Market Overview

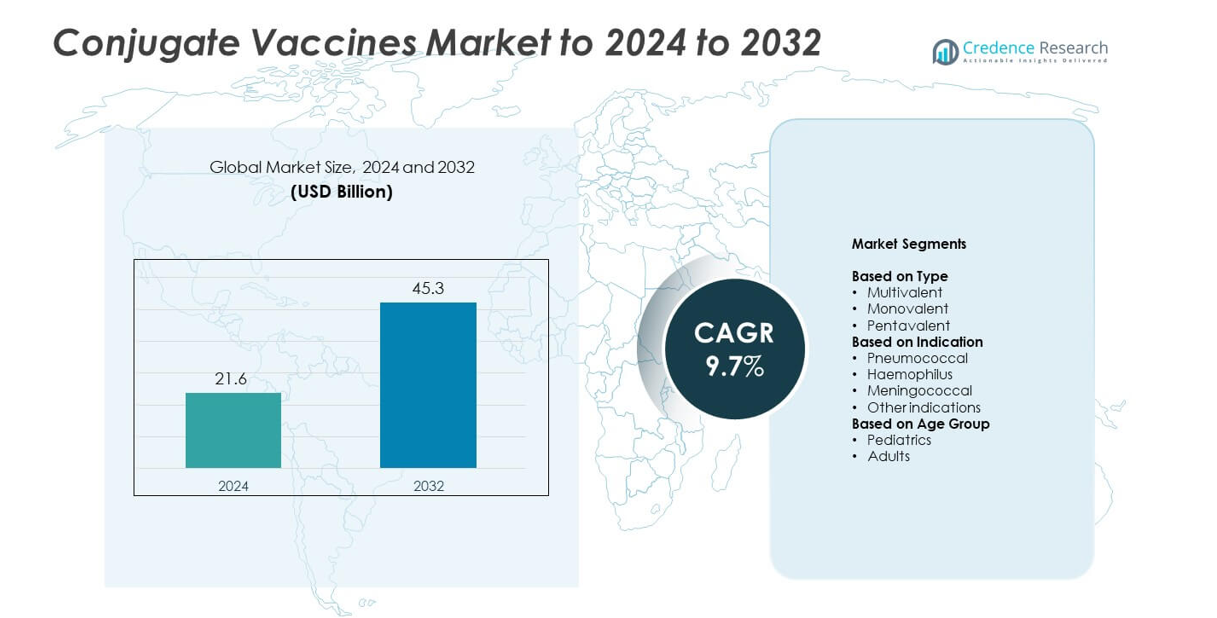

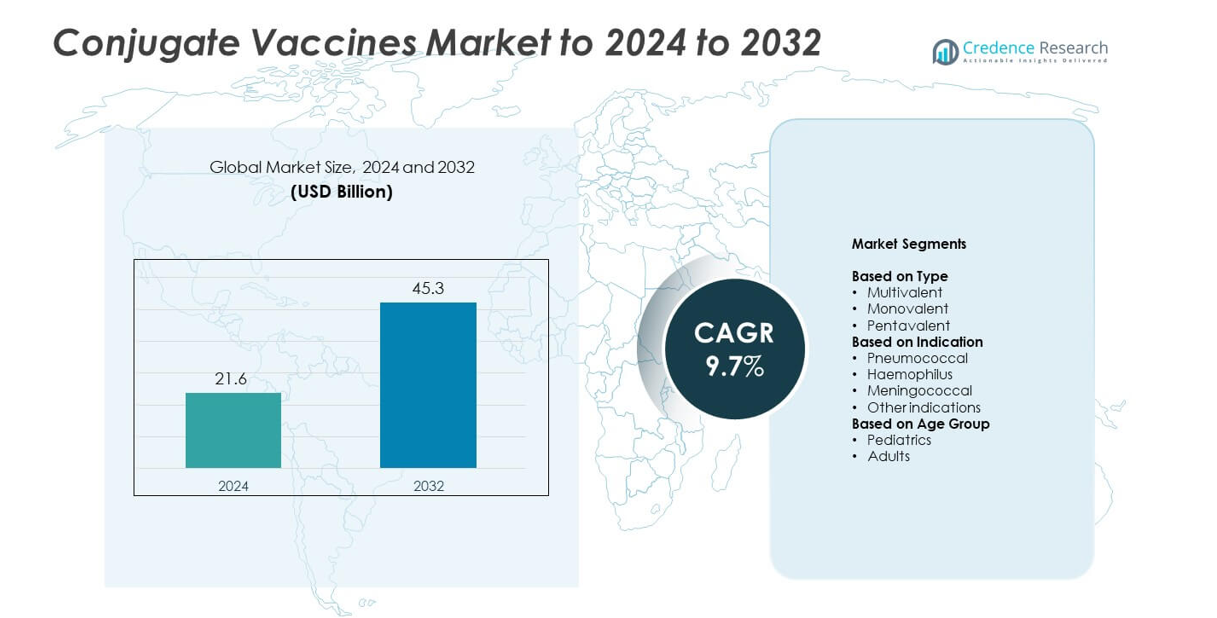

Conjugate Vaccines Market size was valued at USD 21.6 billion in 2024 and is anticipated to reach USD 45.3 billion by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conjugate Vaccines Market Size 2024 |

USD 21.6 billion |

| Conjugate Vaccines Market, CAGR |

9.7% |

| Conjugate Vaccines Market Size 2032 |

USD 45.3 billion |

The Conjugate Vaccines Market is driven by leading companies such as Pfizer, Inc., Serum Institute of India Pvt. Ltd., GSK plc, Sanofi, Merck & Co., Inc., Novartis AG, CSL Limited, Bharat Biotech, Biological E. Ltd, Bavarian Nordic, Bio-Med, Taj Pharmaceuticals Ltd., and GSPBL. These manufacturers compete through expanded higher-valent formulations, large-scale immunization supply contracts, and strong global distribution networks. North America leads the market with about 41% share in 2024, supported by high vaccination uptake and strong healthcare infrastructure. Europe follows with nearly 30% share, driven by robust national immunization programs. Asia Pacific remains the fastest-growing region with around 20% share due to rising birth rates and expanding access to pediatric vaccines.

Market Insights

- The Conjugate Vaccines Market reached USD 21.6 billion in 2024 and is projected to hit USD 45.3 billion by 2032, growing at a CAGR of 9.7%.

- Strong market growth is driven by expanding national immunization programs and high demand for pneumococcal vaccines, which held about 52% share in 2024.

- Higher-valent vaccine development and rising adult vaccination awareness shape key trends, with Asia Pacific emerging as one of the fastest-growing regions.

- Competition remains intense as major manufacturers expand production capacity and focus on broader serotype coverage, while multivalent vaccines lead the type segment with nearly 58% share.

- North America leads with about 41% share, followed by Europe at nearly 30%, while Asia Pacific holds around 20% and continues to grow due to increasing pediatric vaccinations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Multivalent vaccines held the dominant share of about 58% in 2024. Their lead came from broad protection against multiple serogroups and strong use in national immunization programs. Healthcare agencies prefer multivalent products because they reduce the number of doses and improve compliance. Growing demand for expanded-coverage pneumococcal conjugate vaccines and wider adoption in both pediatric and adult groups support this segment. Monovalent and pentavalent vaccines grow at a steady pace as countries upgrade immunization schedules and expand disease-specific protection.

- For instance, Pfizer agreed to supply up to 740 million Prevenar 13 doses by 2025.

By Indication

Pneumococcal conjugate vaccines accounted for the largest share of nearly 52% in 2024. High prevalence of pneumococcal infections, strong government procurement, and routine pediatric immunization drive this dominance. Global health bodies continue to scale pneumococcal vaccination programs due to strong clinical efficacy and reduced hospitalization risk. Rising uptake of next-generation higher-valent pneumococcal products also strengthens this segment. Haemophilus and meningococcal vaccines expand as countries widen newborn and adolescent immunization coverage.

- For instance, GSK agreed to supply 720 million Synflorix doses by the mid-2020s.

By Age Group

Pediatrics led the market with about 61% share in 2024. Strong uptake of routine childhood vaccination, high inclusion of conjugate vaccines in national schedules, and large birth cohorts support this lead. Pediatric programs emphasize early protection against pneumococcal, meningococcal, and Haemophilus diseases, making conjugate vaccines a core part of immunization strategies. Adult vaccination grows steadily as awareness of pneumococcal disease risk rises and governments promote immunization for older adults and high-risk groups.

Key Growth Drivers

Rising Immunization Coverage

Global immunization programs continue to expand as governments strengthen vaccine mandates and invest in nationwide rollouts. Conjugate vaccines gain priority due to high effectiveness against pneumococcal, meningococcal, and Haemophilus infections. Strong support from public health agencies and international organizations boosts vaccine uptake across low and middle-income countries. Higher birth rates in developing regions and rapid improvements in healthcare access further contribute to consistent demand.

- For instance, Serum Institute of India currently produces around 1.9 billion vaccine doses annually as of 2023.

Advancements in Higher-Valent Vaccines

The shift toward higher-valent conjugate vaccines fuels rapid market expansion. Manufacturers develop vaccines offering broader serotype protection, which increases clinical value and strengthens adoption across pediatric and adult groups. Regulatory approvals for next-generation pneumococcal conjugate vaccines accelerate market penetration. These advanced formulations reduce disease burden more effectively, encouraging larger public procurement and wider inclusion in national immunization schedules.

- For instance, Merck’s V116 pneumococcal conjugate vaccine covers 21 serotypes across eight Phase 3 studies.

Growing Adult Vaccination Awareness

Awareness of adult vulnerability to pneumococcal and meningococcal infections continues to rise. Health systems encourage adult immunization to reduce hospitalization risk among older adults and immunocompromised groups. This shift expands the target population beyond pediatrics, creating new revenue opportunities for manufacturers. Strong recommendations from public health authorities and employer-based vaccination programs further support adult-segment growth.

Key Trends & Opportunities

Expansion of National Immunization Programs

Many countries expand routine vaccination schedules by adding new conjugate vaccines and increasing coverage across underserved regions. Governments focus on reducing childhood and adult mortality linked to vaccine-preventable infections. Digital tracking tools and improved cold-chain networks enhance last-mile delivery. These developments create strong opportunities for long-term procurement partnerships and increased public-sector demand.

- For instance, AstraZeneca has delivered over 3 billion Vaxzevria doses to more than 180 countries.

R&D Focus on Combination Vaccines

Manufacturers invest in combination vaccines that reduce the number of injections and improve patient compliance. These products streamline immunization workflows and lower operational burden on healthcare systems. Combination conjugate vaccines gain interest due to enhanced convenience, reduced clinic visits, and stronger acceptance among parents and caregivers. Growing demand for efficient immunization strategies strengthens opportunities in this area.

- For instance, Takeda’s QDENGA dengue vaccine has been studied in over 60,000 participants worldwide.

Improved Manufacturing Capacity

Global vaccine producers increase production capacity to support rising demand from both pediatric and adult markets. Investments in advanced bioprocessing, scalable fermentation systems, and fill-finish technologies help reduce supply gaps. Improved capacity ensures stable availability during outbreak seasons and supports large public tenders. This trend opens new opportunities for regional supply partnerships.

Key Challenges

High Development and Production Costs

Conjugate vaccines require complex manufacturing steps, including polysaccharide purification and protein conjugation, which raise production costs. These expenses limit participation by smaller manufacturers and reduce affordability in low-income regions. High clinical trial costs and stringent regulatory requirements further slow the entry of new products. As a result, pricing pressures and funding constraints remain major hurdles for broader market penetration.

Supply and Distribution Limitations

Many countries face gaps in cold-chain infrastructure and uneven healthcare access, which disrupt vaccine distribution. Remote regions experience delays in routine immunization, reducing coverage for key conjugate vaccines. Limited storage capacity and logistical challenges increase the risk of stockouts during high-demand periods. These constraints continue to affect timely vaccine delivery and hinder market growth.

Regional Analysis

North America

North America held about 41% share in 2024 due to strong immunization programs, high healthcare spending, and wide access to advanced conjugate vaccines. The region benefits from established vaccination infrastructure and strong uptake of pneumococcal and meningococcal vaccines among children and adults. Ongoing support from public health agencies and steady introduction of higher-valent products strengthen long-term demand. The presence of leading vaccine developers and consistent government procurement further maintains the region’s dominant position.

Europe

Europe accounted for nearly 30% share in 2024, supported by strong public health policies, high vaccination awareness, and widespread inclusion of conjugate vaccines in national immunization schedules. The region shows stable demand across both pediatric and adult groups, particularly for pneumococcal and meningococcal vaccines. Government-funded programs ensure high coverage rates, while ongoing R&D initiatives boost product availability. Expanded surveillance systems and strong regulatory oversight continue to support market growth across major European countries.

Asia Pacific

Asia Pacific held around 20% share in 2024 and is among the fastest-growing regions due to rising birth rates, improving healthcare access, and growing government investments in vaccination programs. Countries expand national immunization schedules to include more conjugate vaccines for newborns and high-risk populations. Increasing awareness of disease burden and wider adoption of higher-valent vaccines strengthen market traction. Rapid urbanization and growing private healthcare networks also support higher vaccine uptake across the region.

Latin America

Latin America captured nearly 6% share in 2024, driven by expanding childhood immunization programs and support from regional health organizations. Several countries improve vaccine accessibility through public procurement and partnerships with global health agencies. Rising awareness of pneumococcal and meningococcal infections encourages broader coverage in infants and adolescents. Economic constraints and supply chain gaps remain challenges, but continued investments in healthcare systems support gradual market expansion across the region.

Middle East and Africa

The Middle East and Africa region held about 3% share in 2024, reflecting limited but growing adoption of conjugate vaccines. Immunization efforts strengthen through government-led initiatives and international funding aimed at reducing vaccine-preventable diseases. Expanding pediatric vaccination coverage and improved distribution networks support incremental progress. However, uneven healthcare access and supply challenges slow widespread uptake. Ongoing collaborations with global health bodies and rising awareness of infectious disease risks help create long-term growth potential.

Market Segmentations:

By Type

- Multivalent

- Monovalent

- Pentavalent

By Indication

- Pneumococcal

- Haemophilus

- Meningococcal

- Other indications

By Age Group

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Conjugate Vaccines Market is shaped by leading companies such as Pfizer, Inc., Taj Pharmaceuticals Ltd., Serum Institute of India Pvt. Ltd., GSK plc, Bavarian Nordic, Merck & Co., Inc., CSL Limited, Novartis AG, Bharat Biotech, Sanofi, Biological E. Ltd, Bio-Med, and GSPBL. The market features strong competition driven by continuous product innovation, expansion of higher-valent formulations, and large-scale supply commitments to national immunization programs. Manufacturers focus on scaling production capacity, improving conjugation technologies, and enhancing global distribution reach, especially across developing regions. Strategic partnerships with public health agencies and advancements in clinical programs strengthen market positioning. Companies also prioritize regulatory approvals and competitive pricing to secure government tenders. Rising demand across pediatric and adult vaccination segments pushes firms to expand research pipelines and upgrade manufacturing infrastructure. The competition further intensifies with growing interest in combination vaccines and broader serotype coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pfizer, Inc.

- Taj Pharmaceuticals Ltd.

- Serum Institute of India Pvt. Ltd.

- GSK plc

- Bavarian Nordic

- Merck & Co., Inc.

- CSL Limited

- Novartis AG

- Bharat Biotech

- Sanofi

- Biological E. Ltd

- Bio-Med

- GSPBL

Recent Developments

- In 2025, Biological E. Ltd has entered a strategic partnership with Bavarian Nordic to expand access to Bavarian Nordic’s Chikungunya vaccine, including technology transfer to Biological E’s facilities for local manufacturing intended for low- and middle-income countries.

- In 2025, Merck & Co., Inc. received European Commission approval for CAPVAXIVE®, a 21-valent pneumococcal conjugate vaccine aimed at preventing invasive pneumococcal disease and pneumonia in adults

- In 2024, Sanofi, in collaboration with SK Bioscience, launched a Phase III clinical trial program for PCV21, a pneumococcal conjugate vaccine candidate covering more than 20 serotypes.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Higher-valent conjugate vaccines will gain wider adoption across all age groups.

- National immunization programs will expand coverage for pneumococcal and meningococcal vaccines.

- Adult vaccination rates will rise as awareness of infection risks increases.

- Manufacturers will invest more in combination conjugate vaccines for better compliance.

- Global production capacity will grow to support stable supply and reduce shortages.

- New regulatory approvals will accelerate the entry of advanced conjugate formulations.

- Digital tracking tools will enhance vaccine delivery and improve coverage in remote areas.

- Public–private partnerships will expand to support immunization in low-income regions.

- R&D will focus on broader serotype protection and improved immunogenicity.

- Market competition will intensify as more firms enter emerging economies.