Market Overview

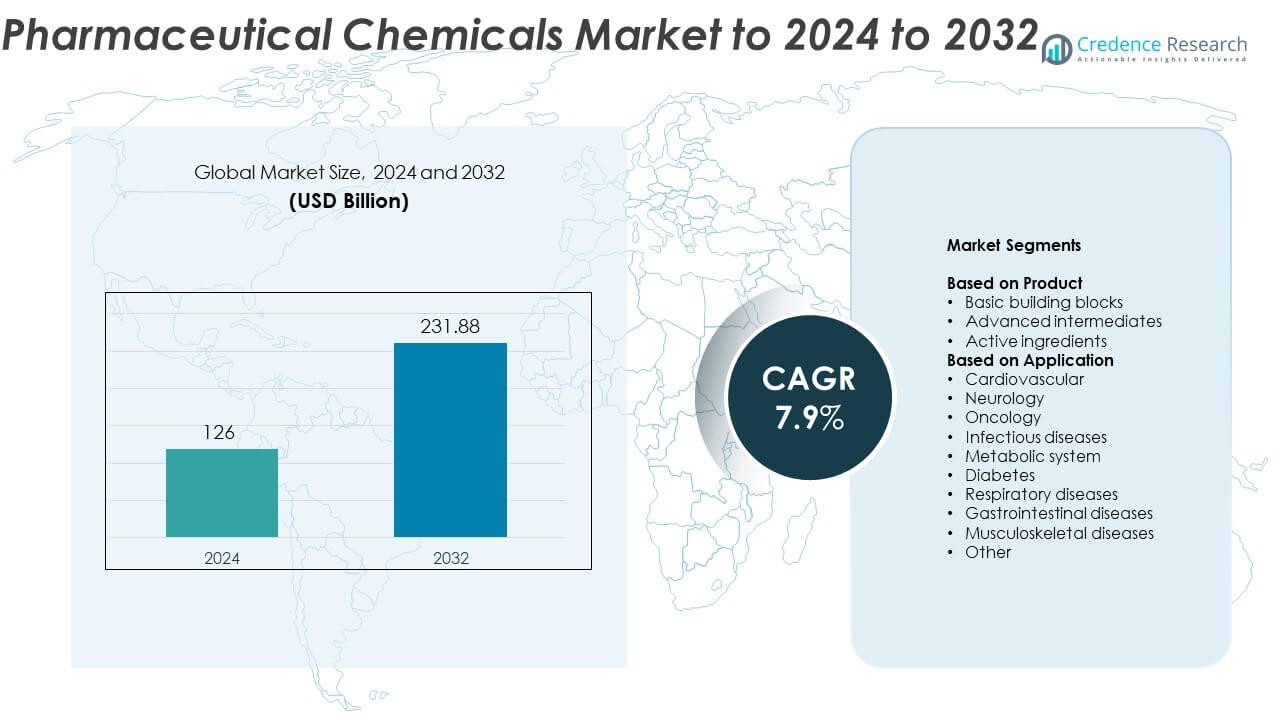

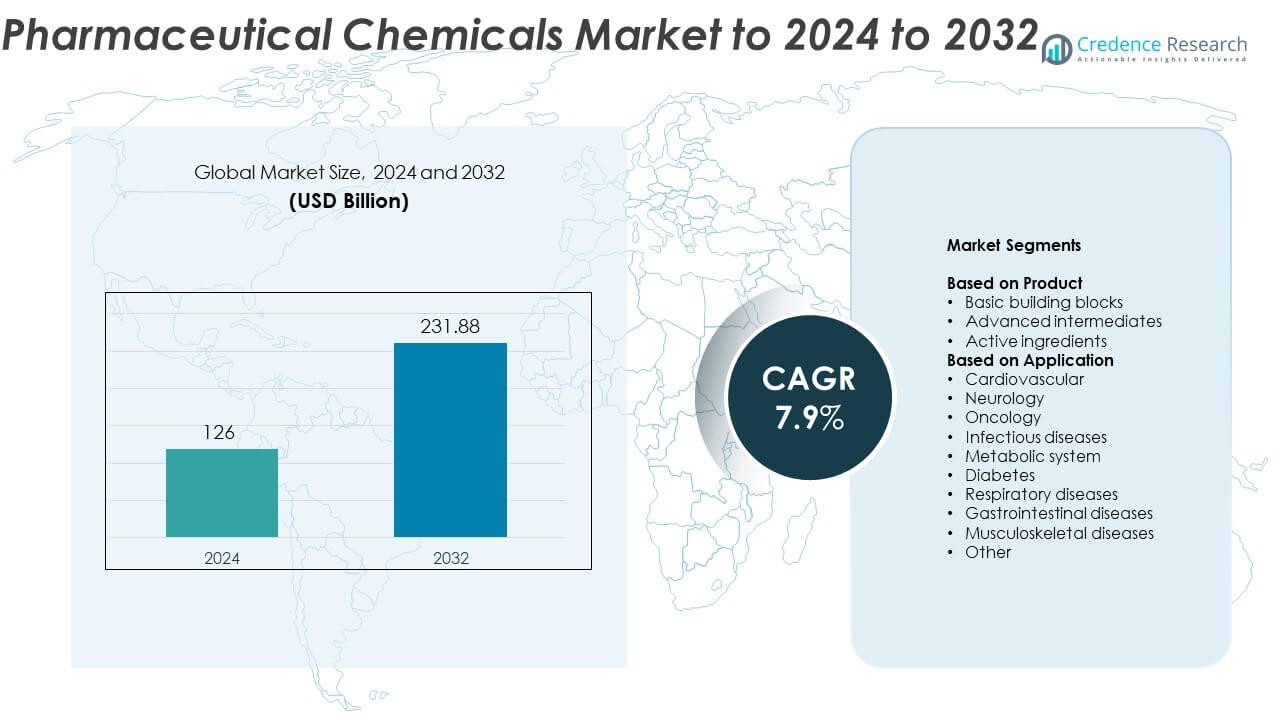

Pharmaceutical Chemicals Market size was valued USD 126 billion in 2024 and is anticipated to reach USD 231.88 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Chemicals Market Size 2024 |

USD 126 Billion |

| Pharmaceutical Chemicals Market, CAGR |

7.9% |

| Pharmaceutical Chemicals Market Size 2032 |

USD 231.88 Billion |

The pharmaceutical chemicals market is characterized by the presence of prominent players such as Lonza, Hikal, Johnson Matthey, Jubilant Life Sciences, Vertellus Holdings, Abbott, BASF, Porton Fine Chemicals, Dishman, and Lanxess. These companies are driving innovation through advanced synthesis technologies, sustainable manufacturing, and strategic partnerships with global pharmaceutical firms. North America leads the market with a 38.7% share in 2024, supported by strong R&D infrastructure and high demand for active ingredients. Europe follows with 27.4% share, driven by regulatory excellence and green chemistry initiatives, while Asia Pacific holds 24.8%, emerging as a fast-growing manufacturing hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The pharmaceutical chemicals market was valued at USD 126 billion in 2024 and is expected to reach USD 231.88 billion by 2032, growing at a CAGR of 7.9%.

- Rising prevalence of chronic diseases and increasing demand for high-purity active ingredients are key drivers boosting market growth.

- Growing adoption of sustainable manufacturing, automation, and AI-driven synthesis marks a strong trend shaping future production efficiency.

- The market remains highly competitive, with global companies investing in innovation, capacity expansion, and regulatory compliance to strengthen their presence.

