Market Overview:

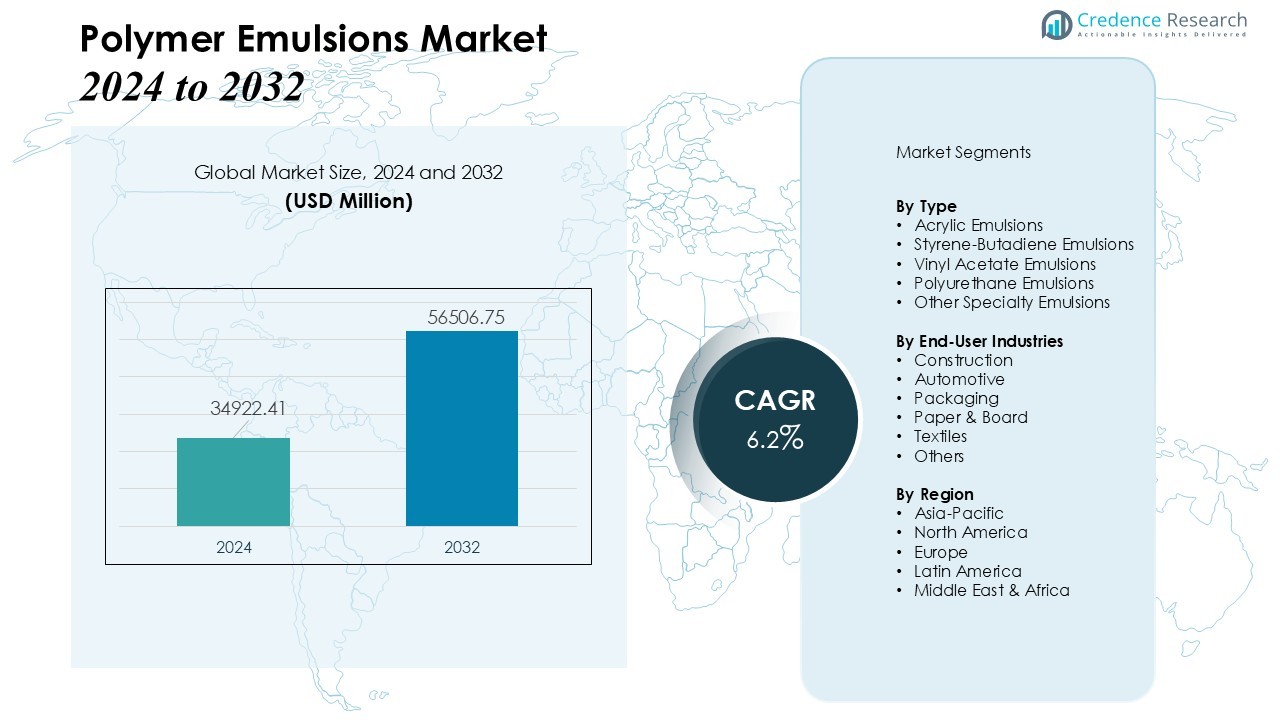

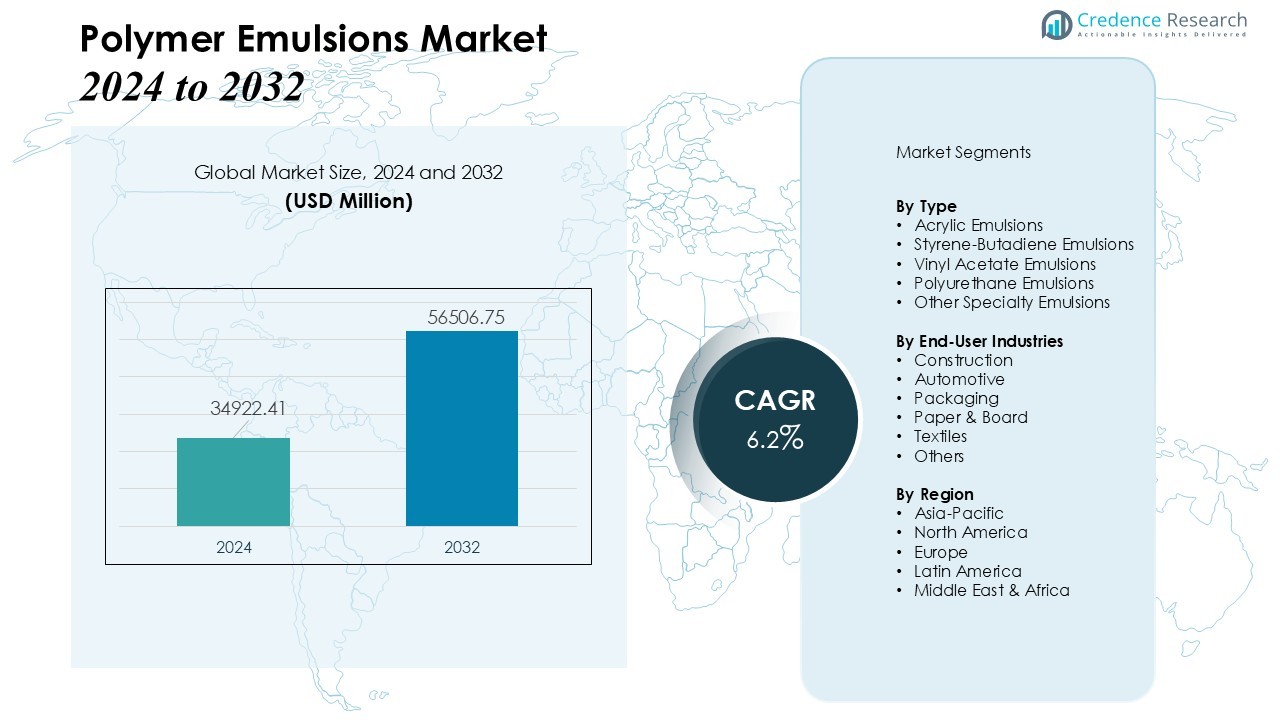

The Polymer Emulsions Market size was valued at USD 34922.41 million in 2024 and is anticipated to reach USD 56506.75 million by 2032, at a CAGR of 6.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polymer Emulsions Market Size 2024 |

USD 34922.41 Million |

| Polymer Emulsions Market, CAGR |

6.2% |

| Polymer Emulsions Market Size 2032 |

USD 56506.75 Million |

Growing environmental regulations and rising demand for low‑VOC, water‑based coatings, adhesives, and sealants are major growth drivers. The shift away from solvent‑based formulations toward more sustainable solutions is fuelling adoption across industries such as construction, automotive, packaging, textiles, and paper & board. Additionally, expanding infrastructure and renovation activities globally — along with increasing automotive production — are boosting consumption of polymer emulsions in paints, coatings, and adhesives.

Regionally, the Asia‑Pacific region exerts the most significant influence, accounting for a substantial share of global demand. High growth in construction, industrialization, and urban development in countries such as China and India is driving strong uptake of polymer‑emulsion‑based products in coatings, adhesives, and textiles. Emerging economies in Southeast Asia also contribute to this momentum. Meanwhile, North America and Europe register stable growth, supported by stringent environmental standards and increasing preference for sustainable, performance‑oriented coatings and adhesives in mature markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polymer Emulsions Market size was valued at USD 34,922.41 million in 2024 and is projected to reach USD 56,506.75 million by 2032, growing at a CAGR of 6.2%.

- Rising environmental regulations and growing demand for low-VOC, water-based coatings, adhesives, and sealants drive adoption across construction, automotive, packaging, textiles, and paper industries.

- Expansion in construction and infrastructure projects in emerging economies increases demand for durable, high-performance materials, boosting consumption of polymer emulsions in coatings, adhesives, and sealants.

- The automotive sector fuels market growth with higher requirements for paints, coatings, and adhesives, including applications in electric vehicles that demand advanced, high-performance materials.

- Asia-Pacific holds 45% of the market, followed by North America at 25% and Europe at 20%, with growth driven by industrialization, urbanization, regulatory compliance, and increasing consumer preference for eco-friendly, high-quality products.

Market Drivers:

Market Drivers:

Increasing Demand for Eco-friendly and Sustainable Products

The growing shift toward environmentally friendly and sustainable solutions is a key driver in the polymer emulsions market. Stringent regulations surrounding volatile organic compound (VOC) emissions have heightened the demand for water-based formulations, particularly in paints, coatings, adhesives, and sealants. These formulations not only comply with environmental standards but also offer improved performance and safety. Consumers’ preference for eco-friendly products continues to push manufacturers to innovate and expand their product offerings.

- For instance, Impact Solutions developed bio-emulsion polymers using biologically derived styrene via engineered metabolic pathways, replacing traditional petrochemically sourced styrene to produce sustainable latex.

Expanding Construction and Infrastructure Activities

The construction and infrastructure sectors are experiencing robust growth, which directly impacts the polymer emulsions market. The increasing number of construction projects, especially in emerging economies, calls for durable, high-performance materials. Polymer emulsions are widely used in coatings, adhesives, and sealants, which are essential in modern buildings, roads, and bridges. This sector’s growth, fueled by urbanization and industrialization, continues to drive demand for polymer-based products.

- For instance, Dow’s PRIMAL™ CS-4000 emulsion polymer enhances adhesion on concrete surfaces with 48% solids content by weight for superior water resistance.

Rising Automotive Production and Adhesive Demand

The automotive industry’s expansion significantly influences the polymer emulsions market. As automotive production increases globally, the demand for adhesives, paints, and coatings also rises. These materials, formulated with polymer emulsions, are essential for automotive assembly, enhancing vehicle durability, aesthetics, and environmental compliance. Furthermore, the growing trend towards electric vehicles, which require high-performance materials for battery management systems and interior coatings, continues to increase the consumption of polymer emulsions.

Advancements in Textile and Paper Industries

Technological advancements in the textile and paper industries contribute to the growing need for polymer emulsions. In textiles, polymer emulsions are used in coatings, printing, and finishing processes to enhance fabric durability, appearance, and performance. Similarly, in the paper industry, they are essential for improving the quality and strength of paper products. These applications, combined with the rise in consumer demand for high-quality materials, further support the polymer emulsions market’s growth.

Market Trends:

Increasing Preference for Water-based Formulations and Low-VOC Products

One of the most significant trends in the polymer emulsions market is the growing preference for water-based formulations that offer low volatile organic compound (VOC) emissions. Strict environmental regulations and consumer demand for safer, more sustainable products continue to push manufacturers toward water-based technologies. This shift not only aligns with global sustainability goals but also provides superior performance in many applications, such as coatings, adhesives, and sealants. Water-based emulsions are increasingly replacing solvent-based alternatives due to their reduced environmental impact, improved safety profiles, and compliance with increasingly stringent environmental standards. The growing trend toward eco-friendly products across industries like construction, automotive, and packaging is expected to continue driving demand for water-based polymer emulsions.

- For instance, BASF offers various Acronal® water-based emulsions which enable the formulation of architectural coatings with very low or near-zero VOC levels (e.g., as low as 0.27 g/L in Acronal® ECO 7653).

Advancements in Customization and Functional Properties

Another key trend in the polymer emulsions market is the growing demand for customized solutions with enhanced functional properties. Manufacturers are focusing on developing advanced emulsions that offer superior attributes such as improved adhesion, durability, and resistance to heat, chemicals, and water. Customization enables polymer emulsions to meet specific requirements in industries such as automotive, textiles, and packaging, where performance characteristics are critical. This trend is driven by the need for materials that can withstand harsher environments, higher stress, and more complex applications. Additionally, there is a focus on the development of emulsions with enhanced bio-based content, which supports the broader movement towards more sustainable and renewable raw materials in manufacturing processes. These innovations are expected to fuel continued growth in the polymer emulsions market.

- For instance, Arkema introduced a bio-based emulsion variant that incorporates 40% renewable content while maintaining 25% better heat resistance up to 150°C for packaging applications.

Market Challenges Analysis:

Raw Material Price Fluctuations

One of the significant challenges facing the polymer emulsions market is the volatility in raw material prices. The cost of key ingredients, such as acrylics, styrenes, and other polymers, can fluctuate due to global supply chain disruptions, geopolitical tensions, and changes in oil prices. These fluctuations can directly impact production costs, making it difficult for manufacturers to maintain consistent pricing. As raw material costs rise, manufacturers may face pressure to either absorb these increases or pass them on to customers, both of which could affect their competitiveness in the market. Such uncertainties may lead to challenges in long-term planning and profitability.

Intense Competition and Market Saturation

Another challenge in the polymer emulsions market is the intense competition and market saturation. Numerous global and regional players are continuously vying for market share, which can lead to price wars and thin profit margins. The widespread availability of polymer emulsions in various industries has led to increased competition, particularly in mature markets where growth is slower. Companies must focus on differentiating their products through innovation, quality improvements, and sustainable offerings to maintain a competitive edge. This high level of competition makes it more difficult for smaller players to establish themselves and secure a foothold in the market.

Market Opportunities:

Expansion in Emerging Economies and Infrastructure Development

The polymer emulsions market presents significant opportunities in emerging economies due to rapid urbanization and industrial growth. Increasing construction and infrastructure projects in countries like India, China, and Southeast Asia drive strong demand for adhesives, coatings, and sealants formulated with polymer emulsions. It enables manufacturers to tap into growing markets with high consumption potential. Rising investments in residential, commercial, and industrial projects create consistent demand for high-performance materials. Expanding middle-class populations and increasing disposable incomes further support the adoption of advanced polymer-based products. Companies that establish localized production and distribution networks can benefit from cost efficiencies and faster market penetration.

Innovation in Sustainable and High-Performance Applications

Opportunities also exist through the development of sustainable and high-performance polymer emulsions for diverse industrial applications. Industries increasingly require materials that offer improved durability, chemical resistance, and bio-based content. It allows manufacturers to create differentiated products that meet both environmental regulations and performance expectations. Growth in sectors such as automotive, packaging, textiles, and electronics provides avenues to introduce tailored solutions. Continuous innovation in functional properties, such as water resistance, adhesion, and thermal stability, can strengthen market presence. Companies that focus on R&D to deliver eco-friendly and technologically advanced emulsions are likely to capture a larger share of the expanding global market.

Market Segmentation Analysis:

By Type: Acrylic, Styrene-Butadiene, and Specialty Emulsions

The Polymer Emulsions Market is segmented by type, with acrylic emulsions holding the largest share due to their superior adhesion, durability, and resistance to environmental conditions. Styrene-butadiene emulsions are widely used in adhesives, coatings, and textile applications, offering balanced performance at competitive costs. Specialty emulsions, including vinyl acetate and polyurethane, serve niche applications requiring flexibility, water resistance, and chemical stability. It enables manufacturers to provide tailored solutions that meet the performance demands of diverse industries while supporting sustainability and regulatory compliance.

- For instance, Dow developed styrene-butadiene (SB) emulsion polymers with improved water resistance, reaching a global market volume in the range of a few million metric tons (or valued in billions of USD) for enhanced durability in construction.

By End-Use Industries: Construction, Automotive, Packaging, Paper, and Textiles

Construction represents the largest end-use segment in the polymer emulsions market, driven by demand for paints, coatings, adhesives, and sealants that enhance durability, aesthetics, and weather resistance. The automotive industry consumes emulsions for coatings, adhesives, interior components, and electric vehicle applications, supporting both performance and regulatory standards. Packaging and paper sectors utilize polymer emulsions to improve strength, surface finishing, and printability of products. The textile industry relies on emulsions for fabric coating, printing, and finishing to enhance durability and performance. It is essential for manufacturers to align products with industry-specific needs to capture growth across mature and emerging markets.

- For instance, Sun Chemical’s WATERSOL AC line features hybrid polyurethane–acrylic matrix coatings providing high gloss and mar resistance while eliminating up to 90% of VOC emissions, helping automotive brands meet stringent environmental standards.

Segmentations:

By Type

- Acrylic Emulsions

- Styrene-Butadiene Emulsions

- Vinyl Acetate Emulsions

- Polyurethane Emulsions

- Other Specialty Emulsions

By End-Use Industries

- Construction

- Automotive

- Packaging

- Paper & Board

- Textiles

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Leading Market Share and Strong Growth

Asia-Pacific holds 45% of the global polymer emulsions market. Rapid industrialization, urbanization, and infrastructure development drive strong growth in construction, automotive, and packaging sectors. Countries like China, India, and Southeast Asia contribute significantly to demand for polymer emulsions in coatings, adhesives, and sealants. It benefits from a large manufacturing base, which supports cost-effective production and distribution. The growing middle-class population further drives demand for eco-friendly and high-performance materials in various industries, making the region a key player in the global market.

North America: Steady Growth and Sustainability Focus

North America accounts for 25% of the polymer emulsions market, fueled by demand for sustainable, high-performance products. The region’s construction, automotive, and packaging industries require coatings, adhesives, and sealants that comply with stringent environmental standards. It experiences growing demand for low-VOC and water-based emulsions. The shift toward eco-friendly solutions opens new opportunities for market expansion. Innovations in bio-based polymers and advanced applications, particularly in automotive manufacturing, continue to drive growth in the region, reinforcing North America’s critical role in the polymer emulsions market.

Europe: Mature Market with Innovation at its Core

Europe holds 20% of the polymer emulsions market, supported by its mature industries and regulatory focus on sustainability. The region’s established automotive, construction, and packaging sectors increasingly demand water-based emulsions due to strict environmental standards. It benefits from a high level of consumer awareness regarding eco-friendly products, which supports growth in demand for polymer emulsions. Germany, France, and the UK lead technological advancements, focusing on improving properties such as water and chemical resistance. Despite slower growth compared to other regions, Europe remains a key market for high-quality, sustainable polymer emulsion solutions.

Key Player Analysis:

- BASF SE

- Dow Inc.

- Arkema Group

- Celanese Corporation

- Lubrizol Corporation

- Wacker Chemie AG

- Synthomer plc

- Merck KGaA

- Ashland Global Holdings, Inc.

- H.B. Fuller Company

- Mitsui Chemicals, Inc.

- Omnova Solutions Inc.Top of Form

Competitive Analysis:

The Polymer Emulsions Market is highly competitive, characterized by the presence of numerous global and regional players striving to capture market share. Leading companies focus on product innovation, sustainability, and performance enhancement to differentiate themselves in the market. It emphasizes the development of water-based, low-VOC, and bio-based emulsions to meet stringent environmental regulations and evolving customer preferences. Strategic collaborations, mergers, and acquisitions help companies expand their geographic presence and strengthen supply chains. Companies also invest in research and development to create specialized emulsions for automotive, construction, packaging, and textile applications. Price competitiveness, technological advancement, and consistent product quality remain critical factors influencing market positioning. Smaller players face challenges in establishing a foothold due to the dominance of established manufacturers, but niche applications and customized solutions provide opportunities to compete effectively and gain recognition in the global polymer emulsions market.

Recent Developments:

- In December 2025, Arkema signed a strategic partnership with Semcorp for battery separator technologies.

- In June 2025, Merck KGaA launched a strategic partnership with Simtra BioPharma Solutions for integrated antibody-drug conjugate manufacturing services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, End-User Industries and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The polymer emulsions market will continue to benefit from the global shift toward sustainable and eco-friendly materials.

- Demand for water-based and low-VOC coatings, adhesives, and sealants will grow across construction, automotive, and packaging sectors.

- Emerging economies will present significant opportunities due to expanding infrastructure and urban development projects.

- The automotive sector, particularly electric vehicles, will drive consumption of high-performance polymer emulsions for coatings and interior applications.

- Manufacturers will focus on developing bio-based and renewable polymer emulsions to meet regulatory standards and consumer preferences.

- Technological advancements in textile and paper industries will increase the use of polymer emulsions for coatings, finishing, and printability enhancement.

- Product customization for specific industry applications will become a key competitive strategy for market players.

- Digitalization and smart manufacturing practices will optimize production, improve efficiency, and reduce operational costs.

- Partnerships, mergers, and acquisitions will help companies expand regional presence and strengthen supply chains.

- Continuous innovation in functional properties, including water resistance, chemical resistance, and durability, will support long-term market growth and adoption.

Market Drivers:

Market Drivers: