Market Overview

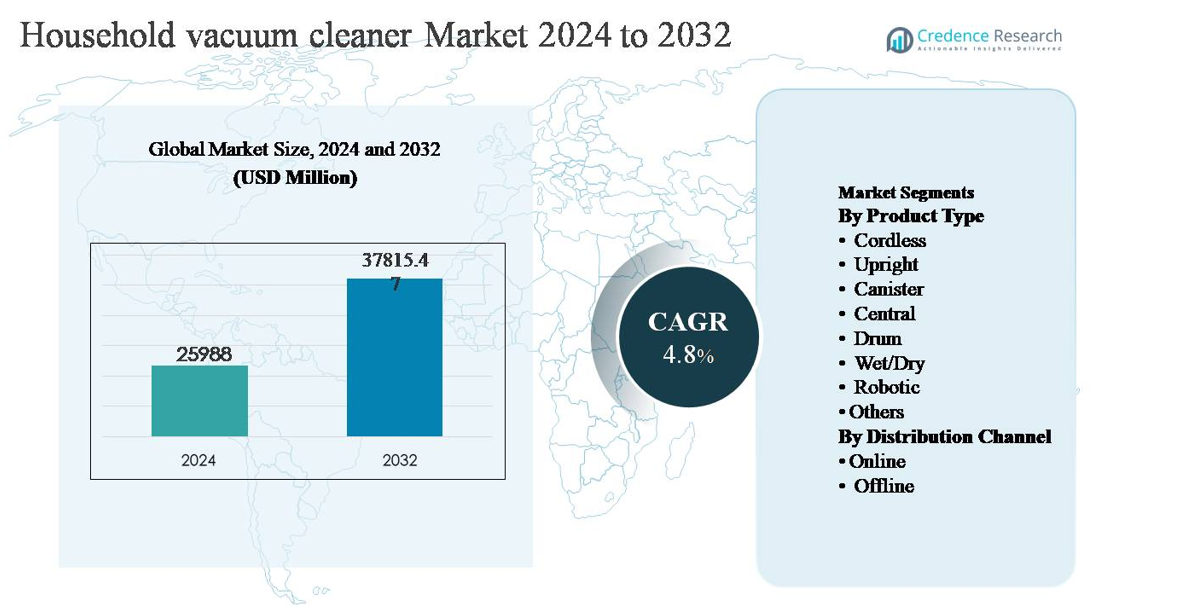

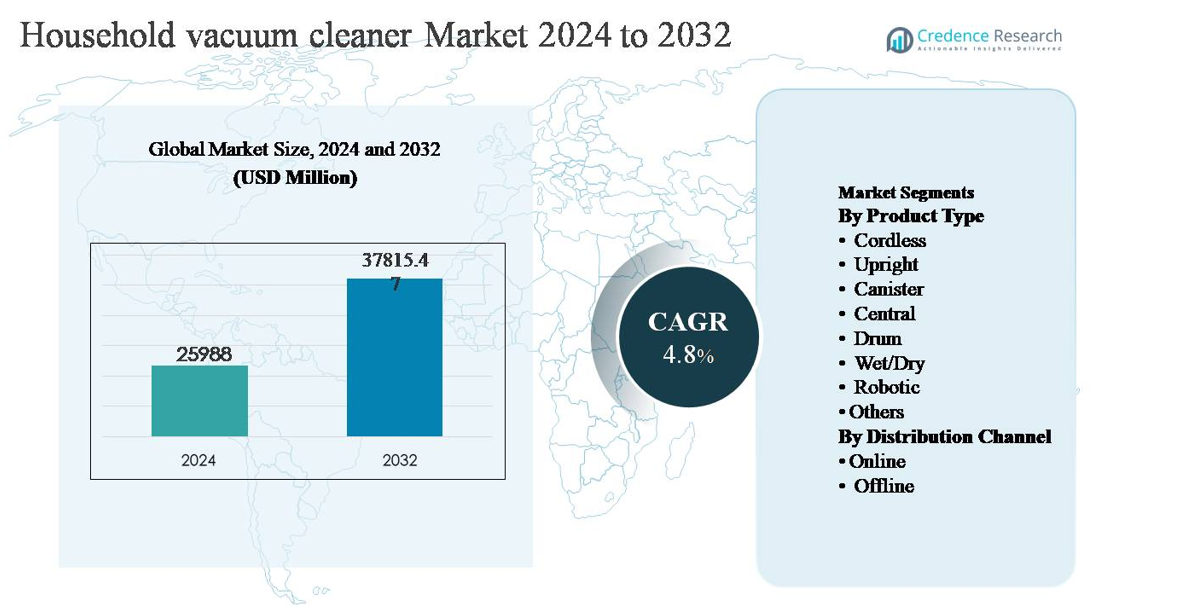

The global household vacuum cleaner market was valued at USD 25,988 million in 2024 and is projected to reach USD 37,815.47 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Household Vacuum Cleaner Market Size 2024 |

UUSD 25,988 million |

| Household Vacuum Cleaner Market, CAGR |

4.8% |

| Household Vacuum Cleaner Market Size 2032 |

USD 37,815.47 million |

The household vacuum cleaner market is led by a mix of global appliance manufacturers and technology-driven specialists, including Dyson Ltd., Electrolux AB, LG Electronics Inc., Panasonic Corporation, Miele & Cie. KG, Bissell Inc., iRobot Corporation, De’Longhi Appliances S.r.l., Hoover, and Eureka. These companies compete on innovation, product reliability, and portfolio depth, with strong emphasis on cordless and robotic models. North America is the leading region, holding approximately 32% of the global market share, supported by high appliance penetration, premium product adoption, and strong replacement demand. Europe follows closely, while Asia-Pacific drives volume growth through expanding urban households and rising disposable incomes, reinforcing a globally competitive and innovation-focused market structure.

Market Insights

- The household vacuum cleaner market was valued at USD 25,988 million in 2024 and is projected to reach USD 37,815.47 million by 2032, growing at a CAGR of 4.8% during the forecast period.

- Market growth is primarily driven by rising urbanization, busy lifestyles, and increasing focus on home hygiene and indoor air quality, which are accelerating adoption of efficient and automated cleaning appliances across residential households globally.

