Market Overview

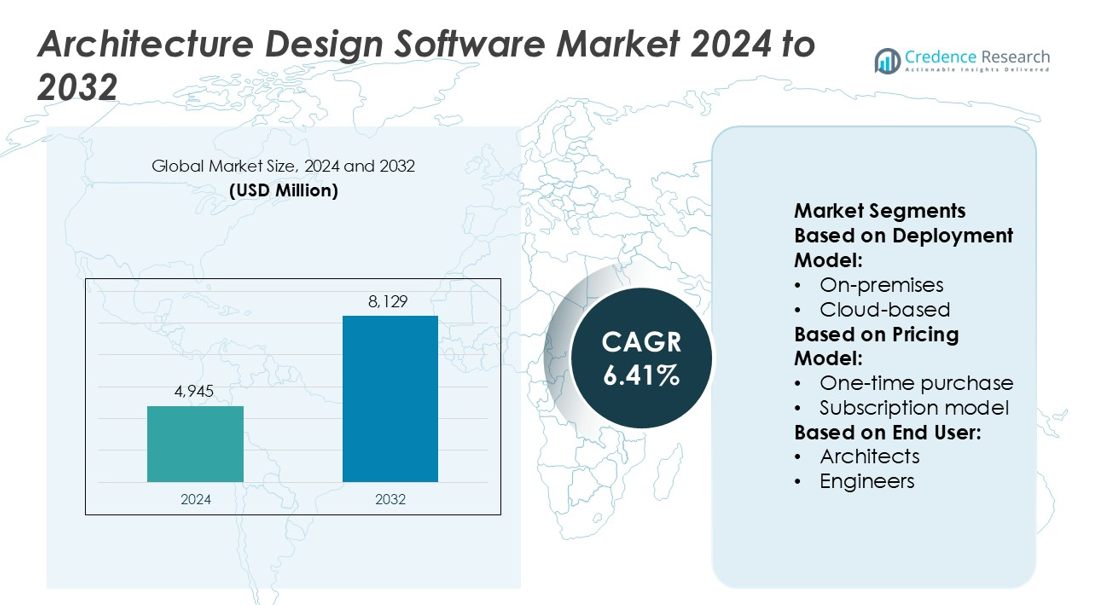

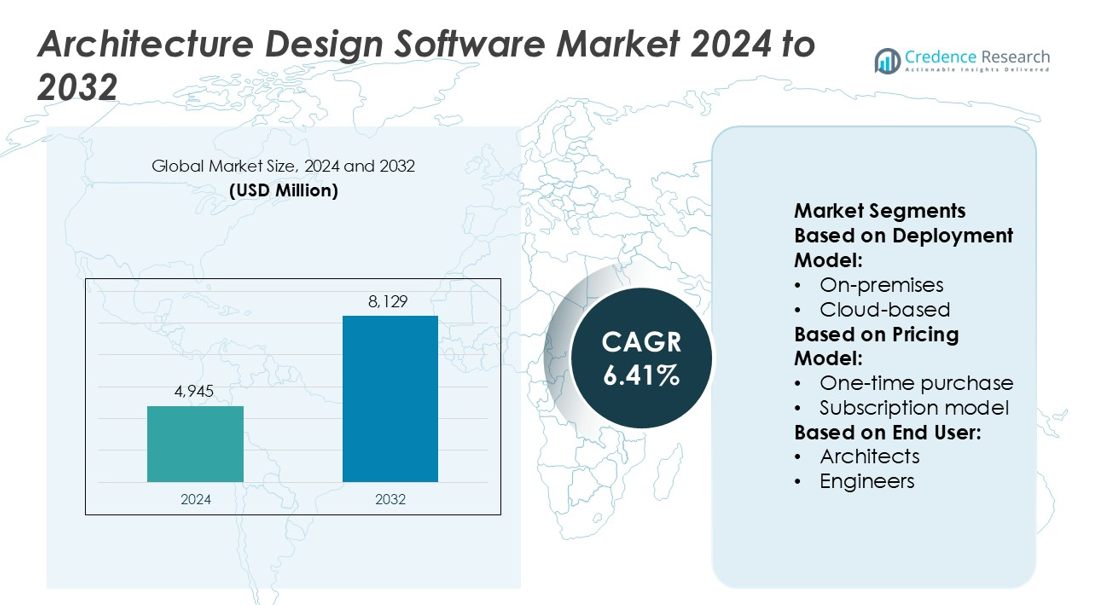

Architecture Design Software Market size was valued USD 4,945 million in 2024 and is anticipated to reach USD 8,129 million by 2032, at a CAGR of 6.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Architecture Design Software Market Size 2024 |

USD 4,945 million |

| Architecture Design Software Market, CAGR |

6.41% |

| Architecture Design Software Market Size 2032 |

USD 8,129 million |

The architecture design software market is driven by major players such as Autodesk Inc., Trimble Inc., BENTLEY SYSTEMS, Oracle Corporation, Microsoft Corporation, SAP SE, RIB Software SE, Constellation Software Inc., Sage Group plc, and Vectorworks, Inc. These companies focus on cloud-based solutions, AI-powered design automation, and enhanced interoperability to strengthen their global footprint. Autodesk and Bentley Systems lead with advanced BIM platforms that support collaboration and sustainability in modern infrastructure projects. Among regions, North America dominates the market with a 36% share, supported by strong digital adoption, robust infrastructure investment, and widespread use of smart design technologies across the U.S. and Canada.

Market Insights

- The Architecture Design Software Market was valued at USD 4,945 million in 2024 and is projected to reach USD 8,129 million by 2032, growing at a CAGR of 6.41%.

- Market growth is driven by the rising adoption of Building Information Modeling (BIM), 3D visualization, and cloud-based collaboration tools that improve design accuracy and project efficiency.

- The market is witnessing strong trends in AI-driven generative design, sustainable architecture, and integration of AR/VR technologies to enhance client engagement and visualization.

- Competition remains intense, with Autodesk Inc., Bentley Systems, Trimble Inc., Oracle Corporation, and SAP SE leading innovation through automation, interoperability, and flexible subscription models.

- North America holds a 36% share, leading the global market, while the cloud-based deployment segment dominates due to scalability and lower infrastructure costs, followed by rapid adoption across Asia-Pacific supported by smart city development and infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Model

The cloud-based segment dominates the architecture design software market, holding a major share due to its scalability and remote access capabilities. Cloud deployment enables real-time collaboration, data security, and cost-efficient updates, attracting small and medium design firms. It eliminates hardware dependency, allowing professionals to access advanced design tools from any location. Growing adoption of Building Information Modeling (BIM) in cloud environments further boosts this segment. On-premises solutions continue to serve enterprises prioritizing data privacy and offline processing, but cloud models are rapidly expanding due to lower setup costs and continuous integration features.

- For instance, Microsoft has enhanced its Azure App Service platform to provide native support for Progressive Web Apps (PWAs) and seamless integration with serverless technologies like Azure Functions. The service is deployed across more than 70 Azure regions worldwide, enabling developers to build and deploy highly responsive and scalable web apps.

By Pricing Model

The subscription model leads the market, supported by flexible payment structures and continuous software upgrades. This model allows users to access the latest tools without large upfront investments. Vendors like Autodesk and Trimble increasingly prefer subscriptions to enhance recurring revenue and provide cloud-linked services. The one-time purchase model still attracts long-term users needing offline functionality or budget predictability, but its appeal is shrinking. The growing preference for SaaS platforms, which offer monthly or annual billing, supports widespread adoption among architects and design firms seeking cost efficiency and scalability.

- For instance, RevolutionEHR’s RevClear module reduces each claim transaction by 8.5 minutes, a feature listed among the benefits of the claims processing service.

By End User

Architects represent the leading end-user segment, accounting for the largest share of the architecture design software market. They rely heavily on advanced visualization, 3D modeling, and rendering tools to conceptualize building layouts and aesthetics. Increased integration of AI and parametric design enhances accuracy and project speed for architects. Engineers and construction professionals use these tools for structural validation, energy modeling, and collaboration, while designers employ them for creative visualization. However, architectural firms remain the primary growth driver, adopting integrated design ecosystems that link planning, simulation, and real-time project management.

Key Growth Drivers

Rising Adoption of BIM and 3D Visualization

The growing use of Building Information Modeling (BIM) and 3D visualization tools is driving the architecture design software market. These technologies enhance project accuracy, visualization, and collaboration among stakeholders. Architects and engineers use them to detect design flaws early and optimize construction processes. The integration of cloud-based BIM solutions allows real-time collaboration, reducing project delays and costs. Companies are increasingly adopting advanced 3D tools to improve design quality, sustainability, and energy efficiency in modern infrastructure projects.

- For instance, Waystar’s Claim Manager maintains a 98.5% first-pass clean claim rate, powered by more than 2.5 million built-in claim edits updated in real time. This level of automation reduces resubmission delays and supports faster reimbursement across 5,000 payer connections.

Expansion of Smart City and Infrastructure Projects

Rapid urbanization and government initiatives to develop smart cities are accelerating demand for advanced design software. Large-scale infrastructure projects require precise planning, design simulation, and digital modeling capabilities. Architecture software enables efficient space management, structural optimization, and environmental impact assessment. The focus on sustainable and intelligent urban spaces is encouraging design professionals to adopt advanced tools that integrate IoT and GIS functionalities. As developing economies invest heavily in infrastructure, demand for digital design platforms continues to expand.

- For instance, NextGen Ambient Assist, introduced nearly two years ago, now handles 1.5 million patient encounters annually. It saves providers up to two hours per day in documentation by transcribing encounters in real time and generating summaries via AI.

Increasing Shift Toward Cloud-Based Solutions

Cloud-based architecture design platforms are becoming key growth drivers due to their flexibility, scalability, and lower operational costs. These solutions support remote collaboration, real-time updates, and centralized data storage, which are vital for distributed design teams. Firms benefit from subscription-based models that reduce upfront costs and ensure continuous access to software updates. Integration with AI-powered design tools further enhances productivity and automation. The growing adoption of cloud ecosystems across small and medium architecture firms strengthens market expansion.

Key Trends & Opportunities

Integration of AI and Generative Design

Artificial intelligence and generative design technologies are transforming architectural workflows. AI-based tools can automatically generate optimized layouts, structural forms, and material choices based on project constraints. This reduces design time and improves sustainability outcomes. Generative algorithms help architects explore multiple design possibilities and enhance creativity. The trend toward intelligent automation is enabling professionals to focus more on innovation and less on repetitive modeling tasks, improving overall project efficiency.

- For instance, Questel Orbit Intelligence platform the database included over 100,000 patent families declared essential to 2G, 3G, 4G, and 5G standards. It also included thousands of families with manual essentiality reviews. The database is continually updated.

Growing Demand for Sustainable and Green Design Tools

The push for eco-friendly construction practices is boosting demand for architecture software that supports energy modeling and environmental simulation. Designers are using tools that assess energy consumption, daylighting, and material sustainability. Governments and organizations emphasize green certifications such as LEED and BREEAM, prompting architects to adopt sustainability-integrated platforms. This trend creates opportunities for vendors offering software with advanced performance analytics, enabling architects to design buildings with reduced carbon footprints and better energy efficiency.

- For instance, LexisNexis launched the Protégé™ AI Assistant in PatentSight+, which draws on a harmonized global database of over 90 million patent family records and more than 100 baked-in patent metrics to answer natural language queries with visual insights.

Increasing Collaboration Through AR and VR Technologies

Augmented reality (AR) and virtual reality (VR) are emerging as major trends in architectural design. These immersive technologies allow clients and project teams to visualize spaces in real time before construction. AR/VR integration enhances communication, reduces design errors, and improves client engagement. Architecture firms leverage these tools to conduct virtual walkthroughs and simulations, leading to faster decision-making. As hardware becomes more affordable, AR/VR-enabled design environments are gaining traction in both commercial and residential projects.

Key Challenges

High Cost of Software and Licensing

The high initial cost of architecture design software and recurring licensing fees remains a major challenge, especially for small firms. Advanced 3D modeling, rendering, and BIM platforms require substantial investment in both software and hardware infrastructure. While subscription models reduce upfront costs, total long-term expenses can still burden smaller design studios. The cost factor often limits adoption in developing markets, restricting access to the latest digital design tools and slowing market growth.

Data Security and Integration Issues

With increased reliance on cloud-based platforms, data security and system integration have become critical concerns. Design files often contain sensitive project details, and any breach can lead to financial or reputational losses. Firms also face challenges in integrating various design, visualization, and project management tools into a unified workflow. Inconsistent data formats and interoperability issues between software platforms hinder seamless collaboration, making cybersecurity and compatibility key priorities for both developers and end-users.

Regional Analysis

North America

North America dominates the architecture design software market with a 36% share, driven by strong adoption of BIM and advanced visualization tools. The U.S. leads due to high infrastructure spending and widespread use of cloud-based design platforms among architectural firms. Major players such as Autodesk, Trimble, and Bentley Systems continue to innovate through AI integration and collaborative design ecosystems. The region’s focus on green building design, digital twins, and smart infrastructure enhances software demand. Government initiatives supporting sustainable urban development further strengthen North America’s leadership in the global market.

Europe

Europe holds a 28% market share, supported by stringent energy efficiency regulations and increasing use of sustainable design solutions. Countries like Germany, the U.K., and France are major contributors due to their emphasis on digital construction and modernization projects. European architects prioritize eco-friendly design tools aligned with LEED and BREEAM certifications. Companies are integrating AI-driven modeling and VR-based design collaboration to meet evolving client expectations. The ongoing transition to cloud-based and interoperable software platforms is fostering digital transformation across the European architecture and engineering ecosystem.

Asia-Pacific

Asia-Pacific accounts for a 25% share of the architecture design software market and is the fastest-growing region. Rapid urbanization, smart city initiatives, and expanding construction industries in China, India, and Japan drive market growth. The region’s architects increasingly rely on cloud-based platforms for large-scale infrastructure and residential projects. Government investments in digital transformation and sustainable urban planning enhance adoption. Rising awareness of BIM and 3D design technologies accelerates the shift toward automated, collaborative workflows. Global and local vendors are expanding partnerships to serve this emerging, high-demand market.

Latin America

Latin America captures an 8% market share, driven by modernization of infrastructure and the adoption of cost-effective cloud-based design tools. Brazil and Mexico lead regional growth, supported by government investments in commercial and public construction projects. Increasing awareness of digital design benefits and improved internet access are encouraging small architecture firms to transition from manual drafting to 3D modeling. Software vendors are introducing flexible subscription models tailored to local market needs. However, limited technical expertise and inconsistent connectivity remain barriers to wider adoption across smaller economies.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the architecture design software market, with rising opportunities in smart city and luxury real estate projects. The UAE and Saudi Arabia lead adoption through large-scale initiatives such as NEOM and Dubai Smart City. Architecture firms in the region are investing in BIM, AR, and VR technologies to support advanced urban planning and sustainable infrastructure. Collaboration with international software developers enhances access to cutting-edge tools. Despite steady growth, high software costs and limited digital training constrain broader market expansion.

Market Segmentations:

By Deployment Model:

By Pricing Model:

- One-time purchase

- Subscription model

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The architecture design software market features leading players including RIB Software SE, Sage Group plc, Trimble Inc., Vectorworks, Inc., Oracle Corporation, Constellation Software Inc., Autodesk Inc., BENTLEY SYSTEMS, Microsoft Corporation, and SAP SE. The architecture design software market is characterized by intense competition and rapid technological evolution. Companies are focusing on developing cloud-based and AI-driven design platforms to enhance collaboration, automation, and real-time project visualization. The integration of Building Information Modeling (BIM) with advanced analytics and digital twin technologies is reshaping design workflows, enabling better accuracy and sustainability. Vendors are investing in partnerships, product innovation, and strategic acquisitions to strengthen their presence across global markets. Continuous software upgrades, subscription-based pricing, and mobile accessibility are helping firms cater to diverse customer needs, from independent architects to large construction enterprises.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RIB Software SE

- Sage Group plc

- Trimble Inc.

- Vectorworks, Inc.

- Oracle Corporation

- Constellation Software Inc.

- Autodesk Inc.

- BENTLEY SYSTEMS

- Microsoft Corporation

- SAP SE

Recent Developments

- In March 2024, Oracle announced the availability of Java 22. It is the latest version of the world’s number-one programming language and development platform.

- In February 2024, Autodesk Informed Design is a new cloud-based solution that simplifies the building design and construction process by connecting design and manufacturing workflows. This solution empowers architects to utilize customizable, pre-defined building products, ensuring accurate results. Manufacturers can easily share its products with design stakeholders, streamlining collaboration.

- In September 2023, Trimble introduced SketchUp Viewer for Meta Quest 2, Meta Quest Pro, and Meta Quest 3, enabling immersive viewing and presentation of 3D SketchUp models in virtual reality (VR). This tool empowers AEC professionals to conduct design reviews, collaborate, and make informed decisions using VR headsets, enhancing flexibility and efficiency

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, Pricing Model, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increasing integration of AI and machine learning to automate design processes.

- Cloud-based architecture software will continue to dominate due to flexibility and remote collaboration benefits.

- Adoption of Building Information Modeling (BIM) will expand across both developed and emerging markets.

- Sustainable and energy-efficient design tools will gain more demand with stricter green building regulations.

- Augmented and virtual reality will enhance visualization and client presentation in architectural projects.

- Subscription-based pricing models will grow as vendors shift toward recurring revenue strategies.

- Interoperability between design, simulation, and project management platforms will improve workflow efficiency.

- Increased government investments in smart cities and digital infrastructure will create new growth avenues.

- Vendors will focus on cybersecurity measures to protect sensitive design and project data.

- Mobile and tablet-based design solutions will rise, supporting on-site design access and real-time edits.