Market Overview

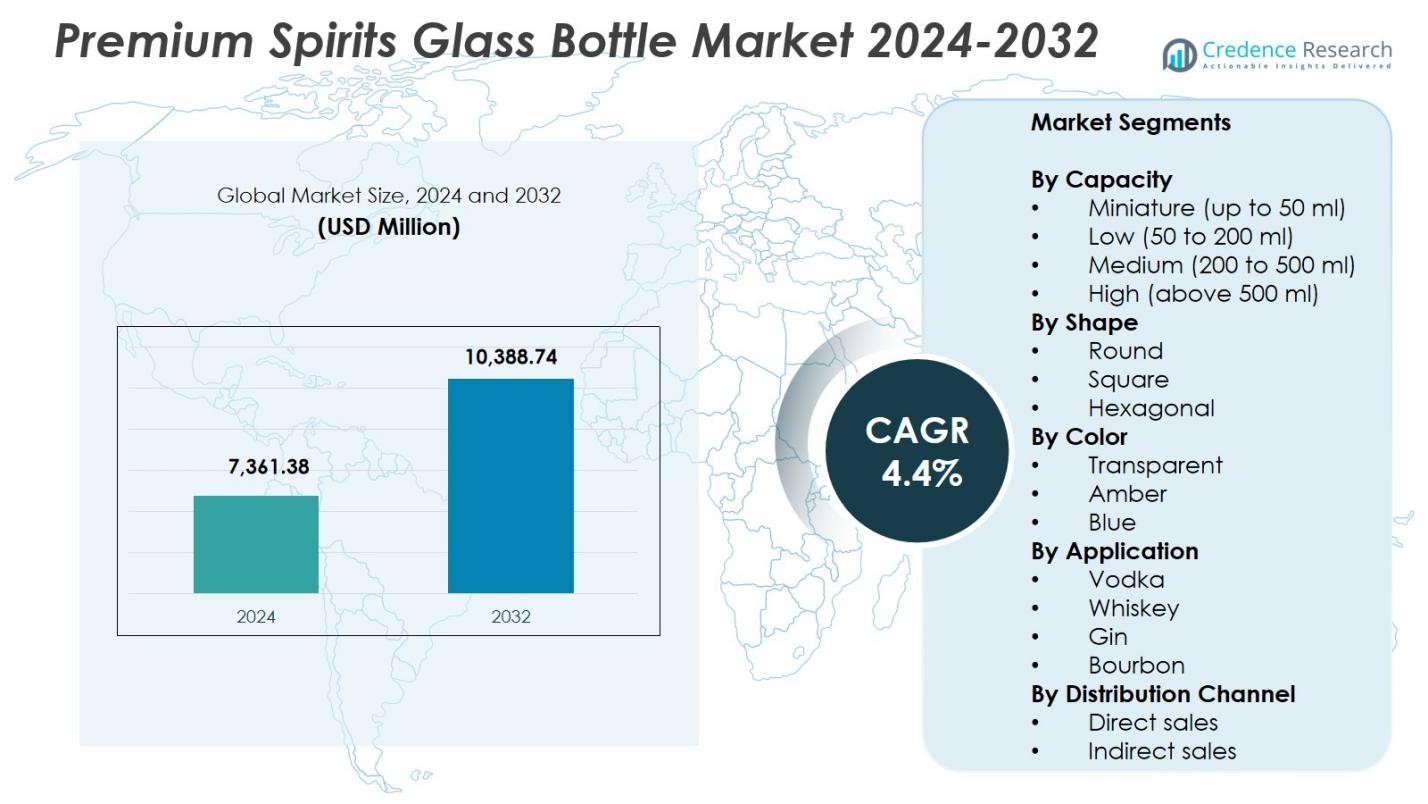

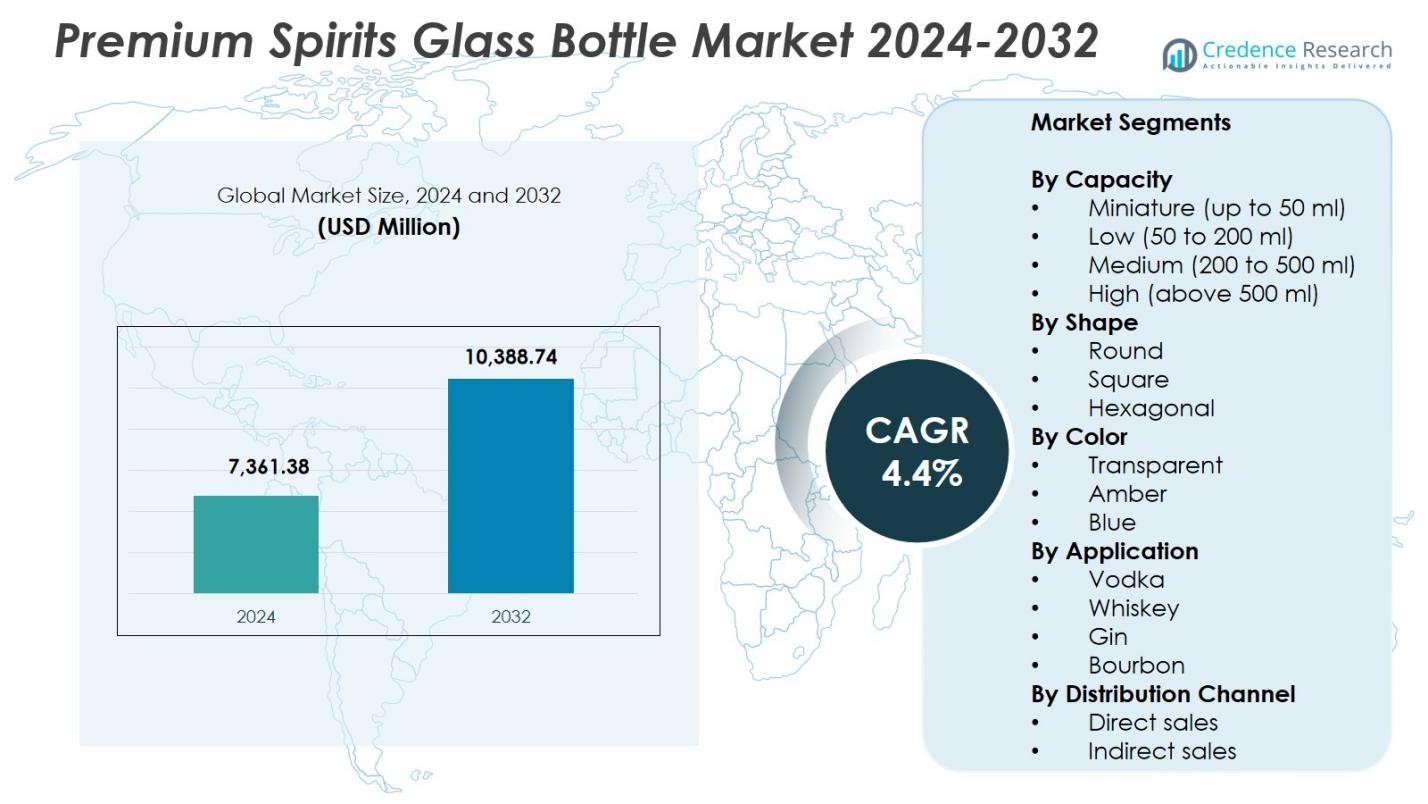

Premium Spirits Glass Bottle Market size was valued at USD 7,361.38 Million in 2024 and is anticipated to reach USD 10,388.74 Million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Spirits Glass Bottle Market Size 2024 |

USD 7,361.38 Million |

| Premium Spirits Glass Bottle Market, CAGR |

4.4% |

| Premium Spirits Glass Bottle Market Size 2032 |

USD 10,388.74 Million |

Premium Spirits Glass Bottle Market features leading players such as Saverglass, AGI Glaspac, Gallo Glass, Estal Packaging, Roetell, Deco Glas, Blueglass of Sweden, Sklarny Moravia, Rawlings & Son (Bristol), and PGP Glass, all of which focus on premium design, customization, and sustainable production to meet evolving brand requirements. These companies strengthen their presence through advanced decoration techniques and flexible manufacturing for small-batch and large-volume spirits. Regionally, North America led the market with a 34.2% share in 2024, supported by strong premium spirits consumption, established distilleries, and growing demand for high-aesthetic glass packaging across retail and on-trade channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Premium Spirits Glass Bottle Market was valued at USD 7,361.38 Million in 2024 and will grow USD 10,388.74 at a CAGR of 4.4% through 2032.

- Market growth is driven by rising premiumization across whisky, vodka, gin, and tequila categories, with manufacturers adopting high-aesthetic glass packaging to enhance brand identity and consumer appeal.

- Transparency remains the dominant segment with a 62.7% share in 2024, supported by strong demand from brands highlighting purity, clarity, and craftsmanship in premium spirits.

- Key players strengthen their presence through custom bottle designs, decorative finishes, and sustainable production practices, addressing the needs of expanding craft distilleries and premium product lines.

- North America led the market with a 34.2% share in 2024, while Europe held 29.6% and Asia-Pacific reached 24.8%, reflecting strong luxury spirits consumption and growing investment in premium packaging across major regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Capacity

In the Premium Spirits Glass Bottle Market, the Medium (200–500 ml) segment dominated the category with a 41.6% share in 2024, driven by its strong adoption across premium whisky, vodka, gin, and craft liquors that prioritize premium shelf presence and ergonomic handling. Brands increasingly prefer this capacity for balancing visual appeal with consumer convenience, supporting premiumization trends globally. The High (above 500 ml) segment also shows steady demand due to gifting and limited-edition launches, while Miniature and Low capacities gain traction in tasting packs and travel retail formats.

- For instance, Diageo introduced the Johnnie Walker Blue Label Ultra in a 70cl (700 ml) handblown teardrop-shaped glass bottle weighing just 180g without the closure, advancing lightweight premium packaging for whisky.

By Shape

The Round shape segment held the leading position with a 58.3% share in 2024, supported by its structural strength, cost-efficient manufacturing, and versatility across multiple premium spirit categories. Distillers favor round bottles for their superior filling-line compatibility and broad consumer acceptance, enabling consistent branding across core product lines. Square bottles continue to gain attention in luxury spirits and craft labels seeking differentiated aesthetics, while Hexagonal formats remain niche but attractive for ultra-premium launches that emphasize exclusivity, artisanal craftsmanship, and shelf distinction in competitive retail environments.

- For instance, Johnnie Walker historically uses an iconic square bottle design, reimagined in the Blue Label Ultra as a lightweight 180g teardrop variant while retaining angular influences.

By Color

The Transparent bottle category dominated the market with a 62.7% share in 2024, driven by strong preference among premium vodka, gin, and tequila brands that rely on clear visibility to showcase purity, clarity, and product craftsmanship. Transparent packaging enhances brand storytelling and appeals to consumers seeking authenticity and premium cues. Amber bottles retain a solid position in aged spirits due to their UV-blocking capability that protects flavor integrity, while Blue bottles appeal to premium niche launches focused on visual differentiation and contemporary luxury positioning across global markets.

Key Growth Drivers

Rising Premiumization Across Spirits Categories

Premiumization remains a major force driving growth in the Premium Spirits Glass Bottle Market as consumers increasingly shift toward high-value whisky, vodka, gin, and tequila segments. Brands adopt sophisticated glass packaging to reinforce craftsmanship, authenticity, and luxury positioning. The demand for premium gifting formats and limited-edition launches further accelerates adoption of custom-designed bottles. Distillers focus on enhancing tactile feel, embossing, and innovative shapes that elevate brand identity, enabling glass bottle manufacturers to secure long-term contracts with premium and super-premium spirit producers worldwide.

- For instance, O-I introduced its Contemporary Collection with 70cl flint glass bottles in LUX, ATTENUA, and NOBLE shapes, featuring high fill points, push-up bottoms, and label protection panels alongside customization options like embossing and tactile effects.

Brand Differentiation Through Custom Bottle Design

Customized glass bottles support enhanced brand storytelling, prompting spirits manufacturers to collaborate closely with packaging specialists for bespoke shapes, engravings, and decorative finishes. This emphasis on visual identity strengthens shelf appeal and influences consumer purchase decisions, particularly in competitive retail and duty-free environments. Advanced forming technologies and flexible production lines allow suppliers to offer shorter batches with high design precision. As premium and craft distillers expand their product portfolios, the demand for tailored glass packaging continues to rise, creating steady growth opportunities for specialized bottle producers.

- For instance, Ponfeigh Distillery selected Stoelzle’s 750ml “Edinburgh” bottle from their standard collection, which was screen-printed locally in Pennsylvania to match the brand’s artwork and aesthetic perfectly.

Sustainability-Driven Material Innovation

Sustainability commitments by global spirits brands drive substantial demand for lightweight, recycled-content, and low-carbon glass bottles. Manufacturers increasingly integrate high cullet percentages and adopt energy-efficient furnaces to meet brand sustainability targets without compromising premium aesthetics. Regulatory pressure to reduce packaging waste and carbon emissions further accelerates the shift toward eco-engineered glass solutions. Consumers also favor environmentally responsible packaging, reinforcing the need for recyclable and reusable premium spirits bottles. These developments position sustainable glass manufacturing as a central driver supporting long-term market expansion and brand value enhancement.

Key Trends & Opportunities

Expansion of Smart and Decorative Glass Technologies

A growing trend in the Premium Spirits Glass Bottle Market is the integration of advanced decorative technologies, including UV-printed graphics, metallized finishes, frosted textures, and tactile embossing that enhance premium identity. Smart features such as NFC-enabled tags and scannable QR codes support digital engagement, brand authentication, and traceability. These innovations unlock opportunities for distillers to create experiential packaging that attracts younger, tech-savvy consumers. As brands prioritize differentiation and anti-counterfeit protection, the adoption of smart and decorative glass solutions continues to expand across premium spirit categories.

- For instance, Rémy Martin pioneered NFC integration in its Club Connected Bottle for Fine Champagne Cognac, embedding a tamper-proof NFC tag in the capsule that allows consumers to verify authenticity and detect if the bottle has been opened via a smartphone app.

Rising Demand from Craft Distilleries and Limited Editions

Craft distilleries increasingly contribute to the market’s growth by emphasizing artisanal quality and design-driven packaging. Their focus on small-batch production, unique bottle shapes, and premium storytelling creates strong opportunities for glass manufacturers offering customization flexibility and low-volume runs. Limited-edition seasonal and collector releases enhance demand for specialty glass bottles with distinctive shapes and decorative elements. This trend reinforces the market’s shift toward personalization and premium aesthetics, enabling suppliers to strengthen partnerships with emerging high-growth spirit brands globally.

- For instance, Silent Pool Distillers uses striking blue glass bottles with detailed floral patterns and copper lithography, designed by Croxsons to showcase the spirit’s clarity and reflect local botanicals.

Key Challenges

High Production and Energy Costs in Glass Manufacturing

Glass manufacturing remains energy-intensive, exposing producers to fluctuating fuel and electricity costs that directly affect pricing and profitability. Compliance with emission regulations increases operational expenditures, particularly for manufacturers upgrading furnaces or transitioning toward low-carbon technologies. Maintaining premium design standards such as embossing, coloring, or custom shaping further adds to production complexity and capital requirements. These cost pressures can constrain margins for suppliers and limit flexibility for small and mid-sized brands, making operational efficiency and technological modernization essential for sustained market competitiveness.

Supply Chain Disruptions and Raw Material Constraints

The industry faces ongoing challenges from irregularities in raw material availability, including silica sand, soda ash, and cullet, which affect production timelines and delivery commitments. Logistics disruptions, container shortages, and geopolitical tensions have intensified volatility in global supply chains, impacting lead times for premium bottle shipments. Distillers relying on niche shapes and decorative finishes remain particularly vulnerable to delays. These constraints compel manufacturers to diversify sourcing strategies, expand regional production capabilities, and strengthen inventory planning to maintain supply continuity for premium spirits brands.

Regional Analysis

North America

North America held a 34.2% share in 2024, driven by strong demand from premium whisky, bourbon, tequila, and craft spirits producers. The region benefits from high consumer spending on luxury alcoholic beverages and the rapid expansion of craft distilleries seeking differentiated bottle designs. Leading brands increasingly invest in customized glass packaging to reinforce authenticity and premium positioning. Sustainability initiatives, including lightweight glass and higher recycled content usage, further support market growth. The U.S. remains the dominant country-level market, supported by large-scale distilleries and a mature premium spirits retail ecosystem.

Europe

Europe accounted for a 29.6% share in 2024, supported by its long-established spirits heritage and strong presence of premium whisky, gin, and vodka brands. The region’s glassmakers focus heavily on innovation, offering high-quality decorative finishes that cater to luxury product lines and limited editions. Growing consumer preference for artisanal and craft spirits also stimulates demand for distinctive glass packaging. Sustainability remains a major driver, with manufacturers integrating low-carbon glass production and circular-economy practices. Key markets such as France, the U.K., Italy, and Germany anchor regional demand through their strong premium spirits traditions.

Asia-Pacific

Asia-Pacific recorded a 24.8% share in 2024, fueled by rising disposable incomes, premium product adoption, and accelerated urban consumption patterns. Markets such as China, Japan, India, and South Korea drive strong demand for high-end whisky, brandy, and imported spirits, boosting the need for premium glass bottles. International brands expand localized production partnerships to meet growing regional preferences for premium aesthetics and gifting formats. The region also sees increasing traction for digitally enabled packaging solutions. Continued growth in luxury hospitality and e-commerce channels strengthens long-term demand for premium glass packaging.

Latin America

Latin America captured a 7.3% share in 2024, supported by demand from tequila, rum, cachaça, and emerging craft spirits categories. Premiumization trends gain momentum as consumers gravitate toward higher-quality local and international spirit brands. Glass bottle manufacturers benefit from the region’s cultural emphasis on heritage-inspired packaging, especially for agave-based spirits. Mexico and Brazil remain core markets due to expanding export production. However, supply chain volatility and fluctuating raw material costs pose challenges, prompting producers to optimize operations and enhance design flexibility to meet evolving brand requirements.

Middle East & Africa

The Middle East & Africa region held a 4.1% share in 2024, driven by growing consumption of premium imported spirits in urban hospitality hubs and duty-free retail channels. Premium packaging demand is reinforced by tourism-led expansion in the UAE, South Africa, and select Mediterranean destinations. International brands continue to introduce specialty and limited-edition formats tailored to luxury-oriented consumers. Despite regulatory restrictions in several countries, the region experiences steady demand for premium spirits packaging supported by high-income expatriate populations and growing retail modernization. Investments in upscale on-trade venues further strengthen market opportunities.

Market Segmentations:

By Capacity

- Miniature (up to 50 ml)

- Low (50 to 200 ml)

- Medium (200 to 500 ml)

- High (above 500 ml)

By Shape

By Color

By Application

- Vodka

- Whiskey

- Gin

- Bourbon

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Premium Spirits Glass Bottle Market features key players such as Saverglass, AGI Glaspac, Gallo Glass, Estal Packaging, Roetell, Deco Glas, Blueglass of Sweden, Sklarny Moravia, Rawlings & Son (Bristol), and PGP Glass. These companies focus on delivering high-quality, custom-designed bottles that enhance brand identity for premium whisky, vodka, gin, tequila, and craft spirits. Manufacturers increasingly emphasize advanced decoration techniques, including embossing, metallization, and UV printing, to support premiumization trends. Sustainability also shapes competitive strategy, with leading players integrating recycled content, lightweighting, and low-carbon furnaces to meet environmental goals. Strategic collaborations with distilleries, expansion of flexible production lines for small-batch customization, and investments in smart packaging technologies strengthen market presence. As demand grows for differentiated designs and luxury aesthetics, companies continue expanding global manufacturing footprints and enhancing design capabilities to support evolving brand requirements across the premium spirits sector.

Key Player Analysis

Recent Developments

- In June 2025, AGI Glaspac partnered with UK-based Glass Futures to drive development of low-carbon glass production for sustainable spirits packaging.

- In August 2024, Saverglass added the “MALTY” glass bottle to its spirits portfolio, expanding its range for premium liquors.

- In June 2024, Saverglass unveiled “SO TONIC” and a redesigned classic bottle “OSLO (SOLO)” with optimized weight while preserving premium aesthetics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Capacity, Shape, Colour, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand as premiumization strengthens across whisky, vodka, gin, and tequila categories.

- Manufacturers will expand customized bottle design capabilities to support brand differentiation and luxury positioning.

- Sustainability initiatives will accelerate adoption of lightweight, recycled-content, and low-carbon glass production.

- Smart packaging features, including NFC tags and QR-based authentication, will gain wider integration among premium brands.

- Craft distilleries will drive demand for small-batch, design-flexible glass packaging solutions.

- Decorative technologies such as embossing, metallization, and frosted finishes will see increased investment.

- Regional production expansion will help reduce supply chain risks and address localized design preferences.

- Limited-edition and collector-focused spirits launches will boost demand for high-aesthetic specialty bottles.

- E-commerce alcohol sales growth will push brands to adopt durable and visually distinctive packaging.

- Partnerships between distilleries and glass manufacturers will intensify to support innovation and long-term design planning.

Market Segmentation Analysis:

Market Segmentation Analysis: