Market Overview

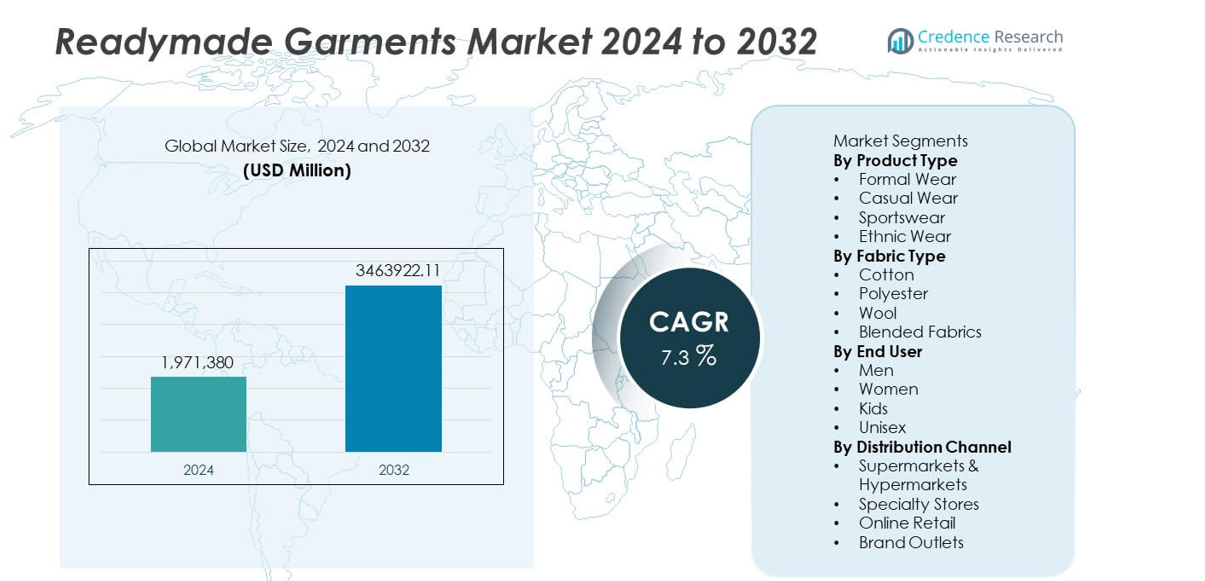

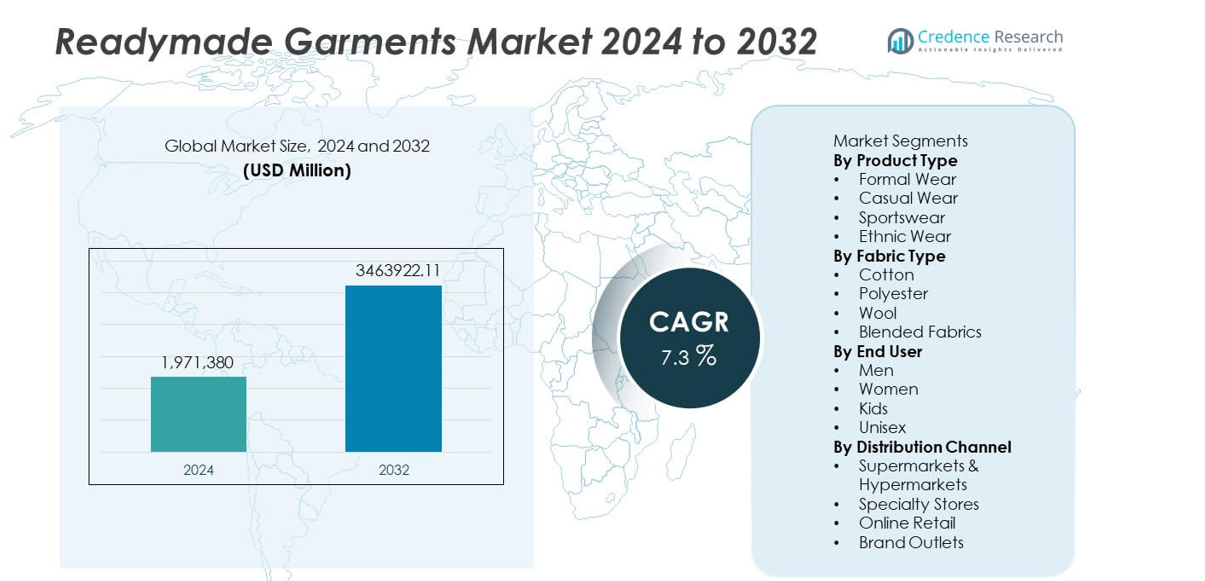

The Readymade Garments Market was valued at USD 1,971,380 million in 2024 and is projected to reach USD 3,463,922.11 million by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Readymade Garments Market Size 2024 |

USD 1,971,380 million |

| Readymade Garments Market, CAGR |

7.3% |

| Readymade Garments Market Size 2032 |

USD 3,463,922.11 million |

Top players in the Readymade Garments market include Zara (Inditex), H&M Group, Nike Inc., Adidas AG, PVH Corp., Gap Inc., Levi Strauss & Co., VF Corporation, Uniqlo (Fast Retailing), and Ralph Lauren Corporation. These companies lead through strong global branding, rapid product development, and extensive retail and e-commerce networks. Their strategies emphasize trend responsiveness, advanced fabric innovation, and sustainability-driven collections. Asia Pacific remains the dominant region with a 36% market share, supported by large-scale production, urban demand, and expanding fashion influence. North America follows with 29%, driven by strong premium and athleisure adoption, while Europe holds 27%, supported by established fashion culture and .

Market Insights

- The Readymade Garments market reached USD 1,971,380 million in 2024 and is set to grow at a CAGR of 7.3% through 2032, supported by rising global apparel demand.

- Casual wear leads the product type segment with a 46% share, driven by lifestyle shifts and strong preference for comfortable, versatile clothing across key consumer groups.

- Fashion trends accelerate due to social media influence, sustainability initiatives, and rising demand for athleisure, pushing brands to innovate with eco-friendly fabrics and fast design cycles.

- Intense competition from fast-fashion players and fluctuating raw material costs restrain growth, especially for manufacturers dependent on cotton and polyester supply stability.

- Asia Pacific dominates with a 36% share, followed by North America at 29% and Europe at 27%, supported by strong retail networks, high purchasing power, and evolving fashion preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Casual wear dominates the product type segment with a 46% market share, driven by rising demand for comfortable, everyday clothing influenced by lifestyle changes and increased remote work culture. Consumers prefer versatile garments suitable for both work and leisure, which pushes brands to expand denim, knitwear, and athleisure-inspired casual ranges. Formal wear records steady demand due to corporate requirements, while sportswear grows as fitness awareness increases. Ethnic wear maintains strong traction in culturally driven markets. Product diversification and fast-fashion cycles continue to strengthen market growth across all product categories.

- For instance, Inditex expanded its casual assortment supported by a digital design system that cuts sampling time per style. The company uses technology to accelerate the design and production process, allowing new collections to move from design to stores in a matter of weeks, significantly faster than the months-long cycles of traditional fashion retailers.

By Fabric Type

Cotton leads the fabric type segment with a 38% share, supported by its breathability, comfort, and wide acceptance across global climates. Rising preference for natural and sustainable materials strengthens cotton’s dominance, especially in casual and ethnic wear categories. Polyester remains popular due to affordability and durability, while blended fabrics gain momentum as they offer improved elasticity, moisture control, and enhanced comfort. Wool holds a smaller share due to seasonal demand. Increasing sustainability awareness and eco-friendly manufacturing practices shape fabric selection trends across the market.

- For instance, Arvind Limited expanded its organic cotton program by working with thousands of farmers in farm clusters in India. The company has focused on increasing the total area under sustainable cultivation to meet growing global demand for products made with responsibly sourced cotton.

By End User

Women’s wear dominates the end-user segment with a 41% share, driven by high product variety, frequent fashion rotation, and rising spending on apparel for work, leisure, and social occasions. The segment benefits from strong adoption of western wear, fast fashion, and premium lifestyle clothing. Men’s wear continues to grow steadily due to increasing interest in casual and athleisure categories, while kids’ wear gains traction with rising demand for durable, comfortable garments. The unisex category expands as brands introduce gender-neutral designs aligned with modern fashion preferences and inclusive trends.

Key Growth Drivers

Rising Demand for Affordable and Trend-Driven Apparel

The Readymade Garments market grows as consumers seek stylish, affordable, and frequently updated clothing options. Fast-fashion brands introduce new collections quickly, which encourages repeat purchases and boosts volume sales. Social media trends and influencer-driven fashion accelerate product adoption across younger demographics. Companies expand design capabilities and shorten production cycles to meet changing preferences. This demand for trendy, ready-to-wear clothing strengthens market penetration across urban and semi-urban regions.

