Market Overview

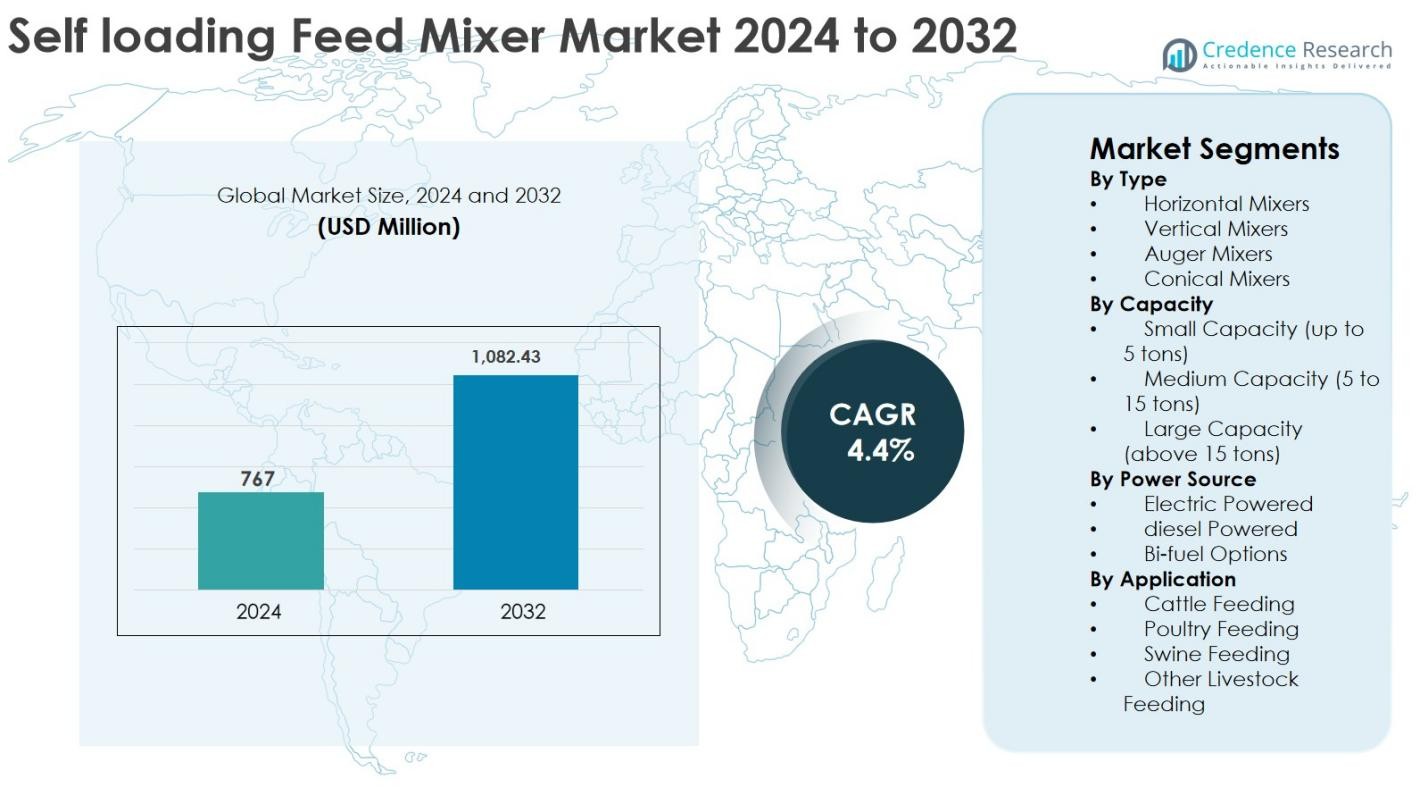

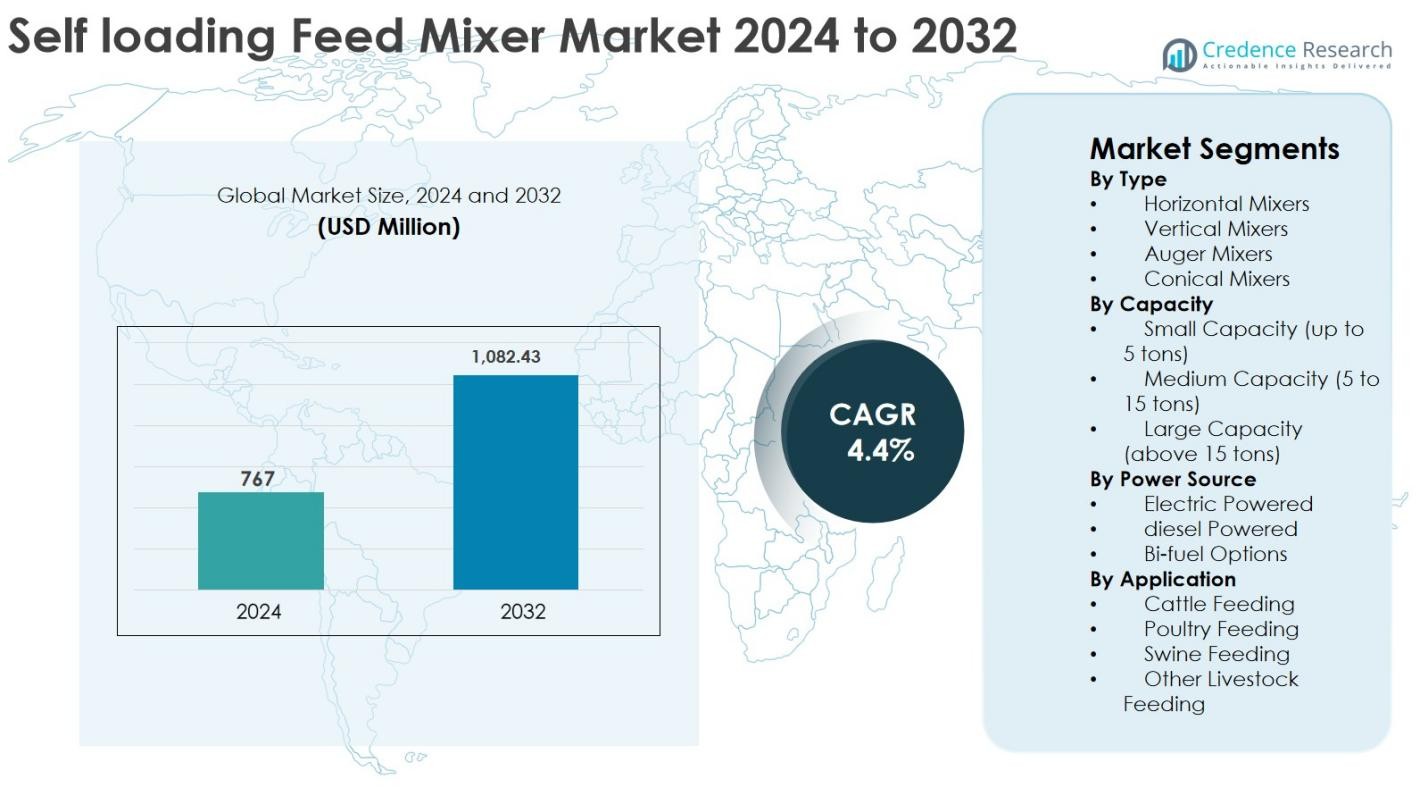

The Self Loading Feed Mixer market size was valued at USD 767 million in 2024 and is anticipated to reach USD 1,082.43 million by 2032, expanding at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self Loading Feed Mixer Market Size 2024 |

USD 767 Million |

| Self Loading Feed Mixer Market , CAGR |

4.4% |

| Self Loading Feed Mixer Market Size 2032 |

USD 1,082.43 Million |

The Self Loading Feed Mixer market is driven by the presence of well-established manufacturers such as Trioliet, KUHN, Supreme International, Jaylor, RMH Lachish Industries, Casale, Schuitemaker, Meyer Feed Technologies, Hustler Feed Bunks, and Gehl, all of which focus on robust design, efficient mixing performance, and advanced automation features. These players compete through product innovation, capacity diversification, and strong dealer networks to support commercial and large-scale livestock operations. North America leads the market with a 32.6% share, supported by highly mechanized dairy farms and large herd sizes, followed by Europe at 28.4%, driven by precision feeding adoption and sustainability-focused farming practices. Asia Pacific accounts for 22.1%, reflecting rapid commercialization of dairy farming, while Latin America and the Middle East & Africa together contribute the remaining share through gradual mechanization and farm modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Self Loading Feed Mixer market was valued at USD 767 million in 2024 and is projected to reach USD 1,082.43 million by 2032, growing at a CAGR of 4.4% during the forecast period.

- Market growth is driven by rising mechanization of dairy and livestock farming, increasing labor shortages, and growing focus on feed efficiency and uniform ration mixing to improve milk yield and animal health across commercial farms.

- Key trends include adoption of automated weighing systems, precision feeding technologies, and fuel-efficient designs, with vertical mixers leading by type with 46.8% share and medium-capacity mixers (5–15 tons) dominating with 41.5% share in 2024.

- Leading players such as Trioliet, KUHN, Jaylor, Supreme International, and RMH Lachish Industries compete through product innovation, capacity expansion, and strong dealer networks, while regional players gain traction through cost competitiveness.

- Regionally, North America leads with 32.6% share, followed by Europe at 28.4%, Asia Pacific at 22.1%, Latin America at 9.4%, and Middle East & Africa at 7.5%, supported by gradual farm modernization.

Market Segmentation Analysis:

By Type

The Self Loading Feed Mixer market, by type, is led by Vertical Mixers, which accounted for 46.8% market share in 2024. This dominance is driven by their superior mixing efficiency, ability to process diverse feed ingredients, and suitability across small to large livestock operations. Vertical mixers ensure uniform ration blending, reduce mixing time, and support lower power consumption. Growing adoption in dairy farming, rising herd sizes, and increasing demand for precise feed formulation further strengthen this segment. Auger and conical mixers continue to serve niche and compact farm applications.

- For instance, KUHN’s Profile Plus vertical mixer series is engineered to handle high-fiber rations efficiently, helping dairy farms maintain consistent TMR quality while optimizing mixing time and energy use.

By Capacity

By capacity, the market is dominated by Medium Capacity Feed Mixers (5 to 15 tons), holding 41.5% share in 2024. This segment benefits from an optimal balance between productivity, operational flexibility, and capital cost, making it ideal for mid-sized dairy and livestock farms. Medium-capacity mixers support frequent feeding cycles without excessive fuel or maintenance expenses. The expansion of commercial dairy farms, mechanization of feeding operations, and focus on feed efficiency drive strong demand for this capacity range.

- For instance, Trioliet’s Solomix 2 series offers mixer wagons in the 10–16 m³ class, designed for herds of roughly 60–120 cows, enabling multiple daily feedings without prolonged mixing or high operating costs.

By Power Source

Based on power source, Diesel Powered Self Loading Feed Mixers held 52.3% market share in 2024. Their dominance is supported by high torque output, durability, and reliable performance in rural areas with limited electricity access. Diesel-powered units are widely preferred for heavy-duty and continuous feeding operations. Advancements in fuel-efficient engines, increasing livestock mechanization, and demand for mobile feeding equipment sustain growth, while electric and bi-fuel options gain gradual traction due to sustainability initiatives.

Key Growth Drivers

Rising Mechanization of Livestock and Dairy Farming

The increasing mechanization of livestock and dairy farming is a major growth driver for the Self Loading Feed Mixer market. As farms expand to meet rising demand for milk and meat products, traditional manual feeding methods are becoming inefficient and labor-intensive. Self loading feed mixers integrate loading, mixing, and distribution into a single operation, significantly reducing labor requirements and feeding time. Labor shortages in rural areas, rising wage costs, and the need for operational efficiency further accelerate adoption. Government initiatives supporting agricultural mechanization and easier access to equipment financing also contribute to higher penetration across commercial and semi-commercial livestock farms.

- For instance, Faresin Industries’ Leader PF self-propelled self-loading mixers are used on intensive dairy units in Italy and France to automate feed collection from silage clamps and deliver precise rations, reducing manual handling and fuel consumption.

Focus on Feed Efficiency and Animal Nutrition Management

Improving feed efficiency and optimizing animal nutrition strongly drive demand for self loading feed mixers. Feed represents a substantial share of livestock production costs, encouraging farmers to adopt equipment that ensures uniform mixing and accurate ration delivery. These mixers support total mixed ration feeding, minimizing feed wastage and improving digestion, milk yield, and weight gain. Integrated weighing systems and automated controls enhance precision and consistency, aligning feeding practices with productivity goals. Growing awareness of scientific feeding practices and performance-based livestock management further supports market growth.

- For instance, Trioliet’s self-loading mixers with the Triotronic weighing system allow operators to dose ingredients to target dry matter intake, improving feed conversion and reducing overfeeding in high-yielding herds.

Expansion of Commercial and Large-Scale Livestock Operations

The expansion of commercial and large-scale livestock operations is another key driver shaping the Self Loading Feed Mixer market. Industry consolidation is leading to larger herd sizes and higher daily feed volumes, increasing the need for efficient and high-capacity feeding solutions. Self loading feed mixers offer scalability, mobility, and reliability, making them well suited for intensive farming environments. Increased investment in modern farm infrastructure and organized dairy farming, particularly in emerging economies, further accelerates demand for advanced feeding equipment.

Key Trends & Opportunities

Integration of Advanced Technologies and Automation

The integration of advanced technologies and automation represents a significant trend and opportunity in the Self Loading Feed Mixer market. Manufacturers are introducing automated weighing systems, digital control panels, and performance monitoring tools to improve operational accuracy and reduce human error. These features support precision feeding and data-driven decision-making, aligning with the broader shift toward smart and connected farming practices. Automation also simplifies operation, reducing dependence on highly skilled labor and creating opportunities for premium product offerings and long-term customer engagement.

- For instance, Faresin’s Leader PF self-propelled mixers offer electronic weighing units with programmable rations and display terminals in the cab, helping operators follow exact feed curves and reduce mixing and distribution errors on large dairy units.

Growing Demand for Sustainable and Energy-Efficient Equipment

Rising fuel costs and environmental concerns are creating opportunities for sustainable and energy-efficient self loading feed mixers. Farmers are increasingly seeking equipment that lowers fuel consumption and reduces emissions without compromising performance. This trend is driving interest in electric and bi-fuel models, particularly in regions with improving rural electrification. Manufacturers focusing on fuel-efficient engines, optimized mixer designs, and lightweight materials are well positioned to benefit from sustainability-driven purchasing decisions.

- For instance, SILOKING’s SelfLine 4.0 series uses modern Stage V-compliant diesel engines and weight-optimized frames to reduce fuel use and emissions while maintaining high mixing performance in intensive European dairy operations.

Key Challenges

High Initial Investment and Ownership Costs

High initial investment remains a major challenge in the Self Loading Feed Mixer market. Advanced machines involve substantial upfront costs due to integrated loading systems, automation, and heavy-duty construction. Small and marginal farmers often face financial constraints, limiting adoption in price-sensitive markets. In addition, ongoing expenses related to fuel, maintenance, and spare parts increase total ownership costs. Income volatility in agriculture and uncertainty in commodity prices further influence purchasing decisions, restraining market penetration.

Maintenance Complexity and Dependence on Skilled Operators

Maintenance complexity and dependence on skilled operators pose another significant challenge. Self loading feed mixers incorporate mechanical, hydraulic, and electronic systems that require regular servicing and proper handling. Limited availability of trained technicians in rural areas can lead to higher downtime and maintenance expenses. Farmers transitioning from manual feeding systems may also face operational learning curves. Addressing this challenge requires strong after-sales support, operator training programs, and simplified machine designs to improve reliability and ease of use.

Regional Analysis

North America

North America accounted for 32.6% of the Self Loading Feed Mixer market share in 2024, driven by highly mechanized dairy and livestock farming practices. The region benefits from large herd sizes, strong adoption of total mixed ration feeding, and high awareness of feed efficiency and animal nutrition. The United States dominates regional demand due to the presence of large commercial dairy farms and strong investment capacity among farmers. Favorable financing options, replacement demand for advanced equipment, and continuous product innovation further support growth. Canada contributes steadily through organized dairy farming and ongoing modernization initiatives.

Europe

Europe held 28.4% market share in 2024, supported by advanced agricultural mechanization and strict livestock productivity standards. Countries such as Germany, France, Italy, and the Netherlands demonstrate strong adoption due to high dairy density and emphasis on efficient feeding systems. European farmers prioritize precision feeding, sustainability, and animal welfare, driving demand for technologically advanced self loading feed mixers. Government incentives for modern equipment and sustainability-driven regulations further support growth. The presence of established manufacturers and frequent equipment upgrades strengthens Europe’s market position.

Asia Pacific

Asia Pacific represented 22.1% of the Self Loading Feed Mixer market in 2024, emerging as the fastest-growing region. Growth is driven by rapid expansion of commercial dairy farming in China, India, Japan, and Australia. Rising demand for milk and meat, increasing herd sizes, and gradual mechanization of feeding operations support adoption. Government initiatives promoting farm modernization and productivity improvements further boost demand. While small-scale farming remains prevalent, investments in organized livestock operations are accelerating equipment adoption across the region.

Latin America

Latin America accounted for about 9.4% market share in 2024, supported by expanding dairy and beef production in Brazil, Argentina, and Mexico. Increasing commercialization of livestock farming and rising awareness of feed efficiency are driving demand for mechanized feeding solutions. Large cattle farms and feedlots are investing in self loading feed mixers to improve productivity and reduce labor dependency. However, price sensitivity and limited access to financing slow wider adoption. Continued agricultural modernization and export-oriented livestock production support steady regional growth.

Middle East & Africa

The Middle East & Africa region held 7.5% share of the Self Loading Feed Mixer market in 2024. Growth is supported by rising investments in modern dairy farms, particularly in Gulf countries aiming to strengthen domestic food production. Large-scale operations in Saudi Arabia, the UAE, and South Africa are adopting automated feeding systems to enhance efficiency. High equipment costs and limited mechanization in parts of Africa constrain adoption, though government-backed agricultural development programs support gradual expansion.

Market Segmentations:

By Type

- Horizontal Mixers

- Vertical Mixers

- Auger Mixers

- Conical Mixers

By Capacity

- Small Capacity (up to 5 tons)

- Medium Capacity (5 to 15 tons)

- Large Capacity (above 15 tons)

By Power Source

- Electric Powered

- diesel Powered

- Bi-fuel Options

By Application

- Cattle Feeding

- Poultry Feeding

- Swine Feeding

- Other Livestock Feeding

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Self Loading Feed Mixer market features a competitive landscape characterized by the presence of established global manufacturers and strong regional players focusing on product innovation, durability, and operational efficiency. Key players such as Trioliet, KUHN, Supreme International, Jaylor, RMH Lachish Industries, Casale, Schuitemaker, Meyer Feed Technologies, Hustler Feed Bunks, and Gehl concentrate on expanding product portfolios across different capacities and power configurations to address diverse farm requirements. Companies emphasize advanced mixing technologies, automated weighing systems, and fuel-efficient designs to enhance feed accuracy and reduce operating costs. Strategic initiatives include new product launches, geographic expansion through dealer networks, and after-sales service strengthening to improve customer retention. Increasing focus on customization, reliability, and ease of operation remains central to maintaining market presence, while regional manufacturers leverage pricing competitiveness and localized support to strengthen their foothold.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jaylor

- Casale

- Trioliet

- KUHN

- Supreme International

- RMH Lachish Industries

- Schuitemaker

- Meyer Feed Technologies

- Hustler Feed Bunks

- Gehl / AGCO

Recent Developments

- In March 2025, Faresin Industries introduced a new self-propelled feed mixer wagon, enhancing operational efficiency and feed quality in livestock farms by reducing working time and improving performance

- In September 2024, Trioliet introduced the Triomix 2 New Edition self-loading feed mixers ahead of Eurotier 2024, featuring improved cutting systems, energy-efficient Load Sensing controls, and enhanced mixing for efficient livestock feeding.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Power Source, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Self Loading Feed Mixer market will continue to benefit from the ongoing shift toward mechanized and automated feeding practices in livestock farming.

- Adoption will increase across medium and large dairy farms as operators focus on labor efficiency and consistent feed quality.

- Demand for precision feeding solutions will rise, supported by greater awareness of animal nutrition management and productivity optimization.

- Manufacturers will increasingly integrate digital controls, weighing systems, and automation features to enhance operational accuracy.

- Fuel-efficient and low-emission models will gain traction as sustainability and operating cost reduction become priorities for farmers.

- Growth of commercial dairy and beef operations will support higher demand for medium and large capacity feed mixers.

- Emerging economies will witness faster adoption due to farm consolidation and improving access to agricultural financing.

- Customization of equipment for different farm sizes and feeding requirements will become a key competitive differentiator.

- After-sales service, maintenance support, and operator training will play a larger role in purchasing decisions.

- Technological innovation and product reliability will remain critical for manufacturers to strengthen long-term market presence.