Market Overview

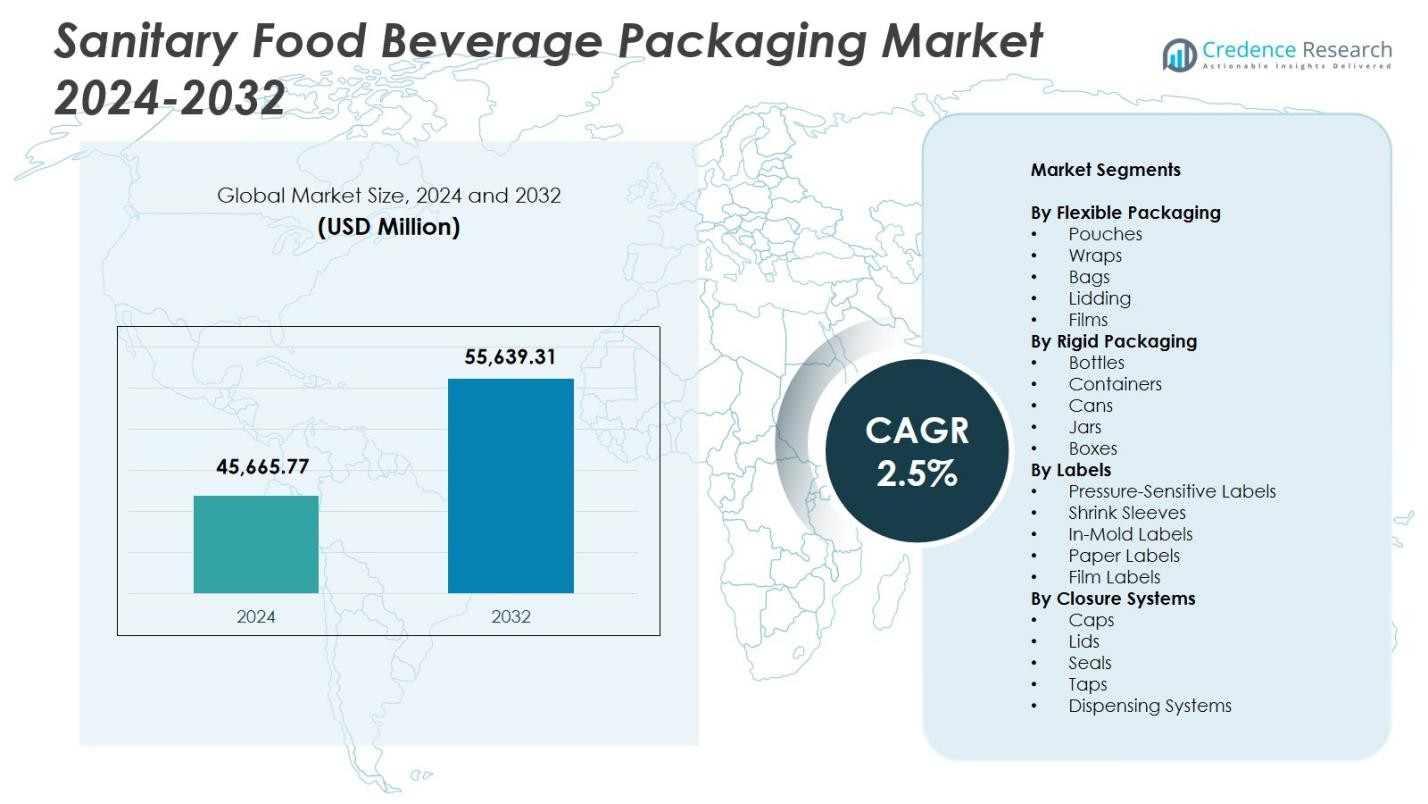

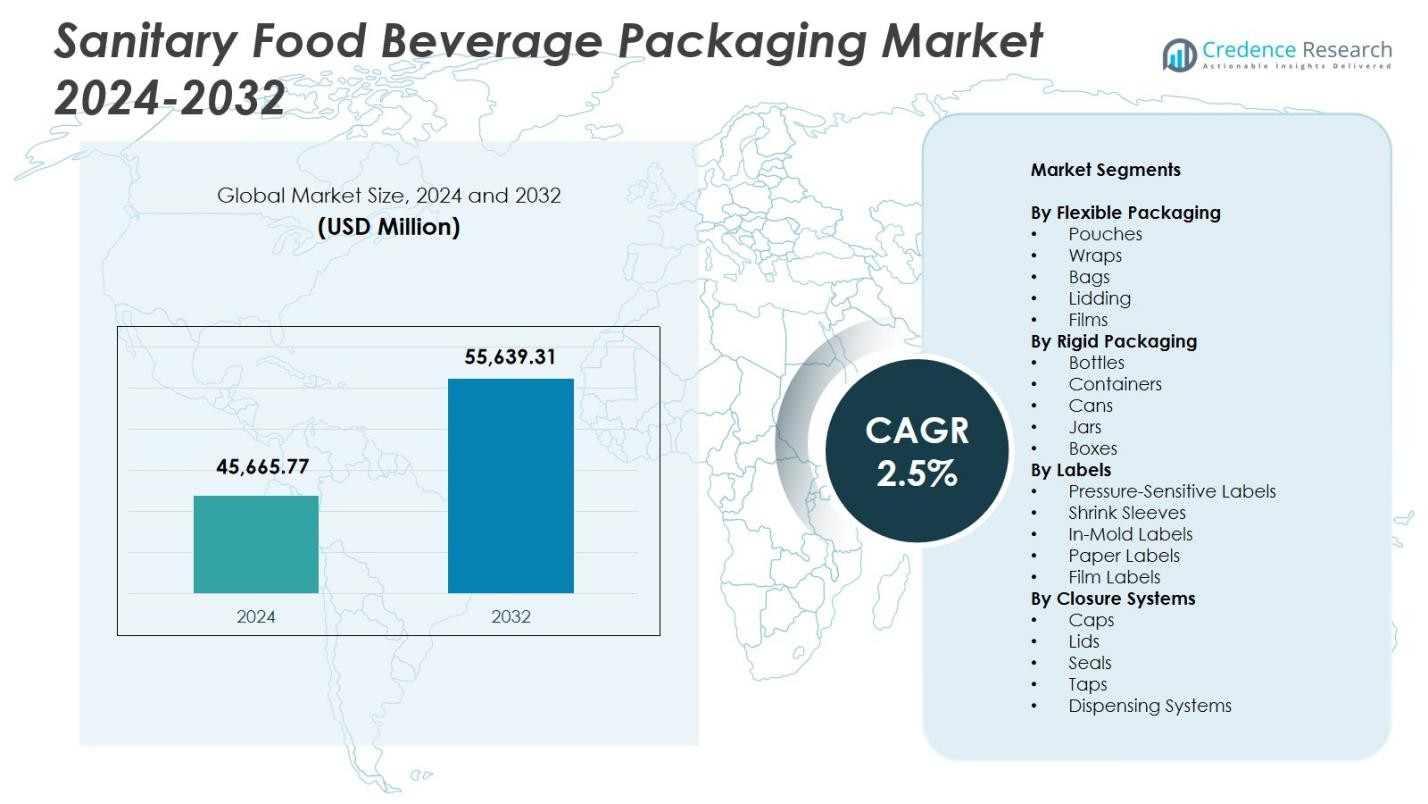

Sanitary Food Beverage Packaging Market size was valued at USD 45,665.77 Million in 2024 and is anticipated to reach USD 55,639.31 Million by 2032, at a CAGR of 2.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sanitary Food Beverage Packaging Market Size 2024 |

USD 45,665.77 Million |

| Sanitary Food Beverage Packaging Market, CAGR |

2.5% |

| Sanitary Food Beverage Packaging Market Size 2032 |

USD 55,639.31 Million |

Sanitary Food Beverage Packaging Market features leading players such as Ball Corporation, Mondi Group, DuPont de Nemours Inc., WestRock Company, Smurfit Kappa Group, Crown Holdings Inc., Sealed Air Corporation, Berry Global Inc., Tetra Pak International S.A., and Amcor plc, all driving advancements in hygienic, sustainable, and contamination-resistant packaging solutions. These companies focus on sterile processing systems, recyclable materials, and smart labeling to meet rising global food safety standards. Regionally, North America leads the Sanitary Food Beverage Packaging Market with a 32.4% share, supported by strong regulatory enforcement, high packaged food consumption, and rapid adoption of aseptic and traceability-enabled packaging technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Sanitary Food Beverage Packaging Market was valued at USD 45,665.77 Million in 2024 and will reach USD 55,639.31 Million by 2032, growing at a CAGR of 2.5%.

- The market grows as demand rises for sterile, contamination-free packaging across dairy, functional beverages, and ready-to-eat foods, with flexible packaging led by pouches holding a 34.6% share due to strong barrier performance and hygiene assurance.

- Key trends include rapid adoption of smart labeling, recyclable mono-material structures, and automation-enhanced aseptic filling systems that improve safety and operational efficiency.

- Leading players such as Ball Corporation, Mondi Group, Smurfit Kappa, Sealed Air, Berry Global, and Amcor focus on sterile processing, sustainable materials, and advanced sealing formats to expand market presence.

- Regionally, North America leads with a 32.4% share, followed by Europe at 28.7% and Asia-Pacific at 24.9%, driven by regulatory enforcement, modernization of food systems, and rising packaged food consumption across these regions.

Market Segmentation Analysis:

By Flexible Packaging

In the Sanitary Food Beverage Packaging Market, the Flexible Packaging segment is dominated by pouches with a 34.6% share, driven by their strong barrier properties, lightweight structure, and suitability for hygienic food handling. Pouches support extended shelf life and contamination-free storage, making them preferred for dairy products, juices, ready-to-eat foods, and nutritional beverages. Films hold a significant share due to high clarity and sealing strength that enhance product safety. Growth in flexible formats is fueled by rising demand for portion-controlled packaging, sustainability-focused materials, and advanced sterilization compatibility.

- For instance, Amul uses flexible poly pouches for its Taaza Toned Fresh Milk in 500ml packs, ensuring safe handling and short-shelf-life compliance under FSSAI standards with printed use-by dates.

By Rigid Packaging

Within the Rigid Packaging segment, bottles lead with a 41.3% market share, supported by high structural integrity, tamper-resistant sealing, and compatibility with aseptic filling lines. Their dominance is reinforced by strong usage in bottled beverages, dairy drinks, and functional nutrition products requiring sanitary handling. Containers also perform well due to rising adoption in processed foods and hygienic meal kits. The segment benefits from increasing regulatory focus on contamination prevention, greater consumer preference for durable packaging formats, and widespread automation of food-grade rigid packaging systems.

- For instance, Amcor supplies PET stock bottles in sizes like 12 oz., 16 oz., 32 oz., and 64 oz. with lightweight Bericap Aseptic finishes for dairy applications, providing superior vacuum absorption and sealing to maintain stability during transport.

By Labels

In the Labels segment, pressure-sensitive labels hold a leading 38.2% share, driven by their superior adhesion, compatibility with diverse packaging surfaces, and ability to withstand moisture and temperature variations in sanitary food environments. These labels support high-speed production lines and maintain print clarity essential for regulatory compliance. Shrink sleeves also contribute strongly as brands adopt 360-degree labeling for hygiene-assured beverages and sealed consumables. Segment growth is driven by the need for tamper-evident labeling, traceability solutions, and enhanced food safety communication across global supply chains.

Key Growth Drivers

Rising Demand for Hygienic and Contamination-Free Packaging

The Sanitary Food Beverage Packaging Market grows significantly as consumers increasingly prioritize contamination-free products and safety-assured packaging formats. Advances in aseptic technologies, antimicrobial coatings, and high-barrier materials support extended shelf life while reducing spoilage risks. Regulatory bodies worldwide mandate stricter sanitation protocols for food and beverage handling, prompting manufacturers to adopt sterile packaging solutions. As ready-to-eat meals, functional beverages, and dairy products gain momentum, hygienic packaging becomes essential for maintaining product integrity, driving sustained demand across global markets.

- For instance, UFlex’s Asepto brand offers aseptic pillow packs in sizes like 200ml, 250ml, and 500ml for milk and curd, featuring six protective layers that block oxygen, light, and moisture to preserve freshness without refrigeration.

Expansion of Convenience Foods and On-the-Go Consumption

Rapid lifestyle changes fuel strong demand for convenient, portable, and single-serve food and beverage products that require high-standards of sanitary packaging. Flexible pouches, rigid bottles, and sealed containers enable safe transportation and long shelf stability, supporting the growth of modern retail, e-commerce grocery channels, and meal delivery services. Busy urban consumers prefer packaging that ensures freshness without manual handling or contamination risks. This shift in consumption behavior encourages manufacturers to innovate lightweight, tamper-evident, and easy-open formats, strengthening market expansion.

- For instance, GUNNA Drinks launched the UK’s first soft drinks in resealable 500ml aluminum bottles, offering a lightweight, portable alternative to single-use 330ml plastic bottles while supporting immune-boosting, additive-free formulations.

Sustainability-Driven Innovations in Packaging Materials

Growing environmental concerns drive adoption of recyclable, biodegradable, and renewable sanitary packaging solutions, positioning sustainability as a major growth catalyst. Brands increasingly integrate mono-material structures, plant-based plastics, and water-based adhesives that maintain sanitary performance while reducing environmental footprint. Regulatory pressure for responsible packaging waste management accelerates the transition toward eco-friendly, food-safe materials. As companies invest in closed-loop systems and advanced sterilization-compatible sustainable formats, demand rises for hygienic packaging that supports both safety and sustainability commitments.

Key Trends & Opportunities

Integration of Smart and Traceability-Enabled Packaging

A major market trend involves the adoption of smart packaging technologies including QR codes, RFID tags, freshness indicators, and digital traceability solutions that enhance food safety monitoring. These technologies support transparent supply chains by enabling real-time tracking of sanitation status, temperature variations, and product origin. As consumers demand proof of hygiene and authenticity, smart packaging becomes an opportunity for brands to differentiate through safety assurance. Growing digitalization in food logistics and compliance requirements strengthens adoption of intelligent, tamper-evident sanitary packaging formats.

- For instance, Walmart partnered with Avery Dennison to deploy RFID-enabled labels on fresh foods like meat, bakery, and deli items, allowing associates to track freshness digitally in high-moisture, cold environments for better inventory rotation.

Rising Use of Automation and Advanced Sterilization Systems

Automation in filling, sealing, and labeling processes creates strong opportunities for sanitary packaging manufacturers by ensuring consistent hygiene standards and reducing human contact. The adoption of aseptic filling, UV sterilization, and high-pressure processing improves product safety while lowering contamination risks. Companies increasingly invest in automated inspection and cleaning systems that enhance packaging precision, especially in dairy, infant nutrition, and ready-to-drink beverage segments. These advancements expand the market’s ability to meet high-volume demand while maintaining stringent sanitary requirements.

- For instance, SIG’s Slimline 12 Aseptic filling machine supports aseptic carton packs for dairy products like white milk, allowing quick switches between volumes from 500ml to 1,100ml on the same line while maintaining sterile processing.

Key Challenges

High Production Costs Associated with Hygienic Materials and Processes

The need for sterilizable, contamination-resistant, high-barrier packaging materials significantly elevates manufacturing costs for sanitary food and beverage packaging. Advanced processes such as aseptic filling, antimicrobial coating application, and cleanroom operations demand considerable capital investment. Small and mid-sized packaging providers struggle to afford compliance upgrades required by evolving global sanitation standards. Additionally, sustainable sanitary materials often come with higher procurement costs, making it challenging for manufacturers to balance affordability with safety and performance expectations.

Regulatory Complexity Across Global Food Safety Standards

The market faces substantial challenges due to the diverse and continually evolving regulatory environments governing food safety, labeling, and sanitary packaging specifications. Manufacturers must comply with multiple regional frameworks such as FDA food-contact rules, EFSA standards, and emerging sustainability mandates. These varying requirements complicate product design, material selection, and process validation. Frequent updates in contamination control guidelines further intensify compliance burdens. Navigating this complex regulatory landscape increases operational costs and slows product launch timelines for global packaging producers.

Regional Analysis

North America

North America holds a leading position in the Sanitary Food Beverage Packaging Market with a 32.4% share, driven by strong regulatory enforcement, advanced food safety systems, and high consumption of packaged beverages and ready-to-eat foods. The region benefits from widespread adoption of aseptic packaging, smart labeling, and recyclable sanitary materials across dairy, functional beverages, and processed food segments. Growth is supported by major investments in automation and sustainable packaging solutions, encouraged by consumer preference for contamination-free, traceable, and convenience-oriented formats. Continuous innovation by leading packaging manufacturers enhances the region’s dominance.

Europe

Europe accounts for a 28.7% share of the Sanitary Food Beverage Packaging Market, influenced by stringent hygiene regulations, rapid sustainability adoption, and strong demand for sterile packaging formats across bakery, dairy, and premium beverage categories. The region’s transition toward recyclable mono-material structures and biodegradable packaging strengthens demand for sanitary-grade materials. Increased consumer focus on clean-label and safety-certified products enhances adoption of tamper-evident and traceability-enabled packaging solutions. The presence of technologically advanced packaging manufacturers and progressive environmental policies accelerates the region’s growth and reinforces its leadership in sanitary packaging innovation.

Asia-Pacific

Asia-Pacific commands a 24.9% share of the Sanitary Food Beverage Packaging Market, driven by rising consumption of packaged food, expanding urban populations, and growth in dairy, confectionery, and beverage sectors. Rapid industrialization and investment in modern food-processing infrastructure accelerate adoption of sanitary packaging in China, India, and Southeast Asia. The region experiences strong demand for flexible, lightweight, and contamination-resistant packaging driven by e-commerce grocery channels and growing awareness of food safety. Government initiatives promoting hygienic food handling and advances in cost-efficient sterilization technologies further strengthen market expansion.

