Market Overview:

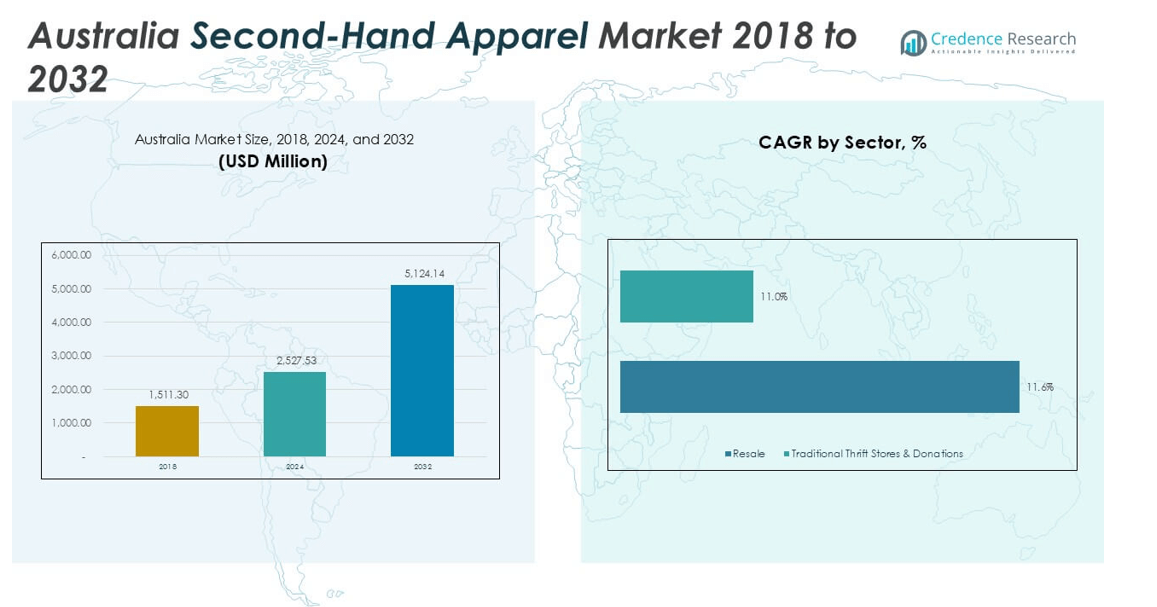

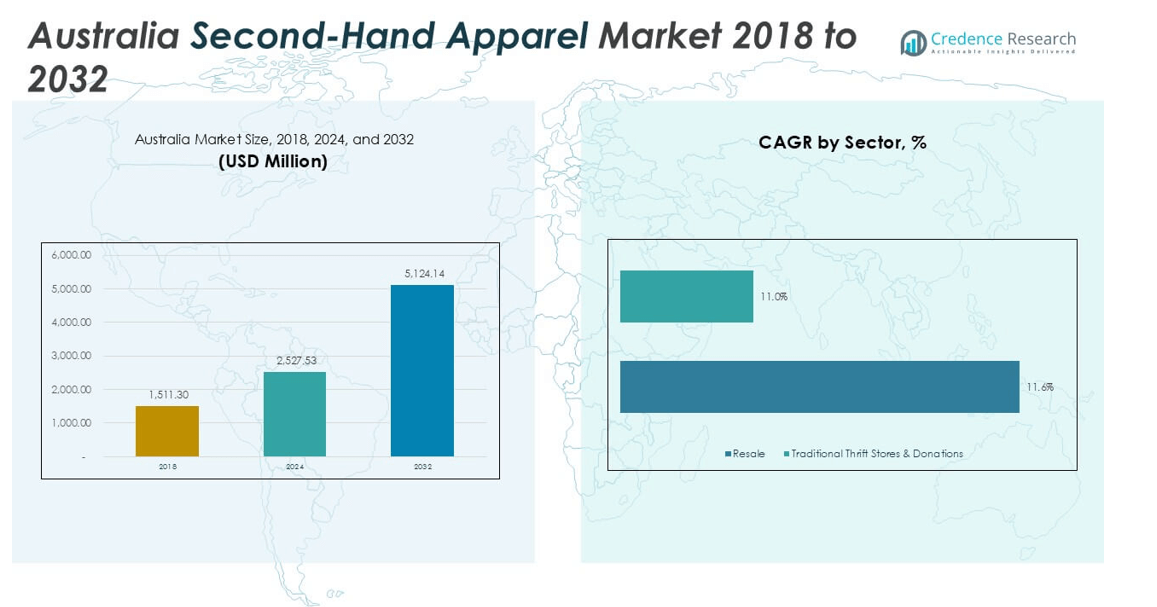

The Australia Second-Hand Apparel Market size was valued at USD 396.6 million in 2018 and grew to USD 578.3 million in 2024. It is projected to reach USD 1,027.1 million by 2032, expanding at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Second-Hand Apparel Market Size 2024 |

USD 578.3 million |

| Australia Second-Hand Apparel Market, CAGR |

7.1% |

| Australia Second-Hand Apparel Market Size 2032 |

USD 1,027.1 million |

The Australia second-hand apparel market is driven by key players including Reluv Clothing Australia, The Closet, SwapUp, Savers AU, Thriftd Australia, and Southern Globe, each contributing through unique models ranging from online resale platforms to traditional thrift store networks. These companies focus on affordability, sustainability, and expanding access to branded apparel, strengthening their competitive positions. Regionally, New South Wales leads with 32% market share in 2024, supported by Sydney’s strong consumer base and advanced digital adoption. Victoria follows with 28%, reflecting Melbourne’s vibrant fashion culture and sustainability-driven demand, making these two regions the dominant growth hubs for the sector.

Market Insights

- The Australia second-hand apparel market was valued at USD 578.3 million in 2024 and is projected to reach USD 1,027.1 million by 2032, growing at a CAGR of 7.1%.

- Key drivers include rising consumer preference for sustainable fashion, affordability of branded clothing, and expanding online resale platforms. These factors are encouraging both urban and suburban adoption of second-hand apparel.

- Market trends show strong momentum in digital resale, social commerce, and circular economy initiatives. Platforms are using technology such as authentication tools and AI personalization to build consumer trust.

- Competitive analysis highlights leading players such as Reluv Clothing Australia, The Closet, SwapUp, Savers AU, Thriftd Australia, and Southern Globe. They focus on affordability, sustainability, and product variety to strengthen market position.

- Regionally, New South Wales holds 32% share, followed by Victoria with 28%. By type, dresses and tops dominate with over 30% share, reflecting high demand from women, who represent the largest consumer group with 55% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

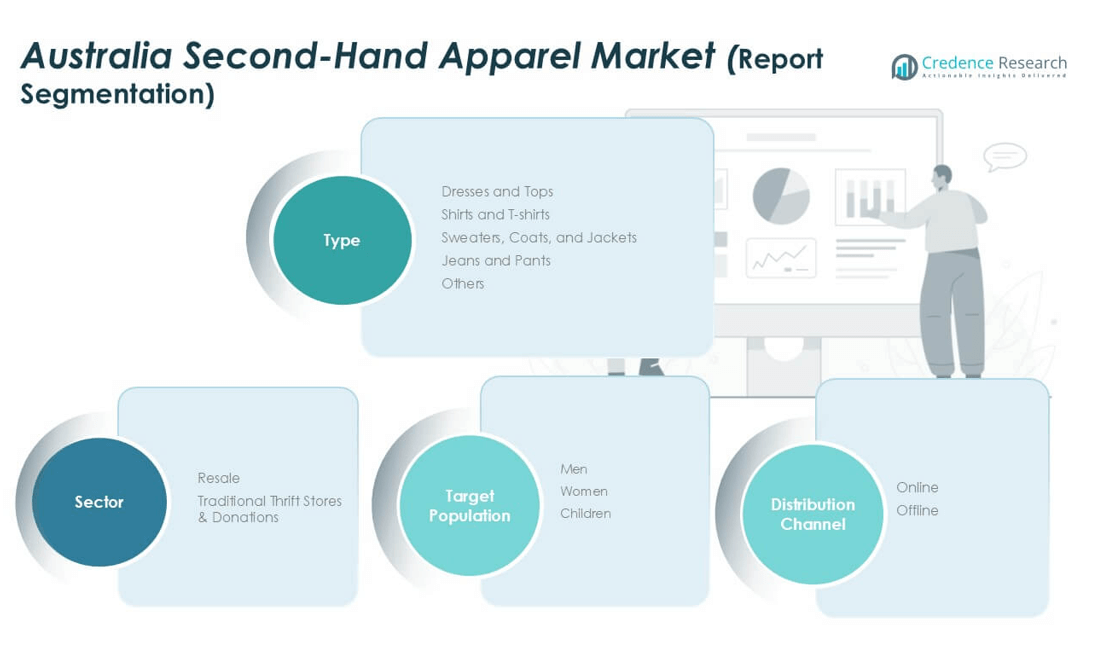

Market Segmentation Analysis:

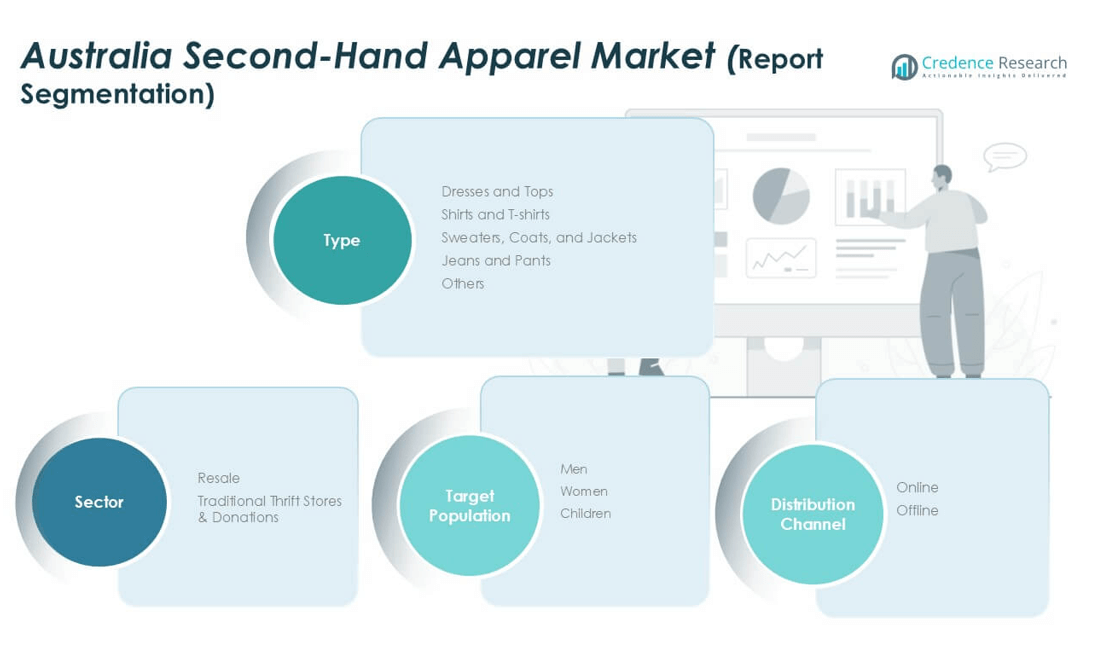

By Type

Dresses and tops dominate the Australian second-hand apparel market, holding over 30% share in 2024. Their popularity is driven by strong demand for affordable fashion, especially among women seeking variety and sustainable options. Shirts and T-shirts follow closely, supported by casual wear trends across younger demographics. Sweaters, coats, and jackets show steady growth due to seasonal demand and premium resale appeal. Jeans and pants contribute consistently as durable items with long lifecycle value. The “Others” category, including accessories, remains smaller but benefits from niche preferences and vintage fashion interest.

- For instance, the Chinese resale company Deja Vu reported selling 550,000 used clothing items by January 2024.

By Sector

The resale segment leads the sectoral analysis with more than 60% share in 2024. Growth is supported by online resale platforms that provide convenience, verified quality, and wide consumer reach. Younger shoppers increasingly embrace resale as a sustainable alternative to fast fashion. Traditional thrift stores and donations continue to serve value-driven and community-focused buyers, particularly in suburban and rural areas. While thrift stores maintain cultural relevance, digital-first resale channels dominate due to structured pricing, strong marketing campaigns, and broader adoption among middle-income consumers seeking branded apparel at lower costs.

- For instance, Salvos Stores utilizes a hybrid model of digital and physical resale ecosystems for its donations, which include large quantities of clothing collected nationwide.

By Target Population

Women represent the dominant consumer group in Australia’s second-hand apparel market, holding nearly 55% share in 2024. Demand is influenced by higher purchase frequency, interest in diverse fashion categories, and sustainability awareness. Men’s share continues to expand, supported by growing acceptance of resale for casual and workwear items. Children’s apparel forms a smaller segment but benefits from parental focus on affordability, given the faster replacement cycle in kids’ clothing. The women’s segment drives overall growth, as fashion-conscious buyers increasingly prefer affordable pre-owned apparel while supporting circular fashion practices and reducing textile waste.

Key Growth Drivers

Rising Consumer Preference for Sustainable Fashion

Sustainability has become a defining factor in consumer purchasing decisions across Australia. Increasing awareness about the environmental impact of fast fashion, such as textile waste and carbon emissions, is pushing buyers toward second-hand apparel. Younger demographics, particularly Millennials and Gen Z, show a strong inclination toward sustainable choices, aligning fashion preferences with eco-conscious values. Circular fashion initiatives and recycling programs further encourage the adoption of resale platforms. The trend is reinforced by global movements promoting sustainable consumption, driving long-term growth for second-hand apparel in both online and offline markets.

- For instance, Patagonia’s Worn Wear program has extended the life of more than 1 million garments since its launch, while The Iconic’s partnership with AirRobe in 2023 enabled over 200,000 Australian consumers to resell and reuse pre-owned fashion items.

Expanding Online Resale Platforms and Digital Adoption

The rapid growth of online resale platforms is a key driver of market expansion. E-commerce models allow consumers to buy and sell pre-owned apparel with ease, providing convenience, verified authenticity, and wider product availability. Companies leverage advanced algorithms, digital marketing, and virtual try-on tools to enhance the shopping experience. Mobile-first platforms and social media reselling groups have also become mainstream, connecting buyers directly with sellers. This digital shift has transformed resale into a structured, organized market, attracting middle- and high-income shoppers. As Australians increasingly embrace online retail, resale platforms will play a pivotal role in scaling the market.

- For instance, in 2024, eBay globally reported strong growth in pre-loved fashion, with nearly 40% of all clothing, shoes, and accessories on its platform listed as pre-owned.

Growing Affordability and Demand for Branded Apparel

Affordability is a central growth driver, as second-hand apparel offers access to premium and luxury brands at lower costs. Consumers seeking branded clothing often find resale platforms an attractive alternative to buying new products at high retail prices. Economic factors, including rising living costs in Australia, have also encouraged more households to shift toward second-hand purchases for value savings. Branded resale not only provides affordability but also ensures quality, as these items often have longer lifecycles. The demand for high-end apparel through resale contributes significantly to the market’s growth, especially among fashion-conscious urban consumers.

Key Trends & Opportunities

Shift Toward Circular Economy and Eco-Friendly Policies

Government policies and public initiatives supporting circular economy practices are accelerating the adoption of resale markets. Australia has been increasingly promoting recycling and sustainable consumption to reduce textile waste. This regulatory push creates opportunities for resale companies to align with eco-friendly goals, establishing partnerships with fashion brands for take-back schemes and recycling programs. Growing collaborations between sustainability-focused organizations and resale businesses are also helping expand market awareness. By embracing the circular economy model, second-hand apparel companies can differentiate themselves and position resale as a mainstream, eco-conscious choice for consumers.

- For instance, in 2023, H&M’s global garment collection program, which is offered in various countries, gathered 16,855 tonnes of textiles worldwide. The collected garments are sorted for reuse or recycling, but the program does not represent a fully “closed-loop” recycling system where all textiles are made into new clothing.

Integration of Technology and Social Commerce

Technology-driven innovation presents major opportunities for second-hand apparel platforms. The integration of artificial intelligence for personalization, blockchain for product authentication, and augmented reality for virtual try-ons are reshaping customer engagement. Social commerce via Instagram, TikTok, and Facebook Marketplace is further fueling resale adoption by connecting communities through interactive shopping. These channels allow consumers to not only purchase but also share, resell, and showcase sustainable fashion. With increasing smartphone penetration and high social media usage in Australia, these digital tools represent strong opportunities for expanding consumer reach and enhancing trust in the resale ecosystem.

Key Challenges

Quality Control and Counterfeit Risks

One of the major challenges in the Australian second-hand apparel market is ensuring product quality and authenticity. Consumers are often concerned about counterfeit products, wear-and-tear, or inaccurate product descriptions when purchasing pre-owned items. While digital platforms implement verification processes, maintaining consistent quality standards remains complex. This issue can affect buyer trust and slow down adoption among mainstream consumers who expect reliable, branded products. Developing robust quality control mechanisms, authentication technologies, and return policies will be essential for platforms and thrift retailers to overcome these barriers and strengthen market credibility.

Competition from Fast Fashion Retailers

The strong presence of fast fashion brands poses a considerable challenge to second-hand apparel growth. Fast fashion companies attract price-sensitive buyers with trendy, low-cost clothing collections, often competing directly with the affordability appeal of resale markets. Aggressive marketing and frequent product launches by these retailers can limit the shift of mainstream consumers toward pre-owned alternatives. Despite growing awareness of sustainability, many consumers continue to prioritize new fashion over second-hand. To overcome this, resale companies need to emphasize the long-term value, environmental benefits, and uniqueness of second-hand apparel to stand out in a highly competitive fashion landscape.

Regional Analysis

New South Wales

New South Wales leads the Australian second-hand apparel market, holding around 32% share in 2024. Sydney serves as the central hub, driven by high population density, strong sustainability awareness, and active participation in online resale platforms. The region benefits from a large base of fashion-conscious consumers who value both affordability and eco-friendly choices. Well-developed thrift store networks and collaborations with global resale platforms also enhance accessibility. The strong urban demand and cultural acceptance of pre-owned fashion position New South Wales as the most influential region, setting growth benchmarks for other Australian states.

Victoria

Victoria accounts for nearly 28% of the market share in 2024, making it the second-largest regional contributor. Melbourne drives this dominance with its vibrant fashion culture, diverse demographics, and rising adoption of circular economy practices. The city’s younger population shows strong engagement with digital resale platforms and social commerce, supporting growth in online second-hand fashion. Thrift stores and community-driven donation programs remain popular, further boosting market penetration. Victoria’s positioning as a trendsetter in sustainable fashion ensures consistent demand, as eco-conscious and budget-conscious consumers alike increasingly prefer pre-owned apparel across multiple categories.

Queensland

Queensland represents approximately 18% share of the second-hand apparel market in 2024, supported by both urban and regional demand. Brisbane leads adoption with growing online resale activity, while suburban areas favor traditional thrift stores and community donation models. Seasonal demand for casual wear, especially shirts, tops, and jackets, drives consistent consumption. Rising cost of living across the state also encourages consumers to choose affordable, branded second-hand clothing. Queensland’s balanced mix of urban digital adoption and regional thrift store reliance contributes to its steady role in the overall market expansion across Australia.

Western Australia

Western Australia holds nearly 12% share of the second-hand apparel market in 2024. Perth remains the primary center, where urban consumers adopt online resale platforms for convenience and access to branded apparel. Regional areas continue to rely more on donation-based thrift stores, reflecting slower digital adoption compared to eastern states. The market in Western Australia benefits from sustainability initiatives and growing awareness among younger demographics. While smaller in size than New South Wales or Victoria, the region shows strong long-term potential, with rising affordability-driven demand supporting steady growth across both resale and thrift segments.

South Australia and Others

South Australia, along with Tasmania and the Northern Territory, collectively contributes about 10% share of the market in 2024. Adelaide drives demand in South Australia through a mix of thrift stores and emerging online resale channels. Tasmania and the Northern Territory remain relatively smaller markets but show increasing consumer interest, particularly in affordable apparel for families and children. Limited scale and slower digital penetration constrain rapid growth, but community-driven sustainability efforts support gradual adoption. These regions provide niche opportunities for resale platforms to expand and capture untapped consumer bases in less competitive markets.

Market Segmentations:

By Type

- Dresses and Tops

- Shirts and T-shirts

- Sweaters, Coats, and Jackets

- Jeans and Pants

- Others

By Sector

- Resale

- Traditional Thrift Stores & Donations

By Target Population

By Distribution Channel

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others (Tasmania, Northern Territory)

Competitive Landscape

The competitive landscape of the Australia second-hand apparel market is characterized by a mix of organized resale platforms, thrift store chains, and emerging digital-first companies. Leading players such as Reluv Clothing Australia, The Closet, SwapUp, Savers AU, Thriftd Australia, and Southern Globe are shaping the industry through differentiated business models. Online resale platforms dominate by offering branded apparel, convenience, and wider reach, attracting younger, urban consumers. Traditional thrift stores remain significant, supported by community-driven donations and strong cultural acceptance. Companies increasingly adopt sustainability-focused strategies, integrating circular fashion initiatives and eco-friendly practices to gain consumer trust. Many players also invest in technology-driven solutions such as authentication systems, AI-based personalization, and social commerce to strengthen customer engagement. Competitive intensity is rising as global resale platforms explore opportunities in Australia, creating pressure on local players to innovate, expand product portfolios, and build stronger digital presence while maintaining affordability and quality standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, ThredUp released its fourth annual impact report detailing environmental, social, and governance strategy and progress.

- In August 2024, ThredUp introduced AI-powered shopping tools to improve the shopping experience in its secondhand clothing marketplace.

- In March 2024, Vinted acquired Danish marketplace Trendsales to strengthen its presence in the Nordic region.

- In February 2024, Thrift+ generated significant contribution towards overheads, setting a path to profitability.

- In January 2024, United Kingdom-based fashion brand HERA launched an integrated platform for secondhand clothing resale, promoting the quality and longevity of its products as part of its circularity journey rather than relying on pre-existing reselling sites.

- In August 2023, Hanna Andersson and H&M launched resale systems to recycle previously owned clothes, promoting sustainability

Report Coverage

The research report offers an in-depth analysis based on Type, Sector, Target Population, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising consumer awareness of sustainability.

- Online resale platforms will dominate growth as digital adoption accelerates.

- Women will remain the largest consumer group, driving demand for diverse categories.

- Dresses and tops will continue leading the product segment due to high fashion appeal.

- Affordability will attract more middle-income households to second-hand apparel.

- Social media and influencer-driven resale channels will boost consumer engagement.

- Traditional thrift stores will retain importance in suburban and rural areas.

- Technology integration such as authentication tools will improve buyer confidence.

- Regional growth will remain strong in New South Wales and Victoria.

- Partnerships with fashion brands for circular economy initiatives will expand market opportunities.