Market Overview

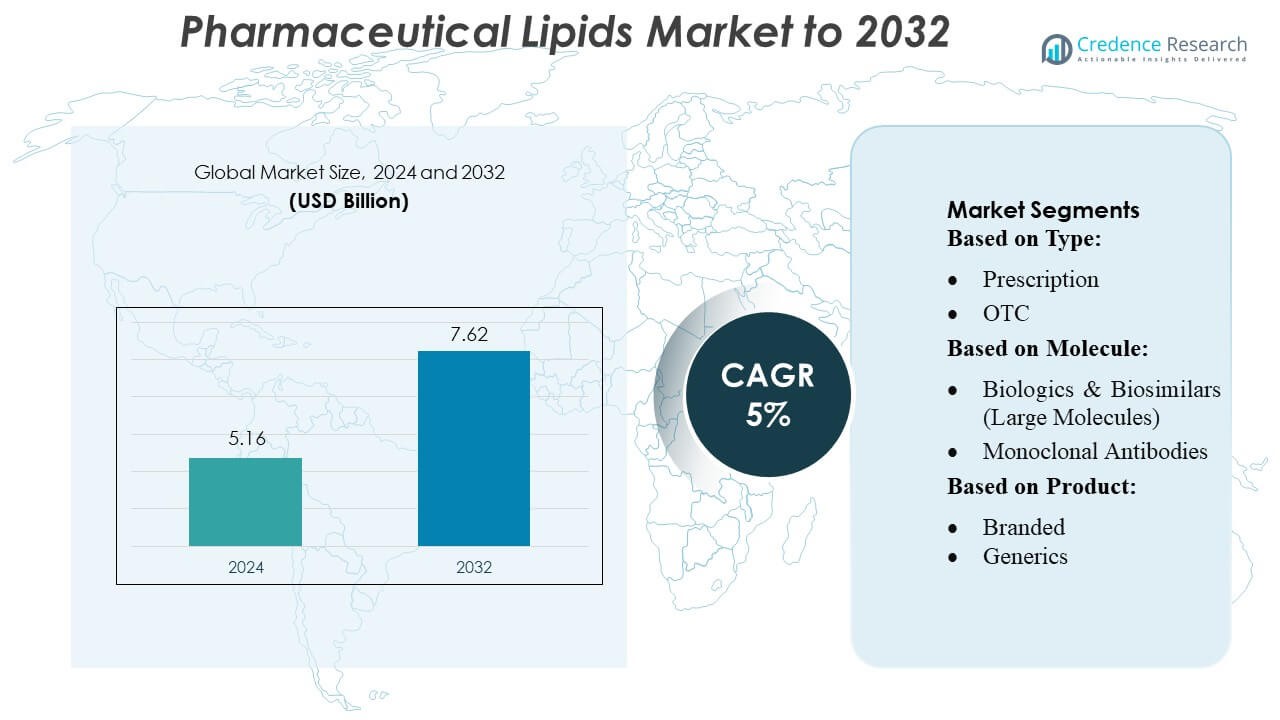

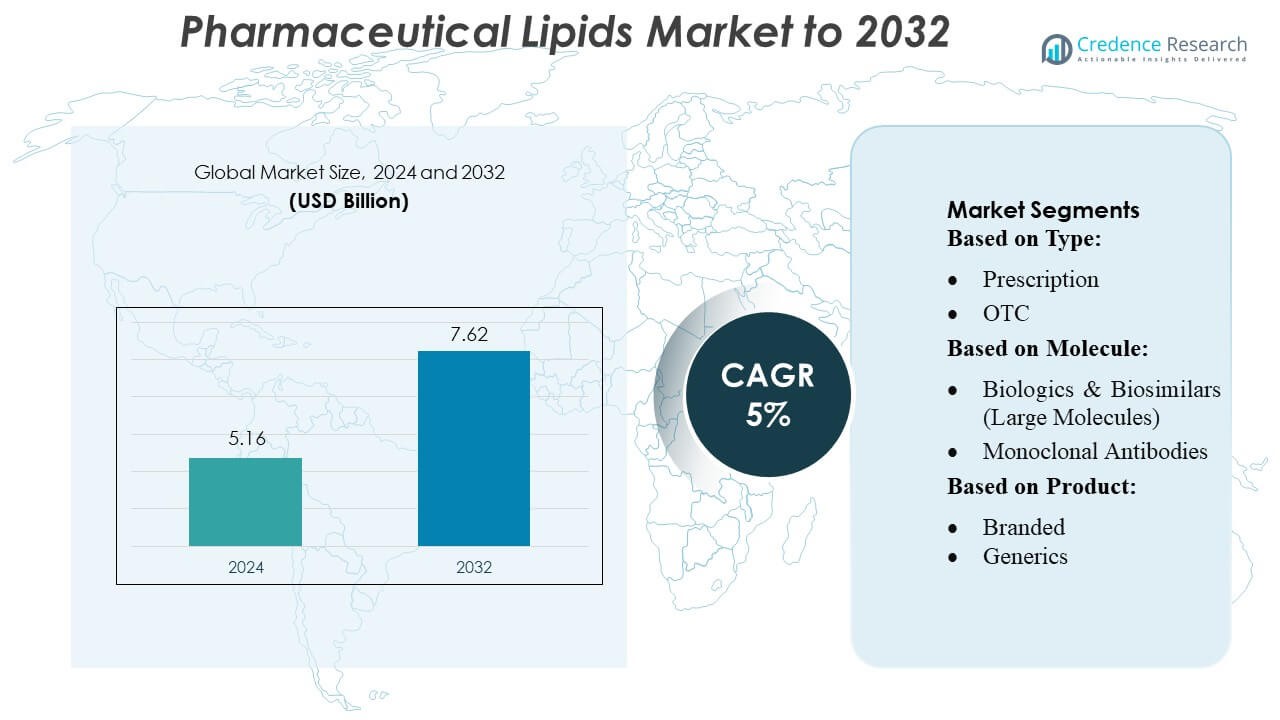

Pharmaceutical Lipids Market size was valued USD 5.16 billion in 2024 and is anticipated to reach USD 7.62 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Lipids Market Size 2024 |

USD 5.16 Billion |

| Pharmaceutical Lipids Market, CAGR |

5% |

| Pharmaceutical Lipids Market Size 2032 |

USD 7.62 Billion |

The pharmaceutical lipids market is dominated by leading global players including Pfizer Inc., AbbVie Inc., GlaxoSmithKline plc., Johnson & Johnson Services, Inc., AstraZeneca, Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd, Novartis AG, Sanofi, and Merck & Co., Inc. These companies focus on innovation in lipid-based drug delivery systems, strategic partnerships, and expansion of manufacturing capabilities to strengthen their market position. They are actively investing in lipid nanoparticles, liposomes, and nanostructured lipid carriers to enhance the stability, bioavailability, and targeted delivery of both small molecules and biologics. North America emerges as the leading region, accounting for approximately 35% of the global market share, driven by advanced healthcare infrastructure, high adoption of biologics, and significant R&D investment in innovative lipid formulations. The region continues to set the benchmark for technological advancements and commercial scalability in lipid-enabled therapeutics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The pharmaceutical lipids market was valued at USD 5.16 billion in 2024 and is projected to reach USD 7.62 billion by 2032, growing at a CAGR of 5% during the forecast period.

- Market growth is driven by increasing demand for lipid-based drug delivery systems, rising prevalence of chronic diseases, and expanding adoption of biologics and personalized medicine.

- Key trends include innovation in lipid nanoparticles, liposomes, and nanostructured lipid carriers, along with growing investment in R&D and strategic partnerships to enhance formulation stability and targeted delivery.

- The market is competitive, with major players such as Pfizer, AbbVie, GSK, Johnson & Johnson, AstraZeneca, Bristol-Myers Squibb, Roche, Novartis, Sanofi, and Merck focusing on technology-driven product development and expansion of manufacturing capabilities.

- North America leads the regional market with approximately 35% share, followed by Europe and Asia-Pacific, while prescription and branded lipid-based formulations dominate the segment share globally due to higher adoption and established clinical use.

Market Segmentation Analysis:

By Type

The pharmaceutical lipids market segmented by type is dominated by the Prescription segment, which accounted for approximately 65% of the market in 2024. Growth is driven by increasing prevalence of chronic diseases, rising demand for targeted drug delivery systems, and the critical role of lipids in enhancing bioavailability of prescription medications. While OTC products are gaining traction due to consumer preference for self-medication and nutraceutical applications, the prescription segment remains the largest contributor due to established clinical adoption and higher formulation complexity requiring professional oversight.

- For instance, Gerresheimer is a well-established systems and solutions provider to the pharma, biotech, and cosmetics industries. Over 40 Production Sites in 16 Countries.

By Molecule

Within the molecule-based segmentation, Biologics & Biosimilars (Large Molecules) hold the dominant share of around 58%, fueled by rising demand for monoclonal antibodies, vaccines, and cell & gene therapies. Lipids play a key role in stabilizing these sensitive molecules, enabling efficient delivery and prolonged shelf-life. Conventional small molecule drugs account for the remaining market, driven by cost-effectiveness and wide therapeutic applications. Increasing investment in biologics R&D and the expanding adoption of advanced lipid-based formulations for complex therapeutics remain primary growth drivers in this segment.

- For instance, Aptar Pharma operates 15 GMP (Good Manufacturing Practice) certified manufacturing sites around the world.Combined Footprint: The total manufacturing space across these sites is approximately 120,000 m².

By Product

In terms of product type, the Branded segment leads with an estimated 60% market share, reflecting the strong preference for established, high-efficacy lipid-based formulations in both prescription and biologic drugs. Branded products benefit from regulatory approvals, marketing advantages, and patient trust, while generic formulations are gradually expanding due to cost-sensitive markets and growing demand in emerging economies. Drivers for this segment include enhanced lipid-based drug delivery technologies, patent-protected innovations, and increasing awareness of the therapeutic benefits of lipids in improving drug absorption and bioavailability.

Key Growth Drivers

- Rising Demand for Targeted Drug Delivery

The pharmaceutical lipids market is driven by the growing need for advanced drug delivery systems that enhance bioavailability and therapeutic efficacy. Lipid-based formulations, such as liposomes and lipid nanoparticles, facilitate targeted delivery of both small molecules and biologics, minimizing side effects and improving patient compliance. The expansion of personalized medicine and increasing adoption of lipid carriers in vaccines and gene therapies further fuel market growth. Continuous innovation in lipid excipients and delivery technologies is a critical factor sustaining robust market expansion globally.

- For instance, SGD Pharma produces over 8 million vials and bottles per day across its five manufacturing plants located in Europe (France, Germany) and Asia (India, China).

- Growth of Biologics and Biosimilars

The rapid rise in biologics and biosimilars significantly propels demand for pharmaceutical lipids. Lipids stabilize large molecules such as monoclonal antibodies, vaccines, and cell & gene therapies, enhancing efficacy and shelf-life. The surge in R&D investments, coupled with increasing approvals of lipid-based biologics, supports market expansion. Additionally, the growing prevalence of chronic and rare diseases worldwide increases reliance on complex therapeutics, making lipid excipients an essential component for formulation development and commercial scalability in both established and emerging pharmaceutical markets.

- For instance, West Pharmaceutical Services has invested in automated production to expand capacity and improve efficiency, with a general plan to introduce a new automated line in early 2026.

- Expanding Geriatric and Chronic Disease Population

The increasing prevalence of chronic diseases, particularly cardiovascular, metabolic, and neurological disorders, drives pharmaceutical lipid utilization. The aging global population creates heightened demand for lipid-based formulations that improve drug absorption and treatment outcomes. Lipids enhance solubility and stability of therapeutics, supporting effective management of long-term conditions. Rising healthcare expenditure and patient awareness regarding the benefits of lipid-based delivery systems further boost adoption. Consequently, the combination of demographic shifts and chronic disease burden serves as a major growth catalyst for the market.

Key Trends & Opportunities

- Advancements in Lipid Nanotechnology

Lipid nanotechnology is emerging as a key trend, offering opportunities for more efficient drug delivery, reduced toxicity, and enhanced therapeutic performance. Innovations such as lipid nanoparticles, solid lipid carriers, and nanostructured lipid systems are gaining adoption in vaccines, oncology, and gene therapy. The COVID-19 mRNA vaccines highlighted the potential of lipid-based delivery systems, accelerating research and commercial interest. Continued advancements in lipid nanocarriers create significant growth opportunities, particularly in precision medicine, targeted therapies, and next-generation biologics.

- For instance, Amcor achieved a 16.67% reduction in plastic use for its flexible tubes in the Bulldog Skincare line, cutting annual plastic consumption by 8.5 metric tonnes, and incorporates over 62% post-consumer recycled (PCR) plastic in the tubes.

- Expansion of Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant opportunities for the pharmaceutical lipids market. Rising healthcare expenditure, increasing disease prevalence, and expanding pharmaceutical manufacturing capabilities drive market adoption in these regions. Growing awareness about advanced lipid-based formulations and increased regulatory support for biologics and generics further enhance market potential. Companies investing in regional manufacturing and distribution networks can leverage cost advantages and unmet medical needs, positioning themselves to capitalize on the rapid growth of lipid-based therapeutics in these high-demand markets.

- For instance, Schott’s new TOPPAC® Nest 160 increases fill-and-finish throughput by 60% compared to the previous nest configuration for prefillable polymer syringes, and improves efficiency by up to 67%, while cutting product carbon footprint by 17%.

- Integration with Personalized Medicine

The integration of lipid-based formulations with personalized medicine is shaping new opportunities. Lipids facilitate patient-specific dosing, improved pharmacokinetics, and targeted delivery of complex biologics and gene therapies. Advances in diagnostics and genomics enable tailored therapeutic interventions, where lipid carriers enhance stability and efficacy. Pharmaceutical companies are increasingly focusing on developing lipid-enabled personalized therapeutics to optimize outcomes. This trend supports growth in high-value segments such as oncology, rare diseases, and immunotherapy, creating opportunities for innovation and competitive differentiation in the global lipid excipients market.

Key Challenges

- Regulatory and Compliance Complexity

Stringent regulatory frameworks for lipid-based pharmaceuticals pose a major challenge. Approval processes for biologics, lipid nanoparticles, and novel excipients are complex and time-consuming, often requiring extensive clinical validation. Variability in regulations across regions adds to the complexity, delaying market entry and increasing development costs. Compliance with safety, stability, and quality standards remains critical, particularly for biologics and gene therapies. Companies must navigate these regulatory hurdles while maintaining innovation pace, which can impact market growth and strategic planning in the pharmaceutical lipids sector.

- High Manufacturing Costs and Technical Complexity

The production of lipid-based formulations involves high costs, sophisticated equipment, and skilled labor. Formulating stable lipid nanoparticles and ensuring batch-to-batch consistency presents technical challenges. Scale-up processes for biologics and advanced lipid systems require significant investment in R&D and infrastructure. High production costs may limit adoption in cost-sensitive markets, particularly for generics and emerging economies. Managing manufacturing complexity while maintaining quality and affordability remains a key challenge, potentially slowing the broader penetration of lipid-based therapeutics despite growing clinical demand.

Regional Analysis

North America

North America leads the pharmaceutical lipids market, holding approximately 35% of the global share in 2024. Growth is driven by high adoption of lipid-based drug delivery systems, extensive biologics R&D, and well-established pharmaceutical infrastructure. The U.S. dominates due to advanced healthcare facilities, rising chronic disease prevalence, and significant investment in innovative lipid formulations, including lipid nanoparticles for vaccines and gene therapies. Canada contributes through increasing pharmaceutical manufacturing and regulatory support for novel excipients. Strong industry-academia collaborations and early adoption of advanced lipid technologies position North America as a key revenue-generating region.

Europe

Europe accounts for around 28% of the global pharmaceutical lipids market, supported by robust biologics and generics manufacturing. The region benefits from stringent regulatory frameworks, extensive R&D investment, and a strong focus on advanced drug delivery technologies. Germany, France, and the U.K. are key contributors, leveraging lipid-based formulations for oncology, vaccines, and chronic disease therapeutics. Increasing demand for personalized medicine, aging population, and government initiatives promoting innovation in pharmaceutical excipients further bolster market growth. Europe’s well-established pharmaceutical ecosystem and strong pipeline of lipid-enabled biologics sustain its competitive market position.

Asia-Pacific

Asia-Pacific holds an estimated 22% of the pharmaceutical lipids market, driven by rapidly growing pharmaceutical manufacturing, rising healthcare expenditure, and expanding biologics adoption. China, India, and Japan lead the region, benefiting from large patient populations and increasing demand for advanced lipid-based therapies. Growth is further supported by government incentives, contract manufacturing opportunities, and rising awareness of lipid-enhanced drug formulations. The region presents opportunities for cost-effective production and market expansion of generics and biosimilars. Increasing infrastructure investment and growing focus on research in lipid delivery systems are key factors accelerating Asia-Pacific’s market growth trajectory.

Latin America

Latin America represents approximately 8% of the global pharmaceutical lipids market, with Brazil and Mexico as major contributors. Market expansion is driven by increasing chronic disease prevalence, growing pharmaceutical R&D investments, and rising adoption of lipid-based formulations in vaccines and small molecule drugs. Limited healthcare infrastructure in some areas poses challenges, yet increasing government initiatives, partnerships with global pharma companies, and regulatory reforms are improving market access. Rising patient awareness and expanding generic drug markets create growth opportunities. Overall, Latin America is witnessing gradual adoption of advanced lipid technologies, positioning it as a developing yet promising market.

Middle East & Africa

The Middle East & Africa contributes around 7% of the global pharmaceutical lipids market. Growth is supported by rising healthcare expenditure, increased prevalence of chronic diseases, and growing demand for lipid-based drug delivery systems in oncology and vaccines. Key markets such as Saudi Arabia, UAE, and South Africa are witnessing infrastructure improvements, regulatory support, and foreign pharmaceutical investments. Challenges include limited local manufacturing capabilities and high import dependence. However, increasing public-private collaborations, expanding pharmaceutical awareness, and adoption of advanced lipid technologies in hospitals and specialty clinics are driving gradual market growth in this region.

Market Segmentations:

By Type:

By Molecule:

- Biologics & Biosimilars (Large Molecules)

- Monoclonal Antibodies

By Product:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The pharmaceutical lipids market is highly competitive, with leading players including Pfizer Inc., AbbVie Inc., GlaxoSmithKline plc., Johnson & Johnson Services, Inc., AstraZeneca, Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd, Novartis AG, Sanofi, and Merck & Co., Inc. The pharmaceutical lipids market is characterized by intense competition driven by innovation in lipid-based drug delivery technologies and formulation development. Companies are increasingly focusing on research and development of advanced lipid nanoparticles, liposomes, and other excipients to enhance the stability, bioavailability, and targeted delivery of both small molecules and biologics. Strategic initiatives such as mergers, acquisitions, and partnerships are commonly adopted to expand geographic presence and product portfolios. The market is also influenced by rising demand for personalized medicine, growing chronic disease prevalence, and the need for cost-effective and scalable manufacturing solutions. Regulatory compliance, technological advancements, and continuous pipeline expansion remain critical factors shaping the competitive dynamics and driving differentiation among market participants.

Key Player Analysis

Recent Developments

- In September 2025, Evonik launched MaxiPure Ploysorbate 80, a highly pure surfactant designed for injectable and biopharmaceutical applications. This MaxiPure Polysorbate 80 excipient is developed to meet the rigorous demands of modern drug development.

- In March 2025, Daiichi Sankyo introduced its Datroway (datopotamab deruxtecan) in Japan for the treatment of adult patients with hormone receptor (HR) positive, HER2 negative (IHC 0, IHC 1+ or IHC 2+/ISH-) unresectable or recurrent breast cancer after prior chemotherapy.

- In January 2025, AstraZeneca announced a CUSD (USD 570m) investment in Canada, creating 700 jobs and expanding its Toronto facility. The investment supports R&D, global clinical studies, and Canada’s life sciences sector, backed by Ontario’s CUSD contribution.

- In January 2025, Sanofi’s Sarclisa, an anti-CD38 treatment, received approval in China for newly diagnosed multiple myeloma (NDMM) ineligible for transplant, based on IMROZ phase 3 study results.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Molecule, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The pharmaceutical lipids market is expected to grow steadily due to increasing adoption of advanced drug delivery systems.

- Lipid-based formulations will play a crucial role in enhancing the stability and bioavailability of biologics and small molecule drugs.

- Rising prevalence of chronic diseases and an aging population will continue to drive demand for lipid-enabled therapeutics.

- Expansion of personalized medicine and targeted therapies will create new growth opportunities for lipid-based delivery technologies.

- Innovations in lipid nanoparticles, liposomes, and nanostructured lipid carriers will support next-generation drug development.

- Emerging markets will witness significant growth due to increasing healthcare infrastructure and pharmaceutical manufacturing capabilities.

- Collaborations, partnerships, and strategic mergers will remain key strategies for market expansion and competitive advantage.

- Regulatory support for novel excipients and advanced formulations will facilitate faster product approvals.

- The trend toward cost-effective generic lipid formulations will enhance market accessibility in price-sensitive regions.

- Continuous R&D investment in lipid technologies will drive long-term innovation and market sustainability.