Market Overview

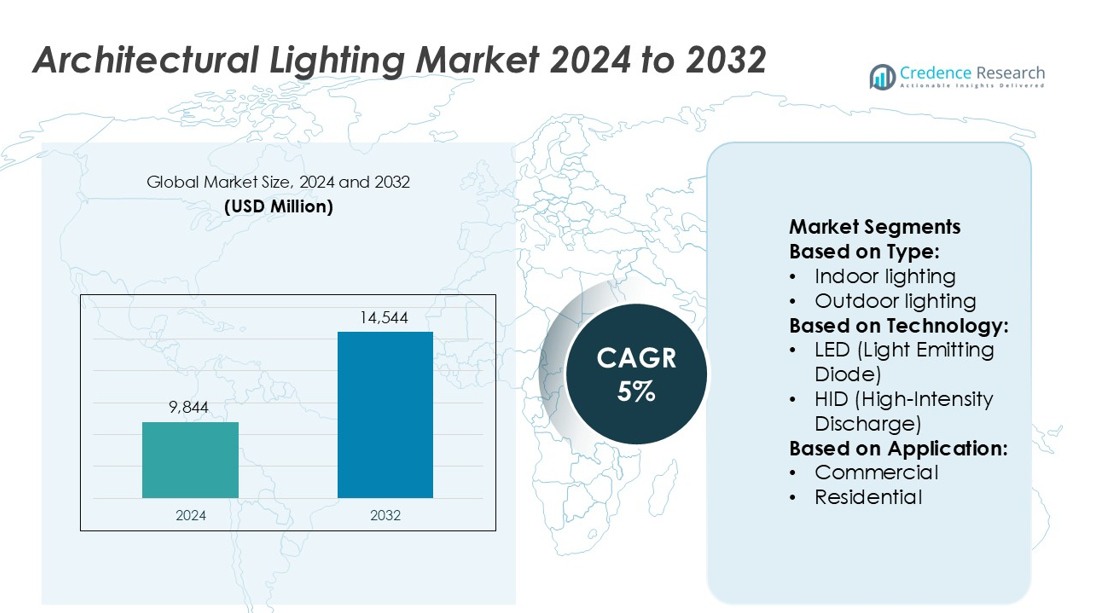

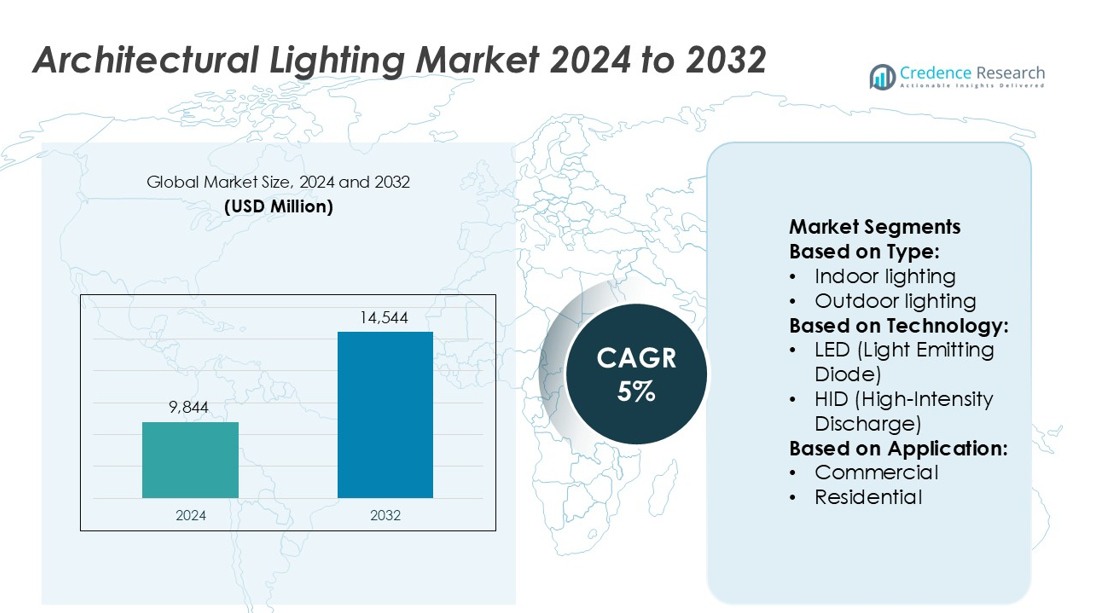

Architectural Lighting Market size was valued USD 9,844 million in 2024 and is anticipated to reach USD 14,544 million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Architectural Lighting Market Size 2024 |

USD 9,844 million |

| Architectural Lighting Market, CAGR |

5% |

| Architectural Lighting Market Size 2032 |

USD 14,544 million |

The architectural lighting market is driven by leading companies including Panasonic Corporation, Hubbell, GVA Lighting, Inc., Signify Holding, OSRAM SYLVANIA Inc., Delta Light, Current Lighting, Siteco GmbH, Acuity Brands, Inc., and Cree Lighting. These players focus on developing advanced LED technologies, intelligent lighting control systems, and design-centric luminaires to enhance building efficiency and aesthetics. Strategic collaborations and expansion into emerging economies strengthen their global presence. Among all regions, Asia-Pacific leads the market with a 34% share, supported by rapid urbanization, infrastructure growth, and widespread adoption of energy-efficient lighting in commercial and residential projects.

Market Insights

- The architectural lighting market was valued at USD 9,844 million in 2024 and is projected to reach USD 14,544 million by 2032, growing at a CAGR of 5%.

- Rising demand for energy-efficient and design-focused lighting systems in commercial and residential spaces drives market growth.

- Trends such as smart lighting integration, human-centric illumination, and adaptive control systems are transforming architectural lighting applications.

- Competitive intensity remains high as key players invest in LED innovations, sustainable materials, and strategic global expansion.

- Asia-Pacific leads with a 34% regional share, while the indoor lighting segment dominates product adoption due to its energy efficiency and design versatility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The indoor lighting segment dominates the architectural lighting market, holding 61% of the total share. This dominance stems from rising demand in offices, retail stores, and residential complexes emphasizing aesthetics and energy efficiency. Indoor lighting systems integrate advanced dimming controls and sensor-based automation to optimize brightness and reduce energy use. Increasing adoption of human-centric lighting, which adjusts color temperature based on circadian rhythms, further supports segment growth. Meanwhile, outdoor lighting is expanding due to smart city projects and enhanced public safety initiatives.

- For instance, Panasonic Corporation introduced its Space Player lighting system, which combines projection and illumination, allowing up to 2,000 lumens of output with precise control over lighting direction and intensity.

By Technology

LED lighting leads the market with 74% share, driven by superior energy efficiency, durability, and design flexibility. LEDs consume up to 80% less power than incandescent or fluorescent lamps, making them the preferred choice across sectors. Manufacturers are investing in tunable white and RGB LED systems to enhance ambiance and user comfort. For instance, dynamic LED installations are now standard in modern architectural facades and museums. Other technologies like HID and fluorescent lights are declining due to shorter lifespan and higher operational costs.

- For instance, Hubbell’s Litecontrol SAE101 pendant light offers a peak indirect efficacy of up to 137 lumens per watt and includes an optional “Dim to Warm” feature for color-temperature tuning from 2,200 K to 3,000 K, enabling design‐flexible illumination that meets both visual comfort and aesthetic requirements.

By Application

The commercial segment accounts for 48% share, making it the largest application area in the architectural lighting market. Rapid development of corporate buildings, shopping centers, and hospitality spaces drives this dominance. Demand for customized lighting designs and energy-efficient illumination enhances market growth. Commercial users prioritize intelligent lighting systems integrated with IoT for automated control and reduced maintenance costs. The residential segment is also growing steadily, supported by rising smart home adoption and focus on interior aesthetics through modern lighting solutions.

Key Growth Drivers

Rising Focus on Energy-Efficient Lighting Solutions

Global demand for energy-efficient lighting systems is a major growth driver for the architectural lighting market. LED technology offers significant energy savings, longer lifespan, and reduced maintenance costs, driving replacement of traditional fixtures. Government incentives promoting sustainable construction further boost adoption in commercial and residential projects. The integration of motion sensors and daylight-responsive systems enhances building efficiency and aligns with green building standards. Increasing energy regulations worldwide continue to encourage investment in advanced lighting technologies across architectural applications.

- For instance, GVA Lighting’s proprietary INFINITY® Technology facilitates long-lighting runs of 300+ metres (1,000+ feet) from a single power and data input point, thereby reducing cabling and installation complexity.

- Expansion of Smart Building Infrastructure

- Smart building projects are accelerating the use of intelligent architectural lighting systems. IoT-enabled lighting allows remote control, occupancy-based adjustments, and predictive maintenance, improving operational efficiency. Commercial developers and facility managers are adopting networked lighting for better energy management and user experience. Smart lighting also supports integration with HVAC and security systems, offering comprehensive automation. The growing penetration of connected technologies in corporate offices, airports, and educational facilities is creating strong demand for digitally controlled architectural lighting solutions.

- For instance, OSRAM’s LIGHTIFY® system supports RGBW tuning from 1900 K to 6500 K in connected luminaires, enabling scene-based lighting behaviour.

- Growing Demand for Aesthetic and Customizable Designs

- Architectural lighting increasingly emphasizes aesthetics, ambience, and design flexibility. Demand for customizable lighting solutions in hospitality, retail, and luxury residences continues to rise. Modern fixtures use dynamic color tuning, laser-based projection, and adaptive intensity to enhance visual appeal. Architects and designers prefer lighting that complements interior themes and highlights structural features. This shift from basic illumination to design-centric lighting has encouraged manufacturers to innovate products combining function, sustainability, and visual performance to meet evolving customer expectations.

Key Trends & Opportunities

Surge in Human-Centric Lighting Adoption

Human-centric lighting (HCL) is gaining momentum as awareness of its wellness benefits grows. HCL systems mimic natural daylight patterns to support circadian rhythms, improving comfort and productivity in workplaces and healthcare environments. Lighting manufacturers are developing tunable white LEDs with advanced control systems for color temperature adjustment. This trend creates opportunities in premium residential and commercial markets. The inclusion of HCL in sustainable building certifications like WELL and LEED further enhances its market potential among eco-conscious developers.

For instance, Delta Light specifies an L70 of 60,000 hours (B50) for lumen maintenance and an initial color consistency within 3 MacAdam steps (SDCM 3).

Integration of Advanced Control Systems and IoT Platforms

Integration of lighting with IoT-based platforms is transforming architectural lighting management. Cloud-controlled systems enable real-time monitoring, occupancy sensing, and energy analytics, enhancing efficiency and user convenience. Opportunities are emerging for AI-driven lighting systems that adjust automatically based on usage data and daylight availability. Manufacturers are collaborating with software providers to develop interoperable ecosystems supporting smart city and building automation initiatives. This digital transformation is driving growth across commercial complexes and public infrastructure projects worldwide.

For instance, Siteco’s CL 31 building-vicinity luminaire offers a luminous flux of 1 500 lm for its bollard version and a service lifetime of 100 000 h (L80/B10).

Expansion in Outdoor Architectural Projects

Infrastructure modernization and smart city initiatives are expanding opportunities in outdoor architectural lighting. Urban beautification, façade illumination, and landscape lighting projects enhance night-time aesthetics and safety. Governments are investing in LED retrofitting and intelligent street lighting systems with centralized controls. Companies offering weatherproof, low-maintenance lighting with dynamic color effects are seeing increased adoption. The focus on energy conservation, public security, and tourism development continues to create long-term growth prospects for outdoor architectural lighting installations.

Key Challenges

High Initial Investment and Installation Costs

Despite operational savings, the high upfront cost of architectural lighting systems remains a challenge. Advanced technologies like LED fixtures, smart controllers, and IoT integration require significant investment during installation. Small and medium-scale developers often find payback periods long, limiting adoption. In emerging economies, limited funding for sustainable infrastructure further restrains market penetration. Manufacturers must focus on cost optimization, modular designs, and financing solutions to make architectural lighting more accessible to a broader user base.

Lack of Standardization and Technical Complexity

The absence of global standards for smart lighting integration poses interoperability challenges. Diverse communication protocols, software compatibility issues, and complex system architectures hinder seamless operation. Building operators often face difficulties in maintaining and upgrading connected lighting networks. Inconsistent quality among low-cost imports also affects performance reliability. Addressing these issues through uniform standards, improved compatibility, and installer training programs is essential to ensure consistent quality and boost adoption in large-scale architectural projects.

Regional Analysis

North America

North America holds a 32% share of the architectural lighting market, driven by extensive adoption of energy-efficient lighting solutions in commercial and residential sectors. The U.S. leads the region with strong implementation of smart building technologies and government incentives promoting LED retrofits. Architectural lighting is increasingly integrated into urban infrastructure and retail spaces to enhance design appeal. Key players such as Acuity Brands, Cree Lighting, and Hubbell focus on product innovation and connected control systems. The region’s emphasis on sustainability, coupled with rising demand for human-centric lighting, continues to accelerate market expansion.

Europe

Europe accounts for 29% of the global market share, supported by strict energy regulations and rapid modernization of public infrastructure. Countries such as Germany, France, and the UK emphasize smart lighting in urban planning and historic preservation projects. The region’s focus on green buildings and eco-friendly materials drives demand for efficient LED and adaptive lighting solutions. Manufacturers like Signify, Zumtobel Group, and Fagerhult dominate through advanced control systems and design-oriented fixtures. Increased renovation of commercial spaces and adoption of daylight-mimicking lighting further sustain market growth across the continent.

Asia-Pacific

Asia-Pacific leads with a 34% share, making it the largest regional market for architectural lighting. Rapid urbanization, large-scale infrastructure projects, and growing smart city initiatives drive significant demand. China, Japan, and India remain major contributors, emphasizing LED adoption in both public and private construction. The region’s expanding real estate sector and government-led sustainability programs boost deployment in offices, hotels, and residential complexes. Local manufacturers such as Opple Lighting and Panasonic strengthen competition with cost-efficient, high-performance products. Increasing disposable income and modern architectural trends continue to fuel the region’s market growth.

Latin America

Latin America holds a 3% market share, driven by gradual adoption of LED lighting and infrastructure development. Brazil and Mexico lead the region due to urban modernization and public building renovations. Government initiatives supporting energy efficiency and environmental sustainability encourage LED integration across commercial and residential projects. Market participants are focusing on affordable yet durable lighting solutions to attract cost-sensitive consumers. Increasing awareness of smart lighting benefits and collaborations with international brands are expected to enhance regional competitiveness over the coming years.

Middle East & Africa

The Middle East & Africa region captures a 2% share, with growth supported by rising investments in hospitality, retail, and urban development projects. The UAE and Saudi Arabia lead the market through large-scale commercial complexes, luxury hotels, and smart city plans. Demand for premium and decorative lighting solutions is rising in high-end architectural applications. Government policies promoting sustainable construction are encouraging LED and control-based lighting installations. Expanding tourism infrastructure and architectural innovation across the Gulf nations continue to create long-term growth potential for the regional market.

Market Segmentations:

By Type:

- Indoor lighting

- Outdoor lighting

By Technology:

- LED (Light Emitting Diode)

- HID (High-Intensity Discharge)

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The architectural lighting market is characterized by strong competition among major players such as Panasonic Corporation, Hubbell, GVA Lighting, Inc., Signify Holding, OSRAM SYLVANIA Inc., Delta Light, Current Lighting, Siteco GmbH, Acuity Brands, Inc., and Cree Lighting. The architectural lighting market is shaped by rapid technological innovation, design customization, and sustainability-focused development. Companies are prioritizing advanced LED technologies, smart control systems, and IoT integration to enhance energy efficiency and user experience. Growing demand for human-centric and dynamic lighting solutions has encouraged manufacturers to invest in tunable white and RGB systems for commercial and residential projects. Strategic mergers, acquisitions, and collaborations with architects and construction firms strengthen market reach and brand visibility. Continuous product diversification, coupled with expansion into emerging economies, remains vital to sustaining competitiveness and long-term growth in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Corporation

- Hubbell

- GVA Lighting, Inc.

- Signify Holding

- OSRAM SYLVANIA Inc.

- Delta Light

- Current Lighting

- Siteco GmbH

- Acuity Brands, Inc.

- Cree Lighting

Recent Developments

- In December 2024, Zumtobel Group AG announced the acquisition of a UK-based LED lighting company, AC/DC. This strategic move enhances Zumtobel’s position in the architectural lighting market by expanding its portfolio with advanced LED lighting solutions.

- In April 2024, Signify Holding introduced ultra-efficient and 3D-printed lighting innovations to support energy-efficient and sustainable workspaces. The new products significantly reduce energy consumption and carbon footprint while maintaining high performance.

- In February 2024, Siemens, Enlighted, and Zumtobel Group have formed a strategic partnership to advance smart building technologies, particularly focusing on intelligent IoT lighting solutions. The partnership aims to establish new standards for efficiency and sustainability in building operations worldwide.

- In August 2023, Acuity Brand, Inc. expanded its lighting product range by introducing new FMLR Round and FMLSQ Square Flush Mounts. These flush mounts provide flexible and attractive lighting options for various locations. They are available in circular and square shapes to suit different design preferences and uses, offering practicality and improved aesthetic appeal.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of smart and connected lighting systems will continue to expand in commercial and residential projects.

- Demand for human-centric lighting will rise as focus on health and productivity increases.

- Integration of artificial intelligence and IoT will enhance energy optimization and automation in lighting control.

- Sustainable and recyclable lighting materials will gain importance in green building designs.

- Dynamic façade and landscape lighting will see higher adoption in modern architecture and smart city projects.

- Growth in renovation and retrofit projects will drive replacement of conventional fixtures with LED solutions.

- Customizable and design-focused luminaires will attract architects and interior designers seeking aesthetic flexibility.

- Wireless and cloud-based lighting management platforms will improve scalability and operational efficiency.

- Emerging economies will offer strong growth potential due to rapid urbanization and infrastructure expansion.

- Continuous innovation in lighting optics, sensors, and controls will define competitive differentiation across the market.