Market Overview

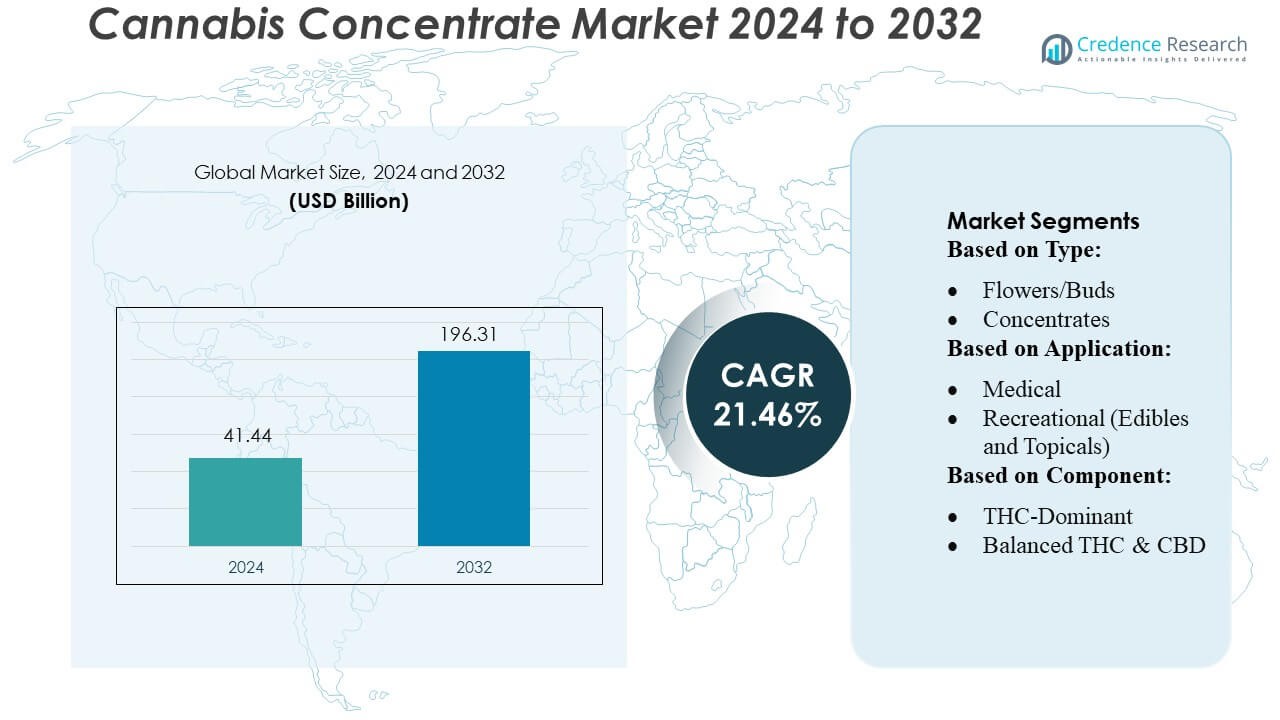

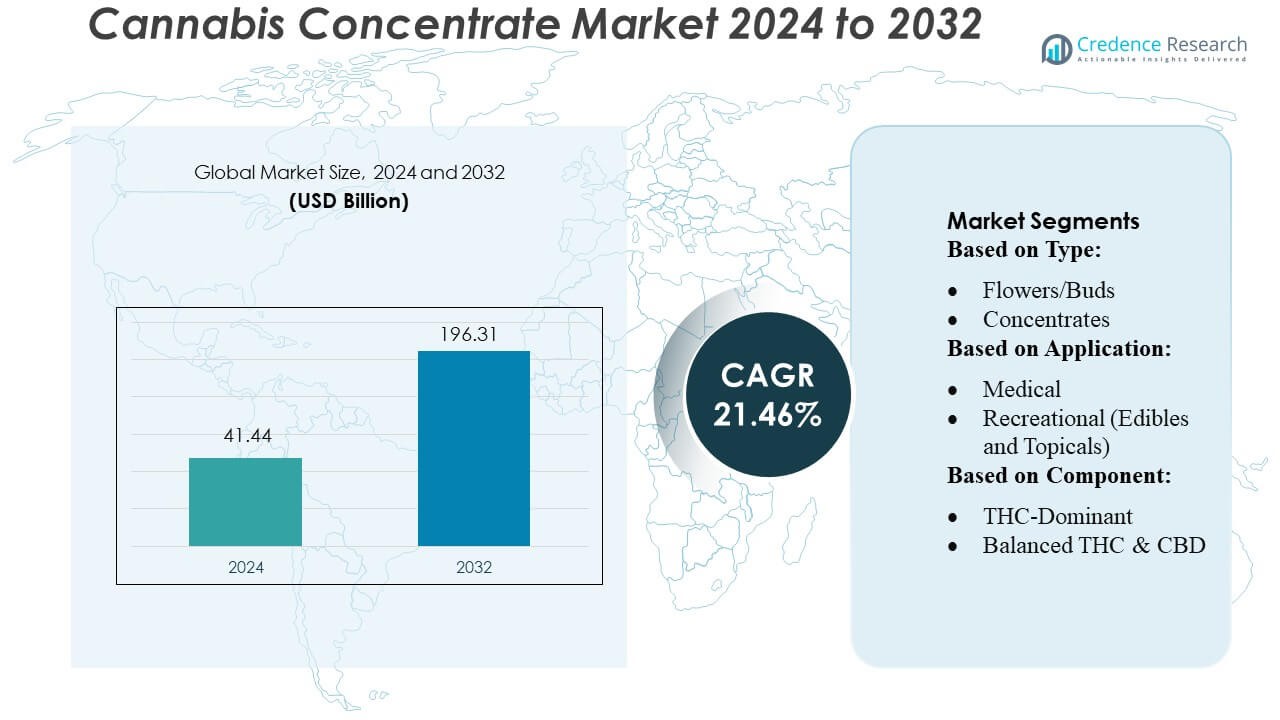

Cannabis Concentrate Market size was valued USD 41.44 billion in 2024 and is anticipated to reach USD 196.31 billion by 2032, at a CAGR of 21.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cannabis Concentrate Market Size 2024 |

USD 41.44 Billion |

| Cannabis Concentrate Market, CAGR |

21.46% |

| Cannabis Concentrate Market Size 2032 |

USD 196.31 Billion |

The cannabis concentrate market is dominated by several key players, including Archer Daniels Midland, Lemon Concentrate, S.L., Sunopata Inc., Kerr Concentrates, Inc., China Haiseng Juice Holdings Co., Ltd, Dohler GmBH, Skypeople Fruit Juice Inc., Agrana Beteiligungs Ag, Royal Cosun, and Rudolf Wild GmBH & Co. Kg. These companies compete through product innovation, advanced extraction technologies, and expansion into emerging markets. They focus on offering high-potency, safe, and clean concentrates to meet the growing medical and recreational demand. North America remains the leading region in the market, accounting for approximately 42% of global share. Strong legalization frameworks, mature distribution networks, and high consumer adoption in the U.S. and Canada contribute to this dominant position. The combination of innovation, regulatory compliance, and strategic partnerships enables these companies to maintain a competitive edge in this fast-growing and dynamic market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cannabis concentrate market was valued at USD 41.44 billion in 2024 and is projected to reach USD 196.31 billion by 2032, growing at a CAGR of 21.46% during the forecast period.

- Key drivers include rising legalization of medical and recreational cannabis, increasing consumer preference for high-potency products, and growing demand for precise and convenient consumption formats like oils, waxes, and vape cartridges.

- Market trends show a focus on product innovation, clean extraction technologies, and the development of diverse formats, including edibles, tinctures, and minor cannabinoid concentrates, to cater to evolving consumer preferences.

- The market is competitive, with leading players emphasizing strategic partnerships, mergers, acquisitions, and expansion into emerging regions to strengthen their position, while regulatory compliance and quality assurance remain critical.

