Market Overview:

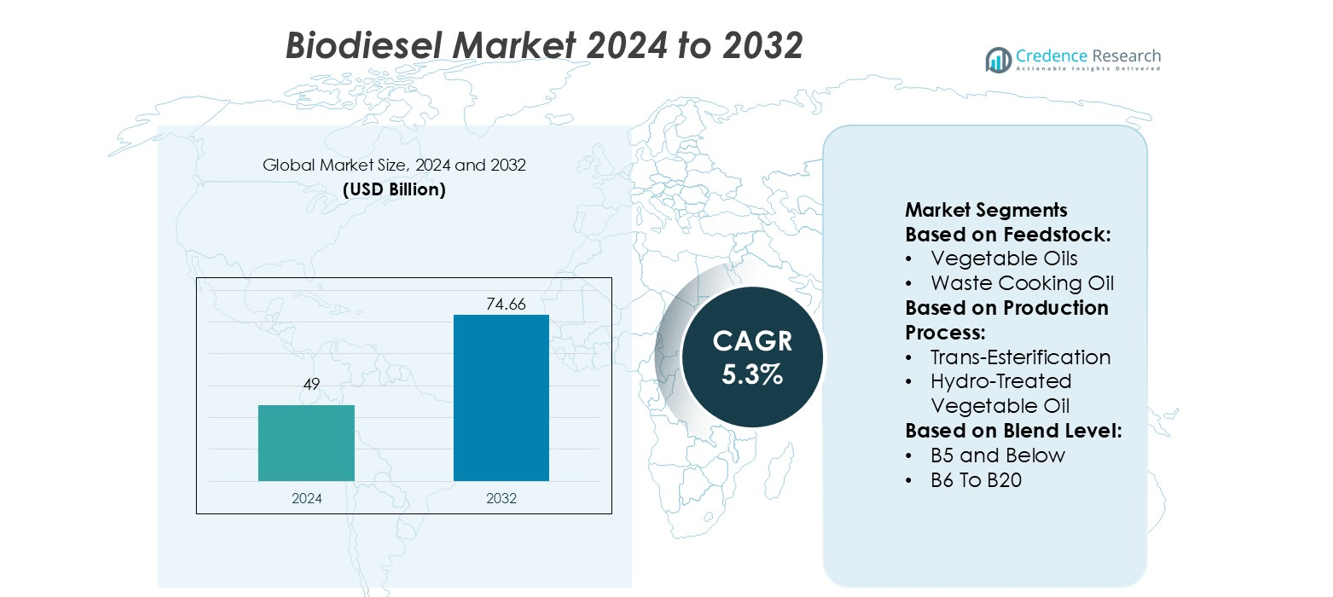

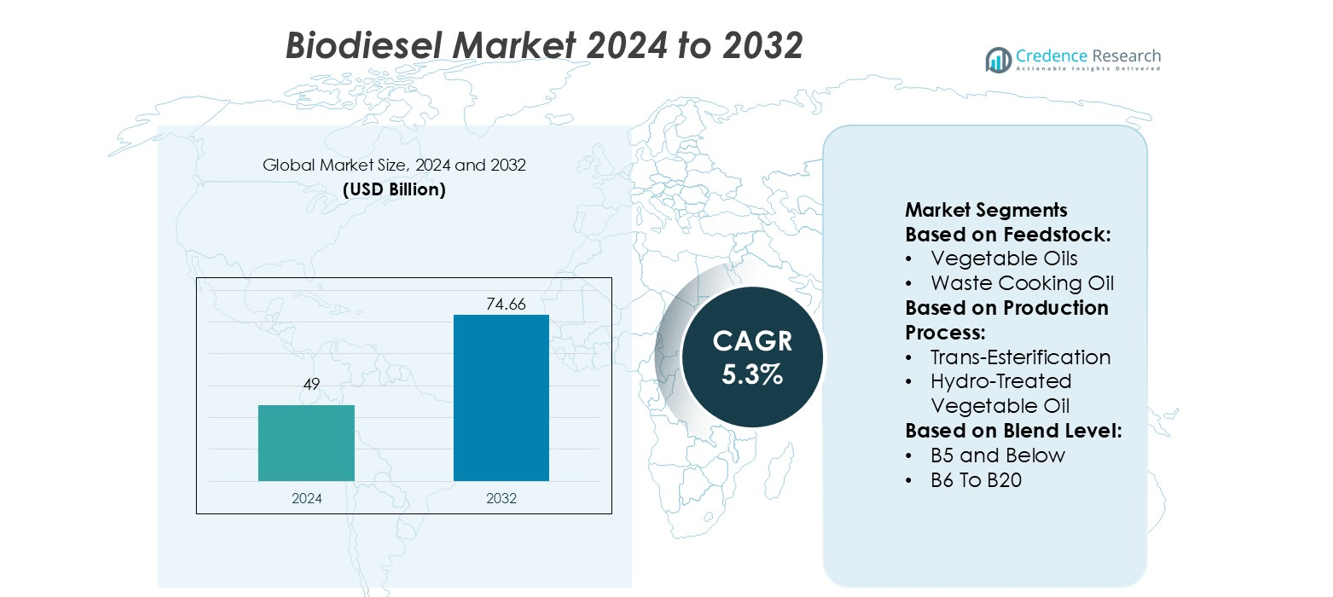

Biodiesel Market size was valued USD 49 billion in 2024 and is anticipated to reach USD 74.66 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biodiesel Market Size 2024 |

USD 49 billion |

| Biodiesel Market, CAGR |

5.3% |

| Biodiesel Market Size 2032 |

USD 74.66 billion |

The biodiesel market is led by key players including Renewable Biofuels, Inc., Cargill, Inc., Bunge Ltd., TerraVia Holdings, Inc., Archer Daniels Midland Company (ADM), Manuelita S.A., Ag Processing, Inc., Ecodiesel Colombia S.A., Wilmar International Ltd., and FutureFuel Corp. These companies maintain competitiveness through strategic feedstock sourcing, advanced production technologies, and global distribution networks. Investments in trans-esterification, hydro-treated vegetable oil (HVO), and co-processing processes enhance fuel quality and operational efficiency. Strong R&D efforts focus on blend optimization, cold-flow properties, and scalable production. Europe emerges as the leading region, holding 42% of the global market share, driven by long-standing renewable fuel mandates, efficient waste-oil collection, and robust vegetable oil production. Supportive policies and technological innovation in Europe continue to strengthen market leadership, while other regions are expanding capacity to meet rising biodiesel demand.

Market Insights

- The global biodiesel market was valued at USD 49 billion in 2024 and is projected to reach USD 74.66 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Europe leads the market with a 42% share, supported by strong renewable fuel mandates, efficient waste-oil collection, and high vegetable oil production. North America holds around 40%, while Asia-Pacific, South America, and the Middle East & Africa share the remainder.

- Vegetable oils dominate the feedstock segment with a 64% share, while trans-esterification leads the production process segment with a 71% share. B5 and below blends account for nearly 48% of the blend-level segment.

- Market growth is driven by government incentives, carbon-reduction initiatives, and increasing adoption of advanced technologies such as HVO, co-processing, and automation in production.

- Competitive pressure is high, with leading players focusing on feedstock diversification, strategic partnerships, and R&D for fuel quality improvement and scalable production to meet rising demand globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Feedstock

The vegetable oils sub-segment dominates the biodiesel market with a 64% share in 2024, driven by the widespread availability of palm, soybean, and rapeseed oils. These feedstocks benefit from established supply chains, mature extraction technology, and strong government incentives supporting first-generation biodiesel. Waste cooking oil and tallow are emerging alternatives due to lower feedstock costs, favorable carbon credit policies, and environmental sustainability. However, their share remains smaller because of limited collection infrastructure and inconsistent quality. Rising global demand for renewable fuels continues to reinforce vegetable oils as the preferred feedstock, especially in regions with large oilseed production.

- For instance, Cargill’s renewable-fuels division reports that its advanced biodiesel facility in Ghent, Belgium will process 115,000 metric tons per year of multi-feedstock (including acid oils, industrial residues, fat recovered from sewage-sludge) waste-and-residue feedstocks — a first for Europe.

By Production Process

Trans-esterification holds the largest share at 71%, maintaining dominance due to mature technology, lower capital requirements, and compatibility with existing biodiesel plants. This process allows efficient conversion of vegetable oils and animal fats into fatty acid methyl esters, meeting industry standards and regulatory approvals. Hydro-treated vegetable oil (HVO) and co-processed/co-refined diesel are witnessing growth due to advantages in fuel quality, improved cold-flow performance, and seamless integration with petroleum refineries. Increasing refinery investments, coupled with demand for premium-quality biodiesel, are supporting the adoption of these advanced processes, especially in markets emphasizing engine performance and emission reduction.

- For instance, Bunge has signed an MoU with Chevron Corporation (September 2021) to develop feed-stock pretreatment capacity: the companies stated they anticipate approximately doubling combined capacity from 7,000 tons per day by end-2024.

By Blend Level

B5 and below leads the blend-level segment with a 48% share in 2024, supported by engine warranty compliance, easy adoption, and existing fuel infrastructure. These low-level blends enable smooth integration into conventional diesel engines with minimal modification, facilitating widespread use. B6 to B20 blends are gradually expanding as fleet operators adopt higher renewable content for environmental compliance. B100 pure biodiesel is growing in niche applications where sustainability and emission reduction are critical, driven by government mandates and corporate sustainability initiatives. Rising awareness of carbon footprint reduction continues to encourage higher blend adoption globally.

Key Growth Drivers

Regulatory Support for Renewable Fuel Mandates

Governments worldwide impose renewable‑fuel blend targets and offer incentives that drive biodiesel adoption. For example, policies under the Renewable Fuel Standard in the U.S. and the Renewable Energy Directive (RED II) in Europe push diesel substitutes into transport fuels. These mandates create a stable demand base and encourage investment in production infrastructure. Coupled with subsidies and tax credits, regulatory frameworks reduce risk for producers and accelerate market growth.

- For instance, ADM’s flagship CCS project at its Decatur, Illinois facility achieved the first milestone by storing 1 million metric tons of CO₂ in the 2011-2014 period.

Pressure to Reduce Carbon Emissions and Energy Security

Rising concern over greenhouse‑gas emissions and dependence on fossil fuels supports biodiesel growth as a replacement for petroleum diesel. Biodiesel made from feedstocks such as vegetable oils, animal fats and waste oils offers a renewable fuel option that aligns with national decarbonisation goals. At the same time, biodiesel supports energy‑security strategies by utilising domestic feedstocks and reducing import dependency. These twin pressures drive industry expansion across transportation and industrial sectors.

- For instance, Manuelita Aceites y Energía reports that its Colombian palm-based biodiesel operations achieved lifecycle greenhouse-gas (GHG) savings of up to 83 % compared with fossil diesel.

Technological Advancements and Feedstock Diversification

Innovations in biodiesel production processes and feedstock sources enhance efficiency and sustainability, stimulating market expansion. Improvements in trans‑esterification, hydro‑treated vegetable oil (HVO) and co‑processing technologies enable higher yields and better fuel properties. Meanwhile, diversification into waste cooking oil, tallow and non‑food oils helps mitigate feedstock risks. Such developments boost production capacity and lower effective costs, making biodiesel more competitive with conventional diesel.

Key Trends & Opportunities

Shift Towards Waste‑ and Residue‑Based Feedstocks

A growing trend in the biodiesel market is use of non‑food feedstocks such as used cooking oil (UCO), animal fats and other waste streams. These sources reduce competition with food crops and improve the life‑cycle greenhouse‑gas profile of biodiesel. The circular‑economy model opens opportunities for cost‑effective production and new supply chains. As the industry develops more waste‑feedstock processing capacity, producers gain a competitive edge.

- For instance, studies on 100% biodiesel (B100) compared to conventional diesel show significant reductions in various emissions, including up to a 47% reduction in particulate matter, a 67% reduction in unburned hydrocarbons, and a 48% reduction in carbon monoxide.

Premium Applications and New Sectors (Marine, Rail, Power Generation)

Biodiesel is increasingly penetrating hard‑to‑electrify sectors such as marine, rail and power generation where low‑carbon liquid fuels are needed. These segments present significant opportunity because electrification is challenging and policymakers favour drop‑in biofuels. Producers expanding into these applications can capture value beyond traditional road transport. Expansion into these sectors supports higher volume growth and diversifies end‑use markets.

- For instance, Ecodiesel’s primary facility in Barrancabermeja, Santander has an annual biodiesel production capacity of 120,000 metric tons. This large scale permits adaptation of its palm-based biodiesel to tougher duty cycles such as power generation where continuous run-time is required.

Key Challenges

Feedstock Availability, Price Volatility and Sustainability Concerns

Feedstock sourcing remains a major challenge for biodiesel producers. Vegetable oils, animal fats and waste oils face competition from food, feed and other bio‑industries, driving up prices and creating supply uncertainty. Moreover, concerns about land‑use change, deforestation and sustainability of first‑generation feedstocks raise regulatory and reputational risks. These factors can increase production cost and hinder scale‑up of biodiesel operations.

Competitive Pressure from Other Renewable Fuels and Renewable Diesel Technologies

The biodiesel market encounters headwinds from alternative renewable‑diesel technologies (such as HVO and synthetic diesel) and stricter electric‑vehicle adoption trajectories. These competitors may offer better fuel properties or lower lifecycle carbon intensity, attracting investment and policy support. Biodiesel producers must continually improve efficiency, feedstock sourcing and product quality to maintain market position in the evolving clean‑fuel landscape.

Regional Analysis

North America

North America holds approximately 40% of the global biodiesel market in 2024, making it a key regional contributor. Growth is driven by strong renewable fuel mandates, especially the U.S. Renewable Fuel Standard, and state-level incentives supporting production and blending. The region benefits from abundant feedstocks, including soybean oil, waste cooking oil, and animal fats. Producers are retrofitting existing diesel plants to expand capacity while reducing costs. Established logistics, blending infrastructure, and continuous government support ensure stable market expansion and attract further investment in biodiesel production.

Europe

Europe accounts for about 42% of the global biodiesel market in 2024, holding the largest regional share. Growth is supported by long-standing renewable fuel mandates, effective collection of waste cooking oil, and strong vegetable oil production in Germany, France, and Italy. Carbon reduction policies and sustainability targets drive demand further. Advances in trans-esterification and hydro-treated vegetable oil (HVO) production enhance fuel quality and efficiency. Government incentives, premium pricing for low-carbon fuels, and technological upgrades support production expansion, consolidating Europe’s leadership in biodiesel consumption and innovation.

Asia-Pacific

Asia-Pacific holds approximately 10% of the biodiesel market in 2024 but is one of the fastest-growing regions. Growth is fueled by rising diesel vehicle fleets, large oilseed production in Indonesia, Malaysia, and India, and government biofuel policies promoting renewable blends. Waste cooking oil collection and higher blend mandates improve feedstock availability. Investment in scalable production technologies and refinery integration enhances output. Rising environmental awareness and carbon reduction goals accelerate adoption across transportation and industrial sectors, positioning Asia-Pacific as a key future growth market in the biodiesel industry.

South America

South America represents about 5% of the global biodiesel market in 2024. Growth is driven by abundant soybean feedstock in Brazil and Argentina, along with national blending mandates that support local consumption. Export opportunities further strengthen market potential. Infrastructure modernization and technological upgrades in production processes are underway. However, regulatory inconsistencies and feedstock logistics challenges limit expansion. Continued government support, increased awareness, and investment in production facilities are expected to drive higher biodiesel adoption, both domestically and internationally.

Middle East & Africa

The Middle East & Africa accounts for around 3% of the global biodiesel market in 2024. Growth is emerging through waste-oil and municipal solid-waste conversion, supported by energy diversification policies in oil-producing countries. Government initiatives for cleaner fuels and renewable energy integration encourage adoption. Limited feedstock availability, high production costs, and underdeveloped infrastructure restrict large-scale operations. Investments in technology, regional collaborations, and policy support are expected to gradually increase biodiesel production and consumption, unlocking long-term market potential in this region.

Market Segmentations:

By Feedstock:

- Vegetable Oils

- Waste Cooking Oil

By Production Process:

- Trans-Esterification

- Hydro-Treated Vegetable Oil

By Blend Level:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global biodiesel market include Renewable Biofuels, Inc., Cargill, Inc., Bunge Ltd., TerraVia Holdings, Inc., Archer Daniels Midland Company (ADM), Manuelita S.A., Ag Processing, Inc., Ecodiesel Colombia S.A., Wilmar International Ltd., and FutureFuel Corp. The global biodiesel market is highly competitive, driven by technological innovation, feedstock diversification, and expanding production capacity. Companies focus on improving trans-esterification, hydro-treated vegetable oil (HVO), and co-processing techniques to enhance fuel quality and efficiency. Strategic partnerships and acquisitions enable entry into new regions and access to diverse feedstocks. Continuous R&D aims to optimize blend quality, cold-flow properties, and process scalability. Adoption of AI-driven process optimization and automation reduces operational costs and improves production efficiency. Sustainability initiatives, compliance with renewable fuel mandates, and carbon credit programs further strengthen market positioning and drive growth in domestic and international markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Renewable Biofuels, Inc.

- Cargill, Inc.

- Bunge Ltd.

- TerraVia Holdings, Inc.

- Archer Daniels Midland Company (ADM)

- Manuelita S.A.

- Ag Processing, Inc.

- Ecodiesel Colombia S.A.

- Wilmar International Ltd.

- FutureFuel Corp.

Recent Developments

- In August 2025, D&L Industries Inc., a company that produces food ingredients and industrial chemicals, confirmed it is still considering the establishment of a second biodiesel facility to support future government initiatives to raise the biodiesel blend.

- In April 2025, Neste raised its global SAF production capability to tons per year by starting production at its Rotterdam refinery, and confirmed plans to expand the Rotterdam complex. Once completed in 2027, this expansion will make it the world’s largest renewable diesel and SAF production site with an annual capacity.

- In April 2025, Vast Infraestrutura announced in late March that it and biodiesel producer Be8 signed a memorandum of understanding (MOU) aimed at developing Understanding (MoU) to advance the biofuels market for the maritime industry at the Port of Açu in Rio de Janeiro.

- In April 2025, Aemetis, Inc.’s subsidiary Universal Biofuels secured biodiesel orders worth from India’s three state-owned Oil Marketing Companies (OMCs). This is for shipments of over 33,000 kiloliters of biodiesel to be delivered between May and July, supporting the country’s goal to increase its biodiesel blend to 5%

Report Coverage

The research report offers an in-depth analysis based on Feedstock, Production Process, Blend Level and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global biodiesel market is expected to grow steadily due to rising renewable fuel mandates.

- Adoption of advanced production technologies will enhance fuel efficiency and quality.

- Expansion of waste-oil and non-food feedstock sourcing will reduce production costs.

- Integration of AI and automation will streamline production and optimize operational efficiency.

- Increasing focus on carbon reduction will drive higher blend mandates across regions.

- Emerging markets in Asia-Pacific and Latin America will contribute to significant demand growth.

- Technological innovations in HVO and co-processing will support premium biodiesel applications.

- Strategic partnerships and mergers will enable market expansion and feedstock diversification.

- Investment in sustainable and circular-economy models will enhance competitiveness.

- Growth in industrial, marine, and power-generation sectors will broaden biodiesel adoption.