Latin America

Latin America represents an 8.6% share of the Sanitary Food Beverage Packaging Market, supported by increasing retail modernization and rising demand for packaged dairy, beverages, and convenience foods. Countries such as Brazil, Mexico, and Argentina are adopting stricter food safety regulations, driving uptake of tamper-proof and hygienic packaging. Growing beverage consumption and the expansion of quick-service restaurants contribute to the need for contamination-resistant packaging formats. Although cost constraints affect material choices, manufacturers investing in affordable sanitary-grade solutions gain strong opportunities as consumer expectations shift toward safer and longer-lasting products.

Middle East & Africa

The Middle East & Africa region holds a 5.4% share of the Sanitary Food Beverage Packaging Market, driven by increasing reliance on packaged and imported foods requiring stringent hygiene standards. Growth is supported by expanding beverage markets, rising tourism-driven food service demand, and rapid penetration of modern retail formats. Investment in food safety infrastructure and adoption of sterile packaging solutions are rising in Gulf countries, particularly for dairy and bottled beverages. While affordability challenges persist in parts of Africa, the region shows increasing preference for tamper-evident, shelf-stable, and contamination-free packaging options.

Market Segmentations:

By Flexible Packaging

- Pouches

- Wraps

- Bags

- Lidding

- Films

By Rigid Packaging

- Bottles

- Containers

- Cans

- Jars

- Boxes

By Labels

- Pressure-Sensitive Labels

- Shrink Sleeves

- In-Mold Labels

- Paper Labels

- Film Labels

By Closure Systems

- Caps

- Lids

- Seals

- Taps

- Dispensing Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sanitary Food Beverage Packaging Market features leading players such as Ball Corporation, Mondi Group, DuPont de Nemours Inc., WestRock Company, Smurfit Kappa Group, Crown Holdings Inc., Sealed Air Corporation, Berry Global Inc., Tetra Pak International S.A., and Amcor plc. These companies strengthen market growth through innovations in sterile packaging technologies, sustainable material development, and advanced sealing solutions that support contamination-free food handling. Their portfolios span flexible, rigid, and label-based sanitary packaging tailored for dairy, beverages, ready-to-eat meals, and processed foods. Key strategies include adopting aseptic processing systems, integrating smart packaging for traceability, and expanding recyclable mono-material offerings aligned with global sustainability regulations. Investments in automation, antimicrobial coatings, and lightweight structures enhance efficiency while maintaining stringent hygiene standards. Partnerships with food processors, expansion into emerging markets, and continuous upgrades to cleanroom manufacturing environments help leading companies maintain strong market presence and respond to rising global food safety demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ball Corporation

- Mondi Group

- DuPont de Nemours Inc.

- WestRock Company

- Smurfit Kappa Group

- Crown Holdings Inc.

- Sealed Air Corporation

- Berry Global Inc.

- Tetra Pak International S.A.

- Amcor plc

Recent Developments

- In November 2025 Amcor plc launched a sustainable-packaging capability expansion across North America to serve food and beverage customers.

- In 2025, Tetra Pak International S.A. introduced carton packaging in India that incorporates 5% certified recycled polymers, becoming the first company in the Indian food and beverage packaging industry to do so.

- In April 2025, Amcor plc completed its acquisition of Berry Global Group, Inc., combining their flexible and rigid packaging portfolios into a larger global packaging entity.

Report Coverage

The research report offers an in-depth analysis based on Flexible Packaging, Rigid Packaging, Labels, Closure System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as global food safety regulations strengthen and increase demand for contamination-free packaging.

- Adoption of aseptic, antimicrobial, and high-barrier packaging solutions will rise across major food and beverage categories.

- Smart packaging technologies with tracking, freshness indicators, and tamper evidence will gain broader commercial use.

- Sustainable materials such as recyclable mono-structures and bio-based polymers will experience strong uptake.

- Automation and robotics in filling, sealing, and labeling lines will enhance precision and sanitary compliance.

- Growth in ready-to-eat meals and convenience beverages will boost demand for hygienic flexible and rigid formats.

- Packaging manufacturers will invest more in cleanroom environments and advanced sterilization processes.

- Emerging markets in Asia-Pacific and Latin America will adopt sanitary packaging at accelerating rates.

- Brands will increasingly prioritize transparent, safety-certified labeling to build consumer trust.

- Integration of digital traceability systems will become essential for supply chain hygiene and regulatory compliance.