- For instance, H&M Group used its Product Lifecycle Management platform and other technology to reduce design-to-shelf time, supporting fast-moving collections across its extensive network of stores.

Expansion of E-Commerce and Omnichannel Retailing

Growth accelerates as consumers shift toward online shopping for convenience, wider product choice, and competitive pricing. E-commerce platforms support strong demand through easy returns, personalized recommendations, and discounts. Brands adopt omnichannel models that integrate online and offline experiences, improving customer engagement. Digital payment adoption and improved logistics expand access to both domestic and global apparel brands. This retail shift supports steady growth across all garment categories.

- For instance, Uniqlo (Fast Retailing) uses its digital infrastructure to connect with a vast customer base, enabling unified stock visibility across online channels and stores globally. This integration helps the company respond to customer demand in an agile manner, optimizing everything from production planning to inventory management.

Increasing Adoption of Comfortable and Functional Clothing

Rising preference for comfort-driven clothing fuels demand for lightweight, stretchable, and breathable garments. Athleisure, loungewear, and casual wear gain popularity as consumers prioritize functionality alongside style. Fabric innovations such as moisture-wicking, wrinkle-resistant, and temperature-regulating materials further boost adoption. Changing workplace norms and hybrid work cultures also increase demand for relaxed-fit apparel. This shift encourages manufacturers to invest in fabric technology and expand versatile garment lines.

Key Trends & Opportunities

Growth of Sustainable and Ethical Fashion

Sustainability shapes major market trends as consumers prefer eco-friendly fabrics, recycled materials, and ethical production practices. Brands introduce organic cotton, low-impact dyes, and circular fashion initiatives to reduce environmental footprint. Transparency in sourcing and fair-labor certifications strengthens customer trust. This trend offers opportunities for companies that invest in green manufacturing, biodegradable packaging, and responsible supply chains. Increasing awareness of climate impact continues to push sustainable Readymade Garments into mainstream demand.

- For instance, Patagonia expanded its Worn Wear repair program, supported by traceable supply chains tracked across global factories.

Rising Influence of Customization and Premiumization

Customization gains traction as buyers seek personalized fits, designs, and fabric choices. Technology-driven tools such as 3D body scanning and AI-based size prediction enhance the shopping experience. Premium apparel segments grow due to rising disposable incomes and a shift toward high-quality fabrics and refined styles. Brands expand tailored collections and limited-edition lines to attract aspirational consumers. This trend creates opportunities for companies to differentiate through craftsmanship, premium branding, and enhanced customer services.

- For instance, Nike scaled its customization platform (formerly known as NIKEiD and now as Nike By You) and handled a large number of customized orders using digital design interfaces supported by advanced visualization engines.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of cotton, polyester, wool, and blended fabrics create cost pressure for manufacturers. Weather disruptions, global supply chain issues, and rising transportation costs impact material availability. These fluctuations increase production expenses and may reduce profit margins for brands operating in competitive price segments. Companies adopt long-term contracts and diversify sourcing regions to stabilize supply. However, persistent cost instability remains a challenge for maintaining consistent pricing strategies.

Intense Competition and Rapid Fashion Cycles

The market faces strong competition from global brands, regional manufacturers, and fast-fashion companies offering similar designs at varying price points. Rapid fashion cycles require continuous innovation and quick turnaround, increasing inventory risk for retailers. Small players struggle to match the speed, scale, and marketing capabilities of established brands. High promotional spending further intensifies competitive pressure. Companies must balance trend adoption with cost control to remain profitable in an oversaturated market.

Regional Analysis

North America

North America holds a 29% market share, supported by strong demand for premium apparel, activewear, and casual clothing. Consumers prefer branded garments with high-quality fabrics and modern designs, which drives growth for global fashion labels. E-commerce adoption remains high, improving access to a wide range of ready-to-wear products. Sustainability trends also influence purchasing behavior, encouraging brands to introduce eco-friendly lines. Retail expansion, rising fashion awareness, and strong marketing by leading companies continue to support steady market growth across the region.

Europe

Europe accounts for a 27% market share, driven by strong fashion culture, high spending on apparel, and rising adoption of sustainable garments. Consumers show strong interest in premium-quality fabrics, tailored fits, and designer collections. Stringent environmental regulations push brands to adopt ethical sourcing and eco-friendly manufacturing. Fast-fashion chains maintain significant influence due to trend-driven demand and rapid product cycles. Growth is further supported by expanding online shopping and increasing consumer preference for versatile garments suitable for work and leisure.

Asia Pacific

Asia Pacific leads the global market with a 36% market share, driven by a large population base, rising disposable incomes, and rapid urbanization. Demand for affordable, trend-focused garments grows quickly, supported by strong production capabilities in China, India, Bangladesh, and Vietnam. Local and global brands expand aggressively through retail chains and e-commerce platforms. Fast-fashion adoption among younger consumers drives high-volume sales. The region’s manufacturing strength, cost advantages, and expanding fashion influence continue to strengthen long-term market growth.

Latin America

Latin America holds a 5% market share, supported by increasing interest in fashionable yet affordable apparel. Consumers value casual wear and sportswear due to warm climates and growing fitness trends. Regional brands expand product lines to match evolving fashion preferences, while international brands gain traction through online platforms. Economic fluctuations challenge premium segment growth, but demand remains stable for mid-range garments. Retail modernization and rising urban population support gradual market expansion across major countries.

Middle East & Africa

The Middle East & Africa region captures a 3% market share, influenced by rising urbanization, growing youth population, and increasing exposure to global fashion trends. Demand rises for modest wear, luxury apparel, and western casual wear, depending on cultural preferences. Retail expansion through malls and international brand outlets enhances product availability. Economic diversification boosts apparel spending in Gulf countries, while affordability drives demand in African markets. E-commerce growth strengthens access to a wider range of ready-to-wear garments across the region.

Market Segmentations:

By Product Type

- Formal Wear

- Casual Wear

- Sportswear

- Ethnic Wear

By Fabric Type

- Cotton

- Polyester

- Wool

- Blended Fabrics

By End User

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail

- Brand Outlets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading players such as Zara (Inditex), H&M Group, Nike Inc., Adidas AG, PVH Corp., Gap Inc., Levi Strauss & Co., VF Corporation, Uniqlo (Fast Retailing), and Ralph Lauren Corporation. These companies strengthen their position through rapid design cycles, global supply chain integration, and strong brand visibility across digital and offline channels. Fast-fashion leaders capitalize on trend-driven demand by launching frequent collections at competitive prices, while sportswear brands expand athleisure lines supported by performance fabrics and lifestyle marketing. Premium brands focus on quality, craftsmanship, and personalization to retain high-value customers. Investments in e-commerce, sustainability initiatives, and tech-driven retail experiences enhance competitiveness. Regional manufacturers gain share through cost-effective production and culturally aligned designs, intensifying market rivalry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Zara (Inditex)

- H&M Group

- Nike, Inc.

- Adidas AG

- PVH Corp. (Calvin Klein, Tommy Hilfiger)

- Gap Inc.

- Levi Strauss & Co.

- VF Corporation (The North Face, Vans)

- Uniqlo (Fast Retailing Co., Ltd.)

- Ralph Lauren Corporation

Recent Developments

- In December 2025, Zara (Inditex) – Zara rolled out a capsule collection with Japanese designer Soshi Otsuki called “A Sense of Togetherness,” covering men’s, women’s, and kids’ lines.

- In November 2025, Zara (Inditex) – Zara launched a collaboration with designer Ludovic de Saint Sernin for Winter 2025. The collection includes 48 womenswear pieces plus menswear and accessories, marking a high-profile push into more fashion-forward design.

- In September 2025, H&M Group presented its Autumn/Winter 2025 (AW25) collection at London Fashion Week with a major cultural showcase combining runway, music, and public events, reflecting a strategic shift toward “premiumisation”.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Fabric Type, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for trend-driven and affordable garments will rise as fast-fashion cycles accelerate.

- Sustainable fabrics and ethical sourcing will gain stronger adoption across global brands.

- Athleisure and comfort-focused clothing will expand due to lifestyle and fitness shifts.

- E-commerce growth will strengthen as consumers prefer digital shopping and faster delivery.

- AI-driven design tools and virtual fitting solutions will enhance personalization.

- Premium apparel categories will grow as buyers seek higher-quality and long-lasting garments.

- Regional manufacturers will gain more influence through cost-efficient production and local designs.

- Supply chains will become more digitized to improve speed, transparency, and operational resilience.

- Customization services will expand as consumers seek tailored fits and unique designs.

- Competition will intensify, pushing brands to innovate through materials, branding, and omnichannel strategies.