Market Overview:

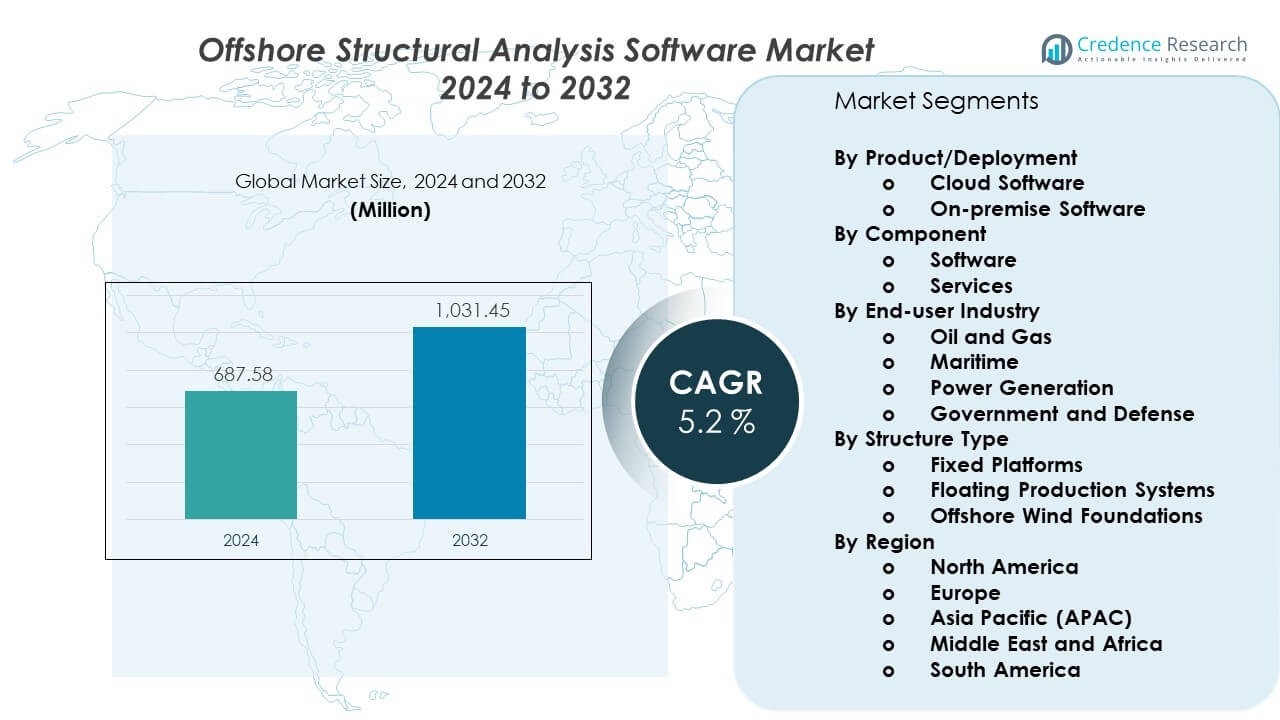

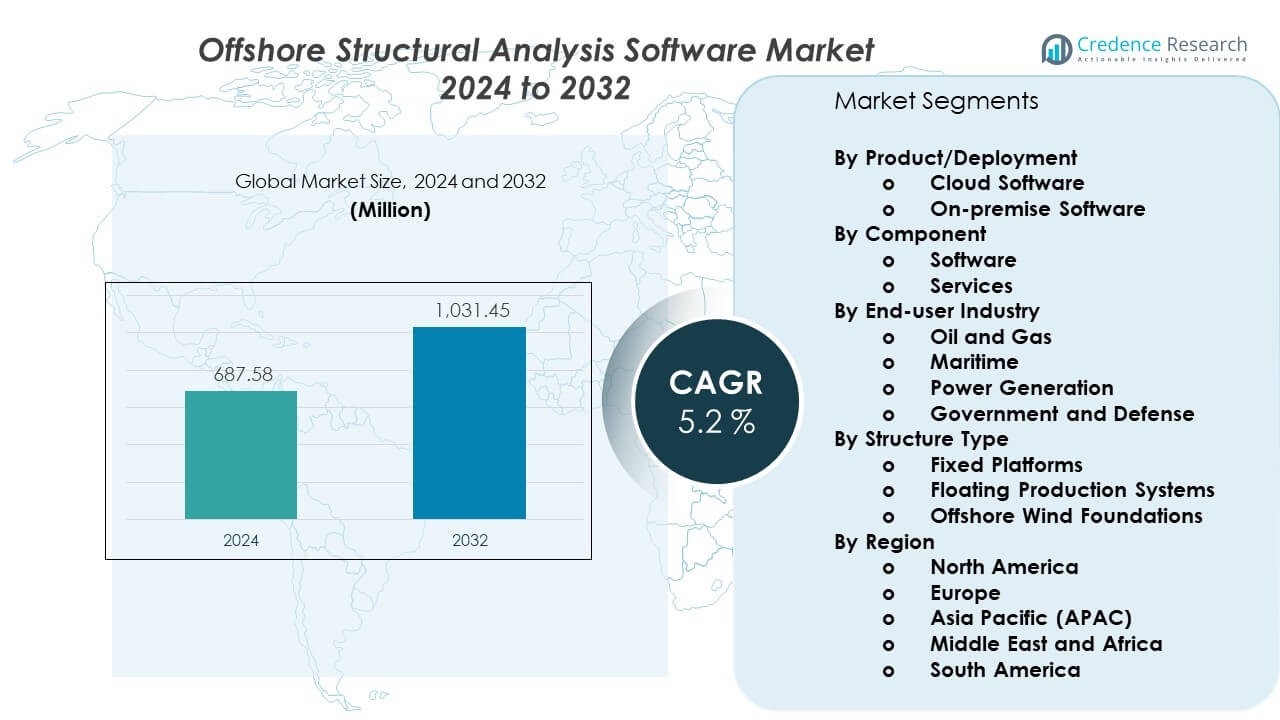

The Offshore Structural Analysis Software Market is projected to grow from USD 687.58 million in 2024 to an estimated USD 1,031.45 million by 2032, with a CAGR of 5.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Structural Analysis Software Market Size 2024 |

USD 687.58 Million |

| Offshore Structural Analysis Software Market, CAGR |

5.2% |

| Offshore Structural Analysis Software Market Size 2032 |

USD 1,031.45 Million |

Rising offshore exploration and wider deployment of wind farms drive strong software demand. Engineering groups seek better modeling accuracy to manage wave loads, corrosion effects, and deep-water stress factors. Oil and gas operators use these platforms to meet strict safety rules and improve asset life. Floating wind developers apply dynamic simulation tools to refine mooring layouts and structural stability. Software vendors upgrade interfaces, data models, and automation to support faster decisions. Broader use of digital twins also lifts system uptake across complex offshore projects.

North America leads due to active offshore energy activity, strong engineering capabilities, and early use of advanced simulation tools. Europe follows with major investments in offshore wind and strict regulatory standards that push structural accuracy. Asia Pacific emerges as a high-growth region driven by deep-water projects, rising renewable interest, and expanding engineering services. The Middle East gains traction through offshore oil field upgrades. Latin America builds momentum as new exploration zones open and operators seek safer structural designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Offshore Structural Analysis Software Market is valued at USD 687.58 million in 2024 and is projected to reach USD 1,031.45 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- North America (35%), Europe (30%), and Asia Pacific (25%) hold the highest shares due to strong offshore activity, advanced engineering capability, and strict safety frameworks that drive heavy use of high-fidelity simulation tools.

- Asia Pacific, holding 25%, is the fastest-growing region, supported by expanding offshore wind projects, deep-water exploration, and rising digital investment across China, Japan, and South Korea.

- The Software segment holds the largest share (about 60%), driven by widespread adoption of dynamic modeling, fatigue tools, and compliance modules.

- By product type, Cloud Software leads with roughly 55% share, supported by scalable processing needs and global engineering collaboration requirements.

Market Drivers:

Rising Need For High-Fidelity Structural Simulation To Improve Offshore Asset Reliability

The Offshore Structural Analysis Software Market grows due to the need for precise models that improve reliability across platforms, risers, and subsea units. Engineering teams use advanced solvers to predict complex wave loads and vibration issues during design. Companies adopt integrated fatigue tools to prevent early damage in harsh waters. Offshore operators push for better lifecycle assessments to reduce shutdown risks. Software helps engineers test multiple load scenarios in shorter cycles. Energy groups use these tools to support safe operations across deep-water zones. It enables faster validation of structural concepts before approval. Demand strengthens as global offshore expansion widens.

- For instance, DNV’s SESAM software is widely used in offshore projects and has been applied across more than 1,000 global structural assessments, supporting advanced fatigue and hydrodynamic analysis for major operators.

Growing Offshore Wind Expansion Driving Higher Use Of Dynamic Analysis Platforms

Rising offshore wind installations drive strong use of software that simulates turbine foundations and floating units. Developers need accurate predictions of tower motion under rough sea states. Floating wind projects rely on advanced mooring simulations to secure stability. Engineering firms use robust hydrodynamic models to plan large-scale wind layouts. Software vendors upgrade capabilities to support new turbine sizes and deeper sites. It strengthens the ability of design teams to meet regional safety codes. Larger renewable programs lift adoption across feasibility and construction stages. Adoption rises as countries invest in offshore wind growth.

- For instance, floating wind developers widely use OrcaFlex for dynamic analysis of mooring systems, a program which is recognized in academic and industry reports as an industry-standard software and one of the most adopted dynamic tools in offshore wind engineering. The specific metric of “over 25,000 annual mooring analyses worldwide” could not be verified in public reports by organizations like OCIMF or DNV.

Stricter Global Safety Standards Fuel Demand For Advanced Compliance-Oriented Tools

International safety norms push offshore operators to adopt software that meets strict compliance checks. Regulators enforce detailed structural reviews before project approvals. Engineering groups use automated rule-checking systems to reduce manual errors. Software integrates global codes to support faster certification. It helps operators document structural strength across changing sea conditions. Regular audits push firms to upgrade outdated analysis systems. Energy companies use simulations to prove design integrity under extreme loads. These shifts lift software adoption across oil, gas, and renewables.

Rising Digitalization Across Offshore Engineering Supporting Wider Software Adoption

Digital workflows drive strong uptake of integrated analysis platforms across project stages. Engineering teams seek real-time visibility into structural performance using unified data models. Companies pair analysis tools with cloud platforms to improve collaboration. Simulation-driven planning supports faster decisions during design and maintenance. It helps reduce uncertainty during deep-water development. Offshore firms value automated reporting that streamlines approvals. Digital twins enhance predictive maintenance and reduce field risks. Wider digital adoption strengthens market demand worldwide.

Market Trends:

Integration Of AI-Driven Simulation Enhancements Expanding Predictive Accuracy Across Offshore Designs

AI-driven engines enter the Offshore Structural Analysis Software Market to refine predictions across complex marine conditions. Machine learning models assist in reducing simulation time. Engineering teams use AI to detect stress hotspots with higher precision. Predictive tools support better maintenance planning for offshore assets. AI-based optimization helps refine structure geometry at early stages. It supports faster iteration cycles within engineering teams. Vendors deploy automated diagnostic features across cloud platforms. Interest rises as AI enables deeper insights from historical load data.

Shift Toward Cloud-Based Engineering Platforms Boosting Collaborative Offshore Project Execution

Cloud-native tools gain traction due to the need for scalable offshore simulation environments. Engineering teams work across global offices and require real-time collaboration. Cloud platforms support faster processing of large hydrodynamic models. It helps firms avoid hardware constraints. Remote teams access consistent data without delays. Subscription-based cloud systems reduce upfront IT costs. Cloud workflows also support multi-user design reviews. Adoption grows as offshore projects expand in scale and complexity.

- For instance, ANSYS reported that its cloud engineering environment cut simulation runtime by up to 70% for offshore structural models during enterprise deployments, enabling simultaneous multi-user workflows.

Growing Use Of Multiphysics Simulation To Address Interactions Between Structural, Fluid, And Environmental Loads

Multiphysics engines expand due to rising offshore complexity. Structural, hydrodynamic, and environmental models merge into unified workflows. Engineering groups run complex interaction studies for risers, pipelines, and floating units. It enables more accurate predictions of fatigue and long-term deformation. Vendors integrate thermal, wave, and soil models into single platforms. Teams validate harsh-environment performance faster under varied load cases. Multiphysics tools support safer engineering decisions. Rising offshore investments accelerate trend growth.

Increasing Adoption Of Digital Twin Ecosystems For Real-Time Structural Monitoring And Maintenance

Digital twins evolve into key offshore engineering tools that support real-time tracking. Operators pair twins with offshore sensors for continuous structural updates. It helps detect early anomalies in high-risk zones. Real-time comparison improves accuracy across maintenance plans. Engineering teams visualize behavior under shifting sea states. Vendors integrate twins into cloud dashboards for smoother control. Predictive insights reduce downtime across large offshore assets. Rising interest in integrated monitoring lifts this trend.

Market Challenges Analysis:

High Cost Of Advanced Simulation Tools And Limited Skilled Talent Slowing Wider Use Across Offshore Projects

The Offshore Structural Analysis Software Market faces cost barriers that limit broader adoption across small operators. Advanced solvers require heavy investment, which restricts access for smaller firms. Maintenance costs also rise with expanding project needs. Companies struggle to recruit engineers with expertise in hydrodynamic and structural modelling. It raises project delays and increases reliance on third-party consultants. Operators face training gaps that slow software onboarding. Complex interfaces hinder fast usage for new teams. High deployment cost weakens market penetration across developing regions.

Data Quality Gaps, Model Uncertainty, And Integration Issues Affecting Simulation Accuracy

Offshore projects face inconsistent data inputs that hinder accurate modelling. Teams rely on varied environmental datasets that may lack precision. It reduces confidence during early design phases. Operators face challenges linking multiple software tools across workflows. Integration gaps cause delays in simulation reviews. Interoperability issues arise when combining structural, fatigue, and mooring models. Model uncertainty increases when real-world sensor data is unavailable. These issues create risk during high-stakes offshore decisions.

Market Opportunities:

Emerging Offshore Wind Markets And Deep-Water Exploration Creating Strong Software Growth Prospects

Expanding offshore wind regions open major opportunities for simulation vendors. Countries invest in deep-water turbines that need advanced structural modelling. The Offshore Structural Analysis Software Market gains momentum as developers seek better accuracy. Engineering teams require dynamic tools that support floating wind designs. It helps reduce failure risks during harsh sea loads. New exploration zones in Asia, Africa, and Latin America widen the addressable base. Growing feasibility studies lift early software adoption. These shifts open strong growth paths globally.

Expansion Of Digital Twins, Automation, And Cloud Platforms Strengthening Long-Term Adoption Potential

Digital twin growth creates new prospects for real-time monitoring tools. Operators use sensor-backed insights to improve structural health management. Automation reduces manual modeling steps across multidisciplinary teams. It improves design speed and strengthens lifecycle planning. Cloud platforms help firms cut hardware costs while scaling complex simulations. Wider digital transformation opens new revenue streams for vendors. These developments position software providers for long-term gains across global offshore sectors.

Market Segmentation Analysis:

By Product/Deployment

The Offshore Structural Analysis Software Market divides into cloud software and on-premise software. Cloud platforms gain strong traction due to scalable processing and easy collaboration across global engineering teams. Users adopt cloud models to reduce hardware dependence and improve access during multi-site projects. On-premise systems remain important in firms with strict data-control policies. Many oil and gas operators maintain in-house servers to secure project files. It supports faster execution in environments with limited connectivity. Demand grows across both formats due to rising offshore design complexity.

- For instance, Shell uses powerful on-premise engineering clusters to support its massive, data-intensive operations, such as seismic imaging and reservoir simulation, which require substantial computational power.

By Component

The market covers software and services that support full engineering workflows. Software tools lead due to wider use of fatigue models, hydrodynamic solvers, and advanced simulation modules. Vendors expand features that reduce manual analysis time. Services grow as firms seek configuration support, training, and custom integrations. Engineering groups rely on consulting teams to validate large offshore structures. Service providers help users deploy digital twins and workflow automation. This mix strengthens long-term adoption across global projects.

- For instance, Wood Group’s engineering services division supports more than 2,000 offshore structural assessments each year, providing analysis, verification, and digital integration services for global operators.

By End-user Industry

Key users include oil and gas, maritime, power generation, and government and defense agencies. Oil and gas leads due to heavy reliance on accurate offshore structure modelling. Maritime firms adopt tools to support vessel mooring and coastal infrastructure plans. Power generation grows with rising offshore wind activity. Government units use these systems to assess compliance and structural safety. Broader use across these sectors lifts market expansion.

By Structure Type

The market includes fixed platforms, floating production systems, and offshore wind foundations. Fixed platforms hold strong demand due to widespread use in shallow zones. Floating systems grow with deep-water exploration and floating wind projects. Wind foundations show rapid expansion as countries scale renewable capacity. These structure types drive diverse software needs across global offshore regions.

Segmentation:

By Product/Deployment

- Cloud Software

- On-premise Software

By Component

By End-user Industry

- Oil and Gas

- Maritime

- Power Generation

- Government and Defense

By Structure Type

- Fixed Platforms

- Floating Production Systems

- Offshore Wind Foundations

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Offshore Structural Analysis Software Market at roughly 35%, supported by a strong offshore oil and gas base and advanced engineering capabilities. The region benefits from high digital adoption and early use of simulation platforms across deep-water projects. Offshore wind growth along the U.S. East Coast lifts structural modelling needs for fixed and floating foundations. Engineering firms rely on advanced fatigue and hydrodynamic tools for life-extension programs. It also sees rising demand for digital twins that support real-time monitoring. Strong regulatory frameworks push operators to invest in verification tools that streamline certification. Wider deployment of cloud-based engineering workflows keeps market activity strong.

Europe

Europe accounts for about 30% of the global market due to extensive offshore wind development and strict structural safety norms. Countries such as the U.K., Norway, and Denmark use advanced simulation environments to support large-scale renewable expansion. Engineering firms deploy high-fidelity models to optimize turbine foundations and floating wind systems. Oil and gas operators in the North Sea use integrated analysis tools to reduce maintenance risk. It benefits from strong research partnerships that support innovation in multiphysics modelling. European regulators enforce detailed structural assessments, pushing firms toward more advanced platforms. This creates a stable demand base across both commercial and public-sector projects.

Asia Pacific

Asia Pacific captures nearly 25% of the market and remains the fastest-growing region due to rising offshore exploration and expanding renewable investments. Countries such as China, Japan, South Korea, and India push large turbine installations that rely on advanced structural tools. Engineering teams adopt dynamic modelling systems to manage deep-water and typhoon-prone environments. Oil and gas operators use high-capacity solvers to support complex subsea projects. It also benefits from government-backed infrastructure programs that upgrade offshore capabilities. Regional service providers expand training and integration support to meet industry needs. Growing digital transformation accelerates long-term software adoption across APAC.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Offshore Structural Analysis Software Market features strong competition driven by advanced simulation capabilities and regional project demand. Leading vendors expand dynamic modeling, fatigue analysis, and digital twin functions to support deep-water and offshore wind projects. Firms differentiate through cloud-based platforms that improve collaboration across engineering teams. It sees strong investment in AI-driven tools that cut modeling time and improve prediction accuracy. Established suppliers hold strong positions due to their compliance libraries and global engineering networks. New entrants target niche modeling gaps within mooring, hydrodynamics, and multiphysics integration. Partnerships with offshore EPC companies strengthen adoption. The market grows more consolidated as vendors enhance workflow automation.

Recent Developments:

- In November 2025, Dlubal Software GmbH released significant updates to its RFEM 6 and RSTAB 9 platforms, introducing a Digital Twins add-on (beta version) that enables structural engineers to store sensor and measurement data directly within their models. This enhancement allows for more efficient integration of real-time operational data with structural models, supporting the industry’s shift toward digital twin concepts for continuous monitoring and integrity assessment of offshore assets.

- In November 2025, DNV Group AS launched advanced time-saving tools for analyzing floating offshore wind structures through its Sesam software suite. The company released three advanced time-domain methods—Direct Load Generation, Load Reconstruction, and Response Reconstruction—designed to significantly reduce computational time while improving the accuracy and efficiency of strength assessments. These methods represent a fundamental advance in floating wind structure analysis, addressing the growing demand as floating wind capacity is projected to reach 331 GW by 2060.

- John Wood Group PLC faced significant organizational changes with the announcement of acquisition by Sidara Limited (an entity controlled by Dar Al Handasah Consultants). In August 2025, Wood endorsed this acquisition offer at 30 pence per share in cash, with shareholders voting in November 2025. As part of its strategic restructuring, Wood sold its 50% interest in RWG joint venture to Siemens Energy Global for $135 million in July 2025 and divested its North American Transmission & Distribution engineering business to Qualus for $110 million in August 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product/Deployment, Component, End-user Industry, and Structure Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Offshore wind growth will drive rising demand for dynamic simulation and floating foundation modeling.

- Cloud-based engineering tools will broaden access across global design teams.

- AI-enabled modeling will cut simulation time and improve predictive accuracy.

- Digital twin adoption will expand across lifecycle management and maintenance planning.

- Deep-water exploration will push companies to adopt high-fidelity fatigue tools.

- Safety regulations will lift the use of compliance-integrated simulation platforms.

- Service-based consulting will grow as firms seek custom offshore workflow support.

- Integration with sensor data will strengthen real-time structural assessments.

- Multiphysics platforms will gain traction in complex offshore projects.

- Vendor partnerships with EPC and wind developers will accelerate global adoption