Market Overview

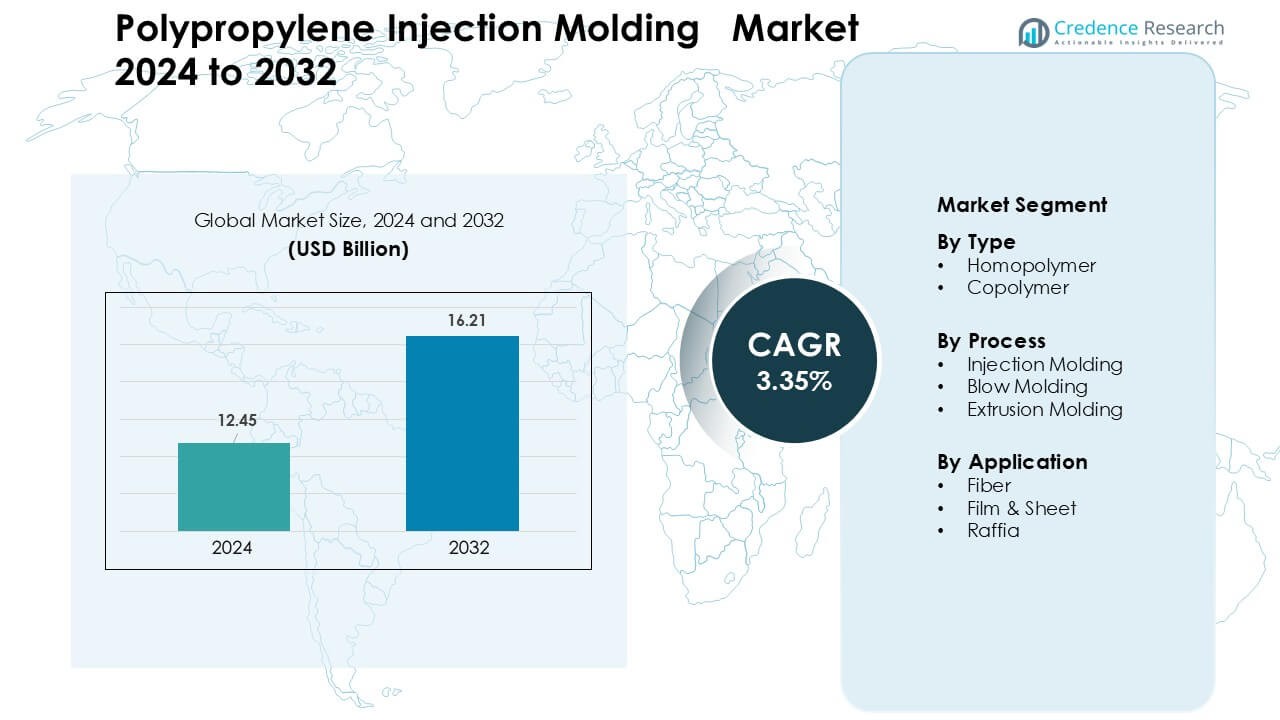

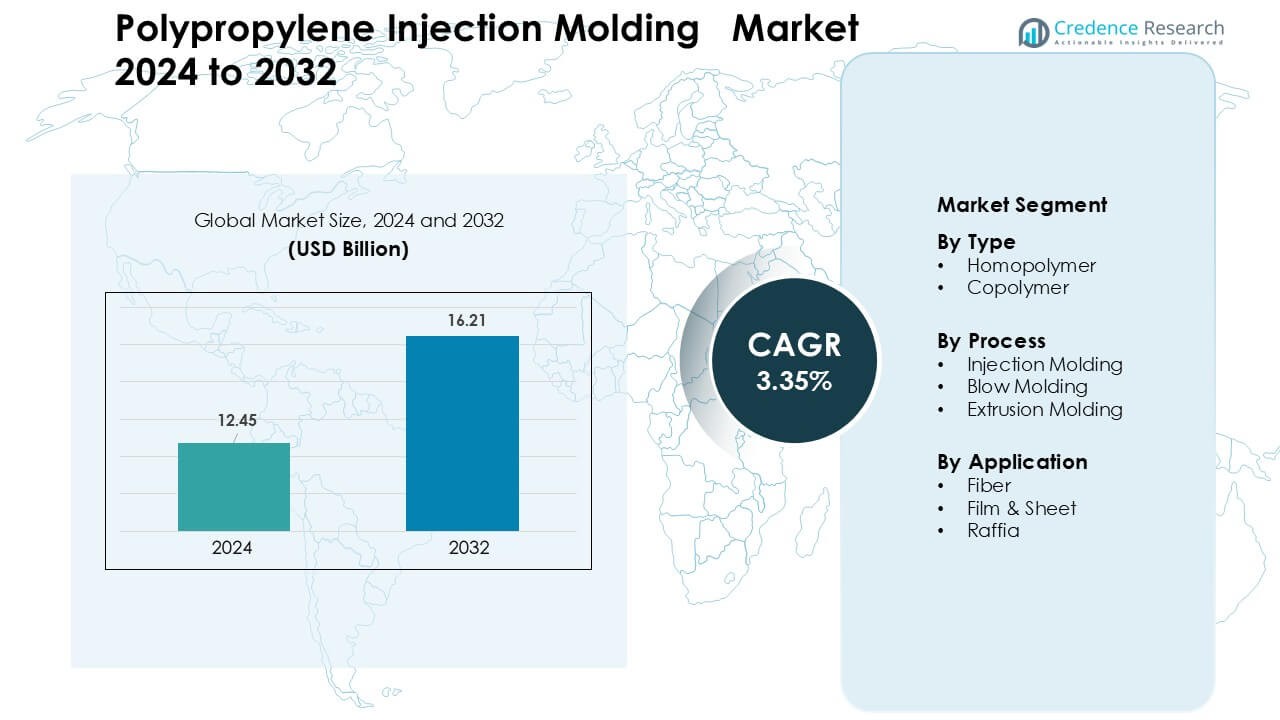

Polypropylene Injection Molding market was valued at USD 12.45 billion in 2024 and is anticipated to reach USD 16.21 billion by 2032, growing at a CAGR of 3.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Injection Molding Market Size 2024 |

USD 12.45 Billion |

| Polypropylene Injection Molding Market, CAGR |

3.35% |

| Polypropylene Injection Molding Market Size 2032 |

USD 16.21 Billion |

The polypropylene injection molding market is shaped by major players including DuPont, Braskem, Reliance Industries Limited, INEOS Group, LG Chem, SABIC, LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, BASF SE, and Borealis AG, each expanding advanced polypropylene grades for packaging, automotive, and consumer goods. These companies invest in reinforced, high-clarity, and recyclable materials to support large-volume molding operations across global manufacturing hubs. Asia-Pacific remained the leading region in 2024 with 41% share, driven by strong production capacity, rapid industrial growth, and rising demand from FMCG, automotive, electronics, and appliance sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The polypropylene injection molding market reached USD 45 billion in 2024 and is projected to hit USD 16.21 billion by 2032 at a CAGR of 3.35 %.

- Demand grew as packaging, automotive, and consumer goods producers increased use of lightweight, durable, and recyclable polypropylene components.

- Adoption of sustainable materials, recycled polypropylene, and advanced reinforced grades shaped new product trends across high-volume molding lines.

- Leading companies enhanced competitiveness through capacity expansion, high-performance grade development, and stronger partnerships with OEMs and converters.

- Asia-Pacific led the market with 41% share, while homopolymer dominated the type segment with 58% share and injection molding remained the top process with 61% share.

Market Segmentation Analysis:

By Type

Homopolymer dominated the type segment in 2024 with nearly 58% share due to strong use in rigid packaging, consumer goods, automotive interiors, and appliance components. Buyers preferred homopolymer because the grade offers high stiffness, good chemical resistance, and lower processing cost that supports large-volume output. Demand stayed solid as FMCG brands expanded lightweight packaging formats. Copolymer grew at a steady pace due to tougher impact properties, yet homopolymer maintained a lead because manufacturers used it widely for injection-molded caps, containers, and functional parts.

- For instance, LyondellBasell one of the world’s largest polypropylene homopolymer producers describes its homopolymer resins as delivering exceptional strength, clarity, and processability via Ziegler-Natta-catalyst technology, enabling efficient high-volume injection molding for packaging and automotive applications.

By Process

Injection molding held the dominant share in 2024 with roughly 61% because the process supports fast cycle time and high part accuracy for mass production. Producers relied on this process to supply automotive trims, storage boxes, medical components, and closures. Injection molding stayed ahead due to better design flexibility and lower scrap generation. Blow molding expanded in bottles and large hollow products, while extrusion molding gained use in sheets and profiles. Yet injection molding stayed the preferred option for polypropylene due to its broad industrial acceptance.

- For instance, the low melt viscosity and low moisture absorption (PP absorbs less than 0.01% water over 24 h) mean PP does not require pre-drying before molding, simplifying the processing workflow and speeding up throughput for large-scale production runs.

By Application

Film & sheet led the application segment in 2024 with close to 36% share, supported by heavy consumption in flexible packaging, food wraps, labels, and lamination structures. Packaging converters selected these grades for high clarity, strong seal strength, and good barrier improvement after metallization. Fiber grades grew due to geotextiles and hygiene products, while raffia advanced in woven bags for agriculture and cement. Film & sheet remained dominant because packaging producers scaled high-volume lines to meet rising demand for lightweight and recyclable solutions.

Key Growth Drivers

Growing Demand from Packaging and Consumer Goods

Strong expansion in packaging and consumer goods remained a major growth driver for the polypropylene injection molding market. Brands used injection-molded polypropylene for caps, closures, tubs, trays, and rigid containers because the material supports light weight, durability, and high design freedom. Global food and beverage companies expanded recyclable packaging lines, which pushed greater adoption of polypropylene grades designed for efficient molding cycles. Growth in personal care and household products increased purchases of molded components with high stiffness and chemical resistance. E-commerce also boosted demand for protective packaging formats. Rising output from FMCG and retail supply chains strengthened long-term market momentum.

- For instance, rigid PP boxes and stackable containers are widely used for warehousing and distribution of consumer goods, enabling lightweight, strong and reusable packaging an advantage in high-volume online retail logistics.

Rising Use of Polypropylene in Automotive Light weighting

Automotive manufacturers drove steady growth as polypropylene injection-molded components replaced heavier metal and rubber parts. Carmakers increased the use of molded polypropylene for dashboards, trims, consoles, under-the-hood parts, and battery housings to reduce vehicle weight. The shift toward fuel-efficient and electric vehicles raised demand for lighter components with high impact resistance and dimensional stability. Suppliers adopted advanced reinforced polypropylene grades to meet structural and safety needs while keeping costs low. Large investments in mobility platforms across Asia, Europe, and North America supported volume production. Growing EV manufacturing capacity further strengthened polypropylene consumption in automotive interiors and functional parts.

- For instance, when designing battery housings and under-hood components, many suppliers use fibre-reinforced polypropylene such as Fibremod from Borealis because it delivers structural strength and rigidity comparable to heavier materials while reducing mass of components significantly.

Advancement in High-Performance Polypropylene Grades

Continuous improvement in high-performance polypropylene grades created strong market expansion. Producers introduced impact-modified, mineral-filled, and glass-reinforced variants that enhanced stiffness, heat resistance, and moldability. These materials supported new applications in appliances, medical devices, electrical housings, and industrial components. Faster cycle times, better color consistency, and improved recyclability encouraged broader adoption in high-volume production lines. Innovations in odor-reduction and food-contact compliance increased demand from consumer and packaging industries. Growing investment in sustainable, low-VOC, and post-consumer recycled polypropylene solutions also created new opportunities for injection-molded parts across major end-use sectors.

Key Trends & Opportunities

Shift Toward Recycled and Sustainable Polypropylene Solutions

A key trend shaping the market is the rise of recycled and sustainable polypropylene grades. Brands increased commitments to circular packaging, which pushed demand for high-quality recycled polypropylene suitable for molding closures, housings, and consumer containers. Advances in chemical recycling improved feedstock purity and color stability. Regulations on plastic waste drove industries to adopt recyclable mono-material structures in packaging. Manufacturers also explored bio-based polypropylene grades for reduced carbon impact. Growth in closed-loop systems across FMCG and automotive supply chains created long-term opportunity for molded components using environmentally aligned materials.

- For instance, Amcor’s recyclable mono-PP bottles and containers use a combination of high-quality PP grades and optimized design for injection molding, allowing FMCG brands to meet circular economy goals while retaining durability and design flexibility.

Automation and Digitalization in Injection Molding Operations

Automation became a major opportunity as factories adopted robotic handling, smart mold monitoring, and real-time quality control. These systems enabled consistent part accuracy, lower defect rates, and rapid tool changes. Machine learning-based process optimization reduced cycle time and stabilized output during large production runs. Demand for integrated MES and Industry 4.0 platforms expanded in automotive, electronics, and medical molding facilities. Smart molding technology also helped reduce energy use, supporting sustainability goals. Rising investment in advanced molding machinery created room for capacity growth and operational efficiency improvements.

- For instance, Engel Austria integrates robotic pick-and-place systems and multi-axis automation with its injection molding machines, enabling cycle times under 20 seconds for small consumer parts while maintaining tight dimensional tolerances of ±0.05 mm.

Key Challenges

Volatility in Raw Material Supply and Pricing

Fluctuating polypropylene resin prices created a major challenge for manufacturers. Supply disruptions in propylene monomer markets, refinery outages, and trade restrictions triggered recurrent price variability. Production cost uncertainty affected profitability for molding companies serving packaging, automotive, and consumer goods. Smaller processors struggled with margin control during high-price cycles. Global dependence on petrochemical feedstocks limited flexibility for suppliers. Volatile resin costs also impacted contracts with large OEMs, forcing frequent renegotiations and tighter cost control across supply chains.

Competition from Alternative Materials and Processes

The market faced pressure from materials such as ABS, polyethylene, and engineering plastics that offered better strength, thermal stability, or surface finish for specific applications. Composites and 3D-printed materials also gained traction in low-volume or customized production. Regulatory pressure on plastics increased interest in paper-based and biodegradable alternatives, especially in packaging. These substitutions reduced polypropylene demand in selected segments. Competing molding processes like thermoforming and blow molding also captured opportunities in lightweight packaging and large hollow products. Manufacturers needed continuous innovation to maintain polypropylene’s competitive position.

Regional Analysis

North America

North America held nearly 28% share in 2024 due to strong demand from packaging, automotive, medical devices, and household goods. The United States led regional consumption as major FMCG and healthcare manufacturers expanded rigid packaging and molded component production. Automakers adopted lightweight polypropylene parts for trims, interiors, and EV-related components, which supported steady output. The region also saw higher interest in advanced copolymer grades and recycled polypropylene for sustainable packaging. Investments in automated molding lines and smart manufacturing strengthened market growth across key end-use sectors.

Europe

Europe accounted for about 24% share in 2024, driven by strict sustainability targets and high adoption of recyclable polypropylene packaging. Germany, Italy, and France strengthened demand through strong automotive, industrial, and electrical sectors that relied on high-performance molded parts. Regional regulations on single-use plastics pushed brands to expand mono-material polypropylene packaging. Growth in medical molding and consumer goods also supported volume expansion. Investments in bio-based polypropylene and chemical recycling technologies helped maintain Europe’s competitive position. Demand grew steadily as manufacturers adopted advanced molding systems to meet quality and efficiency standards.

Asia-Pacific

Asia-Pacific dominated the global market in 2024 with nearly 41% share, supported by large-scale packaging, automotive, electronics, and appliance production. China and India led demand growth due to expanding FMCG consumption and rising manufacturing output. Automakers invested in polypropylene components to support lightweight design in passenger vehicles and electric mobility. Southeast Asia strengthened demand through flexible packaging and consumer product manufacturing. Large production capacities and low-cost processing made the region a global hub for polypropylene molding. Continuous investments in extrusion, injection, and compounding facilities supported long-term expansion.

Latin America

Latin America captured close to 4% share in 2024, driven by growth in food packaging, household goods, and automotive component production. Brazil and Mexico remained the key contributors as regional converters expanded polypropylene-based rigid packaging for food, cosmetics, and cleaning products. Automotive suppliers increased use of molded polypropylene parts to support local vehicle assembly. Cost-sensitive sectors preferred homopolymer grades for mass-market goods. Infrastructure investment and rising urban consumption supported moderate growth. Recycling initiatives gained momentum, improving adoption of sustainable polypropylene solutions across regional manufacturing lines.

Middle East & Africa

Middle East & Africa held nearly 3% share in 2024 with demand driven by packaging, construction, and consumer product manufacturing. GCC countries expanded polypropylene molding capacity due to proximity to petrochemical feedstocks. Food and beverage companies increased use of rigid packaging formats, supporting steady demand. Africa’s growth came from rising consumption of low-cost household goods and expanding manufacturing clusters. Regional investments in plastics processing facilities strengthened local supply. Gradual adoption of modern injection molding systems and interest in recyclable polypropylene supported future market growth.

Market Segmentations:

By Type

By Process

- Injection Molding

- Blow Molding

- Extrusion Molding

By Application

- Fiber

- Film & Sheet

- Raffia

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the polypropylene injection molding market features major players such as DuPont, Braskem, Reliance Industries Limited, INEOS Group, LG Chem, SABIC, LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, BASF SE, and Borealis AG, each strengthening their position through capacity expansions, advanced polypropylene grade development, and investments in high-efficiency molding materials. These companies focus on impact-modified, reinforced, and recyclable polypropylene solutions to meet rising demand from packaging, automotive, electronics, and consumer goods sectors. Strategic partnerships with converters and OEMs help secure long-term supply agreements. Many producers also invest in circular polymer programs, chemical recycling technologies, and bio-based polypropylene to align with sustainability requirements. Continuous upgrades in compounding capabilities, regional distribution networks, and application development centers enhance competitiveness and support large-scale adoption across global manufacturing ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont

- Braskem

- Reliance Industries Limited

- INEOS Group

- LG Chem

- SABIC

- LyondellBasell Industries Holdings B.V.

- Exxon Mobil Corporation

- BASF SE

- Borealis AG

Recent Developments

- In September 2025, Borealis AG announced an investment of over €100 million to expand and upgrade its polypropylene compounding facilities in Schwechat, Austria, adding new PP compounding capacity aimed at high-performance applications such as automotive and appliance injection-molded parts.

- In June 2024, DuPont announced an agreement to acquire Donatelle Plastics Incorporated, a contract manufacturer specializing in medical‑device components via injection molding, silicone processing, and precision tooling. This strengthens DuPont’s presence in healthcare‑segment molded plastic components.

- In January 2024, Braskem, in collaboration with Shell Chemicals, announced a program to produce circular polypropylene using ISCC‑PLUS–certified feedstock (from pyrolysis oil of plastic waste). This circular PP is intended for use in packaging, automotive, and other applications

Report Coverage

The research report offers an in-depth analysis based on Type, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as packaging and FMCG companies expand recyclable rigid packaging.

- Automotive suppliers will increase use of lightweight polypropylene components for EV platforms.

- Advanced copolymer and reinforced grades will support new applications in appliances and electronics.

- Growth in medical molding will boost demand for high-purity and chemical-resistant polypropylene.

- Automation and smart molding systems will enhance production speed and accuracy.

- Chemical recycling and bio-based polypropylene will gain stronger industry adoption.

- Manufacturers will invest in high-clarity and odor-controlled grades for food and personal care packaging.

- Asia-Pacific will continue to hold the dominant regional position due to large processing capacity.

- Regulatory pressure on sustainability will shift brands toward mono-material packaging formats.

- Global players will expand compounding and molding support centers to strengthen market presence.