- North America leads with 38.7% share, followed by Europe with 27.4% and Asia Pacific with 24.8%, while active ingredients hold 46.3% share as the dominant product segment.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Active ingredients dominate the pharmaceutical chemicals market, accounting for nearly 46.3% share in 2024. Their leadership arises from the growing demand for therapeutic formulations in chronic and infectious disease management. Increased outsourcing of active ingredient production and strict regulatory focus on quality and efficacy further drive growth. Advanced intermediates are expanding due to innovation in molecular synthesis and specialty drug development, while basic building blocks maintain stable demand supported by consistent use in large-volume generic formulations across global pharmaceutical manufacturing.

- For instance, According to Aurobindo Pharma’s March 2025 investor presentation, reflecting data as of the end of December 2024, the company reports 297 US DMF filings for APIs and over 4,000 total API dossier filings globally (outside the US).

By Application

Oncology leads the pharmaceutical chemicals market with around 28.6% share in 2024. The dominance stems from rising cancer prevalence and continuous advancements in targeted and immunotherapy drugs. High R&D investment and the growing use of precision medicine accelerate demand for high-purity active ingredients and complex intermediates. Cardiovascular and neurology applications follow, supported by increasing cases of lifestyle-related diseases. Expanding adoption of pharmaceutical chemicals in metabolic and respiratory disorders also contributes to steady market expansion.

- For instance, Piramal Pharma Solutions has manufactured more than 1,000 ADC batches, and its Grangemouth expansion lifted ADC capacity by about 70–80%.

