Market Overview:

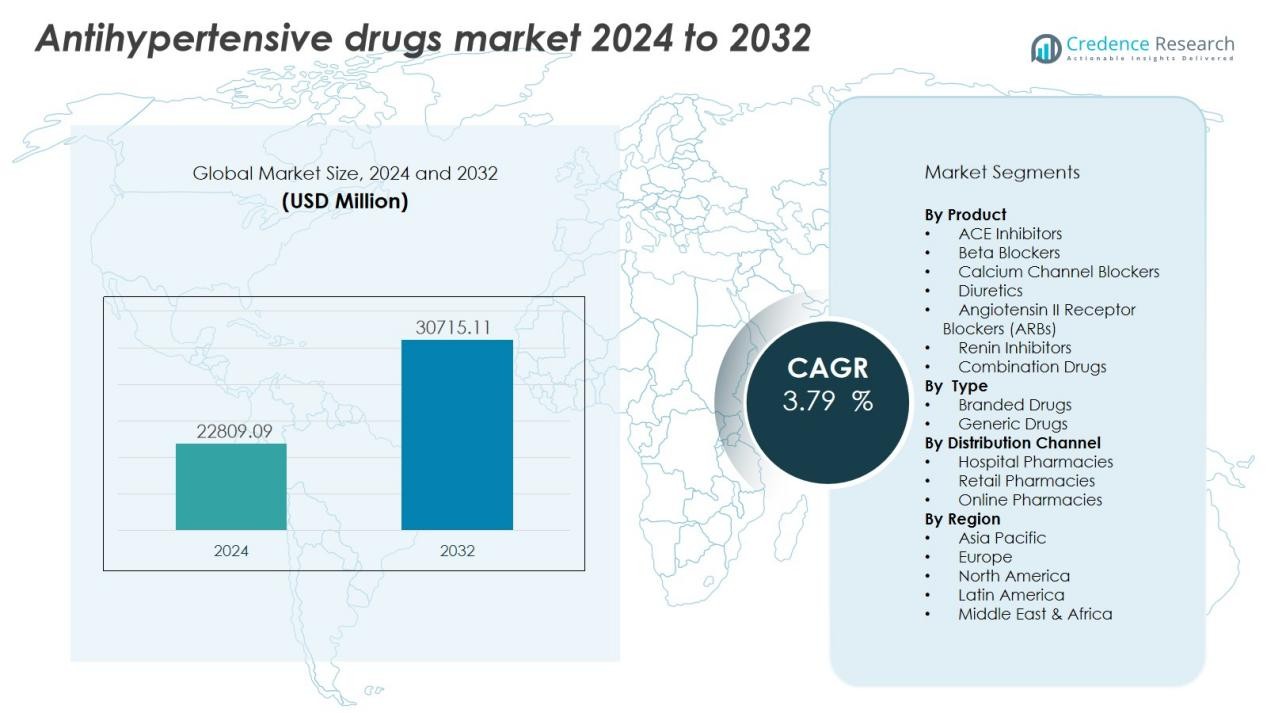

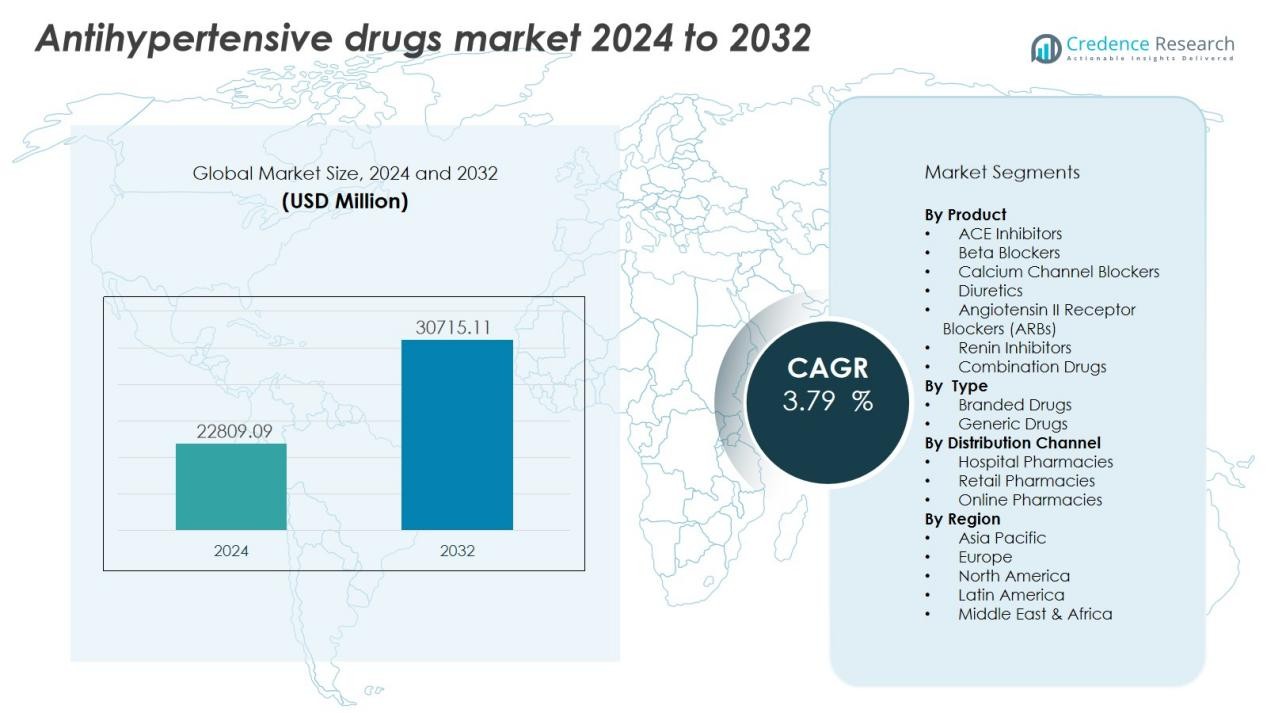

The Antihypertensive drugs market size was valued at USD 22809.09 million in 2024 and is anticipated to reach USD 30715.11 million by 2032, at a CAGR of 3.79 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Hypertensive Drugs Market Size 2024 |

USD 22809.09 Million |

| Anti-Hypertensive Drugs Market, CAGR |

3.79% |

| Anti-Hypertensive Drugs Market Size 2032 |

USD 30715.11 Million |

Key market drivers include rising awareness of cardiovascular risks, increasing access to healthcare, and the availability of generic formulations. The development of combination therapies and improved drug delivery systems enhances treatment outcomes and patient compliance. Growing focus on personalized medicine and the adoption of long-acting formulations also encourage market growth, especially in chronic hypertension management.

Regionally, North America dominates due to high diagnosis rates, robust healthcare infrastructure, and significant spending on chronic disease management. Europe follows with strong support from government-led prevention programs and research investments. The Asia-Pacific region is expected to record the fastest growth owing to urbanization, growing healthcare expenditure, and the expanding patient base in countries such as China and India. Latin America and the Middle East & Africa present emerging opportunities through public health initiatives and improved pharmaceutical access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Antihypertensive Drugs Market was valued at USD 19,206.44 million in 2018, reached USD 22,809.09 million in 2024, and is projected to attain USD 30,715.11 million by 2032, growing at a CAGR of 3.79% during the forecast period.

- North America leads with a 38% share, driven by advanced healthcare systems, high diagnosis rates, and strong pharmaceutical innovation supported by major industry players.

- Europe follows with a 29% share, supported by preventive healthcare policies, sustainable manufacturing, and government-funded cardiovascular research programs enhancing long-term treatment adoption.

- Asia Pacific holds a 22% share and represents the fastest-growing region, driven by large patient populations, expanding healthcare coverage, and strong demand for affordable generic formulations across China, India, and Japan.

- By product outlook, ACE inhibitors and ARBs collectively account for 42% share, while retail pharmacies dominate distribution channels with 51% share due to easy accessibility and consistent patient engagement.

Market Drivers:

Market Drivers:

Rising Global Prevalence of Hypertension and Cardiovascular Disorders

The Antihypertensive Drugs Market grows steadily due to the increasing burden of hypertension worldwide. Sedentary lifestyles, poor dietary habits, and obesity raise blood pressure levels in both developed and developing regions. According to the World Health Organization, over 1.2 billion people suffer from hypertension, with two-thirds living in low- and middle-income countries. The growing number of cardiovascular events, such as stroke and heart failure, pushes the demand for effective antihypertensive therapies. It continues to attract strong attention from public health agencies and pharmaceutical companies aiming to reduce global mortality rates.

