Market Overview

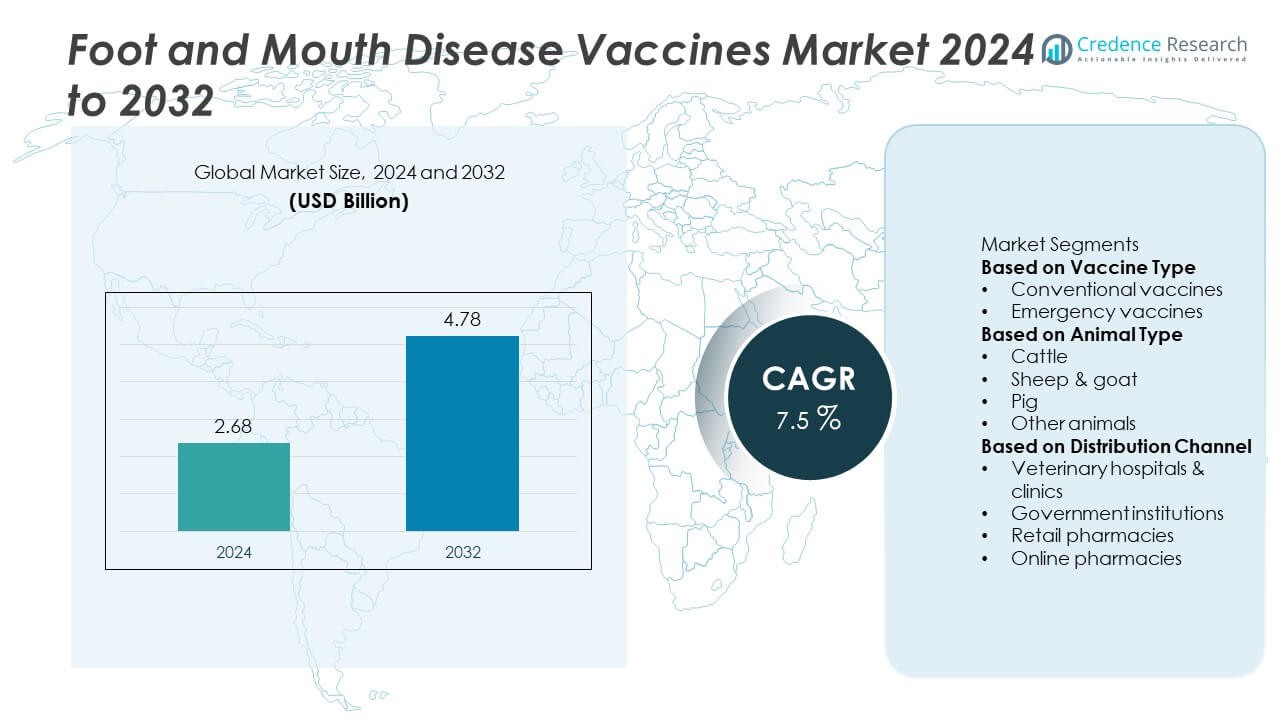

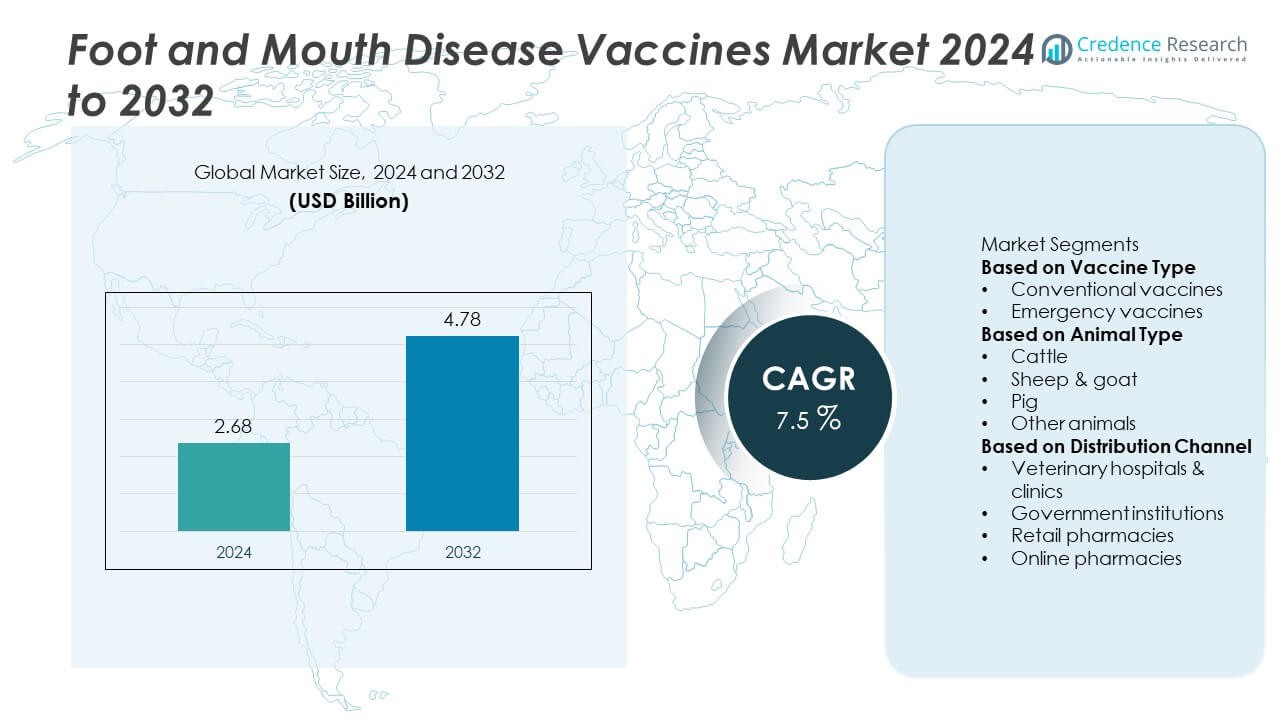

The Foot and Mouth Disease (FMD) Vaccines market size was valued at USD 2.68 billion in 2024 and is projected to reach USD 4.78 billion by 2032, growing at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Foot and Mouth Disease (FMD) Vaccines Market Size 2024 |

USD 2.68 Billion |

| Foot and Mouth Disease (FMD) Vaccines Market, CAGR |

7.5% |

| Foot and Mouth Disease (FMD) Vaccines Market Size 2032 |

USD 4.78 Billion |

The Foot and Mouth Disease (FMD) vaccines market is driven by major players including Ceva Santé Animale, Biogénesis Bagó, Merck & Co., Inc., Brilliant Bio Pharma Private Limited, Inner Mongolia Biwei Antai Biotechnology Co., Ltd., Biovet Private Ltd, C.H. Boehringer Sohn AG & Co. KG, Kenya Veterinary Vaccines Production Institute, BVI, and Indian Immunologicals Ltd. These companies leverage large-scale production capabilities, strong regional presence, and partnerships with government immunization programs to secure market share. Asia-Pacific led the market in 2024 with 40% share, driven by high livestock populations and national vaccination campaigns in India and China. Europe accounted for 20%, supported by strict regulatory frameworks and vaccine banks, while North America held 15% due to preparedness strategies and preventive stockpiling. Latin America captured 13%, led by Brazil’s large-scale cattle vaccination, and the Middle East & Africa contributed 12%, reflecting growing immunization efforts supported by international aid and regional programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Foot and Mouth Disease (FMD) vaccines market was valued at USD 2.68 billion in 2024 and is projected to reach USD 4.78 billion by 2032, expanding at a CAGR of 7.5%.

- Growth is driven by rising livestock populations and large-scale government immunization programs, with conventional vaccines holding 70% share due to their established use in mass vaccination campaigns.

- Trends include rising demand for emergency vaccines, development of thermostable formulations, and expansion of veterinary and online distribution networks that improve access beyond government institutions.

- The competitive landscape is led by companies such as Ceva Santé Animale, Biogénesis Bagó, Merck & Co., Indian Immunologicals Ltd., and Boehringer Ingelheim, all focusing on innovation, supply chain expansion, and regional partnerships.

- Regionally, Asia-Pacific led with 40% share in 2024, followed by Europe with 20%, North America with 15%, Latin America with 13%, and the Middle East & Africa with 12%, reflecting strong global adoption patterns.

