Market Overview:

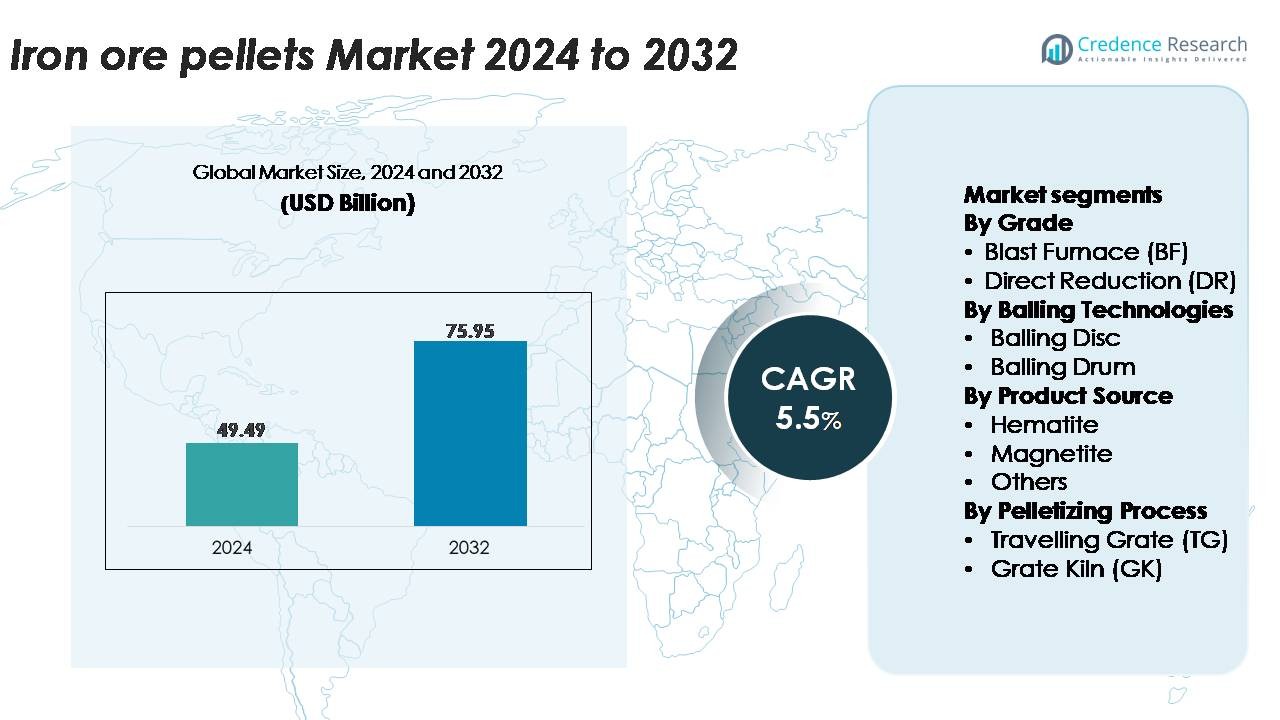

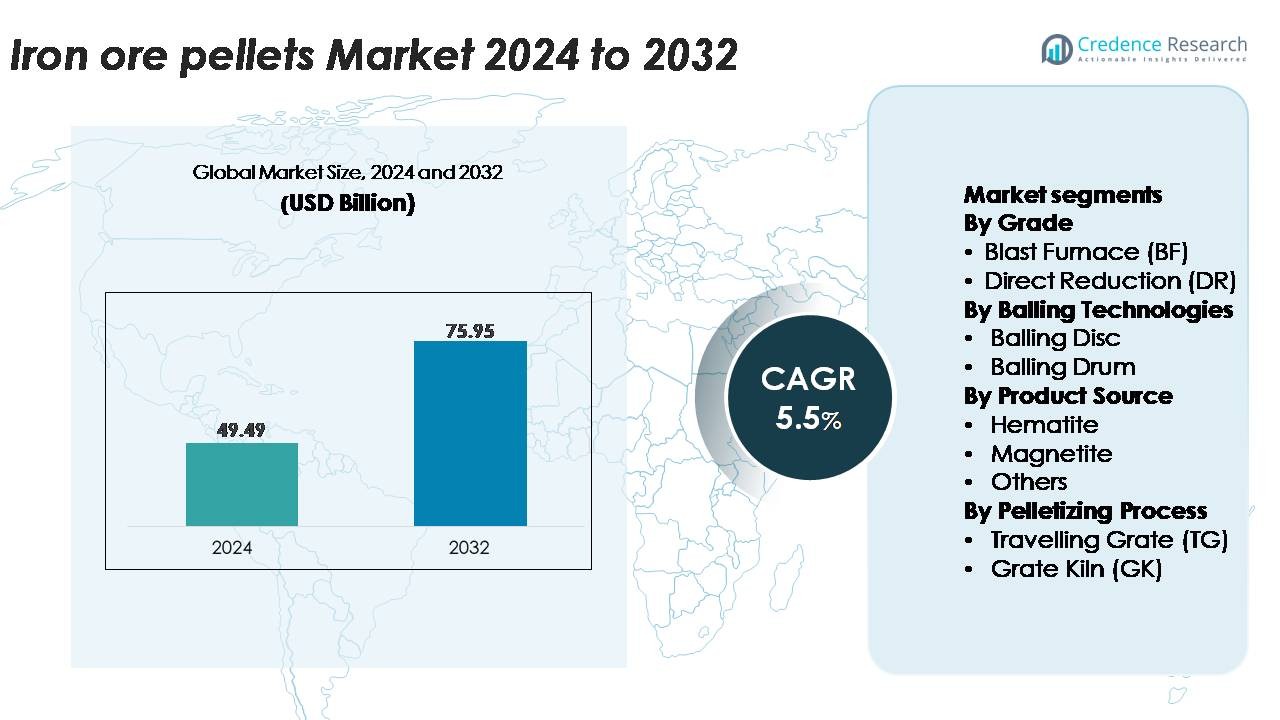

The global iron ore pellets market was valued at USD 49.49 billion in 2024 and is anticipated to reach USD 75.95 billion by 2032, reflecting a CAGR of 5.5% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Iron Ore Pellets Market Size 2024 |

USD 49.49 Billion |

| Iron Ore Pellets Market, CAGR |

5.5% |

| Iron Ore Pellets Market Size 2032 |

USD 75.95 Billion |

The iron ore pellets market is shaped by a strong group of global producers that leverage extensive mining assets, advanced beneficiation technologies, and long-term partnerships with major steelmakers. Leading players such as METALLOINVEST, Iron Ore Company of Canada, Bahrain Steel, FERREXPO, Anglo American, LKAB Koncernkontor, Cleveland-Cliffs, Evraz, Jindal SAW, and BHP Billiton focus on high-grade pellet output for both BF and DR applications. These companies continue to expand pelletizing capacity, invest in magnetite processing, and adopt energy-efficient induration systems to meet rising global steel demand. Regionally, Asia-Pacific dominates the market with approximately 45% share, driven by its large-scale steel production, expanding pelletizing facilities, and strong integration of pellets in blast furnace operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global iron ore pellets market was valued at USD 49.49 billion in 2024 and is projected to reach USD 75.95 billion by 2032, expanding at a CAGR of 5.5% over the forecast period.

- Steady growth in steel production, the shift toward DR–EAF pathways, and increased adoption of high-grade pellet feed drive market expansion, with BF pellets holding over 60% share due to widespread use in integrated steel plants.

- Key trends include rising demand for DR-grade pellets, increased magnetite beneficiation, and technological upgrades in travelling grate and grate-kiln systems supporting consistent high-strength pellet output.

- Competition intensifies as METALLOINVEST, LKAB, Cleveland-Cliffs, BHP Billiton, and FERREXPO expand pellet capacity and focus on energy-efficient, low-emission production amid challenges such as fluctuating ore quality and high operational costs.

- Regionally, Asia-Pacific leads with 45% share, followed by Europe at 22% and North America at 18%, driven by strong steelmaking ecosystems and expanding pelletizing infrastructure across these regions.

Market Segmentation Analysis:

By Grade

Blast Furnace (BF) pellets represent the dominant grade segment, accounting for over 60% of the market share, driven by their widespread use in integrated steel plants and compatibility with large-scale hot metal production. BF pellets offer high cold-crushing strength, consistent size distribution, and superior permeability, enabling efficient blast furnace operations. The rapid expansion of long-product and flat-steel manufacturing facilities further reinforces BF demand. Direct Reduction (DR) pellets continue to grow steadily, supported by rising adoption of gas-based DRI plants and the increasing shift toward lower-emission steelmaking pathways.

- For instance, LKAB produces BF-grade pellets at its Kiruna facility using grate-kiln and/or straight-grate induration lines, contributing to the company’s total annual production capacity of approximately 22–25 million tonnes, which ensures optimal mechanical durability and reducibility.

By Balling Technologies

Balling Disc technology holds the largest share, contributing around 55–60% of pelletizing capacity, due to its ability to produce uniform green pellets with controlled moisture and enhanced sphericity. Steel producers favor disc-based systems for their flexibility in handling varying ore fineness and lower operating costs. Balling Drum systems, while suitable for high-throughput operations, see comparatively lower adoption because of higher binder demand and reduced pellet uniformity. Growth in Balling Disc installations is further supported by modernization efforts in Asian and Middle Eastern plants seeking efficient and energy-optimized pelletizing lines.

· For instance, Metso Outotec’s large industrial balling discs, utilized by major iron ore producers such as Vale and LKAB, typically operate at diameters of up to 7.5 meters and rotational speeds reaching around 10 revolutions per minute, enabling high-precision pellet formation at capacities that can exceed 150 tonnes per hour.

By Product Source

Hematite-based pellets dominate the market with over 65% share, supported by their abundant availability, high iron content, and suitability for both BF and DR processes. Major producing regions, particularly India, Australia, and Brazil, rely heavily on hematite ores for pellet feedstock, ensuring stable supply chains. Magnetite pellets remain an important secondary segment, gaining traction due to their superior heat hardening properties and lower energy requirement during induration. The “Others” category including limonite and taconite maintains niche usage in regions with specific ore compositions or older beneficiation infrastructure.

Key Growth DriversS:

Rising Global Steel Production and Capacity Expansion

Growing steelmaking capacity remains the strongest driver for the iron ore pellets market, as integrated and DRI-based plants increasingly prioritize high-quality pellet feed to improve furnace efficiency. Steel producers across Asia, the Middle East, and Latin America continue to expand crude steel output, accelerating pellet consumption in both blast furnace and direct reduction routes. Pellets offer superior physical strength, uniform size, and high Fe content, enabling lower coke rates, reduced emissions, and improved productivity. Major steelmakers are also upgrading sinter-to-pellet substitution ratios to meet stricter environmental norms and support low-carbon metallurgical operations. As demand for flat steel, long products, and specialty grades rises across automotive, construction, and machinery sectors, plants adopt pellet-intensive technologies to enhance consistency and reduce impurities. Increased investment in pelletizing plants near mining hubs further ensures steady supply, reinforcing pellets as a critical raw material for modern steelmaking ecosystems.

- For instance, Vale’s Tubarão complex is home to eight pelletizing plants, though not all operate solely for pellets today, with some capacity converted to new products. The complex produces high-quality BF (Blast Furnace) and DR (Direct Reduction) pellets with typical product specifications including Fe grades reaching around 67.5% and low silica levels below 1.2%.

Expansion of Direct Reduction Iron (DRI) and Low-Carbon Steelmaking

The accelerating shift toward low-emission steelmaking significantly boosts demand for DR-grade pellets, which offer higher Fe content and lower gangue levels essential for gas-based DRI technologies. As countries pursue decarbonization, steel producers increasingly invest in DRI–electric furnace routes to reduce dependence on coal-based blast furnaces. Hydrogen-ready and natural gas–based DRI projects under development in the Middle East, Europe, and India require large volumes of high-quality pellets, strengthening long-term consumption. DR-grade pellets also support operational stability by ensuring uniform metallization rates and lower energy consumption. Government-backed green steel initiatives, carbon pricing mechanisms, and technological collaborations further accelerate the transition toward direct reduction processes. With global DRI capacity projected to expand rapidly, pellet manufacturers are upgrading beneficiation and induration systems to meet stringent quality specifications. This shift positions DR-grade pellets as a pivotal enabler of sustainable, low-carbon steel production worldwide.

- For instance, Emirates Steel Arkan operates a 0 million-tonne-per-year Energiron DRI module capable of achieving metallization levels above 94%, using high-Fe pellets sourced from certified DR-grade producers such as Bahrain Steel and Metalloinvest.

Advancements in Pelletizing Technologies and Beneficiation Infrastructure

Rapid technological advancements in beneficiation, balling, and induration systems drive market growth by enabling the production of higher-strength, lower-impurity pellets suitable for premium BF and DR applications. Modern pelletizing plants integrate automated moisture control, improved ore grinding, and real-time pellet-size monitoring, enhancing output uniformity and mechanical durability. Upgraded travelling grate and grate-kiln systems offer improved energy efficiency, lower fuel consumption, and better temperature control, ensuring consistent pellet quality. Investments in ore beneficiation such as wet high-intensity magnetic separation (WHIMS), flotation systems, and advanced screening support the use of lower-grade ores, expanding feedstock availability. Mining companies increasingly deploy digitalization and process automation to optimize throughput and reduce waste, making pellet production more cost-effective. These technological improvements strengthen competitiveness and ensure reliable pellet supply for global steelmakers seeking stable, high-performance raw materials.

Key Trends and Opportunities:

Growing Adoption of Green Pellets and Low-Emission Processing

One of the most significant trends shaping the market is the rising adoption of green pellets and energy-efficient pelletizing processes. As steelmakers commit to emission reduction, pellet manufacturers implement low-carbon fuel alternatives, waste-heat recovery systems, and advanced combustion technologies. Increased focus on using biomass, hydrogen, and renewable electricity in induration lines creates new opportunities across the value chain. The shift toward carbon-neutral steel production also encourages research into cold-bonded pellets, bio-binders, and low-additive formulations that reduce energy intensity. Environmental regulations in Europe and emerging carbon taxation frameworks accelerate the transition to eco-friendly pelletizing, prompting producers to invest in cleaner technologies. These innovations position green pellets as a strategic growth avenue for both BF and DR applications.

- For instance, LKAB’s HYBRIT pilot line in Sweden has successfully produced fossil-free green pellets using 100% hydrogen-based heating, demonstrating reductions of up to 90% in induration-related CO₂ emissions; the pilot furnace operates at temperatures exceeding 1,250°C while maintaining pellet strength comparable to conventional processes.

Increasing Use of Magnetite Ores and High-Grade Pellet Feed

Another major trend is the growing industry preference for magnetite-based pellet feed due to its superior heat-hardening properties and lower net energy requirement during induration. Magnetite concentrate enables the production of stronger pellets with more stable metallurgical performance, supporting both DR and BF routes. Mining companies are expanding magnetite beneficiation projects, especially in Australia, Brazil, Sweden, and India, to meet rising demand from advanced steelmaking operations. Increasing adoption of high-grade pellet feed also aligns with steel producers’ efforts to reduce slag volume, improve furnace permeability, and increase overall efficiency. As the global steel industry seeks higher productivity with lower emissions, magnetite-based pellets offer a significant long-term opportunity.

- For instance, LKAB’s magnetite concentrate from the Kiruna and Malmberget mines contains Fe grades of up to 70%, and its processing system integrates autogenous grinding mills capable of handling over 85,000 tonnes of ore per day, supplying high-grade feed for BF and DR pellets.

Key Challenges:

Volatility in Iron Ore Quality and Limited Availability of High-Grade Feedstock

Fluctuations in iron ore quality and the declining availability of high-grade hematite and magnetite resources present a critical challenge for pellet manufacturers. Many mining regions face increasing ore impurities such as silica, alumina, and phosphorus, requiring more intensive beneficiation to meet pelletizing standards. This raises production costs, increases energy consumption, and pressures margins. Supply constraints in premium ore grades also disrupt long-term feedstock planning for pellet plants. Dependency on complex beneficiation circuits, coupled with variability in ore deposits, can hinder consistent pellet quality and limit producers’ ability to meet stringent DR-grade specifications demanded by emerging low-carbon steel routes.

High Capital Intensity and Energy Costs in Pelletizing Operations

Pelletizing plants require significant capital investment for beneficiation equipment, grinding mills, balling circuits, and high-temperature induration systems. Operating costs remain high due to energy-intensive processes, particularly in travelling grate and grate-kiln technologies. Rising prices of natural gas, electricity, and furnace fuels increase cost pressures, especially for DR-grade pellets requiring precise thermal control. Stricter environmental compliance adds additional expenses for emission-reduction systems and monitoring technologies. For new entrants, financial barriers limit expansion, while established producers must continually invest in modernization to maintain competitiveness. These economic and operational pressures remain key constraints for the global pellet supply chain.

Regional Analysis:

North America

North America accounts for around 18% of the global iron ore pellets market, supported by strong steel production in the U.S. and Canada and the region’s gradual shift toward EAF- and DRI-based technologies. The presence of large magnetite reserves and pelletizing facilities in Minnesota and Michigan further strengthens supply capabilities. Rising investment in green steel initiatives and the modernization of integrated mills enhances pellet demand, particularly for DR-grade pellets. Infrastructure development, automotive manufacturing, and construction activity provide steady downstream consumption, while environmental regulations encourage higher usage of low-emission, high-quality pellet feed.

Europe

Europe holds about 22% market share, driven by its advanced steelmaking ecosystem and rapid transition toward low-carbon DRI–EAF pathways. Countries such as Sweden, Germany, and Austria actively expand DR-ready pellet demand as part of their green steel roadmaps. The region benefits from abundant magnetite resources, especially in the Nordic countries, which support high-grade pellet production. Strict emission standards and carbon taxation policies accelerate sinter-to-pellet substitution across integrated mills. Growing investments in hydrogen-based steelmaking, spearheaded by European steel majors, further reinforce long-term opportunities for premium DR-grade pellets in the region.

Asia-Pacific

Asia-Pacific dominates the global market with around 45% share, led by massive steel production capacities in China, India, Japan, and South Korea. Rapid urbanization, manufacturing expansion, and infrastructure megaprojects drive extensive pellet consumption across BF and emerging DR facilities. India and China continue expanding pelletizing capacities to utilize lower-grade iron ore resources efficiently. The region also benefits from cost-effective beneficiation operations and rising adoption of pellet-based burden optimization in blast furnaces. Increasing investment in energy-efficient pelletizing technologies and the push toward greener steelmaking strengthen APAC’s position as the primary demand hub for global pellet suppliers.

Latin America

Latin America represents around 8% of the market, supported by significant pellet production in Brazil and Mexico. Brazil, a leading exporter of high-quality pellets, drives most of the region’s output through large-scale operations benefitting from rich hematite and magnetite reserves. Growing steel production in Mexico and targeted modernization of blast furnace facilities contribute to rising domestic consumption. Export-oriented strategies and competitive production costs enable regional producers to supply European, Middle Eastern, and Asian markets. Continued investments in beneficiation, logistics infrastructure, and environmental compliance strengthen Latin America’s role in global pellet supply chains.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% market share, with rapid growth driven by expanding DRI-based steelmaking hubs in the UAE, Saudi Arabia, Oman, and Iran. The region’s focus on natural gas–based DRI technologies fuels strong demand for high-grade DR pellets. Africa’s emerging mining and beneficiation projects, particularly in South Africa and Mauritania, enhance supply potential. Government-backed industrialization programs and investments in new pelletizing facilities support long-term market development. Strategic geographic proximity to Europe and Asia further strengthens MEA’s role as a regional producer and exporter of premium pellets.

Market Segmentations:

By Grade

- Blast Furnace (BF)

- Direct Reduction (DR)

By Balling Technologies

- Balling Disc

- Balling Drum

By Product Source

- Hematite

- Magnetite

- Others

By Pelletizing Process

- Travelling Grate (TG)

- Grate Kiln (GK)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the iron ore pellets market is characterized by a concentrated group of global mining and pelletizing leaders that prioritize high-grade pellet production, technological modernization, and long-term supply agreements with steel producers. Major companies including Vale, Rio Tinto, LKAB, Cleveland-Cliffs, Arya Iron & Steel, Bahrain Steel, and Ferrexpo focus on expanding beneficiation capacity, improving pellet quality, and enhancing energy-efficient induration technologies to meet rising demand from BF and DR routes. Players increasingly invest in magnetite processing, WHIMS-based beneficiation, and digital process optimization to strengthen operational efficiency and product consistency. Strategic initiatives such as capacity expansions, joint ventures with steelmakers, and supply diversification into Europe, the Middle East, and Asia support competitive positioning. Additionally, industry leaders are aligning with global decarbonization trends by developing DR-grade and green pellets tailored for hydrogen-based steelmaking, ensuring long-term relevance as the sector transitions toward low-carbon production pathways.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- METALLOINVEST

- Iron Ore Company of Canada

- Bahrain Steel

- FERREXPO

- Anglo American

- LKAB Koncernkontor

- Cleveland-Cliffs

- Evraz

- Jindal SAW

- BHP Billiton

Recent Developments:

- In June 2024, Metalloinvest signed a 15-year supply agreement with OMK to deliver approximately 53 million tonnes of DR-grade iron ore pellets, reinforcing its focus on high-grade pellet output for direct-reduction routes.

- In August 2023, Bahrain Steel signed a Letter of Intent (LOI) with Essar Group to supply 4 million tpa of DR-grade pellets to the Green Steel Arabia project starting production around 2027.

- In February 2024, IOC (via Rio Tinto) received C$18 million from the Canadian government’s Low-Carbon Economy Fund to decarbonise pellet and concentrate production, especially replacing heavy fuel oil in pelletising operations.

Report Coverage:

The research report offers an in-depth analysis based on Grade, Balling Technologies, Product Source, Pelletizing Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-grade BF and DR pellets will rise as steelmakers expand low-emission and high-efficiency production routes.

- Global DRI capacity growth will accelerate the need for premium DR-grade pellets with higher Fe content and lower gangue levels.

- Adoption of hydrogen-based steelmaking will create new opportunities for green pellets and low-carbon induration technologies.

- Investments in magnetite beneficiation will increase as producers seek consistent, high-quality pellet feed for advanced steel processes.

- Pelletizing plants will integrate more automation, AI-driven control systems, and digital monitoring to improve productivity and reduce costs.

- Energy-efficient travelling grate and grate-kiln systems will become standard as manufacturers target lower fuel consumption and stricter emissions compliance.

- Expansion of pelletizing capacity in Asia-Pacific and the Middle East will strengthen regional supply chains.

- Mining companies will intensify exploration of lower-grade ores to secure long-term feedstock availability.

- Trade flows will shift as pellet exporters diversify beyond traditional Asian and European markets.

- Sustainability requirements will push producers to adopt renewable energy, bio-binders, and waste-heat recovery across pelletizing operations.