Market Overview

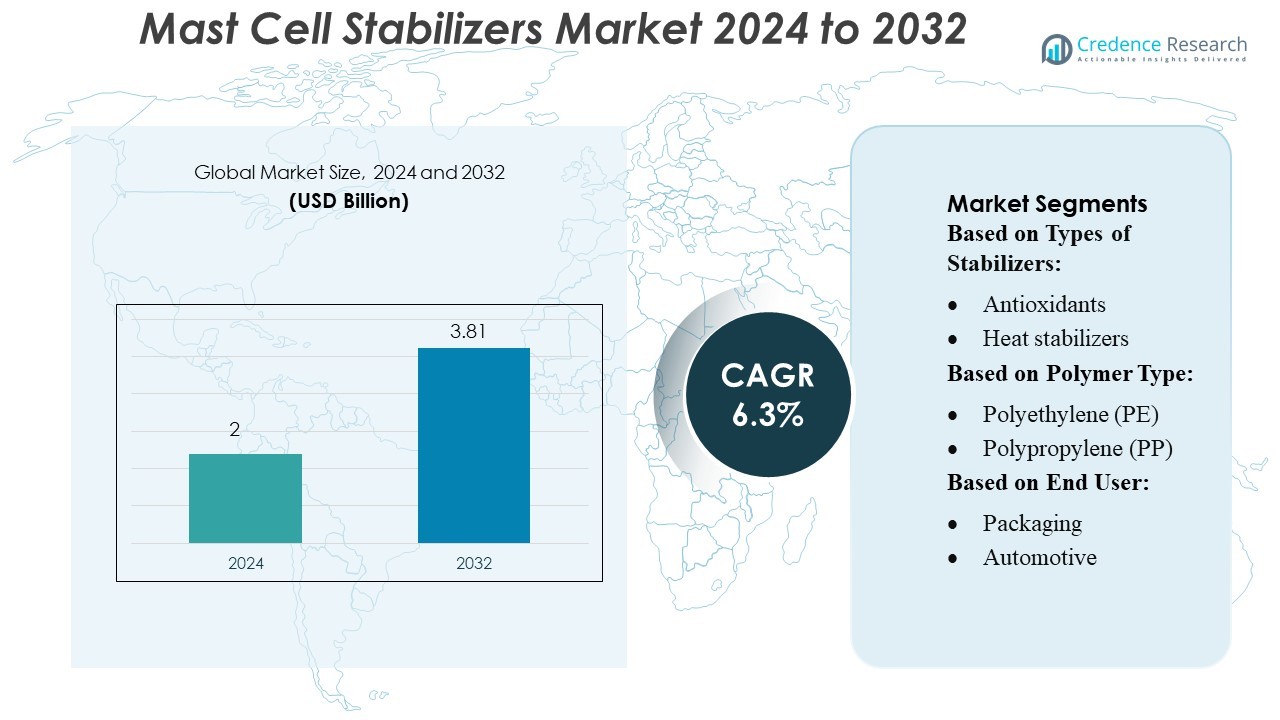

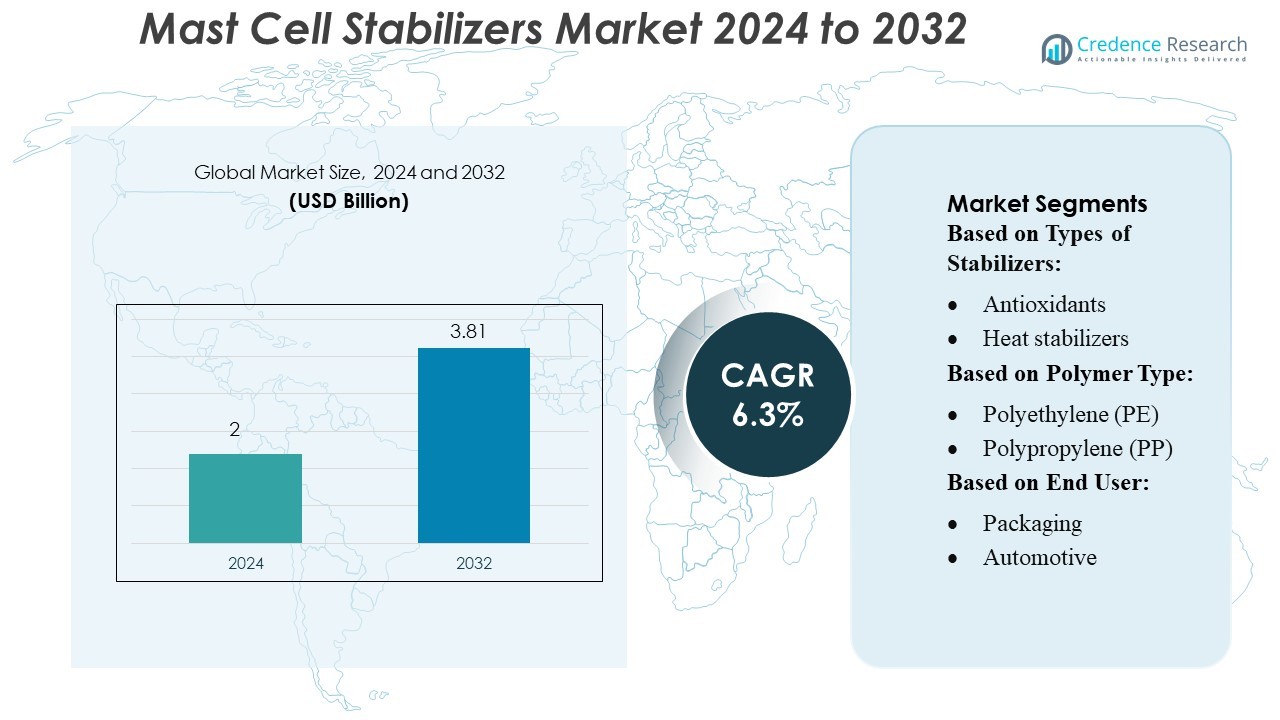

Mast Cell Stabilizers Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 3.81 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mast Cell Stabilizers Market Size 2024 |

USD 2 Billion |

| Mast Cell Stabilizers Market, CAGR |

6.3% |

| Mast Cell Stabilizers Market Size 2032 |

USD 3.81 Billion |

The Mast Cell Stabilizers Market is characterized by active participation from leading companies such as Perstorp Holding AB, Clariant, Polyvel, Evonik Industries, Chitec Technology, PMC Group, Baerlocher, BASF SE, Adeka Corporation, and Dover Chemical Corporation, all of which focus on advancing formulation efficiency and improving product stability for pharmaceutical applications. These companies strengthen competitiveness through R&D investments, capacity expansion, and collaborations with drug manufacturers. North America leads the global market with an exact market share of 40%, driven by strong healthcare infrastructure, high diagnosis rates of allergic and respiratory disorders, and consistent adoption of advanced non-steroidal therapeutic solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mast Cell Stabilizers Market was valued at USD 2 billion in 2024 and is projected to reach USD 3.81 billion by 2032, expanding at a CAGR of 6.3% as demand for effective non-steroidal allergy and asthma treatments continues to rise.

- Rising prevalence of respiratory disorders and increasing preference for cromolyn-sodium–based formulations, which account for the largest segment share at around 45%, are driving strong market growth across global healthcare systems.

- Technology-focused players enhance competitiveness through R&D in advanced stabilizer chemistry, capacity expansion, and strategic partnerships with pharmaceutical manufacturers to strengthen product availability and formulation performance.

- High production costs and stringent regulatory requirements restrain market expansion, particularly for smaller manufacturers, creating barriers in scaling high-purity pharmaceutical-grade stabilizers.

- North America leads with 40% regional market share, followed by Europe and Asia Pacific, as strong infrastructure, rising diagnosis rates, and widening adoption of non-steroidal therapies reinforce regional dominance and support stable long-term demand.

Market Segmentation Analysis:

By Types of Stabilizers

Antioxidants hold the dominant position in the mast cell stabilizers market among stabilizer types, accounting for the largest share due to their strong capability to prevent oxidative degradation and maintain product integrity during storage. Their wide adoption is driven by high thermal resistance, extended shelf-life performance, and compatibility with multiple formulations. Heat stabilizers and light stabilizers follow, supported by expanding applications in temperature-sensitive and UV-exposed environments. Antimicrobial stabilizers are gaining traction as manufacturers prioritize hygiene-focused formulations, but they remain secondary compared with antioxidants, whose reliability and broad applicability continue to reinforce their leadership.

- For instance, Perstorp Holding AB has integrated renewable-methanol–based production into its antioxidant-related chemical processes through its Project Air initiative, enabling the manufacture of up to 200,000 tons of sustainable methanol per year, which enhances the environmental performance of stabilizer ingredients.

By Polymer Type

Polyethylene (PE) represents the leading polymer type in the mast cell stabilizers market, holding the highest share owing to its extensive use in pharmaceutical packaging, medical components, and storage systems requiring chemical resistance and long-term stability. Its dominance is supported by high processing flexibility and strong compatibility with stabilizing agents that maintain material performance over time. Polypropylene (PP) maintains a substantial portion of demand due to its cost efficiency and structural integrity, while PVC and polystyrene (PS) serve niche applications. The ongoing shift toward lightweight and durable medical-grade polymers further strengthens PE’s leadership.

- For instance, Clariant recently introduced its PFAS-free AddWorks™ PPA 101 FG, featuring a 100% active fine-grain composition that improves extrusion efficiency and eliminates shark-skin defects in PE film applications.

By End User

Packaging emerges as the dominant end-user segment in the mast cell stabilizers market, securing the largest share as stabilizers are widely used to maintain material quality, prevent degradation, and support extended product shelf life in pharmaceutical and medical packaging systems. The segment’s growth is driven by the rising adoption of sterile, high-performance packaging solutions. The automotive, consumer goods, and building & construction sectors continue contributing steadily as they integrate stabilizers to enhance durability and environmental resistance. Other industries, including electronics and healthcare accessories, provide additional niche demand but remain secondary to packaging.

Key Growth Drivers

- Rising Prevalence of Allergic and Inflammatory Disorders

The growing incidence of asthma, allergic rhinitis, atopic dermatitis, and chronic inflammatory conditions significantly drives demand for mast cell stabilizers. Healthcare systems increasingly rely on these agents as safe, long-term treatment options with minimal systemic effects. The expansion of diagnostic capabilities and higher patient awareness promote earlier therapeutic intervention, boosting market adoption. Furthermore, pediatric patients—who often require non-steroidal alternatives—represent a major user base. As allergic conditions continue rising globally, especially in urban populations, mast cell stabilizers gain sustained clinical relevance.

- For instance, Polyvel’s softening masterbatches for nonwoven polypropylene (PP) are dosed as low as 0.5% by weight and are confirmed to be safe for use in products that contact human skin and food, without compromising safety.

- Increasing Shift Toward Non-Steroidal and Safer Therapeutic Alternatives

A strong market driver is the industry-wide movement toward non-steroidal therapies with favorable safety profiles. Mast cell stabilizers, known for their minimal long-term side effects, are increasingly preferred over corticosteroids for prophylactic treatment of allergic and respiratory conditions. The rising emphasis on long-term disease management in chronic asthma, food allergies, and ocular allergies enhances adoption. Regulatory bodies also promote safer alternatives, encouraging manufacturers to expand stabilizer-based formulations. This shift supports higher usage in vulnerable groups such as children, elderly patients, and individuals requiring prolonged therapy.

- For instance, Evonik Industries recently inaugurated a spray-drying facility in Darmstadt exclusively for its EUDRAGIT® polymer excipients, increasing production capacity while reducing its carbon footprint by saving over 1,000 tons of CO₂ equivalents annually.

- Advancement in Drug Delivery Technologies

Innovations in drug delivery—such as improved inhalation devices, sustained-release ocular formulations, and highly bioavailable intranasal sprays—are expanding the therapeutic potential of mast cell stabilizers. These technologies enhance onset of action, improve patient compliance, and enable targeted delivery to respiratory or ocular tissues. Pharmaceutical companies are increasingly investing in delivery platforms that enhance absorption and stability, especially for agents like cromolyn sodium and nedocromil. As device-drug integration advances, stabilizers gain stronger competitiveness against antihistamines and biologics, supporting broader clinical usage across respiratory and ocular segments.

Key Trends & Opportunities

- Expansion of Combination Therapies in Respiratory and Ocular Care

A key market trend is the rising integration of mast cell stabilizers into combination therapies with antihistamines or leukotriene inhibitors. These combinations offer improved symptomatic control, especially in moderate asthma, seasonal allergic conjunctivitis, and chronic rhinitis. Pharmaceutical companies view combination formulations as high-value innovations that strengthen product differentiation. Increased clinical trial activity exploring multi-mechanism treatment profiles creates opportunities for new fixed-dose combinations. As polytherapy becomes standard in allergy management, stabilizers gain renewed relevance within comprehensive treatment regimens.

- For instance, Chitec Technology is strengthening its formulation portfolio via its high-performance stabilizers: at ECS 2025, the company showcased its Chiguard® R-455 UV absorber, which can copolymerize into polyurethane and integrate directly into polymer backbone—its molecular design allows incorporation at a loading of up to 15 wt % without phase separation.