Market Segmentation Analysis:

By Vaccine Type

Conventional vaccines held the largest share of the Foot and Mouth Disease vaccines market in 2024, accounting for nearly 70% of total revenue. Their dominance is driven by wide adoption in endemic regions, established cold-chain distribution, and lower cost compared to advanced emergency vaccines. Farmers and government programs prefer conventional vaccines for routine immunization of livestock, supporting mass vaccination campaigns. Emergency vaccines are gaining traction in outbreak-prone areas due to rapid response advantages, yet conventional vaccines remain the preferred choice given their proven efficacy and large-scale supply availability.

- For instance, Indian Immunologicals Ltd. operates a facility in Hyderabad with an annual production capacity exceeding 360 million doses of FMD vaccine, ensuring steady supply for India’s national livestock vaccination program.

By Animal Type

The cattle segment dominated the market by animal type in 2024, capturing around 55% of global demand. High susceptibility of cattle to FMD and their critical role in dairy and meat production drive this dominance. National livestock health programs and mandatory vaccination initiatives in countries with large cattle populations further support segment growth. Sheep and goats also represent a steady market, particularly in Asia and Africa, while pigs contribute notably in East Asia. However, cattle remain the primary revenue generator due to their significant economic importance in agriculture.

- For instance, Biogénesis Bagó produces 200 million doses of FMD vaccines annually at its Garin plant in Argentina, and the majority of its Latin American production is distributed to cattle producers in the region under government immunization programs.

By Distribution Channel

Government institutions emerged as the leading distribution channel in 2024, holding nearly 50% share of vaccine supply. Centralized procurement policies, mass immunization campaigns, and subsidies for livestock farmers underpin this dominance. Veterinary hospitals and clinics also account for a substantial share, providing direct access to vaccination services for both commercial and smallholder farms. Retail and online pharmacies are expanding steadily, especially in developed markets, as farmers seek accessible procurement channels. However, large-scale FMD control programs funded by governments ensure institutional channels continue to drive the majority of vaccine distribution globally.

Key Growth Drivers

Rising Livestock Population and Economic Dependence

The steady rise in global livestock numbers, particularly cattle and pigs, remains a major driver for FMD vaccine demand. Countries reliant on dairy, beef, and pork exports prioritize vaccination to safeguard trade and food security. For instance, Asia and Africa together account for more than 60% of the global cattle population, creating consistent vaccination needs. Strong dependence on livestock for income in developing regions further ensures government and private sector investment in mass immunization programs, boosting the adoption of FMD vaccines worldwide.

- For instance, Ceva Santé Animale operates vaccine manufacturing facilities in Brazil and Africa to provide a wide range of animal health products. The company has expanded its operations through acquisitions and investment in production sites to support global initiatives against infectious diseases in livestock.

Government Initiatives and Mass Immunization Programs

National governments and regional health agencies drive growth through mandatory vaccination campaigns and subsidies. The World Organisation for Animal Health (WOAH) and Food and Agriculture Organization (FAO) coordinate programs in endemic regions, ensuring large-scale coverage. In 2024, government distribution channels accounted for nearly 50% of vaccine supply, highlighting the role of public funding. Countries with strong export markets enforce routine vaccination to maintain FMD-free status, directly supporting demand. These initiatives not only improve herd health but also ensure compliance with international trade regulations.

- For instance, Indian Immunologicals Ltd. (IIL) is a major supplier of Foot-and-Mouth Disease (FMD) vaccines to India’s National Animal Disease Control Programme (NADCP), covering cattle and buffalo across multiple states through government-funded campaigns.

Advancements in Vaccine Manufacturing and Storage

Technological innovation in vaccine development and cold-chain logistics has accelerated adoption. Improved oil-adjuvanted and aqueous vaccines offer longer immunity and reduced booster requirements, enhancing cost efficiency for farmers. Manufacturers are also investing in thermostable formulations to address storage challenges in remote areas. Expanded production facilities in Asia and South America help meet rising demand, while collaborations with local governments ensure consistent supply. These innovations support higher vaccination coverage, reduce disease recurrence, and enhance the overall effectiveness of FMD control programs, making them a key driver for market expansion.

