| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Aerosol Market Size 2024 |

USD 86,055.59 Million |

| Aerosol Market, CAGR |

6.58% |

| Aerosol Market Size 2032 |

USD 1,42,532.80 Million |

Market Overview:

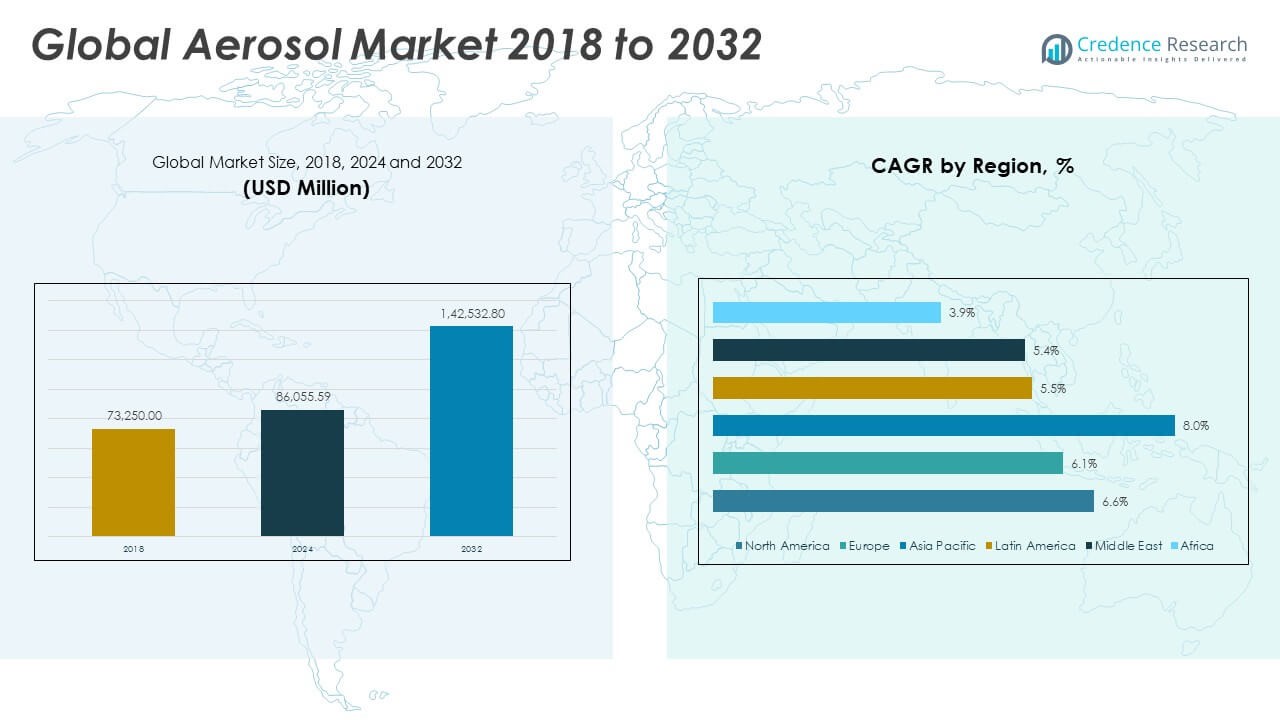

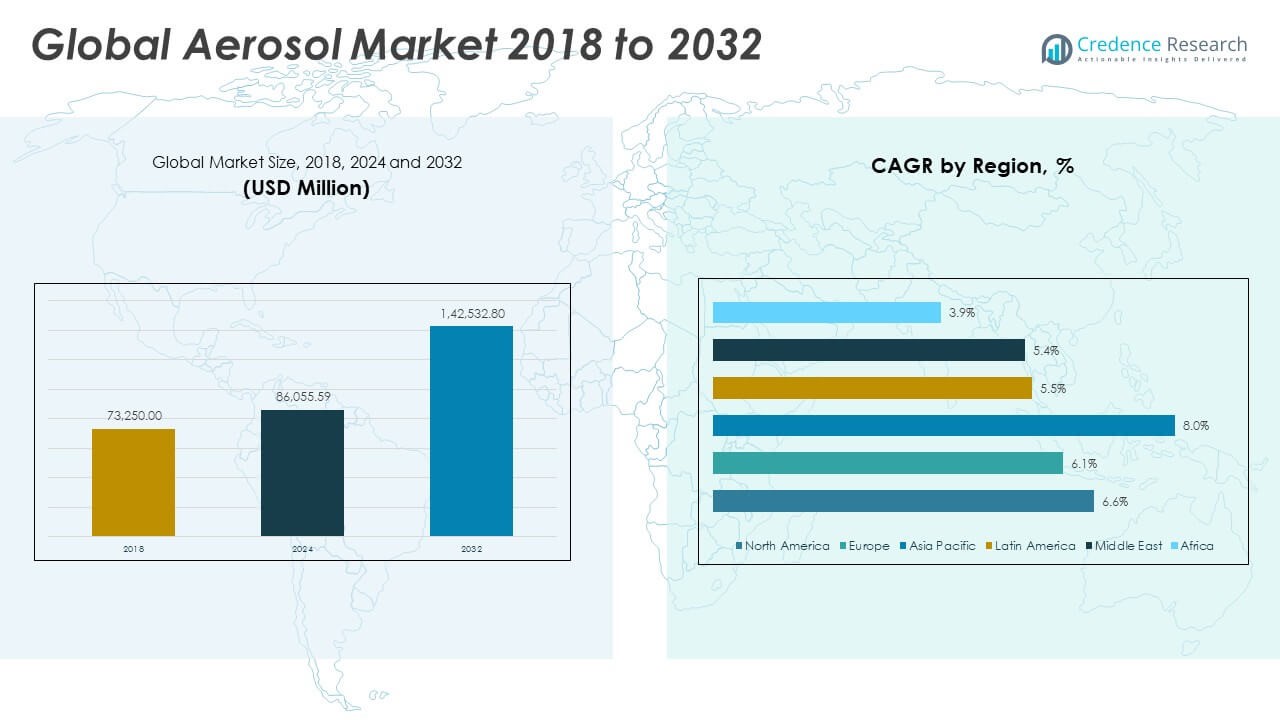

The Global Aerosol Market size was valued at USD 73,250.00 million in 2018 to USD 86,055.59 million in 2024 and is anticipated to reach USD 1,42,532.80 million by 2032, at a CAGR of 6.58% during the forecast period.

The key drivers propelling the growth of the Global Aerosol Market include the rising demand for personal care and hygiene products, growing urbanization, and heightened focus on sanitation and cleanliness, especially after the COVID-19 pandemic. Personal care remains the dominant application segment, supported by increased usage of aerosol-based deodorants, shaving foams, dry shampoos, and cosmetic sprays. The growing emphasis on grooming and self-care, particularly among younger demographics and working professionals, is expanding the market base. In the healthcare sector, aerosols play a vital role in drug delivery systems, such as inhalers for asthma and other respiratory treatments. Household products including surface cleaners, disinfectants, and air fresheners are also seeing elevated usage, driving demand from residential and commercial spaces alike. Manufacturers are increasingly incorporating environmentally friendly packaging materials and adopting hydrofluoro-olefins (HFOs) and compressed air as safer alternatives to conventional propellants to meet environmental regulations.

Regionally, Europe holds the largest share of the Global Aerosol Market. The region benefits from a mature personal care industry, high environmental awareness, and strong regulatory frameworks that promote the use of sustainable packaging and low-emission propellants. North America follows closely, driven by high per capita consumption of personal care and cleaning products and advanced product innovation. The Asia Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization, rising disposable incomes, and expanding middle-class populations in countries such as China, India, and Indonesia. Growing consumer awareness and shifting lifestyles are boosting demand for aerosol-based personal care and household products in the region. Latin America, the Middle East, and Africa represent developing markets with increasing penetration of Western lifestyles and rising demand for convenience products. However, limited regulatory enforcement and cost-sensitive consumers pose moderate challenges in these regions. Collectively, these regional trends highlight a globally diverse and expanding aerosol industry landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Aerosol Market was valued at USD 73,250.00 million in 2018, reached USD 86,055.59 million in 2024, and is projected to hit USD 142,532.80 million by 2032, growing at a CAGR of 6.58%.

- Rising demand for personal grooming and hygiene products, especially among urban youth and professionals, is significantly boosting market growth.

- Healthcare applications such as asthma inhalers, nasal sprays, and antiseptic aerosols are expanding due to aging populations and respiratory illness trends.

- Aerosol-based household products like air fresheners, disinfectants, and insect repellents are in high demand due to increased focus on cleanliness.

- Europe holds the largest market share, supported by environmental regulations, mature personal care demand, and high product innovation.

- Asia Pacific is the fastest-growing region, fueled by rising incomes, urbanization, and changing consumer preferences in China, India, and Southeast Asia.

- Environmental regulations and raw material cost volatility are challenging manufacturers to innovate with sustainable propellants and recyclable packaging.

Market Drivers:

Surging Demand for Personal Care and Cosmetic Products Across Demographics:

The rising use of personal grooming and hygiene products is a major growth driver for the Global Aerosol Market. Urban populations are increasingly adopting aerosol-based deodorants, hair sprays, shaving foams, and dry shampoos due to their convenience and portability. The growing influence of social media, personal image consciousness, and demand for time-saving personal care routines is accelerating product uptake. It is especially noticeable among younger consumers and working professionals in both developed and emerging economies. Evolving lifestyle habits are shaping the need for aerosol formats that allow consistent application and ease of use. Product innovation focused on skin sensitivity, dermatological safety, and natural ingredients further supports growth in this segment.

- For instance, Unilever reported continued strength in deodorants in 2024, with personal care driving underlying sales growth of 5.2% and volume growth of 3.1% for the year. The company launched new whole body deodorant innovations under its Sure and Lynx brands, targeting incremental growth and leveraging advanced odour-adapt technology.

Expansion of Healthcare and Pharmaceutical Applications:

The role of aerosols in the healthcare sector has expanded significantly in recent years. Inhalers for treating respiratory diseases such as asthma and COPD are widely manufactured in aerosol form due to their precise dosage control and effective drug delivery. The Global Aerosol Market benefits from rising incidences of respiratory conditions and an aging global population, which increase the demand for metered-dose inhalers and nasal sprays. It plays a critical role in non-invasive drug delivery solutions and supports patients requiring frequent administration. Pharmaceutical-grade aerosol products also include antiseptics, wound care sprays, and topical anesthetics. Rising healthcare awareness and medical accessibility in emerging markets strengthen this trend.

- For instance, GlaxoSmithKline’s Ventolin HFA (albuterol sulfate) metered-dose inhaler remains a leading product, relied upon by approximately 35 million patients globally. In 2024, GSK began phase 3 trials of a low-carbon version of its Ventolin inhaler, aiming to reduce greenhouse gas emissions from inhaler use by around 90% if successful. The current Ventolin inhaler accounts for 49% of GSK’s carbon footprint, highlighting the significance of this transition.

Growth in Household and Cleaning Product Categories:

Demand for aerosol-based household products is growing due to rising attention to cleanliness and sanitation. Consumers are using aerosol sprays for surface disinfectants, air fresheners, insect repellents, and fabric refreshers in homes and commercial spaces. The Global Aerosol Market is responding to this demand by offering multi-purpose sprays that ensure hygiene with minimal effort. Product innovation in this category focuses on fast-acting formulations and eco-friendly packaging. Household cleaning products experienced accelerated growth during the COVID-19 pandemic and have retained a strong market position. It continues to gain traction in urban settings where consumers prefer convenient and efficient cleaning solutions.

Focus on Convenience, Portability, and Controlled Application:

The overall appeal of aerosol packaging lies in its ease of use, controlled dispensing, and portability. Consumers across segments seek products that offer precise, hygienic application without spillage or wastage. The Global Aerosol Market thrives on these advantages, especially in categories where uniform application is critical. Aerosol containers are lightweight, tamper-proof, and suitable for both liquid and foam formulations, offering a consistent user experience. It supports product differentiation and brand loyalty, particularly in highly competitive consumer goods segments. The demand for ergonomic and travel-friendly packaging continues to shape design and functionality in aerosol-based product development.

Market Trends:

Shift Toward Eco-Friendly Propellants and Sustainable Packaging Materials:

Environmental concerns and regulatory pressure are driving the transition toward sustainable aerosol products. Manufacturers are phasing out hydrofluorocarbons (HFCs) and replacing them with low-global warming potential (GWP) propellants such as hydrofluoroolefins (HFOs) and compressed air. The Global Aerosol Market is witnessing a growing focus on recyclable aluminum and post-consumer recycled (PCR) plastics in packaging. It reflects changing consumer expectations for environmentally responsible product choices. Companies are investing in eco-design and life cycle assessment to meet carbon reduction targets. The push for biodegradable formulations and minimal plastic usage continues to influence packaging innovation across all application segments.

Rising Adoption of Bag-on-Valve (BoV) and Continuous Spray Technology:

Technological advancements in dispensing mechanisms are shaping the evolution of aerosol delivery systems. Bag-on-valve (BoV) technology, which separates the product from the propellant, is gaining popularity for its superior product preservation, 360-degree spray capability, and reduced contamination risk. The Global Aerosol Market is increasingly incorporating BoV in applications like pharmaceuticals, cosmetics, and food-grade sprays. It offers extended shelf life, precise dosing, and compatibility with natural or preservative-free formulations. Continuous spray systems are also being favored for their consistent, fine mist delivery in personal care and home cleaning products. These innovations are enhancing consumer experience and product safety.

- For example, Coster Group reported that its bag-in-valve aerosol systems were used in over 300 million pharmaceutical and cosmetic units in 2024, achieving a 99% product evacuation rate and zero propellant contamination in end-user testing.

Expansion of Private Label and Niche Brand Offerings in Retail:

Retail dynamics are shifting toward private label and niche brands that offer value-driven or specialty aerosol products. Supermarkets, pharmacies, and online platforms are increasingly stocking store-brand aerosols that compete on price and quality. The Global Aerosol Market is experiencing heightened activity from smaller brands that target specific consumer needs such as fragrance-free, organic, or vegan formulations. It supports market diversification and gives consumers more personalized choices. Niche brands are leveraging e-commerce and direct-to-consumer models to expand reach. Product storytelling, sustainable sourcing, and ethical claims are being used to build customer loyalty in a crowded retail space.

- For instance, S. C. Johnson launched the FamilyGuard Brand in May 2023, a new line of disinfectant sprays and cleaners designed for use on over 100 surfaces, and this product line was recognized as a Product of the Year winner in the Home Cleaning category.

Increased Integration of Digital Labeling and Smart Packaging Features:

Smart packaging technologies are making inroads in the aerosol industry to enhance traceability, user engagement, and product authenticity. Brands are using QR codes, NFC tags, and augmented reality to provide interactive content and verify product origin. The Global Aerosol Market is exploring these tools to communicate usage instructions, recycling tips, and promotional campaigns. It allows companies to differentiate products and gather consumer behavior insights in real time. Smart labeling also supports compliance with evolving regulations by simplifying ingredient disclosure. The integration of digital tools into aerosol packaging is adding value across product lifecycles and improving supply chain transparency.

Market Challenges Analysis:

Stringent Environmental Regulations and Propellant Restrictions:

Environmental regulations concerning volatile organic compounds (VOCs), hydrofluorocarbons (HFCs), and packaging waste are creating challenges for aerosol manufacturers. Regulatory bodies in North America and Europe are tightening limits on high-GWP propellants, compelling companies to reformulate products and adopt alternatives. The Global Aerosol Market faces increased pressure to comply with sustainability mandates, which often raise production costs and require reengineering of supply chains. It must also adapt to evolving regional policies on recyclability, extended producer responsibility (EPR), and carbon labeling. Smaller manufacturers may struggle to invest in eco-friendly technologies, creating competitive imbalances. Maintaining performance and shelf life while shifting to greener materials remains a critical technical challenge.

Fluctuating Raw Material Costs and Supply Chain Disruptions:

Volatility in raw material prices—particularly for aluminum, steel, and specialty chemicals—continues to impact production costs across the aerosol industry. The Global Aerosol Market remains exposed to global supply chain disruptions caused by geopolitical tensions, energy crises, and transportation bottlenecks. It must manage increased lead times, limited availability of inputs, and unpredictable pricing. These factors affect margins and limit the ability of manufacturers to meet consistent demand, especially in fast-moving consumer goods. Packaging components like valves, actuators, and pressure-resistant containers also face sourcing challenges due to component-specific dependencies. Rising inflation and energy costs further complicate long-term planning and profitability.

Market Opportunities:

Emerging Demand from Tier II Cities and Rural Markets in Developing Economies:

Rapid urbanization and rising disposable incomes in tier II cities and semi-urban regions present significant growth potential. Consumers in these areas are increasingly seeking affordable, convenient personal care and household hygiene products. The Global Aerosol Market can capitalize on this demand by introducing value-pack formats and cost-effective product lines tailored for price-sensitive consumers. It benefits from improved retail penetration and expanding distribution networks across India, Southeast Asia, Latin America, and Africa. Localized marketing and culturally relevant branding can enhance product acceptance and build loyalty. Companies that adapt formulations and packaging for regional preferences will unlock new growth channels.

Innovation in Eco-Friendly and Functional Aerosol Formats:

Growing environmental awareness creates strong opportunities for companies offering green, recyclable, and refillable aerosol solutions. Consumers are showing preference for natural ingredients, biodegradable propellants, and low-emission packaging. The Global Aerosol Market can leverage these preferences by investing in sustainable technologies such as compressed air systems and reusable containers. It also has room to innovate with multi-functional sprays that combine personal care, wellness, or therapeutic benefits. Collaborations with green chemistry firms and packaging innovators can speed up product development. Meeting environmental goals while maintaining performance will attract both regulatory support and consumer trust.

Market Segmentation Analysis:

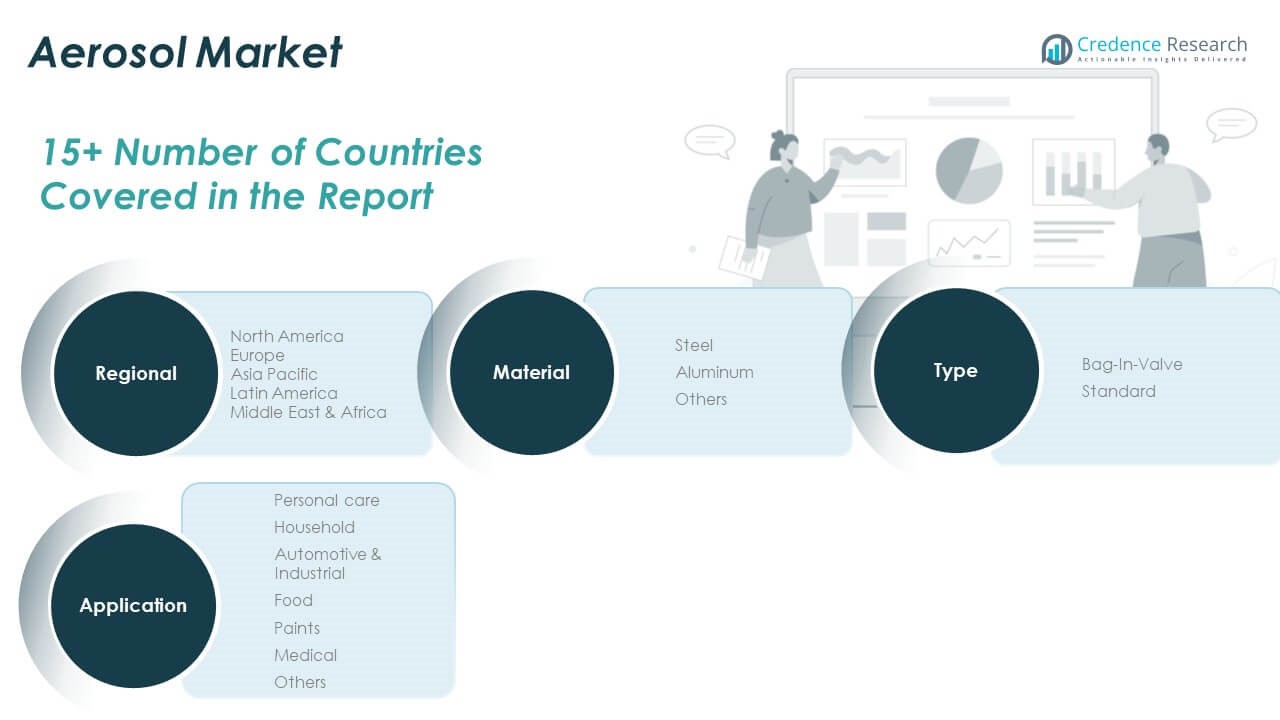

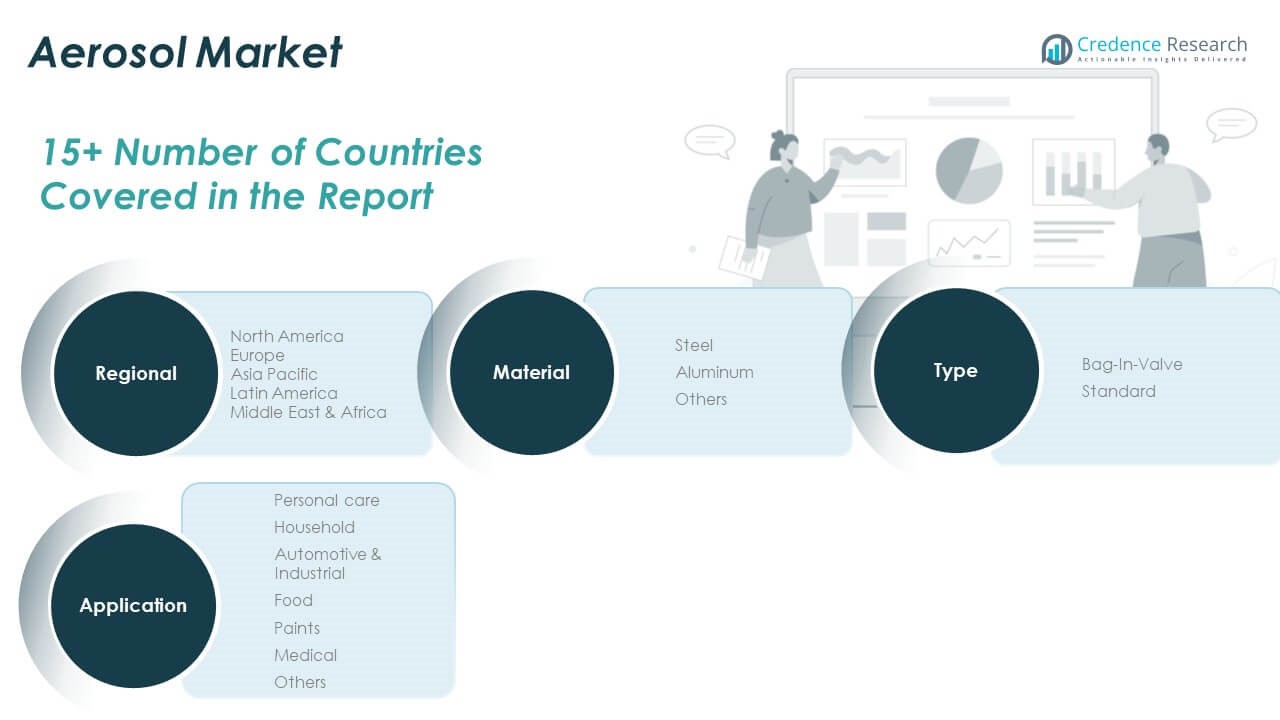

By Type

The Global Aerosol Market is segmented into bag-in-valve and standard types. Standard aerosols account for the larger market share due to their wide usage in personal care, household, and industrial applications. Bag-in-valve systems are gaining popularity for their ability to separate the product from the propellant, enhancing product stability and hygiene. It is increasingly adopted in medical, pharmaceutical, and premium cosmetic applications where product purity and complete evacuation are essential. Environmental regulations and consumer demand for cleaner dispensing methods are accelerating its adoption globally.

- For instance, Coster Group reported that its bag-in-valve aerosol systems were used in over 300 million pharmaceutical and cosmetic units in 2024, with customer data indicating a 99% product evacuation rate and zero propellant contamination in end-user testing.

By Application

The application segment includes personal care, household, automotive & industrial, food, paints, medical, and others. Personal care dominates the Global Aerosol Market, driven by strong demand for deodorants, hair sprays, and shaving foams. Household aerosols such as air fresheners and disinfectants also hold substantial market share, especially in urban regions. Automotive and industrial aerosols serve critical functions in maintenance and cleaning. Food-grade sprays and aerosol paints cater to niche but expanding sectors, while medical aerosols—particularly inhalers and antiseptics—support the healthcare segment’s consistent growth.

- For instance, Reckitt’s Lysol aerosol disinfectant sprays were used in over 70 million households globally in 2024, with independent laboratory testing confirming a 99.9% efficacy rate against common bacteria and viruses on hard surfaces.

By Material

The market by material includes steel, aluminum, and others. Aluminum leads the segment due to its lightweight nature, corrosion resistance, and high recyclability. It is preferred for both personal and medical aerosol products. Steel remains relevant in industrial and automotive sectors where durability and pressure resistance are key. Other materials include plastic-based or hybrid solutions used in specific low-pressure applications. It supports innovation in packaging design and cost-efficiency.

Segmentation:

By Type

By Application

- Personal Care

- Household

- Automotive & Industrial

- Food

- Paints

- Medical

- Others

By Material

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Aerosol Market size was valued at USD 21,081.35 million in 2018 to USD 24,387.64 million in 2024 and is anticipated to reach USD 40,322.79 million by 2032, at a CAGR of 6.6% during the forecast period. North America holds approximately 28% of the Global Aerosol Market share, led by high consumption of personal care, home care, and medical aerosol products. The United States is the dominant contributor, with strong demand for deodorants, air fresheners, and pharmaceutical sprays. The region benefits from advanced manufacturing capabilities, a well-established retail infrastructure, and widespread consumer awareness. It also shows strong innovation in sustainable aerosol packaging and eco-friendly propellant use. Regulatory support for green chemistry and recycling initiatives further shapes product development and brand strategies across the region.

Europe

The Europe Aerosol Market size was valued at USD 26,882.75 million in 2018 to USD 30,702.28 million in 2024 and is anticipated to reach USD 48,853.50 million by 2032, at a CAGR of 6.1% during the forecast period. Europe represents the largest share of the Global Aerosol Market, contributing over 35% of global revenue in 2024. Countries such as Germany, the UK, and France lead demand, backed by a mature personal care sector and robust environmental policies. It demonstrates high consumer adoption of low-VOC and recyclable packaging solutions. The presence of major aerosol manufacturers and strong regulatory oversight ensures product quality, innovation, and sustainability. Ongoing emphasis on carbon-neutral products and circular economy models continues to shape growth.

Asia Pacific

The Asia Pacific Aerosol Market size was valued at USD 16,525.20 million in 2018 to USD 20,347.48 million in 2024 and is anticipated to reach USD 37,471.99 million by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific is the fastest-growing region in the Global Aerosol Market, driven by expanding urban populations, rising disposable incomes, and evolving consumer habits. China, India, and Southeast Asia are key growth centers, with increasing use of personal care and household sprays. It shows rising demand for cost-effective and value-packaged aerosol products. The region is also attracting global and regional manufacturers looking to establish scalable production and distribution capabilities. Regulatory frameworks are developing, encouraging the gradual shift toward safer and more sustainable aerosol technologies.

Latin America

The Latin America Aerosol Market size was valued at USD 4,233.85 million in 2018 to USD 4,921.52 million in 2024 and is anticipated to reach USD 7,507.20 million by 2032, at a CAGR of 5.5% during the forecast period. Latin America holds a moderate share in the Global Aerosol Market, with Brazil and Mexico as key contributors. Demand is driven by personal care and home hygiene products, supported by growing urbanization and consumer awareness. It is experiencing a rise in local production and private label offerings in retail. Economic fluctuations and inflationary pressures challenge consistent growth across some countries. Manufacturers are focusing on affordable formulations and adapting packaging strategies to address price-sensitive consumer segments.

Middle East

The Middle East Aerosol Market size was valued at USD 3,120.45 million in 2018 to USD 3,458.88 million in 2024 and is anticipated to reach USD 5,231.74 million by 2032, at a CAGR of 5.4% during the forecast period. The Middle East contributes a smaller portion to the Global Aerosol Market but shows steady expansion. GCC countries lead regional demand, particularly in personal grooming, automotive care, and air freshening products. It is supported by growing retail distribution networks and increasing consumer spending on convenience products. Domestic production is rising, although imports still account for a significant share. Companies are beginning to explore eco-friendly packaging in response to global sustainability trends.

Africa

The Africa Aerosol Market size was valued at USD 1,406.40 million in 2018 to USD 2,237.79 million in 2024 and is anticipated to reach USD 3,145.59 million by 2032, at a CAGR of 3.9% during the forecast period. Africa holds the smallest share in the Global Aerosol Market but represents untapped potential. Growing urbanization and better access to retail channels are increasing exposure to aerosol-based personal and home care products. South Africa and Egypt are the primary contributors to regional demand. It faces challenges from limited manufacturing capacity and higher dependence on imported products. Pricing remains a key factor in consumer purchasing behavior, which encourages demand for small-size and affordable aerosol formats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Henkel AG & Co. KGaA

- C. Johnson & Son, Inc.

- Procter & Gamble

- Unilever

- Colep Consumer Products

- Akzo Nobel N.V.

- Beiersdorf AG

- Estée Lauder Inc.

- Oriflame Cosmetics S.A.

- Honeywell International Inc.

- Reckitt Benckiser

Competitive Analysis:

The Global Aerosol Market is moderately consolidated, with leading players holding a significant share through diversified portfolios and global distribution networks. Key companies such as Unilever, Procter & Gamble, S. C. Johnson & Son, and Henkel AG dominate in personal care and household segments. It features strong competition driven by innovation, branding, sustainability, and price efficiency. Market leaders focus on eco-friendly packaging, low-emission propellants, and value-added features to retain consumer loyalty. Regional manufacturers and private label brands are increasing market presence by offering cost-effective alternatives. Entry barriers remain moderate due to regulatory requirements, capital investment, and branding challenges. The market rewards players that align with environmental regulations and adapt to shifting consumer preferences toward convenience and sustainability. Strategic partnerships, acquisitions, and product launches are frequent as companies aim to expand geographic reach and enhance technological capabilities. The competitive landscape continues to evolve with a focus on green chemistry and functional product development.

Recent Developments:

- In April 2025, Procter & Gamble’s Febreze brand unveiled its 2025 Scent of the Year, Vanilla Suede, expanding its home fragrance portfolio. This launch aims to enhance living spaces with a new comforting and indulgent scent, reflecting P&G’s ongoing innovation in aerosol-based air care products.

- In February 2025, Henkel introduced new concentrated formulas and packaging for its all®, Persil®, and Snuggle® laundry products, focusing on sustainability by integrating 50% recycled plastic content and reducing resources across the value chain. The new products began shipping in March 2025, furthering Henkel’s commitment to environmental stewardship in its consumer brands.

- In January 2025, Unilever expanded its deodorant business in the UK with the launch of new whole body deodorant collections under the Sure and Lynx brands. These products feature exclusive odour-adapt technology and are designed for use on multiple body areas, responding to growing consumer demand for comprehensive personal care solutions.

- In January 2025, Estée Lauder Companies entered an exclusive agreement with Exuud Inc. to pioneer a smart fragrance expression hardware platform, Soliqaire™, which uses plant-based, biodegradable polymers for controlled fragrance release. The technology will be integrated into Estée Lauder’s fragrance portfolio by the end of 2025, supporting customization, sustainability, and innovation in aerosol-based fragrance delivery.

- In December 2024, Colep Consumer Products launched the Earth Couture AirStyle Hairspray, propelled by nitrogen air and free from silicones, microplastics, and traditional propellants. The formula uses biodegradable polymers and is packaged in a 100% PCR aluminum can, offering 24-hour curl retention and frizz control. The product won the Hair Care Formula category at Cosmopack 2025.

Market Concentration & Characteristics:

The Global Aerosol Market shows moderate market concentration, with a mix of multinational corporations and regional players competing across product categories. It is characterized by strong brand loyalty, innovation-driven growth, and consistent demand in personal care, household, and pharmaceutical applications. Companies focus on product differentiation through packaging design, propellant efficiency, and environmental sustainability. It operates within a tightly regulated framework, especially in developed regions, where compliance with VOC limits and recycling standards is essential. Technological advancements such as bag-on-valve systems and recyclable materials continue to influence market dynamics. The market benefits from repeat consumer use and stable supply chains, which support scalability and product diversification.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising urbanization and lifestyle shifts will increase demand for personal care and home hygiene aerosol products.

- Expansion of the healthcare sector will drive growth in aerosol-based drug delivery systems and medical sprays.

- Technological innovation will enhance product performance through improved valve systems and fine-mist dispensing.

- Growing environmental regulations will accelerate adoption of low-GWP propellants and recyclable packaging.

- Private label and regional brands will expand market share with affordable, tailored product offerings.

- E-commerce and direct-to-consumer channels will broaden product accessibility and brand reach.

- Smart packaging integration will improve traceability, user engagement, and regulatory compliance.

- Food and beverage applications using aerosol technology will gain traction in convenience-focused markets.

- Manufacturers will invest in local production to reduce supply chain risks and meet regional demand.

- Sustainability-driven innovation will shape long-term brand value and influence consumer purchasing decisions.