- Growing R&D Pipeline for Novel Stabilizing Molecules

The market benefits from ongoing research into next-generation mast cell stabilizers with enhanced potency, longer duration of action, and better tissue penetration. Biotech companies are exploring molecules capable of inhibiting multiple mediators beyond histamine, targeting pathways such as tryptase, cytokines, and prostaglandins. This trend creates opportunities for advanced therapeutics that address unmet needs in chronic urticaria, anaphylaxis prevention, and severe asthma. With rising investment in immunology and inflammation research, the pipeline for innovative stabilizers continues to expand.

- For instance, PMC Group’s organometallic division (PMC Organometallix) recently scaled up production of its ADVASTAB® line of heat stabilizers — manufacturing over 2,200 tonnes per year of its flagship organotin-free stabilizer in its Kentucky facility, boosting capacity for next-gen specialty chemistries.

- Increasing Opportunities in Pediatric and Geriatric Treatment Segments

Demand is rising in pediatric and elderly care, where steroid-sparing therapies are strongly preferred. Mast cell stabilizers, known for their favorable safety and tolerability profiles, align well with long-term use in these populations. The opportunity is expanding as healthcare providers increasingly adopt preventive therapy models in chronic allergies and asthma management. Additionally, aging populations experiencing rising rates of ocular allergies and respiratory sensitivities fuel broader market uptake. Tailored formulations—such as mild inhalers and gentle ophthalmic solutions—further strengthen adoption.

Key Challenges

- Limited Immediate Efficacy Compared to Antihistamines and Biologics

A major challenge for the market is the delayed onset of action associated with mast cell stabilizers, which often require several days to achieve full therapeutic effect. This limitation reduces their appeal for acute symptom relief, where antihistamines or fast-acting inhalers dominate. The emergence of biologics targeting IgE or eosinophilic pathways also shifts patient and clinician preference toward more potent, rapid-response therapies. As competitive pressure increases, stabilizers must rely on niche segments requiring long-term prophylaxis rather than quick relief.

- Low Patient Adherence Due to Frequent Dosing Requirements

Many mast cell stabilizer formulations require multiple daily doses, which affects patient compliance and long-term treatment continuity. In respiratory and ocular applications, patients often prefer once-daily or sustained-release alternatives, reducing stabilizer usage. Poor adherence limits clinical effectiveness and restricts broader adoption, particularly in chronic allergic conditions that demand consistent preventive therapy. Manufacturers face challenges in reformulating older drugs to match modern convenience standards, making innovation in delivery systems essential to improving adherence and sustaining market presence.

Regional Analysis

North America

North America holds the largest share of the mast cell stabilizers market, accounting for about 38–40%, driven by strong adoption of advanced allergy and asthma therapies. The region benefits from a well-established pharmaceutical landscape, high diagnosis rates of mast-cell–related disorders, and robust reimbursement frameworks that support patient access to cromolyn-based formulations. Growing clinical focus on managing chronic allergic conditions and increased preference for non-steroidal therapies further elevate market penetration. Major companies collaborate with research institutions to expand trials in immunology, strengthening innovation pipelines and sustaining the region’s leadership in mast cell stabilizer development and commercialization.

Europe

Europe represents around 27–29% of the global mast cell stabilizers market, supported by consistent healthcare investments and rising prevalence of allergy-related diseases across Western and Central Europe. Adoption of prescription-based mast cell stabilizers remains strong, particularly in countries with advanced respiratory and immunology treatment frameworks. Regulatory support from EMA for improving drug safety and production quality enhances manufacturer competitiveness. Growth is further driven by national initiatives promoting early diagnosis of asthma and mastocytosis. The market continues to expand due to increased availability of hospital-grade formulations and sustained research efforts in non-steroidal therapeutic alternatives for chronic inflammatory conditions.

Asia Pacific

Asia Pacific accounts for approximately 22–24% of the mast cell stabilizers market and is the fastest-growing region, driven by large patient populations with rising cases of allergic rhinitis, asthma, and food allergies. Expanding healthcare infrastructure and growing adoption of affordable generics significantly boost accessibility. Countries such as China, India, and Japan increasingly invest in respiratory health programs, improving diagnosis and treatment uptake. Pharmaceutical manufacturers are strengthening local production capacities to meet high demand for cromolyn sodium formulations. Rising awareness of non-steroidal anti-inflammatory options and inclusion of these drugs in national treatment guidelines further accelerate regional market expansion.

Latin America

Latin America captures about 7–8% of the global market, with gradual growth supported by improving healthcare coverage and increasing availability of cost-effective mast cell stabilizers. Countries such as Brazil, Mexico, and Argentina experience rising demand due to higher asthma incidence and expanding public health programs. Although adoption of advanced formulations remains limited compared to developed regions, growing import of branded products and strengthening generic manufacturing ecosystems contribute to market development. Efforts to enhance respiratory disease management and greater involvement of private healthcare providers support consistent uptake of mast cell stabilizing therapies across both urban and semi-urban populations.

Middle East & Africa

The Middle East & Africa region holds roughly 5–6% of the mast cell stabilizers market, with demand supported by increasing awareness of allergic and respiratory disorders. Growth is concentrated in Gulf countries, where high healthcare spending and access to specialty medicines enhance adoption. In Africa, market expansion is slower but supported by gradual improvements in clinical diagnosis and distribution of low-cost generics. International pharmaceutical companies are strengthening partnerships with regional distributors to improve access to cromolyn-based therapies. Rising investment in hospital infrastructure and national respiratory health initiatives positions the region for moderate but steady growth.

Market Segmentations:

By Types of Stabilizers:

- Antioxidants

- Heat stabilizers

By Polymer Type:

- Polyethylene (PE)

- Polypropylene (PP)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mast Cell Stabilizers Market features leading participants such as Perstorp Holding AB, Clariant, Polyvel, Evonik Industries, Chitec Technology, PMC Group, Baerlocher, BASF SE, Adeka Corporation, and Dover Chemical Corporation. The Mast Cell Stabilizers Market is defined by continuous innovation, expanding production capabilities, and increasing emphasis on high-purity formulations that improve therapeutic outcomes. Manufacturers focus on developing advanced non-steroidal stabilizers with enhanced stability, faster absorption, and better compatibility with inhalation and oral delivery systems. Strategic collaborations with pharmaceutical companies strengthen research pipelines and ensure reliable access to specialty chemicals used in drug formulations. Many firms are also investing in sustainable manufacturing practices and improved quality-control frameworks to meet stringent global regulatory standards. Growing demand for chronic allergy and asthma management treatments further motivates companies to optimize supply chains, expand distribution networks, and introduce more efficient formulation technologies to gain a competitive edge in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Perstorp Holding AB

- Clariant

- Polyvel

- Evonik Industries

- Chitec Technology

- PMC Group

- Baerlocher

- BASF SE

- Adeka Corporation

- Dover Chemical Corporation

Recent Developments

- In June 2025, Univar Solutions and Ingredion have partnered in the manufacturing and distribution of highly sought-after functional ingredients for more than 30 years. This collaboration not only bolsters Ingredion’s distribution network across Europe but also aligns seamlessly with the burgeoning clean-label trend.

- In May 2025, Austrade Inc. introduced a non-GMO hydrolyzed sunflower lecithin the powder is produced through a two-step process that combines enzymatic hydrolysis with concentration technology. The manufacturing process involves enzymatic hydrolysis combined with concentration technology.

- In January 2025, SONGWON Industrial partnered with Altek International FZE to distribute its PVC stabilizers across the Middle East and North Africa, a move aimed at meeting the region’s growing demand in construction and packaging sectors. Altek International, a chemical distribution company based in Dubai, was chosen for its expertise and extensive network in the MENA region to help expand SONGWON’s market presence and enhance customer service.

- In October 2024, Lesaffre, that it was acquiring a 70% stake in Biorigin from Zilor, a move designed to expand its presence in yeast derivatives for the savory food and functional beverage markets.

Report Coverage

The research report offers an in-depth analysis based on Types of Stabilizers, Polymer Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience rising demand as allergy, asthma, and mastocytosis cases continue to grow worldwide.

- Manufacturers will prioritize development of advanced non-steroidal stabilizers with improved bioavailability and stability.

- Pharmaceutical companies will increase investments in combination therapies that integrate mast cell stabilizers with modern immunomodulators.

- Growing adoption of inhalation and intranasal delivery systems will support better patient compliance and faster therapeutic response.

- Research will expand into applications beyond allergies, including gastrointestinal disorders and chronic inflammatory conditions.

- Regulatory bodies will strengthen quality and safety requirements, pushing companies to upgrade manufacturing standards.

- Emerging markets will contribute significantly due to expanding healthcare access and increasing awareness of preventive respiratory care.

- Digital health integration will support better disease monitoring and drive demand for maintenance treatments.

- Innovations in excipient technology will improve formulation efficiency and product shelf-life.

- Strategic collaborations between chemical suppliers and pharmaceutical companies will accelerate development of next-generation stabilizer solutions.