Market Overview

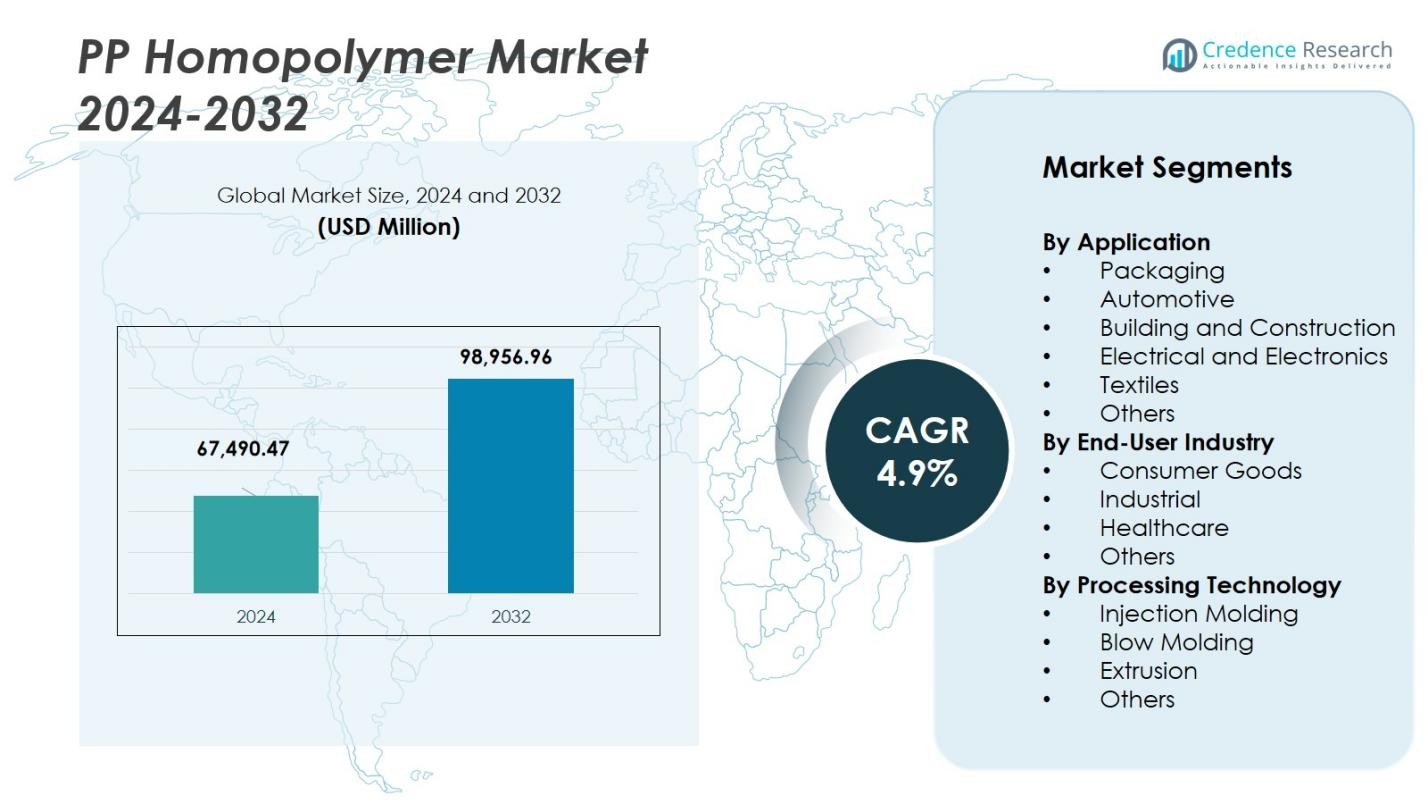

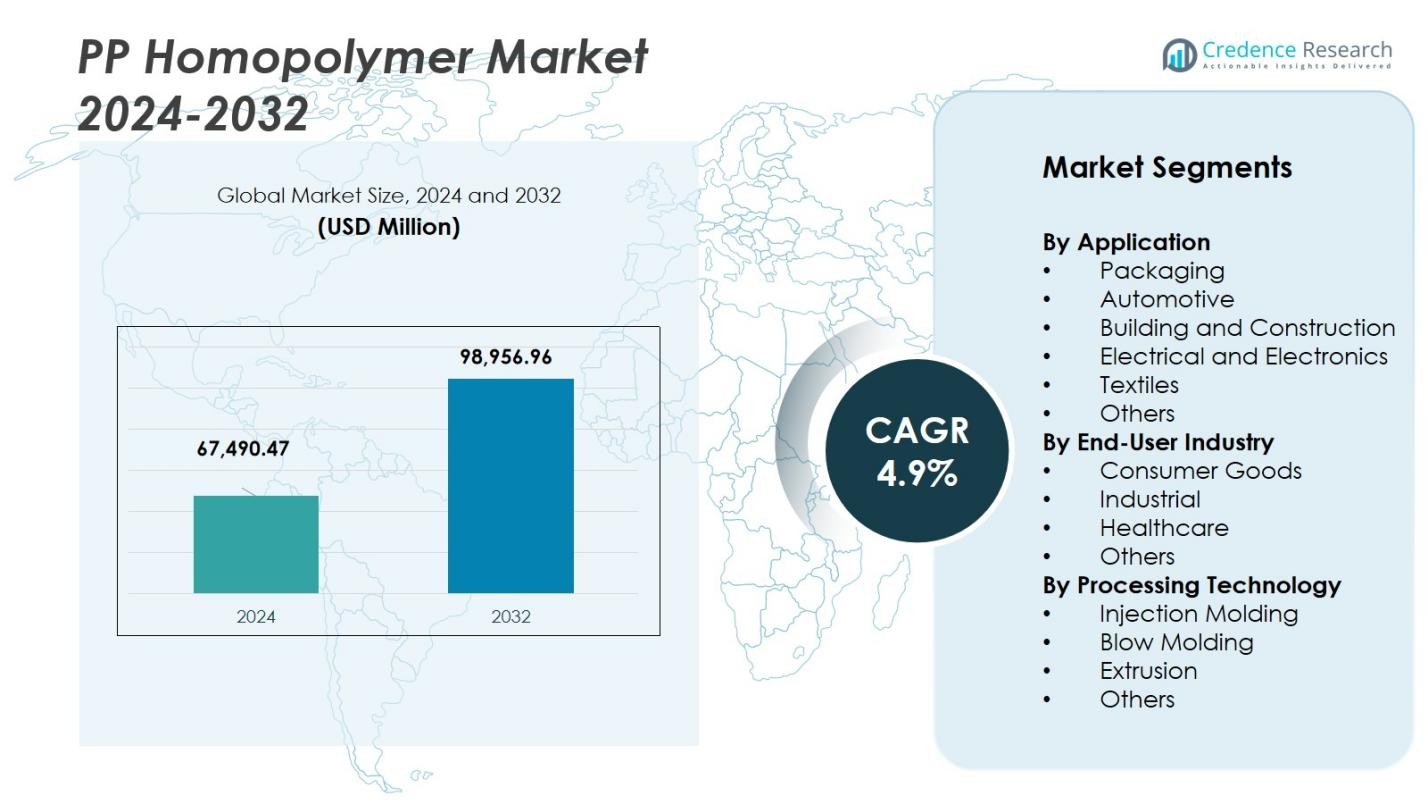

The PP Homopolymer Market size was valued at USD 67,490.47 million in 2024 and is anticipated to reach USD 98,956.96 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PP Homopolymer Market Size 2024 |

USD 67,490.47 Million |

| PP Homopolymer Market, CAGR |

4.9% |

| PP Homopolymer Market Size 2032 |

USD 98,956.96 Million |

The PP Homopolymer Market is driven by key players such as LyondellBasell Industries N.V., Reliance Industries Limited, Braskem S.A., INEOS Group Ltd., and ExxonMobil Corporation. These companies are major contributors to market innovation, production, and distribution, focusing on advancements in processing technologies, sustainability, and product diversification. The Asia Pacific region leads the market, supported by rapid industrialisation and strong demand in sectors like packaging, automotive, and consumer goods. North America follows with significant contributions from its mature industries, including packaging and automotive, while Europe’s market share is sustained by its emphasis on high-performance and recyclable materials. The Middle East and Latin America are emerging markets driven by infrastructure expansion and rising consumer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The PP Homopolymer Market was valued at USD 67,490.47 million in 2024 and is expected to reach USD 98,956.96 million by 2032 at a CAGR of 4.9%.

- Growth is driven by strong demand in packaging (accounting for about 40 % of the market) and the pursuit of lightweight, durable materials in automotive and construction sectors.

- Key trends include increasing uptake of post‑consumer recycled PP, a shift toward bio‑based homopolymer grades, and continuous advancements in injection molding and extrusion technologies.

- The market faces restraints from raw material price volatility, particularly propylene feedstock, as well as tightening environmental regulations that raise compliance costs for producers.

- Regionally, Asia‑Pacific dominates with approximately 45 % share, North America holds roughly 20 %, Europe about 18 %, Latin America around 7 %, and Middle East & Africa about 10 %.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Application:

In the PP Homopolymer market, the Packaging segment holds the largest share due to its widespread use in food packaging, consumer goods, and medical applications. This segment is driven by the growing demand for lightweight, cost-effective, and durable packaging solutions. Packaging accounts for 40% of the market share, as PP Homopolymer offers excellent chemical resistance and high clarity. The automotive industry follows closely, with applications in lightweight components driving its growth, contributing to around 30% of the total market share. Packaging’s dominance is supported by its sustainability and recyclability benefits.

- For instance, in packaging, companies utilize PP homopolymer to produce rigid food containers, such as yogurt tubs and margarine containers. Brands often rely on its high clarity and chemical resistance for consumer goods packaging that needs to maintain product integrity and appeal, such as in the case of specialized blown and cast films.

By End-User Industry:

The Consumer Goods sector is the dominant end-user industry for PP Homopolymer, capturing nearly 45% of the market share. The increasing demand for durable, lightweight, and cost-efficient products drives this segment, with PP Homopolymer being used in items such as household containers, toys, and personal care products. The Industrial segment is also significant, with a market share of about 30%, driven by PP Homopolymer’s strength and versatility in applications like storage tanks and pipes. Consumer goods remain the largest segment due to the material’s widespread use in mass-produced products.

- For instance, LyondellBasell supplies PP homopolymer used in food containers and household items that benefit from the material’s rigidity and chemical resistance.

By Processing Technology:

In the Processing Technology segment, Injection Molding leads with a dominant market share of approximately 50%. This growth is fueled by the material’s ability to produce high-precision and complex components at low cost. Injection molding’s versatility in manufacturing a range of products, from automotive parts to consumer goods, positions it as the preferred method. Extrusion follows with a 30% share, driven by its application in the production of films, sheets, and pipes, especially in the packaging and construction industries. The demand for efficient and scalable production techniques boosts the growth of both segments.

Key Growth Drivers

Rising Demand for Lightweight and Durable Materials

The increasing need for lightweight, durable, and cost-effective materials across industries such as automotive, packaging, and construction is a significant growth driver for the PP Homopolymer market. PP Homopolymer offers superior mechanical properties, such as high tensile strength and chemical resistance, which make it ideal for various applications. This demand is particularly strong in the automotive sector, where there is a constant push for fuel-efficient, lightweight components. Additionally, in packaging, PP Homopolymer’s durability and recyclability align with sustainability goals, further fueling market growth.

- For instance, in the automotive sector, LyondellBasell produces PP homopolymer grades widely used for lightweight components like interior panels and trims, contributing to improved fuel efficiency.

Expanding Packaging Industry

The packaging sector is a major contributor to the growth of the PP Homopolymer market. The material’s excellent clarity, high impact resistance, and ability to be molded into various shapes make it ideal for food and beverage packaging, as well as consumer goods and pharmaceuticals. As consumer demand for efficient, protective, and sustainable packaging increases, PP Homopolymer continues to be the preferred choice. The increasing focus on reducing plastic waste and enhancing the recyclability of packaging further supports the growth of PP Homopolymer in this segment.

- For instance, Braskem supply packaging-grade PP homopolymers known for their clarity, rigidity, and processability used in food containers, caps, and closures.

Technological Advancements in Processing Techniques

Advancements in processing technologies such as injection molding, extrusion, and blow molding have significantly enhanced the efficiency and cost-effectiveness of PP Homopolymer production. These innovations enable manufacturers to create high-quality, precision products with less waste, supporting broader applications across industries. Improved processing techniques also make it possible to scale production more efficiently, driving down costs and increasing the material’s adoption in a range of new markets. As these technologies continue to evolve, PP Homopolymer’s appeal in industrial and consumer goods applications grows.

Key Trends & Opportunities

Sustainability and Recycling Initiatives

Sustainability is becoming increasingly important across industries, presenting a key opportunity for the PP Homopolymer market. With growing concerns over plastic waste, there is a significant push for more recyclable and eco-friendly materials. PP Homopolymer, known for its excellent recyclability, is positioned well to capitalize on this trend. Manufacturers are focusing on improving recycling processes and increasing the use of post-consumer recycled (PCR) PP, thus enhancing the material’s appeal to environmentally-conscious consumers and industries seeking sustainable solutions.

- For instance, SABIC’s TRUCIRCLE initiative advances circular economy principles by increasing the adoption of post-consumer recycled (PCR) polypropylene in consumer goods and packaging, maintaining product performance while reducing environmental impact.

Shift Toward Bio-Based and Sustainable Materials

Another significant trend in the PP Homopolymer market is the growing shift toward bio-based and sustainable alternatives. Companies are exploring new ways to reduce their environmental footprint by adopting renewable raw materials in the production of PP Homopolymer. This shift is driven by increasing regulatory pressures and consumer demand for eco-friendly products. As a result, there are new opportunities for the development of bio-based PP Homopolymer, which not only aligns with sustainability goals but also provides a competitive advantage in an increasingly environmentally conscious market.

- For instance, Polyplastics launched Plastron LFT RA627P, a sustainable composite PP resin reinforced with long cellulose fibers, which reduces the carbon footprint by approximately 30% compared to traditional glass fiber-reinforced PP resin.

Key Challenges

Volatility in Raw Material Prices

One of the major challenges faced by the PP Homopolymer market is the volatility in raw material prices, particularly the price of propylene, which is a key feedstock for polypropylene production. Fluctuating raw material costs can impact the profitability of manufacturers and hinder market stability. Additionally, disruptions in the supply chain or geopolitical tensions affecting oil and gas production further exacerbate these price fluctuations, making it difficult for companies to maintain consistent pricing and supply levels for PP Homopolymer.

Environmental Concerns and Regulatory Pressures

Although PP Homopolymer is recyclable, there are ongoing environmental concerns related to plastic waste and its impact on ecosystems. Increasing regulatory pressures, particularly in Europe and North America, require manufacturers to address the sustainability of their products. Strict regulations on plastic packaging and waste management create challenges for PP Homopolymer producers, pushing them to invest in more sustainable production methods and improve the recyclability of their products. The evolving regulatory landscape presents both compliance challenges and opportunities for innovation in eco-friendly materials.

Regional Analysis

Asia Pacific

The Asia Pacific region holds a commanding share of the Polypropylene Homopolymer (PP Homopolymer) market at 45% of global consumption. This dominance stems from rapid industrialisation, booming packaging and automotive industries, and competitive manufacturing in countries like China and India. Cost‑effective production, expanding consumer goods demand and strong infrastructure investment further amplify uptake. Given the region’s ongoing urbanisation and favourable policies toward petrochemicals, Asia Pacific remains the primary growth engine for PP Homopolymer.

North America

North America commands 20% of the PP Homopolymer market, driven by advanced packaging, automotive and electrical industries with a strong focus on high‑performance and recyclable materials. The region’s mature petrochemical infrastructure and increasing regulatory emphasis on lightweight and sustainable plastics boost demand. Innovations in polymer processing and rising adoption in consumer goods and healthcare applications support steady growth. Thus, North America remains a key region for premium homopolymer applications.

Europe

In Europe, the PP Homopolymer market accounts for 18% share globally. The region benefits from robust automotive manufacturing, sophisticated packaging standards and strong regulatory impetus toward recyclability and circular economy models. European producers increasingly focus on sustainable grades and value‑added applications, such as advanced construction and electrical sectors. Consequently, the region offers a stable yet innovation‑driven market for PP Homopolymer, albeit with slower growth relative to emerging markets.

Latin America

Latin America represents 7% of the PP Homopolymer landscape, supported by expanding consumer goods, packaging and construction activities in Brazil, Mexico and other economies. While infrastructure and industrial maturation lag behind more developed regions, urbanisation and rising disposable incomes are catalysing increased polymer demand. Local manufacturing and import substitution efforts also bolster regional consumption. As a result, Latin America is a smaller but steadily growing market for PP Homopolymer.

Middle East & Africa

The Middle East & Africa region contributes the remaining share 10% of the PP Homopolymer market. Growth here is underpinned by raw material availability, petrochemical investments and rising infrastructure and construction activity in Gulf nations. Although consumption per capita remains lower than in Western regions, increasing urban expansion, packaging demand and industrial diversification position the region as an emerging front for homopolymer uptake.

Market Segmentations:

By Application

- Packaging

- Automotive

- Building and Construction

- Electrical and Electronics

- Textiles

- Others

By End-User Industry

- Consumer Goods

- Industrial

- Healthcare

- Others

By Processing Technology

- Injection Molding

- Blow Molding

- Extrusion

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the PP Homopolymer market features major players such as LyondellBasell Industries N.V., Reliance Industries Limited, Braskem S.A., INEOS Group Ltd., and ExxonMobil Corporation, who actively shape the global market dynamics. These organizations leverage integrated production facilities, expansive distribution networks, and sustained R&D investments to secure competitive advantage. They routinely pursue capacity expansions, product innovations—especially in sustainable and bio-based resins—and strategic alliances to deepen market reach. Pricing pressures from volatile feedstock costs and stiff competition from regional players compel these firms to improve operational efficiency and cost structures. Emerging companies and niche producers intensify competition by focusing on specialized applications and local markets, necessitating continuous adaptation in strategy to maintain leadership.

Key Player Analysis

- National Petrochemical Industrial Company

- Borealis AG

- Braskem S.A.

- ExxonMobil Corporation

- IRPC Public Company Limited

- LyondellBasell Industries N.V.

- Sasol Limited

- Total Petrochemicals USA Inc.

- Reliance Industries Limited

- INEOS Group Ltd.

Recent Developments

- In September 2025, Polychim Industrie partnered with Milliken & Company to bring UL‑validated PP resins into Europe, extending Polychim’s homopolymer PP capabilities for applications including food containers, cosmetic jars and garden furniture.

- In March 2025, Rialti (part of Borealis AG) launched new PP compound grades with post‑consumer recycled (PCR) content designed for structural uses in mobility, home & garden and construction.

- In September 2025, Formosa Plastics Corporation, USA (Point Comfort, Texas) successfully commissioned the largest horizontal polypropylene (PP) reactor in North America, with an annual capacity of 550 million pounds spanning homopolymer, random copolymer and impact copolymer grades.

- In June 2023, Grupa Azoty Group commenced production at its new “Polimery Police” facility in Poland, manufacturing polypropylene (including homopolymer grades) at a capacity of 437,000 tonnes/year.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, End User Industry, Processing Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The PP Homopolymer market is set to expand steadily, driven by rising demand across key end‑use sectors such as packaging, automotive and construction.

- Growing emphasis on lightweighting in the automotive industry is stimulating substitution of heavier materials with PP Homopolymer, thereby increasing its uptake.

- The surge of e‑commerce and changing consumer preferences toward convenience packaging is boosting the need for rigid and flexible PP Homopolymer solutions.

- Sustainability mandates and the growing circular economy movement are creating opportunities for post‑consumer recycled PP Homopolymer and advanced recycling technologies.

- Technological improvements in processing methods (such as more efficient injection moulding and extrusion) are enabling broader application of PP Homopolymer in complex components.

- Emerging economies, particularly in Asia‑Pacific, are escalating industrialisation and urbanisation, which is translating into higher demand for PP Homopolymer in infrastructure and consumer goods.

- Manufacturers are shifting toward bio‑based and specialty grades of PP Homopolymer to differentiate products and meet regulatory and consumer expectations.

- Supply‑side dynamics, including capacity expansions and favourable feedstock access (especially in petrochemical hubs) are improving cost competitiveness of PP Homopolymer.

- Digitalisation and automation across supply chains are enhancing production efficiency and traceability in PP Homopolymer manufacturing, supporting market growth.

- Despite growth prospects, stricter environmental regulations and rising competition from alternative materials will compel PP Homopolymer makers to innovate and adapt to retain market share.

Market Segmentation Analysis:

Market Segmentation Analysis: