Market Overview:

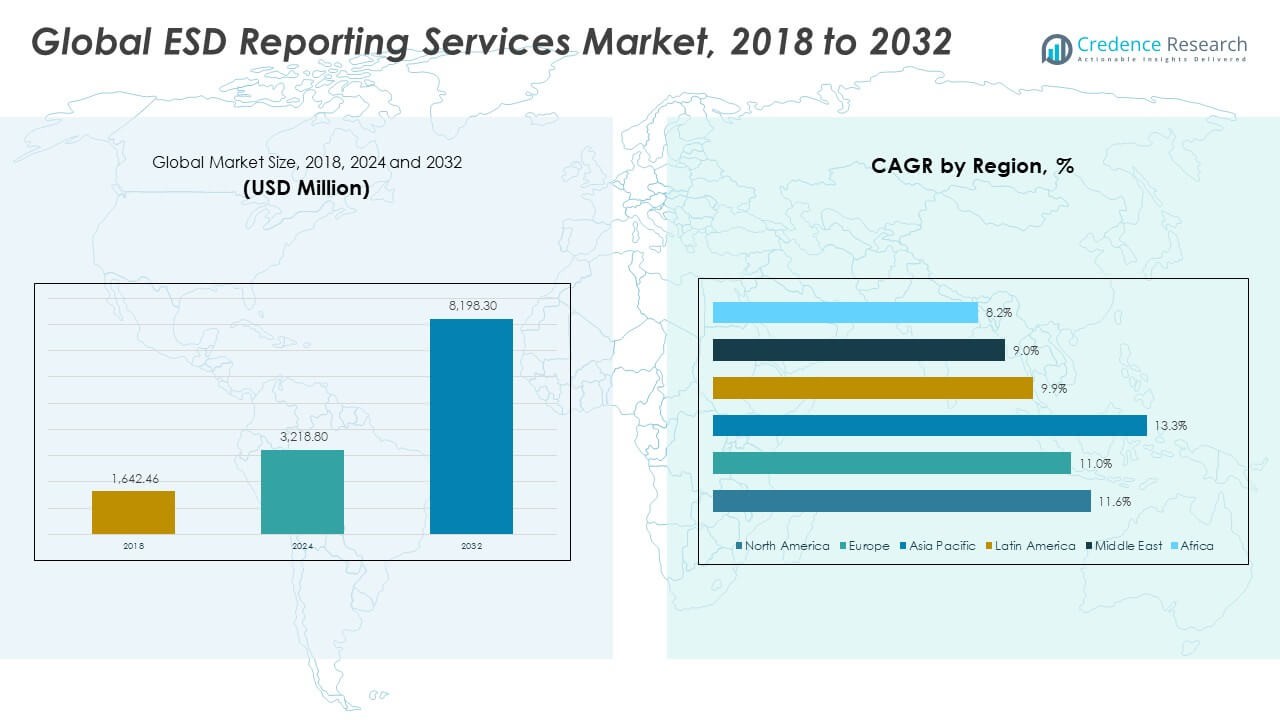

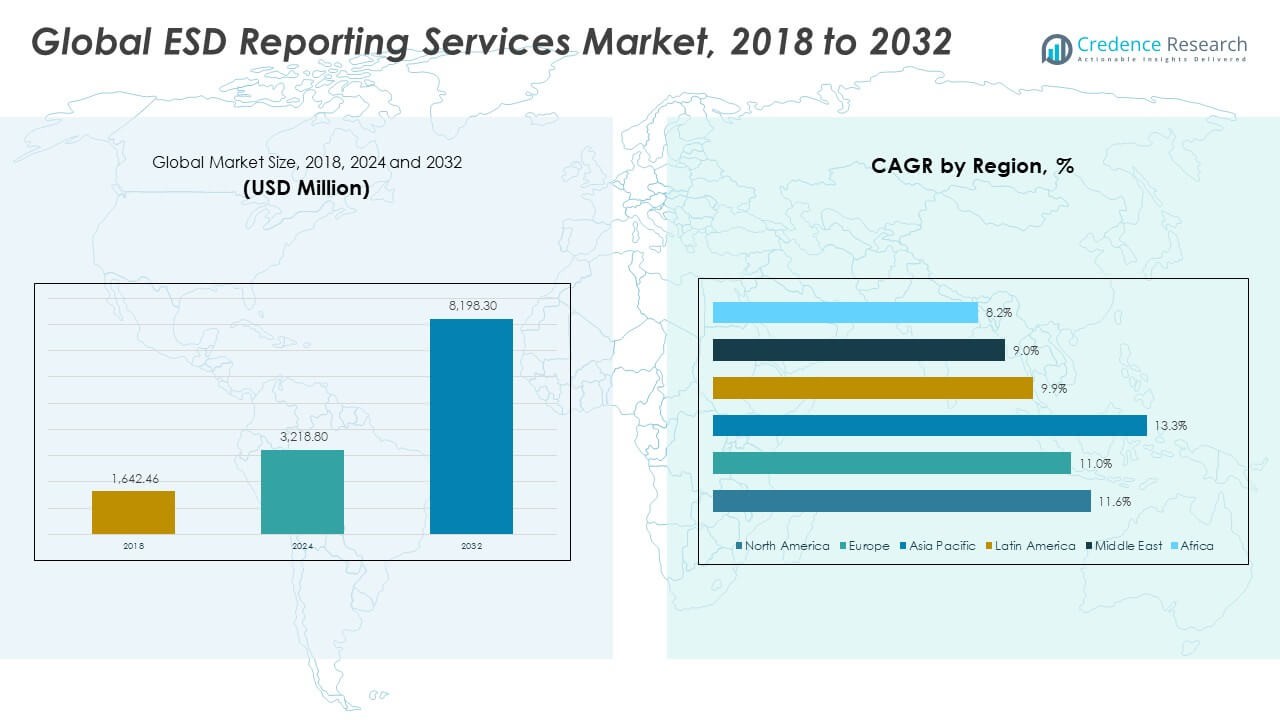

The Global ESD Reporting Services Market size was valued at USD 1,642.46 million in 2018, increased to USD 3,218.80 million in 2024, and is anticipated to reach USD 8,198.30 million by 2032, at a CAGR of 11.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ESD Reporting Services Market Size 2024 |

USD 3,218.80 Million |

| ESD Reporting Services Market, CAGR |

11.55% |

| ESD Reporting Services Market Size 2032 |

USD 8,198.30 Million |

The market growth is driven by stricter environmental regulations, increasing corporate sustainability goals, and the growing need for transparent environmental, social, and governance (ESG) reporting. Organizations are adopting ESD reporting services to measure, track, and disclose sustainability performance with accuracy. Rising investor demand for data-driven insights, digital transformation of compliance systems, and integration of AI-based analytics platforms are also fueling the adoption of these services globally.

Regionally, North America leads due to robust regulatory frameworks and high awareness among enterprises. Europe follows, supported by strong ESG disclosure mandates and sustainability-focused investments. Asia Pacific is emerging rapidly, driven by expanding corporate reporting standards and digital adoption in countries like India, Japan, and China. Latin America and the Middle East & Africa show gradual adoption, with rising focus on environmental accountability and sustainable growth initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global ESD Reporting Services Market was valued at USD 1,642.46 million in 2018, reached USD 3,218.80 million in 2024, and is projected to hit USD 8,198.30 million by 2032, registering a CAGR of 11.55% during the forecast period.

- Europe holds the largest market share of about 34%, followed by North America at 27% and Asia Pacific at 23%. Europe dominates due to strict ESG disclosure mandates and advanced sustainability frameworks, while North America benefits from strong regulatory oversight and early technology adoption.

- Asia Pacific is the fastest-growing region with a 13.3% CAGR, driven by government-led ESG policies, digital transformation, and increasing sustainability awareness among corporations in China, Japan, and India.

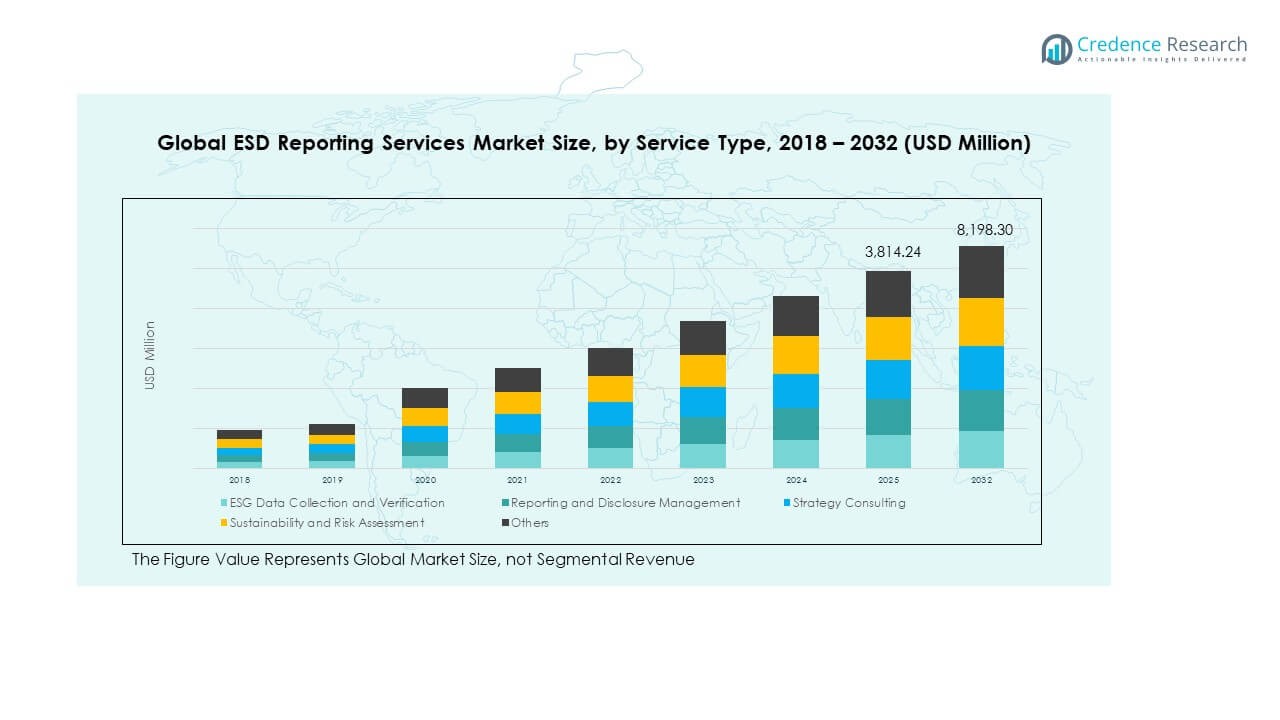

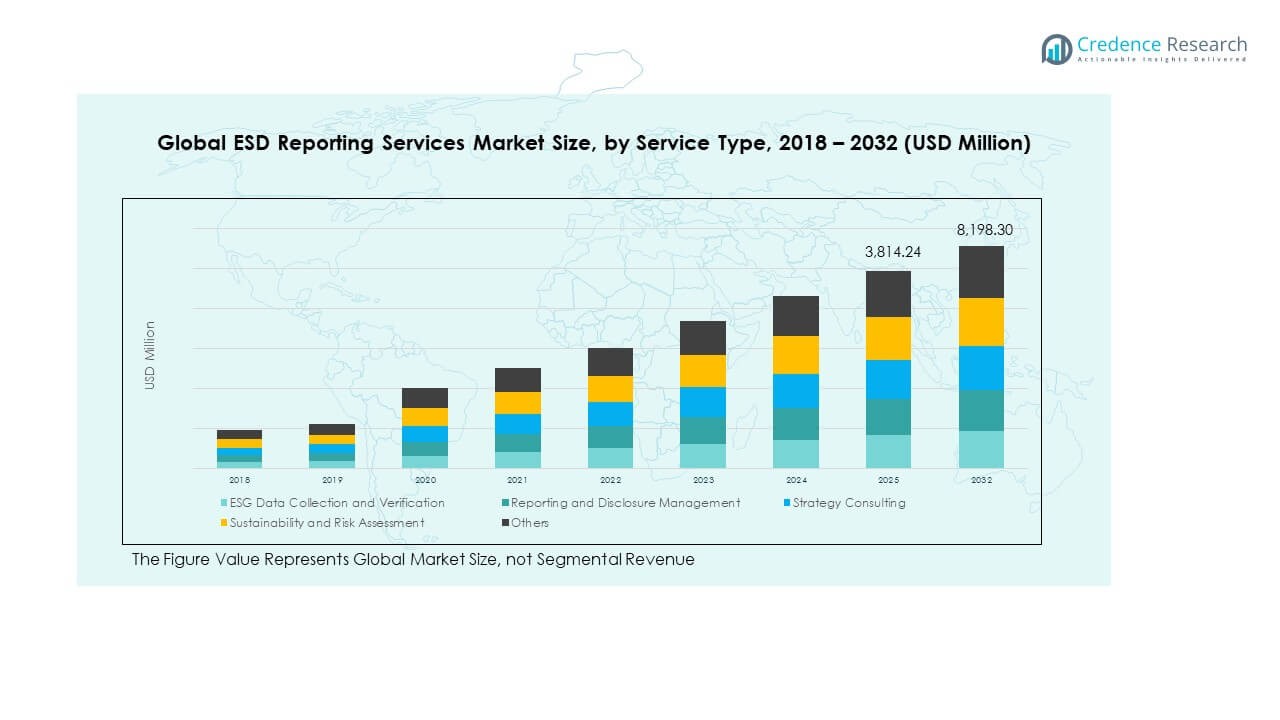

- By service type, ESG Data Collection and Verification accounts for roughly 35% of total market share, supported by rising demand for accurate and compliant sustainability data.

- Reporting and Disclosure Management contributes around 28% share, gaining momentum as corporations standardize sustainability reporting through AI-driven and automated platforms.

Market Drivers:

Rising Emphasis on ESG Compliance and Corporate Accountability

Organizations are facing pressure to meet stricter ESG disclosure norms and sustainability reporting standards. The Global ESD Reporting Services Market benefits from growing regulatory compliance requirements and investor demand for transparent environmental data. Governments and financial institutions are introducing frameworks to ensure responsible resource management and ethical corporate conduct. It has encouraged companies to integrate ESD reporting into their business strategies. The inclusion of sustainability metrics in annual reports enhances stakeholder confidence and brand value. Investors now prioritize firms with verifiable environmental performance data. This shift has increased the use of professional ESD reporting platforms for accurate data collection and analysis. Businesses across industries are now prioritizing structured sustainability communication to attract long-term investment.

- For instance, Microsoft’s 2024 Environmental Sustainability Report confirmed the company contracted 19 GW of new renewable energy across 16 countries and requires select suppliers to use 100% carbon-free electricity by 2030, while its data center energy reduction initiative scaled from a few thousand servers in 2022 to nearly one million globally by the end of 2023, resulting in thousands of MWh in monthly energy savings.

Digital Transformation and Integration of Advanced Analytics Platforms

Enterprises are rapidly digitizing sustainability reporting processes to improve data accuracy and accessibility. The integration of AI and data analytics tools drives automation, enabling faster ESD report generation and compliance monitoring. The Global ESD Reporting Services Market benefits from organizations adopting smart platforms to identify emission sources and measure carbon intensity. It has improved decision-making and enhanced predictive sustainability modeling. Automation tools streamline ESG audits by reducing manual data errors. Firms are using cloud-based ESD reporting solutions for real-time tracking and automated benchmarking. This trend has transformed traditional sustainability reporting into dynamic data-driven ecosystems. The growing adoption of intelligent dashboards supports strategic sustainability planning and risk management.

- For instance, in December 2024, SAP announced that its AI-powered tools can reduce carbon footprint calculation time by 80% and cut ESG reporting time by as much as 98%, through solutions such as SAP Sustainability Footprint Management and SAP Sustainability Control Tower, as unveiled at COP29 in Baku.

Increased Investor and Consumer Focus on Responsible Business Practices

Investors and consumers are influencing corporate sustainability strategies by demanding transparency in operations. The Global ESD Reporting Services Market experiences growth as companies respond to market expectations for ethical and sustainable business models. It has become essential for organizations to demonstrate carbon neutrality, waste reduction, and responsible sourcing. Businesses now recognize sustainability disclosures as a competitive advantage. Stakeholders view accurate ESD reporting as a reflection of long-term business resilience. Rising awareness among consumers drives corporations to adopt credible reporting services. Companies leveraging third-party verified data are gaining better access to green financing opportunities. This accountability trend is creating consistent demand for professional ESD auditing and reporting support.

Growing Role of Government Policies and International Sustainability Frameworks

Government policies are central to expanding the use of sustainability reporting across industries. The Global ESD Reporting Services Market benefits from policy alignment with global standards such as the GRI, SASB, and TCFD frameworks. It encourages firms to disclose measurable metrics on emissions, diversity, and governance performance. Regulatory convergence between nations promotes cross-border transparency in ESG practices. The establishment of carbon pricing mechanisms and emission disclosure rules increases corporate responsibility. Firms are now compelled to improve internal reporting structures to comply with sustainability laws. Global partnerships and green tax incentives are further supporting the use of ESD services. This policy-driven ecosystem ensures continued investment in transparent reporting systems.

Market Trends:

Adoption of AI and Blockchain for Enhanced Data Integrity and Transparency

Emerging technologies are reshaping how organizations report and verify sustainability data. The Global ESD Reporting Services Market is witnessing strong adoption of AI and blockchain for securing and validating environmental performance records. It has helped eliminate data manipulation and improved traceability of sustainability disclosures. AI tools assist companies in predictive modeling of environmental risks. Blockchain ensures immutability in audit trails for ESG data verification. Technology-led platforms are enabling real-time data exchange between supply chain partners. The integration of IoT sensors is enhancing emission tracking accuracy. These advancements foster greater accountability and transparency in corporate sustainability operations.

- For instance, in May 2024, IBM integrated AI-powered emissions planning and forecasting into its Envizi ESG Data Platform, enabling automated supply chain emissions data collection and supporting CSRD sustainability reporting for over 140,000 global emissions datasets, streamlining compliance and forecasting for major enterprises.

Expansion of Industry-Specific Sustainability Reporting Frameworks

Different industries now follow tailored sustainability frameworks that address unique operational challenges. The Global ESD Reporting Services Market is adapting to these sector-based approaches, providing customized metrics for manufacturing, energy, and finance. It has enabled more relevant data disclosure and improved performance comparability. Manufacturing firms emphasize emission and waste reduction metrics. Financial institutions focus on climate risk and social impact assessments. Energy sector companies prioritize renewable transition indicators. Service providers are developing tools aligned with these frameworks to support compliance. This specialization trend strengthens the industry’s ability to deliver precise sustainability insights.

- For instance, Siemens Energy and other large energy companies are aligning their sustainability strategies with the Science-Based Targets initiative (SBTi) and using detailed frameworks for emissions disclosure and resource transition—recent initiatives have been detailed in their official 2024 ESG and SBTi reports.

Increasing Outsourcing of Sustainability Reporting to Specialized Service Providers

Enterprises are increasingly outsourcing sustainability reporting due to the complexity of evolving ESG regulations. The Global ESD Reporting Services Market benefits from businesses seeking expert partners to manage compliance, analytics, and disclosures. It has led to the rise of consultancy-led ESD reporting models. Outsourcing reduces the burden on internal teams and ensures alignment with international standards. Firms are partnering with external providers for data validation and assurance services. Specialized providers use standardized templates and automation for report generation. Outsourcing also enhances report credibility and accuracy in global submissions. The growing reliance on third-party expertise supports consistent market expansion.

Growing Demand for Cloud-Based and Scalable Reporting Platforms

Organizations prefer scalable digital platforms that can accommodate large volumes of environmental and social data. The Global ESD Reporting Services Market has seen a shift toward cloud-based software-as-a-service (SaaS) models. It allows enterprises to manage data efficiently while ensuring security and accessibility. Cloud systems facilitate integration with existing enterprise resource planning tools. Multi-user access supports collaboration between departments and external auditors. Vendors are offering modular solutions to fit diverse corporate reporting needs. These systems simplify updates to evolving regulatory requirements. Cloud scalability also reduces costs and improves efficiency in long-term sustainability management.

Market Challenges Analysis:

Lack of Standardization and Complex Regulatory Diversity Across Regions

The sustainability reporting ecosystem faces inconsistencies in frameworks, terminologies, and evaluation criteria. The Global ESD Reporting Services Market encounters difficulty due to fragmented global standards that differ by region. It complicates cross-border data comparison and hinders harmonization efforts. Organizations must adapt their disclosures to meet both domestic and international expectations. Varying compliance thresholds increase the complexity of reporting processes. Smaller firms face higher costs in meeting multiple framework requirements. The absence of a unified system delays the adoption of consistent performance indicators. This diversity limits benchmarking and increases dependence on consultants for report customization.

Data Reliability Issues and Limited Access to Skilled Sustainability Professionals

Ensuring accurate data collection and validation remains a key challenge for enterprises. The Global ESD Reporting Services Market experiences operational barriers due to poor data quality from decentralized systems. It often leads to inconsistencies in emission measurement, waste tracking, and resource consumption figures. Many firms lack trained sustainability professionals capable of managing ESG databases. This skill gap affects audit readiness and slows report submission timelines. Manual processes further increase the risk of reporting errors. Technology integration demands expertise that is scarce in emerging economies. The shortage of skilled analysts continues to limit scalability and service quality within the sector.

Market Opportunities:

Rising Demand for Real-Time Reporting and Predictive Sustainability Analytics

The growing need for continuous sustainability monitoring is creating new business opportunities. The Global ESD Reporting Services Market is positioned to benefit from the demand for real-time analytics and predictive modeling tools. It enables organizations to identify potential risks before regulatory breaches occur. Predictive analytics helps forecast future sustainability performance based on current trends. Companies can optimize resource allocation and improve decision-making accuracy. Investors increasingly value proactive reporting that provides future-oriented insights. Firms offering integrated data visualization and predictive systems are expected to gain competitive advantage.

Expansion of Emerging Economies and Integration of Circular Economy Principles

Rapid industrialization and policy reforms across developing regions are opening new service opportunities. The Global ESD Reporting Services Market benefits from expanding sustainability awareness in Asia-Pacific, Latin America, and Africa. It aligns with circular economy principles encouraging waste minimization and resource reuse. Governments are launching initiatives to improve ESG disclosure adoption among local businesses. Collaboration with international organizations is fostering the creation of green financing networks. Enterprises are seeking affordable yet reliable reporting solutions suited to regional conditions. This growing inclusiveness ensures strong long-term growth potential for service providers.

Market Segmentation Analysis:

By Service Type

The Global ESD Reporting Services Market is segmented by service type into ESG data collection and verification, reporting and disclosure management, strategy consulting, sustainability and risk assessment, and others. ESG data collection and verification hold the dominant share due to increasing regulatory pressure for accurate sustainability disclosures. Reporting and disclosure management services are expanding rapidly with the adoption of standardized frameworks like GRI and SASB. Strategy consulting and sustainability risk assessment are witnessing strong demand from corporations seeking to align sustainability goals with long-term profitability. Other services include customized ESG reporting solutions tailored to specific industry or regional requirements.

- For instance, SAP’s ESG reporting suite and IBM’s Envizi platform both achieved broad adoption in 2024–2025, with documented automation of ESG data verification, reporting template generation, and direct integration of auditing frameworks, serving large multinational client portfolios as disclosed in recent product performance releases.

By Industry Vertical

The market covers diverse sectors such as BFSI, energy, utilities and mining, manufacturing and industrial, information technology and telecommunications, healthcare and life sciences, and others. BFSI leads due to stringent compliance standards and investor demand for transparent ESG disclosures. The energy and industrial sectors rely heavily on sustainability assessments to manage emissions and optimize resource use. IT and telecom companies adopt reporting services to strengthen governance and digital sustainability commitments. Healthcare organizations use ESD tools to monitor supply chain impact and environmental safety compliance.

- For instance, IBM’s Envizi Emissions API, launched in September 2025, is now integrated across banking and energy sector platforms to enable emissions tracking for thousands of client portfolios under Scope 1–3 disclosure standards, as required by regulations such as the EU’s Corporate Sustainability Reporting Directive (CSRD).

By Organization Size

Based on organization size, large enterprises dominate due to established sustainability frameworks and greater reporting budgets. It benefits from enterprise-wide integration of ESD platforms for compliance and transparency. Small and medium enterprises (SMEs) are emerging as a fast-growing segment driven by government-led ESG programs and investor expectations for accountability. SMEs are adopting affordable reporting solutions to enhance brand credibility and attract sustainable funding opportunities.

Segmentation:

By Service Type

- ESG Data Collection and Verification

- Reporting and Disclosure Management

- Strategy Consulting

- Sustainability and Risk Assessment

- Others

By Industry Vertical

- BFSI

- Energy, Utilities, and Mining

- Manufacturing and Industrial

- Information Technology and Telecommunications

- Healthcare and Life Sciences

- Others

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global ESD Reporting Services Market size was valued at USD 466.84 million in 2018, increased to USD 900.29 million in 2024, and is anticipated to reach USD 2,302.89 million by 2032, at a CAGR of 11.6% during the forecast period. North America holds a market share of around 27% in the Global ESD Reporting Services Market. The region leads due to early adoption of sustainability reporting standards and strict corporate disclosure regulations. It benefits from strong ESG governance in sectors such as finance, energy, and manufacturing. The United States dominates regional growth, supported by mandatory SEC reporting norms and investor-driven ESG integration. Canada shows rising adoption of ESD solutions across mining and energy firms. Businesses are investing in AI-based sustainability analytics to strengthen compliance and transparency. Advanced digital infrastructure and high corporate accountability drive steady expansion across industries.

Europe

The Europe Global ESD Reporting Services Market size was valued at USD 724.89 million in 2018, increased to USD 1,387.68 million in 2024, and is anticipated to reach USD 3,403.26 million by 2032, at a CAGR of 11.0% during the forecast period. Europe commands a market share of about 34% in the Global ESD Reporting Services Market. The region benefits from established sustainability reporting directives such as the EU Non-Financial Reporting Directive (NFRD) and upcoming Corporate Sustainability Reporting Directive (CSRD). It has strong institutional backing for ESG data integration in business practices. Countries like Germany, France, and the UK are pioneers in sustainability disclosures and carbon accounting systems. Growing adoption of green finance and circular economy models boosts the market further. European corporations rely on third-party verification and digital tools to ensure transparent reporting. Demand for industry-specific frameworks is driving steady growth across multiple sectors.

Asia Pacific

The Asia Pacific Global ESD Reporting Services Market size was valued at USD 306.06 million in 2018, increased to USD 651.74 million in 2024, and is anticipated to reach USD 1,886.59 million by 2032, at a CAGR of 13.3% during the forecast period. Asia Pacific accounts for approximately 23% of the Global ESD Reporting Services Market. Rapid industrialization and policy reforms supporting sustainability are driving strong growth across the region. It benefits from rising ESG awareness in China, Japan, India, and South Korea. Governments are implementing disclosure mandates to attract sustainable investments and improve transparency. Enterprises in technology, manufacturing, and energy sectors are adopting digital ESD platforms to meet compliance targets. The expanding presence of multinational corporations enhances cross-border sustainability alignment. Increasing collaboration between regulators and private firms accelerates the adoption of ESG-driven reporting services.

Latin America

The Latin America Global ESD Reporting Services Market size was valued at USD 77.76 million in 2018, increased to USD 150.51 million in 2024, and is anticipated to reach USD 339.40 million by 2032, at a CAGR of 9.9% during the forecast period. Latin America holds a market share of about 7% in the Global ESD Reporting Services Market. The region is witnessing steady adoption of sustainability frameworks, particularly in Brazil, Chile, and Mexico. Governments are strengthening corporate governance norms to align with international ESG standards. Financial institutions and large industrial firms are integrating sustainability metrics into annual reports. Demand for reporting solutions is increasing across mining, agriculture, and manufacturing sectors. The expansion of renewable energy projects supports the need for transparent sustainability reporting. Limited awareness among SMEs remains a restraint but digital transformation initiatives are improving adoption rates.

Middle East

The Middle East Global ESD Reporting Services Market size was valued at USD 43.09 million in 2018, increased to USD 76.70 million in 2024, and is anticipated to reach USD 162.56 million by 2032, at a CAGR of 9.0% during the forecast period. The Middle East accounts for nearly 5% of the Global ESD Reporting Services Market. The region is evolving with growing corporate participation in ESG initiatives. Countries like the UAE and Saudi Arabia are implementing sustainability frameworks in line with Vision 2030 programs. It benefits from expanding renewable energy and smart city projects requiring transparent sustainability disclosures. Financial regulators are introducing green finance reporting policies to encourage ethical investments. Organizations are adopting sustainability data platforms to manage compliance efficiently. The oil and gas sector remains a key contributor to ESG data reporting evolution. Rising private sector awareness continues to expand the service landscape.

Africa

The Africa Global ESD Reporting Services Market size was valued at USD 23.81 million in 2018, increased to USD 51.88 million in 2024, and is anticipated to reach USD 103.60 million by 2032, at a CAGR of 8.2% during the forecast period. Africa represents nearly 4% of the Global ESD Reporting Services Market. The region is gradually embracing sustainability reporting across industries such as mining, energy, and agriculture. South Africa leads the market due to strong corporate governance frameworks and mandatory ESG disclosure norms. Nigeria, Kenya, and Egypt are showing growing awareness of environmental accountability and investor expectations. Regional development banks are promoting ESG reporting through financial inclusion initiatives. Companies are collaborating with international consultants to improve compliance and data accuracy. Limited infrastructure and regulatory fragmentation pose challenges, yet growing public-private partnerships support the long-term market outlook.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- KPMG

- EY (Ernst & Young)

- Deloitte

- PwC

- McKinsey & Company

- Boston Consulting Group (BCG)

- Sustainability Accounting Standards Board (SASB) Compliance Firms

- Refinitiv

- MSCI ESG Research

- Sustainalytics (Morningstar)

Competitive Analysis:

The Global ESD Reporting Services Market is highly competitive, driven by established consulting firms and specialized ESG data providers. It includes major players such as KPMG, Deloitte, PwC, EY, McKinsey & Company, BCG, MSCI ESG Research, Refinitiv, and Sustainalytics. These companies offer integrated sustainability, reporting, and analytics services to support ESG compliance. Strategic partnerships and digital innovation enhance competitiveness through automation and real-time data processing. Market participants are focusing on platform-based solutions that combine consulting with technology. Competitive differentiation depends on data accuracy, regulatory expertise, and industry-specific customization. The growing demand for transparent sustainability disclosures is strengthening rivalry across service providers.

Recent Developments:

- On April 28, 2025, KPMG completed the acquisition of the technology and intellectual property of Metaphor, a pioneering enterprise data mesh platform designed to revolutionize how organizations manage and extract insights from data.

Report Coverage:

The research report offers an in-depth analysis based on service type, industry vertical, organization size, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing corporate focus on ESG transparency will strengthen demand for ESD reporting solutions.

- Integration of AI and machine learning will enhance accuracy in sustainability assessments.

- Cloud-based platforms will dominate future reporting infrastructure for scalable operations.

- Increased regulatory alignment across regions will accelerate standardized disclosures.

- Sector-specific reporting frameworks will evolve to meet targeted compliance needs.

- SMEs will adopt affordable and automated sustainability reporting solutions.

- Strategic collaborations between consultancies and tech providers will drive innovation.

- Demand for real-time ESG analytics and visualization tools will rise sharply.

- Third-party verification and assurance services will gain wider acceptance.

- Sustainability data will become a core metric in global investment decisions.