Key Trends & Opportunities

Shift Toward Emergency and Region-Specific Vaccines

While conventional vaccines dominate, demand for emergency vaccines is rising due to frequent outbreaks in endemic regions. Countries with high cross-border livestock trade increasingly adopt rapid-response vaccines that can control outbreaks within weeks. Manufacturers are also focusing on region-specific vaccines tailored to viral serotypes prevalent in Asia, Africa, and the Middle East. This trend provides opportunities for companies to differentiate products and strengthen their market position by aligning vaccine strains with local epidemiology, improving both response time and disease management outcomes.

- For instance, Boehringer Ingelheim Animal Health and Biogénesis Bagó SA were both awarded contracts to supply multiple types of vaccine products and develop Canada’s first dedicated FMD Vaccine Bank.

Growing Private Sector and Veterinary Distribution Networks

Private veterinary clinics and retail pharmacies are expanding their role in livestock vaccination. In 2024, veterinary hospitals and clinics accounted for over 30% of vaccine distribution, showing rising farmer reliance on private services. The trend is more visible in emerging economies where smallholder farmers seek direct veterinary support. Online pharmacies also present opportunities for broader access, especially in developed regions. The expansion of these channels complements government programs, creating a hybrid distribution model that ensures both mass immunization and targeted coverage for high-value livestock groups.

- For instance, Brilliant Bio Pharma, based in Hyderabad, has an expanded production capacity of up to 300 million Foot-and-Mouth Disease (FMD) vaccine doses annually. With a strong pan-India distribution network, the company supplies vaccines through private veterinary channels and is also a significant participant in government FMD control programs.

Key Challenges

Cold Chain and Infrastructure Limitations

Maintaining vaccine potency requires strict cold-chain management, which remains a major challenge in developing countries. Remote rural areas often lack reliable storage and transport systems, leading to vaccine wastage and limited coverage. Although efforts to develop thermostable vaccines are underway, large-scale adoption is still limited. These infrastructure gaps delay effective vaccination, reduce herd immunity, and increase outbreak risks. Until sustainable cold-chain solutions are implemented, especially in Africa and South Asia, market growth potential will remain partially constrained by logistical inefficiencies.

High Cost Burden on Farmers in Low-Income Regions

Despite government subsidies, vaccine affordability continues to challenge smallholder farmers in low-income countries. Routine immunization campaigns require repeated doses, increasing overall costs for farmers with limited income. In regions where subsidies do not fully cover expenses, farmers may delay or avoid vaccination, leaving livestock vulnerable. This issue reduces vaccine penetration and creates uneven coverage within herds, weakening disease control measures. Unless long-term funding mechanisms or low-cost formulations are introduced, affordability will remain a key barrier to widespread adoption of FMD vaccines.

Regional Analysis

North America

North America accounted for 15% share of the FMD vaccines market in 2024, driven by strong government disease surveillance programs and strict livestock health standards. The United States and Canada maintain FMD-free status, but preventive vaccine stockpiling and research funding support steady demand. Growing cattle populations and high-value meat exports further drive investments in vaccine reserves to avoid trade disruptions. Veterinary hospitals and private clinics play a role in sustaining preparedness strategies. While outbreaks are rare, the region’s emphasis on rapid response and biosecurity continues to support the market.

Europe

Europe held a 20% market share in 2024, supported by regulatory frameworks under the European Commission and World Organisation for Animal Health (WOAH). Countries such as the UK, France, and Germany enforce stringent import regulations and maintain vaccine banks to mitigate risks. The region focuses on safeguarding meat exports and protecting its dairy sector, which forms a large share of agricultural GDP. Growing awareness among farmers, coupled with government support programs, drives continued vaccine adoption. Europe’s emphasis on emergency vaccination and disease-free certification underpins its steady demand in the global FMD vaccine market.

Asia-Pacific

Asia-Pacific dominated the market with a 40% share in 2024, fueled by the world’s largest livestock populations in China, India, and Southeast Asia. Frequent outbreaks, especially in smallholder and cross-border herds, create continuous vaccine demand. National immunization campaigns in India and China distribute millions of doses annually, supported by government subsidies. The cattle and pig segments drive consumption as they represent critical protein sources for the region. Vaccine manufacturers in India, South Korea, and China also expand supply capacity to meet local and export demand, reinforcing Asia-Pacific’s leadership in the global FMD vaccine industry.

Latin America

Latin America captured a 13% market share in 2024, led by Brazil and Argentina, where cattle production dominates agricultural exports. Governments enforce widespread immunization programs to maintain trade competitiveness, particularly in beef exports to North America and Europe. Brazil conducts semi-annual vaccination campaigns covering hundreds of millions of cattle, reflecting the region’s scale. Expanding veterinary service networks and improved vaccine storage facilities support coverage in remote farming areas. While compliance rates remain high, the region continues to focus on eradicating outbreaks to achieve full FMD-free status, strengthening its role in the global vaccine market.

Middle East & Africa

The Middle East and Africa accounted for 12% market share in 2024, with demand driven by frequent outbreaks in endemic regions such as Sub-Saharan Africa. Livestock represents a key source of livelihood, and governments prioritize vaccination through international aid and donor-supported programs. Gulf nations, including Saudi Arabia, focus on preventive vaccination to secure food security and reduce reliance on imports. Infrastructure gaps, especially in vaccine cold-chain systems, remain a challenge. However, partnerships between global suppliers and regional governments support growing vaccination campaigns, positioning the region as a developing but vital contributor to global demand.

Market Segmentations:

By Vaccine Type

- Conventional vaccines

- Emergency vaccines

By Animal Type

- Cattle

- Sheep & goat

- Pig

- Other animals

By Distribution Channel

- Veterinary hospitals & clinics

- Government institutions

- Retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Foot and Mouth Disease (FMD) vaccines market is characterized by the presence of leading players such as Ceva Santé Animale, Biogénesis Bagó, Merck & Co., Inc., Brilliant Bio Pharma Private Limited, Inner Mongolia Biwei Antai Biotechnology Co., Ltd., Biovet Private Ltd, C.H. Boehringer Sohn AG & Co. KG, Kenya Veterinary Vaccines Production Institute, BVI, and Indian Immunologicals Ltd. These companies compete through large-scale manufacturing capacities, strategic partnerships, and continuous investments in vaccine research. Asia-Pacific players like Indian Immunologicals and Brilliant Bio Pharma benefit from high livestock populations and government contracts, while European firms such as Boehringer Ingelheim and Ceva Santé Animale focus on advanced formulations and emergency vaccines. Latin American producers, including Biogénesis Bagó, emphasize strong regional vaccination campaigns to support cattle exports. Competition is also shaped by innovations in cold-chain logistics, collaborations with veterinary institutes, and expansion into emerging markets where disease prevalence and vaccination demand remain high.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ceva Santé Animale

- Biogénesis Bagó

- Merck & Co., Inc.

- Brilliant Bio Pharma Private Limited

- Inner Mongolia Biwei Antai Biotechnology Co., Ltd.

- Biovet Private Ltd

- H. Boehringer Sohn AG & Co. KG

- Kenya Veterinary Vaccines Production Institute

- BVI

- Indian Immunologicals Ltd.

Recent Developments

- In July 2025, Biogénesis Bagó was named a supplier to Canada’s new Foot-and-Mouth Disease (FMD) vaccine bank alongside Boehringer Ingelheim.

- In June 2025, Botswana Vaccine Institute (BVI) dispatched emergency FMD vaccine shipments to South Africa amid expanding outbreaks.

- In May 2025, C.H. Boehringer Sohn AG & Co. KG (Boehringer Ingelheim Animal Health) secured contracts to supply FMD vaccines for Canada’s national vaccine bank.

- In 2025, Ceva Santé Animale signed an agreement to use Touchlight’s dbDNA platform to accelerate next-gen veterinary vaccine development.

Report Coverage

The research report offers an in-depth analysis based on Vaccine Type, Animal Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for FMD vaccines will rise with increasing livestock populations in Asia and Africa.

- Government-led immunization campaigns will remain the backbone of global vaccine adoption.

- Conventional vaccines will continue to dominate due to cost efficiency and proven effectiveness.

- Emergency vaccines will expand steadily as outbreak preparedness becomes a policy priority.

- Veterinary hospitals and clinics will strengthen their role in complementing government distribution.

- Technological advances will improve thermostable vaccine formulations for use in remote areas.

- International trade regulations will drive adoption in export-oriented cattle and dairy markets.

- Regional manufacturers will expand production capacity to meet local and global supply needs.

- Partnerships between global companies and national institutes will enhance vaccination coverage.

- Market competition will intensify as companies invest in innovation and regional expansion.