- Key trends include rapid adoption of robotic vacuum cleaners, which represent the dominant product segment due to automation and smart home compatibility, alongside strong growth in cordless models; offline channels remain dominant, while online sales continue expanding steadily.

- Competitive dynamics are shaped by innovation-led players focusing on suction performance, battery efficiency, filtration systems, and smart connectivity, intensifying competition particularly in robotic and cordless segments.

- Regionally, North America leads with ~32% market share, followed by Europe at ~27% and Asia-Pacific at ~30%, with Asia-Pacific showing the fastest growth driven by urban expansion and rising middle-income households.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The household vacuum cleaner market by product type includes cordless, upright, canister, central, drum, wet/dry, robotic, and other specialized models, each addressing distinct cleaning preferences and home layouts. Robotic vacuum cleaners dominate this segment, holding the largest market share due to their autonomous operation, minimal user intervention, and strong alignment with smart home adoption trends. Advancements in sensor-based navigation, AI-driven mapping, and multi-surface cleaning capabilities continue to strengthen demand. Cordless models also show strong uptake, supported by improved battery life and lightweight designs, while upright and canister units maintain relevance for deep-cleaning requirements.

- For instance, Dyson’s Gen5detect cordless vacuum is equipped with a Hyperdymium motor spinning at 135,000 rpm and delivers up to 280 air watts of suction, powered by a removable lithium-ion battery providing up to 70 minutes of runtime in eco mode.

By Distribution Channel

By distribution channel, the market is segmented into online and offline sales platforms, reflecting shifting consumer purchasing patterns. Offline distribution remains the dominant sub-segment, accounting for the majority market share, driven by consumers’ preference for hands-on product evaluation, in-store demonstrations, and immediate product availability. Large appliance retailers, specialty stores, and brand-owned outlets play a key role in influencing purchase decisions, especially for premium and high-capacity vacuum cleaners. After-sales service support, warranty assurance, and the ability to compare multiple models in person continue to reinforce the strength of offline channels.

- For instance, Electrolux maintains a global service network with thousands of authorized technical experts and service partnersacross approximately 120 countries. The availability and speed of repairs, including potential same-day or next-day support for products like vacuum cleaners, depend heavily on the customer’s specific location and the local service partner’s operations.

Key Growth Drivers

Rising Urbanization and Changing Lifestyles

Rapid urbanization and evolving household lifestyles are a major growth driver for the household vacuum cleaner market. Increasing migration to urban areas has led to smaller living spaces, higher population density, and greater emphasis on cleanliness and hygiene. Busy work schedules, dual-income households, and limited time for manual cleaning are pushing consumers toward efficient and time-saving cleaning appliances. Vacuum cleaners address these needs by offering faster, more consistent cleaning compared to traditional methods. Demand is particularly strong in apartments and condominiums, where dust accumulation and indoor air quality are key concerns. As urban consumers increasingly prioritize convenience, automation, and ease of use, vacuum cleaners have become an essential household appliance rather than a discretionary purchase.

- For instance, Xiaomi’s Mi Robot Vacuum-Mop 2 is designed for efficient home cleaning, featuring a visual navigation system capable of mapping living spaces of up to 150 m² (approx. 1600 sq. ft) per cleaning cycle, combined with a suction power of 2,700 Pa to effectively remove fine dust from hard floors and low-pile carpets”.

Technological Advancements and Product Innovation

Continuous technological innovation is significantly accelerating market growth. Manufacturers are integrating advanced motors, improved suction systems, HEPA filtration, and noise-reduction technologies to enhance performance and user comfort. Smart features such as app-based controls, AI-driven navigation, obstacle detection, and multi-surface adaptability are expanding product appeal, especially in robotic and cordless segments. Battery technology improvements have extended run times and reduced charging cycles, making cordless models more practical for daily use. These innovations not only improve cleaning efficiency but also differentiate products in a competitive market, encouraging consumers to upgrade existing devices and adopt premium vacuum cleaner solutions.

- “For instance, Roborock’s S8 Pro Ultra is equipped with a DuoRoller Riser™ brush system and delivers a suction power of 6,000 Pa, while its Reactive 3D obstacle avoidance system uses structured light and infrared image sensors to detect and navigate around objects, enabling precise movement in cluttered living spaces.

Growing Awareness of Health and Indoor Air Quality

Rising awareness of health, hygiene, and indoor air quality is a key driver supporting sustained demand for household vacuum cleaners. Increasing incidence of allergies, asthma, and respiratory conditions has heightened consumer focus on effective dust, pet hair, and allergen removal. Vacuum cleaners equipped with advanced filtration systems help capture fine particles and improve indoor air quality, particularly in households with children, elderly residents, or pets. The post-pandemic emphasis on cleanliness has further reinforced regular and thorough home cleaning practices. As consumers increasingly associate clean indoor environments with overall well-being, demand for efficient vacuum cleaning solutions continues to strengthen across both developed and emerging markets.

Key Trends & Opportunities

Expansion of Smart and Robotic Cleaning Solutions

The rapid expansion of smart and robotic vacuum cleaners represents a major trend and growth opportunity. Consumers are increasingly adopting automated cleaning solutions that integrate seamlessly with smart home ecosystems. Features such as scheduled cleaning, voice assistant compatibility, real-time mapping, and self-charging functionality are driving adoption among tech-savvy households. As prices gradually become more accessible and performance continues to improve, robotic vacuum cleaners are penetrating a broader consumer base. This trend creates opportunities for manufacturers to develop differentiated models, expand software-driven features, and generate recurring revenue through accessories, upgrades, and connected services.

