Market overview

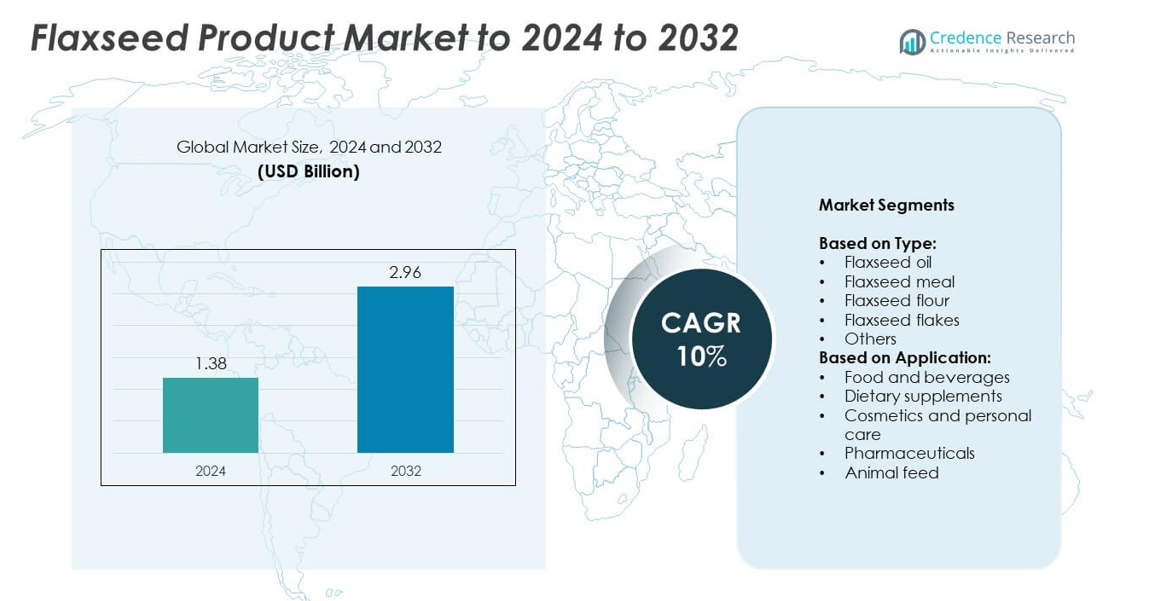

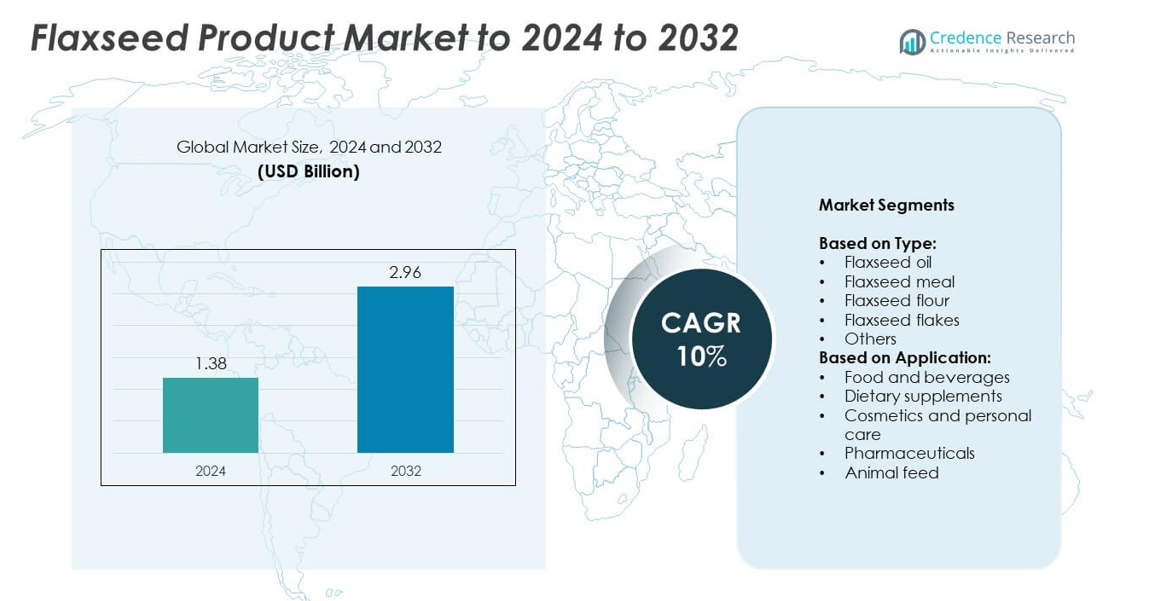

The Flaxseed Product Market size was valued at USD 1.38 billion in 2024 and is anticipated to reach USD 2.96 billion by 2032, expanding at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flaxseed Product Market Size 2024 |

USD 1.38 billion |

| Flaxseed Product Market, CAGR |

10% |

| Flaxseed Product Market Size 2032 |

USD 2.96 billion |

The flaxseed product market is shaped by prominent players including Connoils, Silverline Chemicals, GFR Ingredients, ADM, Spack International, AG Organica, Barlean’s, Fengchen, Hain Celestial, Scoular, Bioriginal, Linwoods Health Foods, and AgMotion. These companies drive growth through diverse product offerings such as flaxseed oil, meal, flour, and supplements, targeting applications in food, nutraceuticals, cosmetics, pharmaceuticals, and animal feed. North America emerged as the leading region in 2024, commanding 38% of the global market share, supported by high consumer awareness, advanced processing facilities, and strong adoption of plant-based nutrition. Europe followed with 29%, while Asia Pacific gained momentum as the fastest-growing market with 22%, driven by rising health awareness and expanding dietary supplement consumption.

Market Insights

- The flaxseed product market was valued at USD 1.38 billion in 2024 and is projected to reach USD 2.96 billion by 2032, expanding at a CAGR of 10% during the forecast period.

- Growth is driven by rising demand for plant-based nutrition, expanding use of flaxseed in nutraceuticals and supplements, and increasing applications in animal feed and personal care products.

- Key trends include the integration of flaxseed into functional foods, fortified beverages, and clean-label cosmetics, along with innovations in processing and product formats to meet evolving consumer preferences.

- The competitive landscape features leading players offering diverse flaxseed-based products across global markets, with strategies focused on innovation, sustainability, distribution expansion, and product diversification to strengthen market positioning.

- Regionally, North America led with 38% share in 2024, followed by Europe at 29% and Asia Pacific at 22%, while flaxseed oil dominated product segments with over 35% share in the same year.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Flaxseed oil held the dominant share of the market in 2024 with over 35%, supported by strong demand in functional foods, nutraceuticals, and personal care. Its rich omega-3 profile and cholesterol-lowering benefits make it a preferred ingredient in fortified products. Flaxseed meal and flour follow, gaining traction in bakery and gluten-free applications, while flakes are rising in ready-to-eat snacks. The “Others” category, including protein isolates and capsules, is expanding in niche dietary and specialty blends, reflecting innovation and growing use of concentrated flaxseed formulations across industries.

- For instance, Barlean’s flax oil delivers 7,640 mg ALA per tablespoon.

By Application

Food and beverages dominated the flaxseed product market with over 40% share in 2024, driven by the incorporation of flaxseed in bakery, dairy alternatives, and fortified snacks. Dietary supplements hold the next largest position, supported by omega-3 demand in plant-based capsules and powders. Cosmetics and personal care applications are expanding with natural oils in skincare and haircare, while pharmaceuticals utilize lignan-rich extracts for cardiovascular and hormonal support. Animal feed also contributes strongly, with flaxseed meal and oil enhancing nutrition in livestock and premium pet food formulations.

- For instance, Bob’s Red Mill’s Brown Flaxseed Meal provides 1,700 mg of ALA and 3 grams of fiber per 2 tablespoons, while the Organic Golden Flaxseed Meal provides 1,800 mg of ALA and 4 grams of fiber per 2 tablespoons.

Key Growth Drivers

Rising Demand for Plant-Based Nutrition

The shift toward plant-based diets has significantly boosted demand for flaxseed products. Consumers increasingly prefer flaxseed oil, meal, and flour as rich sources of omega-3, fiber, and protein. Food and beverage companies incorporate flaxseed in fortified snacks, bakery, and dairy alternatives to meet clean-label and vegan demand. This driver is central to the market’s expansion, as health-conscious consumers replace synthetic ingredients with natural alternatives. The nutritional benefits of flaxseed ensure its steady adoption, making plant-based nutrition the most influential growth driver.

- For instance, The Burnbrae Farms website for the standard Naturegg Omega 3 eggs states that two large eggs provide 150 mg of DHA.

Expanding Use in Nutraceuticals and Supplements

Flaxseed’s role in dietary supplements is expanding due to its proven cardiovascular and digestive benefits. Capsule and powder formulations are marketed as natural alternatives to fish oil, catering to consumers seeking plant-based omega-3. Rising e-commerce sales and personalized nutrition trends support this demand. Manufacturers focus on lignan-rich supplements targeting hormonal balance and immunity enhancement, further strengthening growth. This application broadens flaxseed’s market reach beyond food products, positioning nutraceuticals as a strong driver of long-term market performance across global consumer bases.

- For instance, Nature Made lists 700 mg ALA per 1,400 mg flaxseed-oil softgel; the 1,000 mg SKU lists 500 mg ALA.

Growth in Animal Feed Applications

The use of flaxseed meal and oil in animal and pet nutrition has grown considerably. Livestock industries incorporate flaxseed to improve feed quality and enhance the nutritional value of meat, milk, and eggs. Pet food brands are also integrating flaxseed to meet rising demand for premium, natural feed products. This driver is important as it aligns with both consumer-driven pet humanization and commercial livestock efficiency. The segment’s dual strength in agriculture and pet care positions animal feed as a strategic driver of market expansion.

Key Trends & Opportunities

Integration into Functional Foods and Beverages

A major trend is the integration of flaxseed into functional food and beverage formulations. Manufacturers use flaxseed oil, flour, and flakes to develop products that target heart health, digestion, and weight management. This trend is supported by rising demand for convenient, nutrient-dense foods in urban populations. Opportunities lie in expanding fortified smoothies, cereals, and protein bars that appeal to health-conscious and vegan consumers. The versatility of flaxseed ensures its continued inclusion in innovative formulations, positioning functional foods as a strong opportunity area.

- For instance, Quaker Super Grains lists 160 mg ALA per serving from a blend including flax

Adoption in Clean-Label Cosmetics and Personal Care

The cosmetics sector presents a key opportunity as flaxseed oil gains traction in clean-label skincare and haircare products. Its natural moisturizing and anti-inflammatory properties align with consumer preference for plant-based, chemical-free beauty solutions. Brands leverage flaxseed to position their products within the natural and organic cosmetics segment, which continues to grow globally. This trend is important as consumers associate flaxseed-based formulations with premium wellness, providing opportunities for manufacturers to diversify beyond food and supplements into high-value personal care applications.

- For instance, Klorane’s Volume Shampoo with Organic Flax lists 86% ingredients of natural origin on the official product page. The same page describes the formula as biodegradable.

Key Challenges

Price Volatility and Supply Dependence

One key challenge in the flaxseed product market is price volatility due to crop yield fluctuations. Dependence on agricultural output exposes manufacturers to risks from weather conditions, limited harvest cycles, and trade disruptions. This volatility affects the stability of raw material supply and increases costs for food and supplement producers. As flaxseed production is concentrated in select regions such as Canada and Europe, market players face limited sourcing flexibility. Addressing these risks requires diversified supply chains and investment in sustainable farming practices.

Lack of Consumer Awareness in Emerging Markets

Limited awareness of flaxseed’s nutritional benefits remains a challenge, particularly in developing regions. Consumers in these markets are less familiar with flaxseed-based foods and supplements compared to established markets in North America and Europe. This restricts adoption despite increasing health consciousness. Lack of promotional efforts, coupled with higher product costs, further hinders penetration in price-sensitive regions. Expanding education campaigns and affordable product lines are necessary to overcome this barrier. Without targeted awareness, flaxseed products may struggle to achieve large-scale acceptance in emerging economies.

Regional Analysis

North America

North America dominated the flaxseed product market in 2024, accounting for 38% of the global share. Strong demand for plant-based nutrition and functional foods drives growth across the United States and Canada. Widespread use of flaxseed oil, flour, and supplements in food, nutraceuticals, and personal care industries supports its market position. Health-conscious consumers and the popularity of vegan and gluten-free diets strengthen product adoption. The region benefits from advanced processing facilities, strong retail presence, and established awareness of flaxseed’s health benefits, ensuring its continued dominance in both mainstream and specialty product applications.

Europe

Europe held a 29% share of the flaxseed product market in 2024, supported by strong demand for functional foods, bakery applications, and clean-label supplements. Countries such as Germany, the United Kingdom, and France lead adoption, particularly in health-conscious consumer segments. The region’s preference for organic and sustainable ingredients further supports flaxseed integration into packaged foods and nutraceuticals. Expanding use in personal care and cosmetics also contributes to growth. With growing emphasis on plant-based diets and regulatory support for natural ingredients, Europe maintains its position as the second-largest market, offering opportunities for premium product expansion.

Asia Pacific

Asia Pacific accounted for 22% of the flaxseed product market in 2024, emerging as the fastest-growing regional segment. Rising health awareness and increasing adoption of functional foods in China, India, and Japan are key drivers. Demand for flaxseed oil and meal is rising due to its cardiovascular and digestive health benefits. Expanding e-commerce platforms also promote flaxseed supplements across the region. Growth in urban populations and dietary shifts toward plant-based products support rapid market expansion. Although awareness is still developing, Asia Pacific is expected to gain share steadily, driven by rising disposable incomes and health-focused consumer trends.

Latin America

Latin America represented 7% of the flaxseed product market in 2024, with Brazil and Mexico as the leading contributors. The region’s growth is supported by rising adoption of flaxseed oil and flour in functional foods and bakery products. Increasing demand for plant-based supplements and fortified products adds to expansion. However, limited awareness and higher product costs remain barriers to broader adoption. With growing urbanization and influence of Western dietary habits, flaxseed products are gaining visibility in retail and health-focused channels. While smaller in size, the region shows potential for gradual growth through targeted consumer education.

Middle East and Africa

The Middle East and Africa accounted for 4% of the flaxseed product market in 2024, reflecting a developing stage of adoption. Demand is gradually increasing in urban centers for flaxseed oil and dietary supplements, driven by health-conscious consumers and expanding modern retail channels. Rising focus on preventive health and wellness supports adoption, particularly in Gulf countries. However, challenges such as limited awareness and price sensitivity restrict wider growth. Opportunities exist in promoting flaxseed-based foods and supplements as part of lifestyle-driven health choices. While the smallest regional market, MEA shows long-term potential with gradual consumer adoption.

Market Segmentations:

By Type:

- Flaxseed oil

- Flaxseed meal

- Flaxseed flour

- Flaxseed flakes

- Others

By Application:

- Food and beverages

- Dietary supplements

- Cosmetics and personal care

- Pharmaceuticals

- Animal feed

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flaxseed product market is shaped by the presence of leading players such as Connoils, Silverline Chemicals, GFR Ingredients, ADM, Spack International, AG Organica, Barlean’s, Fengchen, Hain Celestial, Scoular, Bioriginal, Linwoods Health Foods, and AgMotion. These companies focus on offering diversified flaxseed-based products ranging from oil and meal to flour and supplements to capture demand across food, dietary, cosmetic, and feed industries. Market participants emphasize innovation in processing techniques, product formulations, and packaging to meet clean-label, organic, and plant-based preferences. Expansion into emerging markets, strategic partnerships, and investment in distribution networks strengthen their global reach. E-commerce and retail collaborations further enhance accessibility of flaxseed products to wider consumer bases. Sustainability initiatives, coupled with research on functional benefits, help players build strong brand positioning. Competitive intensity remains high as companies differentiate through quality, product innovation, and expanded application portfolios to secure long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Connoils

- Silverline Chemicals

- GFR Ingredients

- ADM

- Spack International

- AG Organica

- Barlean’s

- Fengchen

- Hain Celestial

- Scoular

- Bioriginal

- Linwoods Health Foods

- AgMotion

Recent Developments

- In 2024, Barlean’s introduced new flavored organic linseed oil supplements to appeal to diverse consumer preferences and further its plant-based, vegan-friendly range

- In March 2023, ADM launched the Knwble Grwn brand, expanding its outreach in specialty oils such as flaxseed oil.

- In 2023, Bioriginal made two significant acquisitions at the end of 2023 to expand its global presence, particularly in the Netherlands and Japan, for greater flaxseed product reach and service to the EU and Asia.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The flaxseed product market will expand steadily, driven by rising health-conscious consumer demand.

- Flaxseed oil will remain the dominant product type due to its nutritional profile and versatility.

- Dietary supplements will gain traction as plant-based alternatives to traditional omega-3 sources.

- Food and beverage manufacturers will increasingly use flaxseed in bakery, snacks, and fortified products.

- Asia Pacific will emerge as the fastest-growing regional market with rising urban adoption.

- Clean-label cosmetics and personal care will open new opportunities for flaxseed-based formulations.

- Animal feed applications will strengthen with demand for natural, protein-rich livestock and pet nutrition.

- E-commerce growth will boost availability and global reach of flaxseed supplements and functional foods.

- Innovation in processing and product formats will enhance market penetration across diverse industries.

- Growing awareness campaigns will help overcome barriers in emerging markets and support wider adoption.