Market Overview:

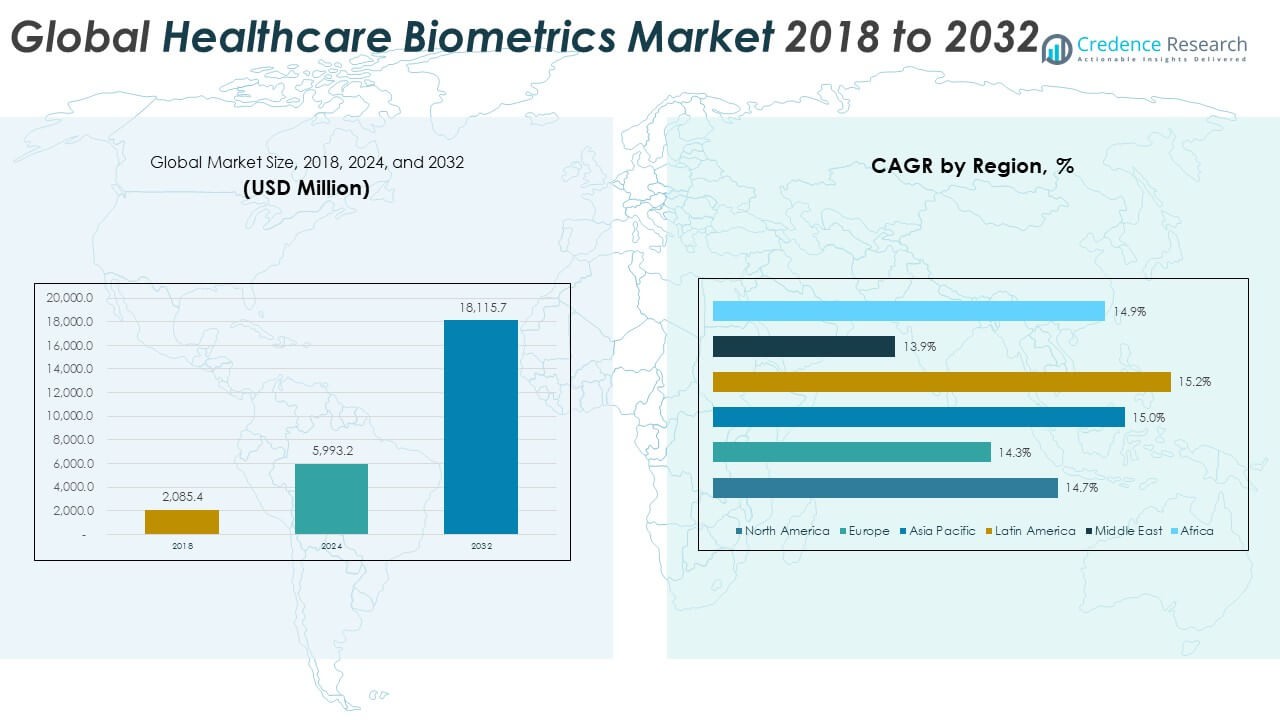

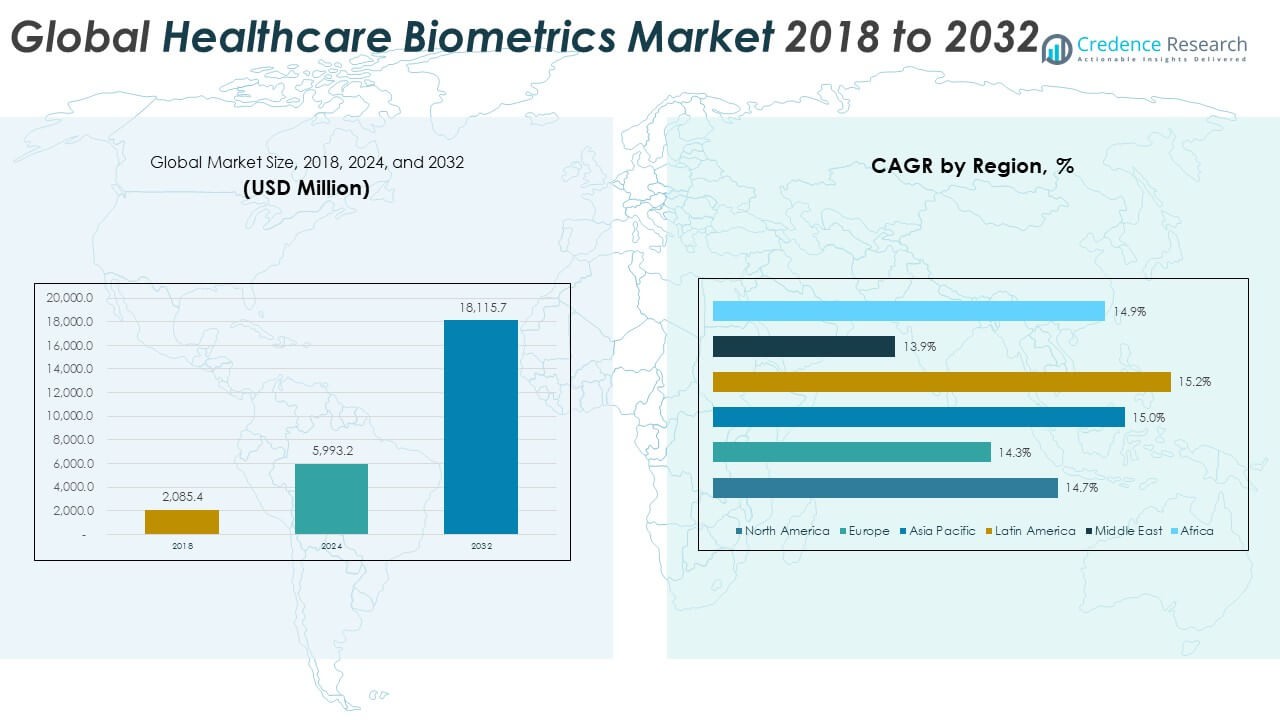

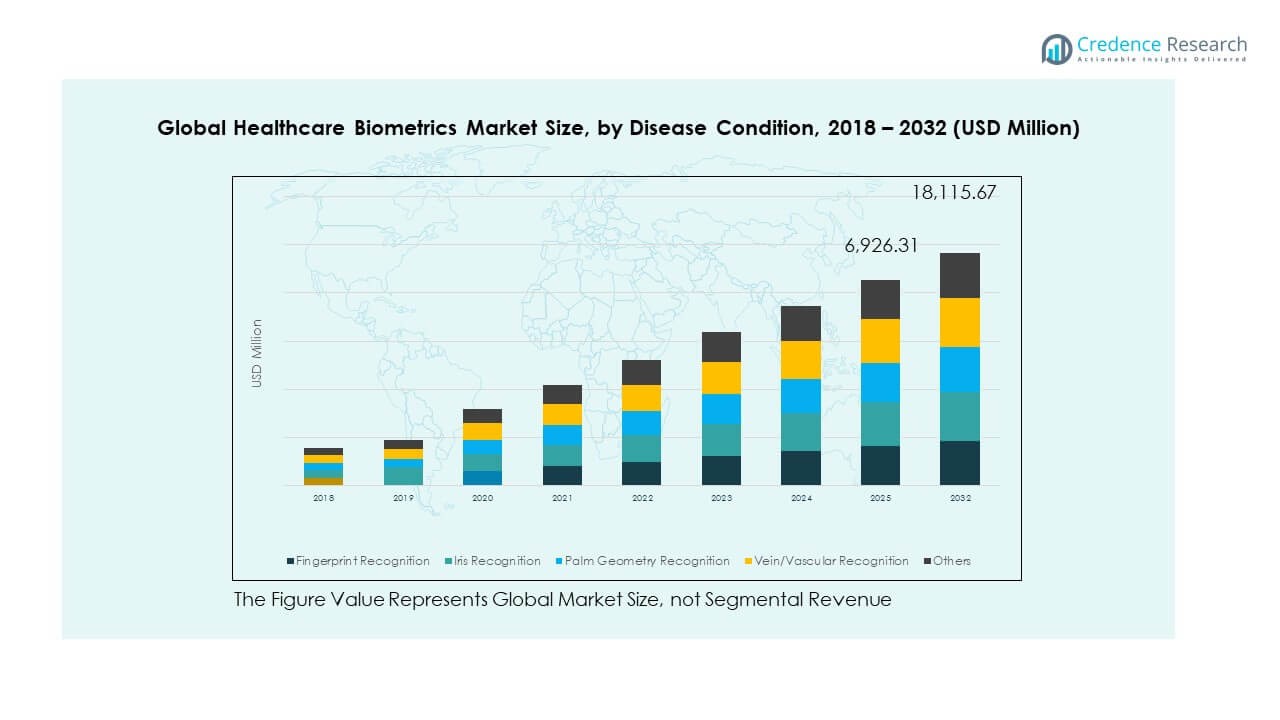

The Global Healthcare Biometrics Market size was valued at USD 2,085.4 million in 2018 to USD 5,993.2 million in 2024 and is anticipated to reach USD 18,115.7 million by 2032, at a CAGR of 14.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Biometrics Market Size 2024 |

USD5,993.2 Million |

| Healthcare Biometrics Market, CAGR |

14.72% |

| Healthcare Biometrics Market Size 2032 |

USD 18,115.7 Million |

The market growth is driven by rising demand for secure patient identification and data protection across healthcare systems. Increasing concerns over medical fraud, identity theft, and unauthorized data access have accelerated biometric adoption. Hospitals and clinics are integrating biometric technologies such as fingerprint, facial, and iris recognition to enhance patient safety and streamline operations. Growing investments in digital health, telemedicine, and electronic health records further support demand. Regulatory mandates for patient privacy compliance also encourage healthcare providers to adopt biometric authentication solutions.

Regionally, North America leads the healthcare biometrics market due to advanced healthcare infrastructure, strong digital adoption, and regulatory frameworks promoting data security. Europe follows with growing adoption of biometric systems in public healthcare facilities, driven by strict privacy regulations and rising digital transformation initiatives. Asia-Pacific is emerging as the fastest-growing region, fueled by rapid healthcare modernization, expanding medical tourism, and government investments in digital health systems. Countries such as China and India are advancing adoption due to their large patient base and increasing emphasis on secure, technology-driven healthcare services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Healthcare Biometrics Market. was valued at USD 2,085.4 million in 2018, reached USD 5,993.2 million in 2024, and is projected to hit USD 18,115.7 million by 2032, growing at a CAGR of 14.72%.

- North America (27.3%), Asia Pacific (35.3%), and Europe (22.3%) accounted for the top three shares in 2024, driven by advanced healthcare infrastructure, strict regulations, and digital adoption.

- Asia Pacific is the fastest-growing region with 35.3% share, supported by healthcare modernization, telemedicine expansion, and large patient volumes.

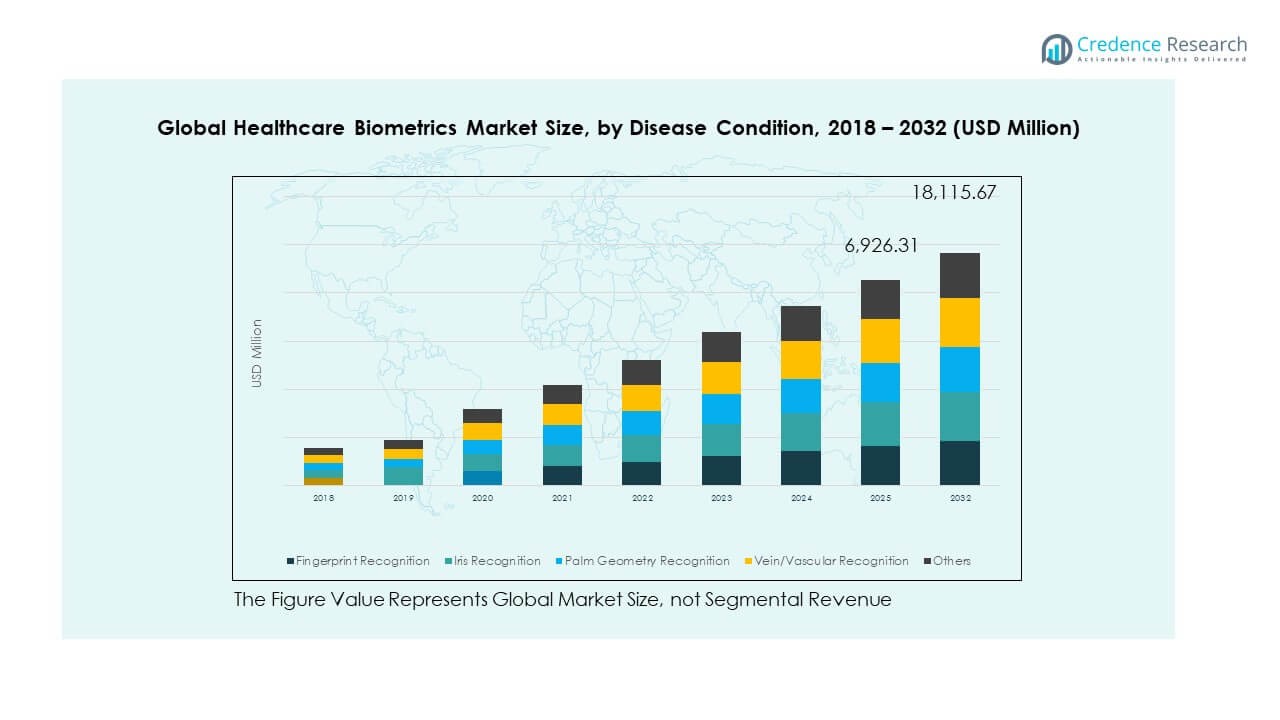

- Fingerprint recognition contributed the largest share among technologies in 2024, reflecting its affordability and widespread deployment.

- Iris recognition and palm geometry recognition collectively represented a significant portion of the Global Healthcare Biometrics Market., highlighting demand for high-precision authentication.

Market Drivers

Growing Need for Secure Patient Identification and Data Integrity in Healthcare Systems

The Global Healthcare Biometrics Market is expanding due to rising concerns over patient data security and identity verification. Healthcare organizations face risks from fraud, unauthorized access, and data breaches that threaten patient safety and trust. Biometrics provide a reliable solution by ensuring accurate patient identification and minimizing duplication of records. Hospitals adopt fingerprint, iris, and facial recognition systems to safeguard medical histories and enhance operational transparency. Biometric authentication also reduces medical errors linked to misidentification. It strengthens compliance with privacy regulations and improves efficiency in electronic health record management. Growing awareness of digital safety in healthcare pushes providers toward biometric adoption.

- For instance, the Biometric Automated Patient and Procedure Identification System (BAPPIS) was developed as a fingerprint-based solution for clinical use. It was designed to minimize patient and procedure identification errors in radiotherapy and surgery. In validation studies, BAPPIS verified fingerprints with 96.9% accuracy for radiotherapy patients. The system showed potential to reduce manual errors by streamlining non-automated steps in the workflow.u

Rising Demand for Fraud Prevention and Cost Reduction in Healthcare Operations

The Global Healthcare Biometrics Market benefits from its role in curbing financial fraud and reducing operational costs. Insurance claims fraud and identity theft continue to burden healthcare systems globally. Biometric solutions provide robust tools for verifying patient identity before treatment or billing processes. Insurers and providers integrate biometrics to streamline claims management and prevent false reimbursement requests. By reducing manual verification processes, biometrics lower administrative costs and improve workflow efficiency. It helps healthcare institutions allocate resources more effectively toward patient care. Regulatory agencies encourage biometric implementation to strengthen fraud detection. The drive to minimize financial losses supports faster adoption of biometric technologies.

- For instance, Humana implemented AI-based fraud detection systems that helped identify and eliminate over $10 million in potential fraudulent claims within the first year of deployment, as documented in verified industry case studies. This achievement highlights measurable cost savings and improved claims accuracy.

Regulatory Compliance and Strengthening Privacy Protection Standards in Healthcare Facilities

The Global Healthcare Biometrics Market experiences growth due to strict global regulations on data privacy and security. Governments enforce compliance standards such as HIPAA and GDPR, requiring healthcare providers to secure sensitive information. Biometric systems deliver secure authentication mechanisms that align with these mandates. Hospitals and clinics use biometrics to protect electronic health records from breaches or unauthorized use. It ensures that only authorized staff access patient files, enhancing confidentiality. Compliance with regulatory norms reduces penalties and boosts institutional credibility. Policymakers highlight biometric integration as part of broader digital transformation initiatives in healthcare. This alignment between compliance and technology adoption strengthens demand.

Integration of Biometrics into Digital Health Ecosystems and Telemedicine Platforms

The Global Healthcare Biometrics Market gains momentum from the rapid digitalization of healthcare delivery models. Telemedicine platforms increasingly depend on biometric verification for secure patient-doctor interactions. Digital health applications use biometrics to authenticate users and protect medical data exchanges. Biometric technology also enables secure remote monitoring for patients receiving long-term care. It supports seamless access to online medical services without compromising security. Hospitals integrate biometrics with wearable devices to authenticate users and enhance digital care ecosystems. This integration builds trust between providers and patients in a connected health environment. The surge of digital health adoption drives sustained biometric demand.

Market Trends

Expansion of Multimodal Biometric Systems for Higher Accuracy in Healthcare Services

The Global Healthcare Biometrics Market is witnessing a trend toward multimodal systems that combine fingerprint, iris, and facial recognition. Multimodal authentication delivers higher accuracy compared to single-mode approaches. Healthcare institutions deploy these systems to reduce identity mismatches and improve patient safety. Multimodal biometrics ensure redundancy, providing reliable verification even if one method fails. It enhances usability for diverse patient populations, including elderly or disabled individuals. Hospitals integrate these systems in access control, patient registration, and prescription validation. Growing reliance on multimodal technologies demonstrates their rising role in critical care environments. This trend reflects the demand for precision in healthcare security.

- For instance, a peer-reviewed study by El Rahman et al. (2024) introduced a multimodal biometric system combining ECG and fingerprint data in a clinical setting. The sequential approach achieved an AUC of 0.985, surpassing unimodal ECG (0.951) and fingerprint (0.866). The findings confirmed higher authentication accuracy for patient verification in healthcare applications.

Adoption of Cloud-Based Biometric Solutions in Healthcare Infrastructure

The Global Healthcare Biometrics Market is shifting toward cloud-based biometric solutions for scalability and flexibility. Cloud integration allows hospitals to manage biometric databases securely across multiple locations. Cloud-enabled systems improve interoperability between healthcare providers and insurance platforms. It reduces the burden of on-premises hardware maintenance and enhances system efficiency. Cloud-based biometrics also support rapid deployment for telemedicine platforms and digital health services. Vendors invest in cloud technologies to offer affordable and secure solutions for smaller healthcare facilities. This trend accelerates the reach of biometrics in developing economies. Cloud adoption continues to reshape the operational model of healthcare biometrics.

- For instance, BIO-key International launched its PortalGuard® Identity-as-a-Service platform, which delivers biometric authentication through the cloud, enabling healthcare providers to manage secure access across multiple facilities while reducing IT maintenance costs.

Increasing Use of Mobile Biometrics for Patient Authentication and Access Control

The Global Healthcare Biometrics Market is experiencing a surge in mobile biometric applications. Smartphones and tablets equipped with fingerprint and facial recognition features simplify patient authentication. Mobile biometrics enable secure access to telemedicine platforms and health records. It empowers patients to manage their medical information with greater control. Healthcare providers also deploy mobile solutions for field staff managing homecare services. The convenience of mobile authentication strengthens adoption across outpatient and community healthcare systems. This trend highlights the shift toward patient-centric care supported by secure digital solutions. Rising smartphone penetration further accelerates mobile biometric adoption in healthcare.

Integration of Artificial Intelligence to Enhance Biometric Accuracy and Security

The Global Healthcare Biometrics Market is advancing with the integration of artificial intelligence in biometric systems. AI algorithms improve accuracy by reducing false acceptance and rejection rates. Intelligent biometric solutions adapt to different environments and lighting conditions. It ensures consistent performance across diverse healthcare settings. AI-powered biometrics also enable predictive analytics to detect unusual access patterns. Hospitals rely on AI to enhance security monitoring and patient verification processes. Vendors develop AI-integrated biometric platforms to strengthen fraud detection capabilities. This trend aligns with the growing need for intelligent and adaptive security systems in healthcare.

Market Challenges Analysis

High Implementation Costs and Complexity of Biometric System Integration in Healthcare Facilities

The Global Healthcare Biometrics Market faces barriers due to the high cost of advanced biometric systems. Hospitals and clinics in developing regions often struggle to allocate budgets for implementation. Integration of biometric systems with existing healthcare IT infrastructure presents additional complexity. Legacy systems lack compatibility with modern biometric technologies, creating operational challenges. It slows adoption among small and mid-sized healthcare providers with limited digital capacity. Technical training requirements further increase costs and strain resources. The high initial investment often limits adoption despite long-term savings. Vendors must focus on cost-efficient solutions to overcome these challenges.

Concerns Over Data Privacy, Ethical Issues, and Patient Acceptance of Biometric Systems

The Global Healthcare Biometrics Market also encounters challenges related to privacy concerns and ethical debates. Patients often express reluctance in sharing biometric data due to fear of misuse. Healthcare institutions face public scrutiny regarding storage and use of sensitive biometric information. It creates hesitation among providers, especially in regions with weaker data protection laws. Ethical concerns over consent and data ownership add to resistance. Inaccurate readings or system failures may compromise patient trust and safety. Biometric databases also remain vulnerable to cyberattacks, raising security risks. Building transparency and trust becomes essential to ensure patient acceptance and compliance.

Market Opportunities

Expanding Role of Biometric Authentication in Telemedicine and Remote Healthcare Delivery

The Global Healthcare Biometrics Market offers strong opportunities through its integration with telemedicine services. Remote consultations require secure authentication to protect patient-doctor interactions. Biometrics provide trust by ensuring only verified individuals access sensitive health information. It enhances digital healthcare experiences and builds stronger patient confidence. The expansion of wearable devices with biometric authentication strengthens growth potential. Governments promote digital health adoption, creating favorable opportunities for technology providers. Demand for secure remote monitoring solutions further widens the scope for biometrics.

Rising Adoption of Biometric Systems in Emerging Economies and Public Health Programs

The Global Healthcare Biometrics Market gains opportunities from rising healthcare investments in emerging economies. Countries across Asia, Africa, and Latin America are modernizing healthcare systems with biometric technologies. Public health programs increasingly deploy biometrics to verify patient identity and reduce fraud. It improves healthcare access and ensures accurate service delivery in large populations. Governments emphasize biometrics for national health schemes and insurance coverage. Vendors benefit by expanding into underserved markets with scalable, cost-effective solutions. The growing focus on universal healthcare access expands adoption of biometrics worldwide.

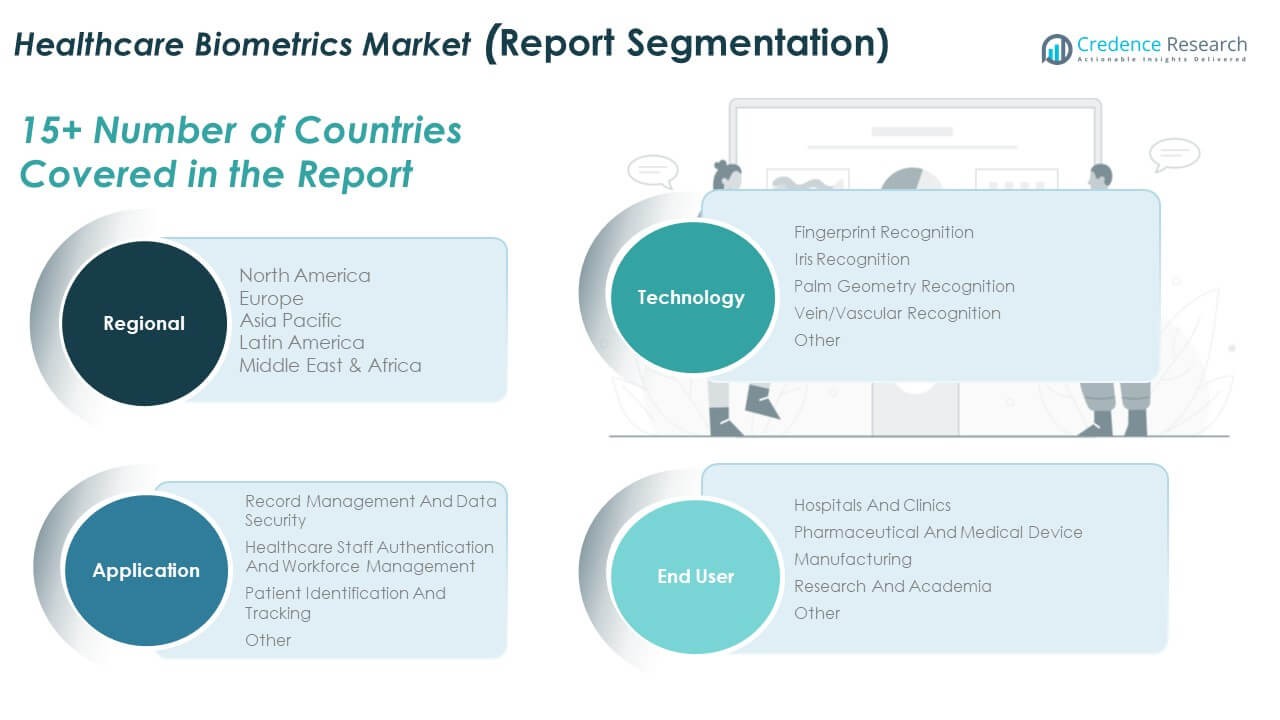

Market Segmentation Analysis:

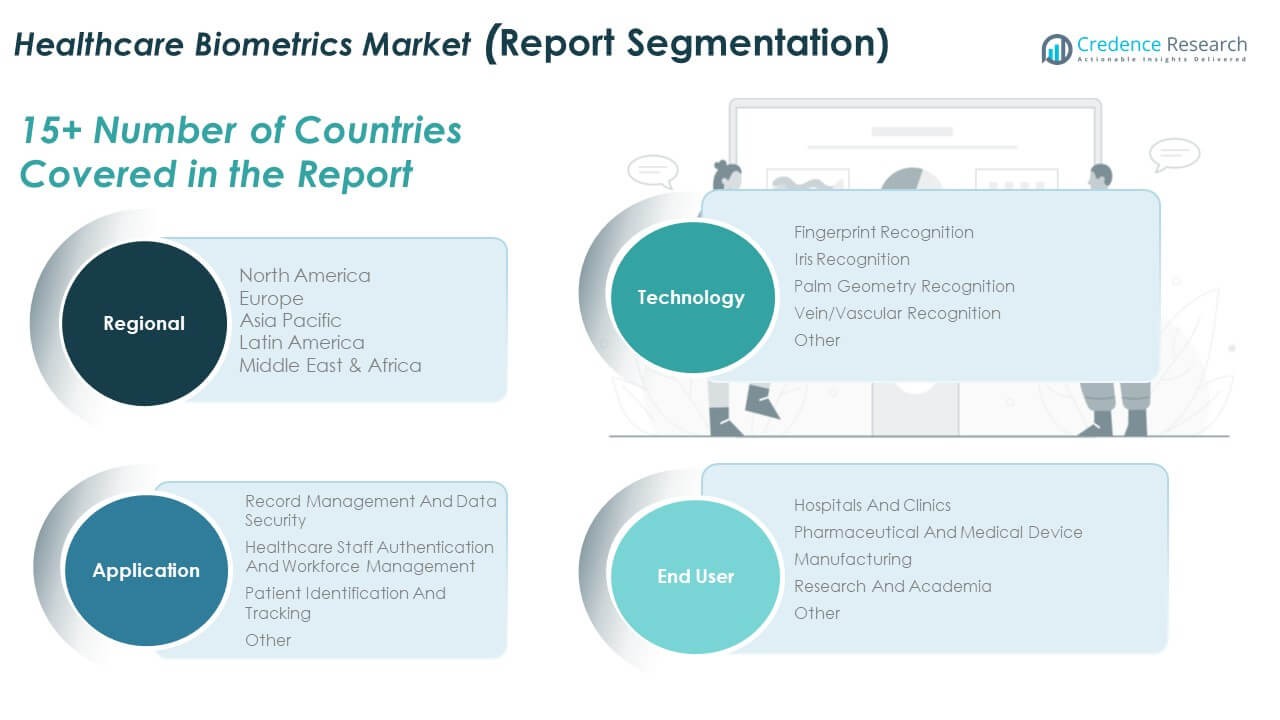

The Global Healthcare Biometrics Market is segmented by technology, application, and end user, reflecting the diverse adoption of biometric solutions across healthcare systems.

By technology

Fingerprint recognition holds widespread use due to its affordability and established reliability, while iris recognition is expanding in high-security environments that require precision. Palm geometry recognition and vein/vascular recognition are gaining interest for their advanced accuracy and reduced susceptibility to duplication. Other biometric technologies, including behavioral and voice recognition, are emerging as supportive tools in patient engagement and remote healthcare. It demonstrates a broad spectrum of technological adoption to address varying healthcare needs.

- For instance, NEC’s fingerprint scanners and facial recognition technologies achieved top accuracy scores in multiple NIST evaluations, while Hitachi’s VeinID palm vein technology has been deployed in healthcare environments to ensure secure patient authentication.

By application

Record management and data security dominate as healthcare providers prioritize compliance with privacy regulations and secure handling of electronic health records. Healthcare staff authentication and workforce management represent a growing segment, driven by the need to control access within medical facilities. Patient identification and tracking support error reduction and patient safety, making it an essential growth driver. Other applications extend biometrics into insurance verification and telemedicine platforms, strengthening digital health integration.

- For instance, BIO-key International’s PortalGuard® biometric identity platform has been implemented in healthcare systems to safeguard electronic health record access, and Apple Face ID integrated into Epic’s MyChart app enables patients to securely log in to their health data via smartphones.

By end user

Hospitals and clinics lead adoption due to large patient volumes and the need for efficient verification processes. Pharmaceutical and medical device companies adopt biometrics for secure research and regulatory compliance, while manufacturing facilities use it to safeguard operational workflows. Research and academia integrate biometric systems to secure sensitive data and ensure controlled access. Other end users, including public health agencies, further expand the application landscape across regions.

Segmentation:

By Technology

- Fingerprint Recognition

- Iris Recognition

- Palm Geometry Recognition

- Vein/Vascular Recognition

- Other Biometric Technologies

By Application

- Record Management and Data Security

- Healthcare Staff Authentication and Workforce Management

- Patient Identification and Tracking

- Other Applications

By End User

- Hospitals and Clinics

- Pharmaceutical and Medical Device Companies

- Manufacturing Facilities

- Research and Academia

- Other End Users

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Healthcare Biometrics Market size was valued at USD 571.82 million in 2018 to USD 1,637.69 million in 2024 and is anticipated to reach USD 4,927.46 million by 2032, at a CAGR of 14.7% during the forecast period. North America holds 27.3% share of the Global Healthcare Biometrics Market. Strong healthcare infrastructure, advanced adoption of digital health technologies, and strict regulatory frameworks drive regional dominance. Hospitals and clinics in the U.S. and Canada implement biometrics to improve patient identification and reduce fraud in insurance claims. Government policies encourage adoption by ensuring compliance with HIPAA and other security standards. It benefits from growing investment in electronic health records and telemedicine platforms. The demand for secure workforce management in healthcare facilities further strengthens growth. The U.S. leads the region due to early adoption, while Canada shows steady growth supported by government-backed healthcare digitization.

Europe

The Europe Global Healthcare Biometrics Market size was valued at USD 461.09 million in 2018 to USD 1,299.16 million in 2024 and is anticipated to reach USD 3,822.41 million by 2032, at a CAGR of 14.3% during the forecast period. Europe accounts for 22.3% share of the Global Healthcare Biometrics Market. Stringent data privacy regulations, including GDPR, fuel adoption across healthcare providers. Hospitals across Germany, France, and the UK integrate biometrics into patient management systems to ensure compliance and accuracy. It gains momentum from public investments in digital transformation of healthcare infrastructure. Patient safety initiatives emphasize biometric authentication to avoid misidentification and medical errors. Adoption extends to pharmaceutical and research institutions, safeguarding clinical trial data. Growth in Eastern Europe reflects modernization of healthcare services. Demand for reliable security systems positions Europe as a critical hub for biometric adoption.

Asia Pacific

The Asia Pacific Global Healthcare Biometrics Market size was valued at USD 725.31 million in 2018 to USD 2,112.96 million in 2024 and is anticipated to reach USD 6,501.72 million by 2032, at a CAGR of 15.0% during the forecast period. Asia Pacific contributes 35.3% share of the Global Healthcare Biometrics Market. Rapid healthcare digitalization and government initiatives in China, India, and Japan drive growth. Hospitals deploy biometric systems to handle large patient volumes and secure electronic records. It benefits from rising medical tourism and expanding telemedicine services in Southeast Asia. The region sees significant vendor investment to meet the growing demand for low-cost and scalable biometric solutions. Population growth and increasing chronic disease management accelerate adoption. Government-backed universal healthcare programs integrate biometrics for transparency. Asia Pacific remains the fastest-growing region due to its scale and modernization pace.

Latin America

The Latin America Global Healthcare Biometrics Market size was valued at USD 185.81 million in 2018 to USD 547.87 million in 2024 and is anticipated to reach USD 1,711.93 million by 2032, at a CAGR of 15.2% during the forecast period. Latin America holds 9.3% share of the Global Healthcare Biometrics Market. Brazil and Mexico drive adoption, supported by government focus on secure healthcare access. Hospitals integrate biometrics to minimize fraud and enhance efficiency in public health systems. It benefits from rising investment in digital healthcare solutions across urban centers. Pharmaceutical companies in the region also use biometrics to secure R&D facilities. The challenge of healthcare inequality creates demand for cost-effective biometric technologies in underserved areas. Governments emphasize biometrics in national health programs. Latin America shows strong growth potential with technology adoption increasing beyond metropolitan areas.

Middle East

The Middle East Global Healthcare Biometrics Market size was valued at USD 99.68 million in 2018 to USD 274.66 million in 2024 and is anticipated to reach USD 782.60 million by 2032, at a CAGR of 13.9% during the forecast period. The Middle East represents 4.2% share of the Global Healthcare Biometrics Market. Strong investments in smart healthcare infrastructure across GCC countries fuel growth. Hospitals in Saudi Arabia and the UAE adopt biometrics to align with digital health initiatives. It benefits from the push toward modernization of healthcare systems under national transformation programs. Governments emphasize biometric integration to reduce fraud and ensure transparency in public healthcare. Israel demonstrates adoption in advanced medical facilities with strong R&D integration. Expansion of medical tourism in the region encourages secure biometric verification. The market is supported by both public and private sector investments.

Africa

The Africa Global Healthcare Biometrics Market size was valued at USD 41.71 million in 2018 to USD 120.89 million in 2024 and is anticipated to reach USD 369.56 million by 2032, at a CAGR of 14.9% during the forecast period. Africa accounts for 1.9% share of the Global Healthcare Biometrics Market. Growth is driven by rising healthcare investments in South Africa, Nigeria, and Egypt. Public health programs increasingly use biometrics to verify patient identity and prevent fraud. It supports equitable distribution of healthcare services in large population bases. Adoption in urban hospitals is expanding, while rural deployment remains limited due to infrastructure challenges. Governments integrate biometrics into national insurance schemes to improve accountability. International aid projects promote biometric use for better healthcare delivery. Africa demonstrates high potential for future adoption as digital healthcare infrastructure expands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BIO-key International, Inc.

- TOC Biometrics

- Princeton Identity, Inc.

- BioConnect

- NEC Corporation

- Cross Match Technologies, Inc.

- NuData Security, Inc.

- FST Biometrics Corporation

- HID Global Corporation

- Iris ID Systems, Inc.

- MorphoTrak, Inc.

- Other Key Players

Competitive Analysis:

The Global Healthcare Biometrics Market is highly competitive with a mix of established technology providers and emerging innovators. Companies such as NEC Corporation, HID Global, BIO-key International, and Iris ID Systems focus on expanding their product portfolios with advanced fingerprint, iris, and multimodal biometric solutions. It remains driven by continuous innovation in accuracy, integration, and user experience. Vendors invest in AI-powered biometric platforms to enhance security and reduce error rates across healthcare facilities. Strategic mergers, acquisitions, and partnerships strengthen market presence and broaden geographic reach. Firms also target cloud-based and mobile-enabled solutions to meet growing digital health requirements. Competition intensifies as regional players introduce cost-effective technologies to address local healthcare needs. Global leaders maintain an edge through research, compliance with regulatory frameworks, and large-scale deployments. The market reflects a balance between innovation-driven global players and localized providers catering to specific healthcare demands.

Recent Developments:

- In December 2024, Stockholm-based Fingerprint Cards AB (Fingerprints), a renowned biometrics company, announced a partnership with Anonybit, a pioneer in privacy-enhancing biometric infrastructure. The collaboration is set to deliver next-generation multimodal biometric identity solutions to the enterprise healthcare market.

- In February 2024, Norwegian biometrics leader NEXT Biometrics signed a strategic partnership with a major Beijing-based company dominant in China’s healthcare and medical insurance market. The agreement aims to make NEXT’s technology the preferred biometrics solution in the Chinese healthcare sector, with deliveries expected to begin in the second half of 2024.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Healthcare Biometrics Market will expand with rising adoption of multimodal authentication systems in hospitals.

- Growth will be supported by increasing integration of biometrics with telemedicine and digital health platforms.

- Artificial intelligence will enhance biometric accuracy, reducing errors and improving patient trust in healthcare systems.

- Demand for mobile-based biometric applications will rise with the spread of smartphone-enabled healthcare access.

- Regulatory pressure on data protection will continue to drive investments in advanced biometric security solutions.

- Public health programs in emerging economies will adopt biometrics to ensure transparency in healthcare delivery.

- Cloud-based biometric solutions will gain traction, offering scalability and interoperability for healthcare providers.

- Medical research institutions will expand biometric use for safeguarding sensitive trial data and intellectual property.

- Growing medical tourism will create demand for biometric verification to improve patient identification in cross-border care.

- Vendors will focus on affordable and adaptable biometric technologies to penetrate underserved healthcare markets.