- Regionally, North America leads with approximately 42% share, followed by Europe and Asia-Pacific, while concentrates dominate over other product segments due to higher potency, convenience, and medical adoption.

Market Segmentation Analysis:

By Type

The market segment by type remains dominated by the Flowers/Buds sub‑segment. Traditional flower products continue to command the largest share due to consumer familiarity, ease of use, and broad availability despite the growing interest in extracts. Concentrates hold a substantial minority share, driven by their higher potency, fast‑acting effects, and variety of concentrate formats (e.g., oils, waxes, shatter). The rising demand for discreet and potent consumption methods supports growth in the concentrate sub‑segment, though flower remains the backbone of overall cannabis consumption due to user habits and regulatory comfort.

- For instance, Urja Bio System Private Limited, offer industrial food waste crushers and composting machines with capacities reaching up to 1,000 kg/hr, which can reduce waste and enhance efficiency in waste management.

By Application

Within application-based segmentation, the Medical sub‑segment leads the market, reflecting widespread therapeutic use of cannabis concentrates for chronic pain, neurological conditions, and other health needs. Medical use benefits from growing physician support, increasing acceptance of cannabis-based therapies, and regulatory reforms expanding legal access. While recreational consumption (including edibles and topicals) is gaining traction, particularly where adult-use legalization expands, medical demand remains the primary driver—supported by consumer preference for controlled dosing and health-oriented applications. Industrial hemp application, though present, lags behind both medical and recreational demand by a considerable margin.

- For instance, ENCON’s product documentation for its MVC evaporators consistently states a typical operating energy cost of $0.01–$0.02 per gallon of distilled water, based on an assumed electricity cost.

By Component

Among active‑constituent profiles, the THC‑Dominant sub‑segment remains dominant, reflecting consumer demand for higher potency products, especially in recreational markets. THC‑rich concentrates provide stronger psychoactive effects and satisfy preference for intensity, which fuels their popularity. Meanwhile, Balanced THC & CBD and CBD‑Dominant products are gaining interest among medical and wellness‑oriented users seeking more nuanced therapeutic benefits, but have not yet surpassed THC-dominant variants in overall market share. The demand for high‑potency experiences, combined with regulatory environments that permit THC use, underpins the dominance of the THC‑focused segment.

Key Growth Drivers

- Legalization and Regulatory Support

The legalization of cannabis, both for medical and recreational use, is one of the biggest factors driving growth in the cannabis concentrate market. More countries and states are updating their laws to allow legal sale and use, which creates new opportunities for businesses and consumers alike. Legalization also reduces the risks associated with production and distribution, encouraging investment and innovation in the market. Over time, this regulatory support allows more stores, online platforms, and medical dispensaries to sell concentrates, expanding access and increasing overall demand.

- For instance, Pall’s Keraflux™ TFF technology enables breweries to recover up to 80% of extract from surplus yeast, reducing waste and allowing beer blending at ratios up to 5% without negatively impacting quality.

- High Potency and Convenient Consumption

Cannabis concentrates are much stronger than traditional cannabis flowers, often containing 40–90% or more of active cannabinoids like THC or CBD. This higher potency allows consumers to feel effects faster and use smaller amounts. Concentrates also come in convenient forms such as vape cartridges, oils, waxes, tinctures, and edibles. These formats are easy to use, portable, and discreet, making them attractive to modern consumers who want quick, efficient, and private ways to consume cannabis. The combination of strength and convenience has made concentrates a preferred choice for many users.

- For instance, Evoqua operates in more than 160 locations across ten countries, serving over 38,000 customers worldwide. Their extensive network enables them to provide localized solutions and support for water and wastewater treatment needs globally.

- Medical and Therapeutic Demand

There is growing recognition of the medicinal benefits of cannabis for conditions like chronic pain, epilepsy, anxiety, and nausea. Cannabis concentrates are often preferred in medical applications because they allow precise and consistent dosing, which is important for patient safety and treatment effectiveness. Standardized concentrates enable doctors and patients to control how much of a compound like THC or CBD is consumed. As awareness of therapeutic benefits grows, medical patients are increasingly turning to concentrates, helping to expand the market steadily.

Key Trends & Opportunities

- Advanced and Cleaner Extraction Technologies

The cannabis concentrate market is benefiting from improvements in extraction technology. Methods like CO₂ extraction, solvent-less techniques, and other modern processes improve product purity, safety, and potency. These technologies also preserve important natural compounds like terpenes, which enhance flavor and effects. As more producers adopt these advanced methods, they can offer higher-quality products that appeal to both medical patients and recreational users, creating opportunities for premium and health-focused product lines.

- For instance, KSS launched the INDU-COR™ HD tubular membrane system, designed for industrial wastewater treatment applications. This system offers a higher packing density of up to 300%, making crossflow filtration more economical while occupying less space.

- Product Innovation and Format Diversification

There is a growing trend toward innovative product formats that cater to different consumer preferences. In addition to traditional oils and waxes, companies are offering tinctures, vape cartridges, edibles, sprays, and topical applications. Some products focus on minor cannabinoids or full-spectrum effects, appealing to users looking for specific health benefits or unique experiences. Product innovation allows companies to attract a wider range of consumers, including wellness-focused users, medical patients, and recreational enthusiasts.

- For instance, Emerson’s Ovation™ distributed control system was utilized in a UK waste-to-energy plant. The plant processes 320,000 tons of waste annually, producing 28 megawatt-hours of electricity per hour, enough to power approximately 40,000 homes.

- Expansion into Emerging and Global Markets

As cannabis laws evolve globally, emerging markets outside North America and Europe are beginning to open up. These regions present significant opportunities for growth, especially for companies with established regulatory knowledge and product experience. Early entry into these markets can help companies gain a strong market presence and capture new consumers, driving overall industry growth. Expanding globally also helps diversify revenue sources and reduce dependence on any single market.

Key Challenges

- Complex and Fragmented Regulations

While legalization is expanding, cannabis laws remain inconsistent across regions. Each country, state, or province can have different rules regarding production, testing, labeling, packaging, and distribution. This fragmented regulatory environment increases the cost and complexity of operating in multiple markets. Companies must invest in compliance, licensing, and legal expertise to avoid fines or shutdowns. Navigating these rules is especially challenging for smaller players and can slow down overall market growth.

- Quality, Safety, and Public Perception Issues

Ensuring high quality and safe products is critical in the cannabis concentrate market. Variations in extraction methods, plant material, or production standards can lead to inconsistent potency or harmful residues. Safety concerns, particularly with high-potency concentrates or vaping products, have caused negative media attention and public skepticism. Poorly made products can damage trust, hinder adoption by new users, and limit the willingness of regulators to support market expansion. Maintaining consistent quality and safety standards is therefore essential for sustainable growth.

Regional Analysis

North America

North America is the largest market for cannabis concentrates, holding around 40–45% of global share. The U.S. and Canada lead due to established legalization, mature retail networks, and high consumer demand for both medical and recreational products. Clear regulations and strong industry players support steady growth. Consumers prefer high-potency products like oils, waxes, and vape cartridges, while medical use continues to rise. North America remains the most developed and competitive region, attracting significant investment and product innovation in the cannabis concentrate market.

Europe

Europe accounts for roughly 25% of the global market. Medical cannabis is gradually gaining acceptance across countries like Germany, the UK, and the Netherlands. While recreational legalization is limited, evolving regulations and public awareness are driving growth in concentrates. European consumers are increasingly using oils, tinctures, and other convenient formats. Investment in extraction technology and medical-grade products is rising. The market is developing steadily, supported by regulatory approvals and healthcare demand, making Europe a key region for expansion despite slower growth than North America.

Asia-Pacific (APAC)

Asia-Pacific holds about 18% of global market share. Historically smaller than North America and Europe, APAC is growing quickly due to increasing awareness of medical cannabis and evolving regulations in countries like Thailand and South Korea. Demand for concentrates is rising, especially for medicinal and wellness applications. Companies are exploring new markets and products to meet growing consumer interest. With regulatory changes and growing investment, APAC is emerging as an important growth region for cannabis concentrates.

Latin America

Latin America represents around 10% of the global market. Growth is slower but steady, driven mainly by medical cannabis adoption in countries such as Colombia, Chile, and Brazil. Regulatory reforms and consumer interest in cannabis concentrates are gradually increasing. Products like oils, tinctures, and vape cartridges are becoming more available. As laws evolve and acceptance grows, Latin America has potential for market expansion, especially in medical and wellness segments.

Middle East & Africa (MEA)

MEA contributes about 7–8% of the market. Legal restrictions and cultural barriers limit growth, but medical cannabis is slowly gaining acceptance in some countries. Investment and production are emerging, creating early opportunities for cannabis concentrates. Consumers are primarily focused on medical and therapeutic use. While the market is small, gradual regulatory change and increased awareness could help MEA develop into a larger market over time.

Market Segmentations:

By Type:

- Flowers/Buds

- Concentrates

By Application:

- Medical

- Recreational (Edibles and Topicals)

By Component:

- THC-Dominant

- Balanced THC & CBD

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cannabis concentrate market is highly competitive, with key players including Archer Daniels Midland, Lemon Concentrate, S.L., Sunopata Inc., Kerr Concentrates, Inc., China Haiseng Juice Holdings Co., Ltd, Dohler GmBH, Skypeople Fruit Juice Inc., Agrana Beteiligungs Ag, Royal Cosun, and Rudolf Wild GmBH & Co. Kg. The cannabis concentrate market is highly competitive, driven by continuous innovation, product differentiation, and regulatory compliance. Companies compete on quality, potency, extraction methods, and product variety, focusing on clean and safe concentrates to meet consumer demand. Strategic initiatives such as mergers, acquisitions, and partnerships are frequently employed to expand market presence and enter emerging regions. Firms also emphasize brand recognition, distribution efficiency, and customer loyalty to maintain a competitive edge. Continuous development of new concentrate formats, flavors, and cannabinoid profiles allows differentiation, while adherence to evolving legal and safety regulations remains critical. Overall, market competition is fueled by innovation, operational excellence, and the ability to respond to rapidly changing consumer preferences and regulatory environments.

Key Player Analysis

- Archer Daniels Midland

- Lemon Concentrate, S.L.

- Sunopata Inc.

- Kerr Concentrates, Inc.

- China Haiseng Juice Holdings Co., Ltd

- Dohler GmBH

- Skypeople Fruit Juice Inc.

- Agrana Beteiligungs Ag

- Royal Cosun

- Rudolf Wild GmBH & Co. Kg

Recent Developments

- In July 2025, SUEZ and SIAAP inaugurated France’s largest biogas production unit at the Seine Aval wastewater treatment plant near Paris. The facility processes 130,000 tonnes of sludge annually, generating 350 GWh of renewable energy. This covers over half the plant’s energy needs.

- In April 2025, Leanpath introduced a mobile reporting app designed for the foodservice industry. This app, which utilizes AI, makes it easier for chefs and kitchen managers to engage with food waste data.

- In January 2025, Calgon Carbon Corporation, a subsidiary of Kuraray Co., Ltd., secured a contract to supply activated carbon systems for wastewater treatment at a beverage manufacturing facility in the Asia Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily as more countries and states adopt legal frameworks for medical and recreational cannabis.

- Consumer demand for high-potency and convenient concentrate products will continue to rise.

- Technological advancements in extraction methods will drive safer and higher-quality products.

- Product innovation and diversification in formats such as oils, waxes, tinctures, and edibles will expand market opportunities.

- Increased adoption of concentrates for medical and therapeutic applications will support long-term growth.

- Emerging markets, particularly in Asia-Pacific and Latin America, will present significant expansion opportunities.

- Strategic partnerships, mergers, and acquisitions will shape competitive dynamics and market consolidation.

- Regulatory clarity and standardization across regions will encourage investment and reduce operational risks.

- Consumer awareness and education about the benefits of concentrates will drive adoption.

- Companies focusing on sustainability, clean production processes, and quality assurance will strengthen their market position.