Market Overview:

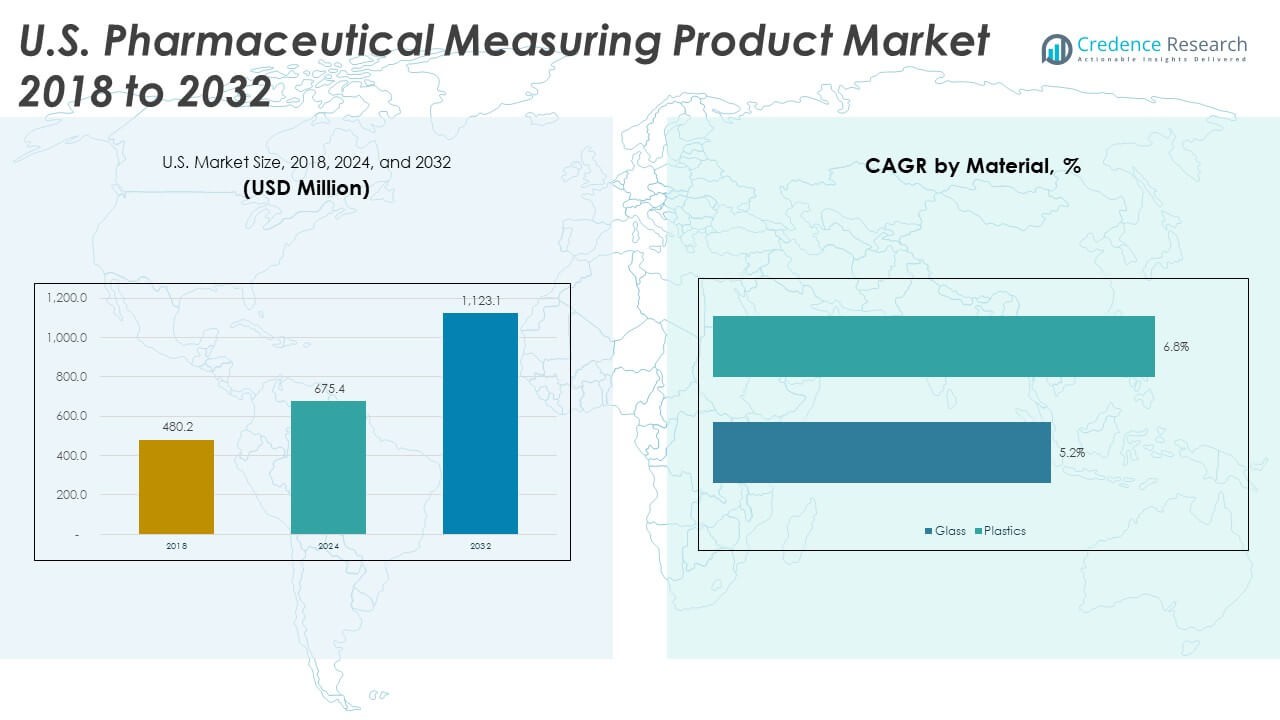

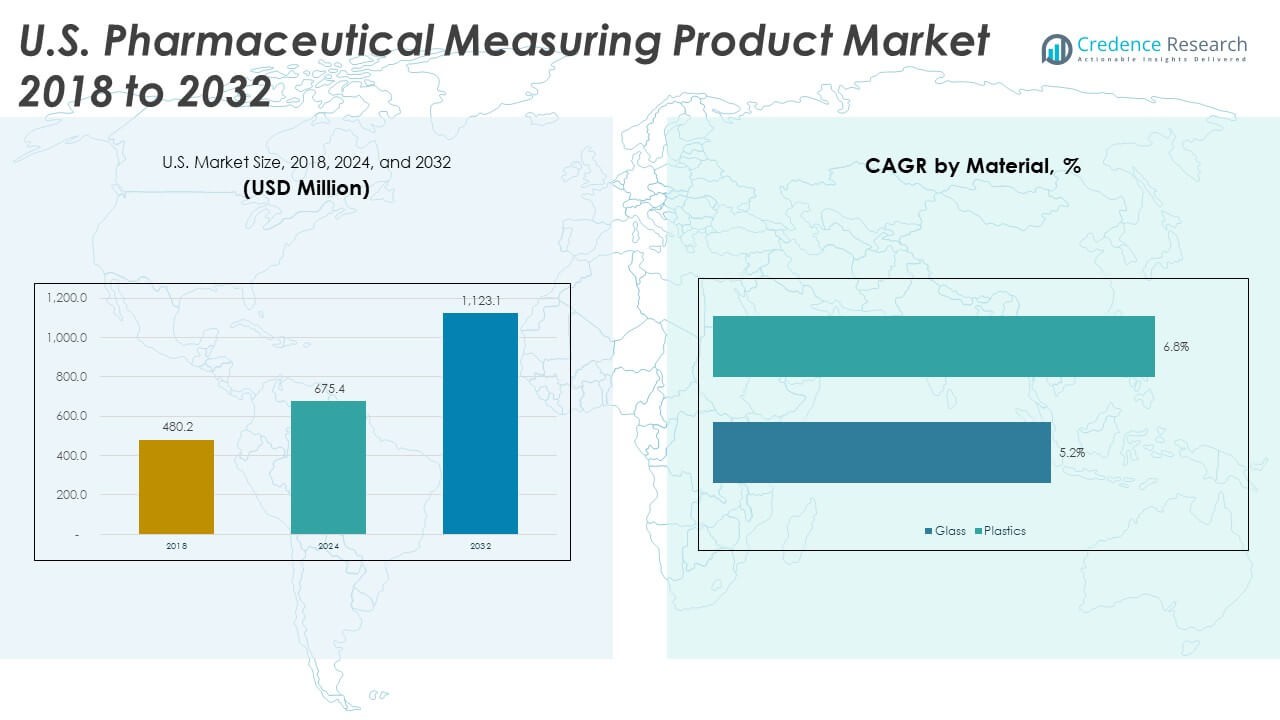

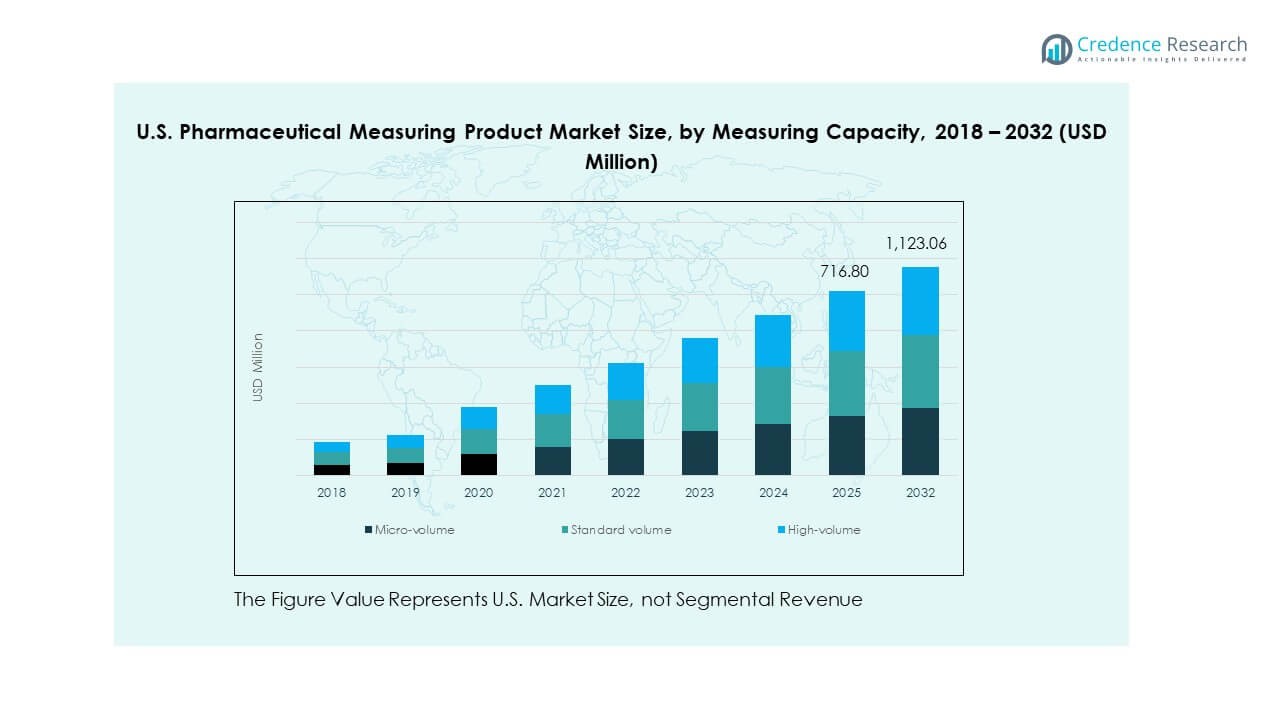

The U.S. Pharmaceutical Measuring Product Market size was valued at USD 480.2 million in 2018 to USD 675.4 million in 2024 and is anticipated to reach USD 1,123.10 million by 2032, at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Pharmaceutical Hoses Market Size 2024 |

USD 675.4 Million |

| U.S. Pharmaceutical Hoses Market, CAGR |

6.62% |

| U.S. Pharmaceutical Hoses Market Size 2032 |

USD 1,123.10 Million |

Strong market drivers include rising medication use across chronic illness groups and expanding self-administration trends. Producers supply advanced cups, syringes, droppers, and calibrated devices that support correct dosing practice. Drugmakers apply precision tools across manufacturing floors to meet uniformity needs. Hospitals focus on devices that improve patient safety during treatment cycles. Home-care users depend on clear markings that support correct measuring practice. The sector benefits from greater awareness of dosing errors and the demand for standardized tools. Growth remains steady due to expanding pharmaceutical production in the country. Device makers also develop ergonomic designs that improve user comfort and satisfaction.

Regional growth patterns remain concentrated across major U.S. healthcare hubs. States with large hospital networks lead adoption due to high patient volume and strong compliance norms. Regions with growing life sciences clusters show rising demand due to increased drug development and packaging activity. Emerging states adopt calibrated tools as they expand outpatient care and home-care programs. Strong pharmaceutical manufacturing corridors further accelerate uptake of dosing devices. Retail pharmacies across urban and suburban regions support wide distribution. Overall demand remains consistent nationwide due to rising medication usage and stronger emphasis on dosing accuracy across all care settings.

Market Insights:

- The U.S. Pharmaceutical Measuring Product Market grew from USD 480.2 million in 2018 to USD 675.4 million in 2024 and is projected to hit USD 1,123.10 million by 2032, supported by a 6.62% CAGR driven by stronger dosing accuracy needs.

- The Northeast (32%), Midwest (28%), and South (26%) lead the market due to dense pharma clusters, strong manufacturing bases, and extensive hospital networks that rely on calibrated measuring tools.

- The West (14%) is the fastest-growing region, driven by expanding biotechnology ecosystems, high R&D activity, and strong adoption of advanced dosing technologies.

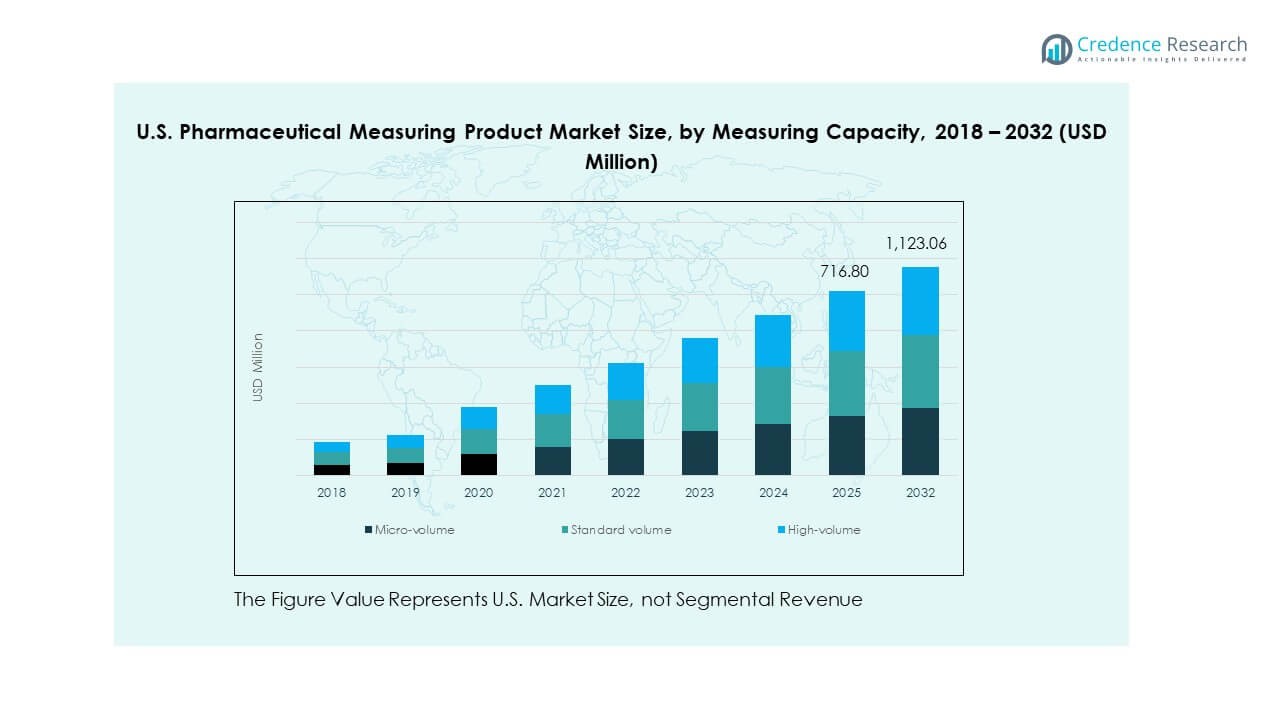

- Standard-volume tools dominate segment share at roughly 45%, supported by their wide use in hospitals, pharmacies, and routine medication workflows across the country.

- High-volume products hold about 35%, while micro-volume formats account for nearly 20%, reflecting balanced demand across compounding labs, diagnostics, and specialized dosing applications.

Market Drivers:

Growing Need For Accurate Medication Dosing Across Clinical And Home-Care Settings

The U.S. Pharmaceutical Measuring Product Market grows due to rising demand for precise dosing tools that support patient safety. Healthcare providers rely on calibrated devices to avoid errors during treatment cycles and drug administration. Home-care users prefer clear markings that guide correct dosage for liquid medicines. Manufacturers upgrade measuring cups, droppers, and syringes to improve readability and handling comfort. Drugmakers integrate precision tools across production lines to maintain dose uniformity. Hospitals enforce strict dosing standards that increase procurement of high-accuracy devices. Retail pharmacies promote products that support safer medication habits. Strong focus on error prevention lifts adoption across varied user groups.

- For instance, Baxter’s Exacta-Mix system is used across more than 1,500 hospitals in the U.S. and supports automated compounding of formula combinations with validated dosing accuracy.

Rising Use Of Chronic Disease Medication And Expanding Self-Administration Practices

Chronic illnesses increase medication frequency, which drives higher demand for reliable dosing tools. Patients managing long-term therapies depend on calibrated devices that support safe consumption patterns. The U.S. Pharmaceutical Measuring Product Market benefits from rising interest in tools that improve dose clarity. Medical professionals encourage self-administration with devices that reduce confusion during daily use. Product developers design ergonomic shapes that support handling by seniors and children. Hospitals recommend measuring tools that prevent mistakes during liquid drug intake. Community clinics support use of high-visibility markings that guide treatment accuracy. Growing patient education programs further expand product usage.

- For instance, BD (Becton, Dickinson and Company) produces more than 34 billionmedical devices annually. While only a portion of these are safety-engineered injection devices, the company has expanded its manufacturing capacity in this area, adding hundreds of millions of units annually to support safer self-administration and controlled dosing for chronic patients.

Stricter Quality Standards And Regulatory Focus On Dosing Safety

Tighter guidelines from regulatory bodies increase demand for devices that meet accuracy norms. Manufacturers improve quality control steps to align with evolving compliance rules. Product designs shift toward materials that support clear marking stability. The U.S. Pharmaceutical Measuring Product Market sees stronger adoption due to strict oversight of drug handling tools. Hospitals audit measuring devices to maintain consistent dosing reliability. Retail channels stock certified tools that match national safety expectations. Production facilities deploy calibrated tools that enhance quality checks. Growing enforcement of labelling standards shapes new product development.

Integration Of Advanced Materials And User-Centric Product Engineering

Producers adopt advanced polymers and improved molding techniques to achieve stronger precision. Device surfaces now support enhanced clarity for dosage lines. The U.S. Pharmaceutical Measuring Product Market gains traction as companies develop products with higher durability. Hospitals seek tools that withstand repeated cleaning without marking erosion. Home-care buyers value soft-grip elements that support daily handling comfort. Manufacturers explore lean designs that reduce weight while maintaining strength. Retailers promote innovations that improve dose visibility among older adults. User-centric engineering encourages broader adoption across diverse care settings.

Market Trends:

Shift Toward Digital And Smart Measuring Tools Across Pharmaceutical Workflows

The growing adoption of digital dosing devices shapes new product preferences. Smart tools integrate sensors that support accurate tracking during medication intake. Hospitals explore connected devices that guide safe drug administration steps. The U.S. Pharmaceutical Measuring Product Market adapts to demand for advanced features that reduce manual effort. Producers test digital readout designs that improve visibility for low-vision patients. Self-administration routines benefit from tools that provide dosage reminders. Pharmaceutical labs review smart tools that support precision during compounding tasks. Retail channels begin introducing digital options for home users seeking enhanced accuracy.

- For instance, Aptar Pharma’s digital inhaler platform logs up to 200 inhalation events and transmits real-time usage data to mobile applications for adherence management.

Growth Of Sustainable And Eco-Friendly Measuring Product Designs

Manufacturers increase use of recyclable materials to align with environmental goals. Products shift toward low-waste designs that reduce the need for frequent replacement. The U.S. Pharmaceutical Measuring Product Market observes rising interest in bio-based polymers. Hospitals evaluate sustainable measuring cups and syringes to lower plastic use. Retailers highlight eco-friendly lines to match consumer awareness trends. Product designers develop lightweight structures that cut material consumption. Drug packaging units review greener alternatives that support compliance. Sustainability goals influence new investment decisions across factories.

- For instance, Corning’s Valor® Glass reduces particulate contamination by up to 96% and drastically lowers container damage during filling operations, supporting cleaner and more sustainable pharmaceutical workflows.

Rising Adoption Of High-Visibility And Color-Coded Dosing Tools

Color-coded designs support error prevention during busy clinical workflows. Home-care users prefer bright markings that simplify daily medicine routines. The U.S. Pharmaceutical Measuring Product Market expands with new products designed for visual clarity. Manufacturers create high-contrast measurement lines to guide accurate dosing. Pediatric care units favor color-coded droppers that support safe administration. Hospitals adopt multicolor systems to separate drug categories. User-friendly visuals help patients follow treatment schedules. Wider focus on clear communication drives continuous design upgrades.

Greater Integration Of User Education And Instruction-Aligned Tool Designs

Manufacturers provide tools that align with educational guidelines shared by nurses and pharmacists. Hospitals promote devices that pair with easy-to-read instructions. The U.S. Pharmaceutical Measuring Product Market evolves with products that support simplified training. Retailers provide packaged kits that include clear dosage guides. Home-care programs endorse tools that align with literacy needs. Pediatric centers request products with visual cues that help caregivers. Device developers collaborate with clinicians to improve functional design. User education efforts encourage stronger trust in calibrated devices.

Market Challenges Analysis:

Quality Variation Across Low-Cost Products And Limited Standardization In Certain Segments

Variation in product quality creates confusion for buyers who seek consistent accuracy. Many low-cost devices fail to maintain marking clarity after repeated cleaning cycles. The U.S. Pharmaceutical Measuring Product Market faces pressure due to inconsistent quality control among smaller producers. Hospitals avoid unreliable tools, which narrows options for budget-sensitive users. Retail outlets often carry mixed-grade products that complicate purchase decisions. Manufacturers with weaker compliance frameworks struggle to meet regulatory expectations. User trust declines when devices display fading measurement lines. Limited standardization slows broader acceptance of new product formats.

High Regulatory Burden And Slow Product Approval Timelines

Stringent testing requirements extend the time needed to bring new tools to market. Firms face complex labelling rules that demand frequent design changes. The U.S. Pharmaceutical Measuring Product Market navigates ongoing cost pressure linked to certification processes. Smaller producers struggle with resource constraints during regulatory reviews. Hospitals delay procurement when new criteria emerge without transition guidance. Retailers adjust inventories cautiously due to shifting compliance needs. Manufacturers handle repeated audits that drain operational bandwidth. These hurdles slow innovation and restrict launch momentum.

Market Opportunities:

Market Opportunities:

Advancement Of Smart Dosing Technologies And Integration With Digital Health Tools

Smart measuring tools that connect with digital platforms create large growth potential. Hospitals consider devices that support automated dosage verification. The U.S. Pharmaceutical Measuring Product Market can benefit from tools linked to monitoring apps. Home-care users value digital prompts that support treatment adherence. Manufacturers explore sensors that record dosage events for clinical reviews. Retailers may offer digital bundles that expand product reach. Partnerships with software firms can unlock new use cases across care settings. Broader integration with telehealth strengthens demand for modern dosing tools.

Rising Demand For Ergonomic And Patient-Friendly Designs Across Diverse User Groups

Ergonomic enhancements create strong openings for new product lines. Hospitals prefer tools with better grip features for busy clinical routines. The U.S. Pharmaceutical Measuring Product Market gains potential from designs that support low-vision and senior users. Child-friendly tools appeal to pediatric units that need safer dosing support. Home-care buyers value simplified structures that guide correct handling. Retail channels promote comfort-focused designs to improve patient trust. Producers can expand portfolios with inclusive products for varied abilities. User-centric innovation shapes long-term opportunity for leading brands.

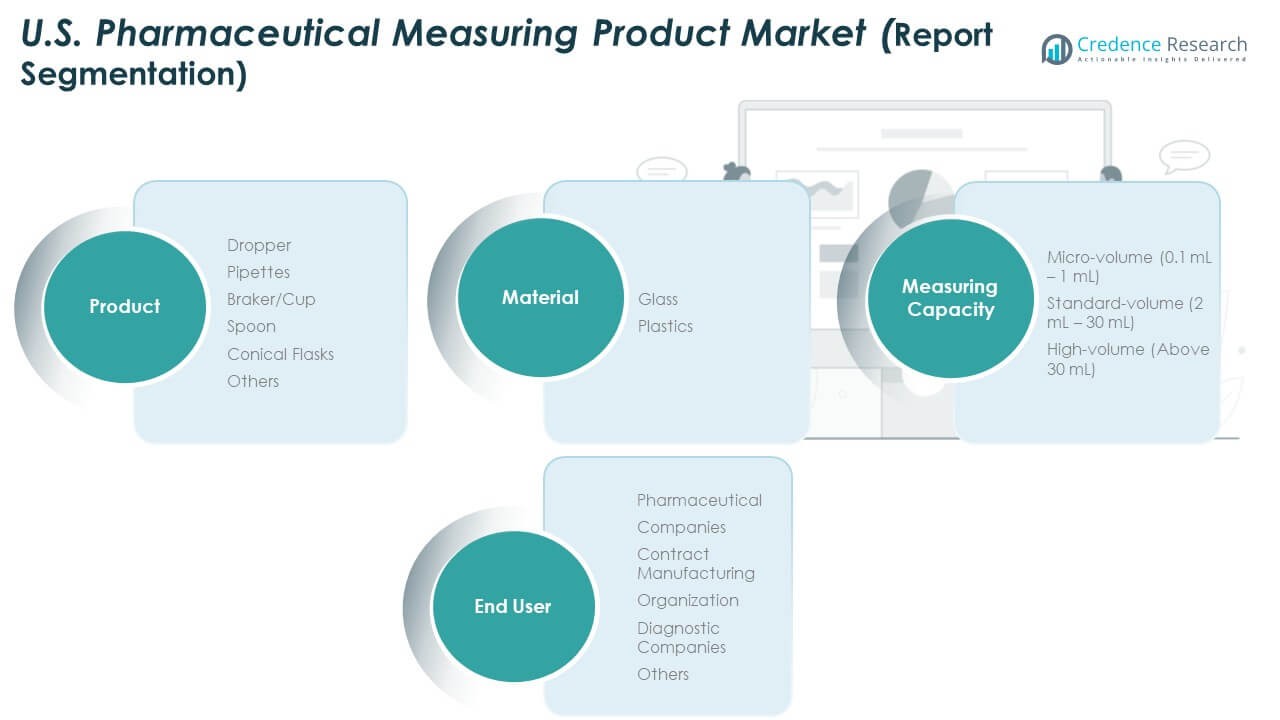

Market Segmentation Analysis:

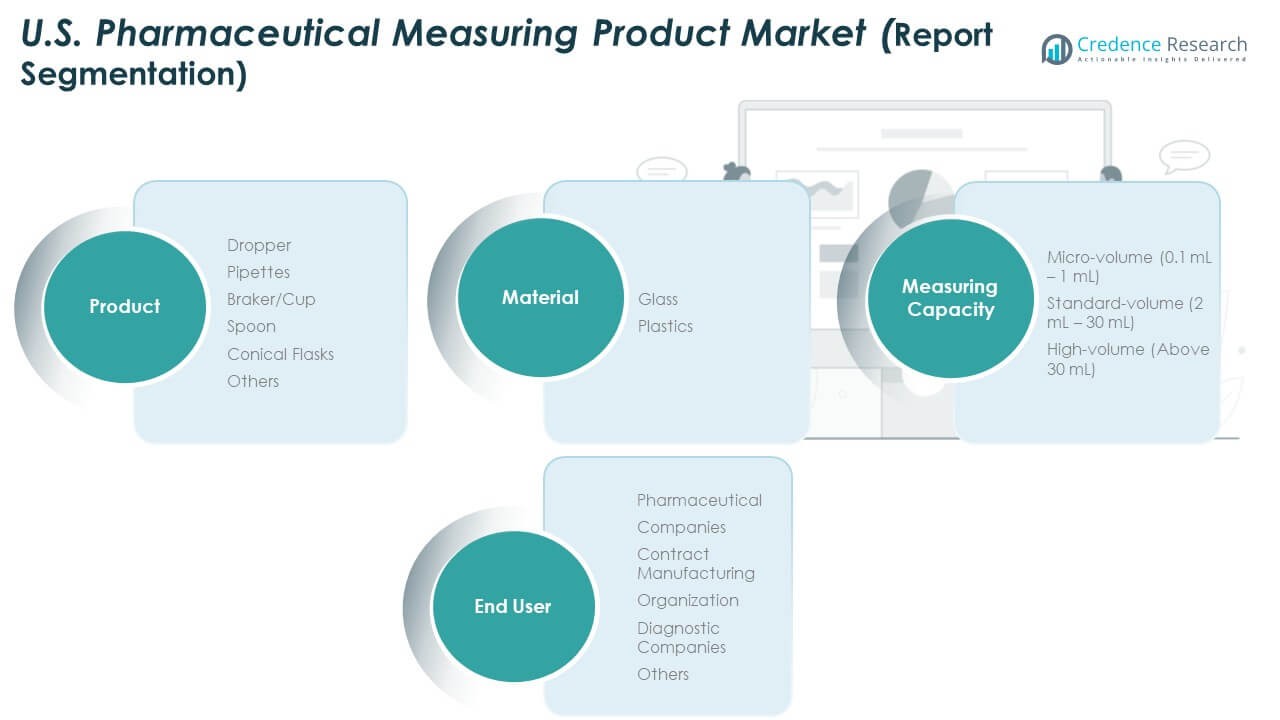

By Product

The U.S. Pharmaceutical Measuring Product Market shows strong demand across droppers, pipettes, beakers or cups, spoons, conical flasks, and other formats. Droppers lead usage in liquid dosing for both clinical and home-care settings. Pipettes gain traction in labs that require controlled transfer of micro-volumes. Beakers and cups support high-volume dispensing across production lines. Spoons remain common for pediatric and general oral medication needs. Conical flasks serve compounding and research workflows that need accurate calibration. Other products cover specialized tools designed for niche pharmaceutical tasks. Product variety supports broad adoption across diverse operations.

- For instance, Eppendorf Research plus pipettes are engineered for high precision and are designed to be extremely reliable and durable, with testing demonstrating they can withstand over 200,000 pipetting strokes and over 100,000 tip attachment cycles. While engineered for robust performance, these precision instruments require regular calibration and maintenance to ensure continued laboratory-grade accuracy, especially for specific liquids or at high altitudes

By Material

Glass and plastics define material preferences across regulated settings. Glass maintains demand due to chemical resistance and stable calibration lines. Plastic options dominate high-volume distribution due to low cost and light structure. It supports safe handling during transportation and non-breakable use in busy care units. Rising interest in cleanroom-grade materials lifts adoption of premium plastics.

- For instance, Gerresheimer produces over 17 billion pharmaceutical glass and plastic products each year, including precision-molded dosing and packaging tools used across global healthcare systems.

By Measuring Capacity

Micro-volume tools support precision dosing between 0.1 mL and 1 mL in specialized labs. Standard-volume devices between 2 mL and 30 mL dominate routine administration needs. High-volume formats above 30 mL serve bulk preparation tasks and industrial workflows.

By End User

Pharmaceutical companies lead demand with strong procurement for production and quality control units. Contract manufacturing organizations use calibrated tools to ensure batch accuracy. Diagnostic companies rely on precise instruments for sample handling. Others include hospitals, clinics, and home-care buyers that require consistent dosing support.

Segmentation:

By Product

- Dropper

- Pipettes

- Beaker/Cup

- Spoon

- Conical Flasks

- Others

By Material

By Measuring Capacity

- Micro-volume (0.1 mL – 1 mL)

- Standard-volume (2 mL – 30 mL)

- High-volume (Above 30 mL)

By End User

- Pharmaceutical Companies

- Contract Manufacturing Organizations

- Diagnostic Companies

- Others

Regional Analysis:

Northeast Region

The U.S. Pharmaceutical Measuring Product Market holds a strong base in the Northeast, which accounts for 32% of national share. The region benefits from dense pharmaceutical clusters and research institutions that depend on high-precision dosing tools. Hospitals and specialty clinics adopt calibrated devices to meet strict quality norms. It gains steady demand from contract labs that require micro-volume and standard-volume instruments. Drug manufacturers in New Jersey and Pennsylvania drive procurement of high-accuracy products. Retail pharmacy networks support wide availability of consumer-grade measuring tools. Strong regulatory compliance across the region supports consistent growth.

Midwest and South Regions

The Midwest captures 28% of market share with strong adoption in industrial pharmaceutical hubs. It relies on advanced measuring tools for large-scale production and diagnostic testing. University research centers in states such as Illinois and Minnesota support growing use of lab-focused devices. The South holds 26% share due to large hospital chains and expanding manufacturing corridors. It shows rising demand for high-volume formats used in compounding and batch preparation. Retail expansion across fast-growing metro areas increases product penetration. It continues to gain traction due to rising healthcare infrastructure investment.

West Region

The West region accounts for 14% share, supported by strong biotechnology activity and high innovation uptake. The U.S. Pharmaceutical Measuring Product Market benefits from the presence of advanced research labs in California. Healthcare providers demand ergonomic products that support diverse outpatient care needs. It sees growing use of digital-friendly measuring tools that align with technology adoption patterns. Pharmacy chains across urban centers maintain steady stock of calibrated cups, droppers, and spoons. Diagnostic firms in the region prefer micro-volume devices for sample accuracy. Growth remains stable due to strong R&D culture and expanding home-care use.

Key Player Analysis:

- Desiccare Inc.

- Fuji Silysia Chemical Ltd.

- Pharma Desiccants

- Porocel

- Silica Gel Desiccant

- WISESORBENT TECHNOLOGY LLC

- Clariant

- Baltimore Innovations

- Sanner

Competitive Analysis:

The U.S. Pharmaceutical Measuring Product Market features strong competition driven by product innovation, regulatory alignment, and multi-segment expansion. Leading companies enhance portfolios with calibrated droppers, pipettes, cups, and high-visibility dosing tools. It gains competitive momentum from firms that invest in durable materials and clear marking technologies. Manufacturers focus on precision engineering to meet dosing standards across clinical, diagnostic, and home-care settings. New entrants target low-cost, high-volume tools, while established players emphasize premium accuracy solutions. Strategic partnerships with pharmaceutical producers help expand distribution channels. Companies also refine ergonomic designs to increase user safety and reduce error rates. The market remains shaped by material selection, manufacturing quality, and compliance strength.

Recent Developments:

- In November 2024, Sanner announced major strategic updates for the pharmaceutical packaging industry. The company revealed plans to optimize its TabTec CR desiccated container system, designed specifically for on-the-go self-care applications. The optimized design features improved tightness and tailored desiccants to provide optimal moisture protection for highly sensitive active ingredients.

- In June 2023, Clariant launched Desi Pak ECO, a new line of plastic‑free, bio‑based bentonite clay desiccant packets designed to reduce the environmental impact of moisture‑adsorbing solutions while maintaining high adsorption efficiency for sensitive packaged goods, including healthcare and pharmaceutical products, with packet sizes ranging from 1 g to 33 g and manufactured using sustainably grown raw materials and water‑based inks and adhesives.

Report Coverage:

The research report offers an in-depth analysis based on product, material, measuring capacity, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-clarity dosing tools will rise due to stricter clinical accuracy norms.

- Ergonomic designs will gain traction among home-care and senior users nationwide.

- Micro-volume instruments will expand usage across diagnostics and research labs.

- Smart and digital-friendly dosing tools will attract long-term investment plans.

- Glass products will retain value in chemical-resistant applications across labs.

- Plastic measuring tools will dominate high-volume distribution in retail and pharma units.

- Contract manufacturing demand will rise with stronger outsourcing trends.

- High-volume tools will gain wider use in compounding and batch preparation facilities.

- Regional growth will strengthen in the Northeast due to dense pharma clusters.

- New product innovations will help firms improve safety, clarity, and calibration standards.

Market Opportunities:

Market Opportunities: