Market Overview

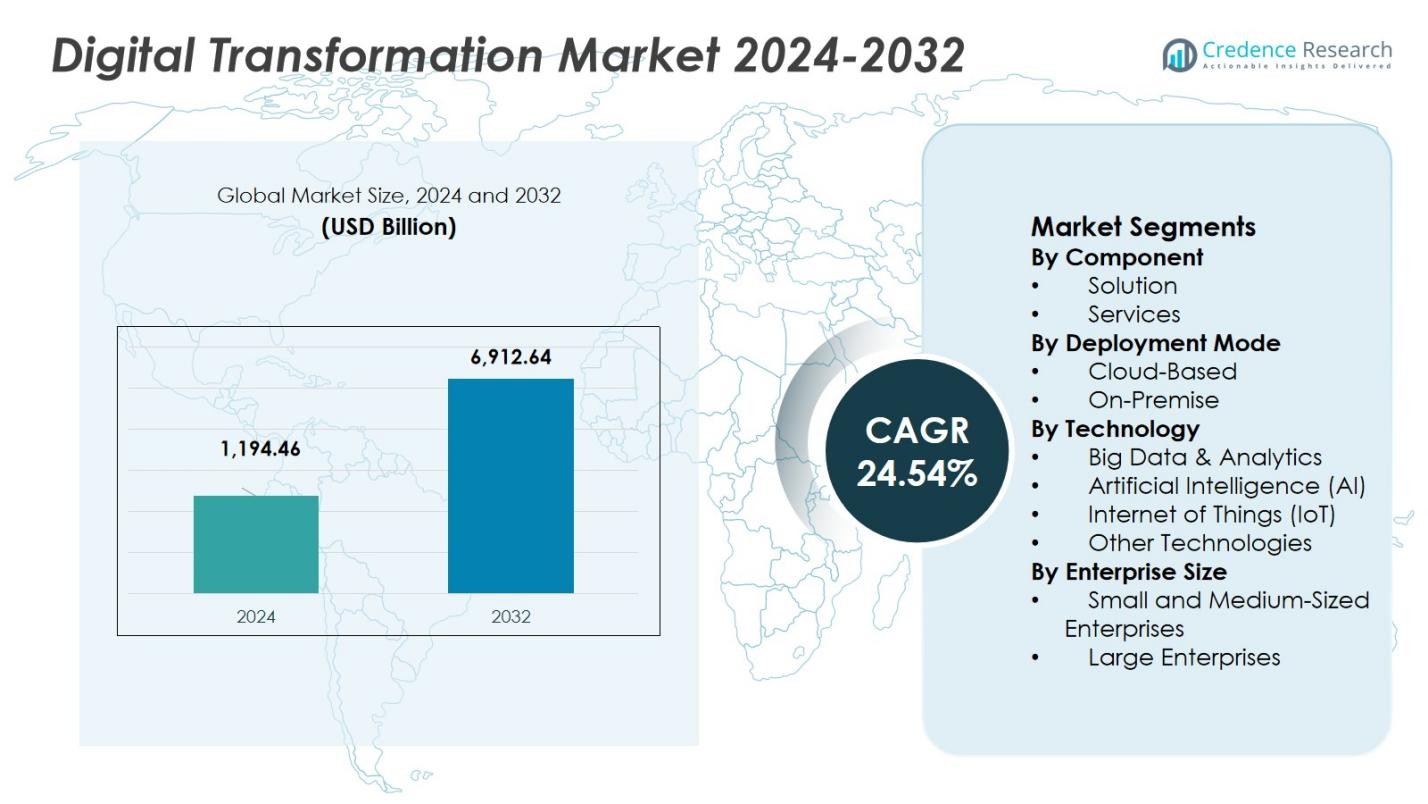

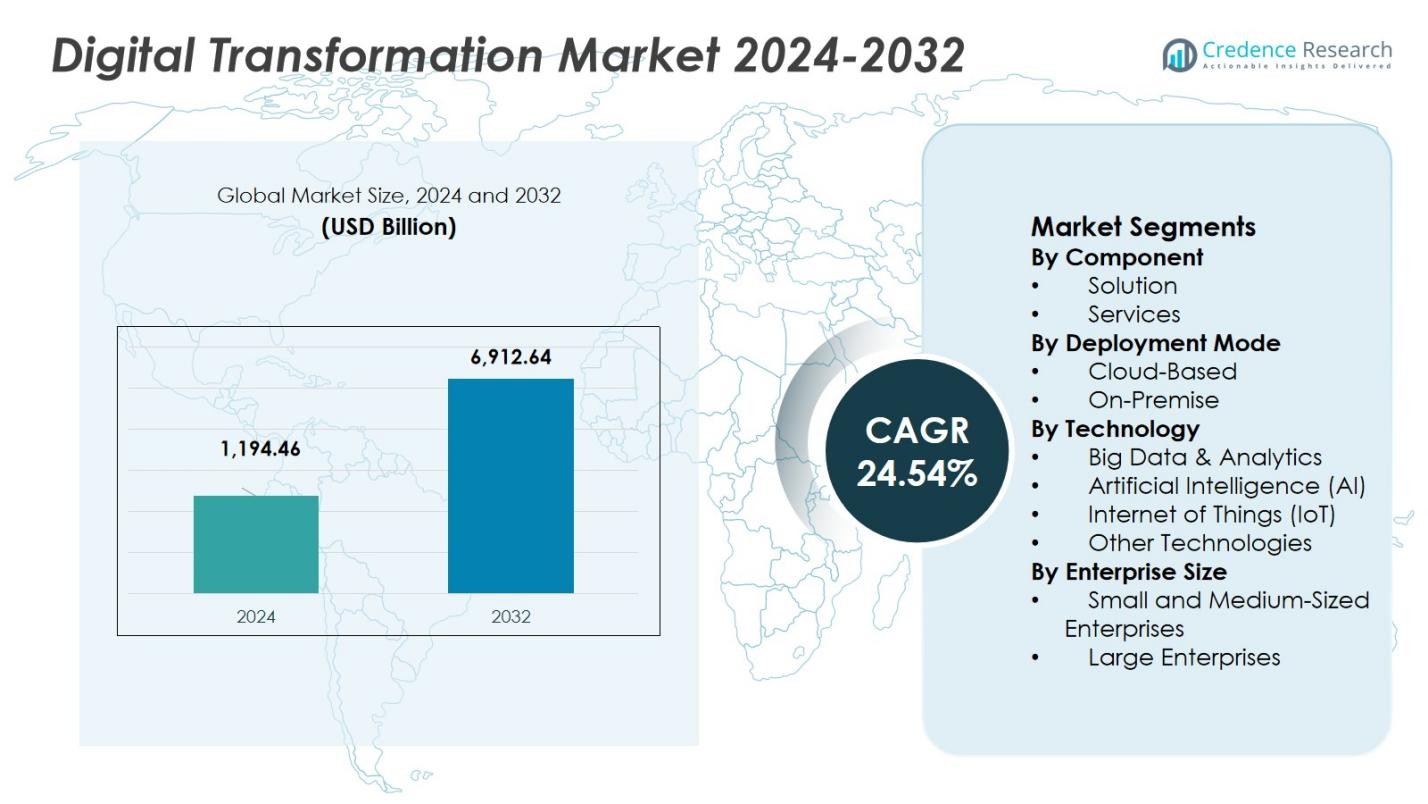

The Digital Transformation Market was valued at USD 1,194.46 Billion in 2024 and is anticipated to reach USD 6,912.64 Billion by 2032, growing at a CAGR of 24.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Transformation Market Size 2024 |

USD 1,194.46 Billion |

| Digital Transformation Market, CAGR |

24.54% |

| Digital Transformation Market Size 2032 |

USD 6,912.64 Billion |

The Digital Transformation Market benefits from the presence of top-tier players including IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., Google LLC, SAP SE, Cisco Systems, Inc., Salesforce, Inc., Oracle Corporation, Tata Consultancy Services Limited, and Accenture Plc. These companies lead the market by offering extensive cloud infrastructure, AI-driven analytics, ERP/CRM suites, and end-to-end consulting and managed services enabling enterprises to adopt scalable, secure, and integrated digital platforms. Regionally, the market concentrates in North America, which commands a market share of 43.2% in 2024, driven by high digital maturity, widespread cloud adoption, and strong enterprise IT spends. Meanwhile, the Asia Pacific region emerges as a rapidly growing hub, with accelerating investments in cloud, AI, IoT, and data analytics fostering rising digital adoption across manufacturing, retail, healthcare, and public-sector industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Transformation Market was valued at USD 1,194.46 Billion in 2024 and is expected to reach USD 6,912.64 Billion by 2032, growing at a CAGR of 24.54% during the forecast period.

