Market Overview

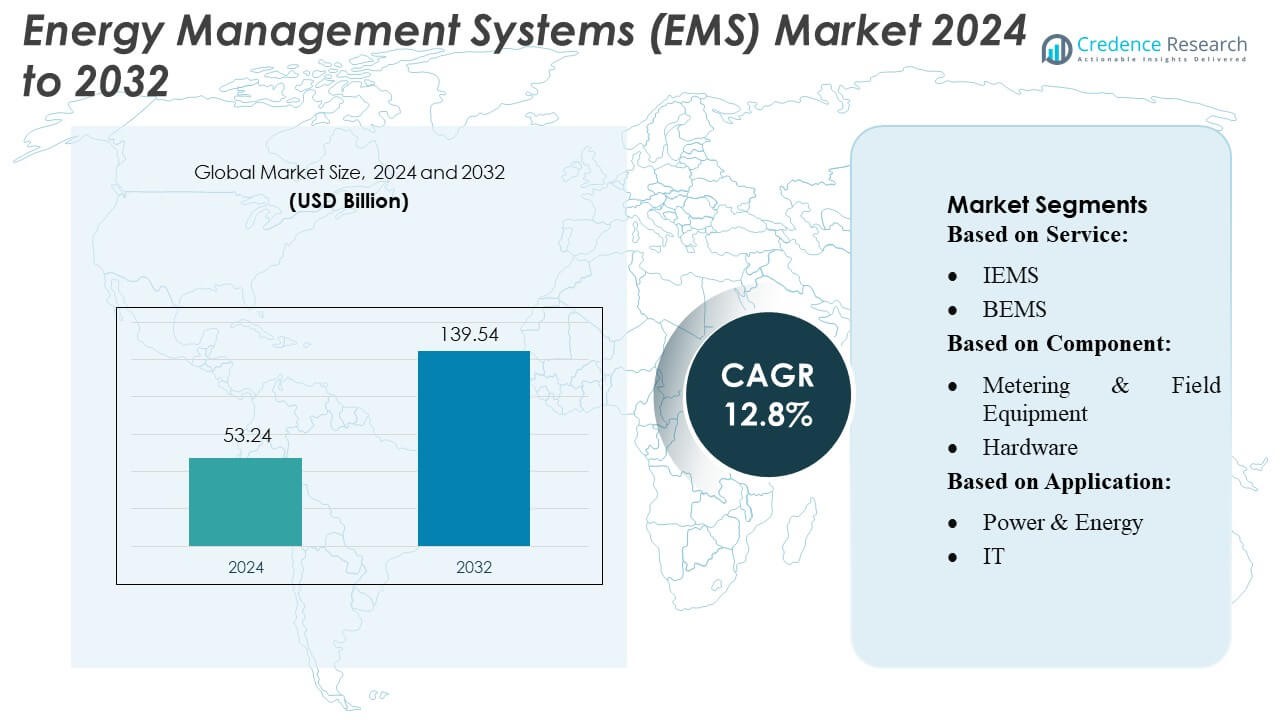

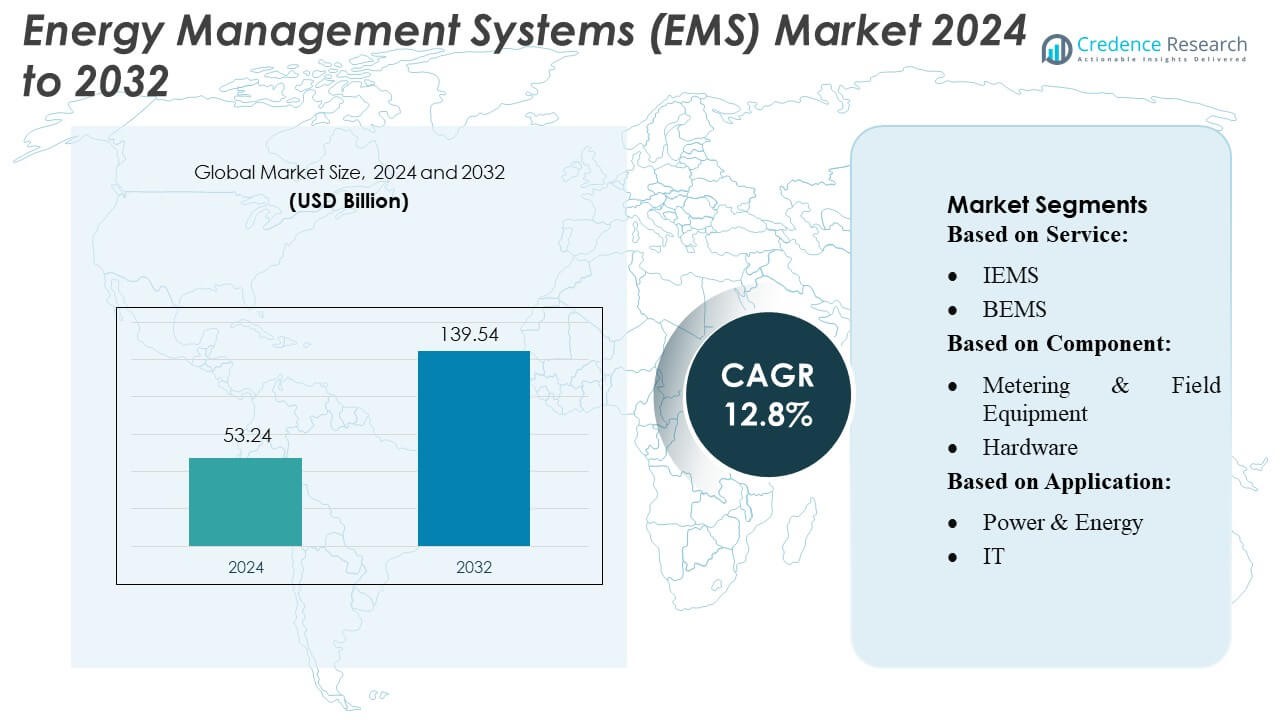

Energy Management Systems (EMS) Market size was valued USD 53.24 billion in 2024 and is anticipated to reach USD 139.54 billion by 2032, at a CAGR of 12.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Energy Management Systems (EMS) Market Size 2024 |

USD 53.24 Billion |

| Energy Management Systems (EMS) Market, CAGR |

12.8% |

| Energy Management Systems (EMS) Market Size 2032 |

USD 139.54 Billion |

The Energy Management Systems (EMS) market is dominated by major players such as GridPoint, Siemens AG, C3.ai, Honeywell International Inc., Cisco Systems Inc., Johnson Controls Inc., ABB, IBM Corporation, Schneider Electric SE, and General Electric, all of which continue to advance digital energy optimization technologies through AI, IoT, and cloud integration. These companies strengthen competitiveness by expanding smart building solutions, enhancing analytics, and supporting renewable integration. North America leads the global EMS market with an exact market share of 33%, driven by strong regulatory support, high smart grid adoption, and rapid digitalization across commercial, industrial, and utility sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Energy Management Systems (EMS) Market reached USD 53.24 billion in 2024 and is projected to hit USD 139.54 billion by 2032, growing at a CAGR of 12.8%, supported by rising demand for intelligent energy optimization and digital infrastructure expansion.

- Growing emphasis on energy efficiency, renewable integration, and AI-driven automation drives market growth as industries adopt advanced EMS to reduce operational costs and meet sustainability goals.

- The market shows strong competitive intensity, with major providers enhancing IoT connectivity, cloud-based analytics, and smart building technologies to strengthen global positioning.

- Limited interoperability between legacy systems and high initial deployment costs constrain adoption, particularly for small and mid-sized enterprises in emerging markets.

- North America leads with a 33% regional share, while the industrial segment accounts for the largest share, driven by high energy consumption and accelerated smart factory adoption across manufacturing, utilities, and heavy industries.

Market Segmentation Analysis:

By Service

In the EMS market, Building Energy Management Systems (BEMS) hold the dominant share, accounting for the largest adoption due to their strong integration in commercial buildings, advanced automation capabilities, and measurable ROI from reduced HVAC and lighting energy loads. BEMS growth accelerates as facility managers prioritize real-time analytics, IoT-enabled controls, and regulatory compliance. Industrial EMS (IEMS) expands steadily as factories digitalize operations, while Home EMS (HEMS) grows faster in regions adopting smart-home devices. Overall, increasing focus on operational efficiency, carbon-reduction targets, and scalable cloud-based dashboards drives service-level differentiation.

- For instance, GridPoint has deployed its platform across more than 18,000 commercial buildings, and in 2023, helped those sites avoid approximately 1.1 million metric tons of CO₂, while saving 1.4 billion kWh of electricity.

By Component

Within components, Software represents the leading segment with the highest market share, driven by its central role in enabling analytics, forecasting, load optimization, and automated control across complex energy infrastructures. The shift toward AI-enabled dashboards, digital twins, and predictive maintenance strengthens software adoption across industries. Hardware, metering devices, sensors, and networking equipment support system deployment but increasingly rely on interoperable platforms for unified visualization. Control systems gain traction as enterprises demand higher automation. Growing investments in grid modernization, IoT connectivity, and cybersecurity-hardened EMS platforms further enhance component-level growth.

- For instance, Siemens AG reports that its EnergyIP® grid software manages more than 90 million metering endpoints globally, enabling advanced load forecasting and energy-data analytics at utility scale.

By Application

The Power & Energy segment dominates the EMS market with the largest share, supported by utilities’ need to optimize grid performance, integrate renewable energy, and manage peak load variability. Advanced EMS platforms help power producers monitor generation assets, streamline distribution, and reduce transmission losses. Manufacturing follows as plants integrate smart-factory systems to manage energy-intensive processes. IT and enterprise facilities adopt EMS to manage data-center loads and improve building efficiency, while healthcare facilities prioritize uninterrupted power quality. Rising emphasis on decarbonization, electrification, and cost-efficient energy use drives adoption across all applications.

Key Growth Drivers

- Rising Energy Efficiency Mandates

Governments increasingly enforce stringent energy-efficiency policies, compelling enterprises, utilities, and commercial facilities to deploy advanced EMS solutions. These mandates require real-time energy monitoring, automated reporting, and compliance with carbon-reduction targets. Organizations adopt EMS to avoid regulatory penalties, reduce operational expenses, and enhance transparency in energy use. Growing participation in global sustainability programs and mandatory energy audits further accelerates EMS uptake across industrial, commercial, and public-sector infrastructures.

- For instance, C3.ai helped a large U.S. utility unify over 20 disparate data sources (including billing, submeter, and asset data) into its AI Energy Management platform, enabling it to surpass a 20% consumption reduction goal with a 23% cut, as verified by the company.

- Rapid Digitalization and IoT Integration

Digital transformation across industries fuels EMS adoption as enterprises integrate IoT sensors, cloud platforms, and AI-driven analytics to optimize energy consumption. Real-time data gathering improves load forecasting, asset performance diagnostics, and energy cost planning. Industrial sites increasingly rely on smart meters, edge devices, and predictive maintenance algorithms to minimize downtime and energy waste. The expanding ecosystem of interoperable IoT devices strengthens the capability of EMS platforms to automate complex energy workflows and deliver measurable efficiency improvements.

- For instance, Honeywell International Inc. deploys its Forge Energy Optimization solution to autonomously adjust HVAC set-points every 15 minutes, making 96 calculated control changes per day across all assets.

- Growing Renewable Energy Penetration

The rapid addition of renewable power sources demands intelligent systems capable of balancing intermittent generation and ensuring grid stability. EMS platforms facilitate renewable asset monitoring, distributed energy resource management, and peak-load optimization. Utilities, microgrid operators, and commercial buildings adopt EMS to integrate solar, wind, and storage assets with minimal operational disruptions. As companies pursue carbon neutrality and diversify their energy portfolios, EMS solutions become essential to manage variability and support long-term decarbonization strategies.

Key Trends & Opportunities

- Expansion of AI-Enabled Predictive Analytics

AI-powered EMS platforms are transforming energy optimization by delivering predictive insights into consumption patterns, equipment failures, and peak-demand scenarios. Predictive analytics enhances load forecasting accuracy and automates energy-intensity adjustments. Vendors increasingly embed machine learning models into cloud dashboards, enabling users to simulate scenarios and improve decision-making. This trend opens opportunities for differentiated EMS offerings, particularly for energy-intensive sectors such as manufacturing, data centers, and utilities seeking quantifiable efficiency gains.

- For instance, Cisco Systems, Inc. reports that its Cisco Energy Management Suite has monitored more than 3,500,000 connected devices across global enterprises, enabling automated analytics-driven controls.

- Growth of Decentralized Energy and Microgrid Management

Microgrid expansion creates opportunities for EMS providers to support distributed energy resource management. Organizations deploy EMS to coordinate renewable energy, batteries, and backup generators to maintain resilience during grid fluctuations. The rise of community energy projects, electric vehicle (EV) charging hubs, and remote industrial sites further boosts demand for localized energy management platforms. Vendors are innovating with modular EMS architectures that support flexible scaling and real-time control of multi-asset systems.

- Increasing Adoption of Cloud-Based EMS Platforms

Cloud-native EMS solutions gain strong momentum due to their scalability, cost efficiency, and ease of remote deployment. Enterprises adopt cloud platforms to centralize multi-site energy data, implement automated optimization routines, and integrate advanced cybersecurity layers. This shift opens opportunities for subscription-based EMS models and rapid feature upgrades. As organizations prioritize digital sustainability strategies and enterprise-wide visibility, cloud EMS becomes a preferred approach for both small and large energy consumers.

- For instance, Johnson Controls, Inc. equips decentralized energy systems through its OpenBlue platform, which processes more than 3,000,000,000 data points daily across 90,000+ connected buildings, enabling real-time control of distributed solar, storage, and backup assets.

Key Challenges

- High Initial Deployment and Integration Costs

Despite long-term savings, EMS implementation requires significant upfront investment in sensors, metering equipment, networking devices, and integration services. Many legacy facilities face additional costs for retrofitting outdated infrastructure, which slows adoption among small and medium enterprises. Complex installation processes and the need for skilled technicians further increase deployment expenses. These financial hurdles often delay decision-making, especially in cost-sensitive sectors, limiting EMS penetration.

- Data Security and Interoperability Concerns

EMS platforms rely on continuous data exchange across IoT devices, cloud servers, and control systems, creating vulnerabilities related to cyberattacks and unauthorized access. Ensuring secure communication protocols, device-level authentication, and compliance with cybersecurity standards remains a critical challenge. Additionally, diverse hardware ecosystems and incompatible communication standards hinder seamless integration. Vendors must address interoperability gaps and strengthen cybersecurity frameworks to build trust and support wider EMS adoption.

Regional Analysis

North America

North America maintains a leading position in the EMS market, accounting for an estimated 32–35% share, driven by strong digital infrastructure, stringent energy-efficiency mandates, and rapid adoption of smart grids across the U.S. and Canada. Utilities and large commercial facilities actively deploy advanced EMS platforms to optimize load management and reduce operational costs. The region benefits from widespread integration of IoT-based monitoring and demand-response systems supported by government incentives promoting carbon reduction. Growing investments in building automation, coupled with rising electricity prices and sustainability targets, continue to strengthen demand for intelligent energy optimization solutions.

Europe

Europe represents an estimated 28–30% share of the global EMS market, supported by aggressive decarbonization goals, mature renewable integration, and strong regulatory frameworks such as the EU Energy Efficiency Directive. Countries like Germany, the U.K., and France lead adoption as industries digitize energy operations to meet strict emission standards. The region’s advanced smart meter penetration and focus on low-carbon buildings accelerate EMS deployment across commercial and industrial sectors. The shift toward distributed energy resources—particularly solar and wind—requires sophisticated energy balancing tools, further stimulating EMS investments across utility, manufacturing, and public infrastructure segments.

Asia-Pacific

Asia-Pacific holds an estimated 30–33% share, making it the fastest-growing EMS market due to expanding industrialization, rising energy consumption, and urban development across China, India, Japan, and Southeast Asia. Governments increasingly mandate efficiency standards and promote smart grid modernization, boosting EMS adoption in manufacturing, commercial buildings, and transport infrastructure. China leads with large-scale deployment of automated energy platforms, supported by its clean-energy transition and digital transformation initiatives. Rapid growth in smart cities, data centers, and renewable energy capacity across the region continues to create strong demand for scalable and cost-efficient energy management solutions.

Latin America

Latin America accounts for an estimated 5–7% share of the EMS market, with growth led by Brazil, Mexico, and Chile. Increasing grid modernization efforts, combined with rising electricity costs and renewable energy expansion, drive EMS adoption across industrial and commercial sectors. Regional governments encourage energy-efficiency projects and invest in smart metering, particularly in urban centers. Industrial facilities seek EMS solutions to enhance visibility, reduce losses, and optimize operational performance. Although adoption rates remain lower compared to mature markets, growing sustainability commitments and improved digital infrastructure strengthen the region’s long-term EMS deployment potential.

Middle East & Africa (MEA)

MEA represents an estimated 4–6% share, with adoption concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. The region increasingly invests in EMS solutions to support large-scale commercial complexes, industrial operations, and ambitious smart city projects such as NEOM. Rising energy demand, coupled with government-led diversification efforts and renewable energy programs, accelerates the use of EMS in utilities and public infrastructure. Energy-intensive industries—oil & gas, chemicals, and metals—implement EMS to achieve operational efficiency and meet sustainability targets. Despite infrastructure gaps in parts of Africa, expanding digitalization continues to drive gradual market growth.

Market Segmentations:

By Service:

By Component:

- Metering & Field Equipment

- Hardware

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Energy Management Systems (EMS) market features a highly competitive environment led by key players such as GridPoint, Siemens AG, C3.ai Inc., Honeywell International Inc., Cisco Systems Inc., Johnson Controls Inc., ABB, IBM Corporation, Schneider Electric SE, and General Electric. The Energy Management Systems (EMS) market exhibits intense competition as companies prioritize digital innovation, advanced automation, and scalable energy optimization technologies to strengthen their market presence. Vendors increasingly invest in AI-powered analytics, cloud-based platforms, and IoT-enabled monitoring tools that deliver real-time visibility and predictive insights across industrial, commercial, and utility operations. The competitive landscape continues to evolve with frequent mergers, acquisitions, and technology partnerships aimed at expanding solution portfolios and accelerating global deployment. As organizations pursue aggressive sustainability targets and stricter regulatory compliance, EMS providers focus on developing interoperable, cybersecure, and cost-efficient systems that enhance grid reliability, reduce operational costs, and support the integration of distributed energy resources.

Key Player Analysis

- GridPoint

- Siemens AG

- ai, Inc

- Honeywell International Inc.

- Cisco Systems, Inc.

- Johnson Controls, Inc.

- ABB

- IBM Corporation

- Schneider Electric SE

- General Electric

Recent Developments

- In May 2025, AEIDTH Technologies of Noida launched an advanced Battery Management System (BMS) for Energy Storage Systems (ESS), which can handle systems up to 1500V DC and are designed for megawatt-level applications. This new system is engineered to optimize energy efficiency and storage for residential and commercial use, supporting large-scale energy storage solutions.

- In May 2025, GoodWe solidified its status as a leader in the global energy storage sector by launching a suite of new solar storage solutions aimed at both residential users and the commercial and industrial (C&I) markets. These solutions are expected to enhance energy independence and reduce reliance on traditional power sources, catering to the growing need for sustainable energy management.

- In October 2024, Schneider Electric and Noida International Airport partnered to implement advanced building and energy management solutions at the airport. This collaboration includes the deployment of comprehensive systems like Electrical SCADA and an Advanced Distribution Management System (ADMS) to enhance operational efficiency, sustainability, and management of airport services.

- In September 2024, Larsen & Toubro Limited’s Power Transmission & Distribution (PT&D) business, through its Digital Energy Solutions (DES) division, secured a project to develop advanced energy management systems at Southern India’s multiple state and regional load dispatch centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will adopt more AI-driven analytics to enable predictive energy optimization across industrial and commercial facilities.

- Cloud-based EMS platforms will expand as enterprises prioritize remote monitoring and scalable energy management capabilities.

- IoT-enabled sensors will integrate more deeply with EMS to improve real-time data accuracy and operational automation.

- Smart grid modernization efforts will accelerate EMS deployment in utilities and public infrastructure.

- Renewable energy growth will increase the need for EMS solutions that balance distributed energy resources effectively.

- Industrial users will adopt EMS more widely to reduce energy intensity and meet stricter sustainability targets.

- Cybersecurity enhancements will become a core focus as EMS platforms handle more mission-critical energy data.

- Demand-response programs will expand, driving adoption of EMS tools that enable dynamic load management.

- Smart buildings will incorporate advanced EMS features to achieve higher efficiency and regulatory compliance.

- Strategic partnerships among technology providers, utilities, and energy service companies will shape future EMS innovation.