. This significant advancement was informed by data from the Phase IIb PADOVA study and ongoing open-label extensions of both the PADOVA and Phase II PASADENA studies. Roche’s Chief Medical Officer, Dr. Levi Garraway, stated that the company is encouraged by the efficacy signals observed across the two phase II trials and their open-label extensions, combined with the favorable safety and tolerability profile of prasinezumab, which may have the potential to become the first disease-modifying treatment for people with Parkinson’s disease.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Indication, Combination Therapy, and Distribution Channel/Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for adjunct therapies will grow with rising Parkinson’s diagnoses across major regions.

- New formulations with improved safety profiles will gain stronger clinical adoption.

- Digital tools will support remote monitoring and optimized dosing strategies.

- Generic expansion will improve affordability and widen treatment access.

- Regulatory agencies will encourage products backed by strong long-term data.

- Hospitals will integrate combination therapy models into structured care pathways.

- Research on early-stage treatment use will open new patient segments.

- Companies will expand partnerships to secure stable global supply.

- Market penetration will rise across emerging regions with better neurology infrastructure.

- Growth momentum will strengthen as therapy awareness improves across community health programs.