Market Overview:

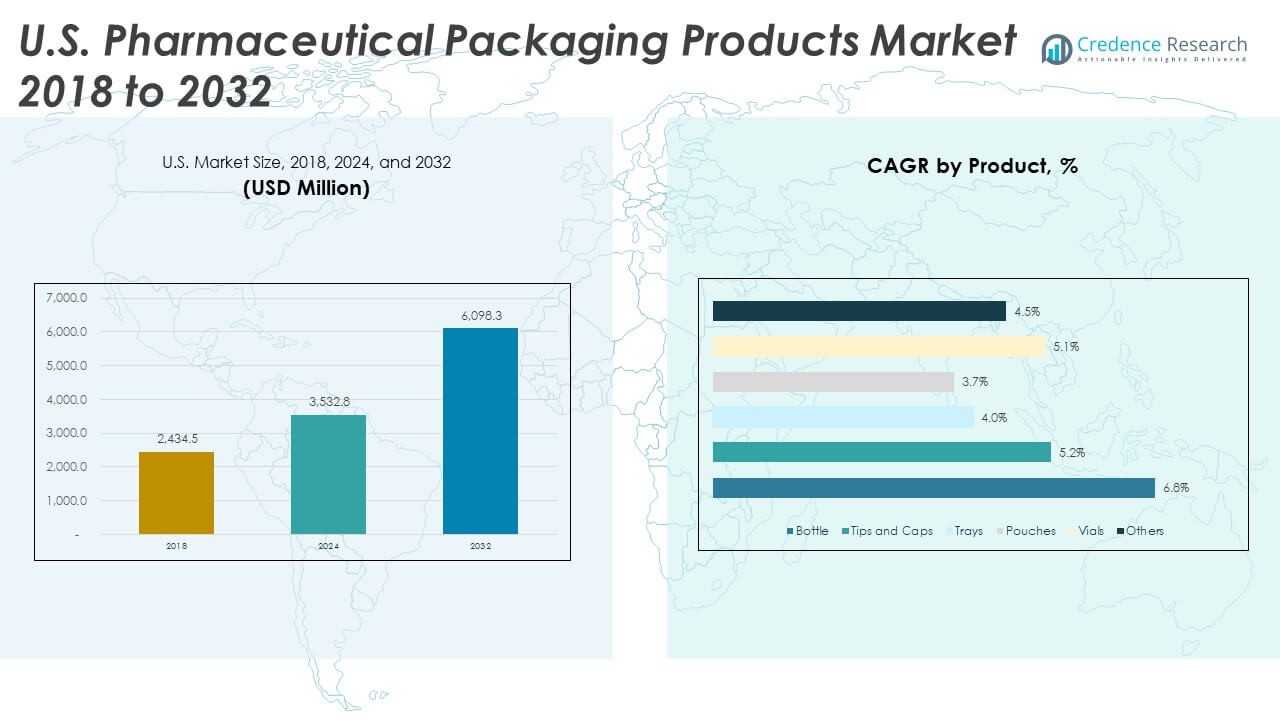

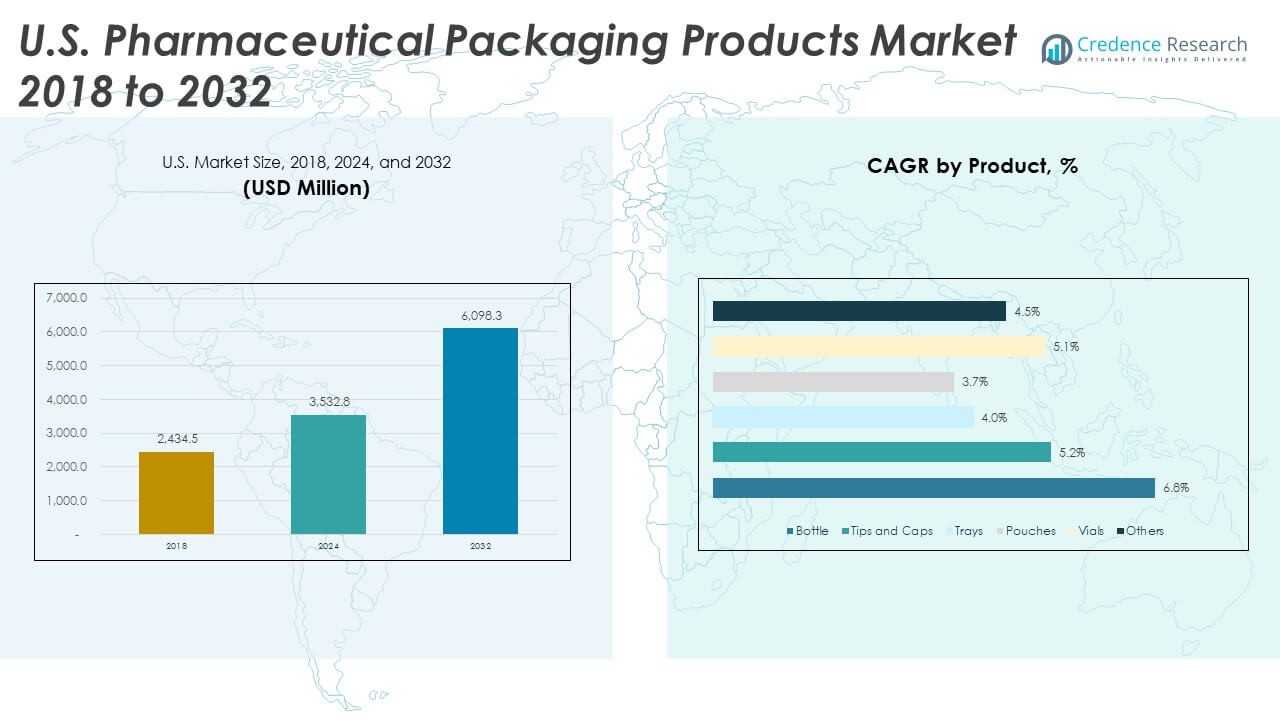

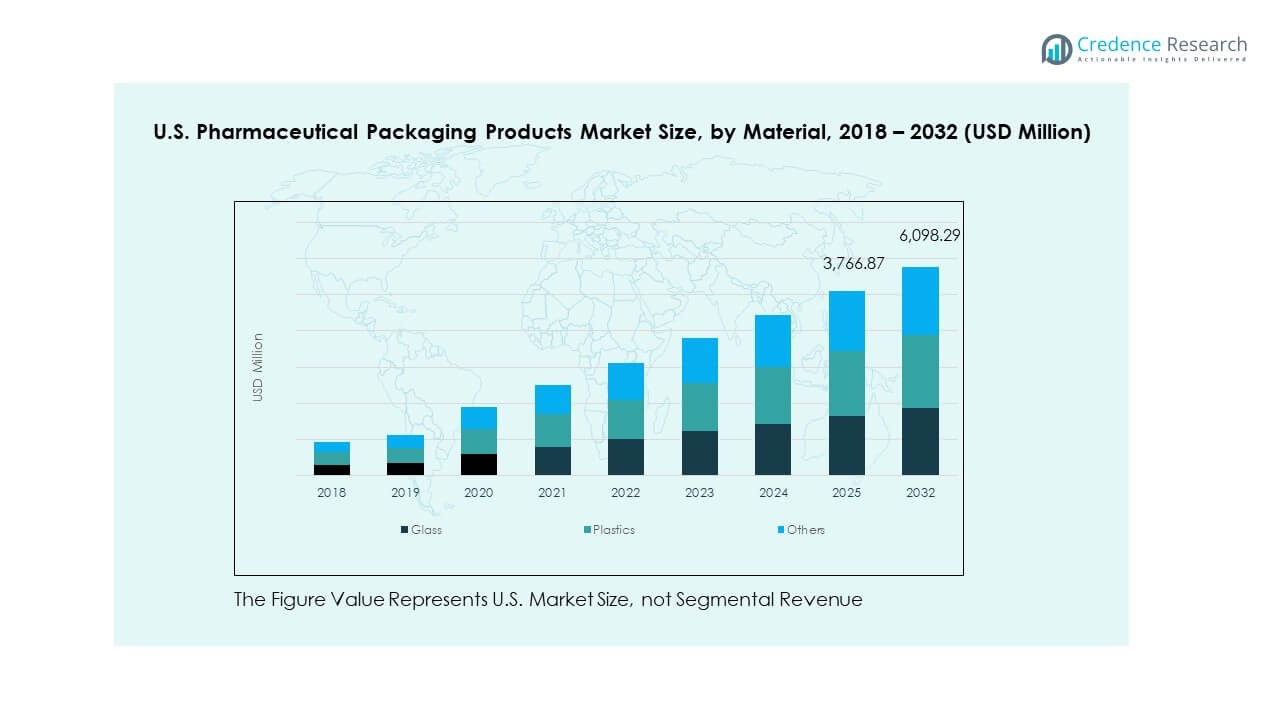

The U.S. Pharmaceutical Packaging Products Market size was valued at USD 2,434.50 million in 2018 to USD 3,532.80 million in 2024 and is anticipated to reach USD 6,098.30 million by 2032, at a CAGR of 7.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Pharmaceutical Packaging Products Market Size 2024 |

USD 3,532.80 Million |

| U.S. Pharmaceutical Packaging Products Market, CAGR |

7.12% |

| U.S. Pharmaceutical Packaging Products Market Size 2032 |

USD 6,098.30 Million |

The U.S. Pharmaceutical Packaging Products Market grows due to strong demand for safe, traceable, and compliant packaging solutions. Drug makers adopt sterile formats that protect product stability during transport and long storage. Biotech expansion boosts consumption of vials, prefilled syringes, and specialized containers. Smart labeling and serialization support stronger supply chain security. Rising preference for sustainable materials encourages wider use of recyclable and lightweight formats. High chronic disease prevalence increases prescription handling, which raises packaging volumes. Contract manufacturing organizations upgrade lines to meet rising complexity across dosage forms.

The U.S. Pharmaceutical Packaging Products Market shows strong activity across manufacturing hubs in the Northeast, Midwest, and West Coast. States with dense pharma clusters lead adoption due to higher output of branded and generic drugs. Emerging regions grow due to rising investment in biotech research and new sterile facilities. Urban centers support packaging innovation because of strong logistics networks and advanced regulatory compliance infrastructure. Southern states gain traction through expanding distribution corridors. Regional competitiveness improves as companies upgrade capabilities in sterile, sustainable, and high-barrier solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

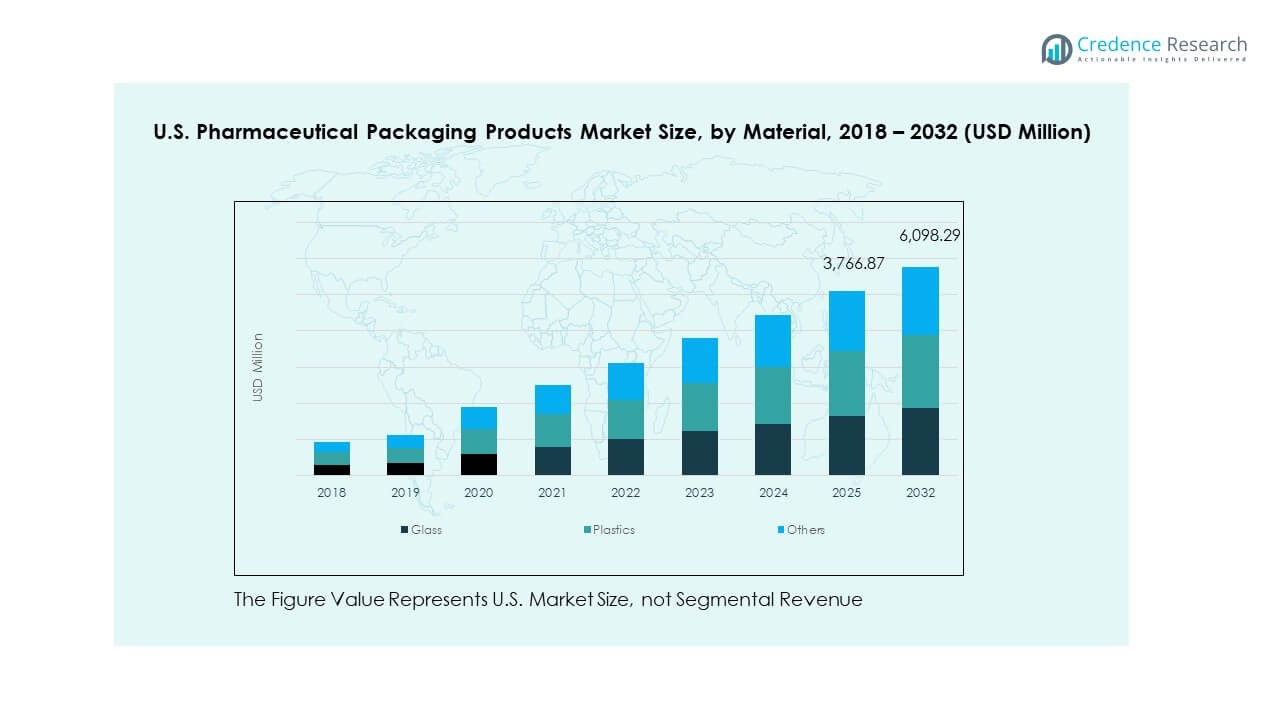

- The U.S. Pharmaceutical Packaging Products Market grew from USD 2,434.50 million in 2018 to USD 3,532.80 million in 2024 and is projected to reach USD 6,098.29 million by 2032, supported by a 7.12% CAGR driven by expanding biologics and sterile packaging demand.

- The Northeast (38%), Midwest (27%), and South & West combined (35%) dominate the market due to strong pharma clusters, advanced manufacturing bases, and expanding logistics corridors.

- The West emerges as the fastest-growing region with rising biotech activity and strong investment in injectable and flexible packaging formats, supported by leading innovation hubs.

- Plastics hold the largest share in the material mix at about 55%, supported by high versatility and broad use across bottles, pouches, caps, and trays shown in the chart.

- Glass accounts for around 30%, while others contribute roughly 15%, reflecting continued reliance on vials and specialty formats for sensitive and high-value formulations.

Market Drivers:

Rising Focus on Drug Safety, Quality, and Product Integrity

The U.S. Pharmaceutical Packaging Products Market grows due to strict quality rules that push makers to use safer materials. Companies invest in high-barrier formats that protect sensitive drugs from moisture and oxygen. Demand for tamper-evident closures increases because regulators expect higher patient safety. Healthcare providers rely on sterile packaging to support infection control standards. Biologic drugs need advanced containers that maintain stability during storage. The shift toward complex formulations encourages broader adoption of engineered polymers. Drug makers adopt serialization to support traceability. It strengthens compliance across national supply chains.

- For instance, SCHOTT manufactures more than 12 billion pharmaceutical containers each year, including vials and ampoules designed to meet stringent sterility and break-resistance requirements.

Expansion of Biopharmaceutical Production and Specialized Dosage Forms

The U.S. Pharmaceutical Packaging Products Market benefits from rapid growth in biotech drugs that require secure packaging. Producers rely on vials, prefilled syringes, and cartridges to support injectable therapies. Cold-chain expansion encourages strong demand for temperature-resilient formats. Complex biologics need materials that resist leachables and maintain purity. Contract manufacturers increase capacity to handle sterile filling. Personalized therapies push adoption of small-batch packaging solutions. Demand rises for tamper-resistant components that support patient safety. It encourages steady upgrades in cleanroom environments.

- For instance, West Pharmaceutical Services delivers over 42 billion components annually, including plungers and seals used in sterile injectable systems.

Increase in Chronic Diseases and High Prescription Consumption

The U.S. Pharmaceutical Packaging Products Market gains strength from rising prescription volumes across chronic disease groups. Makers improve packaging to support patient adherence programs. Demand for blister packs grows due to clear dose visibility. Aging population trends support procurement of unit-dose and senior-friendly formats. Pharmacies prioritize packaging that improves handling safety. Growth in self-administration boosts demand for ready-to-use injector containers. Hospitals adopt sterile closures for high-use injectable medicines. It drives stronger output across primary packaging lines.

Shift Toward Sustainable, Lightweight, and Recyclable Materials

The U.S. Pharmaceutical Packaging Products Market advances due to rising use of eco-friendly materials. Producers test recyclable polymers that meet drug-safety compliance. Demand grows for lightweight packaging that lowers transport loads. Healthcare firms explore bio-based options with strong barrier strength. Regulations guide adoption of plastic-reduction initiatives. Supply chains push cleaner disposal methods for high-volume packaging waste. Drug makers redesign formats to support circular-economy targets. It supports wider acceptance of sustainable production methods.

Market Trends:

Adoption of Smart Packaging and Digital Tracking Technologies

The U.S. Pharmaceutical Packaging Products Market sees rising use of digital features that support real-time monitoring. Makers integrate QR codes for patient guidance. Smart labels gain attention for tracking drug movement. Sensors support temperature checks during long shipments. Pharmacies use scannable tags for inventory control. Digital tools help verify authenticity during distribution. Cold-chain networks use connected labels to check stability. It reinforces supply-chain transparency across national routes.

- For instance, Avery Dennison is the world’s leading supplier of RFID tags and a primary contributor to the industry’s annual volume of over 35 billion tags, supporting authentication and supply-chain visibility for pharmaceutical shipments and other industries.

Growth in Ready-to-Administer and Patient-Convenience Packaging Formats

The U.S. Pharmaceutical Packaging Products Market experiences demand for formats that simplify dosing. Prefilled syringes support faster hospital workflows. Single-dose containers gain traction across outpatient settings. Ready-to-use packs improve patient comfort at home. Demand rises for injector pens in chronic therapy areas. Makers design ergonomic containers for smooth handling. Companies upgrade safety caps to reduce accidental exposure. It improves medication experience for many groups.

- For instance, BD produces more than 3 billion prefillable syringes annually, serving hospitals and self-administration therapy programs.

Wider Adoption of High-Barrier and Contamination-Control Solutions

The U.S. Pharmaceutical Packaging Products Market expands through greater interest in sterile, contamination-free systems. Producers introduce barrier films with improved resistance to oxygen migration. Coated glass vials help reduce particulate risk. Cleanroom packaging improves safety for injectables. Contract packers invest in isolators to support sterile output. Demand grows for closures with stronger sealing accuracy. Barrier pouches support long storage cycles. It enables safer distribution of fragile medicines.

Rising Customization for Biologics, Cell Therapies, and Niche Treatments

The U.S. Pharmaceutical Packaging Products Market develops new formats for advanced treatments. Makers design containers for low-volume, high-value drugs. Specialty polymers support high-sensitivity molecules. Cryogenic packaging expands due to cell-therapy growth. Flexible units support gene-therapy logistics. Personalized treatment kits require tight handling rules. Biopharma startups seek packaging that aligns with clinical-trial needs. It drives innovation across specialized production lines.

Market Challenges Analysis:

Rising Regulatory Pressure and Complex Compliance Requirements

The U.S. Pharmaceutical Packaging Products Market faces strict oversight that raises production complexity. Makers must meet evolving rules for traceability, sterility, and material safety. Testing cycles increase due to wider use of biologics. High documentation needs delay approval timelines. Compliance mistakes risk shipment delays. Small firms struggle with rising validation costs. Frequent regulatory changes stretch supply-chain planning. It challenges operational flexibility across manufacturers.

High Material Costs, Supply Disruptions, and Limited Skilled Workforce

The U.S. Pharmaceutical Packaging Products Market encounters rising costs linked to polymers, glass, and coatings. Global supply shifts create raw-material shortages. Cold-chain components remain vulnerable to disruptions. Skilled labor gaps slow sterile-line expansion. Automation needs raise capital expenditure. Lead times increase due to fluctuating global demand. Sustainability rules complicate material selection. It strains resources for many mid-scale firms.

Market Opportunities:

Expansion in Biologics, Cell Therapies, and High-Value Injectable Treatments

The U.S. Pharmaceutical Packaging Products Market gains new opportunities from advanced therapies that need precision packaging. Growth in cell and gene treatments encourages adoption of cryo-stable formats. Biologic drugs push demand for ready-to-fill vials and premium syringes. Personalized medicines need flexible small-batch packaging. Contract producers invest in specialized filling services. Polymer innovation supports safer handling of sensitive formulations. It creates strong openings for next-generation sterile solutions.

Sustainability Adoption and Advancement in Smart Packaging Integration

The U.S. Pharmaceutical Packaging Products Market benefits from rising investment in recyclable materials. Eco-focused firms explore bio-polymers that support safety goals. Smart labels expand due to interest in patient engagement tools. Digital tags support strong security across supply chains. Lightweight formats lower freight loads. Producers test refill systems for low-risk categories. It encourages broader development of innovative packaging ecosystems.

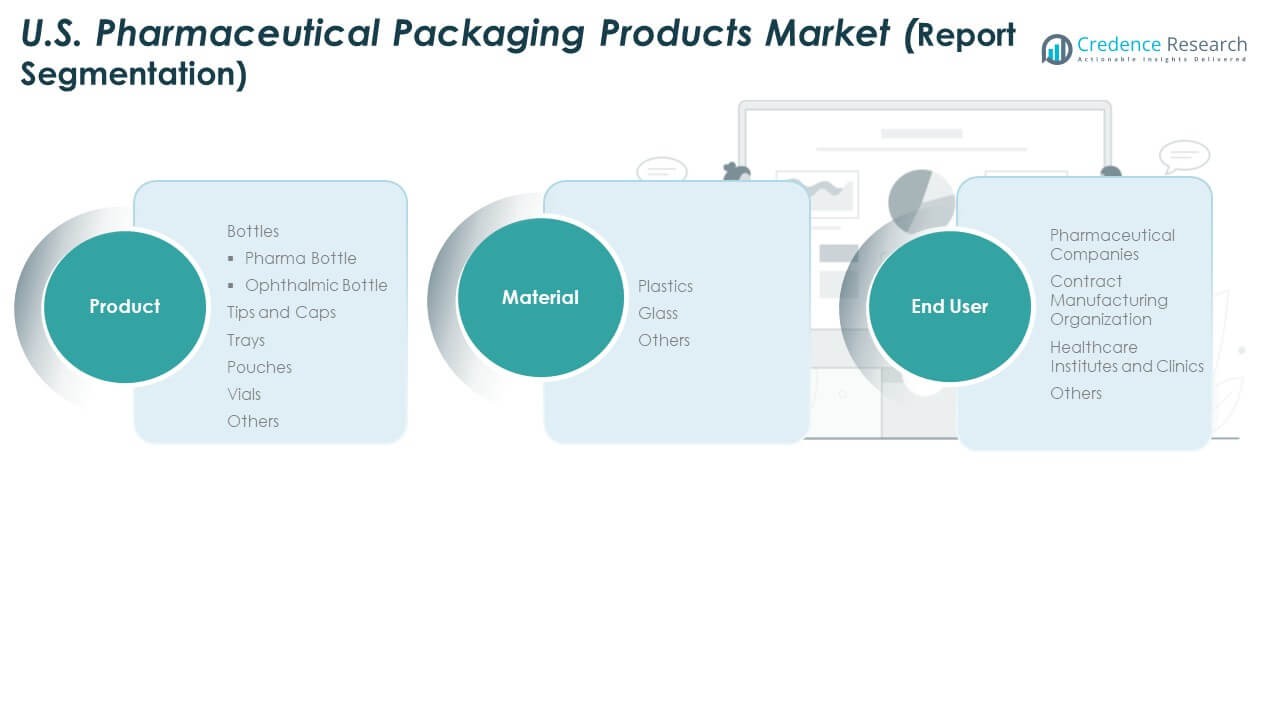

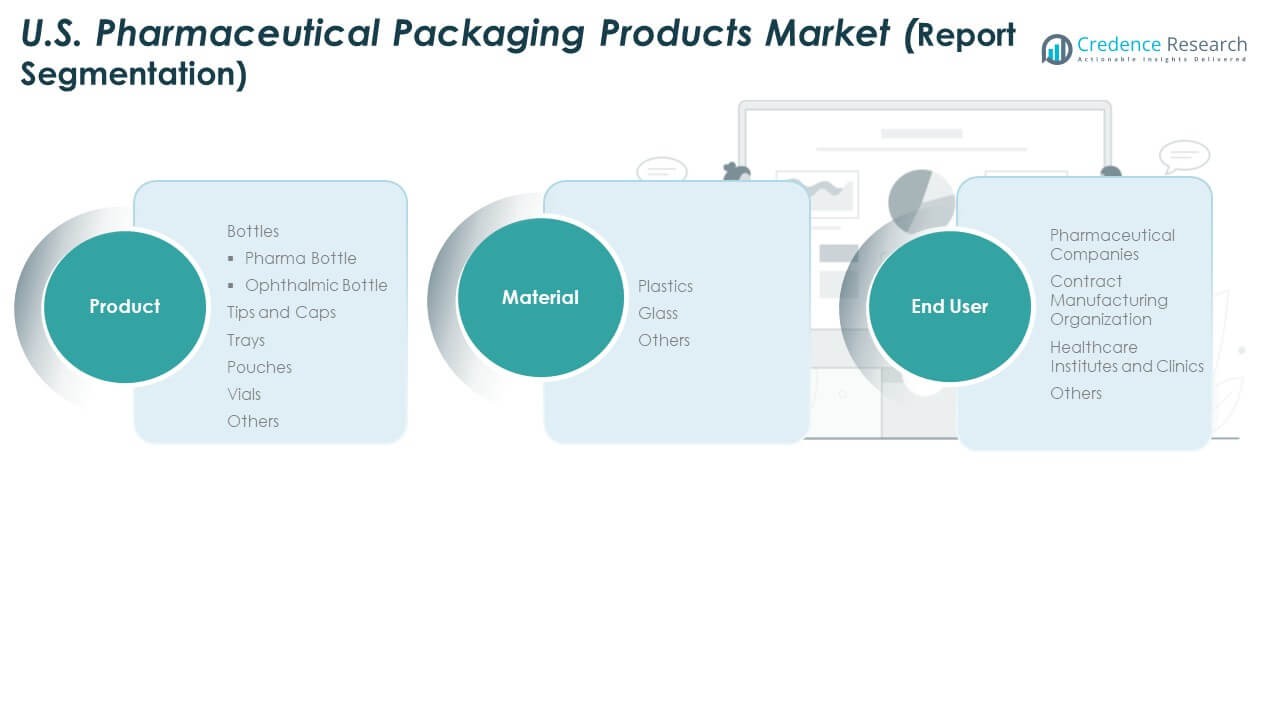

Market Segmentation Analysis:

By Product

The U.S. Pharmaceutical Packaging Products Market shows strong demand across primary and secondary packaging types. Bottles hold wide use for solid and liquid formulations, while pharma bottles support high-volume prescription needs. Ophthalmic bottles gain traction due to rising eye-care consumption. Tips and caps remain essential for precise dispensing. Trays support sterile handling in clinical settings. Pouches grow due to lightweight formats suited for flexible packaging. Vials maintain dominance across injectables and biologics. It benefits from rising interest in secure and contamination-free formats.

- For instance, Gerresheimer produces over 17 billion glass and plastic products each year, including vials widely used in injectable packaging. The company is also a market leader in glass injection vials with an annual production capacity of more than 5 billion vials alone.

By Material

The U.S. Pharmaceutical Packaging Products Market relies on plastics due to durability, low cost, and strong barrier properties. Plastics support high customization across bottles, pouches, and caps. Glass retains importance for injectables, biologics, and heat-sensitive drugs that require chemical stability. Demand for sterile glass vials grows with injectable therapy expansion. Other materials hold niche adoption for specialized or eco-focused applications. Makers explore hybrid structures to improve shelf life and safety. It supports broader shifts toward advanced, compliant materials.

- For instance, Corning’s Valor® Glass platform enhances vial strength by reducing breakage and particle contamination during filling and production.

By End User

The U.S. Pharmaceutical Packaging Products Market serves pharmaceutical companies that lead procurement due to high production volumes. Contract manufacturing organizations expand adoption through sterile filling and specialized packaging needs. Healthcare institutes and clinics depend on safe, ready-to-use formats that support fast dispensing. Rising outpatient and home-care activities strengthen demand for convenient and secure packaging. Others include distributors and secondary packers that handle labelling, bundling, and repackaging tasks. Growth in biologics and chronic therapies supports higher order frequency. It drives stable consumption across all end-user groups.

Segmentation:

By Product

- Bottles

- Pharma Bottle

- Ophthalmic Bottle

- Tips and Caps

- Trays

- Pouches

- Vials

- Others

By Material

By End User

- Pharmaceutical Companies

- Contract Manufacturing Organization

- Healthcare Institutes and Clinics

- Others

Regional Analysis:

Northeast

The U.S. Pharmaceutical Packaging Products Market shows strong leadership in the Northeast, holding an estimated 38% share. The region benefits from dense pharmaceutical clusters in New Jersey, Pennsylvania, and Massachusetts. Drug makers in this corridor invest in sterile packaging, vials, and high-barrier materials. Contract manufacturers expand capacity to meet rising biologics output. Logistics networks support fast distribution across national supply routes. Innovation centers drive research on sustainable and digital packaging. It maintains dominance due to deep industry concentration.

Midwest

The U.S. Pharmaceutical Packaging Products Market records about 27% share in the Midwest. Packaging producers in Illinois, Ohio, and Michigan support strong supply to drug makers and healthcare networks. Demand rises for bottles, tips, caps, and trays used in high-volume prescription handling. Manufacturing infrastructure helps scale production for primary and secondary formats. Healthcare systems in the region rely on compliant packaging to support large patient populations. Growth in medical research hubs strengthens adoption of sterile formats. It maintains stable expansion driven by strong industrial capability.

South and West

The U.S. Pharmaceutical Packaging Products Market secures nearly 35% share across the South and West combined. States such as Texas, California, and North Carolina drive rapid growth due to rising biotech activity. West Coast innovation hubs push demand for vials, pouches, and advanced dosing components. Southern distribution corridors strengthen procurement for clinics and hospitals. Expanding cold-chain routes support injectable therapies and biologics. Investment in new facilities boosts regional capacity for plastics and glass packaging. It gains traction as both regions attract new pharmaceutical and healthcare projects.

Key Player Analysis:

Competitive Analysis:

The U.S. Pharmaceutical Packaging Products Market features strong competition driven by product innovation and compliance needs. Key players focus on sterile formats, barrier materials, and sustainable solutions. Companies expand capacity to support biologics, injectables, and high-volume prescription packaging. Investments strengthen capabilities across vials, bottles, pouches, and advanced closures. Partnerships with pharmaceutical firms help align packaging systems with changing drug requirements. Contract packers upgrade technology to improve speed and accuracy. It remains a competitive space shaped by material innovation and regulatory expectations.

Recent Developments:

- In August 2025, Albéa Group executed a strategic acquisition that significantly expanded its geographic footprint and product portfolio in one of the world’s fastest-growing packaging markets. The company acquired Amfora Packaging, a leading beauty and personal care packaging company with established operations across Latin America, Colombia, and Peru.

- In April 2025, Huhtamaki announced a significant inorganic growth initiative with the acquisition of Zellwin Farms Company, a privately-owned business located in Zellwood, Florida, for an enterprise value of USD 18 million. Zellwin Farms has been serving egg-producing customers throughout the Southeastern United States for more than 20 years and generated annual net sales of approximately USD 20 million. This acquisition supports Huhtamaki’s strategic growth within the molded fiber industry, particularly for egg cartons and egg flats. The transaction responds to the growing regulatory shift in North America toward more renewable and recyclable packaging options, with Huhtamaki positioning itself as a leader in the molded fiber category while delivering enhanced installed capacity and strengthening its manufacturing footprint in North America. Additionally, Huhtamaki has partnered with BOBST to revolutionize sustainable packaging through the development of high-barrier, paper-based, fully recyclable solutions using metallization technology. This collaboration has generated a broad product range from base to maximum barrier level, designed to replace current aluminum-foil structures in both mono PE and paper formats, with solutions that can be sorted and recycled through current recycling streams. The partnership, which leveraged BOBST’s competence centers to expedite development, demonstrates Huhtamaki’s commitment to innovation in sustainability.

- In July 2024, EPL Limited announced a significant strategic investment to support its long-term growth and sustainability objectives. The company signed a Share Purchase Agreement to acquire a 49% stake in Clean Max Aria Private Limited (CMAPL) for the development of captive power generation facilities utilizing renewable energy sources.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on product, material, and end user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Strong adoption of sterile vials will support injectable therapy growth across the U.S.

- Demand for recyclable structures will rise due to sustainability commitments in the U.S. Pharmaceutical Packaging Products Market.

- Smart labels and tracking tools will gain traction to strengthen drug authentication.

- Biologic and cell therapy expansion will drive need for high-value container systems.

- Contract manufacturers will scale sterile filling capacity to meet rising demand.

- Flexible pouches will gain share due to lightweight formats preferred in logistics.

- Packaging automation will increase output speed and improve consistency.

- Material innovation will shape new formats with stronger chemical resistance.

- Growth in outpatient care will encourage higher adoption of ready-to-use formats.

- Regional manufacturing expansion will reduce dependency on imported components.