Market Overview

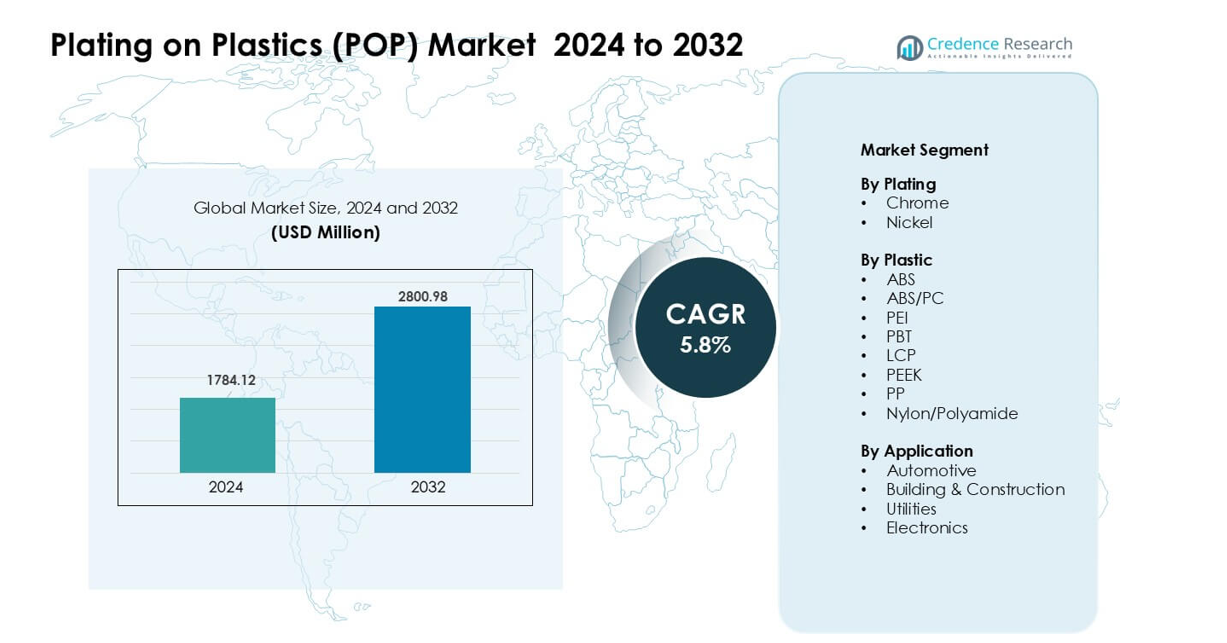

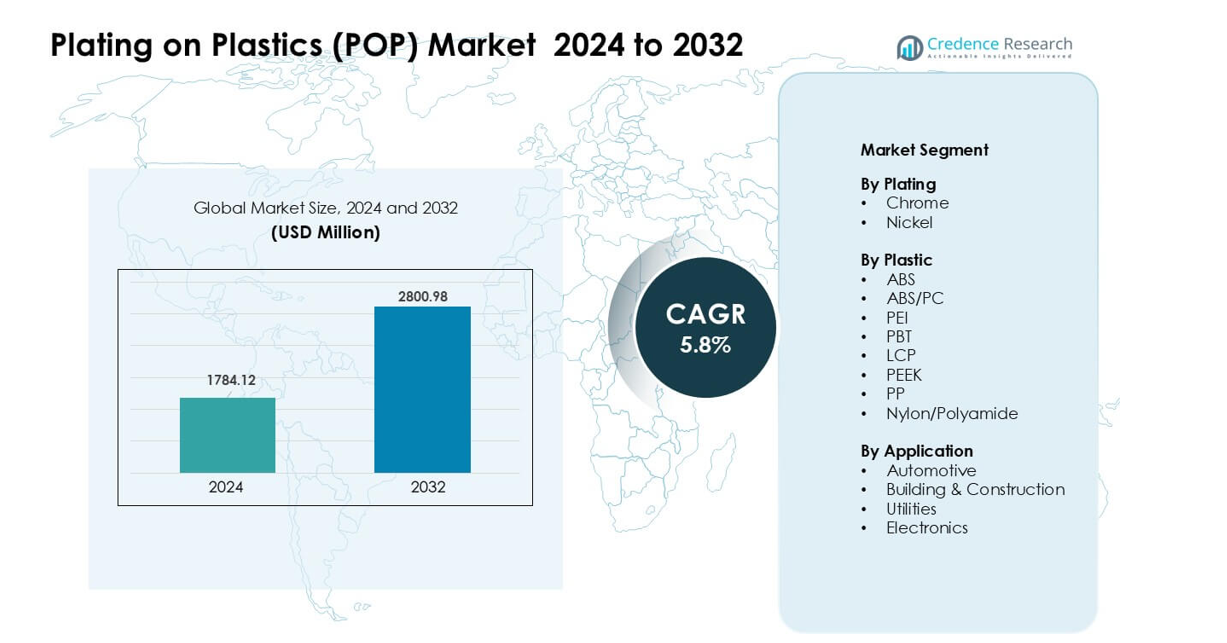

Plating on Plastics (POP) Market was valued at USD 1784.12 million in 2024 and is anticipated to reach USD 2800.98 million by 2032, growing at a CAGR of 5.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plating on Plastics (POP) Market Size 2024 |

USD 1784.12 million |

| Plating on Plastics (POP) Market , CAGR |

5.8% |

| Plating on Plastics (POP) Market Size 2032 |

USD 2800.98 million |

The Plating on Plastics (POP) Market is shaped by leading companies such as ENS Technology, Dymax, Sharrets Plating Inc., DuPont, Cybershield Inc., JCU Corporation, Leader Plating on Plastic Ltd., Element Solutions Inc., MPC Plating Inc., and Quality Plated Products Ltd. These firms strengthened their positions through advanced plating chemistries, improved adhesion technologies, and wider adoption of trivalent chrome solutions. Strong partnerships with automotive and electronics OEMs supported steady demand. Asia Pacific emerged as the leading region with nearly 36% share in 2024, driven by large-scale electronics production, expanding automotive output, and cost-efficient manufacturing capabilities.

Market Insights

- The Plating on Plastics (POP) Market reached USD 1784.12 million in 2024 and is projected to hit USD 2800.98 million by 2032 at a CAGR of 5.8%.

- Strong demand from automotive OEMs drove growth, as chrome-plated ABS components held the largest segment share due to lightweight design and premium surface appeal.

- Key trends included rising adoption of trivalent chrome solutions, eco-friendly chemistries, and increased use of engineering plastics such as ABS/PC and PBT across electronics.

- Leading companies such as ENS Technology, Dymax, DuPont, Cybershield, and Element Solutions Inc. advanced through process automation, high-precision plating, and stronger OEM partnerships.

- Asia Pacific led the global market with nearly 36% share, followed by Europe at about 32% and North America at 28%, supported by strong automotive and electronics output.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Plating

Chrome plating held the dominant share in the Plating on Plastics (POP) Market in 2024 with about 62%. Chrome gained strong traction due to its bright finish, high durability, and strong corrosion resistance. Automakers used chrome to upgrade trim parts and boost exterior styling. Nickel plating grew at a steady pace as firms adopted it for functional layers that improve adhesion and wear strength in electrical and industrial parts. Rising use of chrome-coated components in EVs and premium vehicles continued to drive demand across global markets.

- For instance, a recent industrial‑scale study of chrome‑plated Acrylonitrile Butadiene Styrene (ABS) front‑grille frames, molded for a commercial‑van application, was chrome‑electroplated with a final chrome layer of about 1.65 ± 0.4 µm over copper and nickel base layers demonstrating that chrome plating on ABS yields a metal‑like, durable finish even on complex plastic geometries.

By Plastic

ABS accounted for the largest share of about 68% in 2024, leading the POP Market due to its strong plating ability, smooth surface, and low processing cost. Its wide use in automotive grills, handles, and interior trims strengthened the segment’s dominance. ABS/PC blends followed as firms adopted these materials for better heat resistance and impact strength. Engineering plastics like PBT, PEEK, LCP, and PA gained gradual adoption in high-performance electronics and industrial units where strength and thermal stability remained essential.

- For instance, ABS/PC blends followed as firms adopted these materials for better heat resistance and impact strength. Engineering plastics like PBT, PEEK, LCP, and PA gained gradual adoption in high‑performance electronics and industrial units where strength and thermal stability remained essential.

By Application

Automotive remained the dominant segment with nearly 71% share in 2024. Vehicle makers used plated plastics for trims, emblems, bezels, and functional parts that demand lightweight design and appealing surfaces. Growth in EV models and premium interiors supported higher adoption of chrome-finished components. Electronics formed the next key segment as brands used plated plastics in connectors and decorative covers. Construction and utilities saw moderate growth as firms adopted corrosion-resistant plated surfaces for fixtures, switches, and architectural elements.

Key Growth Drivers

Rising Automotive Demand for Lightweight Decorative Components

Automotive manufacturers increased their reliance on plated plastic parts as lightweight design became a key priority. Plated plastics replaced heavier metal components in grills, trims, handles, bezels, and interior accents, helping automakers reduce vehicle weight and improve fuel efficiency. Growing EV production also boosted adoption because electric models require light structural and decorative elements to optimize battery range. Automakers valued the premium look of chrome- and nickel-plated plastics, which offered metal-like aesthetics without heavy mass. Expanding premium car sales, strong interior customization trends, and higher design flexibility continued to push plated plastics deeper into global automotive supply chains.

- For instance, a recently published overview of modern Plating on Plastics (POP) in automotive design noted that OEMs now specify plastics coatings compatible with high‑performance polymers such as polyamide, polyphenylene sulfide, and polyetherimide signaling that even exterior decorative parts like grilles and bezels are being produced using advanced plastics rather than conventional metal casting.

Expanding Use of Engineering Plastics in Electronics and Industrial Units

Electronics makers increased the use of advanced plastics such as ABS/PC, PBT, PEEK, and LCP for components that require heat resistance, durability, and high surface finish. Plating enhanced these materials by adding conductivity, EMI shielding, and decorative appeal, which supported broader application in connectors, sensor housings, switches, and handheld devices. Industrial equipment manufacturers also used plated plastics to meet corrosion resistance and dimensional stability needs in harsh environments. The transition toward compact, lightweight devices reinforced the demand for metallized surfaces. Growth in smart consumer electronics, IoT devices, and high-performance industrial modules further strengthened the push toward plated engineering resins.

- For instance, a specialized conductive‑plastic technology from a major supplier allows stainless‑steel‑fiber fillers to be compounded into engineering thermoplastics (e.g. PBT, PA, PPS). When molded, even with low filler loading (as little as 0.25% by volume), these molded parts deliver effective EMI/ESD shielding enabling housings for industrial controllers or communications enclosures to replace metal boxes with lighter plastic ones while preserving shielding performance.

Advancements in Surface Treatment and Eco-friendly Plating Technologies

New chemical etching, electroless plating, and surface activation processes improved coating adhesion on complex geometries, supporting higher-quality finishes and reduced defect rates. Innovations in trivalent chrome, low-VOC chemicals, and alternative electrolytes allowed companies to meet strict environmental regulations. These advancements lowered operational risks, cut waste generation, and improved production efficiency for large plating facilities. Automotive and electronics OEMs favored suppliers who adopted cleaner processes due to tightening global standards. Improved plating chemistry also enabled consistent finishing on mixed and high-temperature plastics, broadening material compatibility. These technical gains reinforced expansion in high-value decorative and functional plating applications.

Key Trends & Opportunities

Growing Shift Toward Sustainable and Trivalent Chrome Solutions

Environmental regulations across Europe, North America, and Asia encouraged manufacturers to move away from hexavalent chrome toward safer trivalent chrome technologies. This shift allowed companies to maintain surface quality while aligning with sustainability goals. Brands highlighted environmentally compliant plating as a selling point, especially in automotive and consumer electronics. Investments in closed-loop systems, low-emission chemistries, and recyclable plastics accelerated adoption. As OEMs pushed for green supply chains, demand increased for suppliers capable of large-scale, low-toxicity plating. This trend created opportunities to develop next-generation eco-friendly coatings with improved durability, reduced energy use, and enhanced performance stability.

- For instance, Atotech’s “TriChrome” decorative Cr(III) plating line has been used for over 30 years worldwide and is specifically designed to be ELV, WEEE, RoHS and REACH‑compliant, enabling OEMs to replace traditional Cr(VI) decorative finishes with eco‑friendly Cr(III) without sacrificing appearance or corrosion resistance.

Rising Adoption of Plated Plastics in Electric Vehicles and Smart Devices

EV makers sought advanced lightweight materials that support energy efficiency and enhance external styling. Plated plastics enabled sleek, premium finishes while reducing total weight compared with metal components. EV interiors also used plated surfaces for touchpoints, switches, and accent elements to differentiate cabin design. In smart electronics, plated plastics supported growing demand for EMI shielding, signal protection, and high-grade decorative parts. Rapid growth in connected homes, wearable devices, and compact electronics created broad opportunities for functional plating. Suppliers able to deliver high-precision, defect-free coatings gained strong traction as electronics and EV production scaled globally.

- For instance, plastic‑plating providers such as CYH Plastic Plating offer trivalent chromium plating processes suitable for substrates like ABS and ABS/PC blends, specifically targeting automotive exterior trim parts (door handles, grilles) and interior components enabling EV manufacturers to meet both lightweight design and environmental‑ compliance requirements using the same plating line.

Increasing Customization and Premium Design Demand in Consumer Goods

Consumers sought products with refined surfaces and visually appealing finishes across home appliances, personal care items, and lifestyle goods. Plated plastics offered flexible styling options, enabling glossy, metallic, matte, or textured effects at lower cost than metal components. Manufacturers explored multi-layer decorative plating to enhance durability and brand differentiation. Growing demand for mid-range and premium appliances supported wider use of chrome-finished trims and control panels. As brands expanded design variations within short product cycles, plated plastics gained relevance due to lower tooling costs and faster development timelines. These factors expanded opportunities across multiple consumer goods categories.

Key Challenge

Environmental Compliance and Transition Costs for Hexavalent Chrome Alternatives

Stricter regulations on hazardous substances pushed companies to phase out hexavalent chrome, but transitioning to trivalent chrome or alternative methods remained costly and complex. Many facilities required major upgrades to plating lines, wastewater systems, and chemical handling equipment. Achieving equivalent surface quality and durability also required re-engineering process chemistry, leading to longer validation cycles with OEMs. Smaller manufacturers faced financial pressure due to investment needs and certification timelines. Meeting diverse regional regulations added further compliance burden. These challenges slowed adoption rates and increased operational risks for firms lacking scale or advanced technical capabilities.

High Material and Processing Costs for Engineering Plastics

Although engineering plastics enabled high-performance plating, their cost profile restricted broader market penetration. Materials such as PEEK, LCP, and high-grade ABS/PC blends carried higher prices, making them less attractive for cost-sensitive applications. Processing these materials required tighter temperature control and specialized equipment, which increased production expenses. Achieving consistent adhesion across complex shapes also demanded precise surface preparation, raising operational complexity. Automotive and electronics OEMs often evaluated cost-benefit tradeoffs carefully, slowing adoption in mid-range product categories. These constraints limited use to high-value applications where performance justified material and processing costs.

Regional Analysis

North America

North America held about 28% share of the Plating on Plastics (POP) Market in 2024. The region benefited from strong automotive production, particularly in premium vehicles that use chrome-plated trims and interior accents. Electronics makers in the U.S. and Canada also increased demand for plated plastic components in connectors and device housings. Rising interest in sustainable trivalent chrome solutions supported upgrades across plating facilities. Growing EV adoption further pushed the need for lightweight decorative parts. Steady investments in advanced plating technologies helped maintain the region’s competitive position.

Europe

Europe accounted for roughly 32% share in 2024, making it the largest regional market. The region’s leadership came from strict environmental regulations that accelerated the shift toward trivalent chrome and cleaner plating chemistries. Germany, France, and the U.K. recorded strong demand from luxury automotive brands that rely on premium chrome finishes. Electronics and appliance manufacturers also adopted plated plastics to enhance product aesthetics. EU-wide sustainability goals encouraged modernization of plating infrastructure. The region sustained high-quality standards, supporting strong adoption across automotive interiors, exteriors, and consumer devices.

Asia Pacific

Asia Pacific dominated with nearly 36% share in 2024, driven by large-scale electronics manufacturing and rapid automotive expansion in China, Japan, South Korea, and India. The region benefited from its strong plastics supply chain, cost-efficient production, and rising consumer demand for decorative and functional finishes. EV growth in China accelerated use of plated plastics in exterior accents and control modules. Electronics brands increased demand for EMI-shielded and decorative housings. Investments in advanced plating technologies and expanding industrial output helped Asia Pacific maintain its leadership.

Latin America

Latin America held close to 3% share in 2024, with Brazil and Mexico leading adoption. The automotive sector remained the main driver as regional assembly units used plated plastics for trims, bezels, and exterior accents. Appliance production also increased use of decorative plated parts. Limited plating infrastructure and reliance on imported chemicals slowed growth. However, rising vehicle demand and expansion of local assembly operations created steady opportunities. Growing interest in cost-effective ABS plating supported modest market expansion across the region.

Middle East & Africa

The Middle East & Africa captured about 1% share in 2024, reflecting gradual adoption. Automotive aftermarket customization, construction hardware, and consumer appliances were key demand sources. GCC countries increased use of plated plastics in premium interiors and decorative building elements. Africa showed slow but rising demand from appliance manufacturers. Limited technical expertise and fewer plating facilities constrained growth. However, ongoing urban development projects and rising interest in modern design elements continued to support steady POP adoption across select nations.

Market Segmentations:

By Plating

By Plastic

- ABS

- ABS/PC

- PEI

- PBT

- LCP

- PEEK

- PP

- Nylon/Polyamide

By Application

- Automotive

- Building & Construction

- Utilities

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Plating on Plastics (POP) Market features active strategies from ENS Technology, Dymax, Sharrets Plating Inc., DuPont, Cybershield, Inc., JCU Corporation, Leader Plating on Plastc Ltd., Element Solutions Inc, MPC Plating Inc, and Quality Plated Products Ltd. These companies expanded through stronger plating chemistry portfolios, higher adhesion performance, and wider adoption of trivalent chrome systems across automotive, electronics, and consumer hardware uses. Many suppliers improved pre-treatment steps to support complex plastic substrates such as ABS, ABS/PC, PEEK, and nylon. Several players advanced automation in POP lines to cut defects and raise output for large-volume automotive trim production. Partnership models grew as OEMs sought consistent finish quality and tighter compliance with global environmental rules. Firms also invested in customization services, allowing brands to match texture, reflectivity, and durability for premium components. This shift helped major producers protect share and grow long-term contracts across core sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ENS Technology

- Dymax

- Sharrets Plating Inc.

- DuPont

- Cybershield, Inc.

- JCU CORPORATION

- Leader Plating on Plastc Ltd.

- Element Solutions Inc

- MPC Plating Inc

- Quality Plated Products Ltd

Recent Developments

- In November 2025, Dymax announced multiple trade-show appearances in 2025 where it showcased new light-curing adhesives and dispensers aimed at electronics and medical-assembly applications technologies that are commonly used in POP-related manufacturing lines for bonding, masking and protection (e.g., SMTA International and COMPAMED press releases). These product and event announcements (Oct–Nov 2025) signal Dymax’s continued push to supply UV/LED curing consumables and equipment that support high-throughput POP assembly and post-processing.

- In May 2025, JCU CORPORATION JCU a long-standing supplier of POP surface-treatment chemicals issued a corporate update in May 2025 revising numerical targets in its medium-term management plan; JCU’s published financial/briefing materials also continue to call out POP (plating-on-plastics) chemicals (etching, copper/nickel/chrome plating chemistries) as a core product line supporting automotive and faucet components. These filings and briefing materials show JCU maintaining strategic emphasis on POP chemicals and related businesses through 2024–2025.

- In May 2024, Cybershield, Inc. Cybershield publicly partnered with SABIC to validate and demonstrate electroless-plating and metallization of high-temperature ULTEM™ (PEI) resins, with plated connector backshells shown as part of the collaboration at AIX/NPE events in 2024. This work highlights Cybershield’s expansion of POP capabilities into higher-temperature engineering resins and EMI-shielding applications.

Report Coverage

The research report offers an in-depth analysis based on Plating, Plastic, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plated plastics will rise as automakers expand lightweight and premium design features.

- Trivalent chrome adoption will accelerate as global regulations tighten and sustainability targets grow.

- Electronics manufacturers will increase use of plated engineering plastics for EMI shielding and decorative surfaces.

- EV production growth will drive higher demand for plated trims, bezels, and interior accents.

- Advancements in adhesion chemistry will improve plating quality on complex geometries and high-performance polymers.

- Automation in plating lines will expand to enhance precision, reduce defects, and lower operating costs.

- More companies will invest in closed-loop systems to reduce waste and improve environmental compliance.

- Consumer appliances will adopt more chrome-finished parts to support premium design trends.

- Regional players in Asia Pacific will gain stronger market presence due to cost-efficient production capacity.

- Strategic partnerships between plating firms and OEMs will shape long-term technology development and supply stability.