Market Overview:

The Global Pet Treat Market size was valued at USD 6,500.00 million in 2018, grew to USD 7,594.50 million in 2024, and is anticipated to reach USD 11,244.02 million by 2032, registering a CAGR of 5.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Treat Market Size 2024 |

USD 7,594.50 Million |

| Pet Treat Market, CAGR |

5.08% |

| Pet Treat Market Size 2032 |

USD 11,244.02 Million |

The market growth is driven by increasing pet humanization and rising spending on premium pet nutrition. Pet owners are prioritizing health-focused, natural, and functional treats, enhancing the nutritional and emotional well-being of their pets. Manufacturers are innovating with organic, grain-free, and fortified snacks to meet evolving consumer expectations. The rise of e-commerce platforms and the growing awareness of pet wellness further boost product accessibility and brand visibility.

Regionally, North America leads due to strong consumer purchasing power and established pet care infrastructure. Europe follows, supported by regulatory standards emphasizing ingredient transparency and sustainability. The Asia-Pacific region is emerging rapidly, fueled by urbanization, growing middle-class populations, and rising adoption of companion animals in China, Japan, and India. Latin America and the Middle East show gradual growth with expanding retail networks and pet awareness campaigns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Pet Treat Market was valued at USD 6,500.00 million in 2018, reached USD 7,594.50 million in 2024, and is projected to reach USD 11,244.02 million by 2032, growing at a CAGR of 5.08%.

- North America holds the largest share at 9%, driven by high pet ownership and strong spending on premium pet products. Europe follows with 20.0%, supported by sustainable manufacturing and ingredient transparency.

- Asia Pacific, with a 8% share, is the fastest-growing region due to urbanization, rising incomes, and expanding e-commerce distribution networks.

- By Product Type, Dog Treats accounted for around 55% of the market share in 2024, supported by higher adoption rates and frequent product innovation.

- By Distribution Channel, Online Retail held about 38% of total sales, fueled by growing digital adoption, doorstep delivery options, and improved access to premium brands.

Market Drivers:

Rising Pet Humanization and Focus on Emotional Well-Being

The growing trend of pet humanization is a major force driving the Global Pet Treat Market. Pet owners view their animals as family members and invest in high-quality nutrition to ensure better health and happiness. It benefits from this emotional connection, with consumers willing to spend more on functional and indulgent treats. Increasing awareness about pet wellness encourages owners to provide products that support digestion, dental health, and immunity. Urban households and single professionals are contributing to higher pet ownership rates. The demand for premium and natural ingredients also continues to rise. Social media and influencer campaigns highlighting pet health have further fueled the premiumization trend. The emotional value of pet companionship remains central to market expansion.

- For instance, Mars Petcare launched Pedigree Dentastix, which is clinically proven to reduce plaque by up to 80% in dogs, achieving significant dental health results for millions of pets globally.

Expansion of Premium and Functional Treat Categories

The demand for functional pet treats with added vitamins, probiotics, and minerals continues to rise. The Global Pet Treat Market has seen strong growth in products addressing specific needs like joint care, weight control, and skin health. Pet owners are becoming more aware of preventive nutrition and disease management through daily treats. It allows brands to innovate by introducing tailored solutions across species, age groups, and breeds. The increasing popularity of veterinarian-recommended products strengthens consumer trust. The shift toward fortified and condition-specific snacks boosts long-term product loyalty. Natural, organic, and grain-free formulas are now considered essential rather than optional. Brands focusing on quality sourcing and clean labelling are gaining a competitive edge.

- For instance, Nestlé Purina’s Pro Plan LiveClear reduced major cat hair allergens by 47%, and their digestive health probiotic products saw over 100 SKU innovations launched between 2024 and 2025.

Rapid Growth of E-Commerce and Online Retailing Platforms

Digital platforms are transforming the pet treat industry through direct-to-consumer strategies and personalized marketing. The Global Pet Treat Market benefits from rising online sales and subscription-based delivery models. Pet owners prefer the convenience of doorstep delivery and the ability to compare nutritional profiles. It supports faster adoption of niche and boutique brands that were previously inaccessible through offline channels. AI-driven recommendations help customers select suitable treats based on pet breed and health needs. Online marketplaces also provide insights into consumer preferences and purchase frequency. Retailers are investing in user-friendly interfaces and loyalty programs to improve retention. This digital transformation continues to shape global product visibility and reach.

Increasing Influence of Sustainability and Ethical Production

Sustainability is becoming a key factor influencing product development and brand selection. The Global Pet Treat Market is witnessing a rise in demand for eco-friendly packaging and ethically sourced ingredients. Consumers are choosing brands committed to reducing carbon footprints and supporting animal welfare. It encourages manufacturers to adopt sustainable sourcing and recyclable materials. Plant-based and insect-protein treats are gaining acceptance for their environmental benefits. Companies adopting transparent supply chains attract conscious consumers. Governments and NGOs promoting sustainable pet food practices further strengthen this trend. The growing emphasis on responsible consumption aligns with global environmental awareness.

Market Trends:

Shift Toward Natural, Organic, and Grain-Free Formulations

Consumers are increasingly demanding pet treats made from natural and minimally processed ingredients. The Global Pet Treat Market reflects this transition, with brands reformulating products to remove artificial colors and preservatives. It responds to growing health consciousness among pet owners seeking safer and more nutritious options. The inclusion of superfoods and plant-based proteins supports this trend. Small-batch and locally produced treats appeal to pet parents seeking authenticity. Transparent labelling and clean recipes help strengthen brand credibility. Veterinary endorsements also increase confidence in premium formulations. This shift demonstrates a clear move toward sustainable and holistic pet nutrition.

Growing Popularity of Freeze-Dried and Air-Dried Pet Treats

Technological innovation in preservation methods is driving a surge in freeze-dried and air-dried products. The Global Pet Treat Market benefits from these techniques that retain nutritional integrity and flavor. It supports longer shelf life without synthetic additives. Consumers prefer treats offering raw nutrition benefits in a convenient form. These products appeal to premium buyers focused on freshness and digestibility. Manufacturers are expanding their product portfolios to include high-protein and minimally processed options. Such offerings cater to the increasing preference for ancestral diets in pets. Improved packaging and portion control add further value for urban consumers.

- For instance, Mars Petcare and Big Idea Ventures selected three startups out of 165 applicants in 2025 to develop biotech-based ingredients, essential nutrients, and circular feed innovations in the pet food market. The specific startups selected are ALT-PRO Advantage, Seaqure Labs, and Terramatter, whose work focuses on sustainable and alternative ingredients such as microalgae and fungi-based proteins, rather than solely on freeze-dried solutions.

Personalization and Customization of Pet Nutrition

Personalized nutrition is gaining traction as data-driven insights transform pet care. The Global Pet Treat Market is evolving with brands providing customized treats based on breed, size, and dietary sensitivities. It reflects the shift toward health-based personalization seen in human nutrition. Subscription models now allow periodic deliveries of curated treat boxes. AI and IoT-based health monitoring devices enhance understanding of pet dietary needs. This customization ensures better compliance with health goals and improved satisfaction among pet owners. Pet-tech start-ups are leading innovations in this segment. The growing demand for tailored wellness experiences defines the future of the market.

Increased Focus on Branding, Packaging, and Transparency

Packaging innovation is emerging as a key differentiator in competitive markets. The Global Pet Treat Market is witnessing a surge in sustainable and resealable packaging designs. It helps preserve freshness while improving shelf appeal. Transparent labeling highlighting ingredient sourcing builds consumer confidence. Storytelling through branding helps brands connect emotionally with customers. Minimalist and eco-friendly visuals resonate with sustainability-focused buyers. Companies are using QR codes for ingredient traceability and product verification. These design improvements contribute to higher trust and repeat purchases. The emphasis on packaging transparency reflects evolving consumer values in pet care.

Market Challenges Analysis:

High Production Costs and Ingredient Price Volatility

Volatile raw material prices and high production costs remain major barriers for manufacturers. The Global Pet Treat Market faces pressure from fluctuating meat, grain, and specialty ingredient costs. It affects pricing strategies and profit margins for both small and large producers. Maintaining consistent quality while managing costs is a recurring challenge. Limited access to sustainable supply chains further complicates operations. Manufacturers adopting premium organic or novel proteins often face higher procurement expenses. Inflation in logistics and energy also impacts production economics. These constraints can limit innovation and affect overall market competitiveness.

Regulatory Compliance and Safety Concerns in Pet Nutrition

Strict safety regulations and labelling standards are creating operational challenges for global producers. The Global Pet Treat Market must comply with diverse regional food safety norms and pet health standards. It requires continuous testing, documentation, and certification to maintain compliance. Non-compliance risks product recalls and reputational damage. Regulatory frameworks for ingredient transparency and animal welfare add complexity to global distribution. Differences between U.S., European, and Asian standards increase costs for exporters. Managing traceability across suppliers remains difficult for multinational companies. These compliance burdens demand higher investment in quality control and documentation systems.

Market Opportunities:

Emergence of Novel Protein Sources and Functional Innovation

The demand for alternative protein ingredients is generating strong innovation potential. The Global Pet Treat Market can benefit from insect-based, plant-derived, and lab-grown protein formulations. It opens new avenues for sustainable and allergen-friendly products. Rising interest in functional nutrition encourages the addition of probiotics, collagen, and adaptogens. Companies introducing scientifically validated formulations are likely to capture premium segments. Expanding R&D investments support the creation of unique flavor profiles and nutrient blends. This innovation trend enhances market differentiation and long-term growth.

Rising Demand in Emerging Economies and Digital Expansion

Emerging regions are showing rising pet ownership and disposable income growth. The Global Pet Treat Market is expanding rapidly across Asia-Pacific and Latin America. It gains from increasing e-commerce penetration and improved retail accessibility. Online distribution allows small brands to reach larger audiences. Partnerships with veterinary clinics and local influencers strengthen brand trust. It offers an opportunity to expand customized and affordable products for diverse markets. Rapid digital adoption and growing awareness continue to unlock high-growth potential globally.

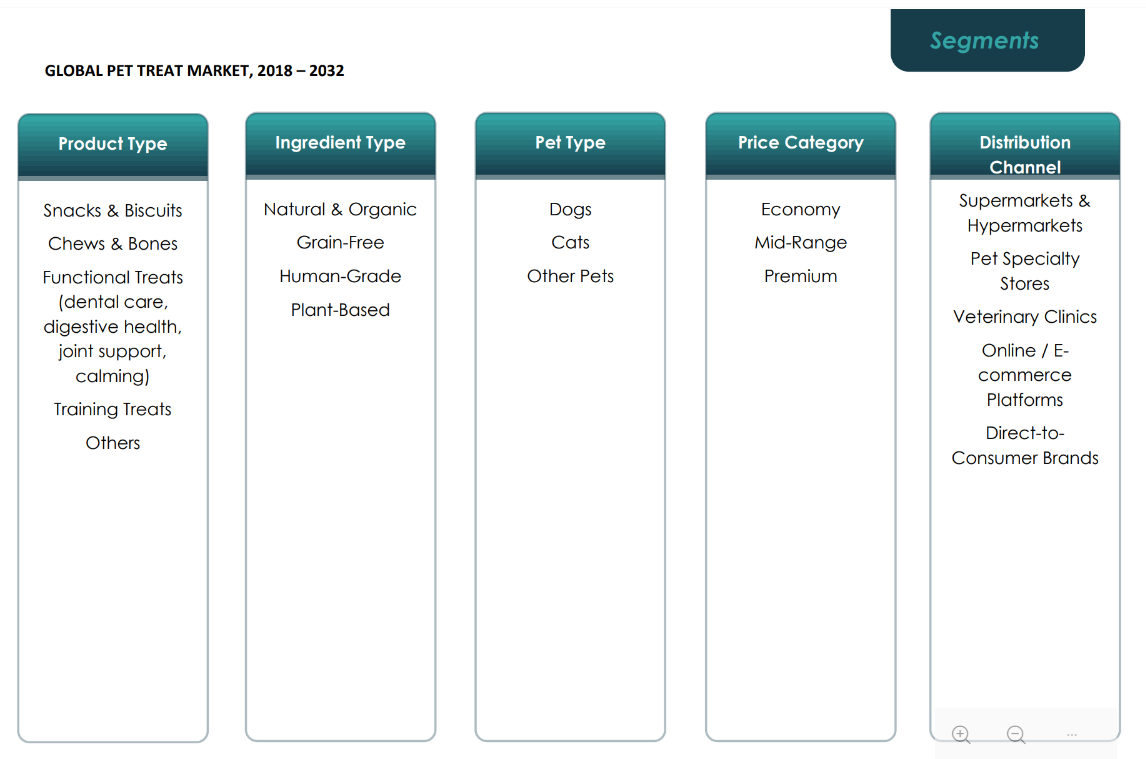

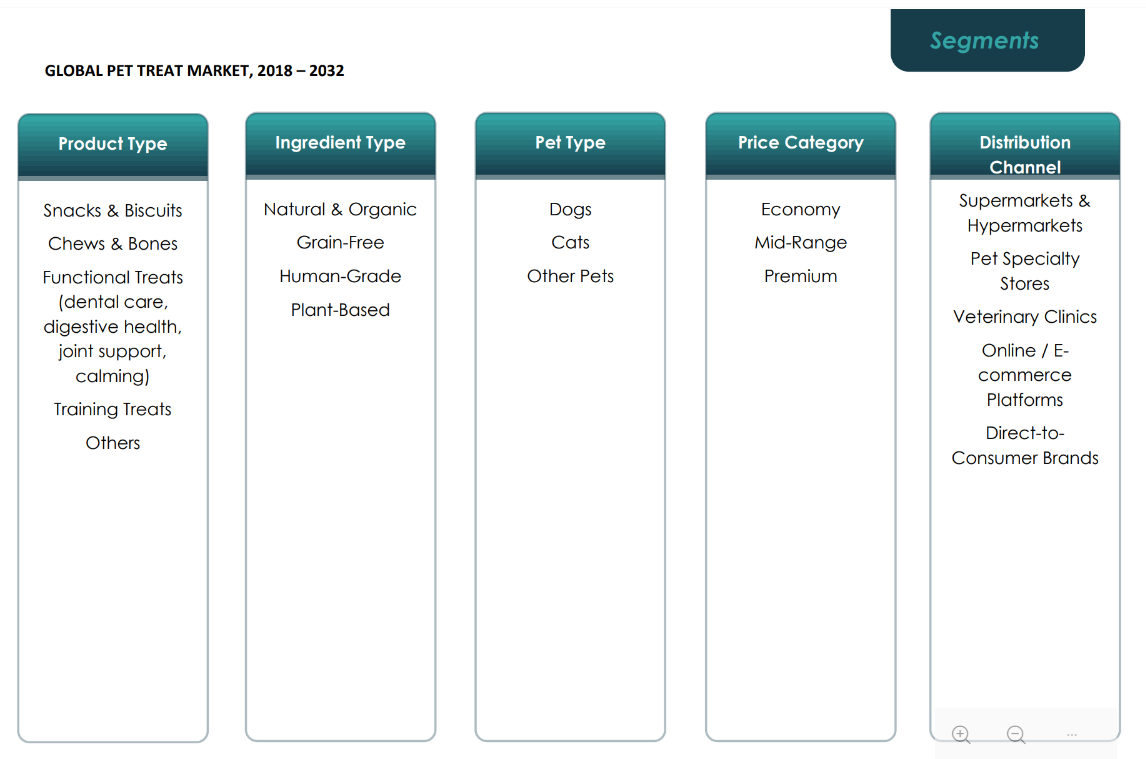

Market Segmentation Analysis:

By Product Type

The Global Pet Treat Market is segmented into dog treats, cat treats, and others. Dog treats hold a dominant share due to widespread dog ownership and a wide range of flavor and health-focused options. Cat treats are growing steadily, supported by rising feline adoption and product innovation in texture and taste. It benefits from the introduction of multifunctional snacks that support oral hygiene and joint health. The “others” segment, including small pets and birds, is also expanding through specialized nutrition-based formulations. Growing awareness about animal wellness drives steady growth across all product lines.

- For instance, Nestlé Purina expanded its Friskies dry cat food range in the Indian market in July 2025 by launching two new variants: “Meaty Grills” and “Indoor Delights”.

By Ingredient Type

The market is categorized into animal-derived ingredients, plant-derived ingredients, functional additives, and organic ingredients. Animal-derived ingredients account for a major share due to high protein content and taste preference among pets. Plant-based and organic components are witnessing increasing demand from environmentally conscious consumers. It is also experiencing growth in functional additives that promote digestion and immunity. Premiumization trends have encouraged innovation in clean-label ingredients. Consumers prefer transparent sourcing and nutrient-rich combinations for everyday feeding. The balance between nutrition, safety, and sustainability defines ingredient development strategies.

- For instance, Blue Buffalo’s pet foods feature its proprietary LifeSource Bits, described as a precise blend of antioxidants, vitamins, and minerals (including from ingredients like cranberries and blueberries) selected by veterinarians and animal nutritionists to support immune system health and a healthy oxidative balance. Blue Buffalo employs a rigorous, multi-point quality control process, including on-site and third-party laboratory testing to ensure product specifications are met.

By Pet Type

The market includes dogs, cats, birds, and others. Dog ownership continues to dominate, driven by growing urban pet adoption and emotional companionship. Cat treats are witnessing strong demand due to convenience and expanding product diversity. It supports a rising focus on nutritional enrichment for smaller pets, including birds and rodents. Manufacturers are developing tailored diets suitable for species-specific needs. Health-conscious pet owners increasingly seek breed-specific and age-appropriate treats. The segment reflects changing household demographics and shifting attitudes toward responsible pet nutrition.

By Price Category and Distribution Channel

Based on price, the market covers economy, premium, and super-premium ranges. Premium and super-premium categories are gaining traction with consumers prioritizing quality over cost. It shows increased spending on high-nutrient, ethically sourced, and veterinarian-approved treats. By distribution, the market includes online retail, specialty stores, supermarkets/hypermarkets, veterinary clinics, and others. Online platforms dominate due to convenience and diverse availability. Specialty stores maintain steady sales through expert recommendations and brand credibility. Supermarkets and clinics contribute to impulse and trust-based purchases, reinforcing overall accessibility.

Segmentation:

By Product Type

- Dog Treats

- Cat Treats

- Others

By Ingredient Type

- Animal-Derived Ingredients

- Plant-Derived Ingredients

- Functional Additives

- Organic Ingredients

By Pet Type

By Price Category

- Economy

- Premium

- Super Premium

By Distribution Channel

- Online Retail

- Specialty Stores

- Supermarkets/Hypermarkets

- Veterinary Clinics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Pet Treat Market size was valued at USD 3,139.50 million in 2018, reached USD 3,634.68 million in 2024, and is anticipated to attain USD 5,375.79 million by 2032, at a CAGR of 5.1% during the forecast period. The region accounts for 47.9% of the Global Pet Treat Market in 2024, driven by high pet ownership and premium spending trends. The market benefits from a strong culture of pet humanization and health awareness. It has established retail networks and major brands focusing on innovation in functional and organic treats. Consumers prefer clean-label, grain-free, and protein-rich snacks that support preventive health. The United States dominates regional sales, supported by advanced product formulation and strong veterinary influence. Canada follows with increasing online pet retail growth. Continuous product launches and celebrity-backed pet brands enhance brand differentiation and category growth.

Europe

The Europe Pet Treat Market size was valued at USD 1,365.00 million in 2018, grew to USD 1,517.17 million in 2024, and is projected to reach USD 2,088.61 million by 2032, expanding at a CAGR of 4.1%. Europe holds a 20.0% market share in 2024, supported by the rising adoption of sustainable and ethically sourced pet products. Consumers emphasize ingredient transparency, animal welfare, and nutritional integrity. It benefits from government regulations encouraging quality standards in pet food production. Western Europe leads with strong consumption in the U.K., Germany, and France. Premium pet treats and organic formulations have gained traction among millennial owners. The growing population of companion animals drives steady demand in Eastern Europe. European brands are expanding product portfolios with customized nutrition and recyclable packaging to meet evolving sustainability goals.

Asia Pacific

The Asia Pacific Pet Treat Market size was valued at USD 1,215.50 million in 2018, reached USD 1,502.54 million in 2024, and is forecasted to attain USD 2,522.04 million by 2032, at a CAGR of 6.7%. The region represents 19.8% of the Global Pet Treat Market in 2024 and is the fastest-growing market. Rapid urbanization, increasing disposable incomes, and changing lifestyles are fueling pet adoption. It benefits from rising awareness about pet health and growing influence of social media in shaping consumer behavior. China, Japan, and India are key contributors, supported by local brand innovation and imported product demand. E-commerce platforms play a central role in driving accessibility and consumer engagement. Pet care startups in emerging economies are expanding through influencer marketing and product personalization. The trend toward premium and health-oriented treats continues to strengthen regional market expansion.

Latin America

The Latin America Pet Treat Market size was valued at USD 461.50 million in 2018, reached USD 534.58 million in 2024, and is projected to reach USD 740.64 million by 2032, registering a CAGR of 4.2%. The region captures a 7.0% market share in 2024, driven by growing pet ownership and economic recovery in key nations. Brazil and Mexico dominate regional sales with a preference for affordable and nutritious pet products. It benefits from rising consumer awareness of pet well-being and improved retail availability. Local manufacturers are expanding production capacity to meet domestic demand. The popularity of small companion animals among urban residents supports category diversification. Online channels and supermarkets are improving product reach across second-tier cities. Strategic collaborations between global and regional brands strengthen competition and market penetration.

Middle East

The Middle East Pet Treat Market size was valued at USD 188.50 million in 2018, increased to USD 201.96 million in 2024, and is expected to reach USD 259.80 million by 2032, growing at a CAGR of 3.3%. The region contributes 2.6% to the Global Pet Treat Market in 2024, supported by the rising trend of pet adoption among urban populations. It is experiencing growing interest in premium and imported pet products. Countries such as the UAE and Saudi Arabia are witnessing the expansion of pet specialty stores and veterinary clinics. Consumers are shifting toward high-quality snacks with natural and digestible ingredients. Rising awareness of pet hygiene and nutrition is shaping product preferences. Regional distributors are collaborating with international brands to expand retail footprints. The growing expatriate population is also boosting spending on companion animal care.

Africa

The Africa Pet Treat Market size was valued at USD 130.00 million in 2018, reached USD 203.56 million in 2024, and is estimated to reach USD 257.14 million by 2032, at a CAGR of 2.6%. The region holds a 2.7% share of the Global Pet Treat Market in 2024, supported by gradual pet adoption and improving economic conditions. South Africa leads regional demand with increasing preference for balanced pet nutrition. It is experiencing gradual market expansion through growing awareness of animal health and hygiene. Limited retail infrastructure and lower disposable incomes still restrict category growth. Urban middle-class families are driving demand for affordable and accessible products. International brands are investing in entry-level product lines to reach broader audiences. The shift toward education-based marketing and digital sales platforms continues to open new opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mars Petcare, Inc.

- Nestlé Purina PetCare

- The J.M. Smucker Company

- Colgate-Palmolive (Hill’s Pet Nutrition)

- General Mills (Blue Buffalo)

- WellPet LLC

- Freshpet Inc.

- Spectrum Brands Holdings (United Pet Group)

- Diamond Pet Foods

- Blue Ridge Naturals

- Zesty Paws

- Three Dog Bakery

- Simmons Pet Food

- Company 14 (Placeholder – to be replaced with the 14th profiled company)

Competitive Analysis:

The Global Pet Treat Market is highly competitive, with major players focusing on innovation, product diversification, and global expansion. Key companies such as Mars Petcare, Nestlé Purina PetCare, and The J.M. Smucker Company dominate through established distribution networks and strong brand equity. It is characterized by continuous product launches emphasizing health, sustainability, and premiumization. Companies are investing in R&D to develop functional and organic treats aligned with consumer wellness trends. Smaller brands are gaining visibility through e-commerce and niche product offerings. Strategic partnerships and regional acquisitions enhance portfolio strength and market reach. Competition is intensifying as players differentiate through ingredient transparency and eco-friendly packaging.

Recent Developments:

- In September 2025, Mars Petcare partnered with Big Idea Ventures, AAK, and Bühler to launch the Next Generation Pet Food Program, a global innovation initiative focused on sustainable ingredients and more environmentally friendly pet treats.

- In September 2025, The J.M. Smucker Company expanded its Uncrustables portfolio by launching new higher-protein PB&J sandwiches with 12g of protein per serving, available nationwide from October 2025 and reflecting Smucker’s continued innovation in snack and treat development. Earlier in March 2025, Smucker announced an investment of over $50 million to upgrade its Buffalo Milk-Bone dog treats manufacturing facility, enhancing capacity for Soft ‘N Chewy Milk-Bone products.

- In July 2025, Nestlé Purina PetCare announced a strategic partnership with Odie Pet Insurance to integrate Petivity—Purina’s AI-powered health ecosystem—into wellness plans, aiming to combine pet health data with smart technology for preventative care in pet nutrition and treats. In October 2025, Purina also hosted “Unleashed by Purina,” an accelerator event in Bengaluru that brought together dozens of pet tech startups to encourage innovation in pet care and treats.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient Type, Pet Type, Price Category, and Distribution Channel.It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing focus on natural and functional ingredients to enhance pet health.

- Rising adoption of e-commerce platforms for global pet treat distribution.

- Expanding role of sustainability and eco-friendly packaging in brand positioning.

- Increased investment in R&D for innovative and species-specific products.

- Growing influence of social media in shaping consumer preferences.

- Strengthening regulatory oversight to ensure ingredient transparency.

- Expanding pet ownership across developing economies.

- Strategic partnerships between manufacturers and retailers driving expansion.

- Increased demand for premium, grain-free, and protein-rich treat categories.

- Ongoing product personalization and customization based on pet health profiles.