Market Overview

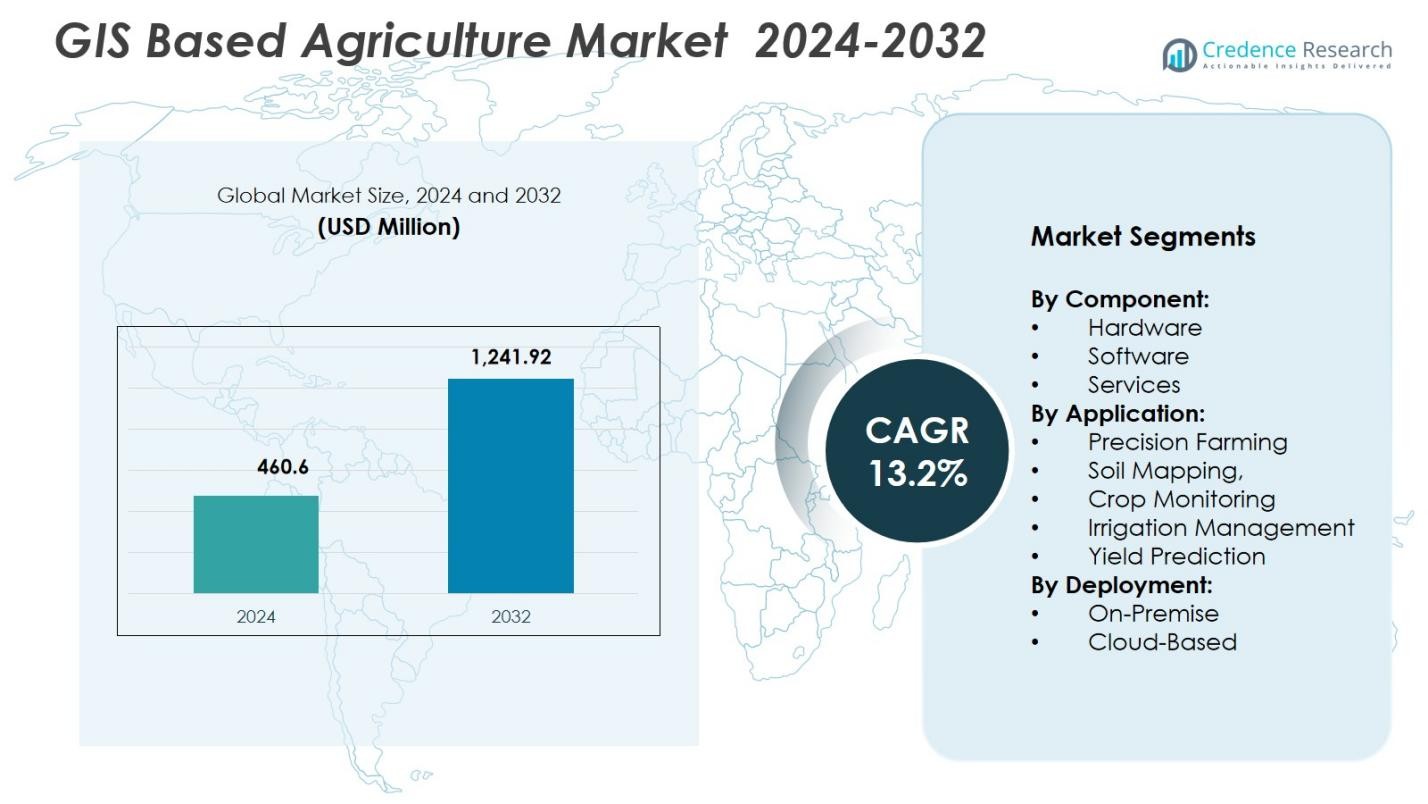

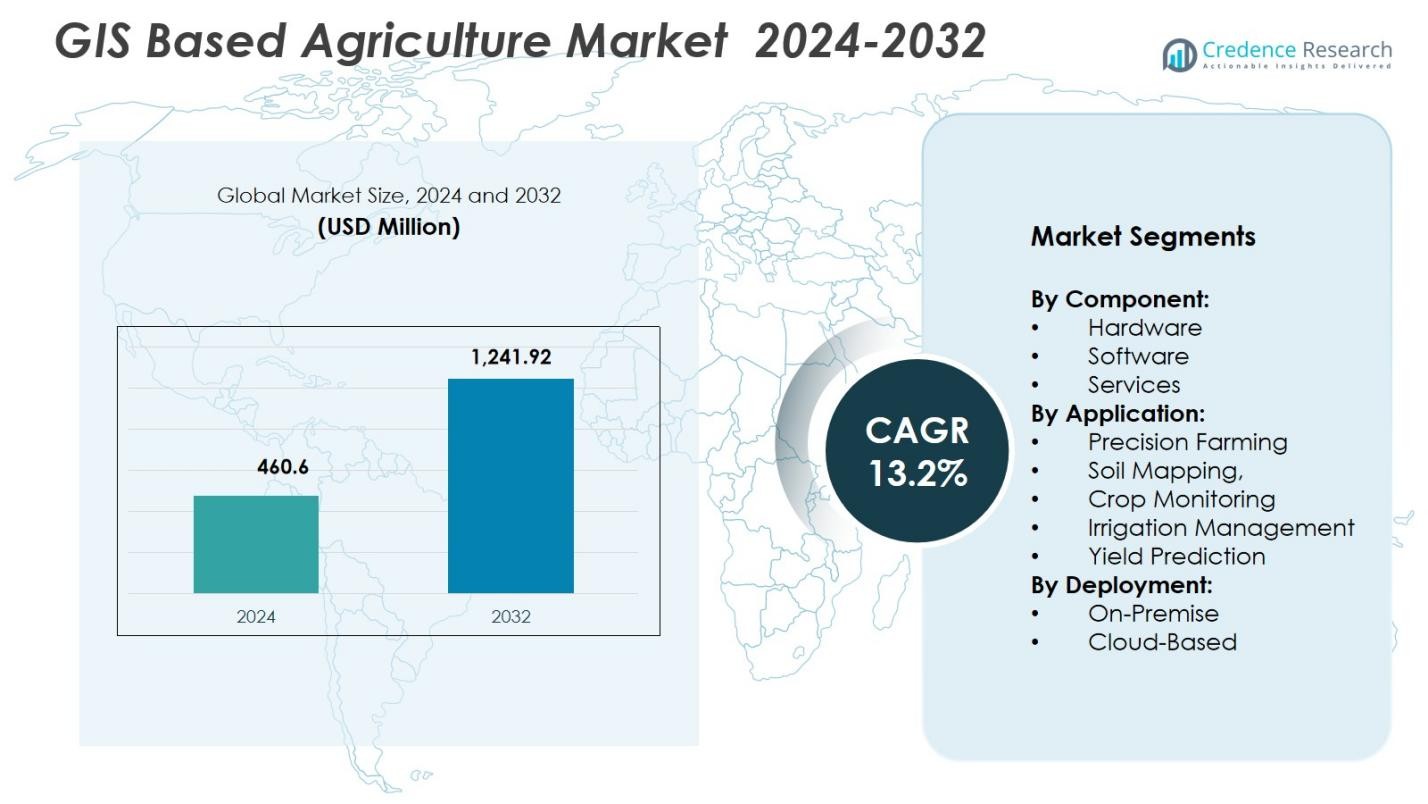

GIS Based Agriculture Market size was valued at USD 460.6 Million in 2024 and is anticipated to reach USD 1,241.92 Million by 2032, at a CAGR of 13.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GIS Based Agriculture Market Size 2024 |

USD 460.6 Million |

| GIS Based Agriculture Market, CAGR |

13.2% |

| GIS Based Agriculture Market Size 2032 |

USD 1,241.92 Million |

GIS Based Agriculture Market is driven by leading players such as Trimble Inc., Hexagon AB, ESRI, SuperMap Software, Deere & Company, AGCO Corporation, Raven Industries, Ag Leader Technology, Topcon Corporation, and Kubota Corporation, all of whom advance geospatial capabilities for precision farming. These companies focus on enhancing GIS software, satellite mapping, GNSS systems, and cloud-based analytics to support real-time decision-making across diverse farm operations. Regionally, North America leads the market with a 38.4% share, supported by high digital adoption and strong agritech infrastructure, followed by Europe with 27.6% and Asia-Pacific with 23.1%, reflecting rapid expansion of smart farming practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The GIS Based Agriculture Market reached USD 460.6 million in 2024 and will grow at a CAGR of 13.2% through 2032, driven by rising digital farming adoption.

- Strong demand for precision farming solutions acts as a key market driver, with the Precision Farming segment holding a 54.8% share due to widespread use of GPS-guided machinery and geospatial analytics.

- Evolving trends such as AI-enabled mapping, drone imagery, and cloud-based GIS platforms continue to enhance real-time field insights and support advanced decision-making.

- Major players including Trimble, Hexagon, ESRI, John Deere, and Topcon focus on expanding GIS software, GNSS tools, and satellite-based solutions to strengthen market presence.

- Regionally, North America leads with a 38.4% share, followed by Europe at 27.6% and Asia-Pacific at 23.1%, while the Software component dominates with a 46.3% share across the global market.

Market Segmentation Analysis:

By Component:

The GIS Based Agriculture Market is led by the Software segment, accounting for 46.3% share in 2024, driven by the growing need for real-time geospatial analytics, farm mapping, and decision-support tools. Farmers increasingly rely on GIS-enabled software platforms to optimize soil health, monitor crop variability, and improve input utilization. Hardware holds a significant share as GNSS devices, sensors, and drones expand precision capabilities, while Services continue to grow as farmers adopt advisory, integration, and training solutions. Rising digitalization across agriculture and the push for data-driven farm management support the dominance of the software segment.

- For instance, ESRI’s ArcGIS platform is widely adopted for precision agriculture applications, providing tools that help optimize irrigation and fertilizer use

By Application:

Precision Farming dominates the application segment with a 54.8% share in 2024, supported by strong adoption of GPS-guided machinery, spatial analytics, and optimized variable-rate input applications. Farmers use GIS tools to enhance seeding accuracy, monitor crop performance, and reduce operational costs. Soil Mapping and Crop Monitoring gain traction as remote sensing and IoT-based field sensors improve data accuracy. Irrigation Management and Yield Prediction show steady growth due to increasing water scarcity, climate variability, and demand for predictive analytics. Precision farming maintains leadership as digital transformation accelerates across global agriculture.

- For instance, John Deere’s GPS-enabled tractors enable farmers to increase seeding precision and reduce input waste, improving overall efficiency.

By Deployment:

The Cloud-Based deployment model leads with a 62.5% share in 2024, driven by its scalability, lower upfront cost, remote accessibility, and seamless integration with multi-source geospatial datasets. Cloud GIS solutions enable real-time collaboration, automated updates, and efficient data processing for large-scale farms and agribusinesses. On-Premise deployment retains relevance among enterprises requiring high data security, customized workflows, and full control over geospatial databases. However, continuous advancements in cloud cybersecurity, analytics capabilities, and subscription-based models ensure cloud deployment remains the preferred choice for modern GIS-enabled agriculture operations.

Key Growth Drivers

Expansion of Precision Farming Practices

The rapid expansion of precision farming serves as a major growth driver for the GIS Based Agriculture Market. Farmers increasingly adopt GIS-integrated tools to optimize seeding, fertilization, irrigation, and crop protection activities with high spatial accuracy. The rising use of GPS-enabled equipment, drones, and IoT sensors accelerates the demand for geospatial analytics, enabling farmers to reduce operating costs and improve productivity. As agriculture shifts toward data-driven decision-making, GIS platforms provide actionable insights that enhance yield outcomes and strengthen long-term farm sustainability.

- For instance, DJI’s agricultural drones, such as the Agras T30, enable precise aerial spraying, reducing pesticide use by 30% on average.

Rising Adoption of Remote Sensing and Satellite Analytics

Growing reliance on remote sensing technologies significantly boosts GIS-based agricultural solutions. High-resolution satellite imagery, UAV-based monitoring, and multispectral sensing enable continuous observation of crop health, soil variability, vegetation stress, and environmental factors. These tools support early issue detection and timely interventions, improving farm efficiency and minimizing yield losses. With advancements in LEO satellites and affordable drone systems, farmers gain access to accurate and frequent field data, enhancing the value and adoption of GIS-driven analytics across diverse agricultural landscapes.

- For instance, Planet Labs operates a constellation of over 200 LEO satellites providing daily high-resolution imagery that allows farmers to monitor crop health changes almost in real time.

Increasing Focus on Resource Optimization and Sustainability

Sustainability-driven farming practices strongly propel GIS adoption as global agriculture faces rising pressure to optimize water, fertilizer, and land resources. GIS tools assist in precise nutrient management, water allocation planning, and identification of soil degradation zones, ensuring efficient resource utilization. Governments and agritech companies promote sustainable cultivation through GIS-supported programs that help reduce greenhouse emissions and minimize wastage. As the shift toward climate-smart agriculture accelerates, GIS-enabled platforms become essential for building resilient farming systems and supporting long-term ecological balance.

Key Trends & Opportunities

Integration of AI, Machine Learning, and Predictive Analytics

A major trend shaping the GIS Based Agriculture Market is the integration of AI and machine learning to enhance predictive analytics and automate spatial data processing. Advanced algorithms improve crop forecasting, disease detection, and anomaly identification using large datasets derived from satellites and sensors. This creates opportunities for intelligent advisory systems that support real-time agricultural decision-making. As AI-driven platforms continue to evolve, they open the door for highly automated, precision-centric farming models that increase profitability and reduce manual intervention.

- For instance, John Deere’s AI-powered Operations Center uses machine learning to analyze satellite and sensor data, enabling farmers to optimize planting and irrigation schedules.

Growth of Cloud-Based GIS Platforms and Digital Agriculture Ecosystems

The rapid expansion of cloud-based GIS platforms creates strong opportunities for scalable, accessible, and collaborative digital agriculture ecosystems. Cloud GIS enables seamless data storage, rapid processing of high-volume geospatial datasets, and integration with IoT devices and climate models. It allows farmers and agribusinesses to access analytics dashboards from any location, enhancing operational adaptability. As subscription-based models grow and connectivity improves, cloud GIS platforms are increasingly adopted for large-scale farm management, multi-user collaboration, and real-time monitoring across distributed agricultural operations.

- For instance, Trimble’s Connected Farm platform integrates cloud GIS with IoT sensors to provide real-time soil moisture and weather data, improving irrigation management across large crop areas.

Key Challenges

High Initial Investment and Limited Technology Adoption Among Small Farmers

A significant challenge in the GIS Based Agriculture Market is the high upfront cost of hardware, software, and data acquisition systems, making adoption difficult for small and marginal farmers. Many regions lack adequate financial support, digital literacy, and infrastructure required to deploy GIS tools effectively. This creates a technological divide that limits full-scale market penetration. While government programs and subsidies help, widespread adoption remains hampered by affordability issues and slow transition from traditional farming practices to digital solutions.

Data Integration Complexity and Skilled Workforce Shortage

Integrating diverse datasets—from satellites, drones, sensors, and field equipment—poses a major operational challenge for GIS-based systems. Ensuring data accuracy, interoperability, and compatibility requires advanced analytical skills and specialized knowledge, which many agricultural regions lack. The shortage of trained GIS professionals and agritech analysts slows implementation and reduces the efficiency of decision-support systems. Additionally, managing large geospatial datasets demands robust IT infrastructure, which is often unavailable in remote farming areas, further hindering seamless adoption of GIS technologies.

Regional Analysis

North America

North America leads the GIS Based Agriculture Market with a 38.4% share, driven by strong adoption of precision farming technologies, advanced satellite mapping solutions, and widespread use of GPS-enabled machinery. The U.S. and Canada benefit from high farm mechanization, robust digital infrastructure, and strong investments in agri-analytics platforms. Government programs supporting sustainable farming and water-efficient irrigation further accelerate GIS deployment. Presence of major agritech companies and rapid integration of drones and remote sensing tools reinforce the region’s leadership, making North America the most mature market for GIS-enabled agricultural solutions.

Europe

Europe holds a 27.6% share of the GIS Based Agriculture Market, supported by stringent environmental regulations, Common Agricultural Policy (CAP) incentives, and rapid digital transformation across farming systems. Countries such as Germany, France, and the Netherlands increasingly implement GIS tools for soil mapping, climate monitoring, and nutrient management. The region prioritizes sustainability, traceability, and carbon-efficient agriculture, which encourages adoption of high-precision geospatial analytics. Strong R&D capabilities, expansion of smart farming projects, and growing use of satellite-based services from European space initiatives further strengthen GIS uptake across the region.

Asia-Pacific

Asia-Pacific accounts for a 23.1% share and represents the fastest-growing region in the GIS Based Agriculture Market due to large agricultural populations, expanding digital penetration, and rising government support for smart farming initiatives. China, India, Japan, and Australia increasingly integrate GIS for crop monitoring, irrigation planning, and yield assessment. Growing food demand, climate variability, and the need for resource optimization accelerate adoption across small and large farms. Advancements in drone mapping, satellite imagery accessibility, and agritech startups contribute to the rapid scaling of GIS solutions throughout the region.

Latin America

Latin America captures a 6.8% share, driven by expanding agribusiness modernization in Brazil, Argentina, and Chile. The region adopts GIS tools to enhance large-scale farming operations, plantation management, and crop health monitoring across soybean, sugarcane, and coffee sectors. Increasing use of drones, remote sensing, and soil analytics supports better land management and productivity. Although adoption remains uneven across smaller farms, rising investment in digital agriculture ecosystems and growing awareness of climate-resilient farming practices strengthen the region’s long-term GIS integration.

Middle East & Africa

The Middle East & Africa region holds a 4.1% share, with growing adoption of GIS solutions to address water scarcity, soil degradation, and climate-induced agricultural challenges. Countries such as Israel, UAE, South Africa, and Kenya leverage GIS-based irrigation management, desert farming techniques, and crop monitoring systems to improve farm efficiency. Investments in smart agriculture, satellite imagery programs, and digital advisory platforms are increasing steadily. While infrastructure limitations remain, rising government initiatives and partnerships with global agritech firms are accelerating GIS adoption across both commercial farms and emerging agricultural hubs.

Market Segmentations:

By Component:

- Hardware

- Software

- Services

By Application:

- Precision Farming

- Soil Mapping,

- Crop Monitoring

- Irrigation Management

- Yield Prediction

By Deployment:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the GIS Based Agriculture Market is shaped by leading players such as Trimble Inc., Hexagon AB, ESRI, SuperMap Software, Deere & Company, AGCO Corporation, Topcon Corporation, Raven Industries, Ag Leader Technology, and Kubota Corporation, who drive continuous innovation in geospatial farming technologies. These companies focus on expanding their portfolios through advanced GIS software, high-precision GNSS systems, remote sensing tools, and integrated farm management platforms. Many players invest heavily in cloud-based analytics, AI-enabled crop intelligence, and satellite data partnerships to deliver real-time insights for large and small farms. Strategic collaborations with agritech startups, digital agriculture service providers, and government agencies strengthen market presence and accelerate technology adoption. Additionally, companies prioritize developing scalable and user-friendly solutions tailored to diverse farm sizes, enhancing accessibility across developing regions. Continuous emphasis on sustainability, resource optimization, and data-driven decision-making remains central to competitive differentiation in the GIS-based agriculture sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trimble Inc.

- Hexagon AB

- ESRI (Environmental Systems Research Institute)

- SuperMap Software Co., Ltd

- Deere & Company (John Deere)

- AGCO Corporation

- Raven Industries, Inc.

- Ag Leader Technology

- Topcon Corporation

- Kubota Corporation

Recent Developments

- In December 2025, Esri India launched its new satellite-image processing software “Bharat ENVI,” aimed at expanding access to integrated satellite analytics across agriculture and planning sectors.

- In July 2025 Topcon Agriculture launched the UC7 Plus boom-height control system, improving spraying accuracy and reducing input and maintenance costs for sprayers.

- In July 2024, Trimble extended its long-standing GIS collaboration with ESRI to advance geospatial software and location-intelligence solutions, reinforcing offerings for agriculture, mapping, and infrastructure clients.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as precision agriculture tools become essential for optimizing field operations and improving overall farm productivity.

- AI-integrated GIS platforms will strengthen predictive capabilities, enabling farmers to anticipate crop needs and act with greater accuracy.

- Drone and satellite imaging will expand, providing real-time multispectral insights that support timely crop monitoring and field interventions.

- Cloud-based GIS solutions will dominate due to their scalability, easy accessibility, and strong integration with modern digital agriculture ecosystems.

- GIS-driven irrigation planning will gain importance as farmers focus on enhancing water efficiency and addressing climate-related resource challenges.

- Government-backed smart farming initiatives will accelerate GIS adoption through subsidies, digital programs, and sustainability-focused agricultural policies.

- Agribusinesses will expand IoT-linked GIS networks, improving data visibility, field connectivity, and real-time agronomic decision-making capabilities.

- Soil health mapping will advance significantly, helping farmers manage nutrient distribution and strengthen long-term land productivity planning.

- Adoption among small and mid-sized farms will rise as affordable GIS tools and subscription-based platforms become widely available.

- Strategic collaborations between agritech companies and satellite data providers will enhance spatial accuracy and broaden high-resolution mapping capabilities.