Market Overview:

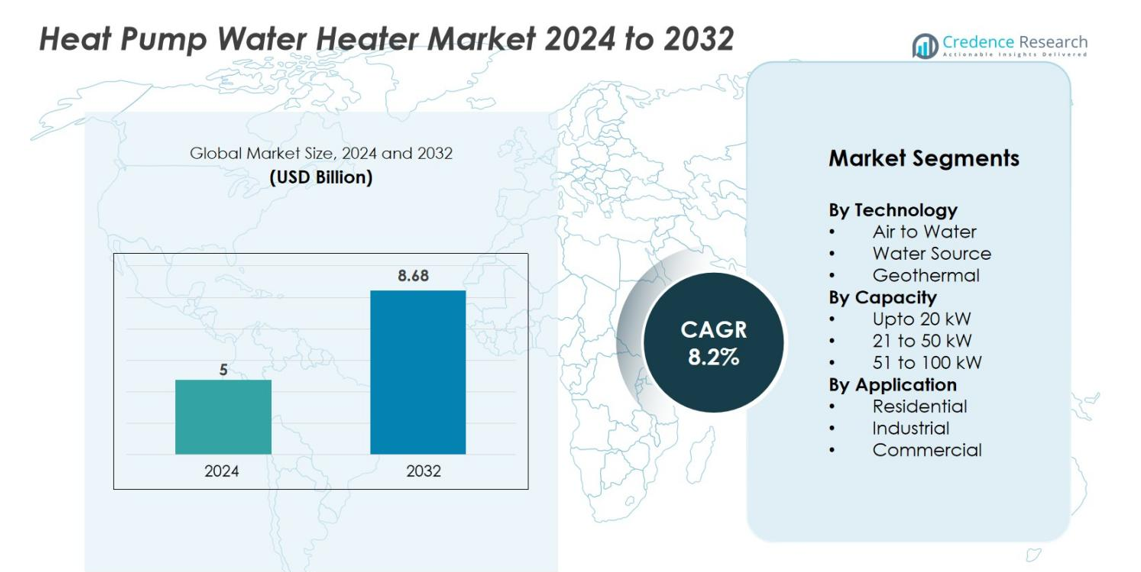

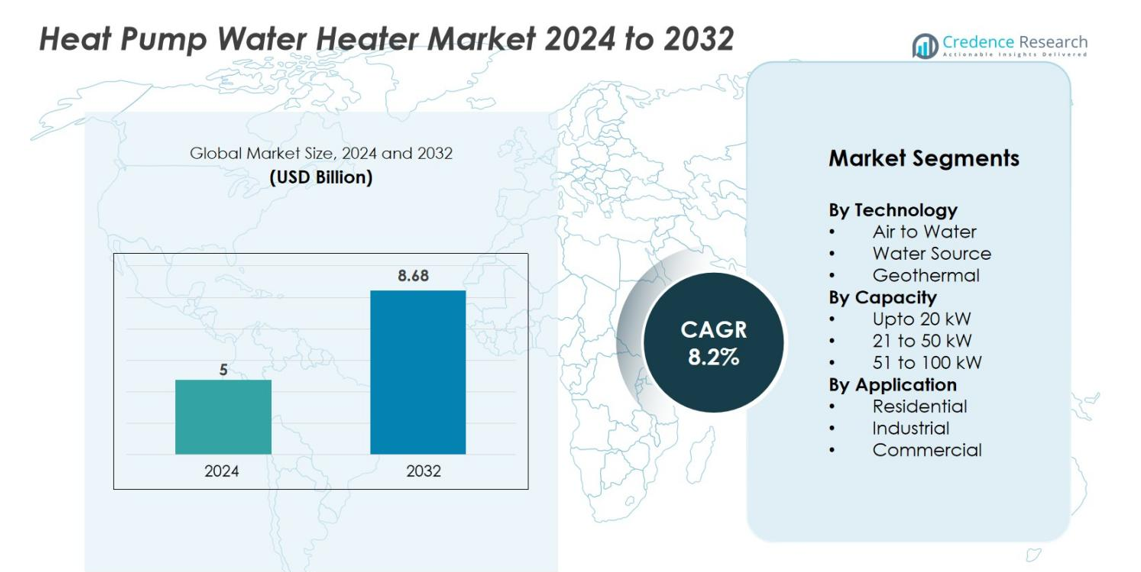

The Heat Pump Water Heater market size was valued at USD 5 billion in 2024 and is anticipated to reach USD 8.68 billion by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heat Pump Water Heater Market Size 2024 |

USD 5 billion |

| Heat Pump Water Heater Market, CAGR |

8.2% |

| Heat Pump Water Heater Market Size 2032 |

USD 8.68 billion |

The Heat Pump Water Heater market is highly competitive and is led by key global players such as A. O. Smith Corporation, Rheem Manufacturing Company, Daikin Industries, Ltd., Bosch Thermotechnology Corp., Trane Technologies and Ariston Group. These firms capitalize on extensive R&D, broad distribution networks and strategic acquisitions to reinforce their market dominance. Regionally, the Asia‑Pacific region is the frontrunner, commanding approximately 46.9% of global market share, while Europe holds around 20‑25% and North America mid‑teens percent. Supportive policies, strong infrastructure and rising consumer demand in these areas continue to bolster the leading players’ growth.

Market Insights

- The Heat Pump Water Heater market size is valued at USD 5 billion in 2024 and is expected to reach USD 8.68 billion by 2032, growing at a CAGR of 8.2% during the forecast period.

- The Asia Pacific region dominates the market, holding approximately 46.9% of the global share, followed by Europe at 20-25% and North America in the mid-teens.

- Key growth drivers include rising demand for energy-efficient systems and government incentives for eco-friendly technologies.

- Air to Water technology leads the market, accounting for 55-60%, driven by its efficiency and lower installation costs, particularly in residential and commercial applications.

- The residential application dominates the market, making up around 50-55% of the share, fueled by increasing consumer preference for energy-efficient solutions and governmental rebates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Technology

The Heat Pump Water Heater market is segmented by technology into Air to Water, Water Source, and Geothermal. Among these, the Air to Water segment holds the dominant market share, accounting for 60% of the total market. This dominance is driven by the technology’s high energy efficiency, lower installation costs, and strong adoption in residential and commercial applications. The growing emphasis on sustainable and cost-effective heating solutions, alongside governmental incentives promoting eco-friendly technologies, continues to drive the growth of this segment.

- For instance, Daikin Industries has made significant advancements in air-source heat pump technology, developing units that deliver an energy efficiency ratio (COP) of up to 4.5, demonstrating superior performance compared to traditional electric heaters.

By Capacity

The market is also segmented by capacity into Upto 20 kW, 21 to 50 kW, and 51 to 100 kW. The Upto 20 kW capacity segment is the dominant sub-segment, holding a market share of 45%. This growth is driven by the increasing demand in residential applications where smaller, cost-effective systems are preferred. With rising interest in energy-efficient solutions for homes and strong environmental incentives, the Upto 20 kW capacity segment is poised for continued dominance and growth.

- For instance, Bosch Thermotechnology Corp’s CS7001i AW Air‑to‑Water heat pump model delivers a heating power of 13.07 kW at A2/W35 conditions and achieves a COP of 4.68 at +7 °C outdoor / W35 flow conditions.

By Application

The application segment of the Heat Pump Water Heater market includes Residential, Industrial, and Commercial. The Residential segment is the dominant sub-segment, capturing approximately 50-55% of the market share. This growth is fueled by the increasing consumer preference for sustainable and energy-efficient home heating solutions, as well as governmental rebates and incentives for eco-friendly upgrades. As the demand for greener technologies rises, the Residential segment remains the leading driver of the heat pump water heater market.

Key Growth Drivers

Increasing Demand for Energy Efficiency and Sustainability

The growing emphasis on energy efficiency and sustainability is one of the primary drivers for the Heat Pump Water Heater market. With increasing global energy consumption and rising concerns about environmental degradation, consumers and businesses alike are seeking solutions that reduce energy usage and lower carbon footprints. Heat pump water heaters offer a highly energy-efficient alternative to traditional water heating systems, as they use renewable energy sources like air, water, or geothermal heat to operate. Additionally, many governments around the world are offering incentives, rebates, and tax credits for adopting energy-efficient technologies, further driving the demand for these systems.

- For instance, Daikin’s Altherma 3 series uses renewable energy from the air and offers efficiency improvements with up to a COP of 5.2, significantly reducing operational costs and greenhouse gas emissions.

Government Initiatives and Incentives

Government initiatives and incentives aimed at promoting eco-friendly technologies have been crucial in driving the growth of the Heat Pump Water Heater market. Governments across various regions are implementing strict regulations on energy consumption and emissions, encouraging consumers to adopt more energy-efficient appliances. For example, tax rebates, subsidies, and financing options are often available for residential and commercial buyers who install heat pump water heaters. These financial incentives significantly reduce the upfront cost, making the technology more accessible. Moreover, many governments are setting ambitious targets for carbon neutrality and renewable energy adoption, making heat pump water heaters an integral part of their green energy plans.

- For instance, the U.S. federal “25C Energy Efficient Home Improvement Credit” allows up to $2,000 in tax credit per year for qualifying heat pump water heaters and related upgrades.

Rising Awareness of Environmental Impact and Cost Savings

As consumers become more aware of the environmental and economic benefits of heat pump water heaters, there is a noticeable shift in purchasing behavior toward sustainable and cost-saving options. Heat pump water heaters use less electricity compared to conventional electric water heaters, which not only reduces utility bills but also decreases greenhouse gas emissions. The increasing emphasis on reducing operational costs while minimizing the environmental impact of home and business appliances has made heat pump water heaters an attractive choice. Furthermore, the rising awareness about climate change and the need to adopt more eco-conscious practices is encouraging consumers to invest in products that contribute to long-term sustainability.

Key Trends & Opportunities

Integration of Smart Technology and IoT

The integration of smart technology and the Internet of Things (IoT) in heat pump water heaters is a significant trend shaping the market. Smart heat pump water heaters are designed to optimize energy consumption and offer convenience by allowing users to monitor and control their water heating system remotely via smartphones or voice assistants. This integration enables real-time energy consumption tracking, fault detection, and scheduling for optimal operation, resulting in better performance and lower energy bills. Additionally, predictive maintenance features provided by IoT-enabled systems help extend the lifespan of the units, reducing the need for costly repairs and replacements.

- For instance, Daikin’s Altherma system integrates with smart home platforms like Amazon Alexa and Google Home, enabling users to adjust settings remotely for improved efficiency.

Expansion of Residential and Commercial Applications

The Heat Pump Water Heater market is witnessing significant growth in both residential and commercial sectors. The growing demand for energy-efficient and eco-friendly solutions in residential applications, driven by rising energy costs and environmental concerns, is one of the key opportunities. In the commercial sector, businesses are increasingly focusing on sustainability as part of their corporate social responsibility initiatives. This presents a major opportunity for heat pump water heaters, which are not only cost-effective in the long term but also align with the sustainability goals of businesses. With advancements in technology, these systems are becoming more scalable, allowing for larger applications in industrial and commercial buildings.

- For instance, A.O. Smith Corporation offers residential heat pump water heaters that align with ENERGY STAR® ratings, helping homeowners reduce their carbon footprint.

Key Challenges

High Initial Installation Costs

One of the significant challenges in the adoption of heat pump water heaters is the high initial installation cost. Although these systems offer long-term energy savings and environmental benefits, the upfront cost of purchasing and installing a heat pump water heater is considerably higher than traditional water heating systems. This can deter price-sensitive consumers from adopting the technology, especially in regions where energy efficiency incentives are limited. Despite the long-term cost savings, the initial financial barrier remains a challenge, particularly for residential buyers who are unwilling to pay higher upfront costs. Manufacturers are focusing on reducing production costs and offering more affordable models, but the high installation cost continues to be a significant challenge that could slow the widespread adoption of heat pump water heaters.

Limited Awareness and Technical Expertise

Another key challenge for the Heat Pump Water Heater market is the limited awareness among consumers regarding the benefits and availability of these systems. While the technology is growing in popularity, many consumers are still unfamiliar with how heat pump water heaters operate and the advantages they offer over traditional systems. Additionally, the installation and maintenance of heat pump water heaters require specialized technical expertise, which may not be readily available in all regions. The lack of skilled professionals who can properly install and maintain these systems creates a barrier to entry for potential customers. Raising awareness through education, advertising, and training programs for technicians will be crucial to overcoming these challenges and enabling broader market adoption.

Regional Analysis

Asia Pacific

The Asia Pacific region commands the largest share of the market, accounting for 46.9% of global revenue in 2024. This dominance is driven by strong growth in countries such as China, India, and Japan, where rising urbanization, expanding construction activity, and supportive government policies on energy efficiency encourage the adoption of heat pump water heaters. Consumers in the region increasingly prioritize sustainable infrastructure and cost-effective heating solutions, making this region a key growth arena for suppliers and manufacturers.

North America

In North America, the market is experiencing robust uptake, supported by regulatory incentives, rising consumer awareness, and new construction trends. The U.S. market, in particular, is growing rapidly, backed by federal and state-level rebate programs for high-efficiency water heating systems. Although its share 15% of global revenue is lower than Asia Pacific, North America’s focus on large-scale retrofits and smart home integration is increasing its importance. The region’s position as a key secondary market is reinforced by a strong push toward energy-efficient building standards and advanced residential technologies.

Europe

The European market share is also significant, driven by stringent carbon-emission regulations, mature infrastructure, and strong homeowner awareness of sustainability. Many European countries have launched subsidy programs and energy-efficiency mandates for residential and commercial water-heating systems. The region commands 22% of global revenue, reflecting both its mature market status and a continual need for replacing outdated systems with heat pump-based alternatives. Strong government support and clear decarbonization goals continue to drive adoption across key markets like Germany, France, and the UK.

Latin America

The Latin American market is emerging, holding a smaller but growing share of global revenue, typically around 7%. Growth is driven by rising electricity costs, increasing awareness of sustainable technologies, and expanding middle-class demand in countries such as Brazil and Mexico. The market remains less mature than those in developed regions, presenting both challenges and high potential for early-mover manufacturers. Favorable demographic shifts and growing residential construction activity are expected to further support future expansion.

Middle East & Africa

The Middle East & Africa region currently accounts for a modest share of the market also estimated at around 6% but it exhibits high growth potential. Factors such as favorable climatic conditions, growing urban infrastructure, and governmental efforts to diversify energy sources support future expansion. However, adoption remains limited by cost, awareness, and technical expertise, making this region a key frontier for longer-term investment. Development of localized manufacturing and lower-cost models could accelerate adoption in this promising market.

Market Segmentations

By Technology

- Air to Water

- Water Source

- Geothermal

By Capacity

- Upto 20 kW

- 21 to 50 kW

- 51 to 100 kW

By Application

- Residential

- Industrial

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global heat pump water heater market features a mix of established HVAC and water‑heating giants alongside innovative players aggressively expanding their heat pump portfolios. Leading participants such as A. O. Smith Corporation, Rheem Manufacturing Company, Daikin Industries, Ltd., Bosch Thermotechnology Corp, Ariston Group and EcoTech Solutions are driving the market through product innovation, global footprint expansion and strategic M&A. Many firms are focusing on smart, inverter‑driven systems, improved coefficients of performance and integrated IoT functionality to differentiate their offerings in a crowded marketplace. As regulatory frameworks tighten on energy efficiency and customers demand lower operating costs, companies are leveraging economies of scale and advanced manufacturing to reduce production cost and installation complexity. Competitive pressure is intensifying as regional players in Asia‑Pacific and Europe increase their presence, prompting price competition and driving manufacturers to enhance service networks, installation partnerships and after‑sales support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daikin

- A. O. Smith Corporate

- Carrier

- Trane

- Zealux Electric Limited

- Bosch Thermotechnology Corp

- Ariston Group

- Rheem Manufacturing

- Arctic Heat Pumps

- EcoTech Solutions

Recent Developments

- In May 2025, Lennox International and Ariston Group entered into a joint venture to launch a new line of residential water heaters (including high-efficiency heat-pump-based models) in the USA and Canada.

- In May 2025, Ariston Group and Lennox International Inc. formed a joint venture in North America named Ariston Lennox Water Heating North America focused on water heater technologies.

- In March 2025, Panasonic Corporation announced a capital and business alliance with tado° GmbH, an IoT‑based home energy management platform provider, to strengthen its heating equipment business

Report Coverage

The research report offers an in-depth analysis based on Technology, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Heat Pump Water Heater market is expected to witness sustained growth, driven by increasing demand for energy-efficient solutions across residential, commercial, and industrial sectors.

- Government incentives and subsidies for energy-efficient technologies will continue to support the adoption of heat pump water heaters.

- The integration of smart technology and IoT features will enhance product functionality, offering consumers greater control over energy consumption and performance.

- Rising environmental awareness and a shift towards sustainable living will further drive the demand for green technologies like heat pump water heaters.

- Increased urbanization and the growth of infrastructure projects in developing regions will create opportunities for heat pump water heater adoption.

- Cost reduction in production due to technological advancements will make heat pump water heaters more accessible to a broader range of consumers.

- Asia Pacific will remain the dominant region, with significant market growth expected from China, India, and Japan due to rapid urbanization and supportive policies.

- Europe and North America will continue to be strong markets, supported by stringent environmental regulations and rising consumer awareness.

- Technological advancements in heat pump systems, including improved efficiency and capacity, will lead to greater market penetration in commercial applications.

- Competition will intensify as new entrants and regional players focus on cost-effective solutions and expanding their market presence through strategic partnerships and collaborations.