- Technological advancements in AI, cloud computing, and IoT are driving market growth as enterprises adopt these solutions to improve operational efficiency, enhance customer experiences, and streamline business processes.

- The increasing demand for cloud-based solutions, along with the rise of automation and big data analytics, presents key trends and opportunities for businesses to improve decision-making and predictive capabilities.

- Key players like IBM, Microsoft, AWS, and SAP continue to lead the market, leveraging their extensive portfolios in cloud infrastructure, AI, and digital transformation consulting to maintain dominance.

- North America holds the largest regional share at 43%, followed by Asia Pacific, which is growing rapidly with a projected share of 30%, driven by strong investments in cloud and AI technologies.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Component

In the Digital Transformation Market, the Solution segment leads with a dominant share of 63% in 2024. This dominance is driven by the increasing need for businesses to streamline operations, enhance customer experiences, and improve decision-making. The demand for cloud-based software and integrated digital tools across various industries, including manufacturing, retail, and finance, supports this growth. Solutions like Software-as-a-Service (SaaS) are crucial for providing scalable, cost-effective digital transformation, making them highly sought after by businesses of all sizes.

- For instance, Oracle’s cloud infrastructure supports digital transformation through scalable SaaS and PaaS offerings, enabling enterprises to modernize applications and data management.

By Deployment Mode

The Cloud-Based deployment mode holds the largest share at 74% in 2024, benefiting from its flexibility, scalability, and cost-efficiency. Businesses are increasingly adopting cloud solutions to manage remote work, store data securely, and integrate various technologies seamlessly. Cloud-based deployments offer scalability and lower upfront costs, which are key drivers for organizations undergoing digital transformation. These factors, along with the growing demand for on-demand computing resources, continue to drive the cloud-based model’s dominance in the market.

- For instance, McDonald’s integrated Amazon Web Services (AWS) for its point-of-sale system, achieving 8,600 transactions per second and exceeding performance targets by up to 66%.

By Technology

Among the technologies powering digital transformation, Big Data & Analytics holds a substantial share of 32% in 2024. The growing reliance on data for decision-making across industries is a key factor behind the rapid adoption of big data platforms. These technologies enable businesses to process vast amounts of information, gain insights into customer behavior, and optimize operational efficiency. The integration of AI and IoT further enhances the power of big data, enabling predictive analytics and real-time decision-making, thus driving the widespread adoption of big data solutions.

Key Growth Drivers

Technological Advancements and Innovation

The rapid pace of technological advancements is a primary driver of digital transformation across industries. Innovations in Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and Big Data are enabling organizations to automate processes, improve customer experiences, and optimize operational efficiency. These technologies empower businesses to stay competitive in an increasingly digital landscape. The growing adoption of cloud computing, along with the rise of edge computing, further accelerates digital transformation by providing scalable, flexible, and cost-effective solutions for organizations worldwide.

- For instance, Microsoft Azure’s edge computing services help companies deploy applications closer to data sources, enhancing real-time responsiveness and reducing latency.

Increased Demand for Operational Efficiency

Organizations are increasingly turning to digital transformation to enhance operational efficiency and reduce costs. By integrating automated workflows, data analytics, and cloud-based solutions, companies can streamline their operations, optimize resource utilization, and improve productivity. These improvements directly lead to higher profitability and a competitive edge. As businesses across all sectors seek to improve speed, accuracy, and decision-making, the demand for digital transformation solutions continues to rise, fueling growth in this market.

- For instance, Siemens implemented digital twin technology to simulate operations, which improved resource utilization and cut maintenance costs by 15%.

Growing Focus on Customer Experience

Customer-centricity is a critical driver for digital transformation, as businesses increasingly focus on improving the customer experience. The demand for personalized, real-time, and omnichannel interactions has led companies to adopt digital solutions that enable better customer insights, faster service delivery, and seamless engagement. The rise of mobile applications, AI-powered chatbots, and CRM systems is helping businesses interact more effectively with customers, leading to higher satisfaction and loyalty. As customer expectations evolve, organizations are compelled to embrace digital technologies to meet these demands and stay ahead in the competitive market.

Key Trends & Opportunities

Integration of AI and Automation

One of the most significant trends in digital transformation is the increasing integration of Artificial Intelligence (AI) and automation. AI-driven technologies are enabling businesses to automate routine tasks, enhance decision-making, and improve operational efficiency. As organizations adopt AI-powered chatbots, predictive analytics, and automated processes, they are able to scale operations and reduce human error. The growth of intelligent automation platforms presents a major opportunity for companies to optimize business functions, gain insights from data, and deliver superior customer experiences, thereby accelerating digital transformation across industries.

- For instance, Amazon uses AI-powered predictive analytics in its supply chain to optimize inventory levels and reduce delivery times, enhancing overall customer satisfaction.

Rise of Cloud-Native Applications

Cloud-native applications are becoming a cornerstone of digital transformation strategies, enabling businesses to deliver more agile, scalable, and cost-efficient solutions. Cloud-native architectures, built around microservices and containerization, allow companies to rapidly innovate and deploy new products and services. The increasing adoption of hybrid and multi-cloud environments is further expanding the scope of cloud-native applications, providing organizations with enhanced flexibility and performance. This shift creates significant opportunities for businesses to enhance their digital capabilities, improve operational agility, and drive long-term growth.

- For instance, Netflix uses cloud-native microservices on AWS to stream content smoothly, dynamically scaling services to handle millions of users worldwide.

Key Challenges

Data Security and Privacy Concerns

As organizations increasingly digitize their operations, data security and privacy become major challenges. With the growing amount of sensitive data being collected and stored, businesses face heightened risks of cyberattacks, data breaches, and compliance issues. Protecting customer information and ensuring compliance with data protection regulations such as GDPR and CCPA are critical concerns for companies undergoing digital transformation. Ensuring robust cybersecurity measures, data encryption, and secure cloud infrastructures is essential to mitigate these risks and build trust with customers in an increasingly connected world.

Resistance to Change and Legacy Systems

One of the key challenges hindering digital transformation is resistance to change within organizations. Many companies still rely on legacy systems and traditional processes, which can be difficult to integrate with new digital technologies. Employees may also resist adopting new tools and workflows, fearing disruptions to their routines. Overcoming this resistance requires a shift in organizational culture, clear communication about the benefits of digital transformation, and strategic investments in training and change management. Companies must also invest in modernizing their legacy systems to support the integration of new digital solutions.

Regional Analysis

North America

North America holds the largest share of the global Digital Transformation Market, with a market share of 43% in 2024. The dominance stems from the region’s mature IT infrastructure, early adoption of cloud computing, AI, IoT, and high digital maturity among enterprises. Strong vendor presence and widespread cloud- and analytics-driven deployments among large enterprises drive demand. In addition, robust investment in digital channels and online payments supports the acceleration of digital transformation across multiple sectors.

Asia Pacific

The Asia Pacific region registers as the fastest-growing regional market, with a projected growth rate surpassing other regions. Significant digital infrastructure investments, rising smartphone and internet penetration, and a surge in AI & IoT deployments across manufacturing, retail, healthcare, and public sectors contribute to the region’s rapid expansion. By 2024, Asia Pacific is expected to capture 30% of the market share. This combination of rising digital adoption and government digitization initiatives positions Asia Pacific as a high-growth hub for digital transformation.

Europe

Europe captures a meaningful portion of the Digital Transformation Market, with a market share of 19% in 2024. Growing adoption of cloud- and AI-enabled solutions, increasing digital maturity across enterprises, rising 5G penetration, and strong demand for process automation and data analytics drive regional demand. The region’s focus on regulatory compliance, data privacy, and digital sovereignty also encourages enterprises to invest in comprehensive digital transformation strategies. Expansion of digital payment methods, mobility solutions, and increasing enterprise budgets for IT modernization further underpin regional growth.

Latin America

Latin America participates in the global digital transformation wave, though it lags compared to North America, Europe, and Asia Pacific, holding 5% of the global market share in 2024. Its growth is driven by increasing adoption of cloud computing, digital payment solutions, and demand from retail, BFSI, and government sectors seeking to modernize legacy systems and improve customer reach. While market share remains modest relative to other regions, improving internet infrastructure, rising digital-service penetration, and growing interest in data-driven business models suggest increasing uptake in the coming years.

Middle East & Africa (MEA)

The Middle East & Africa region contributes 3% to the global digital transformation demand. The market’s growth is driven by rising cloud adoption, government-led digitization programs, and increasing investments in AI, analytics, and ICT infrastructure. Enterprises across sectors such as banking, utilities, and public services are increasingly implementing digital solutions to improve efficiency and service delivery. Growing urbanization, expanding internet penetration, and regulatory digital initiatives support gradual but steady market growth across the MEA region.

Market Segmentations:

By Component

By Deployment Mode

By Technology

- Big Data & Analytics

- Artificial Intelligence (AI)

- Internet of Things (IoT)

- Other Technologies

By Enterprise Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Digital Transformation Market is highly competitive, with key players such as IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., Google LLC, SAP SE, Cisco Systems, Inc., Salesforce, Inc., Oracle Corporation, Tata Consultancy Services Limited, and Accenture Plc leading the charge. These companies offer a wide range of solutions, including cloud services, AI-driven analytics, IoT integration, and enterprise resource planning (ERP) tools. They differentiate themselves through robust cloud infrastructures, advanced analytics platforms, and comprehensive digital consulting services. IBM, Microsoft, and Amazon Web Services dominate the enterprise sector with hybrid-cloud solutions, while Salesforce and SAP lead in CRM and business application software. The increasing demand for end-to-end solutions, data security, and seamless integration drives fierce competition. Strategic partnerships, acquisitions, and investments in new technologies are key strategies employed by these players to maintain their market leadership in the rapidly evolving digital transformation landscape.

Key Player Analysis

Recent Developments

- In October 2025, IBM acquired Cognitus to enhance its SAP‑transformation services globally and strengthen its AI‑led consulting and cloud‑ERP offerings.

- In September 2025, IBM and Amazon Web Services (AWS) expanded their strategic collaboration and announced plans to launch a joint Innovation Hub in Riyadh to accelerate cloud adoption and digital transformation across the Middle East.

- In November 2025, HCLTech entered a strategic collaboration with AWS to deliver AI‑powered, regulation‑compliant solutions for financial services firms, targeting modernization and digital engagement improvements.

- In November 2025, SAP SE partnered with Snowflake to extend SAP Business Data Cloud with Snowflake’s data and AI platform marking a major joint initiative to enhance enterprise data and analytics capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Technology, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will accelerate as enterprises continue to adopt cloud computing, AI, and IoT technologies to drive operational efficiency, agility, and scalability.

- Organizations will increasingly shift to hybrid- and multi-cloud architectures to balance flexibility, security, and cost, enabling seamless integration of legacy systems with modern digital platforms.

- Demand for AI-driven analytics and automation will rise sharply, as businesses seek to harness data for better decision-making, predictive insights, and customer personalization.

- Digital transformation initiatives will expand beyond large enterprises to include small and medium-sized enterprises (SMEs), increasing overall market penetration and diversification.

- Industry-specific digital solutions (e.g., for healthcare, manufacturing, retail, logistics) will gain traction as organizations demand tailored platforms to address unique operational needs.

- Remote and hybrid work models will continue to drive demand for collaboration, cybersecurity, and digital workplace solutions, reinforcing enterprise reliance on transformation tools.

- Regulatory pressures around data privacy, compliance, and digital governance will push organizations to invest in secure, compliant, and transparent digital architectures.

- The increasing pace of technological innovation, including edge computing, 5G/6G networks, and real-time connectivity, will open new opportunities for IoT, real-time analytics, and smart infrastructure adoption.

- Demand for end-to-end digital transformation consulting and managed services will grow as organizations require expertise in strategy, implementation, change management, and integration of complex systems.

- Sustainability and energy-efficient IT practices will increasingly shape digital transformation strategies, with companies seeking to optimize infrastructure usage, reduce environmental footprint, and align with ESG commitments.

Market Segmentation Analysis:

Market Segmentation Analysis: