Market Overview:

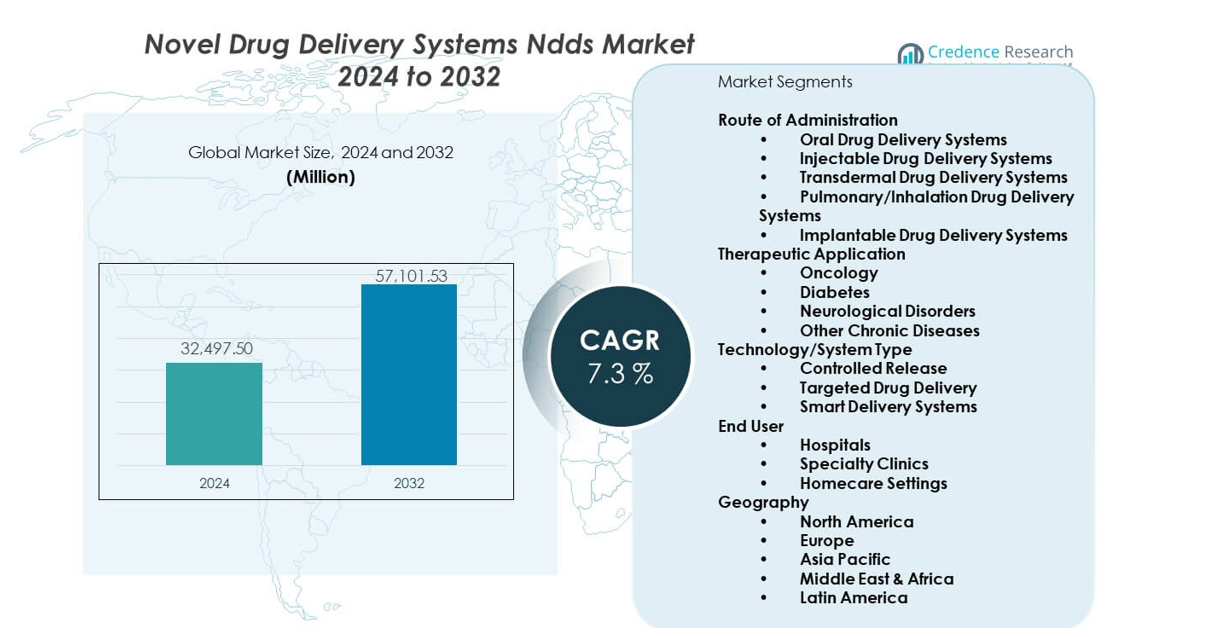

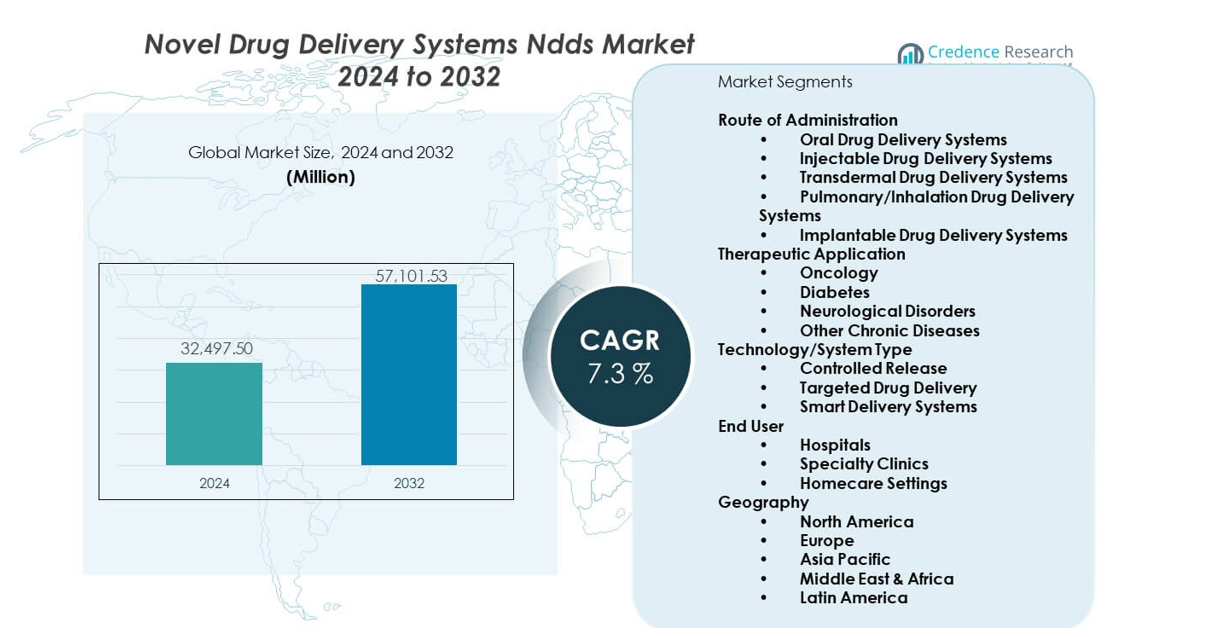

The Novel Drug Delivery Systems (NDDS) is projected to grow from USD 32,497.5 million in 2024 to an estimated USD 57,101.53 million by 2032, with a CAGR of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Novel Drug Delivery Systems (NDDS) Market Size 2024 |

USD 32,497.5 million |

| Novel Drug Delivery Systems (NDDS) Market, CAGR |

7.3% |

| Novel Drug Delivery Systems (NDDS) Market Size 2032 |

USD 57,101.53 million |

Demand grows due to rising interest in controlled-release formulations that improve therapeutic results. Drug makers invest in nano-based and polymer-based carriers to unlock complex molecule delivery. Biologics expansion encourages wider use of smart delivery platforms that support precision dosing. Research groups explore inhalable, transdermal, and implantable systems to reduce dosing frequency. Patient preference shifts toward less invasive options, which supports rapid development. Pharma companies embrace advanced technologies to extend product lifecycles. These factors build consistent momentum across global pipelines.

North America leads the market due to strong R&D activity, high adoption of advanced therapies, and a mature regulatory environment. Europe follows with sustained investment in innovative delivery models and broad use of biologics. Asia Pacific emerges as a high-growth region driven by expanding healthcare access, rising chronic disease rates, and growing biotech manufacturing. Countries such as China, India, and South Korea attract major clinical and commercial activities. Latin America and the Middle East develop gradually as adoption improves across healthcare systems.

Market Insights:

- The market grows from USD 32,497.5 million in 2024 to USD 57,101.53 million by 2032, with a 7.3% CAGR.

- North America 40%, Europe 28%, and Asia Pacific 22% lead due to strong R&D and high adoption.

- Asia Pacific, holding 22%, is the fastest-growing region driven by rising healthcare investment.

- Injectable systems hold about 38% share due to biologics demand across major therapies.

- Oncology applications hold nearly 32% share supported by high use of precision delivery systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Shift Toward Targeted and Controlled-Release Therapeutics

The Novel drug delivery systems ndds market gains momentum through strong demand for targeted therapies that enhance clinical outcomes. Healthcare providers seek platforms that deliver drugs precisely to diseased tissues. Pharma companies invest more in controlled-release formats to improve patient adherence. These systems support longer dosing intervals that appeal to chronic disease patients. Biologics expansion creates higher need for stable and precise delivery systems. Research teams refine delivery vehicles to enhance bioavailability. Developers emphasize patient-friendly designs to support compliance. The market strengthens as innovators reduce toxicity and improve safety profiles.

- For instance, Johnson & Johnson received FDA approval in 2025 for IMAAVY (nipocalimab), which blocks the neonatal Fc receptor to reduce circulating IgG antibodies, demonstrating superior disease control throughout 24 weeks with intravenous infusion every two weeks. Pharma companies invest more in controlled-release formats to improve patient adherence.

Rise of Biologics and Complex Molecule Development Driving Platform Innovation

Biologics growth pushes companies to adopt advanced delivery designs that handle sensitive molecules. Developers work on systems that protect active ingredients from degradation. The Novel drug delivery systems ndds market benefits from this shift toward complex therapeutics. Firms explore nano-based carriers to increase drug absorption. Research groups design transdermal films that bypass gastrointestinal barriers. Injectable depots gain wider use to improve release consistency. High global demand for precision therapies supports heavy development. The trend accelerates as healthcare providers shift toward customized care.

- For instance, Bayer’s BlueRock Therapeutics advanced bemdaneprocel, a stem cell-based Parkinson’s therapy, to Phase III clinical trials in 2025, with the investigational therapy receiving FDA Regenerative Medicine Advanced Therapy (RMAT) designation for surgically implanting dopamine-generating nerve cell precursors.

Increasing Preference for Non-Invasive and Patient-Friendly Delivery Approaches

Non-invasive formats gain strong acceptance across patient groups seeking comfort and convenience. Transdermal patches reduce need for frequent hospital visits. Inhalable systems support rapid onset and reduced discomfort. Pharma players design oral thin films for easier consumption. Smart delivery devices improve dosing accuracy for chronic conditions. Consumers favor solutions that fit daily routines without disruptions. Developers introduce wearable devices to enable continuous drug release. The shift strengthens the market as providers prioritize patient-centered treatment models.

Expanding Clinical Applications Across Chronic and Lifestyle-Related Diseases

Chronic diseases stimulate ongoing demand for advanced delivery technologies. Healthcare systems integrate long-acting formulations to support consistent patient outcomes. Oncology applications push firms to develop more accurate carriers for toxic drugs. Diabetes therapy incorporates newer delivery systems that reduce daily dosing. Respiratory disease care uses inhalable carriers that enhance treatment effectiveness. The Novel drug delivery systems ndds market expands with broader clinical adoption. Providers adopt implantable systems for long-term release. Demand increases as global chronic illness rates rise.

Market Trends:

Advancements in Nanotechnology Driving Precision and Ultra-Targeted Delivery Expansion

Nanotechnology adoption grows rapidly across development pipelines. Researchers use nanoparticles to deliver drugs directly to disease sites. This approach reduces systemic exposure and enhances therapeutic efficiency. Companies optimize nanoformulations to stabilize fragile ingredients. The Novel drug delivery systems ndds market gains from these advancements. Developers experiment with lipid nanoparticles for genetic medicine. Polymer-based nanocarriers improve long-term release control. Precision delivery gains traction in oncology and rare disease care. Firms increase investments to expand nano-enabled product portfolios.

- For instance, genome-targeted therapy response rates increased from 2.73% in 2006 to 7.04% in 2020, with eligibility rising from 5.13% to 13.60% over the same period, spanning 18 cancer types and 36 genomic indications. Firms increase investments to expand nano-enabled product portfolios.

Growth of Smart, Connected, and Sensor-Enabled Drug Delivery Devices

Smart devices reshape the delivery landscape through integrated sensors and feedback systems. Wearable injectors allow automated dosing adjustments. Connected inhalers track usage patterns for clinical monitoring. Digital platforms collect adherence data for treatment planning. Companies design smart depots that adjust release levels based on real-time cues. The Novel drug delivery systems ndds market benefits from this digital transformation. Patient engagement improves through app-linked delivery systems. Providers adopt remote monitoring to manage chronic conditions. The trend advances personalized care models globally.

- For instance, Merck (Merck KGaA) and Flex won the 2025 PDA Drug Delivery Innovation Award in October 2025 for their connected autoinjector system integrating smart injection device, cloud-based data, patient mobile app, and healthcare professional dashboard. The trend advances personalized care models globally.

Increasing Adoption of Long-Acting and Extended-Release Delivery Systems Across Therapy Areas

Long-acting formulations attract widespread interest due to their convenience and therapeutic consistency. Developers refine depot injections that sustain release over months. Extended-release oral designs support improved medication adherence. Transdermal systems evolve to offer multi-day delivery durations. Healthcare teams prefer these platforms for chronic treatments. The Novel drug delivery systems ndds market expands through their broad use. Drug makers rely on extended-release formats to strengthen product lifecycles. Patients benefit from reduced frequency of dosing. The trend continues as research focuses on durability and stability.

Expansion of Gene, RNA, and Cell-Based Therapies Creating New Delivery System Demand

Advanced therapeutic modalities increase demand for specialized carriers. Gene therapies require systems that protect genetic material during transport. RNA therapeutics rely on delivery vehicles that improve cellular uptake. Cell-based therapies need controlled microenvironments for administration. Developers invest in next-generation carriers for precision placement. The Novel drug delivery systems ndds market aligns with these therapeutic advancements. Researchers focus on lipid-based platforms for RNA delivery. Companies experiment with viral and non-viral vectors. Growth accelerates as advanced therapies enter larger markets.

Market Challenges Analysis:

Technical, Regulatory, and Manufacturing Complexities Slowing Large-Scale Adoption

The sector faces technical hurdles that complicate development timelines. Many delivery formats require sensitive materials that demand strict handling. Manufacturers struggle with scale-up due to precision requirements. Regulators apply tighter scrutiny to ensure patient safety. The Novel drug delivery systems ndds market must navigate complex approval pathways. Companies balance innovation with long validation cycles. Developers invest more resources to meet compliance needs. These challenges slow entry of newer systems into global markets. Firms continue refining processes to reduce risk and improve reliability.

High Development Costs, Limited Patient Awareness, and Reimbursement Barriers

High development spending restricts participation for smaller firms. Delivery systems often require specialized materials and advanced equipment. Healthcare providers face cost pressures that limit adoption of premium formats. Patients may lack awareness of advanced delivery options. Payers resist reimbursement for newer platforms without strong clinical evidence. The Novel drug delivery systems ndds market is affected by these financial hurdles. Firms respond by building stronger real-world data to support coverage. Long-term success depends on better education, pricing strategies, and reimbursement approvals.

Market Opportunities:

Expansion Into Personalized Medicine, Rare Disease Care, and Precision Therapeutic Platforms

Personalized treatment models create strong demand for advanced delivery systems. Developers build carriers that match individual patient needs. The Novel drug delivery systems ndds market benefits as precision care expands. Rare disease therapies require targeted delivery designs for optimal impact. Drug makers explore micro-dosed systems that improve safety. Providers adopt solutions that support complex molecular structures. Growth strengthens with demand for patient-specific therapies. Broad innovation encourages deeper pipeline investment.

Strong Potential in Emerging Markets, Home-Based Care, and Non-Invasive Delivery Modalities

Emerging economies adopt advanced delivery technologies at faster rates. Healthcare systems improve infrastructure to support innovation. Home-care adoption rises with demand for self-administered treatments. Non-invasive solutions appeal to wider patient segments. The Novel drug delivery systems ndds market gains traction through accessible formats. Pharma companies expand into regions with rising chronic illness rates. Wearable and portable systems match the needs of modern care. Long-term opportunities expand with broader global participation.

Market Segmentation Analysis:

Route of Administration

Oral drug delivery systems retain high acceptance due to convenience and compatibility with multiple therapies. Injectable drug delivery systems expand with the rise of biologics and long-acting formulations. Transdermal systems appeal to patients seeking non-invasive and steady-release options. Pulmonary and inhalation systems support both respiratory and systemic treatments. Implantable platforms gain interest for sustained release in chronic disease care. Each route strengthens performance across therapeutic areas. Innovation improves dose accuracy and patient experience. The Novel drug delivery systems ndds market benefits from broad adoption.

- For instance, transdermal drug delivery avoids first-pass metabolism and improves bioavailability, with iontophoresis successfully delivering biologically active human basic fibroblast growth factor (17.4 kDa) in therapeutically relevant amounts. Pulmonary and inhalation systems support both respiratory and systemic treatments. Implantable platforms gain interest for sustained release in chronic disease care.

Therapeutic Application

Oncology drives strong demand for targeted and precision-based delivery systems. Diabetes treatment uses extended-release and device-supported formats that support steady dosing. Neurological disorders require delivery platforms that improve penetration and bioavailability. Other chronic diseases rely on systems that enhance consistency and reduce treatment burden. Each area pushes developers to refine delivery efficiency. Providers adopt advanced systems to support long-term care plans. Adoption grows with better clinical outcomes. Diverse applications expand market depth across global healthcare settings.

- For instance, Roche announced a $50 billion investment over five years in April 2025 for its U.S. pharmaceutical and diagnostics business, covering both research and development (R&D) and manufacturing facilities for next-generation metabolic medicines, gene therapy, and weight loss treatments. Meanwhile, Sanofi completed its $9.1 billion acquisition of Blueprint Medicines in July 2025, adding Ayvakit with net revenues of $479 million in 2024 and potential global revenues of $2 billion by 2030.

Technology/System Type

Controlled release systems support stable dosing and reduce fluctuations in therapeutic exposure. Targeted drug delivery platforms enable more accurate placement of active ingredients. Smart delivery systems integrate sensors and digital support for improved adherence. Developers refine material science to enhance performance. Healthcare providers rely on these systems for complex therapeutic needs. Research activity accelerates design improvements. Adoption increases as technology reduces dosing frequency. These advancements strengthen overall reliability in treatment delivery.

End User

Hospitals remain leading adopters due to complex treatment requirements and advanced therapeutic needs. Specialty clinics integrate targeted and precision delivery systems for focused care pathways. Homecare settings expand with rising demand for user-friendly and self-administered formats. Device-based systems support remote treatment management. Providers choose systems that improve stability and ease of use. Demand rises with chronic disease prevalence. Innovation supports broader use across all care environments. Each end user segment enhances overall market penetration.

Segmentation:

Route of Administration

- Oral Drug Delivery Systems

- Injectable Drug Delivery Systems

- Transdermal Drug Delivery Systems

- Pulmonary/Inhalation Drug Delivery Systems

- Implantable Drug Delivery Systems

Therapeutic Application

- Oncology

- Diabetes

- Neurological Disorders

- Other Chronic Diseases

Technology/System Type

- Controlled Release

- Targeted Drug Delivery

- Smart Delivery Systems

End User

- Hospitals

- Specialty Clinics

- Homecare Settings

Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the novel drug delivery systems ndds market, accounting for around 40% of global revenue. Strong R&D investment and early adoption of biologics drive consistent demand. The region benefits from advanced healthcare systems that support premium delivery technologies. Pharma companies expand targeted and controlled-release platforms to strengthen treatment outcomes. The market gains support from high adoption of smart and connected delivery devices. It grows with continuous product innovation and regulatory clarity. Healthcare providers in the United States and Canada lead global usage across multiple therapeutic areas.

Europe

Europe represents the second-largest regional share, contributing about 28% of the novel drug delivery systems ndds market. The region benefits from strong regulatory standards and broad clinical acceptance of advanced delivery formats. Biotech expansion in Germany, France, and the United Kingdom supports steady adoption. Hospitals integrate long-acting and targeted systems to enhance treatment accuracy. The market grows through expanded use of non-invasive and controlled-release therapies. It strengthens with collaborative research supported by academic and industry partnerships. Rising chronic disease cases further increase demand across major EU countries.

Asia Pacific

Asia Pacific holds nearly 22% share and stands as the fastest-growing region in the novel drug delivery systems ndds market. Rising healthcare spending supports higher adoption of innovative delivery systems. Strong manufacturing capabilities in China, India, and South Korea create competitive production advantages. Healthcare providers shift toward targeted platforms to manage chronic disease burdens. Growing awareness of long-acting and patient-friendly systems expands usage across urban centers. It gains strong momentum through technology transfer and increasing biologics adoption. Expanding clinical trials contribute to broader system integration across major markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Johnson & Johnson

- Novartis AG

- Pfizer Inc

- GlaxoSmithKline plc (GSK)

- Merck & Co Inc

- Roche Holding AG

- Sanofi

- AstraZeneca plc

- Bayer AG

- Abbott Laboratories

Competitive Analysis:

The Novel drug delivery systems ndds market shows strong competition among global pharma leaders. Companies focus on precision systems, non-invasive formats, and advanced biologic delivery. Firms invest in sensor-enabled platforms to improve adherence and reduce dosing issues. It pushes developers to upgrade materials and device design. Key players acquire small innovators to expand technology access. Many brands launch controlled-release systems to strengthen clinical outcomes. The landscape favors companies with strong pipelines and broad regulatory experience. Competitive intensity rises as demand shifts toward customized delivery formats.

Recent Developments:

- In November 2025, Johnson & Johnson reinforced its leadership in hematology by unveiling paradigm-shifting research at the ASH 2025 conference, featuring more than 60 abstracts spotlighting innovations in drug delivery for blood cancers. The company highlighted advancements with DARZALEX FASPRO®, which is co-formulated with Halozyme’s ENHANZE® drug delivery technology, enabling subcutaneous administration with improved patient convenience.

- In October 2025, Merck (known as Merck KGaA in Europe) and Flex won the prestigious 2025 PDA Drug Delivery Innovation Award for their collaboration on a connected autoinjector system. The award-winning solution integrates a smart injection device, cloud-based data system, patient mobile app, and healthcare professional monitoring dashboard. The connected device supports automated injection, real-time data sharing, personalized settings, and intuitive interfaces to enhance treatment adherence and patient outcomes in chronic disease management.

- In September 2025, Pfizer reached a landmark agreement with the U.S. Government to lower drug costs for American patients while securing certainty from tariffs and establishing a balanced global pricing framework. The agreement provides Pfizer with a three-year grace period during which products under Section 232 investigation won’t face tariffs, provided the company further invests in U.S. manufacturing.

- In April 2025, Johnson & Johnson received FDA approval for IMAAVY™ (nipocalimab-aahu), a novel FcRn blocker monoclonal antibody designed to treat generalized myasthenia gravis. The approval represents a significant advancement in drug delivery for autoimmune diseases, as IMAAVY provides long-lasting disease control through intravenous infusion every two weeks. The therapy works by blocking the neonatal Fc receptor to reduce circulating IgG antibodies that cause the disease, demonstrating superior disease control throughout 24 weeks compared to placebo plus standard of care.

Report Coverage:

The research report offers an in-depth analysis based on Route of Administration, Therapeutic Application, Technology/System Type, Geography, and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand rises for patient-friendly systems across chronic therapies worldwide.

- Smart devices gain broader use in remote and digital care models.

- Nano-based carriers expand across oncology and rare disease pipelines.

- Non-invasive systems grow with higher comfort and acceptance levels.

- Controlled-release formats gain priority in long-term therapies.

- Biologics growth drives new precision-focused delivery platforms.

- Emerging markets adopt advanced formats with rising healthcare spending.

- Wearable injectors strengthen home-based treatment models.

- AI-enabled monitoring improves system efficiency and user compliance.

- Global partnerships accelerate innovation in high-value systems.