Market overview

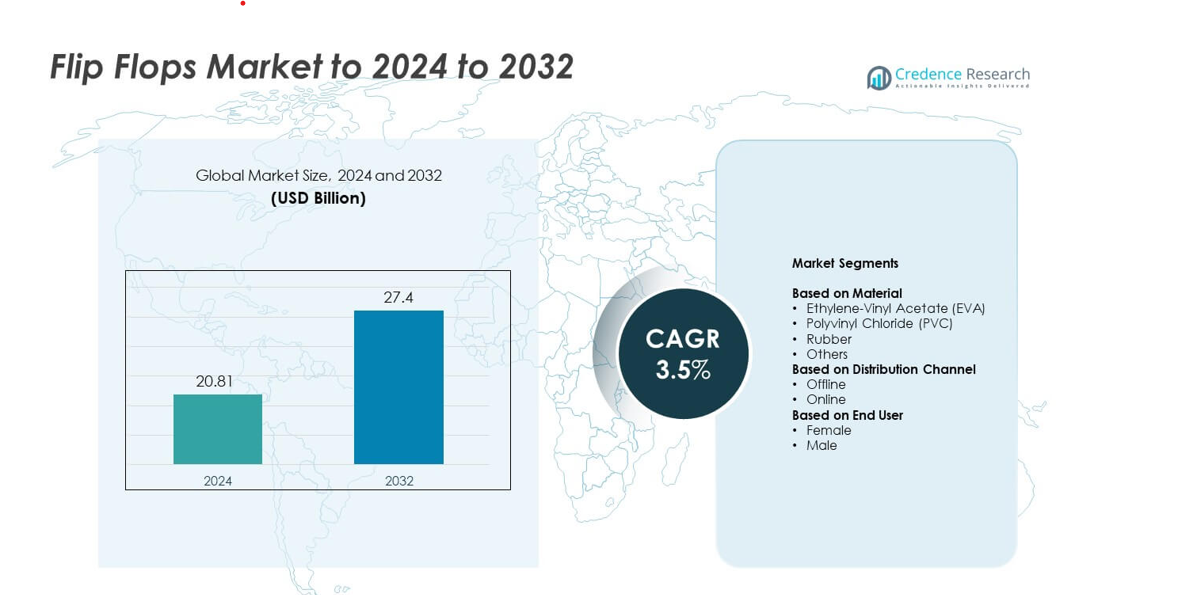

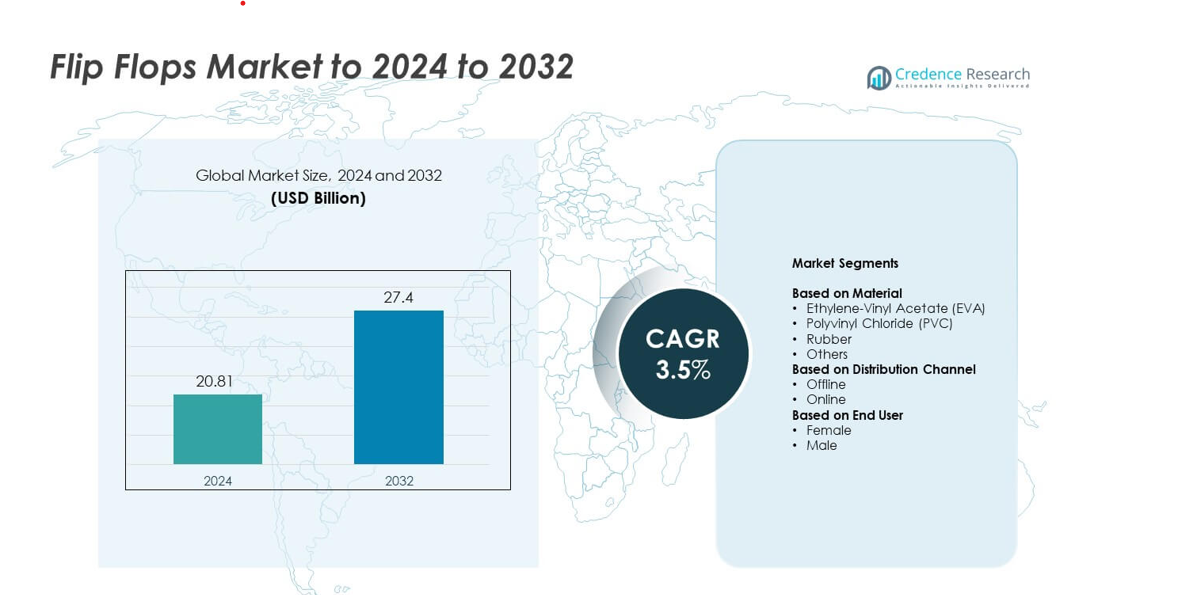

Flip Flops Market size was valued at USD 20.81 Billion in 2024 and is anticipated to reach USD 27.4 Billion by 2032, at a CAGR of 3.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flip Flops Market Size 2024 |

USD 20.81 Billion |

| Flip Flops Market, CAGR |

3.5% |

| Flip Flops Market Size 2032 |

USD 27.4 Billion |

The Flip Flops Market features leading players such as Nike, Inc., Crocs, Adidas AG, Skechers USA, Inc., Deckers Brands, C. & J. Clark International Ltd, Tory Burch LLC, Kappa, Havaianas, and Fat Face. These companies strengthen their positions through design innovation, comfort-focused materials, and expanding retail and online reach. Asia Pacific emerged as the leading region in 2024 with around 34% share, driven by high population density, warm climates, and strong demand for affordable casual footwear. North America and Europe follow with steady growth supported by lifestyle trends, premium product adoption, and rising interest in sustainable materials across both regions.

Market Insights

- The Flip Flops Market reached USD 20.81 Billion in 2024 and is projected to hit USD 27.4 Billion by 2032, registering a CAGR of 3.5 %.

- Rising demand for lightweight casual footwear drives market growth, with EVA leading the material segment at about 41 % due to its comfort and affordability.

- Fashion-led designs, sustainable materials, and strong online retail expansion shape major trends as consumers seek style variety and eco-friendly options.

- Competition remains strong as global brands enhance cushioning technologies, expand digital sales channels, and strengthen seasonal launches to increase visibility and customer retention.

- Asia Pacific dominated with nearly 34 % share in 2024, while North America held around 28 % and Europe about 24 %, supported by high adoption of comfort wear; the female end-user segment led overall demand with close to 57 % share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Ethylene-Vinyl Acetate (EVA) led the material segment in 2024 with about 41% share due to its light weight, flexible structure, and low production cost. EVA remains the preferred choice for mass-market flip flops because brands rely on its strong cushioning and durability advantages. PVC and rubber categories grow at steady rates as consumers shift toward longer-lasting and eco-aligned options, while other materials cater to niche comfort and premium style needs. Rising demand for affordable leisure footwear keeps EVA at the center of global volume sales.

- For instance, Alpargatas S.A. reported in its 2023 summary report that its total volume sold (which includes Havaianas) was approximately 208 million pairs.

By Distribution Channel

Offline channels dominated the market in 2024 with nearly 68% share because shoppers prefer in-store trials for comfort and size accuracy. Footwear chains, supermarkets, and specialty stores continue to attract strong walk-in demand, especially in developing regions. The online segment expands quickly as brands promote digital catalogs, fast delivery, and seasonal discounts. Growth in e-commerce platforms strengthens as younger buyers adopt mobile shopping, but offline outlets retain leadership due to immediate product access and higher repeat purchases.

- For instance, as of the end of 2024 (December 31, 2024), Skechers USA, Inc. and its global partners operated a total of 5,296 Skechers-branded stores worldwide.

By End User

The female category held the dominant position in 2024 with close to 57% share, supported by broader style variety, color options, and seasonal purchasing patterns. Women’s flip flops show higher replacement frequency due to fashion-driven buying behavior, which boosts segment revenue. The male segment grows at a steady pace as comfort-centric designs and outdoor-ready soles gain traction. Expansion of leisure travel, beachwear trends, and affordable comfort footwear strengthens demand across both categories, but the female segment remains the largest contributor to overall market sales.

Key Growth Drivers

Rising Demand for Affordable Casual Footwear

The market grows as consumers choose cost-effective casual footwear for daily use. Flip flops attract buyers seeking comfort, light weight, and easy maintenance across warm regions. Brands introduce wider color ranges and improved cushioning to strengthen repeat purchases. Expanding urban populations and relaxed lifestyle trends further boost volume sales. Tourism activity also supports higher demand for beachwear and leisure footwear, keeping this driver central to long-term market expansion.

- For instance, the Bata Group reports selling more than 180 million pairs of shoes annually through its network of over 5,300 retail stores and 21 manufacturing facilities.

Expansion of Organized Retail and E-Commerce

Growth accelerates as organized retail chains and digital platforms expand global reach. Large retailers promote seasonal collections and bundle offers to increase walk-ins, while online channels bring better accessibility for smaller brands. Fast delivery, flexible return policies, and digital payment options raise consumer confidence. Wider product visibility helps companies target varied age groups and fashion preferences. This driver plays a major role in strengthening distribution coverage across regions.

- For instance, Decathlon had 1,817 stores across 79 countries in 2024, illustrating global organized sports-footwear retail reach.

Product Innovation Focused on Comfort and Sustainability

Manufacturers invest in new materials and ergonomic designs to enhance foot support and long-term comfort. Eco-aligned materials gain attention as buyers prefer sustainable choices for everyday footwear. Improved sole patterns and lightweight formulations boost user experience, encouraging premium purchases. Product upgrades help brands differentiate in crowded markets and attract health-conscious consumers. This driver remains important for brands aiming to capture higher-value segments.

Key Trends & Opportunities

Growing Shift Toward Eco-Friendly Flip Flops

Sustainability emerges as a major trend as buyers move toward biodegradable, recycled, and plant-based materials. Brands adopt greener manufacturing to align with rising environmental awareness. This shift opens opportunities for companies to introduce premium sustainable lines with stronger brand appeal. Government emphasis on waste reduction and responsible sourcing further supports adoption. The trend creates long-term potential for high-margin eco-focused product portfolios.

- For instance, Allbirds’ M0.0NSHOT shoe was documented with a net carbon footprint of 0 kg CO₂e, compared with an industry-average running shoe footprint of about 14 kg CO₂e.

Rising Popularity of Fashion-Driven Designs

Flip flops evolve from basic utility footwear to trend-led accessories. Brands release vibrant colors, themed collections, and gender-specific patterns that appeal to style-driven consumers. Social media influence helps limited-edition designs attract younger buyers. This shift creates opportunities for companies to offer personalized and seasonal collections. The trend strengthens premiumization and expands revenue potential for fashion-focused product lines.

- For instance, Nike’s contract manufacturers operated 123 finished-goods footwear factories in 11 countries in fiscal 2023, supporting broad style and design variety.

Key Challenges

High Market Fragmentation and Price Competition

The market faces intense competition due to many regional and informal manufacturers. Price-sensitive consumers often shift toward low-cost substitutes, limiting premium product adoption. Brands struggle to maintain margins as raw material prices fluctuate. Heavy discounting across retail channels increases pressure on established companies. This challenge affects long-term differentiation and brand loyalty.

Limited Durability Among Low-Cost Products

Low-priced flip flops often lack durability, causing quicker wear and replacement needs. This reduces customer satisfaction and pushes buyers toward alternative footwear during certain seasons. Manufacturers must address quality issues without increasing production cost significantly. Durability concerns also restrict growth in regions with rising outdoor activity. This challenge remains significant for companies aiming to balance quality and affordability.

Regional Analysis

North America

North America held about 28% share in 2024, supported by strong demand for casual and beachwear footwear. Consumers prefer lightweight and durable products for daily and leisure use. Retail chains and online platforms expand product visibility, helping both premium and value brands grow. Style-driven buying habits and rising summer tourism further push category sales. Continued adoption of eco-focused materials strengthens brand positioning across urban markets, keeping the region steady in global share.

Europe

Europe accounted for nearly 24% share in 2024 due to high adoption of comfort footwear and strong interest in sustainable materials. Consumers favor well-designed products with long wear life, which supports premium and mid-range offerings. Growth in leisure travel and outdoor activities boosts category demand across Southern Europe. Expanding e-commerce penetration enhances accessibility for smaller brands. The region remains driven by fashion preferences, environmental awareness, and seasonal tourism patterns.

Asia Pacific

Asia Pacific dominated the market with around 34% share in 2024, driven by its large population, warm climate, and high volume sales. Affordable EVA-based products attract strong demand across India, China, and Southeast Asia. Rapid urbanization and rising middle-income groups support higher spending on everyday footwear. Expanding organized retail and digital platforms improve availability across cities and rural areas. The region grows quickly due to strong manufacturing capabilities and broad product adoption.

Latin America

Latin America captured close to 9% share in 2024, led by strong cultural acceptance of casual and beachwear footwear. Countries like Brazil show high flip flop penetration due to year-round warm weather and vibrant lifestyle trends. Local brands compete actively with international players, keeping pricing competitive across segments. Expanding retail networks and tourism activity support steady growth. The region benefits from rising adoption of fashion-oriented and durable products.

Middle East and Africa

Middle East and Africa held about 5% share in 2024, driven by warm climates and increasing use of lightweight daily footwear. Affordable products dominate demand, especially in urban centers with expanding young populations. Growth in retail malls and online platforms enhances brand exposure. Tourism-heavy regions show higher flip flop usage during travel seasons. Although price sensitivity remains high, gradual adoption of improved designs and durable materials supports long-term market expansion.

Market Segmentations:

By Material

- Ethylene-Vinyl Acetate (EVA)

- Polyvinyl Chloride (PVC)

- Rubber

- Others

By Distribution Channel

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes Nike, Inc., Crocs, Adidas AG, Skechers USA, Inc., Deckers Brands, C. & J. Clark International Ltd, Tory Burch LLC, Kappa, Havaianas, and Fat Face. Market competition stays intense as brands expand design ranges and improve comfort technologies. Companies increase focus on sustainable materials to meet rising environmental expectations. Many players invest in digital channels to reach younger buyers faster. Retail partnerships help widen product access across urban regions. Seasonal launches support stronger brand recall and higher repeat purchases. Firms enhance cushioning systems to grow premium demand. Marketing campaigns highlight lifestyle appeal to attract trend-driven shoppers. Global players refine supply chains to reduce delivery time and cost. Smaller brands use price advantages to defend regional shares. Product diversification strengthens engagement across varied age groups and style preferences. Continuous innovation supports long-term competitiveness across major markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike, Inc.

- Crocs

- Adidas AG

- Skechers USA, Inc.

- Deckers Brands (Teva, UGG)

- C. & J. Clark International Ltd

- Tory Burch LLC

- Kappa

- Havaianas

- Fat Face

Recent Developments

- In 2025, UGG, another Deckers brand, introduced the GoldenRise sandal as part of their Spring/Summer 2025 Golden Collection.

- In 2025, Teva, a brand under Deckers Brands, launched its Spring-Summer 2025 collection with multiple new performance sandal styles, including the Grandview Max Sandal family designed for trail, water, and camp activities.

- In 2025, Havaianas unveiled a new flip flop collection co-designed with global brand ambassador Gigi Hadid, featuring retro-inspired silhouettes and vibrant shades that capture effortless style.

Report Coverage

The research report offers an in-depth analysis based on Material, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for casual and lightweight footwear rises.

- Sustainable and recycled materials will gain wider adoption across major brands.

- Fashion-focused designs will strengthen premium sales and seasonal collections.

- Online channels will capture faster growth due to higher digital shopping rates.

- EVA-based products will remain popular, while eco-friendly alternatives will grow.

- New cushioning and ergonomic technologies will boost comfort-driven purchases.

- Emerging markets in Asia and Latin America will lead volume growth.

- Brand collaborations and limited editions will attract younger consumers.

- Organized retail expansion will improve accessibility in developing economies.

- Durability improvements will help brands compete against low-cost local manufacturers.