- For instance, iRobot’s Roomba Combo j9+ integrates a retractable mopping system with an onboard Clean Base that can store up to 60 days of debris, enabling fully autonomous dry and wet cleaning cycles without daily user involvement.

Growth of E-Commerce and Direct-to-Consumer Sales

The increasing importance of online retail channels presents a strong opportunity for market expansion. E-commerce platforms enable brands to reach a wider audience, showcase detailed product specifications, and offer competitive pricing. Online channels also support direct-to-consumer strategies, allowing manufacturers to strengthen brand engagement and collect consumer insights. The availability of product reviews, comparison tools, and flexible delivery options further enhances online purchasing confidence. As digital adoption continues to rise, especially in emerging economies, online sales are expected to complement traditional retail and support faster market penetration for both established and new vacuum cleaner brands.

- For instance, Amazon’s dedicated vacuum cleaner category supports high-resolution product views (including 360-degree views or 3D models on select listings), video demonstrations, and rapid delivery options such as next-day or even same-day shippingthrough a vast network of logistics facilities.

Key Challenges

High Price Sensitivity and Competitive Pressure

Price sensitivity remains a significant challenge in the household vacuum cleaner market, particularly in developing regions. While premium models offer advanced features and superior performance, a large portion of consumers remains cost-conscious and hesitant to invest in higher-priced products. Intense competition among global and regional manufacturers further pressures pricing and profit margins. Frequent product launches and promotional discounting make it difficult for brands to sustain differentiation. Balancing affordability with innovation is a key challenge, as manufacturers must control production costs while meeting rising consumer expectations for performance and durability.

Maintenance, Durability, and After-Sales Concerns

Maintenance requirements and after-sales service issues pose another challenge to market growth. Consumers often express concerns related to battery degradation, filter replacement costs, and long-term durability, particularly for cordless and robotic models. Inadequate service networks and limited availability of spare parts can negatively impact brand perception and repeat purchases. Additionally, improper usage or lack of maintenance awareness can reduce product lifespan, leading to dissatisfaction. To address this challenge, manufacturers must invest in robust service infrastructure, clear maintenance guidance, and durable product designs to build long-term customer trust and loyalty.

Regional Analysis

North America

North America holds a significant share of the household vacuum cleaner market, accounting for around 32% of global revenue. The region benefits from high appliance penetration, strong consumer awareness of indoor air quality, and early adoption of advanced cleaning technologies. Demand is driven by widespread use of robotic and cordless vacuum cleaners, supported by smart home integration and high disposable income levels. The presence of established manufacturers, well-developed retail infrastructure, and strong after-sales service networks further supports market maturity. Replacement demand and premium product upgrades continue to sustain steady growth across the United States and Canada.

Europe

Europe represents approximately 27% of the global household vacuum cleaner market, supported by stringent hygiene standards and strong demand for energy-efficient appliances. Consumers across Western and Northern Europe increasingly prefer advanced vacuum cleaners with low noise, reduced power consumption, and high filtration efficiency. Robotic and cordless models are gaining traction, particularly in urban households. Regulatory focus on sustainability and product efficiency is encouraging innovation in eco-friendly designs. Countries such as Germany, the UK, and France remain key contributors, while Eastern Europe shows rising adoption due to improving living standards.

Asia-Pacific

Asia-Pacific dominates growth momentum and accounts for about 30% of the global market share, making it the fastest-growing regional market. Rapid urbanization, expanding middle-class populations, and rising disposable incomes are driving vacuum cleaner adoption across China, Japan, South Korea, and India. Smaller living spaces and busy lifestyles are accelerating demand for compact, cordless, and robotic models. Increasing awareness of hygiene and air quality further supports growth. Strong manufacturing presence, competitive pricing, and expanding e-commerce channels are enabling deeper market penetration across both developed and emerging Asia-Pacific economies.

Latin America

Latin America holds an estimated 6% share of the global household vacuum cleaner market, with growth driven by gradual urbanization and improving consumer purchasing power. Countries such as Brazil, Mexico, and Argentina are leading demand, particularly for mid-range upright and canister vacuum cleaners. While penetration remains lower than in developed regions, rising awareness of modern cleaning appliances is supporting steady adoption. Offline retail continues to dominate sales, although online channels are gaining importance. Economic volatility and price sensitivity remain constraints, but long-term prospects remain positive as household appliance adoption expands.

Middle East & Africa

The Middle East & Africa region accounts for around 5% of global market share, supported by rising residential construction and increasing adoption of modern home appliances. Demand is strongest in the Gulf Cooperation Council countries, where higher disposable incomes and premium housing developments drive uptake of advanced vacuum cleaners, including robotic models. In Africa, market growth remains gradual, led by urban centers and upper-income households. Expanding retail networks, improving consumer awareness, and increasing focus on hygiene are expected to support moderate but consistent growth across the region.

Market Segmentations:

By Product Type

- Cordless

- Upright

- Canister

- Central

- Drum

- Wet/Dry

- Robotic

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The household vacuum cleaner market features a competitive landscape characterized by the presence of global appliance manufacturers and regionally strong brands competing on technology, product breadth, and brand equity. Leading players focus on continuous innovation in suction efficiency, battery performance, filtration systems, and smart connectivity to differentiate their offerings. Robotic and cordless vacuum cleaners remain key areas of competition, with companies investing heavily in AI-based navigation, app-enabled controls, and compact designs. Strategic initiatives such as new product launches, portfolio upgrades, and geographic expansion are common, alongside investments in after-sales service and distribution networks. Price competition remains intense, particularly in mid-range segments, while premium brands emphasize performance, durability, and design. Strong branding, broad retail presence, and rapid adoption of smart home-compatible products continue to shape competitive positioning across developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Corporation

- Dyson Ltd.

- Electrolux AB

- LG Electronics Inc.

- Miele & Cie. KG

- Bissell Inc.

- iRobot Corporation

- De’Longhi Appliances S.r.l.

- Hoover

- Eureka

Recent Developments

- In November 2025, In Australia, LG released its CordZero A9L handstick vacuum range, broadening its cordless product portfolio with advanced battery and motor performance aimed at daily home cleaning users.

- In September 2025, Dyson unveiled several new floorcare products at its global launch event in Berlin, introducing the Dyson PencilVac touted as the world’s slimmest vacuum cleaner with a 38 mm thin profile and powered by Dyson’s compact Hyperdymium 140k motor. Alongside this, Dyson also launched the Dyson Spot+Scrub AI Robot Vacuum Cleaner with 18 000 Pa suction power, blending robotic autonomy with advanced stain-detection cleaning capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of robotic vacuum cleaners will accelerate as households increasingly prioritize automation and time-saving cleaning solutions.

- Integration of smart home ecosystems will become standard, with greater compatibility with voice assistants and home automation platforms.

- Cordless vacuum cleaners will gain wider acceptance due to continued improvements in battery life, charging speed, and motor efficiency.

- Demand for advanced filtration systems will rise as consumers place greater emphasis on indoor air quality and allergen control.

- Manufacturers will focus on lightweight, compact designs to meet the needs of urban apartments and smaller living spaces.

- E-commerce channels will play a larger role in product discovery, comparison, and direct-to-consumer sales.

- Product differentiation will increasingly rely on software features, connectivity, and user experience rather than hardware alone.

- Sustainability considerations will influence product design, including energy efficiency and recyclable materials.

- After-sales service quality and availability of spare parts will become key factors in brand loyalty and repeat purchases.

- Emerging markets will contribute a growing share of demand as appliance penetration and disposable incomes continue to rise.