- For instance, Idorsia Pharmaceuticals’ TRYVIO (aprocitentan) demonstrated clinical efficacy in the PRECISION Phase 3 trial, achieving an initial placebo-subtracted reduction of -3.8 mm Hg in systolic blood pressure at Week 4 (the primary endpoint), which was an absolute mean reduction of approximately -15.3 mm Hg from baseline in the aprocitentan group, compared to an absolute mean reduction of -11.5 mm Hg in the placebo group at that same time point.

Advancements in Combination Therapies and Drug Formulations

Combination therapies offer better patient outcomes by improving blood pressure control and reducing side effects. Pharmaceutical companies develop fixed-dose combinations to simplify treatment and increase compliance. The Antihypertensive Drugs Market benefits from innovations such as once-daily extended-release tablets and formulations integrating calcium channel blockers with ACE inhibitors. These advances support consistent patient adherence and reduce hospital visits. It enhances convenience while maintaining long-term therapeutic effectiveness across varied patient populations.

- For example, AstraZeneca’s baxdrostat, an aldosterone synthase inhibitor, achieved a placebo-adjusted reduction of 8.7 mmHg in mean seated systolic blood pressure in a Phase III trial for resistant hypertension, showcasing its clinical efficacy and tolerability.

Growing Awareness and Preventive Healthcare Initiatives

Rising awareness about hypertension’s complications drives more people toward early diagnosis and treatment. Governments and healthcare providers launch nationwide screening and education campaigns to reduce untreated cases. The Antihypertensive Drugs Market benefits from preventive programs promoting lifestyle management and timely medical intervention. Health organizations, including the CDC and WHO, support community-level initiatives encouraging regular blood pressure checks. It strengthens the overall treatment ecosystem by improving detection and management rates globally.

Expansion of Generic Drug Availability and Healthcare Access

Patent expirations of major branded antihypertensive drugs have led to wider availability of affordable generics. This shift improves accessibility in emerging economies, allowing broader patient coverage. The Antihypertensive Drugs Market experiences strong growth in low- and middle-income regions where cost-effective solutions are in demand. Governments and NGOs collaborate to ensure consistent medicine supply through subsidy and insurance programs. It fosters equitable treatment access and promotes long-term control of hypertension worldwide.

Market Trends:

Integration of Digital Health Technologies and Remote Monitoring Solutions

The Antihypertensive Drugs Market is witnessing a shift toward digital health integration for improved disease management. Wearable devices and remote blood pressure monitors allow real-time tracking of patient data, enabling personalized treatment adjustments. Pharmaceutical companies partner with health tech firms to link medication regimens with monitoring platforms, supporting continuous care. It encourages better adherence and early detection of abnormal readings. Telemedicine expansion strengthens patient–physician engagement, especially in remote or underserved regions. Artificial intelligence tools also help physicians analyze long-term trends and optimize drug combinations for better control. This digital transformation enhances patient outcomes and creates new collaboration opportunities within the healthcare ecosystem.

- For instance, the Teladoc Health (formerly Livongo) Hypertension Management Program showed that members with an elevated baseline blood pressure (over 130/80 mmHg) achieved an average reduction of 11.2 mmHg in systolic blood pressure and 5.2 mmHg in diastolic blood pressure after six weeks in one clinical study.

Focus on Personalized Therapies, Novel Drug Classes, and Sustainable Manufacturing

The market is gradually transitioning toward personalized antihypertensive therapies based on genetic and metabolic profiling. Research on pharmacogenomics helps predict individual responses to drugs such as beta-blockers and ACE inhibitors. The Antihypertensive Drugs Market benefits from the emergence of novel classes, including dual-acting angiotensin receptor and neprilysin inhibitors, which improve efficacy in resistant hypertension cases. It supports the development of targeted therapies that minimize side effects while enhancing blood pressure control. Sustainability also becomes a growing trend, with manufacturers adopting green chemistry and eco-efficient production methods. Strategic collaborations among pharmaceutical companies and research institutes accelerate innovation pipelines. The trend toward precision, sustainability, and integrated patient care defines the next phase of industry growth.

- For Instance, Illumina provides various pharmacogenomic (PGx) testing solutions, such as workflows using the Illumina Global Screening Array (GSA) chip, which can analyze over 500 distinct genetic variants across 25 pharmacogenes that are associated with a wide range of over 300 clinically actionable drugs.

Market Challenges Analysis:

Poor Treatment Adherence and High Rate of Undiagnosed Cases

The Antihypertensive Drugs Market faces a major challenge from low treatment adherence among patients. Many individuals discontinue medication once symptoms improve, leading to uncontrolled blood pressure and higher risk of complications. Limited awareness in rural and low-income regions contributes to late diagnosis and inconsistent follow-up care. It weakens the overall impact of drug effectiveness and increases healthcare costs. Physicians struggle to maintain long-term compliance despite the availability of improved formulations. The lack of patient education programs and access to continuous monitoring remains a persistent barrier to achieving optimal treatment outcomes.

Patent Expirations and Rising Generic Competition

Frequent patent expirations of leading antihypertensive drugs intensify market competition and pressure profit margins. Generic alternatives dominate prescriptions in many countries, reducing incentives for innovation and new drug development. The Antihypertensive Drugs Market experiences pricing challenges that affect revenue growth, especially for branded pharmaceutical companies. It creates a competitive environment where cost efficiency outweighs research investment. Regulatory delays and stringent approval standards further slow the introduction of novel therapies. Market players must balance affordability with innovation to sustain long-term growth in this competitive landscape.

Market Opportunities:

Expansion in Emerging Economies and Rural Healthcare Access

The Antihypertensive Drugs Market holds strong growth potential in emerging economies with rising healthcare investments. Rapid urbanization, improving diagnostics, and growing awareness of chronic diseases expand the patient base. Governments in Asia, Africa, and Latin America are strengthening primary care systems and promoting regular blood pressure screenings. It creates new demand for affordable and accessible antihypertensive therapies. Pharmaceutical companies focusing on cost-effective formulations and public–private partnerships can capture these untapped markets. Distribution network expansion and telehealth integration also improve access in rural and semi-urban areas. This broadening reach supports sustained growth and better global disease control.

Innovation in Long-Acting and Targeted Therapeutic Solutions

Advances in long-acting drug formulations and precision medicine present major opportunities for market expansion. The Antihypertensive Drugs Market benefits from research focused on sustained-release tablets, fixed-dose combinations, and dual-action therapies. It enhances patient adherence and treatment efficiency while reducing dosing frequency. Biotechnology-driven innovations such as RNA-based drugs and receptor-specific agents promise improved outcomes for resistant hypertension. Pharmaceutical companies investing in R&D pipelines targeting novel mechanisms gain a competitive edge. Strategic collaborations with biotech firms and academic research centers accelerate product innovation. These advancements position the industry for long-term clinical and commercial success.

Market Segmentation Analysis:

By Product Outlook

The Antihypertensive Drugs Market includes product categories such as ACE inhibitors, beta-blockers, calcium channel blockers, diuretics, angiotensin II receptor blockers (ARBs), and combination drugs. ACE inhibitors and ARBs hold the largest share due to their high efficacy and favorable safety profiles. Beta-blockers remain vital in post-myocardial and heart failure treatment protocols. Calcium channel blockers and diuretics are preferred for initial therapy in elderly patients and those with salt-sensitive hypertension. It continues to see increasing adoption of fixed-dose combinations that simplify treatment and improve adherence across diverse patient populations.

- For instance, Daiichi Sankyo’s azelnidipine, a calcium channel blocker, exhibited a 15 mmHg reduction in systolic blood pressure in elderly hypertensive patients within 12 weeks.

By Type

The market is divided into branded and generic drugs. Generic drugs dominate due to their affordability and wide availability in both developed and developing regions. Branded drugs retain demand in developed markets where patients and physicians prefer trusted formulations supported by extensive clinical validation. It benefits from ongoing innovation in extended-release and dual-action products designed for better control in resistant hypertension. The strong presence of generics, however, keeps pricing competitive and accessible globally.

- For instance, Teva Pharmaceutical Industries supplies an estimated 76 billion generic drug tablets and capsules and 1 billion doses of sterile injectable drugs annually across more than 60 markets, supporting increased access for patients across North America, Europe, and emerging markets.

By Distribution Channel

Hospital pharmacies, retail pharmacies, and online platforms form the key distribution channels. Retail pharmacies lead the segment due to convenience and availability of both prescription and over-the-counter products. Hospital pharmacies support acute care management and treatment initiation. It experiences rising sales through online channels, supported by digital prescriptions and teleconsultation growth. The online shift enhances patient access and drives consistent supply in both urban and remote regions.

Segmentations:

By Product Outlook

- ACE Inhibitors

- Beta Blockers

- Calcium Channel Blockers

- Diuretics

- Angiotensin II Receptor Blockers (ARBs)

- Renin Inhibitors

- Combination Drugs

By Type

- Branded Drugs

- Generic Drugs

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Healthcare Infrastructure and Innovation

North America holds 38% share of the global Antihypertensive Drugs Market in 2024, driven by advanced healthcare systems and high diagnosis rates. The United States dominates regional sales due to a large hypertensive population and extensive insurance coverage for chronic diseases. Pharmaceutical innovation and early adoption of novel combination therapies support market strength. It benefits from the presence of key players focusing on R&D and digital health integration. Government awareness programs such as the Million Hearts initiative encourage regular screening and adherence. Canada and Mexico contribute through expanding access to generics and preventive care initiatives. The regional ecosystem promotes continuous treatment advancement and effective hypertension management.

Europe Shows Steady Growth Driven by Preventive Care and Research Focus

Europe accounts for 29% share of the global Antihypertensive Drugs Market in 2024, supported by strong public health frameworks and government-led prevention campaigns. The United Kingdom, Germany, and France lead with robust reimbursement systems and well-established clinical practices. It gains momentum from rising elderly populations and the adoption of fixed-dose combination therapies. Pharmaceutical firms in the region emphasize sustainable manufacturing and biosimilar expansion. EU-funded cardiovascular research projects continue to strengthen clinical development pipelines. The presence of universal healthcare systems ensures steady prescription demand and long-term treatment adherence. Growing investments in pharmaceutical innovation enhance competitiveness across the region.

Asia Pacific Emerges as the Fastest-Growing Regional Market

Asia Pacific holds 22% share of the global Antihypertensive Drugs Market in 2024 and is projected to expand at the highest growth rate through 2032. Rapid urbanization, changing lifestyles, and increasing disposable income accelerate market growth. China, India, and Japan lead due to large patient populations and expanding healthcare coverage. It experiences rising demand for affordable generics supported by local manufacturing capabilities. Government-led awareness and screening initiatives strengthen hypertension control programs. Growing private healthcare investments and telemedicine adoption improve accessibility in rural regions. The region’s expanding healthcare infrastructure positions it as a major growth engine for the global market.

Key Player Analysis:

- Novartis AG

- Sanofi

- Bayer

- Boehringer Ingelheim International GmbH

- DAIICHI SANKYO COMPANY, LIMITED

- Takeda Pharmaceutical Company Limited

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis)

- Sun Pharmaceutical Industries Ltd.

Competitive Analysis:

The Antihypertensive Drugs Market is highly competitive, with global and regional players focusing on innovation, affordability, and portfolio expansion. Key companies include Novartis AG, Sanofi, Bayer, Boehringer Ingelheim International GmbH, and Daiichi Sankyo Company, Limited. These firms invest in research and clinical trials to develop advanced formulations that improve efficacy and patient compliance. It emphasizes strategic collaborations, mergers, and acquisitions to strengthen market presence and expand therapeutic reach. Generic manufacturers intensify competition by offering cost-effective alternatives, especially in developing markets. Leading players prioritize fixed-dose combinations and long-acting formulations to enhance adherence and differentiate products. Continuous innovation, global distribution networks, and digital integration shape the competitive landscape across all major regions.

Recent Developments:

- In October 2025, Novartis AG agreed to acquire Avidity Biosciences, a leading RNA therapeutics innovator, to strengthen its late-stage neuroscience pipeline.

- In July 2025, Sanofi announced the acquisition of Vicebio Ltd., expanding its respiratory vaccine pipeline with molecular clamp technology targeting RSV and hMPV.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Type, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Antihypertensive Drugs Market will continue to expand driven by growing global hypertension cases and lifestyle-related disorders.

- Pharmaceutical companies will focus on next-generation therapies with improved safety and fewer side effects.

- Fixed-dose combinations and long-acting formulations will gain wider adoption to improve patient adherence.

- Digital health platforms and remote monitoring will integrate with hypertension management for real-time treatment tracking.

- The market will see greater investment in precision medicine and pharmacogenomics-based therapies.

- Emerging economies will experience higher demand due to expanding healthcare access and awareness programs.

- Sustainability and eco-friendly manufacturing will become strategic priorities for leading manufacturers.

- Collaborations between pharmaceutical and technology companies will drive innovation in patient-centered care.

- Government-led initiatives for early detection and prevention will enhance long-term treatment outcomes.

- The market will witness strong generic penetration alongside steady innovation in branded formulations, shaping a balanced growth landscape.

Market Drivers:

Market Drivers: