Market Overview

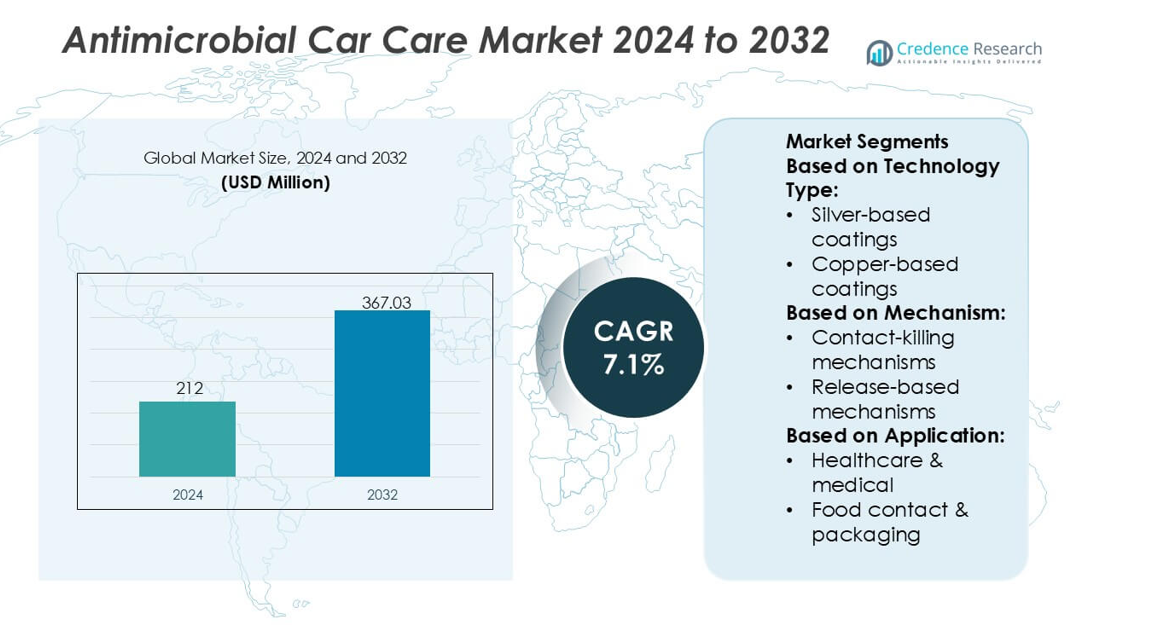

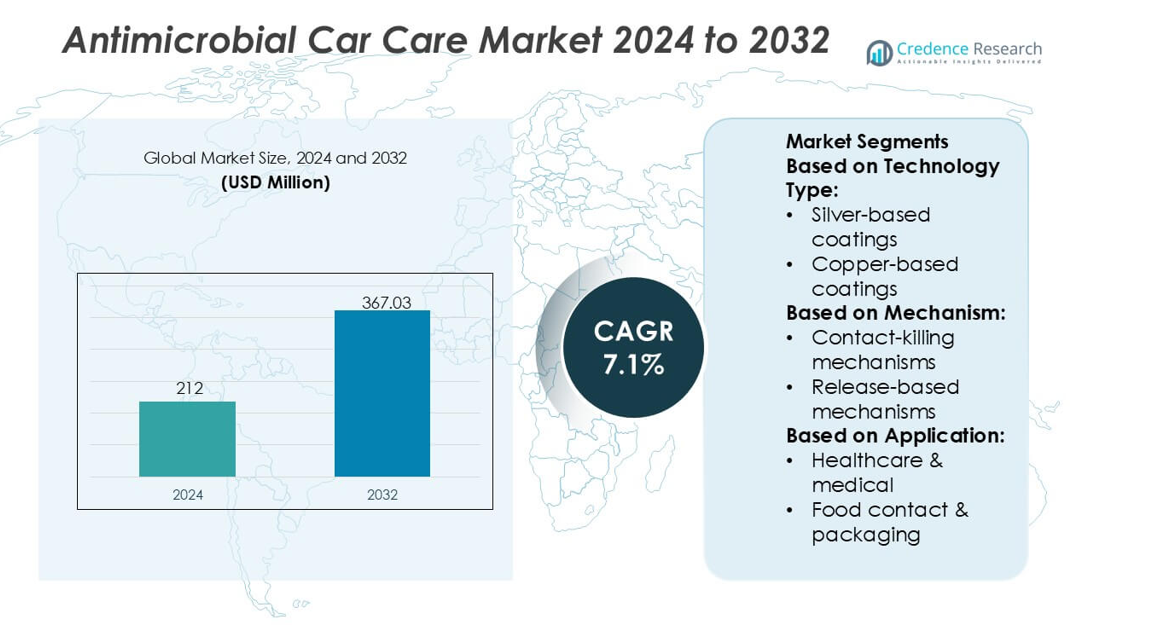

Antimicrobial Car Care Market size was valued USD 212 million in 2024 and is anticipated to reach USD 367.03 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antimicrobial Car Care Market Size 2024 |

USD 212 million |

| Antimicrobial Car Care Market, CAGR |

7.1% |

| Antimicrobial Car Care Market Size 2032 |

USD 367.03 million |

The Antimicrobial Car Care Market is shaped by a competitive group of global manufacturers that continue to advance hygiene-focused vehicle maintenance solutions through innovation, certification-backed formulations, and expanded distribution networks. Leading companies strengthen their portfolios with long-lasting antimicrobial coatings, multi-functional cleaners, and interior protectants designed to meet rising consumer expectations for enhanced vehicle sanitation. The market sees strong product differentiation, with players investing in R&D, material-safe chemistries, and technology-driven performance validation to reinforce brand credibility. North America emerges as the leading region, holding an exact 41% market share, supported by high consumer awareness, advanced automotive service infrastructure, and strong adoption of premium antimicrobial car care products.

Market Insights

- The Antimicrobial Car Care Market was valued at USD 212 million in 2024 and is projected to reach USD 367.03 million by 2032, registering a CAGR of 7.1%.

- Growing hygiene awareness and demand for long-lasting antimicrobial protection drive product adoption, with interior cleaners and protectants holding the dominant segment share due to frequent in-cabin usage.

- Key trends include investment in advanced chemistries, multi-functional antimicrobial coatings, and certification-backed formulations that enhance brand credibility and support premium positioning.

- Competitive activity intensifies as manufacturers expand R&D capabilities, optimize material-safe antimicrobial blends, and strengthen e-commerce and detailing-center partnerships to widen market reach.

- North America leads the global market with a 41% regional share, supported by strong consumer preference for high-performance antimicrobial car care solutions, while Asia-Pacific shows fast expansion driven by rising vehicle ownership and growing interest in hygiene-enhancing maintenance products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology Type

Silver-based coatings represent the dominant technology type with an approximate 34% market share, supported by strong antimicrobial efficacy, durability, and compatibility with interior automotive materials. Automakers favor silver-ion formulations to suppress microbial proliferation on steering wheels, HVAC vents, dashboards, and high-touch plastic components. Demand accelerates as OEMs integrate long-lasting antimicrobial enhancement into premium and mid-range vehicle trims to improve cabin hygiene. Hybrid/combination systems gain traction due to synergistic effects, while photocatalytic and smart coatings expand in advanced models offering self-cleaning or responsive surface activity.

- For instance, Nanosilver additive system validated to reduce microbial load by 99.9% (a 3-log reduction) within 60 minutes, supported by independent laboratory testing in compliance with ISO 22196, and the formulation is designed to maintain effective antimicrobial activity for over 1,200 operational hours under continuous abrasion simulations.

By Mechanism

Contact-killing mechanisms hold the leading position with around 39% market share, driven by their ability to neutralize microbes instantly upon surface interaction and their long coating lifespan without continuous leaching. This mechanism aligns with automakers’ preference for stable antimicrobial solutions that withstand abrasion, frequent cleaning cycles, and varying temperature conditions inside vehicle cabins. Release-based systems remain relevant for slow-diffusion sanitization in enclosed HVAC pathways, while anti-adhesion and multi-modal mechanisms rise in popularity for applications requiring both microbial resistance and surface protection against stains, odors, and organic buildup.

- For instance, MAFRA S.p.A.’s Maniac Line Interior Cleaner Purifier product is certified to achieve at least a 5-log bacterial reduction (a 100,000-fold reduction is required for general purpose disinfectants under this standard) in under 15 minutes according to UNI EN 1276 (or EN 1276) testing, which confirms the formulation provides functional antimicrobial activity as a disinfectant.

By Application

Transportation is the dominant application segment with an estimated 41% market share, propelled by rising consumer expectations for hygienic cabins and expanding OEM adoption of antimicrobial additives in interior components. Antimicrobial car care formulations are increasingly applied in upholstery coatings, air-handling systems, infotainment touch surfaces, and shared mobility fleets. Healthcare & medical fleets show strong uptake due to strict hygiene protocols, while electronics & consumer applications grow as antimicrobial coatings protect in-vehicle screens and control interfaces. Construction & HVAC and marine segments adopt specialized variants for moisture-prone environments

Key Growth Drivers

Rising Consumer Focus on Hygiene and Cabin Health

Heightened concern for in-vehicle hygiene drives strong demand for antimicrobial car care products that limit microbial growth on high-touch surfaces. Consumers prioritize solutions that deliver long-lasting protection across steering wheels, dashboards, upholstery, and HVAC components. Automakers and aftermarket brands respond by integrating antimicrobial additives into cleaning sprays, coatings, and interior materials. This shift expands adoption of premium vehicle sanitization solutions and strengthens recurring product demand from households, shared mobility, and fleet operators that require consistent cleanliness and safety assurance.

- For instance, benzalkonium-chloride–based antimicrobial system which is tested under laboratory conditions to achieve at least a 5-log (100,000-fold) microbial reduction within 10 minutes under ASTM E2315 testing, and specialized formulations can be designed to retain surface activity for over 72 hours following simulated-use evaluations.

Material Innovation and Increased Integration of Advanced Coatings

Continuous innovation in antimicrobial technologies including silver-ion coatings, quaternary ammonium compounds, hybrid organic inorganic systems, and photocatalytic formulations accelerates market expansion. Manufacturers use high-performance coatings that provide durable protection without altering surface aesthetics or texture, making them increasingly suitable for OEM interiors and aftermarket detailing. Improved adhesion, abrasion resistance, and compatibility with plastics, textiles, and leather enhances commercial viability. These advancements support broader automotive industry usage, from interior parts to air filtration components, enabling scalable integration across vehicle models and care product portfolios.

- For instance, Turtle Wax, Inc. launched its EPA-registered Multi-Purpose Cleaner & Disinfectant spray featuring Byotrol® technology, documented to kill over 99.9% of germs including cold and flu viruses on high-touch interior surfaces and maintain sanitizing action for 24 hours following a single application, with formulation safety categorized at the lowest EPA toxicity level (Level IV) and being non-staining and alcohol-free.

Growth in Shared Mobility, Ride-Hailing, and Fleet Services

Shared transportation models such as ride-hailing, subscription cars, and rental fleets intensify the need for frequent interior disinfection and long-lasting antimicrobial protection. Operators seek cost-effective solutions that reduce cleaning cycles, improve passenger safety perception, and maintain interior condition under heavy usage. Antimicrobial coatings, disinfectant wipes, fogging solutions, and HVAC antimicrobial treatments gain traction as standard fleet maintenance components. Regulatory scrutiny in high-traffic mobility ecosystems further boosts adoption, positioning antimicrobial care products as essential tools for operational reliability and rider trust.

Key Trends & Opportunities

Integration of Smart and Long-Acting Antimicrobial Coatings

Long-acting antimicrobial technologies such as smart, self-activating, or responsive coatings represent a fast-growing opportunity in the market. These systems activate under light, moisture, or microbial load, delivering continuous protection and reducing the need for repeated application. Product developers focus on hybrid chemistries that combine antimicrobial, anti-odor, and surface-protective functions, appealing to premium car care segments. The trend aligns with OEM interest in next-generation interior materials that maintain cleanliness for extended periods, creating partnership opportunities between coating innovators and automotive suppliers.

- For instance, TEN 1276, EN 1650, and EN 14476 standards, demonstrating a 5-log microbial reduction within typical contact times (e.g., 5 to 15 minutes) and general virucidal activity against enveloped viruses, as required for commercial use.

Expansion of Eco-Friendly and Bio-Based Antimicrobial Solutions

Rising sustainability requirements steer development toward water-based, low-VOC, and bio-derived antimicrobial formulations that minimize environmental impact. Bio-based agents such as plant-derived antimicrobials and biodegradable polymers allow brands to differentiate in a market increasingly regulated for chemical emissions and consumer safety. Companies explore natural antimicrobials that maintain efficacy against bacteria, fungi, and odor-causing microbes, enabling safer alternatives for sensitive user groups. Demand for green car detailing products accelerates this shift, opening opportunities in specialized interior care, HVAC sanitation, and fabric protection.

- For instance, Armor All offers a dedicated line of EPA-registered aerosol and trigger-spray disinfectants (separate from its Original Protectant line) that are explicitly formulated to kill 99.9% of bacteria and viruses on hard, non-porous car surfaces when used as directed.

Growing OEM Adoption and Factory-Level Integration

Automotive OEMs increasingly integrate antimicrobial materials during vehicle manufacturing especially in upholstery, air filters, touchpoints, and infotainment surfaces. This trend creates strong opportunities for coating suppliers that can meet automotive durability standards. Early-stage integration supports branding strategies focused on health, comfort, and in-cabin wellness, increasingly valued by buyers. OEM-backed antimicrobial features in new vehicles accelerate downstream aftermarket demand as owners seek compatible maintenance products that preserve factory-installed protective properties.

Key Challenges

Regulatory Compliance and Safety Validation Constraints

Stringent regulations governing chemical formulations, antimicrobial claims, and human exposure create significant compliance challenges for market participants. Manufacturers must navigate varying global frameworks related to biocides, VOC limits, and material safety certifications. Extensive toxicity testing, long approval cycles, and restrictions on specific antimicrobial agents increase development costs and slow commercialization. Ensuring product efficacy without compromising vehicle materials or occupant health intensifies scrutiny, particularly for long-lasting coatings intended for enclosed cabin environments.

Performance Limitations Under Real-World Automotive Conditions

Automotive interiors experience fluctuating temperatures, humidity levels, UV exposure, and mechanical abrasion, which reduce antimicrobial performance over time. Many coatings degrade under repeated cleaning cycles or intense usage, leading to inconsistent protection and reduced consumer confidence. Maintaining long-term efficacy without damaging plastics, leather, or electronics remains a technical constraint. These challenges require advanced formulations, improved surface bonding technologies, and robust durability testing factors that increase production complexity and hinder rapid market penetration.

Regional Analysis

North America

North America leads the Antimicrobial Car Care Market with a 41% share, supported by strong consumer emphasis on vehicle hygiene, widespread adoption of premium detailing services, and rapid uptake of antimicrobial coatings in passenger and fleet vehicles. Automakers collaborate with coating suppliers to incorporate antimicrobial interiors, strengthening OEM-level demand. High penetration of ride-hailing, rental, and subscription-based fleets further accelerates recurring purchases of antimicrobial cleaners, HVAC disinfectants, and interior protectants. Regulatory encouragement for safer chemical formulations also drives innovation. Continued expansion of shared mobility and advanced car care channels reinforces North America’s dominant position.

Europe

Europe holds a 29% share, driven by stringent chemical safety regulations, rapid adoption of eco-friendly antimicrobial formulations, and strong consumer preference for high-quality vehicle hygiene products. OEMs increasingly integrate antimicrobial materials into upholstery and air-handling systems to elevate cabin wellness standards. Demand strengthens in markets with dense urban mobility networks, where fleet operators prioritize long-lasting antimicrobial solutions to minimize maintenance cycles. Europe’s mature automotive aftermarket, combined with regulatory incentives promoting low-VOC and bio-based disinfectants, enhances product diversification. Continuous growth in sustainable detailing practices positions Europe as a key innovator within the global market.

Asia-Pacific

Asia-Pacific commands a 22% market share, reflecting rapid urbanization, rising vehicle ownership, and growing consumer focus on in-cabin hygiene across China, India, Japan, and Southeast Asia. Expanding shared mobility services intensify demand for durable antimicrobial treatments that support high-use vehicles. Regional manufacturers increasingly adopt silver-ion coatings, QAC-based disinfectants, and hybrid antimicrobial systems aligned with cost-effective mass-market applications. OEM partnerships accelerate factory-level integration of antimicrobial surfaces. Despite price sensitivity, APAC shows strong momentum due to large fleet density and increasing awareness of microbial safety, solidifying its role as the fastest-advancing regional market cluster.

Latin America

Latin America accounts for a 5% market share, supported by rising interest in vehicle hygiene and the expanding detailing services sector across Brazil, Mexico, and Chile. Market participation grows as local distributors introduce affordable antimicrobial sprays, upholstery cleaners, and air-conditioning sanitization products suited to warm climates that favor microbial growth. Fleet operators in public transport, rentals, and logistics gradually adopt antimicrobial maintenance practices to enhance passenger perception and extend interior durability. However, limited consumer spending and slower regulatory modernization temper growth, although improving product accessibility continues to support incremental market expansion.

Middle East & Africa

The Middle East & Africa region holds a 3% share, driven by increasing awareness of microbial safety in premium vehicle segments and growing demand for high-performance antimicrobial protectants suited to hot and humid conditions. Luxury car ownership and rapid expansion of automotive service centers encourage the use of antimicrobial coatings, HVAC disinfectants, and long-lasting interior treatments. Fleet modernization programs in Gulf countries further support adoption, particularly for taxis and commercial vehicles. Despite limited penetration in low-income markets, rising vehicle maintenance standards and expanding urban mobility solutions contribute to steady but gradual market development.

Market Segmentations:

By Technology Type:

- Silver-based coatings

- Copper-based coatings

By Mechanism:

- Contact-killing mechanisms

- Release-based mechanisms

By Application:

- Healthcare & medical

- Food contact & packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Antimicrobial Car Care Market features a diverse mix of global and regional manufacturers, including Liqui Moly GmbH, MAFRA S.p.A., Chemical Guys, Cartec B.V., Tetrosyl Ltd., Turtle Wax, Inc., Adolf Würth GmbH & Co. KG, Armor All, 3M, and Sonax GmbH. the Antimicrobial Car Care Market is defined by continuous innovation, strong brand differentiation, and growing emphasis on science-backed antimicrobial performance. Market participants focus on developing advanced formulations incorporating long-lasting antimicrobial agents, residue-free application technologies, and surface-safe chemistry that aligns with evolving consumer hygiene expectations. Companies increasingly prioritize R&D in hybrid antimicrobial coatings, bio-based disinfectants, and multifunctional protectants that combine cleaning, deodorizing, and protective capabilities. Expanding digital retail channels and detailer-focused product lines strengthen customer engagement and accelerate product visibility. Competitive strategies also include certification-driven product validation, partnerships with automotive service providers, and marketing campaigns highlighting proven microbial reduction efficacy. Collectively, these factors create an innovation-driven market where performance reliability, regulatory compliance, and product transparency significantly shape brand competitiveness and long-term positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liqui Moly GmbH

- MAFRA S.p.A.

- Chemical Guys

- Cartec B.V.

- Tetrosyl Ltd.

- Turtle Wax, Inc.

- Adolf Würth GmbH & Co. KG

- Armor All

- 3M

- Sonax GmbH

Recent Developments

- In November 2024, Sonax and Motorworld announced a strategic partnership where Sonax became the “Global Preferred Partner” across all Motorworld locations. This collaboration aims to showcase Sonax’s premium car care products and services to car enthusiasts and owners of collector’s vehicles, leveraging the shared passion of both companies for automotive preservation.

- In October 2024, Iterum Therapeutics received FDA approval for ORLYNVAH, a new oral antibiotic combining sulopenem etzadroxil and probenecid for uncomplicated UTIs, targeting resistant bacteria like Escherichia coli.

- In June 2024, NEI Corporation’s NANOMYTE AM-100E is a thin, durable, easy-to-clean coating for plastics, metals, and ceramics, offering over 99.99% E. coli reduction (4-log) per ISO 22196, repelling water/oil, and resisting abrasion, making it ideal for healthcare and food service by simplifying hygiene and reducing cleaning costs.

- In May 2024, 3M Paint Protection Film Series 150 Gloss, a high-gloss polyurethane film designed for premium vehicle protection, featuring self-healing for minor scratches, durability against road damage (chips, stains, UV), and an optimized adhesive for easier, mark-free application, offering a virtually invisible, long-lasting showroom shine.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Mechanism, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward longer-lasting antimicrobial formulations supported by advanced surface-binding chemistries.

- Demand will rise for multi-functional products that combine cleaning, disinfection, and protective coating capabilities.

- Bio-based and low-VOC antimicrobial solutions will gain broader adoption as sustainability expectations strengthen.

- OEMs will increasingly integrate antimicrobial treatments into new-vehicle detailing and aftersales service packages.

- Regulatory frameworks will drive stricter validation of antimicrobial efficacy and product safety claims.

- Smart and responsive antimicrobial coatings will enter commercial use, offering activated protection under specific conditions.

- E-commerce channels will expand their share as consumers prefer convenient access to hygiene-focused car care solutions.

- Professional detailing centers will adopt premium antimicrobial packages to differentiate service offerings.

- Partnerships between chemical formulators and automotive service networks will accelerate product standardization.

- Continuous R&D investment will support innovations in hybrid antimicrobial technologies and enhanced material compatibility.