Market Overview

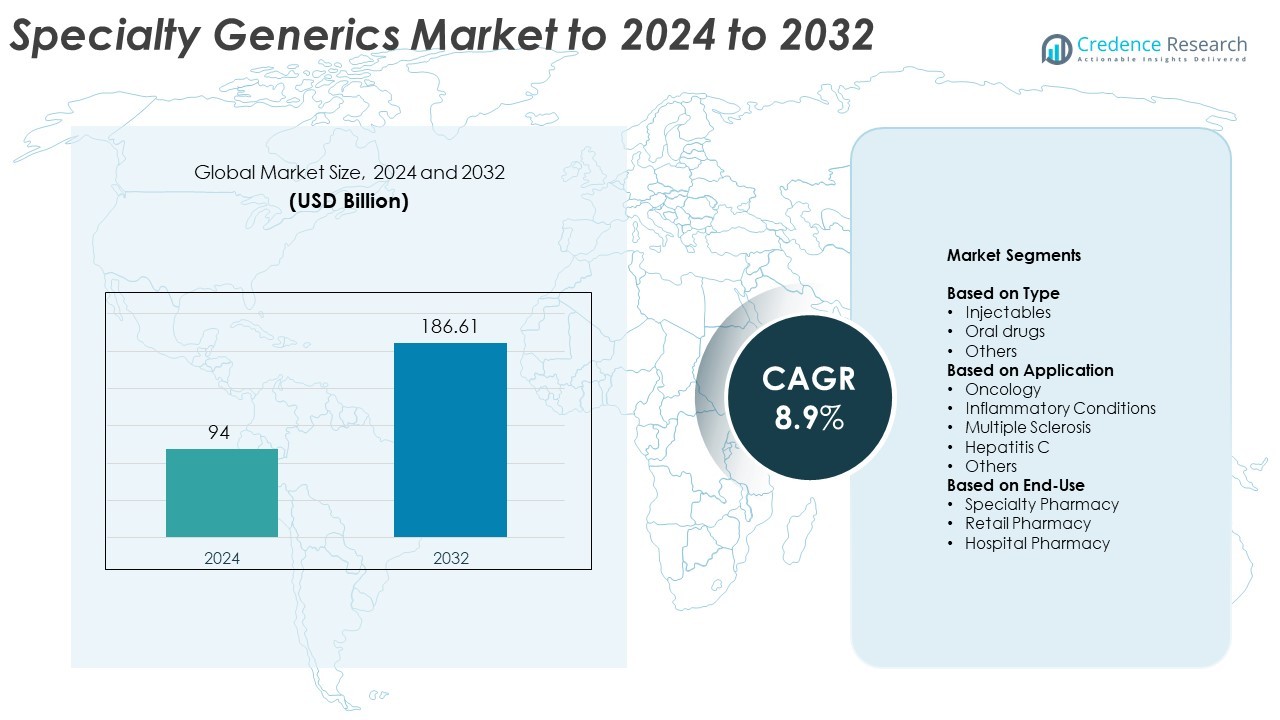

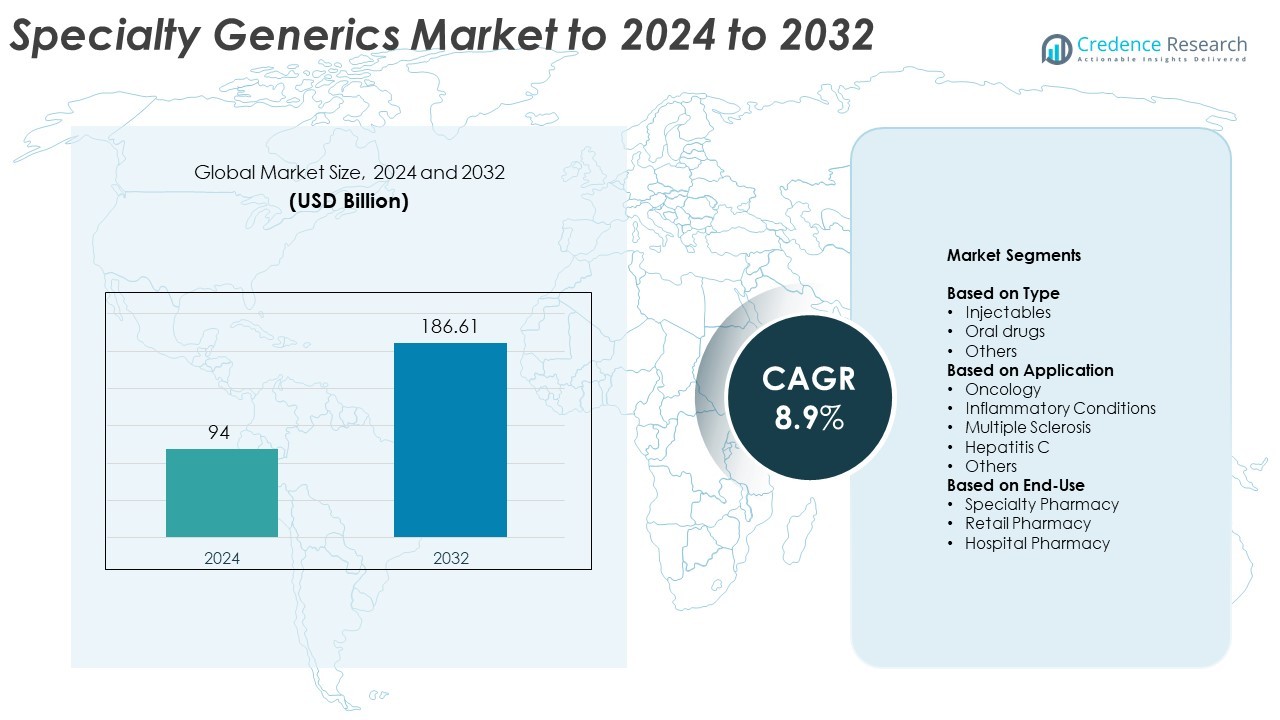

The global Specialty Generics Market size was valued at USD 94 billion in 2024 and is anticipated to reach USD 186.61 billion by 2032, at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Generics Market Size 2024 |

USD 94 Billion |

| Specialty Generics Market, CAGR |

8.9% |

| Specialty Generics Market Size 2032 |

USD 186.61 Billion |

The specialty generics market is dominated by key players including Novartis AG (Sandoz International GmbH), Teva Pharmaceuticals Industries Ltd., Viatris Inc., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., and Hikma Pharmaceuticals PLC. These companies lead through extensive portfolios of complex injectables, biosimilars, and high-barrier oral formulations. Strategic collaborations, product innovation, and strong regulatory compliance strengthen their competitive positions globally. North America leads the market with a 39.2% share in 2024, driven by rapid adoption of biosimilars and robust healthcare infrastructure. Europe follows with 28.4%, supported by pricing reforms and high generic substitution rates, while Asia Pacific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global specialty generics market was valued at USD 94 billion in 2024 and is projected to reach USD 186.61 billion by 2032, expanding at a CAGR of 8.9%.

- Rising demand for affordable and effective treatments for chronic and rare diseases drives market growth, supported by patent expirations of branded drugs and increased adoption of biosimilars.

- Key trends include rapid development of complex injectables, peptide-based formulations, and expansion of specialty pharmacy distribution networks across developed and emerging regions.

- The market is moderately consolidated, with leading players focusing on R&D investment, strategic alliances, and manufacturing advancements to enhance competitiveness and regulatory compliance.

- North America leads with a 39.2% share, followed by Europe at 28.4%, while Asia Pacific shows the fastest growth; injectables account for 58.4% of the market, driven by their rising use in oncology and autoimmune treatments.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Injectables dominate the specialty generics market with a 58.4% share in 2024. Their leadership stems from rising demand for cost-effective biologic and complex formulations used in chronic disease management. Injectable generics offer high therapeutic equivalence and are increasingly used in oncology, autoimmune, and cardiovascular treatments. Growth is also driven by advanced delivery systems and shorter regulatory approval timelines for sterile products. Oral drugs follow, supported by strong adoption in pain management and metabolic disorders, while other dosage forms gain traction in niche therapies.

- For instance, Hikma ranks top-three in U.S. generic injectables and expanded its portfolio to 150+ products, supported by 29 plants worldwide by the year 2023.

By Application

Oncology leads the market with a 42.6% share in 2024. The dominance is due to the increasing prevalence of cancer and the need for affordable treatment alternatives to branded biologics. Specialty generics in chemotherapy and targeted therapies have reduced treatment costs and improved accessibility in major healthcare systems. Inflammatory conditions and multiple sclerosis also represent key growth areas as biosimilar penetration widens and specialty drug patent expiries continue. Other applications, such as hepatitis C, contribute through cost-optimized antiviral generics.

- For instance, Biocon Biologics gained U.S. FDA approval for Jobevne (bevacizumab-nwgd), a biosimilar to the reference product Avastin, on April 9, 2025. The company officially announced the approval on April 10, 2025, noting that it was their 7th biosimilar approved in the U.S. and is indicated for the treatment of several cancer types including metastatic colorectal cancer and non-small cell lung cancer.

By End-Use

Specialty pharmacy dominates the market with a 47.8% share in 2024. These pharmacies specialize in handling complex and high-cost medications, ensuring patient adherence and timely access to therapies. The rise of home infusion services and digital prescription platforms further enhances distribution efficiency. Hospital pharmacies follow closely due to increasing inpatient administration of injectables and oncology products. Retail pharmacies are expanding their role as accessibility points for chronic disease therapies, supported by growing insurer partnerships and integrated healthcare networks.

Key Growth Drivers

Rising Demand for Cost-Effective Therapies

The growing burden of chronic and rare diseases is driving demand for affordable treatment options. Specialty generics offer significant cost savings compared to branded drugs while maintaining therapeutic equivalence. Healthcare providers and payers are adopting these products to reduce overall treatment costs, especially in oncology, autoimmune, and neurological conditions. Expanding patient access programs and government-led cost-containment initiatives further enhance the adoption of specialty generics worldwide.

- For instance, generics and biosimilars account for 90% of U.S. prescriptions but only 13.1% of drug spending, underscoring system-level savings, per AAM.

Patent Expiries of High-Value Branded Drugs

Patent expirations of complex biologics and specialty pharmaceuticals are creating lucrative opportunities for generic manufacturers. As major blockbuster drugs lose exclusivity, companies are developing biosimilars and complex generics to fill the market gap. Regulatory agencies are streamlining approval processes to accelerate market entry of these products. This trend is reshaping competition and enabling smaller players to penetrate previously restricted therapeutic areas.

- For instance, Amgen’s BKEMV became the 1st interchangeable eculizumab biosimilar approved by FDA on 28 May 2024.

Advancements in Manufacturing and Formulation Technologies

Innovations in formulation and manufacturing technologies are boosting product efficiency and stability. Continuous manufacturing, lyophilization, and novel drug delivery systems have improved scalability and quality. These advancements enable the production of complex injectables, liposomal drugs, and peptide-based generics at reduced costs. Enhanced process automation and analytical tools ensure compliance with stringent regulatory standards, supporting faster commercialization timelines.

Key Trends and Opportunities

Expansion of Biosimilar Portfolio

The biosimilar segment within specialty generics is rapidly expanding as healthcare systems aim to control biologic treatment costs. Increasing physician confidence, improved interchangeability guidelines, and payer support are encouraging adoption. Companies are investing in R&D and partnerships to expand product portfolios targeting oncology, immunology, and endocrinology therapies. The rise of real-world data validation is also enhancing acceptance across regulated markets.

- For instance, Fresenius Kabi lists 6 FDA-approved biosimilars across immunology and oncology, with a growing pipeline.

Growing Penetration in Emerging Markets

Emerging economies are becoming vital growth regions due to improved healthcare infrastructure and policy reforms. Governments in Asia-Pacific, Latin America, and the Middle East are promoting generic substitution to reduce treatment costs. Local manufacturing incentives and relaxed import regulations are encouraging international players to expand their footprint. Rising awareness of specialty treatments among healthcare professionals also strengthens market opportunities.

- For instance, Dr. Reddy’s Laboratories serves patients across 76 countries and markets six commercial biosimilars across various regions including India and over 25 other emerging markets. The company’s total global presence extends to over 100 countries.

Key Challenges

Complex Regulatory and Manufacturing Requirements

Developing and commercializing specialty generics requires adherence to stringent regulatory standards and advanced manufacturing processes. These products often demand specialized facilities and analytical capabilities, increasing operational costs. Frequent guideline updates and varied global approval frameworks create additional hurdles for market entry. Maintaining consistent product quality and bioequivalence remains a major concern for manufacturers.

High Competition and Pricing Pressure

The market faces intense price competition due to the presence of multiple generic manufacturers. Price erosion is further accelerated by government-imposed cost caps and payer negotiations. Companies struggle to maintain profitability while investing in R&D and regulatory compliance. Strategic differentiation through innovation and niche product development is becoming essential to sustain growth in the competitive landscape.

Regional Analysis

North America

North America dominates the specialty generics market with a 39.2% share in 2024. The region’s leadership is driven by high healthcare spending, early adoption of biosimilars, and a strong regulatory framework supporting generic substitution. The United States remains the key contributor due to the large patient pool for oncology and autoimmune diseases and the expiration of several high-value branded drugs. Market growth is further supported by favorable reimbursement policies, rapid approvals from the FDA, and the presence of major pharmaceutical companies advancing complex injectable and specialty formulations.

Europe

Europe accounts for about 28.4% of the specialty generics market in 2024. The region benefits from a well-established healthcare infrastructure and proactive government initiatives to encourage the use of cost-effective generic medicines. Countries such as Germany, France, and the United Kingdom are leading adopters due to strong biosimilar acceptance and structured pricing reforms. Regulatory alignment under the EMA streamlines product approvals and enhances market penetration. Growing prevalence of chronic conditions and high demand for oncology and inflammatory disease therapies further strengthen the region’s specialty generics landscape.

Asia Pacific

Asia Pacific holds a 22.6% share of the specialty generics market in 2024, reflecting the region’s fast-paced growth and expanding healthcare access. Rising incidences of chronic diseases, government-backed generic substitution policies, and the expansion of domestic pharmaceutical manufacturing drive this progress. India and China lead production and export activities for complex generics and biosimilars, supported by cost advantages and skilled manufacturing capabilities. Increasing healthcare expenditure, combined with public awareness of affordable therapies, positions Asia Pacific as a major hub for future specialty generics growth.

Latin America

Latin America represents 6.1% of the global specialty generics market in 2024. The region’s growth is supported by rising demand for low-cost specialty medications and increasing government initiatives to strengthen public healthcare systems. Brazil and Mexico lead adoption, driven by growing incidence of oncology and autoimmune disorders. Market expansion is aided by improved regulatory pathways and growing partnerships with international manufacturers. However, pricing instability and uneven reimbursement coverage remain key challenges, limiting faster adoption in certain markets despite a growing focus on healthcare accessibility.

Middle East and Africa

The Middle East and Africa hold a 3.7% share of the specialty generics market in 2024. Growth is influenced by expanding pharmaceutical distribution networks and rising investment in local drug production. Gulf countries, including Saudi Arabia and the United Arab Emirates, are prioritizing healthcare diversification and promoting generic drug usage to reduce import dependence. In Africa, growing awareness of affordable specialty treatments and rising collaborations with global players are driving demand. Despite infrastructure challenges, ongoing regulatory modernization and economic diversification efforts are expected to enhance regional market potential.

Market Segmentations:

By Type

- Injectables

- Oral drugs

- Others

By Application

- Oncology

- Inflammatory Conditions

- Multiple Sclerosis

- Hepatitis C

- Others

By End-Use

- Specialty Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The specialty generics market is led by major players such as Novartis AG (Sandoz International GmbH), Teva Pharmaceuticals Industries Ltd., Viatris Inc., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Hikma Pharmaceuticals PLC, STADA Arzneimittel AG, Bausch Health Companies Inc. (Valeant Pharmaceuticals International, Inc.), Endo Pharmaceuticals Inc., Mallinckrodt, Apotex Corp., and Fresenius Kabi Brasil Ltd. The competitive landscape is characterized by expanding biosimilar portfolios, strategic acquisitions, and investment in complex formulation capabilities. Companies are focusing on sterile injectables, peptides, and modified-release oral drugs to strengthen differentiation. Partnerships with healthcare providers and contract manufacturers are enhancing distribution efficiency and reducing production costs. Continuous innovation in drug delivery systems and regulatory compliance has become essential for maintaining market share. Additionally, strong pipelines targeting oncology, neurology, and autoimmune conditions are positioning manufacturers for sustained growth in high-value therapeutic segments across both developed and emerging markets.

Key Player Analysis

- Novartis AG (Sandoz International GmbH)

- Teva Pharmaceuticals Industries Ltd.

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Hikma Pharmaceuticals PLC

- STADA Arzneimittel AG

- Bausch Health Companies Inc. (Valeant Pharmaceuticals International, Inc.)

- Endo Pharmaceuticals Inc.

- Mallinckrodt

- Apotex Corp.

- Fresenius Kabi Brasil Ltd.

Recent Developments

- In 2025, Teva reported strong progress in their specialty generics and biosimilars portfolio, with 13 biosimilars in the pipeline and a focus on complex generics.

- In 2025, Bausch Health received regulatory approval for its radio-frequency technology device Thermage® FLX in Canada, expanding its specialty offerings beyond pharmaceuticals.

- In 2024, Apotex completed the acquisition of Searchlight Pharma, a Canadian specialty innovative branded pharmaceutical company focused on women’s health, dermatology, allergy, neurology, pain management, and hospital specialty markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as healthcare systems prioritize cost-efficient specialty treatments.

- Growing acceptance of biosimilars will strengthen long-term adoption across oncology and autoimmune therapies.

- Regulatory harmonization across major regions will simplify global product launches.

- Manufacturers will invest more in complex injectable and peptide-based generics.

- Digital distribution networks and specialty pharmacies will boost patient access and adherence.

- Strategic collaborations will accelerate R&D in high-barrier therapeutic areas.

- Emerging economies will drive demand through government-backed generic substitution programs.

- Advanced formulation technologies will enhance product stability and delivery efficiency.

- The focus on lifecycle management and supply chain resilience will improve market competitiveness.

- Increasing public awareness of specialty generics will support sustainable market growth globally.

Market Segmentation Analysis:

Market Segmentation Analysis: