Market Overview

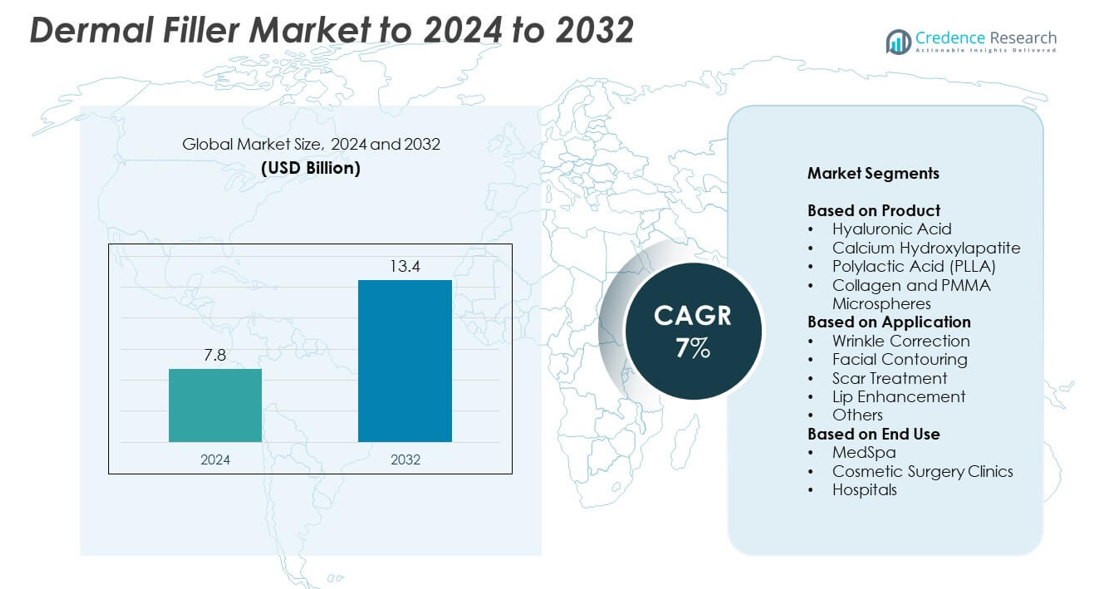

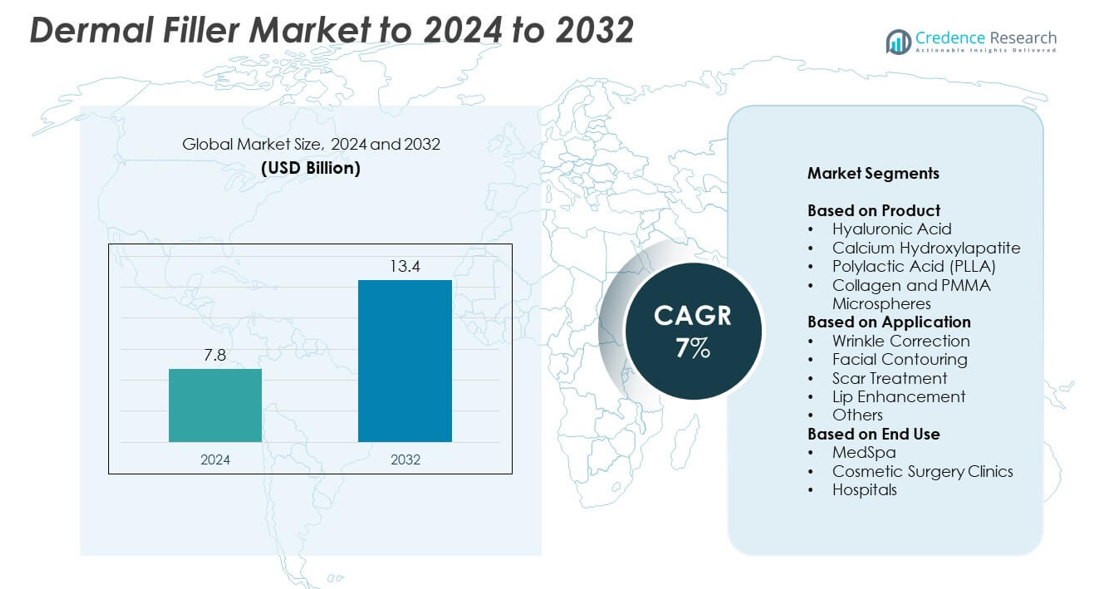

Dermal Filler Market size was valued at USD 7.8 Billion in 2024 and is anticipated to reach USD 13.4 Billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermal Filler Market Size 2024 |

USD 7.8 Billion |

| Dermal Filler Market, CAGR |

7% |

| Dermal Filler Market Size 2032 |

USD 13.4 Billion |

The dermal filler market is highly competitive, with leading players such as Galderma, Merz Pharma, Sinclair Pharma, Teoxane Laboratories, and AbbVie (Allergan) driving global innovation. These companies focus on advanced filler formulations that enhance durability, safety, and natural-looking results. Continuous investment in research, clinical trials, and physician education supports their strong market presence. Strategic collaborations and geographic expansion strengthen their reach in both developed and emerging regions. North America dominated the global market with a 38% share in 2024, followed by Europe at 30%, supported by high aesthetic awareness and established healthcare infrastructure.

Market Insights

- The dermal filler market was valued at USD 7.8 billion in 2024 and is expected to reach USD 13.4 billion by 2032, growing at a CAGR of 7%.

- Increasing demand for minimally invasive aesthetic treatments and aging populations are driving strong market growth worldwide.

- The hyaluronic acid segment dominated with a 65% share in 2024, supported by biocompatibility and reversible properties that ensure safe and natural outcomes.

- The market remains competitive, with global leaders investing in R&D, product innovation, and strategic partnerships to strengthen their positions against emerging regional players.

- North America led the market with a 38% share in 2024, followed by Europe at 30% and Asia Pacific at 22%, reflecting expanding beauty awareness and technological adoption in aesthetic treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The hyaluronic acid segment dominated the dermal filler market with a 65% share in 2024. Its dominance stems from high biocompatibility, reversible nature, and strong hydration properties that deliver natural results. Hyaluronic acid fillers are widely used for wrinkle reduction and facial volume restoration due to their ease of use and low risk of adverse reactions. The growing demand for minimally invasive procedures and FDA-approved products such as Juvederm and Restylane is driving segment growth across aesthetic and dermatological applications.

- For instance, AbbVie: SKINVIVE’s U.S. trial treated 199 participants; treatment-related adverse events were 3.0%, and each pack includes two 1.0 mL syringes.

By Application

Wrinkle correction held the largest market share of 48% in 2024, supported by the growing preference for non-surgical facial rejuvenation. This segment benefits from the aging population and increasing awareness of early skin aging treatments. Advanced filler formulations now target dynamic wrinkles and fine lines more precisely. Demand is further strengthened by social media influence and technological innovations in microinjection techniques that offer faster recovery and longer-lasting results compared to traditional surgical procedures.

- For instance, Merz Aesthetics: Belotero Balance’s pivotal trial enrolled 118 subjects at 6 centers for nasolabial folds with 24-week follow-up.

By End Use

MedSpas accounted for the leading market share of 44% in 2024 due to their accessibility and personalized treatment offerings. The segment’s growth is driven by rising consumer inclination toward affordable and convenient aesthetic enhancements. MedSpas often collaborate with certified dermatologists and cosmetic surgeons, enabling high-quality results with minimal downtime. Increased consumer trust, membership-based services, and the adoption of advanced dermal filler technologies are enhancing patient satisfaction and broadening the client base across urban and semi-urban regions.

Key Growth Drivers

Rising Demand for Minimally Invasive Aesthetic Procedures

The growing preference for non-surgical cosmetic enhancements is a major driver of the dermal filler market. Consumers increasingly opt for injectable treatments due to shorter recovery times and lower procedural risks. Dermatologists and cosmetic clinics report steady growth in anti-aging procedures, especially among millennials and middle-aged groups. The shift toward natural-looking results and quick, outpatient-based solutions continues to boost demand across both developed and emerging economies.

- For instance, Ideal Image: the med-spa chain operates 140+ centers and reports over 20,000,000 treatments completed.

Technological Advancements in Filler Formulations

Innovation in dermal filler formulations is accelerating market growth through improved product safety, longevity, and biocompatibility. Next-generation fillers integrate cross-linking technologies that extend product durability and provide smoother results. Research and development investments by major players are driving the development of hybrid and collagen-stimulating fillers. These advancements are helping aesthetic professionals offer personalized treatments that address fine lines, facial volume loss, and lip enhancement more effectively.

- For instance, The FDA’s Summary of Safety and Effectiveness Data for JUVÉDERM VOLUX confirms that the study database reflected 157 participants randomized to treatment and 49 participants to a delayed-treatment control group.

Expanding Medical and Aesthetic Applications

Dermal fillers are finding broader use in reconstructive and therapeutic treatments beyond cosmetic enhancement. Applications now include scar correction, lip augmentation, and facial contour restoration after trauma or surgery. The medical acceptance of fillers in non-aesthetic dermatology is growing due to their ability to restore tissue volume safely. This expanding application base enhances market penetration across clinical settings, fueling sustained revenue growth globally.

Key Trends and Opportunities

Growing Male Aesthetic Treatment Adoption

The rising participation of men in aesthetic treatments presents a new growth avenue for dermal filler providers. Increasing awareness about appearance and professional presentation is driving male-specific facial contouring and wrinkle correction procedures. Manufacturers are introducing gender-neutral and male-targeted filler formulations that cater to masculine facial structures. This trend is expected to expand the consumer base significantly, particularly in urban centers.

- For instance, Suneva Medical: Bellafill’s acne-scar RCT treated 147 subjects; the primary endpoint was assessed at 6 months.

Integration of AI and 3D Imaging in Aesthetic Planning

Artificial intelligence and 3D facial imaging technologies are revolutionizing filler treatment planning and outcomes. These tools allow precise visualization of facial anatomy and predictive modeling before injection. Clinics using such systems achieve better symmetry, patient satisfaction, and procedure accuracy. The integration of digital visualization enhances clinician confidence and reduces the risk of overcorrection, strengthening patient trust and long-term retention.

- For instance, Canfield Scientific: VECTRA H1 3D imaging showed mean absolute error under 2 mm across tested facial movements.

Key Challenges

Risk of Adverse Effects and Product Complications

Despite technological advances, concerns over filler-related complications remain a challenge. Issues such as bruising, swelling, vascular occlusion, or allergic reactions can impact patient trust. Improper injection techniques and the use of counterfeit products in unregulated markets add further risks. Addressing these safety challenges through stringent regulations, professional training, and patient education remains crucial for sustaining market credibility.

High Cost of Premium Treatments and Limited Reimbursement

Dermal filler procedures remain expensive for many consumers, particularly in developing regions. High costs associated with branded fillers, skilled practitioners, and repeat sessions limit adoption. Moreover, aesthetic treatments are often excluded from insurance coverage, making affordability a significant barrier. This challenge encourages consumers to seek lower-cost alternatives, sometimes compromising treatment quality and safety.

Regional Analysis

North America

North America held the largest share of 38% in the dermal filler market in 2024. The region’s growth is driven by a high number of aesthetic procedures, advanced healthcare infrastructure, and strong consumer spending on cosmetic treatments. The United States leads due to widespread adoption of injectable fillers and frequent product launches by leading manufacturers. Supportive regulatory frameworks and the presence of skilled dermatologists further strengthen regional dominance. The growing acceptance of non-surgical facial rejuvenation among younger demographics continues to expand the market.

Europe

Europe accounted for a 30% share of the global dermal filler market in 2024. Rising aging populations, strong presence of premium aesthetic brands, and favorable reimbursement policies support market expansion. Countries such as Germany, France, and the United Kingdom lead in product innovation and safety compliance. The region also benefits from growing interest in minimally invasive aesthetic procedures. Increasing adoption of biodegradable fillers and awareness of safe injectable practices are key factors propelling growth across European markets.

Asia Pacific

Asia Pacific captured a 22% market share in 2024 and is expected to witness the fastest growth during the forecast period. Rising disposable incomes, expanding medical tourism, and growing beauty consciousness are key growth enablers. South Korea, Japan, and China dominate regional demand with advanced aesthetic clinics and technological innovation. Increasing use of social media and influence of global beauty trends continue to attract younger consumers. Rapid urbanization and government support for cosmetic healthcare infrastructure further enhance the regional market outlook.

Latin America

Latin America represented an 8% share of the dermal filler market in 2024, driven by growing adoption of aesthetic procedures in Brazil and Mexico. Expanding medical tourism and availability of affordable treatments encourage market growth. Rising awareness of non-surgical cosmetic solutions and local production of cost-effective fillers support wider access. However, economic fluctuations and regulatory barriers may limit premium product adoption. Increased marketing efforts by global brands are expected to strengthen regional growth in the coming years.

Middle East and Africa

The Middle East and Africa held a 2% share of the global dermal filler market in 2024. Growth is supported by rising beauty consciousness, expanding luxury medical facilities, and increased adoption of Western beauty trends. The United Arab Emirates and Saudi Arabia lead in aesthetic treatment demand due to high income levels and modern clinics. While limited healthcare accessibility constrains some African nations, growing cosmetic awareness and medical tourism in the Gulf countries continue to drive steady market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product

- Hyaluronic Acid

- Calcium Hydroxylapatite

- Polylactic Acid (PLLA)

- Collagen and PMMA Microspheres

By Application

- Wrinkle Correction

- Facial Contouring

- Scar Treatment

- Lip Enhancement

- Others

By End Use

- MedSpa

- Cosmetic Surgery Clinics

- Hospitals

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The dermal filler market features strong competition among leading players such as Galderma, Croma Pharma, Merz Pharma, Sinclair Pharma, and Teoxane Laboratories. The market is characterized by continuous innovation, expanding product portfolios, and growing adoption of advanced filler formulations. Companies focus on developing longer-lasting, biocompatible, and minimally invasive solutions to meet evolving aesthetic preferences. Strategic partnerships, mergers, and clinical advancements are central to sustaining market leadership. Manufacturers increasingly invest in R&D and global distribution networks to strengthen presence in emerging economies. The industry also sees rising competition from regional brands introducing cost-effective alternatives. Continuous regulatory compliance, physician training programs, and digital engagement initiatives remain vital to maintaining trust and brand loyalty. Growing awareness of non-surgical procedures and evolving consumer preferences are encouraging market players to enhance treatment safety and deliver natural-looking results, fostering steady global expansion.

Key Player Analysis

- Galderma

- Croma Pharma

- Merz Pharma

- Sinclair Pharma

- Teoxane Laboratories

- Bioxis Pharmaceuticals

- Sisram Medical

- Cytophil

- Korman Laboratories

- Suneva Medical

- Mesoestetic

- Skin Tech Pharma

- Laboratories Vivacy

- Vital Esthetique

- Advanced Aesthetic Technologies

- AbbVie (Allergan)

- Evolus

- Allergen Aesthetics

Recent Developments

- In 2025, Allergan Aesthetics announced the expansion of its SKINVIVE® by JUVEDERM® product into 35 new markets globally, bringing the total to 57 international launches in 2025

- In 2025, Galderma launched Sculptra in China and presented new clinical data on its portfolio at AMWC 2025.

- In 2023, Allergan launched Juvéderm Volux XC for jawline definition and received FDA approval for Skinvive by Juvéderm for cheek smoothness.

- In 2023, Croma Pharma enrolled its first patient in a hyaluronic acid dermal filler clinical trial in China.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-surgical cosmetic procedures will continue to rise among younger consumers.

- Technological advancements will improve filler longevity and natural facial integration.

- Hybrid and collagen-stimulating fillers will gain wider clinical acceptance.

- Personalized treatment planning using AI and 3D imaging will enhance outcomes.

- Male-focused aesthetic treatments will become a growing segment in urban markets.

- Medical applications such as scar and volume restoration will expand product use.

- Regulatory focus on product safety and practitioner training will strengthen industry credibility.

- Emerging economies will drive growth through rising incomes and medical tourism.

- Sustainability initiatives will encourage the development of eco-friendly filler materials.

- Strategic partnerships between manufacturers and clinics will accelerate product innovation and market reach.