Key Growth Drivers

Rising Demand for Chronic Disease Therapies

The growing prevalence of chronic diseases such as cardiovascular disorders, cancer, and diabetes drives strong demand for pharmaceutical chemicals. Expanding access to advanced healthcare systems and an aging global population increase consumption of active ingredients and intermediates. Pharmaceutical manufacturers are focusing on developing effective compounds with enhanced bioavailability and safety profiles, supporting long-term growth. Regulatory approvals for innovative drug formulations further enhance production capacity and supply chain expansion across major markets.

- For instance, Concord Biotech has total installed fermentation capacity of 1,250 m³ (equivalent to 1,250 KL), as of March 31, 2023.

Expansion of Contract Manufacturing and Outsourcing

Pharmaceutical companies are increasingly outsourcing chemical synthesis and formulation to contract manufacturers to reduce operational costs and improve scalability. This trend allows large firms to focus on R&D while leveraging specialized production capabilities. Growing partnerships in developing economies with strong regulatory compliance are strengthening supply networks. The rise in small molecule drug production and cost advantages of outsourcing further boost the demand for pharmaceutical intermediates and APIs globally.

- For instance, Thermo Fisher’s pharma services span 60+ sites across 25 countries and completed over 560,000 clinical shipments in 2024.

Innovation in Green and Sustainable Chemistry

Sustainability initiatives are becoming central to chemical manufacturing, with companies adopting green chemistry for reduced environmental impact. Eco-friendly production processes lower waste generation and improve energy efficiency. The development of bio-based intermediates and solvent-free synthesis techniques promotes cleaner manufacturing standards. Regulatory bodies are encouraging sustainable practices, compelling manufacturers to adopt renewable raw materials and minimize emissions, enhancing their competitive positioning in the global market.

Key Trends & Opportunities

Advancements in Biopharmaceutical Production

The rise of biologics and biosimilars is reshaping the pharmaceutical chemicals landscape. Manufacturers are investing in biotechnological processes that combine chemical synthesis with biological systems to produce complex molecules. This shift enhances treatment specificity and reduces side effects in targeted therapies. The growing pipeline of monoclonal antibodies and RNA-based drugs presents significant opportunities for advanced chemical suppliers.

- For instance, Lonza is acquiring Roche’s Vacaville biologics site with total bioreactor capacity of ~330,000 L.

Adoption of Digitalization and AI in Chemical Synthesis

The integration of artificial intelligence and digital modeling in pharmaceutical chemistry accelerates compound discovery and optimization. Automated synthesis platforms improve precision, reduce development time, and lower R&D costs. AI-driven predictive analytics also enable faster screening of active compounds, improving formulation success rates. These technologies are transforming manufacturing workflows, fostering greater efficiency and innovation across the pharmaceutical chemical value chain.

- For instance, in 2019, Insilico published a paper in Nature Biotechnology detailing the use of its GENTRL AI system to identify novel molecules for a known cancer target, DDR1, from concept to experimental validation in just 46 days (which included 21 days for the AI design phase)

Increasing Focus on Specialty and High-Value Compounds

Pharmaceutical firms are prioritizing the production of specialty chemicals for precision medicine and niche therapeutics. The shift from bulk to high-value compounds enhances profit margins and aligns with personalized treatment approaches. Rising demand for oncology, neurology, and metabolic therapies creates new opportunities for suppliers offering complex intermediates and advanced ingredients.

Key Challenges

Stringent Regulatory and Quality Compliance

The pharmaceutical chemicals market faces significant hurdles due to evolving regulatory frameworks and quality control standards. Strict compliance with regional and international guidelines increases production costs and time-to-market. Companies must continuously invest in validation, documentation, and certification processes to maintain approval for manufacturing and exports. Delays in approvals and product recalls due to non-compliance can impact profitability and market reputation.

Volatile Raw Material Prices and Supply Chain Constraints

Fluctuating raw material prices and global supply chain disruptions pose major challenges for manufacturers. Dependence on limited suppliers and geopolitical tensions can lead to shortages and higher costs. Logistics disruptions, particularly in the post-pandemic era, have further impacted lead times. To mitigate risks, companies are diversifying sourcing strategies and investing in localized production facilities to ensure supply continuity and cost stability.

Regional Analysis

North America

North America dominates the pharmaceutical chemicals market, accounting for nearly 38.7% share in 2024. Strong pharmaceutical manufacturing infrastructure, rising R&D investments, and presence of key players drive regional leadership. The United States leads with high demand for active pharmaceutical ingredients and advanced intermediates used in chronic disease therapies. Growth in biologics and adoption of green chemistry practices further strengthen market expansion. Canada contributes with supportive government policies and innovation in specialty chemical manufacturing for drug formulation and development.

Europe

Europe holds around 27.4% share of the pharmaceutical chemicals market in 2024. The region benefits from robust regulatory frameworks, high-quality standards, and strong demand for sustainable and bio-based pharmaceutical ingredients. Germany, Switzerland, and the United Kingdom are major hubs for chemical synthesis and pharmaceutical innovation. Continuous research in oncology and neurology drugs fuels demand for advanced intermediates. The European Union’s focus on cleaner manufacturing processes and circular economy initiatives also supports adoption of eco-friendly chemical solutions across pharmaceutical production lines.

Asia Pacific

Asia Pacific captures approximately 24.8% share in 2024 and is the fastest-growing regional market. Expansion of pharmaceutical manufacturing in China, India, and Japan drives growth. The region benefits from low production costs, skilled labor, and supportive government incentives for API and intermediate production. Rapid healthcare expansion, increasing exports, and partnerships with global pharmaceutical firms strengthen market presence. Rising chronic disease prevalence and growing investments in contract manufacturing further enhance Asia Pacific’s contribution to the global pharmaceutical chemicals sector.

Latin America

Latin America accounts for around 5.6% share of the pharmaceutical chemicals market in 2024. Brazil and Mexico lead the region with growing domestic pharmaceutical industries and increasing import of active ingredients. Government initiatives promoting local drug production and foreign partnerships stimulate market growth. The region is witnessing gradual improvement in healthcare infrastructure and regulatory standards. However, limited R&D capabilities and economic instability in some nations restrain rapid expansion. Rising awareness about generic drugs and cost-efficient formulations supports moderate growth in the region.

Middle East & Africa

The Middle East & Africa region represents about 3.5% share in 2024, showing steady expansion in pharmaceutical chemical consumption. Increasing investments in healthcare and pharmaceutical infrastructure, especially in Saudi Arabia, the UAE, and South Africa, are driving demand. The focus on developing local manufacturing capabilities and reducing dependency on imports supports regional growth. Rising incidence of chronic diseases and government-led healthcare reforms further stimulate demand for high-quality active ingredients and intermediates across domestic and regional pharmaceutical markets.

Market Segmentations:

By Product

- Basic building blocks

- Advanced intermediates

- Active ingredients

By Application

- Cardiovascular

- Neurology

- Oncology

- Infectious diseases

- Metabolic system

- Diabetes

- Respiratory diseases

- Gastrointestinal diseases

- Musculoskeletal diseases

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The pharmaceutical chemicals market features strong competition among leading players such as Lonza, Hikal, Johnson Matthey, Jubilant Life Sciences, Vertellus Holdings, Abbott, BASF, Porton Fine Chemicals, Dishman, and Lanxess. These companies focus on strategic expansion through mergers, collaborations, and technological upgrades to strengthen their market presence. Continuous investment in high-purity active ingredients and sustainable production processes enhances operational efficiency and compliance with global standards. The industry is witnessing increased adoption of automation, AI-driven synthesis, and digital monitoring to improve precision and yield. Regional players are also gaining traction by offering cost-effective intermediates and contract manufacturing services. Overall, innovation, scalability, and adherence to stringent regulatory frameworks define competitiveness in the global pharmaceutical chemicals market.

Key Player Analysis

Recent Developments

- In 2025, BASF opened a new Good Manufacturing Practice (GMP) Solution Center in Wyandotte, Michigan, expanding its GMP manufacturing and product development capabilities tailored for pharmaceutical and biopharma customers.

- In 2025, LANXESS, alongside its subsidiary Saltigo, showcased sustainable chloroformates at Chemspec Europe 2025 in Cologne, Germany. These chloroformates are produced using a sustainable process that involves green chlorine and renewable energy, which can reduce the product’s carbon footprint by up to 40%.

- In 2022, Lonza partnered with the Korean biotech company AbTis to advance antibody drug conjugates (ADCs) by improving bioconjugation techniques critical for pharmaceutical fine chemicals used in innovative medicines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for complex and high-purity pharmaceutical ingredients will drive market expansion.

- Increasing adoption of green chemistry will enhance sustainable manufacturing practices.

- Growth in biologics and biosimilars will boost demand for advanced chemical intermediates.

- Contract manufacturing organizations will play a larger role in global supply chains.

- Digitalization and automation will streamline synthesis, formulation, and quality control processes.

- Emerging markets in Asia Pacific and Latin America will witness rapid production capacity growth.

- Continuous innovation in drug delivery systems will increase the need for specialty chemicals.

- Strategic collaborations between pharmaceutical and chemical companies will accelerate R&D advancements.

- Stringent regulatory compliance will promote higher-quality standards and traceability in production.

- Personalized medicine trends will increase demand for tailored and precision-based chemical compounds.

Market Segmentation Analysis:

Market Segmentation Analysis: