Market Overview

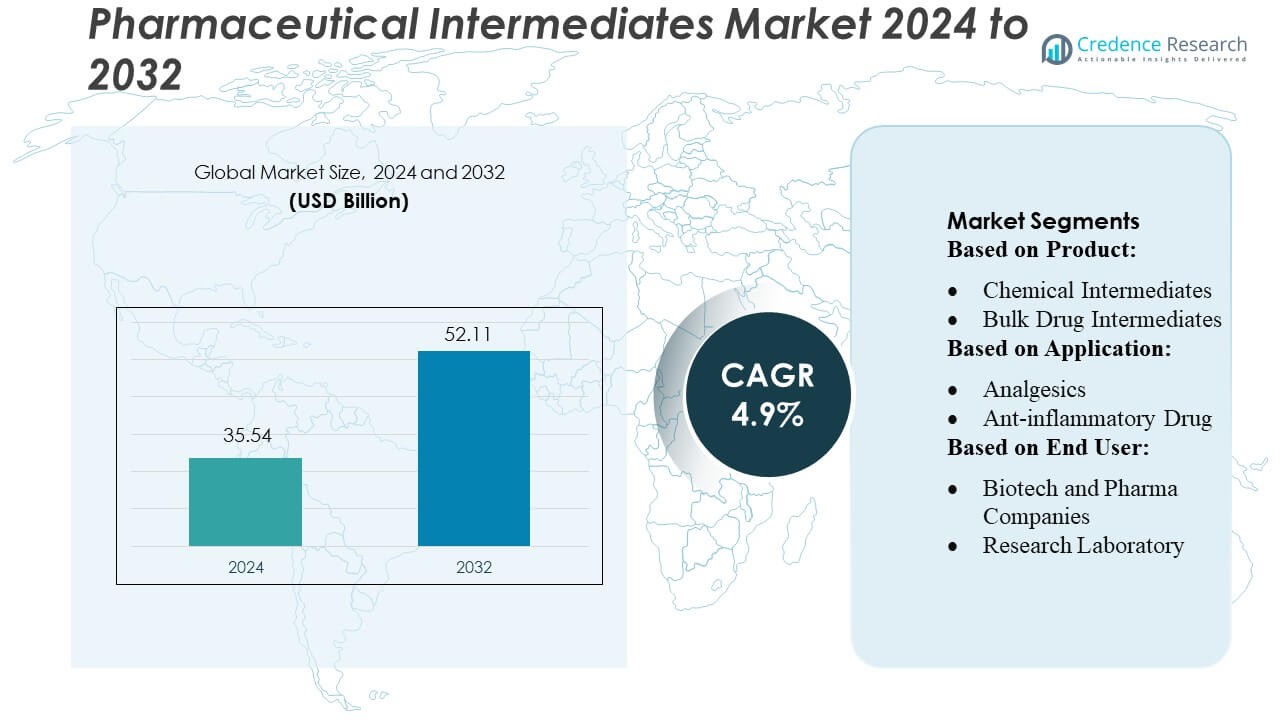

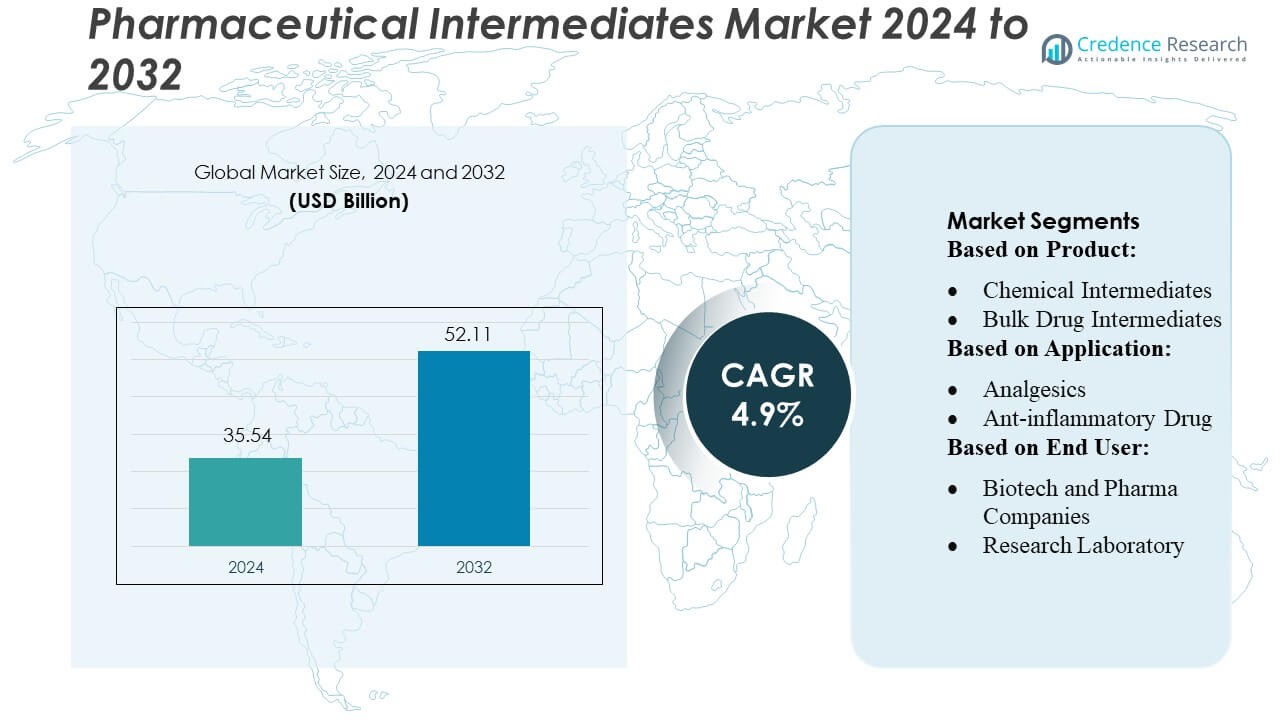

Pharmaceutical Intermediates Market size was valued USD 35.54 billion in 2024 and is anticipated to reach USD 52.11 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Intermediates MarketSize 2024 |

USD 35.54 Billion |

| Pharmaceutical Intermediates Market, CAGR |

4.9% |

| Pharmaceutical Intermediates Market Size 2032 |

USD 52.11 Billion |

The Pharmaceutical Intermediates Market is shaped by top global pharmaceutical and chemical manufacturers that leverage advanced synthesis capabilities, strong R&D pipelines, and extensive CMO/CRO partnerships to maintain competitive strength. These companies focus on producing high-purity intermediates for oncology, cardiovascular, and chronic disease therapeutics, reinforcing their global reach and technological edge. Asia-Pacific emerges as the leading region, holding an exact market share of 32%, supported by large-scale manufacturing hubs, cost-effective production, and rapid expansion of API and intermediate facilities. Its strong supplier ecosystem and growing investment in advanced chemical synthesis solidify its position as the dominant regional contributor.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pharmaceutical Intermediates Market was valued at USD 35.54 billion in 2024 and is projected to reach USD 52.11 billion by 2032, expanding at a CAGR of 4.9%, driven by rising demand for high-purity intermediates in chronic disease and oncology drug development.

- Market growth is supported by strong drivers such as expanding small-molecule API production, increased outsourcing to CMO/CROs, and advancements in continuous-flow and green chemistry technologies.

- Key trends include rising adoption of custom intermediates, increasing investment in sustainable synthesis, and growing integration of digital process automation across manufacturing plants.

- Competitive dynamics are shaped by global players focusing on portfolio expansion, capacity enhancement, and technology-driven efficiency, while market restraints include stringent regulatory requirements and raw-material pricing fluctuations.

- Asia-Pacific leads the market with 32% share, while chemical intermediates dominate the product segment with a significant share driven by broad applicability across therapeutic classes.

Market Segmentation Analysis:

By Product

The pharmaceutical intermediates market remains dominated by chemical intermediates, accounting for an estimated 48–52% of the market share, driven by their extensive use in the synthesis of APIs across therapeutic classes. Their versatility, cost-effectiveness, and compatibility with large-scale manufacturing strengthen market uptake. Bulk drug intermediates follow, supported by expanding generic drug production, while custom intermediates gain traction due to increasing demand for tailored synthesis solutions in complex and high-value therapeutics. Growth across all product types is further accelerated by process optimization technologies and rising investments in advanced chemical synthesis capabilities.

- For instance, Pfizer enhanced intermediate production efficiency by integrating continuous-flow reactors at its Freiburg facility, enabling a documented output capacity increase of 120 tons per year and reducing process cycle time by 40 hours per batch.

