Market Overview:

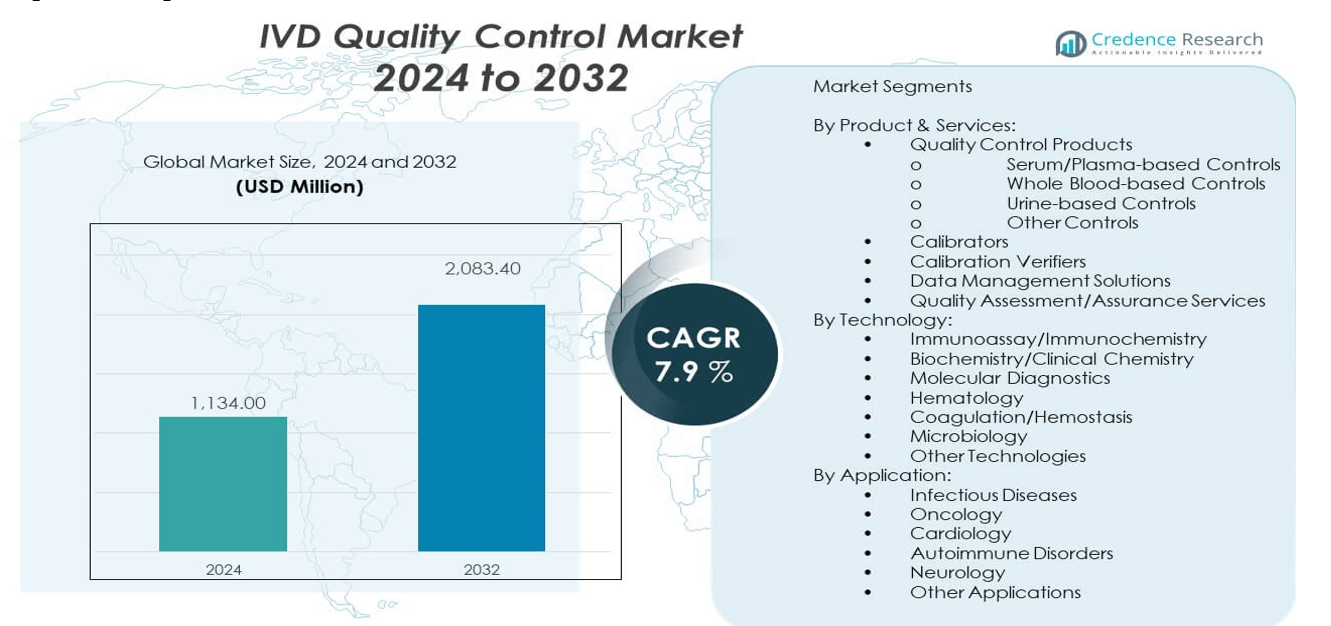

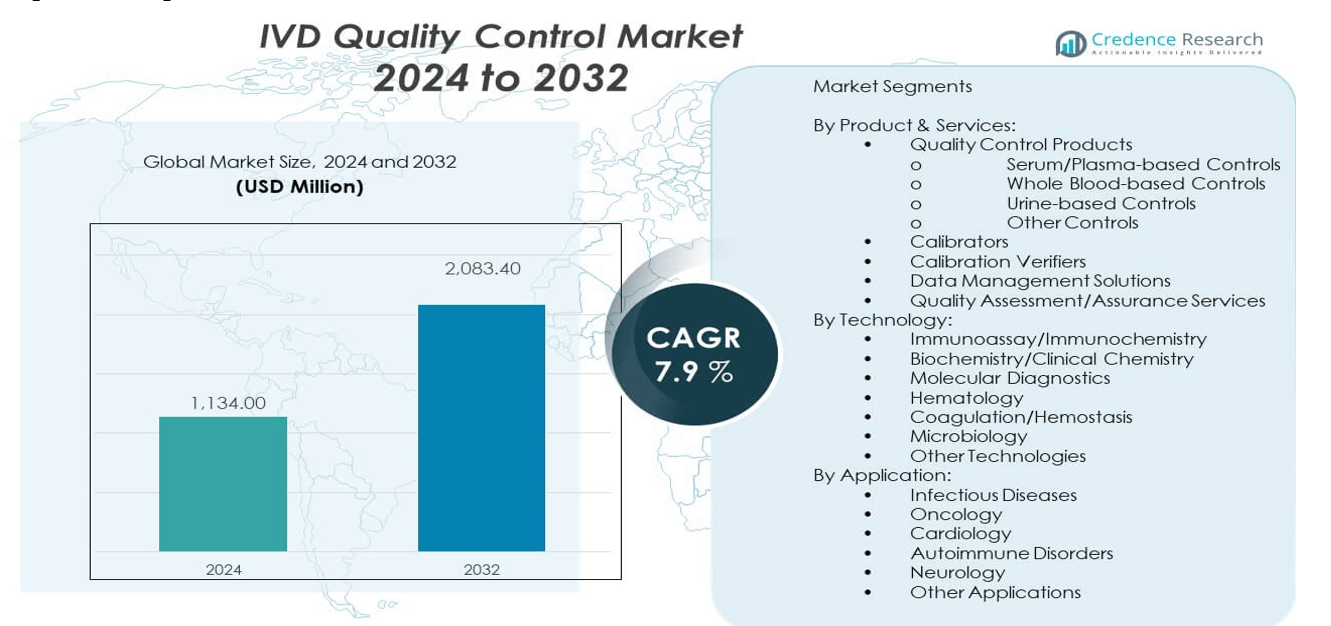

The In-Vitro Diagnostics (IVD) Quality Control Market is projected to grow from USD 1134 million in 2024 to an estimated USD 2083.4 million by 2032, with a compound annual growth rate (CAGR) of 7.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| In-Vitro Diagnostics (IVD) Quality Control Market Size 2024 |

USD 1134 million |

| In-Vitro Diagnostics (IVD) Quality Control Market, CAGR |

7.9% |

| In-Vitro Diagnostics (IVD) Quality Control Market Size 2032 |

USD 2083.4 million |

This market is gaining traction due to the increasing demand for accurate and reliable diagnostic results across clinical laboratories and hospitals. Rising incidences of chronic and infectious diseases are pushing healthcare systems to ensure stringent quality control in in-vitro diagnostic procedures. Regulatory mandates for laboratory accreditation and the growing adoption of third-party quality controls are fueling market growth. Moreover, the rapid expansion of point-of-care testing and molecular diagnostics continues to elevate the need for robust quality control systems, ensuring test reliability and minimizing diagnostic errors.

Geographically, North America leads the IVD quality control market due to its well-established healthcare infrastructure, high diagnostic testing volumes, and strong regulatory frameworks. Europe follows closely, driven by rigorous quality standards and widespread laboratory automation. Asia-Pacific is emerging as the fastest-growing region, propelled by rising healthcare investments, expanding laboratory networks, and increasing awareness of diagnostic accuracy in countries like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa are gradually gaining momentum as healthcare access and diagnostic capacities improve.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The IVD quality control market was valued at USD 1134 million in 2024 and is projected to reach USD 2083.4 million by 2032, growing at a CAGR of 7.9% during the forecast period.

- Increasing demand for accurate diagnostic results and rising test volumes due to chronic and infectious diseases are fueling market growth.

- Regulatory pressure from accreditation bodies is prompting laboratories to adopt stringent quality control practices.

- High cost of advanced QC products and budget limitations in developing regions continue to hinder widespread adoption.

- Integration of third-party controls enhances diagnostic consistency across multi-vendor lab environments.

- North America leads the market due to advanced lab infrastructure and strong regulatory enforcement, while Asia-Pacific is emerging rapidly with expanding diagnostic networks.

- The market shows potential in decentralized testing and personalized quality controls tailored to point-of-care and home-based diagnostics.

Market Drivers:

Regulatory Focus on Diagnostic Accuracy Drives Quality Control Adoption:

Regulatory authorities continue to tighten standards for laboratory diagnostics, compelling clinical labs to implement robust quality control systems. Accreditation bodies such as CAP and ISO place significant emphasis on the consistency and reliability of test outcomes. Laboratories must demonstrate compliance with these standards to retain certification and meet legal obligations. This enforcement has led to a sharp increase in third-party quality control product demand. Hospitals and diagnostic centers now integrate multi-analyte controls to validate assay performance. Quality assurance has become central to institutional reputation and patient safety. The IVD quality control market gains strength from this trend. It aligns with regulatory mandates and addresses the critical need for test precision.

- For instance, Bio-Rad Laboratories reported that over 85% of its molecular quality control products used in clinical labs comply with CAP and ISO standards, ensuring rigorous test accuracy across more than 500 laboratory sites globally.

Rise in Diagnostic Volume from Chronic and Infectious Disease Burden:

Global healthcare systems report a significant increase in diagnostic testing due to rising chronic diseases and recurring infectious outbreaks. Physicians rely on high-frequency testing to monitor conditions such as diabetes, cancer, and cardiovascular disorders. Infectious disease screening, including for influenza and emerging viruses, contributes further to this volume. Each diagnostic test requires internal validation to maintain clinical accuracy. Demand for quality control products rises proportionately with the testing load. Labs seek control materials that ensure minimal variance and consistent performance. The IVD quality control market grows by supporting this expanding test infrastructure. It responds to the need for high-throughput, reliable diagnostics in clinical workflows.

- For example, Thermo Fisher Scientific saw a 40% surge in orders for their respiratory and infectious disease quality control materials in 2024, reflecting demand driven by the COVID-19 pandemic and seasonal influenza testing.

Shift Toward Molecular Diagnostics and Precision Testing:

Healthcare providers are rapidly adopting molecular diagnostics and personalized medicine, prompting a parallel rise in advanced quality control solutions. These sophisticated platforms require controls tailored to nucleic acid testing, sequencing, and multiplex assays. Labs must ensure precise interpretation of low-abundance targets and complex genetic markers. Manufacturers are developing specialized QC products for RNA/DNA-based assays. Performance monitoring becomes critical in preventing false positives or missed mutations. The IVD quality control market supports this technological evolution with customized and platform-specific solutions. It helps laboratories maintain the integrity of advanced diagnostic outputs.

Growing Use of Third-Party Controls Across Laboratory Segments:

Clinical labs increasingly prefer third-party quality controls over manufacturer-provided options for broader verification and independence. Third-party materials offer compatibility across brands and instruments, allowing labs to detect deviations beyond internal thresholds. This flexibility improves the reliability of multi-vendor environments and enhances risk detection. Independent controls also support external quality assessment (EQA) and proficiency testing programs. Labs using unbiased quality control tools meet accreditation criteria more effectively. The IVD quality control market expands due to this strategic shift. It benefits from laboratories prioritizing objectivity and enhanced error tracking in diagnostic operations.

Market Trends:

Integration of Automation in Quality Control Procedures Across Labs:

Laboratories now invest in automation to streamline repetitive processes, including quality control validation and monitoring. Automated systems reduce manual errors and improve data traceability, both of which are critical in regulated diagnostic environments. Software platforms now integrate QC tracking into laboratory information systems (LIS). Real-time dashboards provide alerts for out-of-range values, enabling faster corrective action. Automation helps scale operations without sacrificing test integrity. Many institutions now view digital QC systems as essential rather than optional. The IVD quality control market incorporates this automation wave. It aligns product offerings with smarter, interconnected lab ecosystems.

- For instance, Siemens Healthineers’ Atellica Solution integrates automated QC validation directly into its middleware and laboratory information systems (LIS), enabling real-time data acquisition and error flagging. Their system triggers automated alerts within seconds when QC values deviate beyond established control limits, reducing human intervention by up to 35% and accelerating corrective actions by 40%, as published in their 2023 product performance white paper.

Growing Demand for Multiplex and Multi-Analyte Quality Control Materials:

Healthcare labs now run consolidated panels that test multiple biomarkers in a single assay, increasing the need for multiplex QC materials. Single-analyte controls no longer suffice for comprehensive validation of high-throughput systems. Multi-analyte controls offer operational efficiency and reduce consumable costs. They also enable simultaneous performance evaluation of various test parameters. Diagnostic labs now demand products that mirror clinical complexity without introducing workflow delays. Suppliers have expanded their catalogs to meet this demand. The IVD quality control market reflects this preference for multiplex-ready solutions. It supports evolving diagnostic approaches focused on speed and integration.

- For instance, Bio-Rad Laboratories, a leading supplier in this sector, expanded its Seraseq® multiplex QC portfolio in 2023 to incorporate controls for 12 gene mutations relevant in oncology assays, providing matrix-matched, clinically commutable materials verified through next-generation sequencing (NGS) traceability.

Rise in Cloud-Based Data Analytics for Quality Assurance Management:

Diagnostic institutions are integrating cloud-based systems to manage and analyze quality control data across decentralized lab networks. Cloud platforms offer secure storage, comparative benchmarking, and cross-site performance reviews. They allow labs to standardize QC protocols and access data from multiple geographies. Central dashboards provide rapid insights into instrument stability and technician compliance. Data-driven decision-making strengthens test reliability and regulatory readiness. The IVD quality control market responds to this digital shift. It incorporates cloud-compatibility and remote access features in new product lines.

Adoption of Custom and Lab-Developed Test Controls in Niche Settings:

Specialty labs and academic institutions increasingly require custom quality control solutions tailored to lab-developed tests (LDTs). Standardized controls often fail to match these unique assay formats, creating performance gaps. Providers now collaborate with control manufacturers to co-develop customized materials. These bespoke solutions address rare diseases, non-commercialized assays, and specific population needs. This trend reflects a move toward greater flexibility and scientific innovation in diagnostics. The IVD quality control market adapts by expanding its customization capabilities. It enables precision-driven labs to meet compliance without compromising research output.

Market Challenges Analysis:

High Cost of Advanced Quality Control Products Limits Broad Adoption:

Cost continues to restrict the widespread deployment of high-end quality control materials across low-resource settings and small laboratories. Advanced QC products, especially those for molecular and immunodiagnostic platforms, carry premium pricing. Many labs operate on tight budgets and prioritize core test kits over auxiliary tools. Limited funding in public hospitals and diagnostic chains in developing regions constrains adoption. The IVD quality control market faces resistance in penetrating such price-sensitive segments. It struggles to balance product innovation with affordability. Although demand exists, procurement often falls short due to budgetary ceilings and delayed reimbursement policies.

Complexity in Standardization Across Multi-Vendor Lab Environments:

Labs using instruments and reagents from multiple manufacturers encounter challenges in harmonizing quality control procedures. Instrument-specific controls often lack compatibility outside their native systems. Third-party controls resolve some issues but do not always support all test configurations. This limits their usefulness in highly customized lab settings. Inconsistent QC protocols complicate inter-lab comparisons and increase regulatory risk. The IVD quality control market must navigate this fragmented landscape. It faces pressure to create universally compatible products that still deliver assay-specific precision. Achieving this balance remains a major hurdle in quality assurance efforts.

Market Opportunities:

Expansion of Diagnostic Infrastructure in Emerging Economies Opens Demand:

Rapid growth in diagnostic labs across Asia-Pacific, Latin America, and parts of Africa opens significant opportunity for quality control providers. Government-led healthcare initiatives promote early disease detection and routine screening. New labs require consistent QC systems to meet international accreditation. The IVD quality control market finds room to scale by targeting expanding networks with cost-effective, compliant solutions. It gains further ground through collaborations with public health programs and diagnostic distributors in these regions.

Demand for Personalized QC Products for Point-of-Care and At-Home Testing:

Point-of-care diagnostics and at-home testing kits are becoming common in chronic care and infectious disease management. These tests still require validation to ensure user confidence and regulatory acceptance. Developers now seek compact, assay-specific quality control tools for non-laboratory settings. The IVD quality control market captures value by designing portable, easy-to-use QC products for decentralized applications. It adapts to the trend of democratized healthcare without compromising test reliability.

Market Segmentation Analysis:

By Product & Services

The IVD quality control market includes a wide array of offerings, with quality control products forming the core segment. Among these, serum/plasma-based controls dominate due to their compatibility with various test platforms. Whole blood-based and urine-based controls support hematological and urinalysis procedures, while other controls fill specialized testing gaps. Calibrators and calibration verifiers are essential for ensuring instrument accuracy and reproducibility. Data management solutions gain traction for their role in compliance and workflow efficiency. Quality assessment and assurance services provide external validation support, especially for labs pursuing accreditation.

- For instance, Serum/Plasma-based Controls remain the benchmark for QC compatibility, as documented by Beckman Coulter’s UniCel DxC QC material specifications, where pooled human serum-based controls offer analyte stability across >50 tested chemistry assays. Proprietary matrices in these controls improve commutability and minimize matrix effects, crucial for clinical accuracy.

By Technology

Immunoassay/immunochemistry and biochemistry/clinical chemistry remain the most widely used technologies, reflecting their established role in routine diagnostics. Molecular diagnostics is rapidly gaining ground with increased adoption of genetic and infectious disease testing. Hematology and coagulation/hemostasis continue to support high-volume hospital labs. Microbiology applications demand robust QC for pathogen detection. Other technologies include niche areas such as toxicology and endocrinology. The IVD quality control market supports all these technology areas by providing precise, platform-compatible controls.

- For instance, Immunoassay/Immunochemistry and Biochemistry/Clinical Chemistry: Dominant in routine diagnostics, companies like Abbott report stable QC precision with their chemiluminescent immunoassay controls, sustaining inter-assay precision to <3% CV over 12 months, supported by FDA 510(k) clearance documentation. Roche’s electrochemiluminescence immunoassay (ECLIA) systems incorporate matrix-matched QC designed to mimic patient samples, verified through method comparison studies in peer-reviewed publications.

By Manufacturer Type

Third-party or independent controls hold a significant share due to their cross-platform usability and regulatory alignment. These controls enable labs to maintain consistency across multiple instrument types. OEM controls remain relevant for specific analyzer-based workflows but face limitations in multi-brand environments. It benefits from growing demand for neutral, externally validated materials.

By Application

Infectious diseases lead due to global testing frequency. Oncology and cardiology segments show consistent growth due to rising screening and monitoring needs. Autoimmune and neurological applications contribute to demand for specialized control materials. Other applications include endocrine and metabolic disorder testing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product & Services:

- Quality Control Products

- Serum/Plasma-based Controls

- Whole Blood-based Controls

- Urine-based Controls

- Other Controls

- Calibrators

- Calibration Verifiers

- Data Management Solutions

- Quality Assessment/Assurance Services

By Technology:

- Immunoassay/Immunochemistry

- Biochemistry/Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Coagulation/Hemostasis

- Microbiology

- Other Technologies

By Application:

- Infectious Diseases

- Oncology

- Cardiology

- Autoimmune Disorders

- Neurology

- Other Applications

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads Due to Advanced Diagnostic Infrastructure

North America holds the largest share of the IVD quality control market, accounting for approximately 38% of the global revenue. The region benefits from a well-established healthcare system, early adoption of advanced diagnostic technologies, and strict regulatory compliance standards. Laboratories across the United States and Canada consistently invest in third-party quality controls to maintain accreditation and reduce diagnostic errors. High test volumes driven by chronic disease prevalence and aging populations continue to support demand. The presence of leading market players such as Bio-Rad, Thermo Fisher, and Abbott further strengthens regional dominance. It remains the most mature and innovation-driven region in terms of diagnostic quality management.

Europe Maintains Strong Presence Through Regulatory Rigor and Laboratory Automation

Europe contributes to around 27% of the IVD quality control market, driven by strong laboratory networks and stringent quality assurance regulations across countries like Germany, the UK, France, and Italy. The region emphasizes harmonized diagnostic standards through organizations such as the European Federation of Clinical Chemistry and Laboratory Medicine. Adoption of multi-analyte controls and data management tools supports efficiency in high-throughput labs. Public healthcare systems and routine screening programs sustain demand for reliable QC products. Manufacturers continue to expand distribution networks across Central and Eastern Europe. It demonstrates steady performance with a balanced mix of public and private sector adoption.

Asia-Pacific Emerges as the Fastest-Growing Regional Market

Asia-Pacific accounts for roughly 21% of the IVD quality control market and shows the fastest growth due to expanding diagnostic infrastructure in China, India, Japan, South Korea, and Southeast Asia. Governments in the region are investing heavily in public health systems and laboratory modernization. Rising awareness of diagnostic accuracy and regulatory compliance is accelerating adoption in both urban and semi-urban areas. Local and international manufacturers are targeting the region with cost-effective, scalable QC solutions. Growth in point-of-care and molecular diagnostics fuels further demand. It offers high potential due to increasing healthcare access, rising test volumes, and a growing clinical laboratory workforce.

Rest of the World Represents Emerging Opportunity

The Rest of the World—including Latin America, the Middle East, and Africa—captures the remaining 14% of the IVD quality control market. While the current base is smaller, improvements in healthcare access, rising laboratory accreditation efforts, and increased testing for infectious diseases are creating demand. Governments and non-governmental organizations continue to support diagnostic infrastructure upgrades. Market players are expanding partnerships and distribution channels to reach underserved regions. It reflects emerging growth potential driven by health system development and rising quality expectations.

Key Player Analysis:

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- Randox Laboratories Ltd.

- Siemens Healthineers

- Danaher Corporation

- Abbott Laboratories

- LGC Limited (Group)

- QuidelOrtho Corporation

- Sysmex Corporation

Competitive Analysis:

The IVD quality control market is highly competitive, with global players focusing on innovation, product reliability, and regulatory compliance. Bio-Rad Laboratories maintains a dominant position with a wide portfolio of third-party controls and global distribution. Thermo Fisher Scientific, Abbott, and Roche Diagnostics strengthen their presence through integrated QC systems and automation compatibility. Randox Laboratories and Siemens Healthineers focus on multi-analyte control solutions. LGC Limited and QuidelOrtho target advanced diagnostics and molecular segments. Smaller firms like Streck, ZeptoMetrix, and Microbiologics compete through niche offerings and flexible custom controls. The market favors companies with strong R&D pipelines, international certifications, and scalable manufacturing. It continues to reward technological precision and cross-platform compatibility.

Recent Developments:

- In 2025, Bio-Rad Laboratories, Inc.expanded its droplet digital PCR portfolio with four new platforms including the QX Continuum™ system, supplemented by the acquisition of Stilla Technologies’ digital PCR assets. The company also obtained EU IVDR certification for 40 Exact Diagnostics molecular quality controls and launched Specialty Immunoassay Plus controls.

- In 2025,Thermo Fisher Scientific, Inc. introduced new molecular diagnostic quality control solutions aimed at enhancing lab accuracy and compliance. It also formed strategic partnerships to widen its infectious disease diagnostic portfolio and improve assay performance.

- In 2025,Roche Diagnostics partnered with technology firms to expand independent quality control products and launched new QC materials for molecular diagnostics, focusing on digital integration and data traceability.

- Abbott Laboratories released advanced QC solutions for molecular and immunoassay platforms in 2025 aimed at improving diagnostic accuracy and regulatory compliance. Abbott also entered collaborations to expand QC offerings for infectious diseases.

Market Concentration & Characteristics:

The IVD quality control market exhibits moderate to high concentration, with a few multinational firms capturing significant market share. It remains innovation-driven, with manufacturers investing in automation-ready products and molecular QC solutions. Third-party control providers dominate due to their flexibility and broad compatibility across platforms. The market emphasizes regulatory compliance, reliability, and customization. It supports a mix of high-throughput labs and decentralized testing environments, enabling both standard and specialized product demand.

Report Coverage:

The research report offers an in-depth analysis based on Product & Services, Technology, Manufacturer Type, Application, and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for molecular and genetic diagnostics will drive the need for specialized and high-precision quality control solutions.

- Point-of-care and home-based diagnostics will create new opportunities for portable and user-friendly QC products.

- Digital transformation and integration with LIS/LIMS will enhance real-time QC monitoring and compliance tracking.

- Third-party quality control products will gain broader adoption across multi-vendor laboratory environments.

- Automation in laboratories will increase demand for barcode-enabled, automation-compatible QC materials.

- Regulatory emphasis on laboratory accreditation will strengthen quality assurance protocols worldwide.

- Emerging economies will witness rising QC adoption driven by expanding diagnostic infrastructure.

- Custom quality control materials for lab-developed tests will grow across research and specialty lab segments.

- Industry partnerships and acquisitions will shape competitive dynamics and broaden product offerings.

- Focus on environmental sustainability will lead to innovations in QC packaging and consumable efficiency.