Market Overview

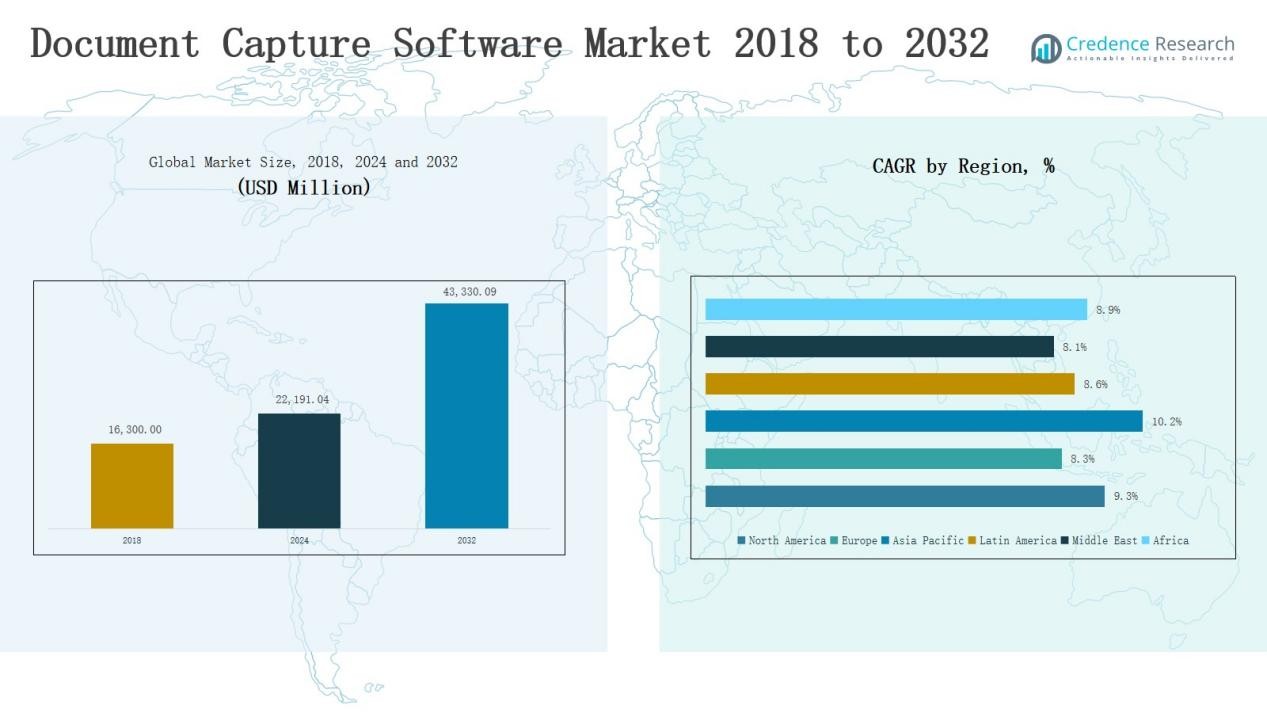

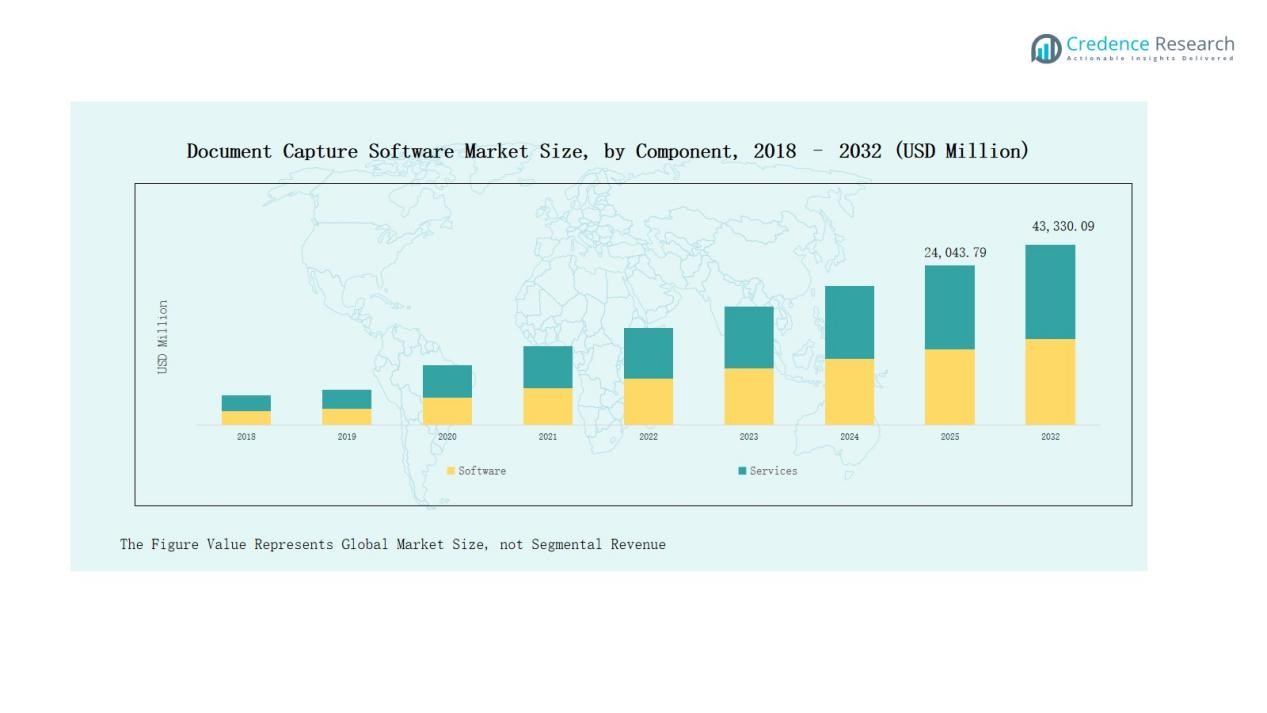

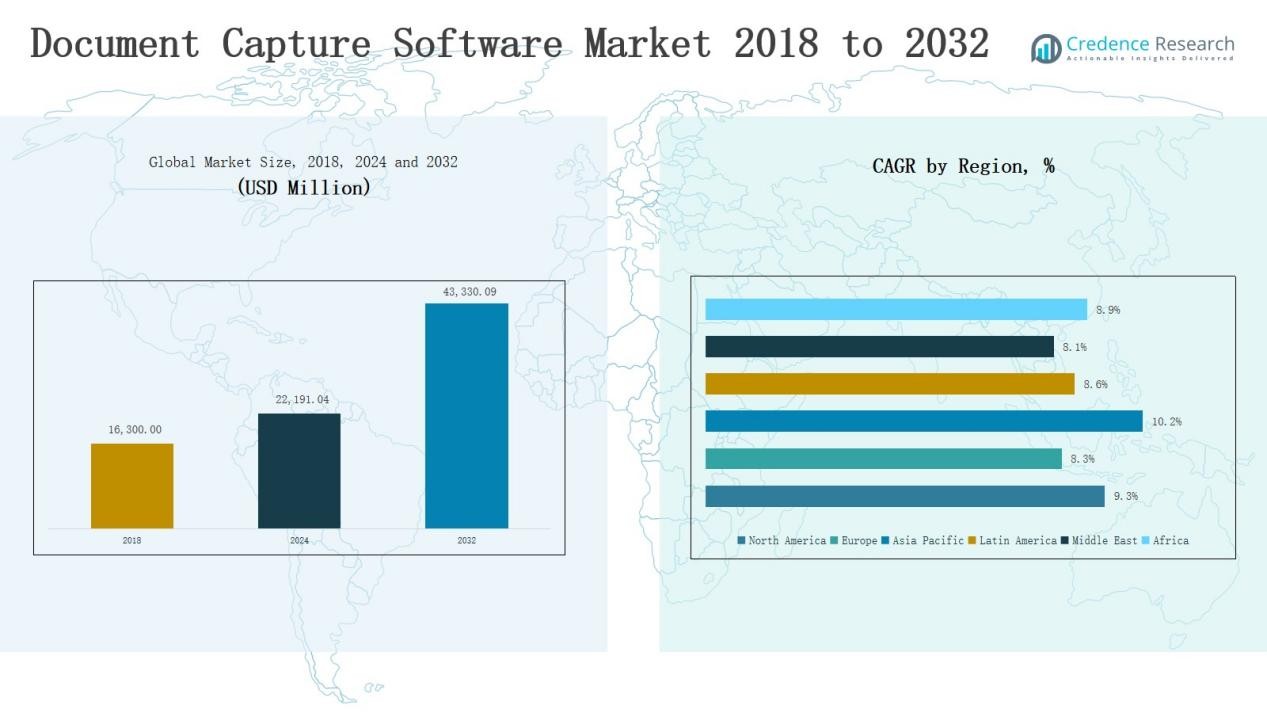

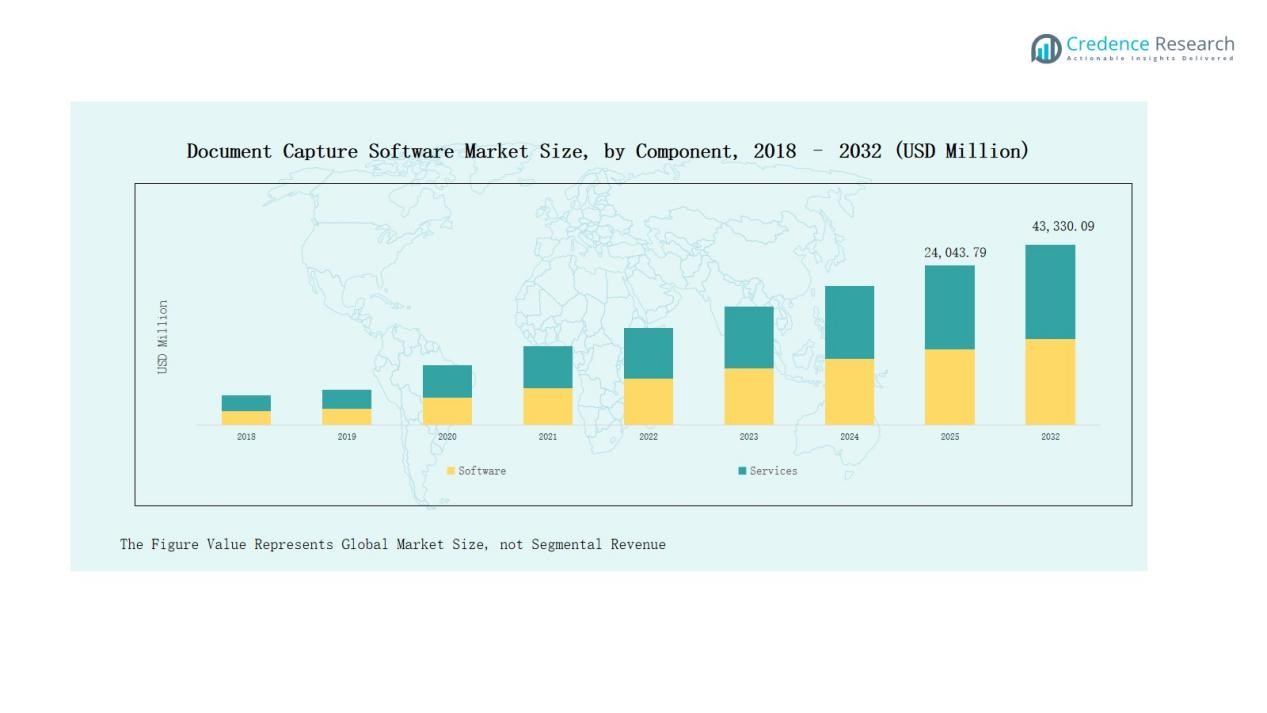

Document Capture Software Market size was valued at USD 16,300.00 million in 2018 to USD 22,191.04 million in 2024 and is anticipated to reach USD 43,330.09 million by 2032, at a CAGR of 8.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Document Capture Software Market Size 2024 |

USD 22,191.04 Million |

| Document Capture Software Market, CAGR |

8.78% |

| Document Capture Software Market Size 2032 |

USD 43,330.09 Million |

The Document Capture Software Market is highly competitive, led by global technology providers and specialized vendors. Key players include Adobe Systems Incorporated, Canon Inc., DocStar, Hyland Software Inc., Artsyl Technologies Inc., Eastman Kodak Company, Knowledge Lake Inc., Oracle Corporation, Xerox Corporation, IBM Corporation, and Newgen Software Technologies Ltd. These companies compete through innovation in AI-driven capture, cloud deployment, and industry-specific solutions. North America emerged as the leading region in 2024, commanding 35% of the global market share, supported by strong digital transformation initiatives, advanced IT infrastructure, and strict compliance requirements across BFSI and healthcare sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Document Capture Software Market grew from USD 16,300.00 million in 2018 to USD 22,191.04 million in 2024 and is expected to reach USD 43,330.09 million by 2032.

- Multiple Channel Capture leads the solution segment with 42% share, followed by Cognitive Capture at 28%, Mobile Capture at 20%, and other solutions at 10%.

- Cloud deployment dominates with 47% share in 2024, while On-Premise accounts for 33% and Hybrid models represent 20% with growing adoption.

- Large Enterprises hold 58% share, while SMEs capture 42% and are expanding faster due to cost-effective SaaS adoption and automation-driven workflows.

- North America leads with 35% market share, followed by Europe at 24% and Asia Pacific at 21%, with Asia Pacific recording the fastest regional growth.

Market Segment Insights

By Solution

Multiple Channel Capture dominates the solution segment with a market share of 42%. Organizations prefer it due to its ability to process inputs from scanners, emails, faxes, and digital platforms, improving workflow efficiency and compliance. Cognitive Capture holds 28%, driven by AI-powered data extraction for unstructured content, while Mobile Capture secures 20% owing to growing smartphone-based enterprise applications. The remaining 10% belongs to other specialized solutions.

- For instance, IBM Datacap provides mobile capture functionality, accessible via REST APIs or the current platform known as IBM Cloud Pak for Business Automation, enabling image and data capture from mobile devices for distributed teams.

By Deployment

Cloud deployment leads with a 47% share, supported by demand for scalability, lower IT costs, and easy remote access. On-Premise accounts for 33%, appealing to highly regulated industries such as BFSI and healthcare requiring data sovereignty. Hybrid models hold 20%, favored by firms balancing legacy infrastructure with flexible cloud adoption. Cloud-first digital transformation strategies remain the primary growth driver.

By Enterprise Size

Large Enterprises represent 58% of market share, driven by heavy investment in digital transformation and high-volume document workflows across BFSI, healthcare, and telecom sectors. SMEs hold the remaining 42%, showing steady growth due to cost-effective cloud-based capture solutions and rising automation needs. The SME segment is expanding faster, fueled by SaaS adoption and improved affordability of capture software.

- For instance, Kofax introduced its Intelligent Automation Cloud platform, helping SMEs deploy capture and workflow automation on a subscription basis without heavy upfront costs.

Key Growth Drivers

Rising Digital Transformation Initiatives

The adoption of digital-first strategies across industries is a major growth driver. Enterprises are increasingly replacing manual document handling with automated capture solutions to improve operational efficiency. This shift is reinforced by the need for faster data processing, regulatory compliance, and cost savings. Financial institutions, healthcare providers, and government organizations lead adoption to streamline workflows, reduce paper dependence, and enhance accuracy. The push toward smart business operations ensures steady demand for document capture solutions, positioning them as an essential part of digital transformation.

- For instance, Adobe integrated advanced document automation tools within Adobe Experience Manager, helping government agencies accelerate electronic form processing and ensure compliance with digital accessibility standards.

Increasing Regulatory Compliance Requirements

The growing emphasis on compliance with data protection and record-keeping laws significantly drives the market. Industries such as BFSI and healthcare face strict regulatory frameworks that mandate secure document storage, quick retrieval, and accurate data capture. Document capture software enables organizations to meet these requirements by digitizing, indexing, and securing critical records. The need to avoid penalties, maintain transparency, and ensure audit readiness strengthens adoption. Compliance-focused digital solutions are therefore becoming indispensable for enterprises navigating complex global and regional regulations.

Expanding Remote and Mobile Workforce

The rise of remote work and mobile-first business models has accelerated demand for flexible capture solutions. Mobile capture enables employees to upload and process documents directly through smartphones and tablets, enhancing productivity outside office environments. This trend is prominent in logistics, retail, and healthcare, where field operations require real-time data access. Remote workforce expansion also increases the adoption of cloud-based platforms, providing secure and collaborative access. The shift toward mobile-friendly and decentralized business operations continues to fuel market growth.

- For instance, TCS Omnistore™ helps the European home improvement company Kingfisher streamline checkout experiences, enhancing operational efficiency with cloud-based, mobile-friendly platforms.

Key Trends & Opportunities

Integration of AI and Cognitive Technologies

Artificial intelligence and machine learning are reshaping the document capture software landscape. Cognitive capture enables automated recognition of unstructured and semi-structured data from invoices, contracts, and forms. These technologies improve accuracy, reduce human intervention, and unlock advanced analytics for decision-making. Vendors are focusing on integrating natural language processing and predictive analytics, creating new opportunities for intelligent document processing. As enterprises seek actionable insights from data, AI-driven capture solutions are expected to witness rapid adoption and stronger market penetration.

- For instance, Microsoft expanded its Azure Form Recognizer with generative AI capabilities, enabling enterprises to process unstructured financial records and contracts with higher precision and faster turnaround times.

Growing Adoption of Cloud and SaaS Models

The rapid migration toward cloud and SaaS-based platforms represents a major opportunity. Enterprises prefer these models for their scalability, lower upfront costs, and seamless integration with existing IT systems. Cloud deployment also supports global accessibility, enabling real-time collaboration across geographically dispersed teams. Small and medium enterprises benefit most, as SaaS-based solutions reduce infrastructure complexity. Vendors offering subscription-based models and industry-specific cloud solutions are well-positioned to capitalize on this trend. This shift ensures continuous revenue growth and broader customer reach.

- For instance, Adobe revealed that its Creative Cloud subscriber base grew to 30 million users, highlighting the success of its subscription model in delivering scalable, cloud-native creative solutions.

Key Challenges

Data Security and Privacy Concerns

Data breaches and cyber threats pose a significant challenge for market growth. Document capture software processes highly sensitive information, making it a prime target for malicious attacks. Enterprises, especially in BFSI and healthcare, face growing concerns about compliance with GDPR, HIPAA, and other data privacy laws. Failure to ensure strong security controls can limit adoption and lead to financial penalties. Vendors must invest in encryption, access control, and secure cloud infrastructure to overcome trust barriers and expand customer acceptance.

High Implementation and Integration Costs

Despite clear benefits, the high cost of implementation remains a barrier for many organizations, particularly SMEs. Expenses associated with software licensing, customization, and integration with legacy systems increase total ownership costs. In some cases, the need for skilled IT teams further adds to the expense. These cost challenges slow down adoption in cost-sensitive markets. Vendors focusing on affordable, modular, and subscription-based offerings are better positioned to address this challenge and attract wider adoption across different enterprise sizes.

Resistance to Change and Skill Gaps

Adoption of document capture software often faces resistance due to entrenched manual processes and lack of digital readiness. Employees accustomed to traditional workflows may resist change, slowing deployment and efficiency gains. Additionally, skill gaps in managing advanced cognitive or AI-based solutions hinder effective utilization. Training and change management become essential to unlock the full potential of these systems. Enterprises that fail to address workforce adaptation may struggle to achieve expected returns, presenting an ongoing challenge for the market.

Regional Analysis

North America

North America leads the global document capture software market with a revenue share of 35% in 2024. Valued at USD 8,445.78 million in 2024, the market is projected to reach USD 16,439.00 million by 2032, expanding at a CAGR of 8.8%. The region’s dominance stems from strong digital transformation initiatives, high adoption of cloud-based platforms, and strict regulatory compliance across BFSI and healthcare. The U.S. drives demand with advanced enterprise IT infrastructure and investments in AI-driven solutions, while Canada and Mexico are steadily expanding adoption in SMEs and logistics.

Europe

Europe holds the second-largest share with 24% in 2024, valued at USD 5,662.55 million and projected to reach USD 10,449.17 million by 2032 at a CAGR of 8.0%. Growth is supported by strong regulatory requirements such as GDPR, boosting secure document capture adoption across financial services, government, and healthcare. Germany, France, and the UK lead adoption, while Southern and Eastern Europe show rising demand in SMEs. The region’s emphasis on compliance, combined with investments in automation and AI-driven technologies, sustains consistent market expansion.

Asia Pacific

Asia Pacific accounts for 21% of the market in 2024, with revenues of USD 4,967.37 million and an expected rise to USD 10,742.00 million by 2032, the fastest CAGR at 10.1%. The region benefits from rapid digitalization, booming e-commerce, and strong adoption of mobile capture solutions. China and India dominate demand due to large-scale enterprise digital transformation, while Japan, South Korea, and Australia lead in innovation and cloud adoption. Growing investments in AI, coupled with rising SME adoption of SaaS-based solutions, position Asia Pacific as the most dynamic regional market.

Latin America

Latin America holds a 7% share in 2024, valued at USD 1,590.88 million, and is forecast to reach USD 2,910.48 million by 2032 at a CAGR of 7.9%. Brazil leads regional demand with strong adoption in BFSI, retail, and healthcare, while Mexico and Argentina contribute to steady growth. Cloud-based solutions are gaining traction among SMEs due to lower IT costs and scalability. Despite slower digital maturity compared to North America and Europe, growing regulatory compliance needs and mobile workforce expansion are fueling adoption across the region.

Middle East

The Middle East captures a 5% market share in 2024, valued at USD 878.62 million, with projections to reach USD 1,564.45 million by 2032 at a CAGR of 7.5%. Growth is driven by digital transformation programs in the GCC countries, particularly in banking, healthcare, and government sectors. Investments in cloud infrastructure and AI adoption are gaining momentum, while countries like the UAE and Saudi Arabia dominate regional adoption. However, uneven IT infrastructure across certain economies presents challenges, making cloud-based SaaS models the most attractive deployment strategy.

Africa

Africa represents a smaller but growing share of 4% in 2024, valued at USD 645.85 million, and is expected to reach USD 1,224.99 million by 2032 with a CAGR of 8.2%. South Africa leads the region, followed by Egypt and Nigeria, where demand is driven by banking modernization, healthcare digitization, and government initiatives. SMEs increasingly adopt affordable mobile and cloud-based solutions to streamline operations. While infrastructure challenges remain, international vendors entering the region with localized SaaS offerings are unlocking new opportunities for growth in the African market.

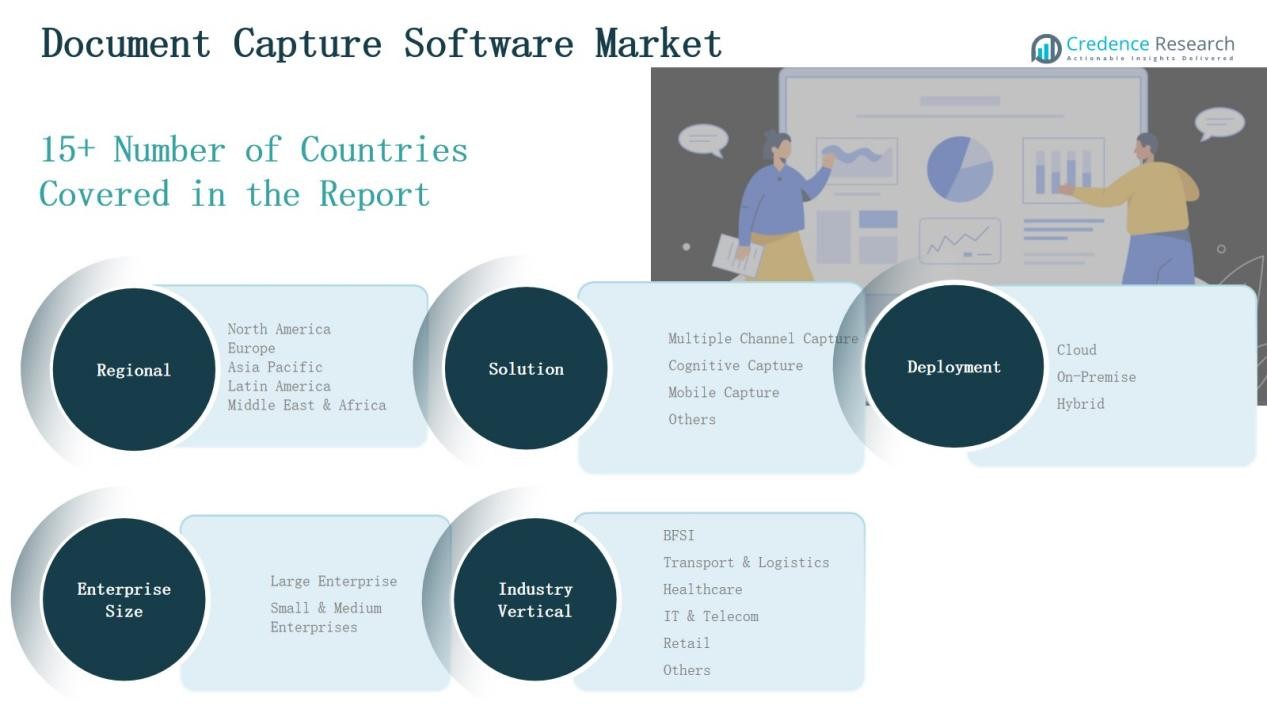

Market Segmentations:

By Solution

- Multiple Channel Capture

- Cognitive Capture

- Mobile Capture

- Others

By Deployment

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- BFSI

- Transport & Logistics

- Healthcare

- IT & Telecom

- Retail

- Others

By Region

- North America(U.S., Canada, Mexico)

- Europe(UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific(China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America(Brazil, Argentina, Rest of LATAM)

- Middle East(GCC, Israel, Turkey, Rest of Middle East)

- Africa(South Africa, Egypt, Rest of Africa)

Competitive Landscape

The competitive landscape of the Document Capture Software Market is characterized by a mix of global technology leaders and specialized solution providers, each striving to strengthen their market positions through innovation, strategic partnerships, and acquisitions. Major players such as Adobe Systems, IBM Corporation, Oracle Corporation, and Xerox Corporation dominate with extensive portfolios and advanced integration capabilities across enterprise IT ecosystems. Companies like Canon, Eastman Kodak, and DocStar maintain strong presence through hardware-software synergy and vertical-specific solutions. Emerging vendors, including Newgen Software, Hyland Software, Artsyl Technologies, and KnowledgeLake, focus on AI-driven cognitive capture, SaaS models, and affordability to target SMEs and niche industries. Cloud deployment, mobile capture, and AI-based automation are the key competitive differentiators, with vendors actively investing in R&D to enhance accuracy and compliance readiness. Intense rivalry drives continuous advancements, while consolidation through partnerships and mergers is reshaping the market toward integrated, intelligent, and scalable capture solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- On June 3, 2025, Kyocera Document Solutions America unveiled its Kyocera Cloud Capture (KCC) platform, enhancing cloud-based document capture with integrated OCR and secure storage.

- On August 19, 2025, Epiq entered into a strategic partnership with IRIS (a Canon company) to advance AI-driven document capture and management capabilities.

- In July 2025, Apryse completed the acquisition of Accusoft, strengthening its portfolio with advanced mobile document processing and imaging SDK solutions.

- In 2025, OpenText launched its Core Content Management Premium Plan, introducing enhanced cloud capture and digital signature features to accelerate SaaS-based adoption.

Report Coverage

The research report offers an in-depth analysis based on Solution, Deployment, Enterprise Size, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness greater adoption of AI-powered cognitive capture for unstructured data.

- Cloud-based platforms will continue to expand as enterprises shift from legacy systems.

- Mobile capture solutions will grow rapidly with the rise of remote and field-based workforces.

- Integration with enterprise content management and workflow automation will strengthen software value.

- SMEs will increasingly adopt SaaS-based solutions due to lower costs and scalability.

- Data privacy and security enhancements will remain a top priority for vendors.

- Industry-specific solutions will gain traction in BFSI, healthcare, and government sectors.

- Partnerships and acquisitions will intensify to build end-to-end intelligent document processing platforms.

- Analytics-driven document capture will rise as enterprises seek actionable insights from data.

- Emerging markets in Asia Pacific, Middle East, and Africa will drive new adoption opportunities.