Market Overviews

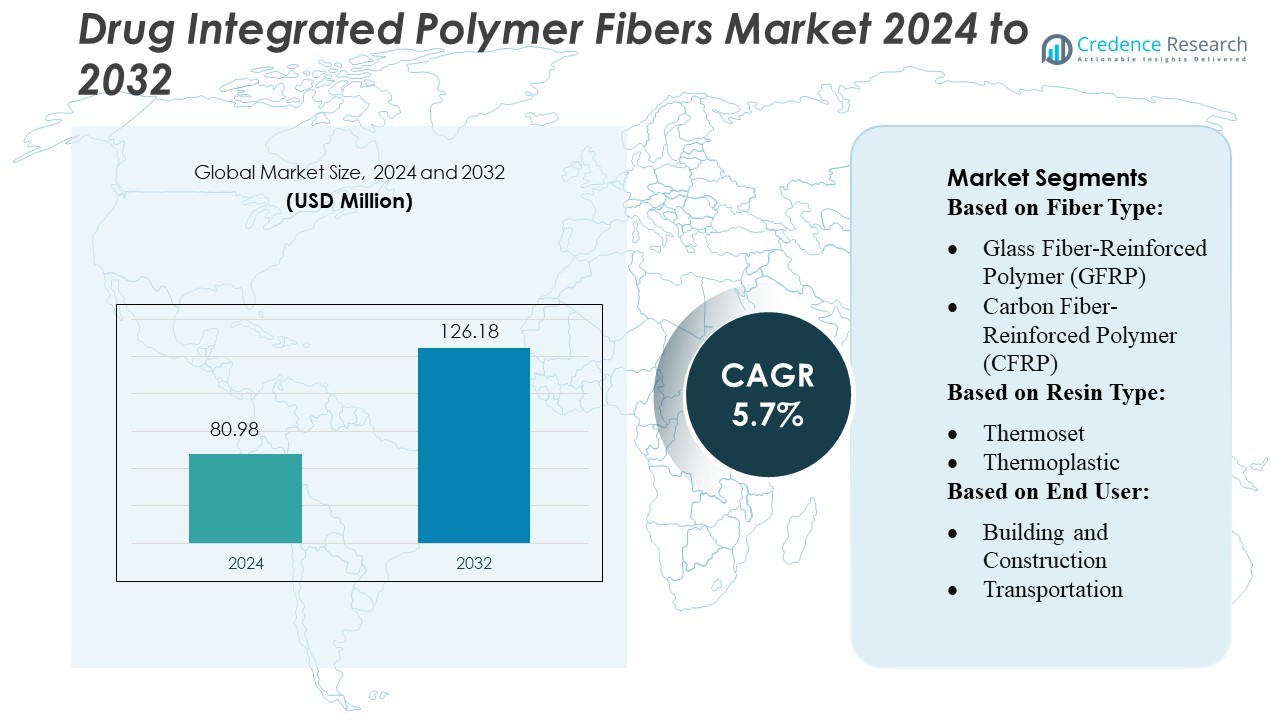

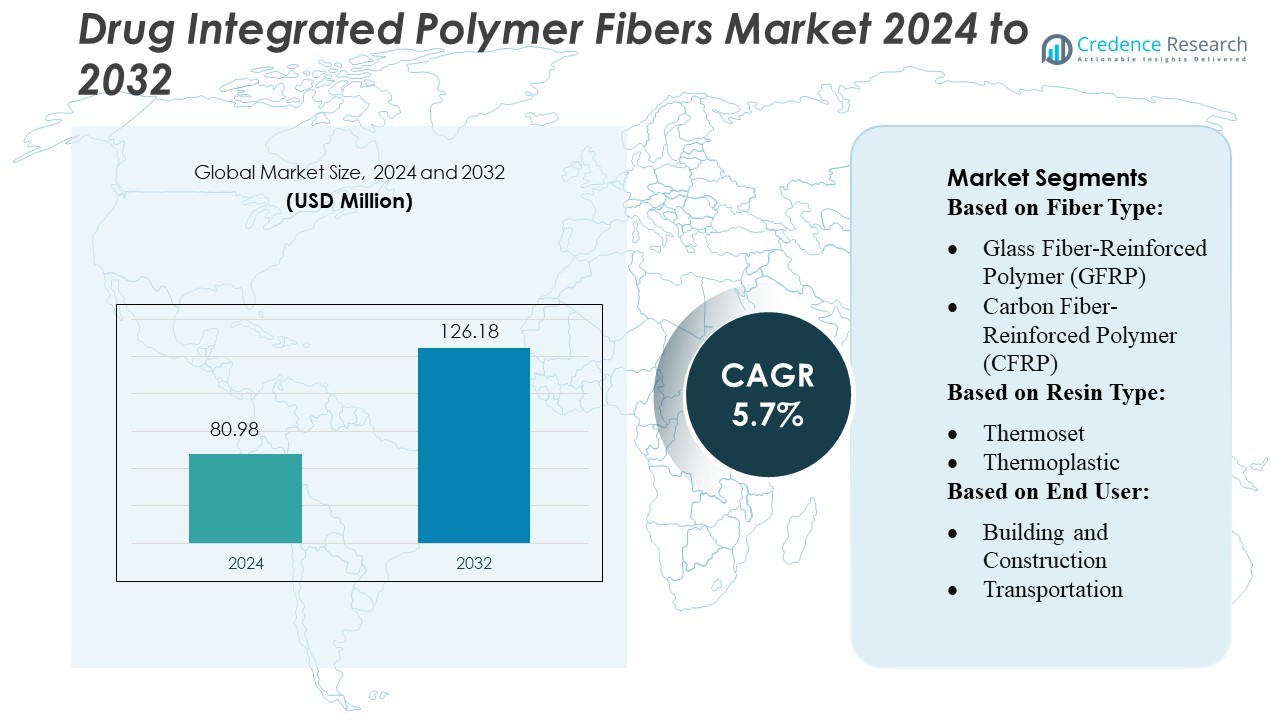

Drug Integrated Polymer Fibers Market size was valued USD 80.98 million in 2024 and is anticipated to reach USD 126.18 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Integrated Polymer Fibers Market Size 2024 |

USD 80.98 Million |

| Drug Integrated Polymer Fibers Market, CAGR |

5.7% |

| Drug Integrated Polymer Fibers Market Size 2032 |

USD 126.18 Million |

The global Drug Integrated Polymer Fibers market is led by major chemical and biomedical players such as BASF SE, Evonik Industries AG, DuPont de Nemours, Inc., Teijin Limited, Toray Industries, Inc., Solvay S.A., DSM N.V., Asahi Kasei, and Teijin Aramid, which together drive innovation in biodegradable fiber systems for controlled drug delivery. The market is strongly concentrated in North America, which commands approximately 42.5% of global share, owing to the region’s advanced R&D infrastructure, favorable regulations, and high adoption of next-generation therapeutic fiber technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Drug Integrated Polymer Fibers Market reached USD 80.98 million in 2024 and is projected to hit USD 126.18 million by 2032, expanding at a 7% CAGR, supported by rising demand for advanced drug-delivery platforms.

- Growing adoption of biodegradable and programmable polymer fibers drives market growth as healthcare systems prioritize controlled, sustained, and localized drug-release technologies.

- Leading players such as BASF SE, Evonik, DuPont, Teijin, Toray, Solvay, DSM, Asahi Kasei, and Teijin Aramid intensify competition through innovations in bio-resorbable materials and fiber-engineered therapeutics.

- High production costs, strict regulatory pathways, and limited large-scale manufacturing capabilities restrain faster commercialization across developing regions.

- North America holds 42.5% of the global market, supported by strong R&D investments, while the biomedical segment accounts for the dominant share due to rising application in wound care, tissue engineering, and implantable drug-delivery systems.

Market Segmentation Analysis:

By Fiber Type

Glass Fiber–Reinforced Polymer (GFRP) dominates the Drug Integrated Polymer Fibers market, accounting for an estimated 55–60% share, driven by its high tensile strength, chemical resistance, and adaptable drug-loading capacity. Manufacturers increasingly use GFRP to embed antimicrobial, anti-inflammatory, or controlled-release compounds into structural materials used in medical and industrial environments. Its compatibility with surface-functionalization techniques and micro-encapsulation processes enables precise dosing profiles, making GFRP the preferred choice for applications requiring both structural reinforcement and therapeutic functionality.

- For instance, Röchling SE & Co. KG manufactures GFRP profiles up to 6,000 mm in length and 1,000 mm in width for high-demand applications, showcasing their ability to embed functional agents into large-format structural parts.

By Resin Type

Thermoset-based drug integrated polymer fibers hold the leading position with approximately 60% market share, supported by their superior dimensional stability, low creep, and strong cross-linked structure that preserves drug uniformity during curing. Epoxy and polyester thermosets provide consistent diffusion pathways, enabling long-acting release performance for embedded pharmaceuticals, biocides, and protective agents. Their thermal resistance and mechanical reliability make them the preferred matrix for advanced composites used in healthcare infrastructure, protective equipment, and specialty components requiring sustained bioactive delivery.

- For instance, Toray Industries’ 3940 thermosetting matrix resin, when paired with their TORAYCA® T1100G carbon fibers, achieves a 30% increase in tensile strength and impact resistance compared to conventional prepregs, while maintaining cross-linked elasticity.

By End User

Building and construction represents the dominant end-user segment with an estimated 45% market share, driven by increasing adoption of drug-integrated fiber composites in antimicrobial panels, self-sterilizing surfaces, corrosion-resistant structures, and smart rehabilitation materials. The ability to integrate agents such as fungicides, anti-bacterial compounds, or healing promoters directly into fiber-reinforced systems enhances durability and safety in high-traffic or moisture-prone environments. Rising demand for infrastructure materials that combine structural function with embedded protective or therapeutic properties continues to accelerate the segment’s growth.

Key Growth Drivers

- Rising Demand for Controlled and Sustained Drug Delivery

The market grows as healthcare and material science industries increasingly integrate controlled-release pharmaceutical technologies into polymer fiber systems. Drug-integrated fibers offer precise dosing, extended release durations, and enhanced therapeutic efficacy compared with conventional delivery methods. Their ability to embed antimicrobials, anti-inflammatory drugs, or biocides within structural materials supports applications in wound care, medical textiles, and infection-resistant infrastructure. Adoption accelerates further as manufacturers develop micro-encapsulation and nanocarrier technologies that improve drug stability, biocompatibility, and targeted release profiles.

- For instance, Avient Corporation leveraged its Dyneema® ultra-high molecular weight polyethylene (UHMWPE) fibers—which are 15× stronger than steel per their own testing.

- Expansion of Smart Materials in Construction and Industrial Applications

Demand accelerates as smart construction materials incorporate drug-integrated fibers to deliver functionalities such as antimicrobial protection, corrosion inhibition, and self-healing performance. These fibers enable long-lasting protection in high-moisture and high-contamination environments, supporting safer building systems, industrial assets, and transportation structures. The ability to embed bioactive compounds directly into composite matrices reduces maintenance needs and extends asset life cycles. Growing interest in intelligent materials for hospitals, public infrastructure, and high-traffic facilities reinforces adoption of drug-integrated polymer fiber composites.

- For instance, Solvay has developed a recyclable thermoset system under its CYCOM® brand that uses cleavable disulfide linkages enabling the recovery of carbon fibers with over 95% retention of original tensile strength.

- Advancements in Fiber Reinforcement and Resin Technologies

Rapid innovation in GFRP and advanced thermoset/thermoplastic matrices significantly strengthens market expansion. New resin chemistries improve drug compatibility, thermal stability, and diffusion control, allowing manufacturers to tailor release rates for diverse use cases. Reinforcement technologies—including hybrid fiber architectures, surface functionalization, and nano-additive integration—enhance mechanical strength without compromising bioactive performance. These advancements broaden applications across medical devices, transportation interiors, protective equipment, and engineered structures, enabling the market to scale into high-performance environments requiring multifunctional material solutions.

Key Trends & Opportunities

- Growth of Antimicrobial and Self-Sterilizing Infrastructure Materials

A major trend involves integrating antimicrobial agents, disinfectants, and pathogen-neutralizing compounds into polymer fiber composites for public and medical infrastructure. Demand increases due to heightened awareness of surface contamination risks in hospitals, transport hubs, and commercial buildings. Drug-integrated fibers create long-acting, self-sanitizing surfaces that reduce infection transmission and maintenance frequency. This trend opens opportunities for manufacturers to introduce specialty fibers tailored for healthcare furniture, HVAC systems, wall panels, and sanitary equipment, supporting global initiatives for cleaner, safer built environments.

- For instance, SABIC offers nine antimicrobial resin grades under its LNP™ and LEXAN™ product lines that leverage silver-based technology; five of these grades achieve a log reduction value above 4, indicating over 99.99% pathogen reduction as per ISO 22196 testing.

- Increasing Use of Bioactive Fiber Composites in Medical Textiles

Medical textiles represent a growing opportunity as manufacturers adopt polymer fibers embedded with wound-healing drugs, anti-inflammatory compounds, and antimicrobial agents. These materials enhance patient outcomes by delivering sustained therapeutic effects while maintaining flexibility, breathability, and structural integrity. Drug-integrated fibers are gaining traction in advanced wound dressings, implantable meshes, suture materials, and wearable health devices. Growth is driven by the rising prevalence of chronic wounds, surgical procedures, and demand for high-performance biomedical fabrics that combine comfort with therapeutic functionality.

- For instance, Hexcel has established a 10-year recycling agreement with Fairmat to repurpose composite scrap — the Fairmat facility spans 15,000 sq ft and recovers Hexcel’s prepreg waste to produce new materials.

- Rising Adoption of Eco-Friendly and Biodegradable Drug-Integrated Fibers

Sustainability goals accelerate the development of biodegradable polymer fibers capable of delivering bioactive agents during their degradation cycle. These solutions reduce environmental impact while supporting controlled drug release for agricultural, medical, and industrial applications. Biodegradable fibers loaded with fungicides, growth stimulants, or therapeutic compounds offer new opportunities in smart agriculture, tissue engineering, and temporary medical implants. Manufacturers exploring bio-based resins, natural reinforcement fibers, and green synthesis methods gain a competitive advantage in markets prioritizing eco-safe materials.

Key Challenges

- Complexity of Drug Compatibility and Stability Within Composite Structures

A major challenge arises from ensuring pharmaceutical compounds remain stable during fiber manufacturing processes, which often involve high temperatures, reactive curing cycles, or mechanical stress. Drug molecules may degrade, lose potency, or exhibit inconsistent distribution within the polymer matrix. Achieving uniform dispersion, maintaining chemical integrity, and preventing premature release require advanced encapsulation and resin engineering techniques. These complexities increase development costs and limit the range of drugs that can be effectively integrated into polymer fiber systems.

- Regulatory and Safety Validation Across Multiple Industries

Drug-integrated polymer fibers face complex regulatory pathways because they combine pharmaceutical and structural material functions. Manufacturers must demonstrate not only mechanical safety and durability but also biocompatibility, controlled release performance, and long-term exposure safety. Regulatory approval varies widely across medical, construction, industrial, and consumer sectors, creating lengthy testing cycles and high compliance costs. The absence of standardized global guidelines further complicates certification, slowing commercialization and increasing barriers for new entrants in the market.

Regional Analysis

North America

North America holds the largest share of the Drug-Integrated Polymer Fibers market, accounting for approximately 38–40% of global revenue, driven by strong adoption in controlled-release drug delivery, regenerative medicine, and wound-care applications. The region benefits from advanced biopolymer innovation, high R&D expenditure, and extensive clinical integration across pharmaceutical and medical device companies. The U.S. leads due to its robust regulatory pathways for combination products and active academic-industry collaborations supporting electrospun fiber technologies. Rising demand for personalized drug-release implants and increased investment in localized drug-elution materials continue to strengthen regional growth and reinforce North America’s leadership position.

Europe

Europe represents around 27–29% of the global market, supported by strong biomedical materials research and early adoption of polymer-based drug-delivery platforms. Countries such as Germany, the UK, and the Netherlands lead innovation in biodegradable fibers used for chronic wound management, oncology implants, and antimicrobial sutures. The region’s stringent quality standards accelerate the development of high-precision polymer fiber technologies tailored for controlled pharmacokinetics. Growing demand for minimally invasive drug-delivery solutions and expanded EU funding for smart biomaterials research further enhance market penetration, while strategic partnerships between universities and medical-technology companies sustain Europe’s competitive position.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding 22–24% of the market and expanding rapidly due to increased investment in healthcare materials, rising chronic disease prevalence, and the scale-up of advanced drug-delivery manufacturing. China, Japan, South Korea, and India are key contributors, driven by strong pharmaceutical production capabilities and government support for biomaterial innovation. The region shows robust adoption of polymer fiber-based implants, antimicrobial dressings, and sustained-release therapeutic devices. Growing clinical integration of electrospun fibers and expanding contract manufacturing services strengthen APAC’s position, enabling rapid commercialization and competitive cost advantages compared with Western markets.

Latin America

Latin America accounts for 6–7% of the Drug-Integrated Polymer Fibers market, with growth driven by modernization of medical infrastructure and gradual adoption of advanced wound-care and drug-delivery materials. Brazil and Mexico dominate regional demand, supported by expanding pharmaceutical manufacturing and increasing focus on cost-effective controlled-release solutions. While high-end polymer fiber implants are still at an early stage of adoption, the region shows rising interest in biodegradable fibers for infection control, diabetic wound management, and localized drug-release therapies. Growing partnerships with global suppliers and improved regulatory harmonization are expected to accelerate long-term market development.

Middle East & Africa

The Middle East & Africa region holds 4–5% of global market share, characterized by emerging adoption of polymer-fiber-based drug-delivery systems, especially in advanced wound-care and postoperative infection-control applications. The Gulf countries lead due to higher healthcare spending and increased procurement of innovative biomaterials, while South Africa drives research-level adoption. Market expansion remains gradual because of limited manufacturing capability, but investments in specialty medical technologies and rising chronic disease burden support long-term demand. International collaborations with medical-device companies and growing awareness of biodegradable drug-eluting fibers are helping integrate these solutions into regional treatment pathways.

Market Segmentations:

By Fiber Type:

- Glass Fiber-Reinforced Polymer (GFRP)

- Carbon Fiber-Reinforced Polymer (CFRP)

By Resin Type:

By End User:

- Building and Construction

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Drug-Integrated Polymer Fibers market features leading material science and advanced composites companies such as Röchling SE & Co. KG, TORAY INDUSTRIES, INC., SGL Carbon, Avient Corporation, Plasan, Solvay, SABIC, Hexcel Corporation, TPI Composites Inc., and Mitsubishi Chemical Group Corporation. The Drug-Integrated Polymer Fibers market continues to evolve as companies intensify their focus on advanced biomaterials, controlled-release technologies, and high-precision fiber manufacturing methods. Industry participants invest heavily in R&D to improve drug-loading capacity, enhance biocompatibility, and tailor degradation rates to clinical requirements. Innovation centers increasingly prioritize scalable electrospinning systems, polymer-blend engineering, and surface-functionalization techniques that enable predictable pharmacokinetics. Strategic collaborations between material science firms, medical device manufacturers, and pharmaceutical companies accelerate product development and support regulatory approvals for next-generation drug-eluting fibers. Competition is driven by performance differentiation, expanding medical applications, and growing demand for minimally invasive therapeutic platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Röchling SE & Co. KG

- TORAY INDUSTRIES, INC.

- SGL Carbon

- Avient Corporation

- Plasan

- Solvay

- SABIC

- Hexcel Corporation

- TPI Composites Inc.

- Mitsubishi Chemical Group Corporation.

Recent Developments

- In March 2025, Thermore launches Ecodown Fibers Sync , an ultra-soft, clump-resistant insulation made from 100 per cent recycled PET bottles. Ecodown Fibers Sync is the power of dual-performance fibers, carefully engineered to offer exceptional ultra-lofty softness and resilience.

- In November 2024, Chalmers University of Technology in Sweden indeed unveiled a silk thread coated with a conductive plastic (polymer) capable of generating electricity from body heat.

- In June 2024, Nautilus Defense achieved a significant technological milestone by successfully demonstrating the world’s first direct die attach of semiconductor chiplets to embroidered conductive yarns at a 180 µm pitch. This breakthrough is a major step toward the scalable, domestic manufacture of high-density, durable, and comfortable textile-integrated electronics for various applications including national defense, medical, and aerospace industries.

- In May 2024, Hexcel Corporation announced 10-year agreement with Fairmat to recycle carbon fiber composite materials. Fairmat is an international carbon fiber composite recycler.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Resin Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand increases for localized and controlled drug-delivery systems across therapeutic areas.

- Advanced electrospinning and melt-spinning technologies will achieve higher precision in fiber morphology and drug-release control.

- Biodegradable and bioresorbable polymers will gain wider adoption, supported by improved safety, tunable degradation profiles, and regulatory acceptance.

- Pharmaceutical–material science collaborations will accelerate the development of customized drug-eluting fiber platforms.

- Implantable fiber-based drug-delivery devices will see rising usage in oncology, orthopedics, wound care, and regenerative medicine.

- Manufacturing scalability will improve through automation and continuous-processing systems that reduce production variability.

- Smart fibers integrating sensors or responsiveness to stimuli will emerge as a new innovation pathway.

- Clinical evidence will expand, increasing physician confidence and accelerating product approvals globally.

- Contract development and manufacturing organizations will play a larger role as companies outsource fiber-processing capabilities.

- Emerging markets will adopt drug-integrated polymer fibers more rapidly due to improving healthcare infrastructure and demand for cost-effective therapeutic solutions.