Market Overview:

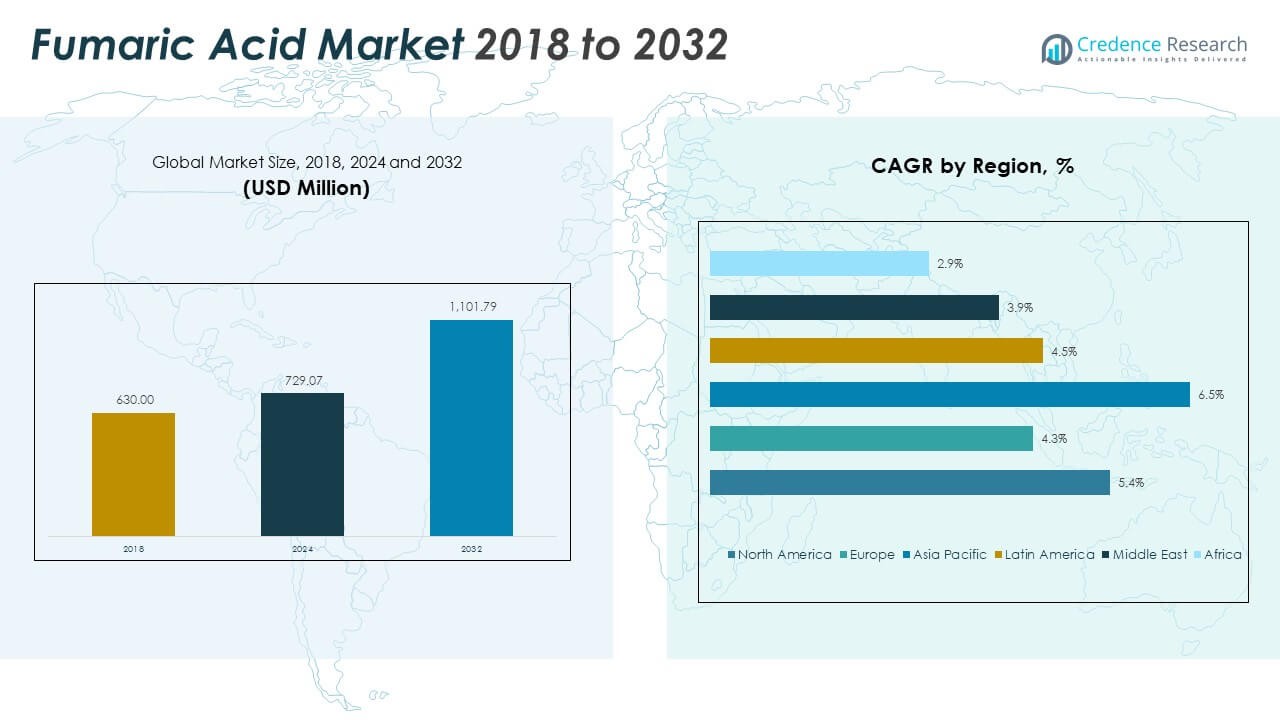

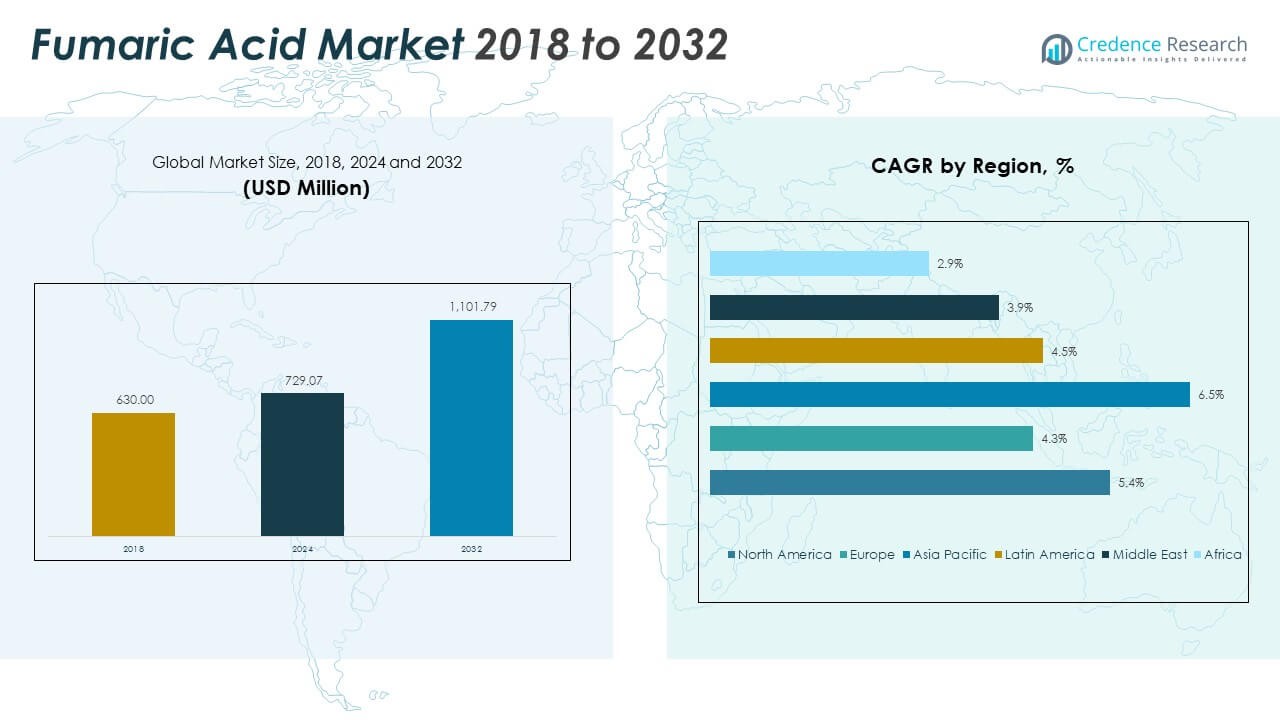

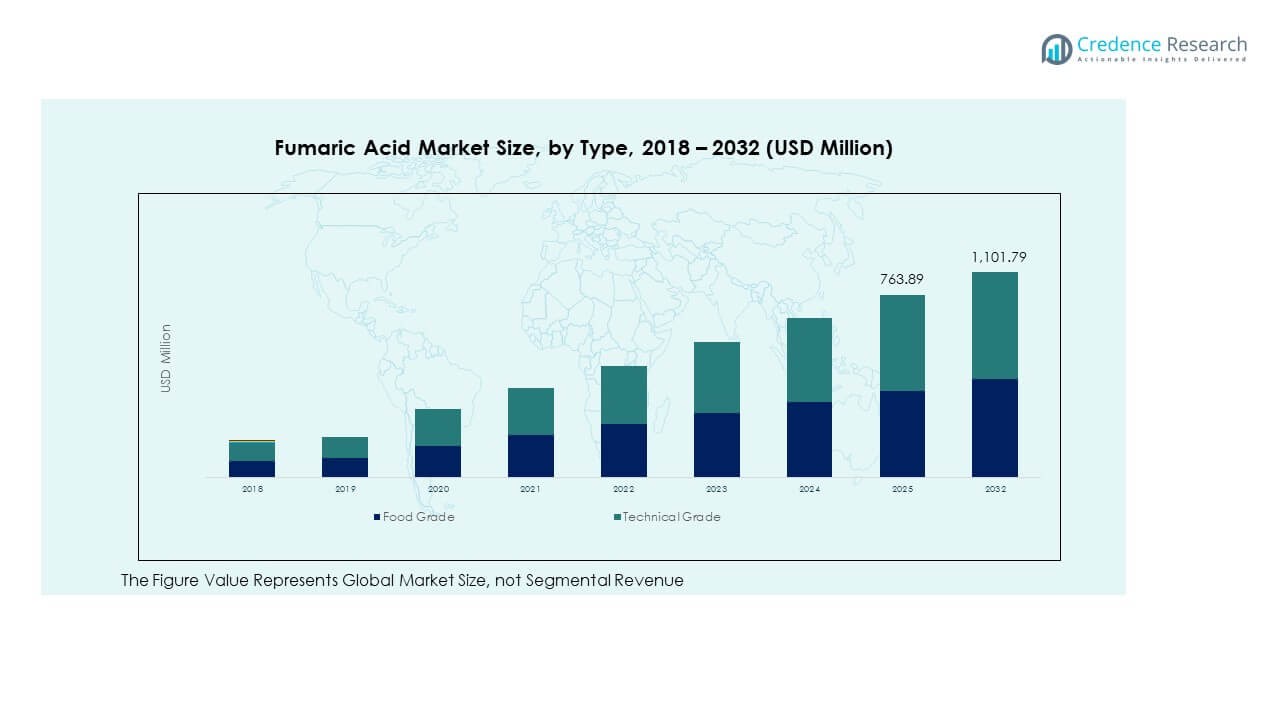

The Fumaric Acid Market size was valued at USD 630.00 million in 2018 to USD 729.07 million in 2024 and is anticipated to reach USD 1,101.79 million by 2032, at a CAGR of 5.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fumaric Acid Market Size 2024 |

USD 729.07 Million |

| Fumaric Acid Market, CAGR |

5.37% |

| Fumaric Acid Market Size 2032 |

USD 1,101.79 Million |

Rising demand from the food and beverage industry remains a key growth driver for this market. Fumaric acid enhances shelf life, improves flavor, and supports clean-label formulations, making it a preferred acidulant. Its expanding use in pharmaceuticals, particularly in dermatology and gastrointestinal applications, further supports market expansion. Industrial use in unsaturated polyester resins strengthens its position across multiple end-use industries, ensuring consistent global consumption.

Asia Pacific leads the Fumaric Acid Market, driven by its strong manufacturing base and growing food processing activities in China and India. North America and Europe show steady growth, supported by mature food, pharma, and chemical sectors. Latin America and the Middle East are emerging markets with rising investments in industrial production. Africa shows moderate growth potential through expanding food industries and improving trade networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Fumaric Acid Market size stood at USD 630.00 million in 2018, reached USD 729.07 million in 2024, and is expected to hit USD 1,101.79 million by 2032, registering a CAGR of 5.37%.

- North America holds 38.21% of the global share in 2024, followed by Asia Pacific with 30.71% and Europe with 18.38%. These regions lead due to strong food processing, pharmaceutical production, and established industrial infrastructure.

- Asia Pacific is the fastest-growing region, supported by rising packaged food demand, rapid manufacturing expansion, and strategic investments in sustainable production technologies.

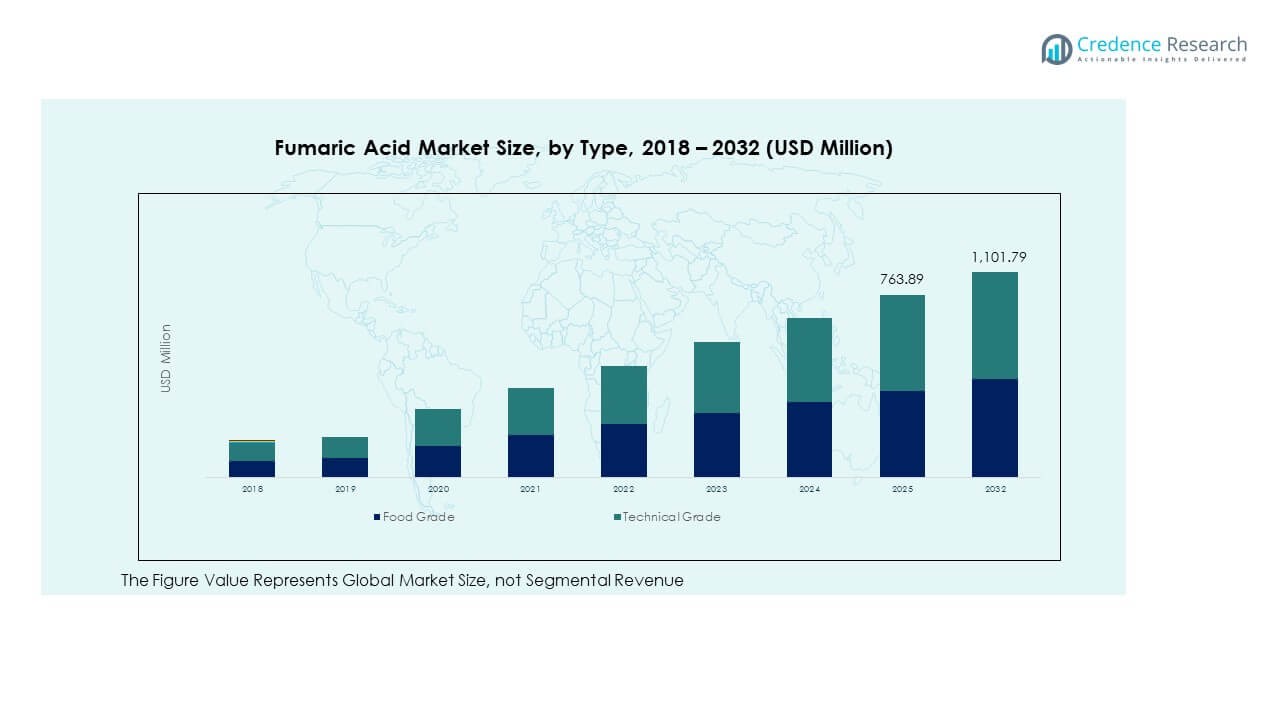

- Food Grade represents 57.3% of the total market share, reflecting strong demand in the food and beverage sector.

- Technical Grade accounts for 42.7% of the market share, supported by applications in industrial resins, coatings, and other manufacturing processes.

Market Drivers

Rising Use in Processed and Packaged Food Applications Enhancing Product Demand

The growing consumption of processed and packaged food creates consistent demand for acidulants with strong flavor stability. The Fumaric Acid Market benefits from its wide use as a preservative, flavor enhancer, and pH regulator. It improves product texture and extends shelf life in baked goods, beverages, and confectionery. The food industry values its low hygroscopic nature, which prevents clumping during storage. Manufacturers prefer it for cost-effective formulation and better acidity control. Growing urbanization fuels higher processed food consumption worldwide. Strong supply chains and expanding distribution channels further drive adoption. This trend aligns with evolving consumer preferences for ready-to-eat products.

Growing Pharmaceutical and Nutraceutical Applications Supporting Market Expansion

Pharmaceutical and nutraceutical manufacturers are integrating fumaric acid for its stability and functional benefits. The Fumaric Acid Market benefits from its use in dermatology, gastrointestinal treatments, and immune-supporting supplements. It enhances formulation stability and supports targeted drug delivery. Nutraceutical producers use it in vitamin blends and mineral supplements. Expanding healthcare awareness strengthens demand in emerging economies. Continuous product development in tablets, capsules, and fortified products sustains strong consumption. Regulatory approvals for fumaric acid in medical applications increase its commercial value. Ongoing clinical research supports broader usage across multiple therapeutic areas.

Expanding Use in Unsaturated Polyester Resins Driving Industrial Growth

Industrial demand for unsaturated polyester resins is increasing due to expanding construction and automotive production. The Fumaric Acid Market benefits from its use as a key intermediate in resin synthesis. Its chemical properties enable better heat resistance, durability, and strength in end products. Manufacturers rely on it for cost-effective resin formulation. Infrastructure investments in emerging economies increase resin consumption across multiple industries. The growing shift toward lightweight automotive components supports higher demand. Its compatibility with other chemicals ensures smooth blending in production. This factor positions fumaric acid as a reliable industrial input.

- For instance, Polynt Group’s Sustainability Report published in May 2025 (covering the 2024 fiscal year) highlights the use of fumaric acid as a key building block in unsaturated polyester resin production. The company emphasizes its integration into advanced resin systems to enhance performance and promote sustainable material development for industrial applications.

Shift Toward Bio-Based Manufacturing Processes Strengthening Sustainability Goals

Sustainability goals drive industries toward cleaner and bio-based production. The Fumaric Acid Market gains momentum through improved fermentation techniques and renewable feedstock use. Bio-based fumaric acid production reduces environmental impact and strengthens green certification. Regulatory pressure encourages industries to adopt low-carbon production methods. Companies invest in biotechnological advancements to reduce costs and enhance yield. Sustainable sourcing aligns with consumer demand for eco-friendly ingredients. Renewable production supports long-term supply stability. This shift ensures competitive positioning in regulated markets focused on sustainability and resource efficiency.

- For instance, BASF SE launched its FUMBIO project in June 2024 to develop a CO₂-neutral, bio-based process for producing fumaric acid using Basfia succiniciproducens. The project aims to achieve a significantly lower or even negative carbon footprint compared to conventional petrochemical routes, as outlined in BASF’s official release.

Market Trends

Integration of Fermentation-Based Production Technologies Improving Process Efficiency

Fermentation-based production is transforming the chemical landscape with cleaner and more efficient processes. The Fumaric Acid Market sees strong adoption of microbial fermentation to replace petrochemical routes. Fermentation lowers energy use and reduces waste generation. Advanced bioreactors support high-yield production with stable quality. Manufacturers implement precision fermentation to optimize strain performance. Regulatory acceptance of bio-based products supports commercialization. This approach enables long-term cost efficiency and supply security. Strategic investments in bioprocessing facilities accelerate global scaling of eco-friendly fumaric acid production.

Expanding Adoption in Personal Care and Cosmetic Product Formulations

Personal care and cosmetic manufacturers are increasing their use of fumaric acid for its stabilizing and texturizing properties. The Fumaric Acid Market benefits from its role in enhancing skin care formulations, sunscreens, and oral care products. Its acidic properties improve pH balance in personal care items. Demand for clean-label ingredients boosts adoption in natural formulations. Manufacturers use it to improve product performance and shelf stability. Consumer focus on safe and effective ingredients fuels growth in this sector. Global beauty and personal care expansion supports this trend. Product diversification across regions strengthens its market relevance.

- For instance, Garnier’s Tri-Acid Renew Skin Renewal Concentrate is listed in the Philippines’ FDA Cosmetic Product Notification database as an approved cosmetic product. This listing confirms regulatory clearance for its sale in the country under established cosmetic standards.

Rising Focus on Functional Food Ingredients with Long Shelf Stability

Food manufacturers are shifting toward functional ingredients that offer stability, extended shelf life, and sensory benefits. The Fumaric Acid Market grows through its use in baked goods, beverages, and confectionery. Its controlled acidity supports consistent flavor profiles in processed products. Consumers prefer longer-lasting packaged foods with minimal preservatives. This trend drives investment in natural and stable acidulants. Brands position fumaric acid-based formulations to meet clean-label demands. Expanding cold-chain infrastructure supports broader product distribution. Global food industry modernization continues to increase demand for functional acidulants.

- For instance, Bartek Ingredients’ technical documentation highlights that fumaric acid helps stabilize moisture and pH in sugar-coated confectionery. The company states that it slows sucrose inversion and does not absorb moisture during storage or distribution, supporting longer shelf stability in candy formulations.

Strategic Collaborations and Capacity Expansions Enhancing Global Supply Networks

Key producers are pursuing strategic collaborations to expand production capacities and secure supply chains. The Fumaric Acid Market gains strength through investments in new facilities and joint ventures. Companies enhance logistics networks to reduce lead times and stabilize pricing. Regional producers focus on technology upgrades to meet rising demand. Cross-border partnerships ensure consistent raw material access. Supply chain resilience becomes a priority to maintain stable market conditions. Global players strengthen distribution networks to reach new markets. These collaborative strategies shape long-term industry growth and competitiveness.

Market Challenges Analysis

Volatility in Raw Material Prices Impacting Production Stability and Profit Margins

Volatile raw material prices create uncertainty for manufacturers and affect cost structures. The Fumaric Acid Market faces challenges when feedstock costs fluctuate due to supply chain disruptions or geopolitical issues. Price instability limits production planning flexibility. Small and mid-sized producers find it harder to maintain consistent margins. Dependency on petrochemical derivatives adds vulnerability to oil price movements. Sudden spikes in raw material prices reduce profitability for producers. Companies respond by diversifying sourcing strategies, but long-term stability remains difficult. This challenge affects both product pricing and investment decisions.

Regulatory Compliance Pressure and Market Competition Restraining Growth Potential

Evolving regulatory standards in food, pharmaceutical, and chemical industries increase compliance burdens. The Fumaric Acid Market must align with global safety, quality, and sustainability frameworks. High compliance costs strain smaller producers and limit their competitiveness. Certification requirements and labeling standards vary across regions, complicating global operations. Strict environmental regulations pressure companies to upgrade production facilities. Intense competition among established and emerging players drives price pressure. These combined factors slow expansion in price-sensitive regions. Producers must balance regulatory obligations with profitability goals.

Market Opportunities

Growing Demand for Eco-Friendly and Sustainable Ingredients Across Multiple Industries

Sustainability initiatives open strong growth opportunities for renewable fumaric acid applications. The Fumaric Acid Market benefits from industries adopting low-carbon solutions. Bio-based production offers cost efficiency over time and meets green standards. Manufacturers position eco-friendly ingredients to attract conscious consumers. Regulatory support for sustainable sourcing accelerates this shift. Expanding industries like food, pharma, and chemicals increase renewable ingredient adoption. This opportunity strengthens competitive differentiation for producers. Global brands align sourcing strategies with sustainability commitments.

Emerging Applications in Energy Storage and Advanced Material Development

Emerging technologies create new demand avenues for fumaric acid beyond traditional industries. The Fumaric Acid Market finds opportunities in advanced material development and energy storage systems. Researchers explore fumaric acid in polymer batteries, resin composites, and specialty coatings. Its properties enable stronger thermal stability and better performance in energy devices. Partnerships with technology developers drive product innovation. Growing clean energy initiatives encourage material diversification. This opportunity enables producers to access high-value niche markets. Long-term adoption depends on scalable production and stable supply chains.

Market Segmentation Analysis:

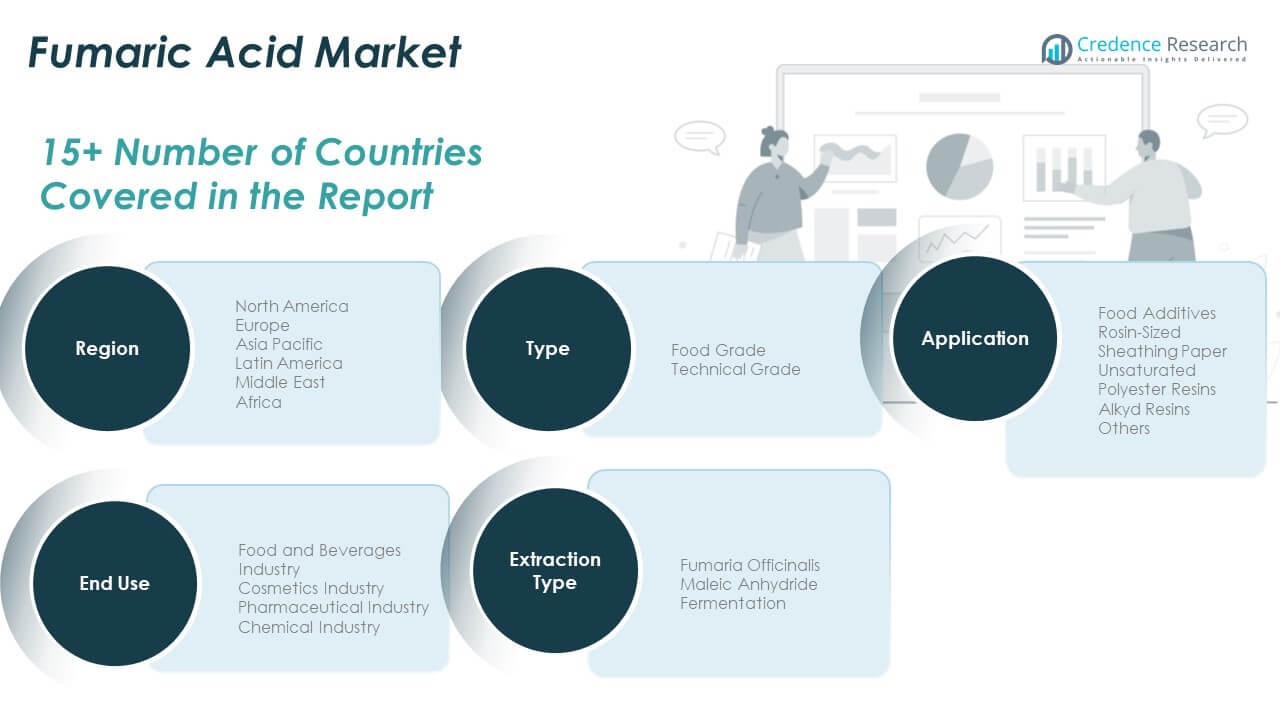

The Fumaric Acid Market is segmented by type, application, end-use industry, and extraction type, reflecting its broad industrial relevance.

By type, food grade dominates due to its extensive use in the food and beverage industry for acidity control and shelf-life enhancement. Technical grade supports applications in resins, coatings, and industrial processes where high purity is not required. This balanced demand across both grades strengthens market stability.

- For instance, Yantai Hengyuan Bioengineering Co., Ltd. in China is recognized as a manufacturer of food-grade fumaric acid. The company supplies fumaric acid for use as an acidulant and acidity regulator in various food applications.

By application, food additives lead due to increasing packaged food consumption and demand for natural acidulants. Unsaturated polyester resins and alkyd resins form another strong segment, driven by expanding construction and automotive activities. Rosin-sized sheathing paper and other niche applications contribute to diversified market adoption.

By end-use, the food and beverages industry remains the largest consumer due to strict quality standards and strong product performance. The pharmaceutical industry shows steady growth through fumaric acid use in formulations, while cosmetics and chemical industries increase consumption through innovative applications in personal care and intermediate manufacturing.

- For instance, Merck KGaA supplies fumaric acid with a typical purity of ≥99.0% for synthesis and research applications. The product is widely used in laboratory and industrial settings but is not classified as pharmaceutical-grade under USP/NF standards.

By extraction type, maleic anhydride remains dominant due to cost efficiency and established processes. Fermentation is gaining traction through its lower environmental footprint and alignment with green production trends. Fumaria officinalis extraction supports specialty and niche applications, adding further diversity to sourcing strategies. This structured segmentation highlights a stable demand base with emerging sustainable production trends.

Segmentation:

By Type

- Food Grade

- Technical Grade

By Application

- Food Additives

- Rosin-Sized Sheathing Paper

- Unsaturated Polyester Resins

- Alkyd Resins

- Others

By End-Use Industry

- Food and Beverages Industry

- Cosmetics Industry

- Pharmaceutical Industry

- Chemical Industry

By Extraction Type

- Fumaria Officinalis

- Maleic Anhydride

- Fermentation

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Fumaric Acid Market size was valued at USD 243.50 million in 2018 to USD 278.57 million in 2024 and is anticipated to reach USD 420.44 million by 2032, at a CAGR of 5.4% during the forecast period. North America holds a 38.21% market share in 2024, driven by strong demand across food, pharmaceutical, and chemical industries. It benefits from mature processing facilities and well-established regulatory frameworks. The U.S. leads production and consumption due to advanced manufacturing and high demand for food acidulants. Canada and Mexico contribute through expanding food processing and industrial activities. Strong focus on product quality and clean-label ingredients supports sustained market growth. Industrial adoption in resin production adds to the region’s market strength. Strategic investments in bio-based technologies reinforce competitive advantages in this region.

Europe

The Europe Fumaric Acid Market size was valued at USD 122.22 million in 2018 to USD 133.98 million in 2024 and is anticipated to reach USD 187.03 million by 2032, at a CAGR of 4.3% during the forecast period. Europe accounts for 18.38% of the global share in 2024, supported by its strong pharmaceutical and food industries. Germany, France, and the UK lead consumption, driven by demand for acidulants in food formulations. It benefits from high regulatory standards that favor consistent product quality. Investment in sustainable production technologies strengthens the regional supply chain. The personal care sector contributes to steady growth in specialty applications. Innovation in resins and coatings provides additional industrial opportunities. Regulatory alignment across the EU enhances trade and market stability.

Asia Pacific

The Asia Pacific Fumaric Acid Market size was valued at USD 186.48 million in 2018 to USD 223.71 million in 2024 and is anticipated to reach USD 367.23 million by 2032, at a CAGR of 6.5% during the forecast period. Asia Pacific holds a 30.71% share in 2024, led by China, India, Japan, and South Korea. Strong demand from food processing, resin manufacturing, and pharmaceuticals drives growth. China dominates production through large-scale manufacturing and export capacity. India shows increasing domestic demand supported by expanding packaged food consumption. Industrial modernization fuels capacity upgrades across the region. Investments in fermentation-based production improve sustainability metrics. Regional supply chains enable cost-effective distribution and competitive pricing. Government incentives for bio-based chemicals support long-term expansion.

Latin America

The Latin America Fumaric Acid Market size was valued at USD 42.84 million in 2018 to USD 49.13 million in 2024 and is anticipated to reach USD 69.27 million by 2032, at a CAGR of 4.5% during the forecast period. Latin America holds a 6.75% market share in 2024, with Brazil leading demand through its expanding food and beverage industry. Rising urbanization supports increasing processed food consumption. Resin production activities are gaining traction in key industrial hubs. The region benefits from growing investments in local manufacturing capacity. Mexico and Argentina contribute through stable demand across food and chemical segments. Supply chain improvement initiatives enhance accessibility and cost efficiency. Strategic partnerships with international producers strengthen market integration. Export-oriented production models support revenue diversification.

Middle East

The Middle East Fumaric Acid Market size was valued at USD 21.74 million in 2018 to USD 23.40 million in 2024 and is anticipated to reach USD 31.52 million by 2032, at a CAGR of 3.9% during the forecast period. The Middle East holds a 3.22% share in 2024, with GCC countries leading market activities. It benefits from a growing processed food industry and developing chemical manufacturing base. Resin and coating applications drive moderate industrial consumption. Expanding infrastructure projects create opportunities for resin-based products. Strategic investments in downstream chemical production support long-term growth. Food acidulants gain popularity through rising demand for packaged products. Regional diversification efforts enhance supply resilience. Partnerships with international players improve production capabilities.

Africa

The Africa Fumaric Acid Market size was valued at USD 13.23 million in 2018 to USD 20.27 million in 2024 and is anticipated to reach USD 26.30 million by 2032, at a CAGR of 2.9% during the forecast period. Africa holds a 2.78% market share in 2024, with South Africa and Egypt leading consumption. Rising population and urbanization create steady demand for food acidulants. Industrial applications remain limited but are gradually expanding. Growing investments in food processing enhance domestic market potential. Regulatory improvements support better product standards. Regional production remains low, creating reliance on imports. Expansion of distribution networks improves access to key end-use industries. Government-led industrialization initiatives encourage future capacity growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Fuso Chemical Co., Ltd.

- Changmao Biochemical Engineering Co., Ltd.

- Anhui Taida New Material Co., Ltd.

- Polynt S.p.A.

- Nippon Shokubai Co., Ltd.

- The Chemical Company

- Spectrum Chemical Mfg. Corp.

- Tianjin Tanggu Jinbin Chemical Co., Ltd.

- Huntsman Corporation

- Merck KGaA

- Shandong Yuanli Science and Technology Co., Ltd.

- JT Baker

- Acros Organics

- Haihang Industry Co., Ltd.

- Penta Manufacturer

- Connect Chemicals

Competitive Analysis:

The Fumaric Acid Market is characterized by strong competition among global and regional producers focused on capacity expansion, product quality, and cost efficiency. Leading companies such as Fuso Chemical Co., Ltd., Changmao Biochemical Engineering Co., Ltd., Polynt S.p.A., Nippon Shokubai Co., Ltd., and Huntsman Corporation hold significant market positions. It benefits from diversified supply chains that strengthen regional availability and price stability. Key players invest in bio-based production technologies to align with sustainability trends. Strategic moves include mergers, acquisitions, and facility expansions to secure raw materials and enhance output. Product differentiation based on purity, formulation quality, and application versatility creates competitive advantages. Regional manufacturers compete on pricing and distribution strength, while global players emphasize technological leadership. Strong R&D pipelines support product innovation and help maintain market share in high-demand segments.

Recent Developments:

- In January 2024, Thirumalai Chemicals Limited opened a new fumaric acid plant in Dahej, India, with a production capacity of 10,000 metric tonnes. For instance, this substantial investment has improved regional supply for the chemical, positioning Thirumalai Chemicals as a major player in the fast-evolving Asian market and addressing growing demand in both food and industrial applications.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-Use Industry, Extraction Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing food and beverage demand will strengthen the position of fumaric acid as a key acidulant.

- Expanding pharmaceutical applications will create new opportunities for formulation development.

- Bio-based fermentation technologies will gain traction, reducing environmental impact and enhancing efficiency.

- Industrial use in resins and coatings will rise with infrastructure development and manufacturing growth.

- Clean-label trends in processed foods will increase demand for food-grade fumaric acid.

- Emerging economies will become major growth hubs through domestic production expansion.

- Strategic mergers and acquisitions will reshape the competitive landscape and strengthen supply chains.

- Digital monitoring and automation will improve production quality and cost control.

- Regional diversification in sourcing will help stabilize global pricing and availability.

- Ongoing investments in R&D will support product innovation across multiple end-use industries.