Market Overview

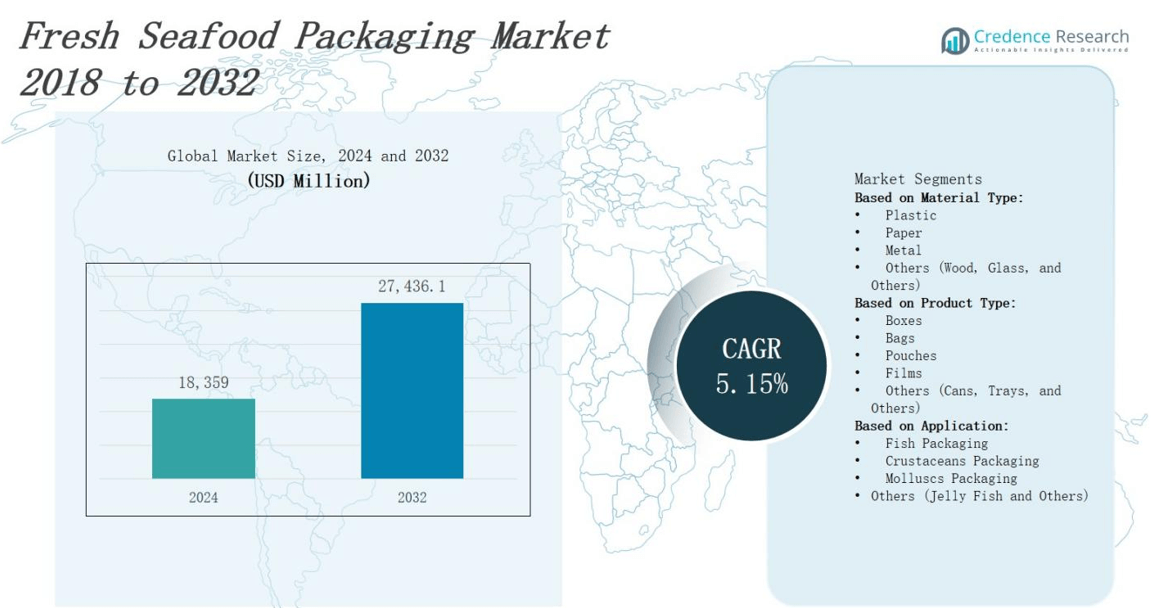

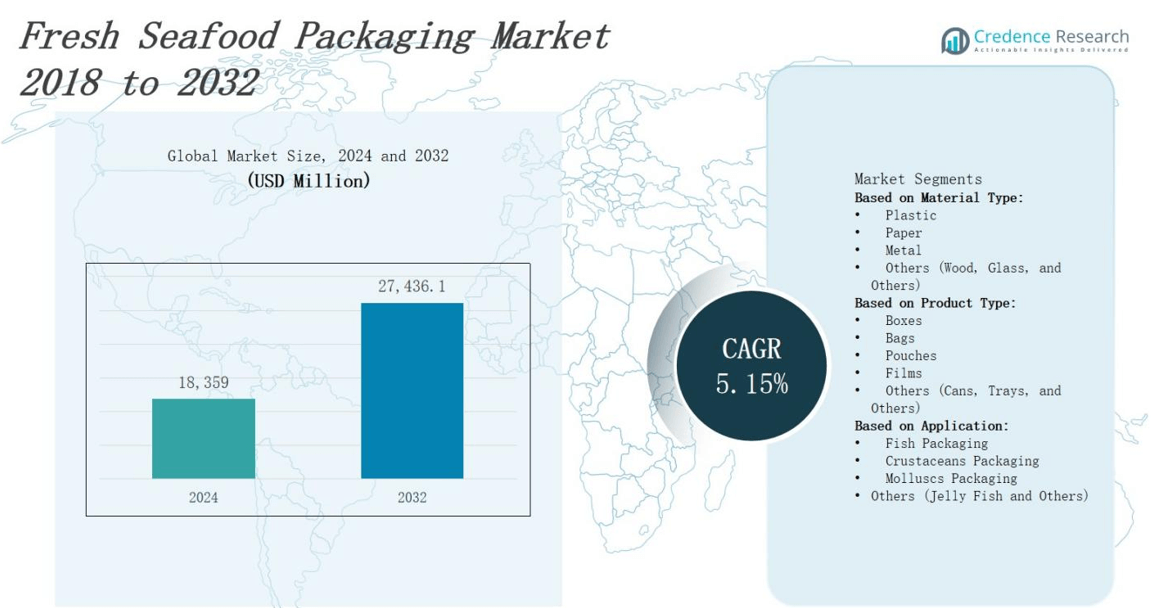

The fresh seafood packaging market is projected to grow from USD 18,359 million in 2024 to USD 27,436.1 million by 2032, reflecting a CAGR of 5.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fresh Seafood Packaging Market Size 2024 |

USD 18,359 million |

| Fresh Seafood Packaging Market, CAGR |

5.15% |

| Fresh Seafood Packaging Market Size 2032 |

USD 27,436.1 million |

The fresh seafood packaging market is driven by rising global seafood consumption, increasing demand for extended shelf life, and stringent food safety regulations. Consumers prefer convenient, sustainable, and leak-proof packaging that preserves freshness and quality during transportation and retail display. Advancements in modified atmosphere packaging (MAP), vacuum sealing, and eco-friendly materials are reshaping product offerings. The trend toward transparent and recyclable packaging enhances product visibility and supports environmental goals. Growing urbanization, expansion of cold chain logistics, and the shift toward ready-to-cook seafood formats further boost market growth across retail, foodservice, and export-oriented channels.

North America leads with advanced cold chain networks and DowDuPont alongside Sealed Air driving innovation. Europe holds strong share thanks to Smurfit Kappa and Printpack meeting traceability standards. Asia Pacific dominates demand with Tri‑Pack Plastics and Frontier Packaging expanding capacity. Latin America growth stems from Victory Packaging and CoolSeal USA optimizing logistics. Middle East & Africa relies on AEP Industries, Star‑Box, PPS Midlands Limited, and Sixto Packaging delivering tailored, sustainable solutions. It highlights key players across all regions driving growth in the fresh sea food packaging market.

Market Insights

- The fresh seafood packaging market will expand from USD 18 359 million in 2024 to USD 27 436.1 million by 2032 at a CAGR of 5 15% during the forecast period.

- Rising global seafood consumption and strict food safety regulations drive demand for packaging that extends shelf life and preserves nutritional quality.

- Consumers prefer convenient, sustainable, leak‑proof solutions that maintain freshness during transport and retail display.

- Innovations in modified atmosphere packaging, vacuum sealing, and bio‑based materials reshape product offerings and reduce waste.

- Transparent, recyclable formats enhance product visibility and support environmental goals.

- Urbanization, expanded cold chain logistics, and demand for ready‑to‑cook formats boost market growth across retail, foodservice, and export channels.

- North America leads with DowDuPont and Sealed Air driving innovation; Europe follows with Smurfit Kappa and Printpack; Asia Pacific dominates demand via Tri‑Pack Plastics and Frontier Packaging; Latin America relies on Victory Packaging and CoolSeal USA; Middle East & Africa depends on AEP Industries, Star‑Box, PPS Midlands, and Sixto Packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Seafood Consumption and Health Awareness

The fresh sea food packaging market benefits from higher global seafood consumption driven by health-conscious consumers. It responds to higher demand for protein‑rich diets and omega‑3 sources. Producers adopt innovative packaging to preserve freshness and nutrition. Manufacturers focus on modified atmosphere and vacuum solutions to extend shelf life. Retailers leverage transparent pouches to showcase product quality. Urban growth intensifies demand in developing regions. Export channels expand reach across international markets.

- For instance, DS Smith’s DryPack seafood box, unveiled at the Seafood Processing North America Expo, provides fully recyclable, fiber-based packaging that maintains fish below 4°C for over 40 hours—replacing traditional foam containers, reducing waste, and supporting long-distance shipping.

Expansion of Cold Chain Infrastructure and Distribution

Expansion of cold chain infrastructure in emerging economies benefits the fresh sea food packaging market. It enables reliable transport from harvest to consumer through controlled temperature networks. Logistics providers invest in refrigerated warehouses and specialty vehicles to maintain quality. Packaging providers collaborate with distributors to optimize load efficiency and reduce spoilage. Retailers implement in‑store chillers to enhance product display. E‑commerce platforms offer cold delivery options to serve urban shoppers.

- For instance, Lineage Logistics, which operates over 400 temperature-controlled facilities worldwide, recently expanded its use of automated warehouses and AI to optimize inventory and reduce spoilage in food distribution.

Regulatory Compliance and Food Safety Standards

The fresh sea food packaging market faces strict food safety regulations imposed by international agencies. It adheres to hygiene protocols and packaging material standards to prevent contamination. Manufacturers perform regular audits and quality checks to meet HACCP and FDA guidelines. Suppliers source certified films and barrier layers that resist microbial growth. Retailers verify supplier credentials to ensure traceability. Consumers gain confidence from tamper‑evident seals on packaging. Innovation adopts antimicrobial coatings for safety.

Sustainability Initiatives and Material Innovation

The fresh sea food packaging market embraces sustainability through bio‑based and recyclable materials. It reduces plastic waste through compostable films and paperboard trays. Research teams test biodegradable polymers that maintain barrier performance. Manufacturers invest in lightweight designs to cut transport emissions. Retailers promote returnable containers and refill stations to engage eco‑conscious consumers. Industry alliances launch take‑back programs to support circular economy goals. Collaborations drive innovation in smeltproof coatings for moisture control.

Market Trends

Digital Printing and Personalization Driving Differentiation

Demand for tailored packaging design rises in the fresh sea food packaging market. It leverages digital printing to create eye‑catching graphics and custom messaging. Brands deploy variable data printing to target demographics and promotions. Packaging lines incorporate high‑speed printers to maintain throughput. Retailers employ on‑demand labeling for seasonal offerings. Suppliers offer proofing services to ensure color accuracy. Designers optimize layouts for brand consistency.

- For instance, CarePac offers digital printing for seafood pouches, allowing brands to customize as few as 1,000 bags with vivid, tailored graphics—ideal for limited-edition flavors or regional promotions, and designers ensure layouts deliver consistent shelf appeal and seal in freshness.

Integration of IoT Sensors Enhancing Quality Assurance

The fresh sea food packaging market adopts smart packaging solutions that monitor temperature and humidity. It integrates RFID tags and QR codes to track product origin and supply chain stages. Brands apply freshness indicators that change color to signal spoilage risk. Logistics teams collect real‑time data to prevent cold chain breaches. Consumers scan codes for harvest date and handling instructions. Suppliers collaborate with tech firms to refine sensor accuracy. Industry bodies establish guidelines for data privacy and interoperability.

- For instance, DATOMS provides an IoT platform that monitors temperature, humidity, and location through sensors in real-time across the seafood cold chain.

Shift Toward Sustainable and Bio‑based Materials

Manufacturers in the fresh sea food packaging market experiment with biodegradable films and compostable trays. It tests polylactic acid and starch blends to replace traditional plastics. Suppliers partner with material science firms to optimize barrier properties. Cafeterias and retail chains trial paper‑based wraps with moisture barriers. Companies adopt mono‑material designs to facilitate recycling streams. Research teams analyze life‑cycle impacts to improve sustainability metrics. Brands market eco‑labels to attract green consumers.

Rise of E‑commerce and Direct‑to‑Consumer Channels

Online sales drive innovation in the fresh sea food packaging market to ensure safe home delivery. It designs insulated mailers and gel packs to maintain cold chain integrity. E‑tailers offer subscription boxes that feature vacuum‑sealed portions. Packaging developers include tamper‑evident seals and easy‑open features. Shoppers expect real‑time tracking and temperature alerts. Logistics providers adopt reusable containers to reduce waste. Industry surveys measure customer satisfaction with packaging performance.

Market Challenges Analysis

Supply Chain Disruptions and Cost Volatility

The fresh sea food packaging market confronts supply chain disruptions and cost volatility that challenge profitability. It faces raw material shortages due to seasonal yield fluctuations and fishing quotas enforced by regulatory bodies. It must manage price swings in plastic resins and barrier films driven by petrochemical market shifts. It relies on refrigerated transport routes that experience capacity constraints during peak demand periods. It secures alternative local suppliers to reduce lead times and buffer against global shipping delays. It monitors fuel price changes and labor expenses that impact logistics budgets. It collaborates with packagers and cold chain providers to optimize cost structures and prevent margin erosion.

Regulatory Complexity and Technological Adoption

The fresh sea food packaging market navigates complex food safety regulations and changing sustainability requirements. It must secure certifications for materials and processes that comply with multiple regional standards. It allocates resources to validate biodegradable and recyclable substrates under strict quality controls. It integrates new technologies such as temperature sensors and traceability platforms to meet transparency mandates. It faces capital constraints when it must upgrade existing lines to handle smart packaging solutions. It trains staff on emerging equipment and data management systems to ensure consistent performance.

Market Opportunities

Premium and Ready‑to‑Cook Formats Creating Niche Segments

The fresh sea food packaging market can exploit growing consumer interest in premium and convenience products. It can design single‑serve vacuum‑sealed trays that simplify meal preparation and reduce waste. Brands can introduce portion‑controlled pouches with built‑in marinades and seasoning compartments. Retailers can feature chef‑curated offerings that justify higher price points and elevate shopper experience. Suppliers can partner with seafood processors to develop heat‑stable packaging for sous‑vide and microwave applications. Industry players can leverage co‑branding opportunities with culinary influencers to drive trial. Longer shelf‑life solutions can open doors in foodservice and ready‑meal channels.

Sustainability Collaboration and Digital Traceability Unlock Growth

The fresh sea food packaging market can harness sustainability mandates by developing recyclable mono‑material films. It can collaborate with biopolymer firms to pilot compostable trays that meet barrier requirements. Technology providers can integrate QR codes and blockchain links to verify catch origin and handling history. E‑commerce platforms can adopt smart packaging with temperature sensors to reduce spoilage during home delivery. Logistics partners can trial reusable container programs to support circular economy goals. Certification bodies can offer eco‑labels that boost consumer trust and command premium margins. Cross‑industry alliances can accelerate standard adoption and streamline regulatory approval.

Market Segmentation Analysis:

By Material Type

The fresh sea food packaging market segments into plastic, paper, metal, and others such as wood and glass. Manufacturers rely on plastic films and trays for cost‑efficiency and barrier performance. Brands adopt coated paperboard for eco‑friendly appeal and lightweight handling. Metal cans and tins protect seafood during long‑distance shipping and export. Wood crates and glass jars serve artisanal and premium products. Suppliers test hybrid materials to balance durability and sustainability.

- For insatnce, Sealed Air Corporation’s Cryovac® brand provides advanced seafood packaging solutions that extend shelf life and reduce waste. This includes vacuum-sealed packaging tailored for various seafood products, ensuring freshness and safety.

By Product Type

The fresh sea food packaging market divides into boxes, bags, pouches, films, and others such as cans and trays. Suppliers design corrugated boxes and rigid trays for bulk storage and retail display. Brands use high‑barrier bags to preserve moisture and freshness. Pouches with zipper closures support convenience formats. Flexible films wrap fillets and steaks to limit oxidation. Cans suit stewed or pickled seafood, while specialty trays accommodate on‑demand portions.

- For instance, TedPack’s seafood packaging pouches use multi-layer barrier films and resealable zip locks to keep seafood such as salmon and shellfish fresh and protected from contaminants.

By Application

The fresh sea food packaging market serves fish, crustaceans, molluscs, and other segments. Fish packaging includes vacuum‑sealed bags and trays that maintain firmness and color. Crustaceans packaging offers moisture‑control liners and secure netted bags for live transport. Molluscs packaging utilizes breathable containers that prevent spoilage during storage. Jellyfish and unconventional seafood find niche packaging solutions such as gel packs and insulated pouches. Suppliers tailor designs to meet species‑specific handling and shelf‑life requirements.

Segments:

Based on Material Type:

- Plastic

- Paper

- Metal

- Others (Wood, Glass, and Others)

Based on Product Type:

- Boxes

- Bags

- Pouches

- Films

- Others (Cans, Trays, and Others)

Based on Application:

- Fish Packaging

- Crustaceans Packaging

- Molluscs Packaging

- Others (Jelly Fish and Others)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands a significant position in the fresh sea food packaging market with a 28% share. It relies on advanced cold chain networks and strict safety standards to preserve product quality. Suppliers deploy high‑barrier films and vacuum trays to extend shelf life. Retailers integrate transparent pouches that enhance product visibility and drive consumer confidence. Logistics firms maintain refrigerated fleets to support timely delivery. Regional players invest in sustainable packaging to address environmental mandates. Latin America holds 7% share, Europe holds 25%, Asia Pacific holds 35%, and Middle East & Africa holds 5%.

Europe

Europe captures 25% of the fresh sea food packaging market through robust regulatory frameworks and consumer demand for traceability. It enforces stringent hygiene codes that drive adoption of tamper‑evident seals and antimicrobial coatings. Manufacturers partner with fishery co‑operatives to ensure sustainable sourcing. Retail chains offer premium ready‑to‑cook formats packaged in recyclable trays. Innovation centers develop paper‑based wraps with moisture barriers. Industry bodies promote mono‑material designs to streamline recycling streams. North America holds 28% share, Asia Pacific holds 35%, Latin America holds 7%, and Middle East & Africa holds 5%.

Asia Pacific

Asia Pacific leads the fresh sea food packaging market with a 35% share driven by rising seafood consumption and expanding cold chain infrastructure. It commissions large‑scale film extrusion facilities to meet growing demand. Brands introduce portion‑controlled pouches and modified atmosphere packs for urban markets. Local governments fund logistics hubs to connect coastal fisheries with inland cities. R&D teams explore bio‑based polymers for sustainable solutions. E‑commerce platforms integrate smart sensors to guarantee freshness. North America holds 28% share, Europe holds 25%, Latin America holds 7%, and Middle East & Africa holds 5%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Frontier Packaging

- AEP Industries Inc.

- Sealed Air Corporation

- CoolSeal USA

- Tri‑Pack Plastics

- Smurfit Kappa Group

- Victory Packaging

- Star‑Box, Inc.

- DowDuPont Inc.

- Sixto Packaging

- PPS Midlands Limited

- Printpack Inc.

Competitive Analysis

Leading companies in the fresh sea food packaging market compete on innovation, sustainability, and cost efficiency. DowDuPont Inc. applies advanced polymer science to enhance barrier performance and reduce material usage. Sealed Air Corporation leverages vacuum and modified atmosphere technologies to extend shelf life while cutting waste. Smurfit Kappa Group invests in paper‑based solutions that meet recycling mandates without compromising strength. Tri‑Pack Plastics focuses on customizable designs and fast turnaround for regional processors. Frontier Packaging emphasizes lightweight trays that lower shipping expenses. CoolSeal USA offers tamper‑evident seals that boost consumer confidence. Victory Packaging and Star‑Box, Inc. provide national distribution networks that ensure consistent supply. PPS Midlands Limited addresses niche artisanal and premium segments with bespoke packaging. Printpack Inc. integrates digital printing for targeted promotions and seasonal campaigns. AEP Industries Inc. and Sixto Packaging pursue biopolymer research to align with eco‑friendly trends. Each player aligns its strategy to secure market share and satisfy evolving customer demands.

Recent Developments

- In March 2025, ULMA Packaging unveiled its FM 305 Flow Pack and other advanced seafood packaging machines at Seafood Expo Global.

- In April 2025, Amcor plc completed its all‑stock combination with Berry Global, broadening its sustainable packaging portfolio and global innovation capabilities.

- In May 2025, SÜDPACK launched its recyclable Multifol® packaging solution for seafood at the Seafood Expo in Barcelona.

- In June 2025, Dow Inc. introduced its INNATE™ TF 220 Precision Packaging Resin and enhanced its collaborations to advance packaging circularity.

Market Concentration & Characteristics

The fresh sea food packaging market exhibits moderate concentration with global leaders commanding significant shares while regional specialists serve local needs. It features major firms such as DowDuPont Inc., Sealed Air Corporation, and Smurfit Kappa Group that leverage advanced polymer and paper‑based solutions to meet mass demand. Smaller players like Tri‑Pack Plastics and Frontier Packaging focus on niche segments and customized orders. Market entry requires investment in cold chain compliant facilities and R&D for barrier performance. Purchase decisions depend on cost efficiency, compliance, and sustainability credentials. Suppliers compete on material innovation, digital print capabilities, and traceability platforms. Price competition remains intense in commoditized product lines, driving consolidation among mid‑sized companies. Technology adoption of modified atmosphere and smart sensors differentiates offerings and supports premium pricing. Strategic alliances between packaging firms and seafood processors strengthen supply chain integration and enhance product consistency across omnichannel retail, foodservice, direct‑to‑consumer e‑commerce, and global export channels. It features global heavyweights.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will integrate IoT sensors into packaging to continuously monitor seafood freshness and temperature conditions.

- Brands will adopt bio‑based polymers and compostable films that align with sustainability and regulatory mandates.

- E‑commerce channels will require insulated mailers, gel packs to maintain seafood quality during home delivery.

- Digital printing capabilities will enable on‑demand packaging customization and targeted consumer promotions at production speeds.

- Collaboration between packaging manufacturers and seafood processors will drive multi‑layer film development featuring barrier properties.

- Retailers will expand ready‑to‑cook seafood offerings packaged in trays and pouches that simplify meal preparation.

- Blockchain traceability systems will provide supply chain insights and build consumer trust in product authenticity.

- Reusable packaging models will reduce environmental impact and lower lifecycle costs through return‑and‑refill logistics frameworks.

- Automated filling and sealing lines will increase operational throughput, minimize labor use ensure consistent packaging.

- Cross‑industry alliances will standardize packaging protocols and accelerate innovation adoption across seafood supply chains globally.