Market Overview

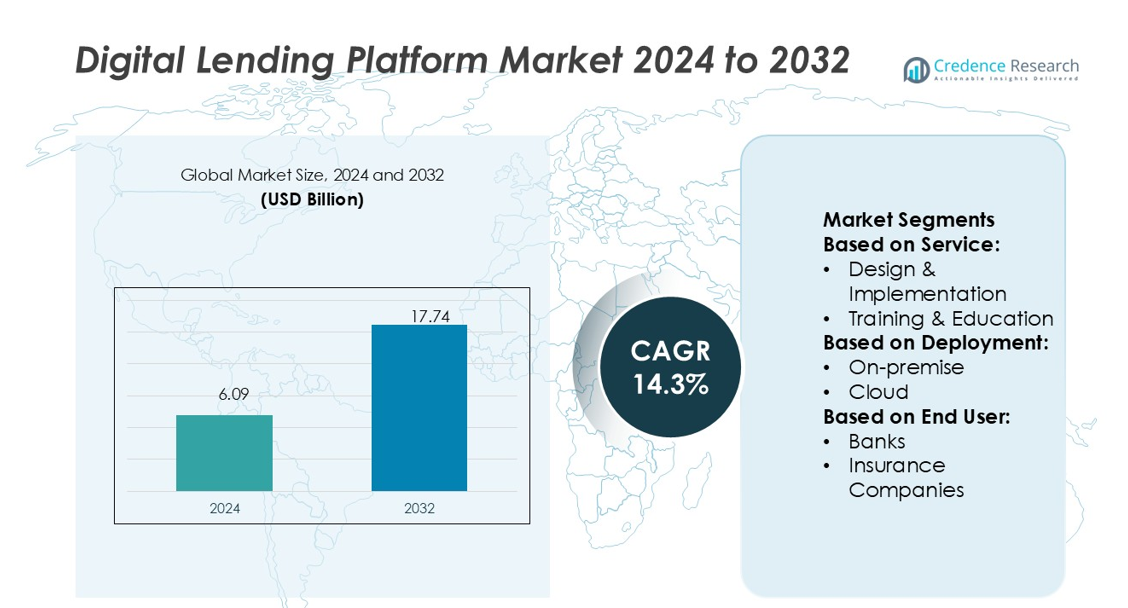

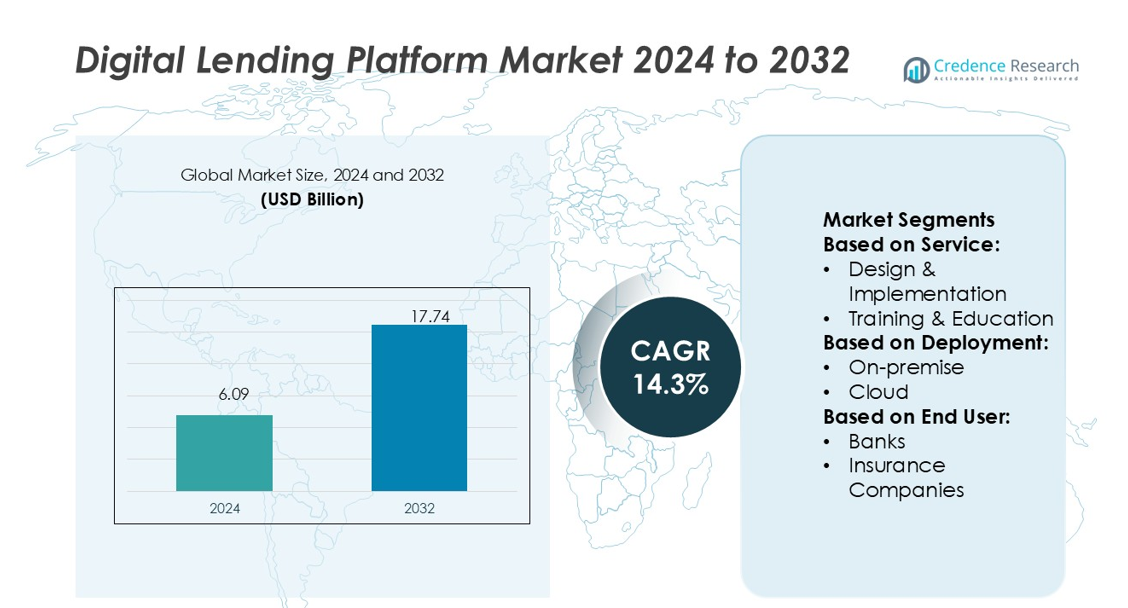

Digital Lending Platform Market size was valued USD 6.09 billion in 2024 and is anticipated to reach USD 17.74 billion by 2032, at a CAGR of 14.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Lending Platform Market Size 2024 |

USD 6.09 billion |

| Digital Lending Platform Market, CAGR |

14.3% |

| Digital Lending Platform Market Size 2032 |

USD 17.74 billion |

The digital lending platform market features strong competition among leading players such as FIS, Fiserv, Inc., Tavant, Pegasystems Inc., Nucleus Software, Ellie Mae, Inc., Newgen Software, Roostify, Sigma Infosolutions, and Wizni, Inc. These companies focus on enhancing automation, cloud integration, and AI-driven analytics to improve lending efficiency and risk assessment. North America leads the global market with a 37% share, supported by advanced fintech infrastructure, strong regulatory frameworks, and high adoption of digital banking solutions. The region’s dominance is reinforced by significant investments in data-driven lending systems and growing collaborations between financial institutions and technology providers.

Market Insights

- The Digital Lending Platform Market was valued at USD 6.09 billion in 2024 and is projected to reach USD 17.74 billion by 2032, growing at a CAGR of 14.3% during the forecast period.

- Market growth is driven by increasing demand for automated loan processing, AI-powered analytics, and seamless digital onboarding across financial institutions.

- Cloud-based deployment holds a dominant segment share of over 60%, offering scalability, cost efficiency, and real-time processing advantages to banks and fintech firms.

- The competitive landscape features key players such as FIS, Fiserv, Tavant, Pegasystems Inc., and Nucleus Software, focusing on AI-driven risk assessment and automation.

- North America leads with a 37% regional share due to advanced fintech infrastructure and strong regulatory frameworks, while Asia-Pacific emerges as the fastest-growing region supported by digital inclusion initiatives and mobile-first lending adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Design & Implementation dominates the digital lending platform market, holding nearly 35% share. This dominance stems from high demand for end-to-end integration of loan origination, underwriting, and disbursement modules. Financial institutions prefer tailored platform setups that align with regulatory and security frameworks. The rise in digital transformation initiatives among banks and fintechs drives the need for seamless design services. Continuous deployment of scalable, API-based architectures enhances efficiency and customer experience, reinforcing the leadership of this segment.

- For instance, FIS’ Code Connect API marketplace hosts over 700 open APIs that support modular lending functions, including credit decisioning, collateral management, and repayment scheduling.

By Deployment

Cloud-based deployment leads the segment with more than 60% market share. Its dominance is driven by scalability, faster implementation, and lower upfront costs compared to on-premise solutions. Financial institutions increasingly adopt cloud-based lending systems to support remote access, real-time analytics, and integration with AI-driven credit scoring tools. Cloud models also improve regulatory compliance and cybersecurity through continuous updates. Providers like Fiserv and Temenos expand their SaaS lending platforms to meet the growing demand from mid-tier banks and credit unions.

- For instance, Roostify has processed over 10 million documents via its cloud platform, using Google Cloud’s Lending DocAI for document extraction and classification.Roostify Beyond service embeds document validation and classification at the point-of-sale, enabling real-time error detection instead of manual review.

By End-user

Banks account for the largest market share, exceeding 45% in the digital lending platform market. Their dominance results from large-scale adoption of automation in loan origination and portfolio management. Banks leverage digital lending solutions to enhance risk assessment, reduce processing time, and improve customer retention. Integration with advanced analytics enables faster credit decisions and personalized lending offers. Rising competition from fintech firms further accelerates digital adoption among banks, making them the primary end-user driving market growth.

Key Growth Drivers

Rising Demand for Automated Loan Processing

Financial institutions are increasingly adopting digital lending platforms to reduce loan approval times and operational costs. Automation in credit scoring, document verification, and underwriting enables faster decision-making and improves customer experience. For instance, banks using AI-driven systems can process applications up to 70% faster than traditional methods. This growing emphasis on workflow automation and efficiency is propelling widespread adoption across retail, SME, and corporate lending segments.

- For instance, Pega has pushed forward its agentic AI and workflow automation fabric capabilities. Its newly launched Agentic Process Fabric™ orchestrates over 150 registered AI agents across systems and datasets.

Expanding Fintech Ecosystem and Strategic Partnerships

The surge in fintech startups and collaborations with traditional banks is a major growth catalyst. These partnerships enhance accessibility to credit through digital channels and mobile-first platforms. For example, fintech APIs enable seamless integration with core banking systems for real-time loan approvals. The growing number of digital-first consumers and financial inclusion initiatives in emerging markets further accelerates this ecosystem expansion, boosting overall market penetration.

- For instance, BRAC Bank in Bangladesh, Nucleus deployed its FinnAxia® solution with an extensive API stack in under 90 days, facilitating real-time credit checks and supply chain finance module integration.

Increasing Adoption of AI and Data Analytics

AI and predictive analytics are transforming the digital lending landscape by improving risk assessment accuracy and customer targeting. Platforms equipped with machine learning models evaluate alternative data sources, such as payment history and digital behavior, to assess creditworthiness. Companies integrating AI-driven analytics report up to 30% lower default rates. The rising focus on personalized loan offerings and fraud detection continues to fuel AI adoption in lending operations.

Key Trends & Opportunities

Growth of Cloud-Based Lending Platforms

Cloud deployment is becoming the preferred model due to scalability, flexibility, and cost efficiency. Institutions using cloud-based platforms benefit from faster deployment cycles and real-time updates. Vendors are introducing SaaS lending platforms with integrated compliance and data security features, reducing maintenance burdens for financial institutions. The ongoing migration to cloud environments presents opportunities for vendors to offer modular and API-driven digital lending ecosystems.

- For instance, Fiserv’s Banking Hub now gives instant, self-service access to over 500 developers integrating with core banking APIs via a unified workspace.

Expansion into SME and Microfinance Segments

Digital lending platforms are gaining traction among SMEs and microfinance institutions seeking quick and transparent funding. Automated credit evaluation using alternative data allows lenders to reach underserved sectors efficiently. This trend supports economic development and financial inclusion goals in developing countries. Vendors offering tailored solutions for small enterprises are expected to capture substantial growth opportunities over the forecast period.

- For instance, Ellie Mae’s Encompass platform connects approximately 186,500 mortgage professionals across lending and service-provider ecosystems via the Ellie Mae Network, enabling electronic ordering of credit, title, fraud, compliance, and more.

Integration of Blockchain for Secure Transactions

Blockchain technology is emerging as a key innovation in ensuring transparency and traceability in digital lending. Distributed ledgers facilitate tamper-proof loan records and smart contract automation, reducing fraud risk. Several fintech companies are piloting blockchain-enabled lending platforms to enhance trust and data integrity. The technology’s ability to improve security and streamline loan settlement processes presents a significant growth avenue.

Key Challenges

Data Privacy and Cybersecurity Concerns

Rising data breaches and security threats pose a serious challenge to digital lending platforms. Financial institutions handle sensitive borrower information, making them prime targets for cyberattacks. Ensuring compliance with data protection regulations such as GDPR and CCPA adds to operational complexity. Vendors must invest in encryption, multi-factor authentication, and secure APIs to maintain user trust and safeguard digital transactions.

Regulatory Compliance and Integration Complexity

Varying regulatory frameworks across regions create hurdles for global platform adoption. Compliance with KYC, AML, and local lending norms requires continuous updates and customization. Integrating digital lending platforms with legacy systems of banks and credit unions further adds complexity and cost. These challenges often delay deployment timelines and increase the total cost of ownership, limiting adoption among smaller institutions.

Regional Analysis

North America

North America dominates the digital lending platform market with a 37% share in 2024. The region’s leadership stems from strong fintech adoption, high internet penetration, and advanced banking infrastructure. U.S. banks and credit unions invest heavily in AI-powered lending systems for faster credit evaluation and fraud prevention. Companies like Fiserv, FIS, and Temenos continue expanding cloud-based solutions that comply with strict regulatory frameworks. The growing collaboration between fintech firms and traditional lenders, combined with digital-first customer preferences, reinforces North America’s position as the largest and most mature market globally.

Europe

Europe accounts for nearly 28% of the global market, driven by open banking regulations and digital transformation initiatives. The U.K., Germany, and France lead adoption through PSD2 compliance and fintech integration. European banks prioritize automation, data analytics, and cloud-based lending to improve efficiency and meet regulatory demands. Companies such as Finastra and Sopra Banking Software are enhancing modular platforms to serve retail and SME lenders. The region’s focus on sustainable finance, coupled with expanding peer-to-peer lending ecosystems, strengthens Europe’s position as a major hub for digital lending innovation.

Asia-Pacific

Asia-Pacific holds a 24% market share and represents the fastest-growing regional segment. Rapid digitalization, mobile banking expansion, and government-backed fintech programs drive market growth in China, India, and Southeast Asia. Banks and non-banking financial institutions adopt digital platforms to serve unbanked and underbanked populations. Leading players like TCS, Infosys Finacle, and OneConnect offer scalable cloud-based platforms tailored for high-volume lending. The region’s strong smartphone adoption and favorable regulations supporting financial inclusion continue to accelerate digital lending adoption across both developed and emerging economies.

Latin America

Latin America captures nearly 7% of the global market share, supported by expanding fintech ecosystems in Brazil, Mexico, and Colombia. The demand for faster credit access and lower borrowing costs drives digital lending platform adoption among banks and microfinance institutions. Fintech startups such as Nubank and Creditas lead innovation through AI-driven loan processing and cloud-native platforms. Governments in the region are implementing open finance initiatives to promote competition and inclusion. Despite challenges related to regulation and cybersecurity, the region’s growing digital literacy supports steady market expansion.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, with growth fueled by increasing investments in financial digitization. The UAE, Saudi Arabia, and South Africa lead adoption due to strong fintech infrastructure and supportive government initiatives. Banks and fintech firms implement digital lending platforms to enhance SME financing and consumer credit services. Regional players like eFinance and Network International are advancing cloud-based systems for faster deployment. While low financial inclusion and connectivity challenges persist, rising smartphone usage and regulatory modernization are driving future growth prospects in the region.

Market Segmentations:

By Service:

- Design & Implementation

- Training & Education

By Deployment:

By End User:

- Banks

- Insurance Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The digital lending platform market is highly competitive, with key players including Sigma Infosolutions, FIS, Roostify, Wizni, Inc., Pegasystems Inc., Nucleus Software, Tavant, Fiserv, Inc., Ellie Mae, Inc., and Newgen Software. The digital lending platform market is characterized by intense competition driven by rapid technological innovation and rising demand for automation in financial services. Companies are prioritizing cloud-based deployment, AI-powered analytics, and API-driven integration to deliver faster, more secure, and customer-centric lending solutions. Vendors focus on improving platform scalability, compliance, and interoperability with core banking systems to attract financial institutions and fintechs. Strategic partnerships, mergers, and product enhancements are common strategies to expand market reach. The increasing emphasis on personalized lending, real-time risk assessment, and digital onboarding continues to shape the competitive dynamics of this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sigma Infosolutions

- FIS

- Roostify

- Wizni, Inc.

- Pegasystems Inc.

- Nucleus Software

- Tavant

- Fiserv, Inc.

- Ellie Mae, Inc.

- Newgen Software

Recent Developments

- In April 2025, Fiserv, Inc. announced that it had entered into a definitive agreement to acquire Brazilian fintech company Money Money Serviços Financeiros S.A. This strategic acquisition aims to enhance Fiserv’s services in Brazil, enabling small and medium-sized businesses (SMBs) to access capital for growth and development.

- In October 2024, the new JioFinance app, developed by Jio Financial Services (JFSL), was launched, offering a comprehensive range of digital financial services. The app offers an aggregated view of users’ bank and mutual fund holdings, improving financial management.

- In September 2024, Akme Fintrade (India) Limited, one of the leading technology-driven lending platforms, entered into a strategic co-lending partnership with MAS Financial Services Limited to provide loans to small business owners.

- In February 2024, Dvara Money, a leading fintech company, announced a strategic partnership with Jana Small Finance Bank Limited (Jana SFB). This collaboration aims to harness the technological capabilities of Jana SFB and the innovative Spark Money platform by Dvara Money to set new standards in digital banking services

Report Coverage

The research report offers an in-depth analysis based on Service, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as banks accelerate digital transformation initiatives.

- AI and machine learning will play a central role in credit scoring and risk management.

- Cloud-based platforms will dominate due to scalability, cost-efficiency, and faster deployment.

- Fintech collaborations with traditional lenders will expand to enhance customer reach.

- Mobile-first lending solutions will rise, targeting underserved and unbanked populations.

- Blockchain adoption will increase to improve transaction transparency and data security.

- Regulatory frameworks will evolve to support open banking and digital compliance.

- Predictive analytics will enhance loan personalization and borrower experience.

- Integration of APIs will streamline workflows across multiple financial services.

- Sustainable and inclusive lending models will gain momentum in emerging economies.