By Application

Within the application segment, anti-cancer drugs hold the largest share at approximately 32–35%, driven by rapid innovations in oncology therapeutics and high global demand for potent, targeted molecules requiring complex intermediates. Cardiovascular and anti-diabetic drugs remain key contributors due to the high prevalence of chronic diseases, while analgesics and anti-inflammatory drugs continue to support steady consumption owing to widespread use in acute and long-term therapies. The segment is further supported by increasing R&D activities, improved synthesis pathways, and rising demand for specialty intermediates designed for both small-molecule and combination drug formulations.

- For instance, AbbVie’s oncology pipeline currently includes ~90 compounds, devices or indications in development either internally or via collaborations.

By End User

Among end users, biotech and pharma companies dominate the market with a 55–60% share, supported by their extensive API manufacturing operations, continuous pipeline development, and strong dependency on high-purity intermediates. CMO/CRO organizations show the fastest growth as pharmaceutical outsourcing rises and companies aim to optimize costs and accelerate development timelines. Research laboratories maintain moderate demand, primarily for early-stage discovery and preclinical synthesis needs. Key drivers include increasing outsourcing of custom synthesis, expansion of small-molecule drug development, and rising production of high-value intermediates for complex therapeutic formulations.

Key Growth Drivers

1. Expanding Demand for Small-Molecule APIs

The pharmaceutical intermediates market benefits significantly from the expanding demand for small-molecule APIs, which continue to dominate global drug pipelines due to their cost efficiency, oral bioavailability, and broad therapeutic applicability. Pharmaceutical companies increasingly rely on high-purity intermediates to enhance API performance and regulatory compliance. The rising prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, further accelerates small-molecule drug production. This demand drives consistent consumption of intermediates across synthesis stages, reinforcing supplier relationships and stimulating investments in advanced manufacturing capabilities.

- For instance, GSK reports 71 medicines and vaccines in its development pipeline, spanning multiple modalities including small molecules, biologics and next‑gen platforms — indicating a robust throughput of new assets.

2. Increased Outsourcing to CMO/CROs

Growing dependence on CMO/CROs for drug development and manufacturing is a major driver, as pharma companies aim to reduce operational costs, streamline R&D processes, and accelerate market entry timelines. Outsourcing enables access to specialized synthesis expertise, high-end instrumentation, and scalable production frameworks. CMO/CROs also support regulatory documentation and quality assurance, easing the compliance burden for drug developers. As companies increasingly outsource complex, multi-step synthesis projects, demand for custom intermediates rises, supporting market expansion while allowing pharmaceutical firms to focus resources on core drug innovation activities.

- For instance, Merck’s broader 2025 expansion included breaking ground in October 2025 on a $3.0 billion, 400,000‑square‑foot pharmaceutical manufacturing facility in Elkton, Virginia.

3. Rising Innovation in Chemical Synthesis Technologies

Advancements in chemical synthesis technologies significantly boost market growth by improving efficiency, yield, purity, and sustainability of intermediate production. Adoption of continuous-flow chemistry, biocatalysis, and green chemistry principles reduces reaction times, minimizes waste, and enhances scalability for complex molecules. These innovations allow manufacturers to meet stringent global regulatory standards while lowering production costs. Improved process automation and digitalization further increase consistency and speed. As pharmaceutical pipelines shift toward structurally complex molecules, modern synthesis technologies become essential, driving increased reliance on advanced intermediates.

Key Trends & Opportunities

1. Increasing Focus on Oncology and Specialty Drugs

A major trend shaping market opportunities is the rising focus on oncology and specialty drugs, which require highly complex and customized intermediates. Growth in targeted therapies, immuno-oncology, and precision medicine increases demand for sophisticated multi-step synthesis processes. Developers prioritize intermediates with improved stability and functionality to support next-generation cancer treatments. This shift presents opportunities for manufacturers to expand their portfolio of high-value intermediates and collaborate with pharma companies during early-stage molecule development. The trend also drives investments in advanced manufacturing technologies to support specialized intermediate production.

- For instance, Sanofi declared a strategic push that includes 12 potential blockbuster assets under clinical evaluation (as of its 2023 R&D update), including novel mechanisms and advanced modalities beyond standard small molecules.

2. Growing Adoption of Green Chemistry

The push toward sustainable manufacturing creates strong opportunities for suppliers adopting green chemistry approaches. Regulatory agencies and pharma companies are prioritizing environmentally friendly production methods, including solvent reduction, energy-efficient reactions, and renewable feedstocks. Manufacturers offering eco-efficient intermediate synthesis gain competitive advantage and improved partner trust. The shift also encourages adoption of biocatalytic processes that enhance selectivity and reduce hazardous byproducts. As sustainability commitments strengthen across the pharmaceutical value chain, green chemistry becomes a defining trend, opening opportunities for innovation and long-term supply partnerships.

- For instance, Novartis reports that it significantly reduced its non-recycled waste, aiming for a 50% reduction by 2025 from a 2016 baseline. As of its 2017 data, it had already achieved a 31.3% reduction in total non-recycled operational waste relative to production quantities compared to a 2010 baseline, showing a robust reduction trend.

3. Rising Customization Demand from Pharma R&D

Growing demand for custom-designed intermediates presents a significant market opportunity as pharmaceutical companies develop increasingly complex and diverse molecules. R&D teams require tailored intermediates that support novel mechanisms of action, enhance drug stability, and optimize synthesis routes. This trend benefits manufacturers capable of offering flexible production models, rapid development cycles, and specialized analytical capabilities. Collaboration during early drug development phases allows suppliers to become long-term partners across clinical and commercial stages. As precision therapeutics expand, demand for bespoke intermediates continues to rise, strengthening this opportunity.

Key Challenges

1. Stringent Regulatory and Quality Compliance

Meeting stringent global regulatory and quality standards remains a critical challenge in the pharmaceutical intermediates market. Regulations require suppliers to maintain rigorous documentation, validated processes, and multi-stage quality checks, significantly increasing operational complexity. Deviations in purity, stability, or traceability can delay downstream API manufacturing and disrupt supply chains. Compliance with frameworks such as GMP, REACH, and regional environmental standards adds cost pressure and demands continuous monitoring. Smaller manufacturers often struggle to adapt, intensifying market consolidation and reducing competitiveness in highly regulated regions.

2. Volatility in Raw Material Prices and Supply Chains

Fluctuating prices of key raw materials used in intermediate synthesis pose a significant threat to profitability and production stability. Geopolitical tensions, export restrictions, and supply shortages disrupt availability of solvents, reagents, and precursor chemicals. Rising logistics costs and dependence on limited regional suppliers add further strain. These challenges often lead to delays in API manufacturing, affecting downstream drug availability. Manufacturers must invest in supply diversification, strategic inventory planning, and long-term sourcing agreements to mitigate price volatility and maintain consistent output in a competitive market.

Regional Analysis

North America

North America holds a dominant position in the pharmaceutical intermediates market, capturing an estimated 32–35% share, driven by its strong pharmaceutical manufacturing base and extensive R&D investments. The presence of leading API producers, advanced synthesis technologies, and strict regulatory frameworks supports high demand for high-purity intermediates. The region benefits from strong growth in oncology, cardiovascular, and specialty drugs, which require complex intermediates. Additionally, increasing outsourcing to U.S.- and Canada-based CMO/CROs strengthens market activity, while government funding for drug innovation continues to stimulate production capacity and technological advancements.

Europe

Europe accounts for approximately 26–28% of the market, supported by a mature pharmaceutical sector and a robust network of intermediate and API manufacturers. Strong regulatory standards, including REACH and GMP compliance, drive consistent demand for high-quality intermediates across therapeutic categories. Germany, Switzerland, and the U.K. lead production due to their advanced chemical synthesis capabilities. Growth in biologics and specialty small molecules encourages investment in custom intermediates, while sustainability-focused manufacturing practices accelerate technological upgrades. The region also benefits from strong export activity and increasing R&D collaborations between academic institutions and pharmaceutical companies.

Asia-Pacific

Asia-Pacific leads as the fastest-growing region, holding an estimated 30–33% market share, fueled by expanding pharmaceutical manufacturing hubs in China and India. Cost-efficient production, large-scale API output, and rapidly advancing chemical synthesis capacities boost regional dominance. Government initiatives supporting drug manufacturing self-reliance further accelerate investment in intermediate production. Japan and South Korea contribute significantly through advanced process technologies and high-value intermediates for specialty drugs. Growing domestic consumption of chronic disease therapeutics and rising CMO/CRO activities strengthen market growth, positioning Asia-Pacific as a key global supplier of both bulk and custom intermediates.

Latin America

Latin America contributes around 6–8% of the global market, driven by expanding pharmaceutical production capabilities in Brazil and Mexico. The region experiences growing demand for intermediates used in generic drug manufacturing, supported by rising healthcare spending and broadening patient access to essential medicines. Government programs encouraging API and intermediate production reduce dependence on imports and create opportunities for local manufacturers. Although the region faces challenges related to limited high-end synthesis infrastructure, increasing collaborations with global CMO/CROs and adoption of modern manufacturing technologies are gradually enhancing production quality and capacity.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–6% share, supported by improving pharmaceutical manufacturing infrastructure and rising demand for essential and chronic disease medications. Countries such as Saudi Arabia, the UAE, and South Africa are investing in localized drug manufacturing to reduce import reliance, creating opportunities for intermediate suppliers. Growth is driven by expanding healthcare coverage, increasing government support for domestic production, and growing private-sector investments. Although the region’s capacity for complex intermediate synthesis remains limited, strengthening partnerships with global manufacturers and rising regulatory modernization are gradually enhancing market potential.

Market Segmentations:

By Product:

- Chemical Intermediates

- Bulk Drug Intermediates

By Application:

- Analgesics

- Ant-inflammatory Drug

By End User:

- Biotech and Pharma Companies

- Research Laboratory

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Pharmaceutical Intermediates Market is shaped by leading global pharmaceutical companies such as Pfizer Inc., AstraZeneca, AbbVie Inc., Bristol-Myers Squibb Company, GlaxoSmithKline plc., Merck & Co., Inc., Sanofi, Novartis AG, Johnson & Johnson Services, Inc., and F. Hoffmann-La Roche Ltd. The pharmaceutical intermediates market exhibits a highly competitive landscape driven by continuous innovation, expanding manufacturing capabilities, and growing demand for high-purity, complex intermediates across therapeutic categories. Companies differentiate themselves through advanced synthesis technologies, including continuous-flow chemistry, biocatalysis, and green chemistry solutions that enhance efficiency and sustainability. Increasing investment in custom synthesis supports the development of specialized intermediates required for emerging small-molecule and targeted therapies. The market also benefits from strong collaborations between manufacturers, CMO/CRO partners, and research institutions, enabling faster development cycles and improved regulatory compliance. Additionally, global expansion of production facilities, digitalized process control, and strategic supply-chain optimization contribute to strengthened competitive positioning in a rapidly evolving pharmaceutical ecosystem.

Key Player Analysis

- Pfizer Inc.

- AstraZeneca

- AbbVie Inc.

- Bristol-Myers Squibb Company

- GlaxoSmithKline plc.

- Merck & Co., Inc.

- Sanofi

- Novartis AG

- Johnson & Johnson Services, Inc.

- Hoffmann-La Roche Ltd

Recent Developments

- In February 2025, Medexus Pharmaceuticals announced the availability of GRAFAPEX (treosulfan) for Injection in the U.S. After one month of FDA approvals, the company has achieved commercial launch in early 2025.

- In January 2025, AstraZeneca announced a CUSD (USD 570m) investment in Canada, creating 700 jobs and expanding its Toronto facility. The investment supports R&D, global clinical studies, and Canada’s life sciences sector, backed by Ontario’s CUSD contribution.

- In January 2025, Daiichi Sankyo acquired full intellectual property rights for gatipotuzumab from Glycotope for USD 132.5 million, covering all milestone payments. Gatipotuzumab is the antibody in DS-3939, a TA-MUC1-directed ADC using DXd technology, currently in Phase 1/2 trials for multiple cancers. No TA-MUC1 therapies are approved.

- In January 2025, Sanofi’s Sarclisa (isatuximab) was approved in China by the National Medical Products Administration (NMPA) for adult patients with newly diagnosed multiple myeloma (NDMM) who are ineligible for a stem cell transplant.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as demand rises for complex intermediates used in oncology, immunology, and chronic disease therapies.

- Manufacturers will increasingly adopt green chemistry and sustainable production methods to meet regulatory and environmental expectations.

- Custom intermediates will gain prominence as pharmaceutical pipelines shift toward highly targeted and specialized small-molecule drugs.

- CMO/CRO partnerships will expand, driven by outsourcing needs for cost efficiency and advanced synthesis expertise.

- Continuous-flow and biocatalytic technologies will accelerate production efficiency and improve product purity.

- Digitalization and automation will strengthen process optimization and quality control across manufacturing facilities.

- Regional diversification of intermediate production will reduce supply-chain risks and increase global capacity.

- Rising R&D investments will support the development of new intermediates for innovative therapeutic classes.

- Regulatory tightening will encourage higher compliance standards, fostering quality-driven market competition.

- Companies will focus on expanding high-value intermediate portfolios to support emerging precision medicine trends.