Market Overview:

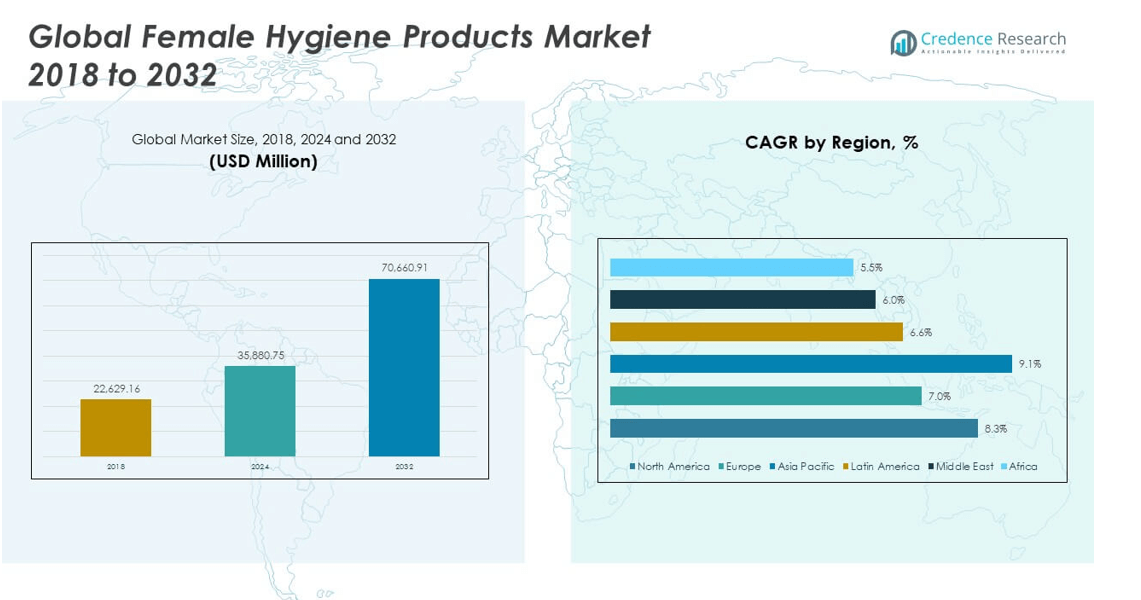

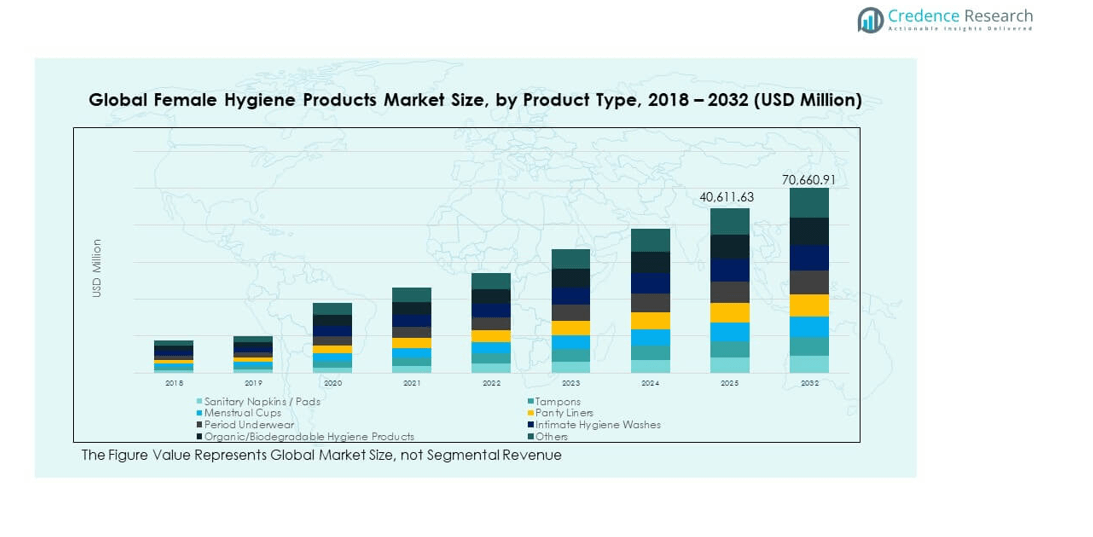

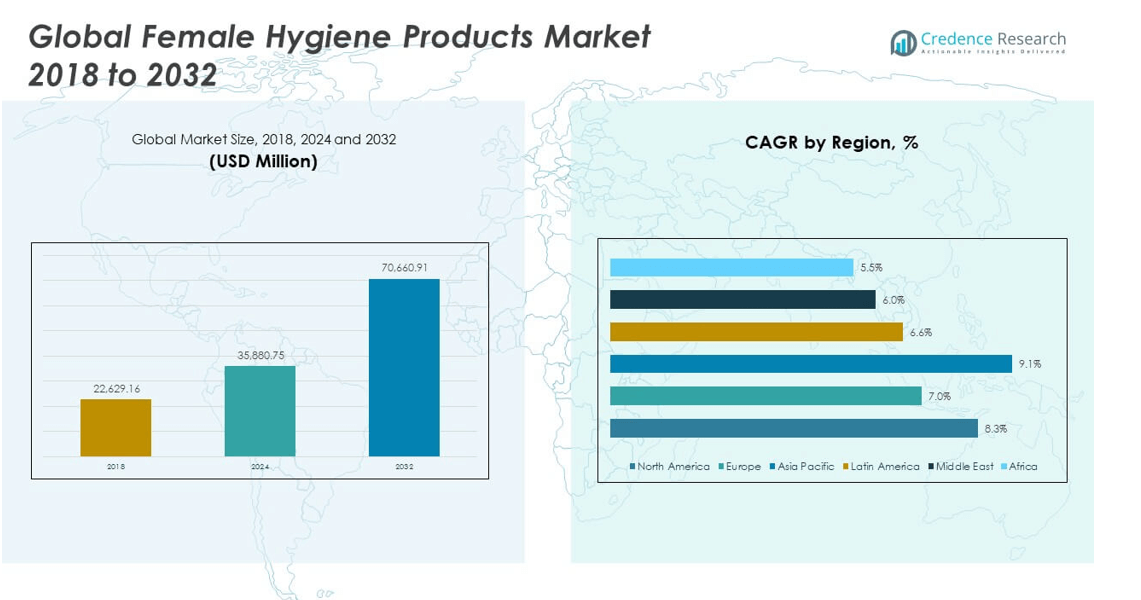

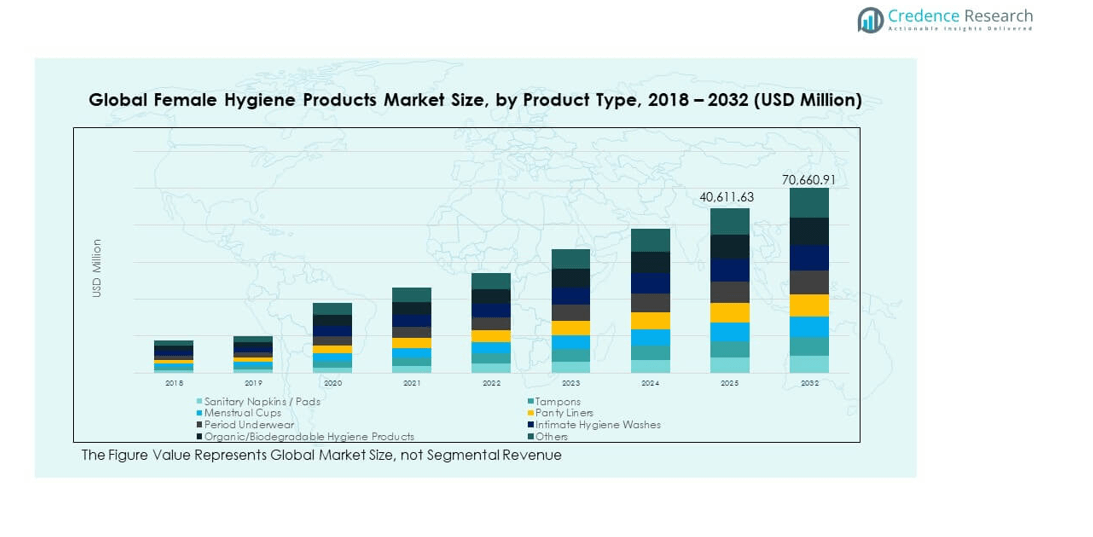

The Global Female Hygiene Products Market size was valued at USD 22,629.16 million in 2018 to USD 35,880.75 million in 2024 and is anticipated to reach USD 70,660.91 million by 2032, at a CAGR of 8.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Female Hygiene Products Market Size 2024 |

USD 35,880.75 million |

| Female Hygiene Products Market, CAGR |

8.23% |

| Female Hygiene Products Market Size 2032 |

USD 70,660.91 million |

Rising awareness about menstrual health, improved access to hygiene products, and government-led initiatives promoting sanitary practices are driving the market. The growth is further supported by innovations in biodegradable and reusable products catering to environmentally conscious consumers. Increasing female workforce participation, urbanization, and the influence of digital marketing are enhancing product adoption, while e-commerce platforms are expanding the availability of diverse product options across both developed and emerging economies.

North America and Europe lead the market due to strong consumer awareness, high purchasing power, and widespread access to premium hygiene products. The Asia-Pacific region is emerging as the fastest-growing market, driven by population growth, increasing education levels, and government programs addressing menstrual hygiene in rural areas. Latin America and the Middle East & Africa are witnessing steady growth, supported by expanding retail networks and gradual cultural acceptance of female hygiene products.

Market Insights:

- The Global Female Hygiene Products Market size was valued at USD 22,629.16 million in 2018, reaching USD 35,880.75 million in 2024, and is projected to attain USD 70,660.91 million by 2032, growing at a CAGR of 8.23% during the forecast period.

- Growing awareness about menstrual health, supported by education campaigns from governments, NGOs, and brands, is significantly boosting product adoption.

- Technological advancements in product design, including skin-friendly, biodegradable, and reusable options, are attracting environmentally conscious consumers.

- Cultural taboos and lack of awareness in rural and conservative regions limit adoption, requiring persistent community engagement and culturally sensitive marketing.

- Affordability challenges in low-income markets hinder wider accessibility, with pricing and distribution strategies needing alignment to local purchasing power.

- North America and Europe lead the market with strong consumer awareness, premium product adoption, and well-established retail networks.

- Asia-Pacific is emerging as the fastest-growing region, driven by urbanization, rising education levels, and supportive government hygiene programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Awareness and Education Campaigns Driving Product Adoption:

The Global Female Hygiene Products Market benefits significantly from rising awareness about menstrual health and hygiene. Government initiatives, NGOs, and private companies are conducting education programs in schools, workplaces, and communities to promote safe menstrual practices. Campaigns focus on reducing stigma, enhancing product familiarity, and encouraging the use of sanitary products over traditional alternatives. Increased media coverage and celebrity endorsements amplify awareness efforts, reaching a wider audience. The shift from awareness to action is supported by improved product affordability and availability. Educational institutions increasingly incorporate hygiene awareness into curriculums, fostering early adoption habits. The market also sees the impact of social media advocacy, where influencers and activists highlight health benefits and sustainability concerns. This combined momentum ensures long-term demand growth and a more informed consumer base.

- For instance, Johnson & Johnson (through its Stayfree brand) supported Project Free Period in India, providing free sanitary pads and menstrual hygiene education to girls in more than 1,500 government schools as of March 2025.

Technological Advancements in Product Design and Material Innovation:

The market experiences growth through constant innovation in product design and materials. Manufacturers are investing in advanced absorbent technologies, skin-friendly materials, and leak-proof structures to improve comfort and safety. Products now cater to sensitive skin and offer chemical-free, hypoallergenic options. Innovation in biodegradable and reusable products aligns with environmental sustainability goals, appealing to eco-conscious consumers. Advanced packaging solutions improve convenience and portability, enhancing user experience. Integration of smart product features, such as period tracking linked to apps, is also gaining attention. It benefits from R&D collaborations with material scientists and healthcare professionals, ensuring high standards. Continuous product upgrades differentiate brands and strengthen consumer loyalty in a competitive environment.

- For instance, Kao Corporation’s Laurier Super Absorbent Fibre Non-woven Sheet technology has been incorporated into its sanitary pads, achieving faster absorption and dryness, according to R&D reports published in 2025.

E-commerce Expansion and Direct-to-Consumer Distribution Models:

Online retail plays a pivotal role in increasing accessibility to female hygiene products globally. E-commerce platforms enable discreet purchasing, a factor critical in regions where cultural taboos still exist. Subscription-based delivery services ensure regular supply, reducing inconvenience for consumers. Digital marketing strategies personalize product recommendations, increasing conversion rates. The Global Female Hygiene Products Market leverages online channels to launch exclusive variants and trial packs. Brands use customer feedback from e-commerce reviews to refine products and packaging. Social media platforms facilitate interactive engagement with target audiences, building trust and brand recognition. This digital shift expands market penetration into both urban and rural sectors.

Urbanization and Rising Female Workforce Participation:

The market thrives as more women join the workforce and urban populations grow. Increased disposable incomes allow women to invest in higher-quality hygiene products. Time constraints and active lifestyles create demand for convenient and long-lasting solutions. Urban retail networks ensure easy availability through supermarkets, convenience stores, and specialty outlets. Working women tend to prefer branded and premium products that promise performance and reliability. Corporate wellness programs increasingly distribute hygiene products as part of employee health benefits. Urban centers also act as early adoption hubs for innovative products, influencing nearby regions. This urban and professional demographic shift fuels consistent revenue growth for the industry.

Market Trends:

Sustainable and Eco-Friendly Product Development Becoming Mainstream:

The market witnesses a strong trend toward environmentally sustainable products. Consumers increasingly demand biodegradable pads, organic tampons, and reusable menstrual cups. Brands invest in plant-based materials and reduce plastic usage in both products and packaging. This aligns with global sustainability goals and regulatory pressure on waste management. The Global Female Hygiene Products Market incorporates life cycle assessments to minimize environmental impact. Consumers support brands that commit to eco-friendly practices, influencing purchasing behavior. Certification labels like organic or cruelty-free further enhance trust. This sustainability wave redefines product innovation and positions environmentally responsible products as premium choices.

- For instance, Maxim Hygiene offers 100% organic cotton, chlorine-free menstrual products, expanding its product line to include over 25 individual SKUs of pads, liners, and tampons by mid-2025—all certified according to international organic and biodegradable standards.

Customization and Personalization in Product Offerings:

Brands are embracing customization to cater to diverse consumer needs and preferences. Personalization ranges from tailored absorbency levels to skin-type specific variants. Subscription services allow consumers to select preferred products and delivery frequencies. The Global Female Hygiene Products Market leverages AI and analytics to recommend products based on purchase history and lifestyle data. Packaging designs increasingly reflect inclusivity, celebrating diverse body types and cultural backgrounds. Limited-edition product lines and personalized messages enhance customer connection. Offering choice in product fragrance, material, and size meets the demand for individualized experiences. This focus on personalization strengthens brand-consumer relationships.

- For instance, DesignRush reported an uptick in limited-edition and collaboration releases, with at least 15 new personalized packaging options released by top global brands in 2025.

Premiumization and Wellness-Oriented Hygiene Solutions:

Consumers show a growing preference for premium hygiene products offering added health benefits. Premiumization introduces innovations like anti-bacterial layers, pH-balanced compositions, and dermatologically tested materials. The Global Female Hygiene Products Market sees synergy with the wellness industry through probiotic-infused and vitamin-enriched products. Luxury packaging and exclusive retail positioning appeal to higher-income groups. Brands associate these premium products with holistic health, positioning them as lifestyle essentials. Collaborations with healthcare professionals enhance credibility. This segment drives higher margins and brand differentiation. Premium offerings often act as flagship products that influence the entire portfolio.

Digital Engagement and Community Building Around Women’s Health:

Brands increasingly focus on building communities centered on women’s health and empowerment. Digital platforms host forums, webinars, and expert Q&A sessions on hygiene and wellness topics. Influencer-led campaigns humanize brand messaging and foster trust. The Global Female Hygiene Products Market uses social media to launch awareness challenges and share user-generated content. Online education modules guide consumers on proper product usage and disposal. Brand-sponsored communities act as safe spaces for women to discuss health concerns. This approach strengthens customer loyalty and generates organic advocacy. Digital communities also serve as feedback loops for product improvement.

Market Challenges Analysis:

Cultural Taboos and Lack of Awareness in Certain Regions:

In several developing regions, cultural norms and taboos surrounding menstruation hinder product adoption. Social stigma prevents open discussions, leaving many women uninformed about safe menstrual practices. The Global Female Hygiene Products Market faces difficulty penetrating rural and conservative markets where traditional methods are still prevalent. Lack of proper education and misinformation discourage the use of modern products. Resistance to change is reinforced by generational practices passed through families. Religious or societal restrictions can limit marketing and outreach efforts. Overcoming these challenges requires persistent community engagement and culturally sensitive campaigns. Collaboration with local leaders and educators is critical to address deep-rooted biases.

Affordability and Accessibility Issues for Low-Income Consumers:

Affordability remains a barrier for large segments of the population, especially in low-income and rural areas. Many women prioritize basic needs over hygiene products due to limited financial resources. The market struggles with high distribution costs in remote regions, affecting retail availability. The Global Female Hygiene Products Market must balance product quality with cost efficiency to serve price-sensitive consumers. Import duties, taxation, and logistical challenges can further increase prices. Non-profit organizations often step in to bridge the gap, but long-term solutions require scalable low-cost manufacturing. Partnerships with governments and aid agencies can help create subsidized programs. Addressing affordability is essential for achieving universal access.

Market Opportunities:

Untapped Rural and Emerging Market Segments Offering Expansion Potential:

The Global Female Hygiene Products Market holds vast potential in rural and emerging economies. Rising literacy rates and targeted awareness programs are gradually shifting consumer attitudes. Mobile retail units and digital ordering systems enhance product reach in remote areas. Brands can adapt packaging sizes and pricing strategies to suit local purchasing power. Government health initiatives that integrate menstrual products into public distribution systems can accelerate adoption. Rural markets offer the opportunity to build long-term brand loyalty through early engagement. Expanding distribution channels in these areas supports both growth and social impact.

Innovation in Reusable and Hybrid Product Lines:

Demand for sustainable yet cost-effective solutions opens avenues for reusable and hybrid products. Menstrual cups, washable pads, and hybrid systems combining disposable and reusable components cater to both environmental and economic needs. The Global Female Hygiene Products Market can leverage technology to create durable, comfortable, and easy-to-maintain reusable options. These innovations appeal to urban eco-conscious consumers as well as rural users seeking long-term savings. Educational campaigns on usage and maintenance are essential for market acceptance. Developing such products also aligns brands with global sustainability and waste reduction goals.

Market Segmentation Analysis:

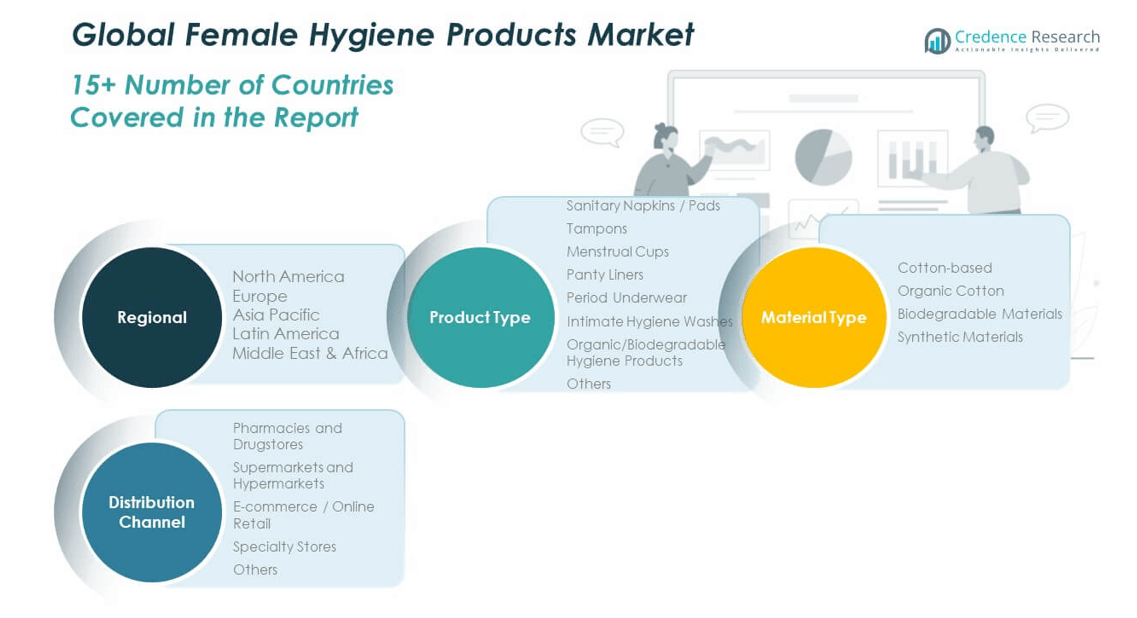

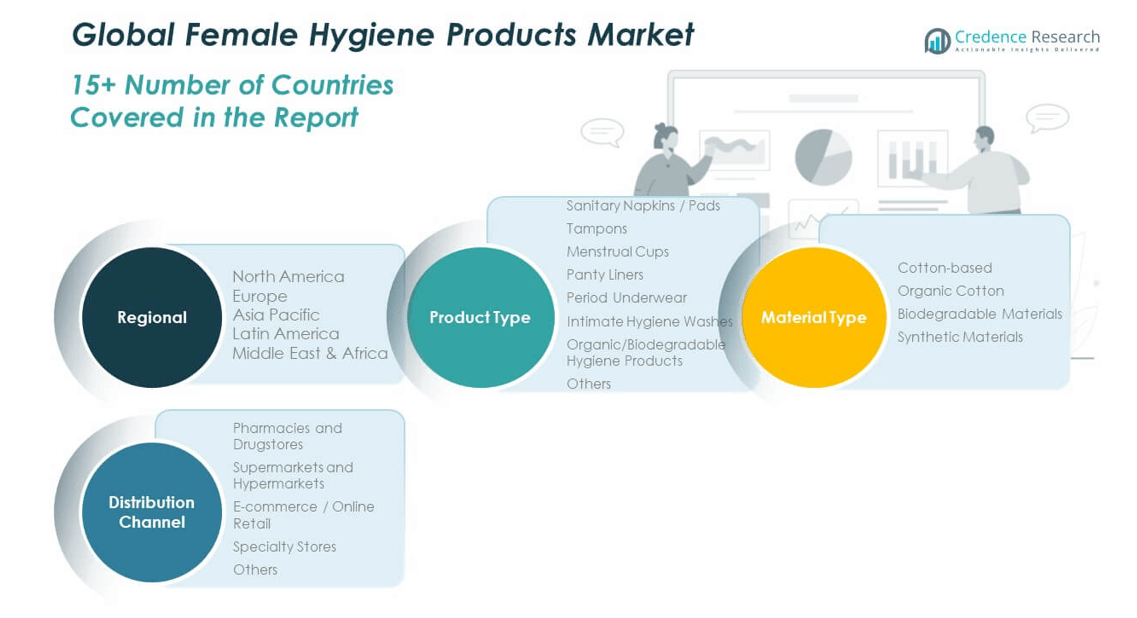

By Product Type

The Global Female Hygiene Products Market is segmented into sanitary napkins/pads, tampons, menstrual cups, panty liners, period underwear, intimate hygiene washes, organic/biodegradable hygiene products, and others. Sanitary napkins and pads lead the segment due to their accessibility, affordability, and ease of use. Tampons and menstrual cups are gaining market share among younger, urban consumers seeking comfort, convenience, and discretion. Panty liners fulfill daily freshness needs, while period underwear is emerging as a popular reusable alternative, driven by sustainability concerns. Intimate hygiene washes are experiencing rising adoption with growing awareness of personal health, and organic/biodegradable options attract environmentally conscious consumers. The “others” category comprises innovative and niche offerings catering to specific needs.

- For instance, Tampons and menstrual cups have gained noticeable share among younger consumers—Diva International’s DivaCup reported sales in more than 9,000 retail locations worldwide.

By Material Type

This segmentation includes cotton-based, organic cotton, biodegradable materials, and synthetic materials. Cotton-based products are widely preferred for comfort and familiarity, while organic cotton appeals to consumers seeking natural, chemical-free solutions. Biodegradable materials are gaining traction due to environmental awareness, offering a reduced ecological footprint. Synthetic materials continue to be relevant for their durability, moisture control, and cost-effectiveness, appealing to price-sensitive markets.

- For instance, Sparkle’s banana-fiber biodegradable pads have scaled past 1 million units per month. Synthetic material-based products by major brands remain relevant for cost-sensitive segments, maintaining large-scale production to meet demand for durable and moisture-wicking options.

By Distribution Channel

Distribution channels include pharmacies and drugstores, supermarkets and hypermarkets, e-commerce/online retail, specialty stores, and others. Pharmacies and drugstores maintain strong consumer trust due to product authenticity and professional advice. Supermarkets and hypermarkets drive large-volume sales through accessibility and variety. E-commerce and online platforms are rapidly expanding, offering privacy, subscription services, and a wide range of brands. Specialty stores attract consumers looking for premium and niche products, while the “others” category covers emerging sales formats such as vending machines and community-driven distribution networks.

Segmentation:

By Product Type

- Sanitary Napkins / Pads

- Tampons

- Menstrual Cups

- Panty Liners

- Period Underwear

- Intimate Hygiene Washes

- Organic/Biodegradable Hygiene Products

- Others

By Material Type

- Cotton-based

- Organic Cotton

- Biodegradable Materials

- Synthetic Materials

By Distribution Channel

- Pharmacies and Drugstores

- Supermarkets and Hypermarkets

- E-commerce / Online Retail

- Specialty Stores

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Female Hygiene Products Market size was valued at USD 6,502.38 million in 2018 to USD 10,147.43 million in 2024 and is anticipated to reach USD 20,068.41 million by 2032, at a CAGR of 8.3% during the forecast period. North America accounts for approximately 28.28% of the global market share in 2024. The market benefits from high consumer awareness, advanced retail infrastructure, and strong penetration of premium and organic hygiene products. It is supported by widespread education on menstrual health and government-backed initiatives to improve accessibility. Brands compete through innovation, offering products with added health benefits, sustainable materials, and personalized features. E-commerce adoption ensures convenient access, with subscription models gaining traction among busy consumers. The region’s strong focus on environmental sustainability has boosted demand for biodegradable and reusable products. Collaborations between brands and healthcare professionals enhance trust and adoption. Overall, North America remains a mature yet innovation-driven market with consistent growth potential.

Europe

The Europe Global Female Hygiene Products Market size was valued at USD 4,438.03 million in 2018 to USD 6,669.97 million in 2024 and is anticipated to reach USD 12,004.77 million by 2032, at a CAGR of 7.0% during the forecast period. Europe holds around 18.59% of the global market share in 2024. The market is characterized by strong regulatory standards, promoting product safety, quality, and sustainability. It benefits from established distribution channels, including hypermarkets, specialty stores, and robust online platforms. Consumer preferences increasingly favor eco-friendly products, leading brands to expand biodegradable and organic offerings. Government and non-profit initiatives promote menstrual health awareness, particularly targeting low-income and migrant populations. Innovation in product design focuses on comfort, skin health, and discreet packaging. Cross-border collaborations within the EU facilitate uniform product availability and quality standards. The market’s stability and focus on premiumization drive steady growth across the region.

Asia Pacific

The Asia Pacific Global Female Hygiene Products Market size was valued at USD 9,584.81 million in 2018 to USD 15,776.58 million in 2024 and is anticipated to reach USD 33,022.32 million by 2032, at a CAGR of 9.1% during the forecast period. Asia Pacific commands the largest share of about 43.97% of the global market in 2024. Rapid urbanization, rising disposable incomes, and expanding awareness about menstrual health drive market growth. Government programs and NGO initiatives target rural and underprivileged areas to improve access to affordable hygiene products. Local and international brands compete aggressively, often introducing smaller, more affordable packaging to suit regional buying patterns. E-commerce platforms are critical in bridging supply gaps in remote areas. Increasing female workforce participation boosts demand for convenient and high-performance products. The market also sees rising interest in sustainable and reusable options among younger consumers. Asia Pacific’s vast population and evolving consumer behavior make it a critical growth hub.

Latin America

The Latin America Global Female Hygiene Products Market size was valued at USD 1,071.38 million in 2018 to USD 1,677.70 million in 2024 and is anticipated to reach USD 2,925.21 million by 2032, at a CAGR of 6.6% during the forecast period. Latin America represents approximately 4.68% of the global market share in 2024. Economic growth, urbanization, and improved retail networks are contributing to market expansion. Awareness campaigns, often driven by NGOs and corporate social responsibility programs, are helping overcome cultural barriers in rural areas. Consumers increasingly seek branded products with higher comfort and safety features. Affordability remains a key consideration, prompting brands to balance quality with cost-effective production. Digital platforms are gaining influence, with online sales growing steadily. Multinational companies are expanding their footprint through partnerships with local distributors. The region offers steady growth prospects despite economic and logistical challenges.

Middle East

The Middle East Global Female Hygiene Products Market size was valued at USD 641.42 million in 2018 to USD 930.69 million in 2024 and is anticipated to reach USD 1,550.19 million by 2032, at a CAGR of 6.0% during the forecast period. The region accounts for around 2.59% of the global market share in 2024. The market is shaped by cultural sensitivities, requiring discreet marketing and tailored product offerings. Urban centers display high adoption of premium products, while rural areas still rely on traditional alternatives. Retail expansion in shopping malls and supermarkets improves accessibility. Awareness about menstrual hygiene is growing through health education initiatives in schools and workplaces. E-commerce adoption is rising, offering privacy in purchasing. Sustainable and organic products are gaining gradual acceptance among higher-income groups. The market’s growth is supported by increased female workforce participation and changing social attitudes.

Africa

The Africa Global Female Hygiene Products Market size was valued at USD 391.15 million in 2018 to USD 678.36 million in 2024 and is anticipated to reach USD 1,090.02 million by 2032, at a CAGR of 5.5% during the forecast period. Africa holds about 1.89% of the global market share in 2024. The market faces significant challenges due to limited awareness, cultural stigma, and affordability issues. Rural populations often lack access to quality hygiene products, relying on traditional methods. Government and NGO-led programs play a vital role in driving awareness and distributing low-cost or free products. Urban markets show growing demand for branded and premium products, supported by expanding retail infrastructure. E-commerce adoption is in early stages but shows promise for future growth. Brands focusing on affordable, reusable, and durable products can tap into long-term demand. Africa’s young population and increasing education rates present opportunities for gradual market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Procter & Gamble

- Unilever

- Glenmark Pharmaceuticals Ltd

- Unicharm Corporation

- Maxim Hygiene

- KCWW (Kimberly-Clark Worldwide, Inc.)

- Premier FMCG (Pty) Ltd.

- Edgewell Personal Care

- Essity Aktiebolag

- Ontex BV

Competitive Analysis:

The Global Female Hygiene Products Market features intense competition among multinational corporations and regional players. Leading companies such as Procter & Gamble, Unilever, Kimberly-Clark, Essity Aktiebolag, and Unicharm Corporation leverage strong brand portfolios, extensive distribution networks, and continuous product innovation to maintain market dominance. It is driven by advancements in sustainable materials, premium product lines, and personalized solutions. Regional brands compete by offering cost-effective products tailored to local preferences, often supported by culturally relevant marketing. E-commerce growth has enabled emerging players to penetrate new markets rapidly, challenging established brands. Strategic mergers, acquisitions, and collaborations are common as companies seek to expand geographic reach and product diversity.

Recent Developments:

- In June 2025, Unicharm established a joint venture with Toyota Tsusho and CFAO Kenya to commence local production of Sofy Long Lasting sanitary napkins in Kenya. The initiative targets low penetration markets—Kenya’s sanitary napkin penetration rate stands at 30%—and leverages Unicharm technology and Toyota Tsusho’s local network to provide affordable, high-quality menstrual products for African markets.

- In June 2025, Kimberly-Clark announced a significant strategic partnership with Suzano to strengthen and expand global hygiene product assets, including feminine care brands like Kotex and Intimus. Kimberly-Clark also celebrated Menstrual Hygiene Day 2025 by engaging manufacturing teams worldwide in campaigns supporting menstrual education and awareness.

- In May 2025, Procter & Gamble’s Always brand launched the new Always Pocket Flexfoam pads, debuting as the official period care partner at Coachella 2025. This portable, mini-format Flexfoam pad is designed for on-the-go protection, featuring a compact pouch and innovative Flexfoam technology for up to 100% leak-free comfort. The launch included on-site activations for festival attendees, making the product widely available and highlighting P&G’s push for accessible and innovative menstrual care products.

Market Concentration & Characteristics:

The Global Female Hygiene Products Market exhibits a moderately concentrated structure, with a few multinational players controlling a significant share alongside a diverse set of regional competitors. It is characterized by high brand loyalty, consistent innovation in product design, and an increasing shift toward eco-friendly and reusable solutions. Price sensitivity in emerging markets contrasts with premiumization trends in developed economies. The industry relies on extensive distribution channels, including modern retail, pharmacies, and e-commerce, ensuring broad market penetration.

Report Coverage:

The research report offers an in-depth analysis based on product type, material type, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Stronger demand for sustainable and biodegradable products across all regions.

- Increased penetration of reusable hygiene solutions in developed and emerging markets.

- Expansion of e-commerce platforms and subscription-based delivery models.

- Integration of health and wellness features into product design.

- Growth in awareness campaigns targeting rural and underserved populations.

- Greater investments in R&D for innovative materials and improved comfort.

- Regional customization of products to suit cultural and lifestyle preferences.

- Intensified competition from private label and niche eco-friendly brands.

- Strategic acquisitions to strengthen market foothold in high-growth regions.

- Rising collaborations between brands and health organizations for awareness programs.