Market overview

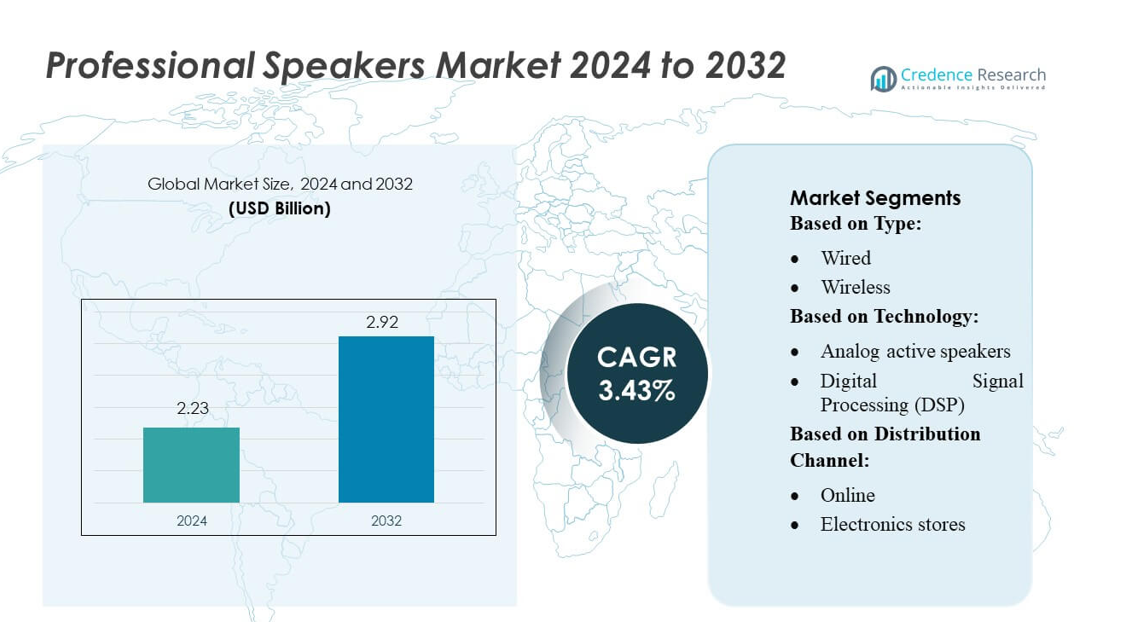

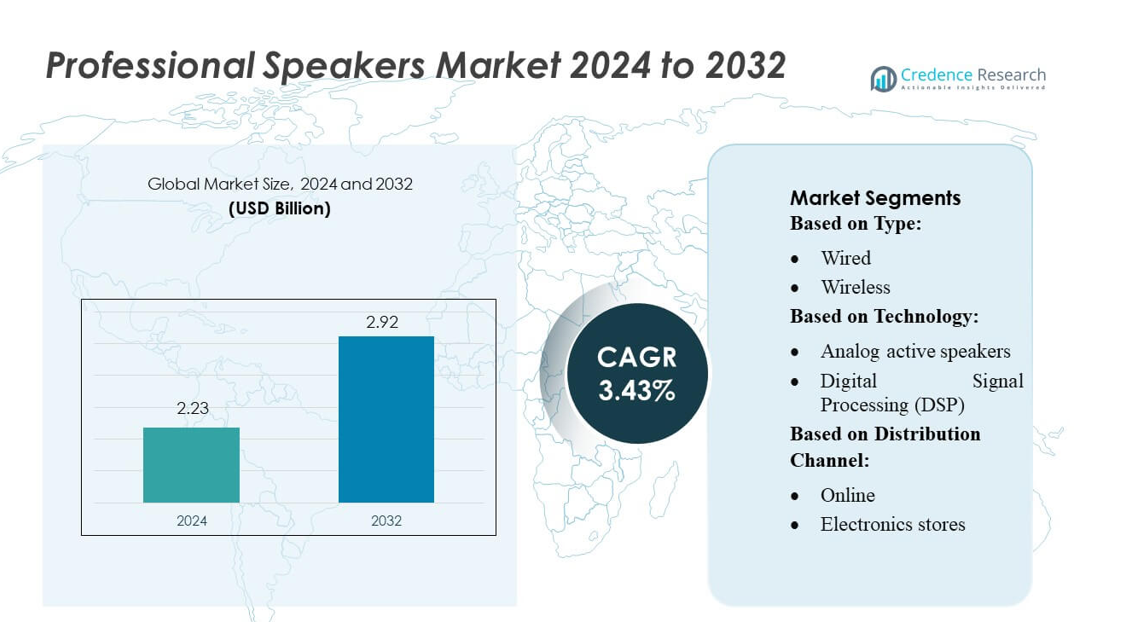

Professional Speakers Market size was valued USD 2.23 billion in 2024 and is anticipated to reach USD 2.92 billion by 2032, at a CAGR of 3.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Professional Speakers Market Size 2024 |

USD 2.23 billion |

| Professional Speakers Market, CAGR |

3.43% |

| Professional Speakers Market Size 2032 |

USD 2.92 billion |

The Professional Speakers Market is shaped by a diverse group of global audio manufacturers that compete through advanced acoustic engineering, DSP-enabled systems, and expanding wireless ecosystems tailored for live events, corporate installations, and commercial venues. Companies strengthen their portfolios with high-efficiency amplifiers, lightweight enclosures, AI-based tuning features, and IP-compatible platforms that support multi-zone audio distribution. Product differentiation centers on sound precision, durability, and seamless integration with professional AV networks. North America leads the global market with approximately 34% share, driven by strong adoption across entertainment venues, enterprise environments, and large-scale event production.

Market Insights

- The Professional Speakers Market was valued at USD 2.23 billion in 2024 and is expected to reach USD 2.92 billion by 2032, registering a CAGR of 3.43% over the forecast period.

- Growth is driven by rising demand for high-output speakers in live events, corporate AV systems, and commercial installations, supported by expanding adoption of DSP-enabled and wireless audio technologies.

- Market trends highlight increasing use of AI-based tuning, lightweight composite enclosures, and IP-compatible multi-zone audio systems, enhancing performance and ease of integration.

- Competitive activity intensifies as manufacturers focus on acoustic precision, durability, and advanced amplification, while restraints include high installation costs and technical complexity for networked audio setups.

- Regionally, North America leads with 34% share, followed by Europe and Asia-Pacific, while wireless speakers dominate the type segment with over 60% share, reflecting strong demand for flexible, scalable audio solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Wireless speakers dominate the Professional Speakers Market with an estimated 62% share, driven by strong adoption across live events, corporate installations, and portable sound applications. Their appeal stems from flexible placement, reduced cabling requirements, and improved transmission stability enabled by Bluetooth 5.x and advanced RF protocols. Manufacturers increasingly integrate long-range wireless modules, multi-speaker synchronization, and adaptive frequency hopping to enhance reliability in crowded venues. Demand accelerates further as event organizers prioritize faster setup times and scalable audio systems suitable for touring events, conferences, and hybrid digital-physical environments.

- For instance, Klipsch offers powerful powered speakers, such as The Nines powered monitors, which deliver significant power (100 W RMS per woofer) to achieve high output and robust sound.

By Technology

Digital Signal Processing (DSP) leads the technology segment with nearly 68% market share, supported by rising demand for precision-controlled audio output across professional entertainment, broadcast, and auditorium applications. DSP-enabled speakers benefit from built-in equalization, dynamic range optimization, FIR filtering, and real-time room correction that elevate sound clarity and system tuning efficiency. Growing deployment of networked audio infrastructures encourages integration of DSP-based loudspeakers with Dante, AVB, and AES67 platforms. The ability to remotely manage presets and automate performance adjustments drives widespread adoption, particularly in large venues requiring consistent, distortion-free audio.

- For instance, Sony Corporation’s SLS-1A spatial sound speaker module incorporates eight individually amplified drivers per unit (each with its own 10 W amplifier) and operates with a DSP engine capable of up to 96 kHz / 24-bit processing, enabling features like beam steering to control the direction of the sound with precision.

By Distribution Channel

Online channels hold the dominant position with approximately 45% share, fueled by rapid expansion of e-commerce platforms, brand-owned digital stores, and B2B procurement portals. Professional buyers increasingly prefer online purchasing due to transparent pricing, product comparison tools, and access to wider inventories, including high-power column arrays, line-array systems, and portable PA speakers. Enhanced virtual demos, customer reviews, and detailed technical documentation further support purchasing decisions. Growth continues as manufacturers strengthen direct-to-customer strategies and offer exclusive online bundles, faster delivery options, and remote configuration support for institutional and event-management clients.

Key Growth Drivers

Rising Demand for Live Events and Large-Scale Venues

Growth accelerates as concerts, festivals, corporate events, and sports ceremonies increasingly rely on high-output, acoustically optimized professional speakers. Demand for scalable line-array systems and advanced PA solutions rises as venues require consistent sound distribution, higher SPL capabilities, and improved speech intelligibility. Event management companies upgrade to efficient, portable, and weather-resistant speaker systems to support frequent outdoor performances. The expansion of global music tours and cultural festivals further strengthens adoption, positioning performance-critical audio systems as core infrastructure in live entertainment and public gatherings.

- For instance, Bose Corporation’s ShowMatch DeltaQ array modules use a multi-emitter design with four EMB2S compression drivers and two 8-inch neodymium LF drivers per unit.

Rapid Expansion of Digital and Hybrid Corporate Environments

Corporate digitization fuels demand for professional speakers across boardrooms, auditoriums, training centers, and hybrid meeting environments. Organizations adopt advanced audio systems to support video conferencing, multi-room presentations, and interactive collaboration platforms. Integrated speakers with DSP tuning, beamforming capabilities, and networked audio compatibility enhance clarity for large-scale communication. Growth in enterprise AV investments, driven by global remote-working trends and rising employee engagement initiatives, accelerates equipment modernization. Companies emphasize high-fidelity sound and reliable acoustic performance to improve productivity and deliver seamless communication experiences across distributed teams.

- For instance, Masimo’s Bowers & Wilkins CWM8.3 D custom installation loudspeaker (part of the CI800 Series Diamond range) integrates a 25 mm diamond-dome tweeter paired with a 130 mm (5-inch) Continuum midrange driver engineered for low-distortion dialogue reproduction.

Technological Advancements and Smart Audio Integration

Breakthroughs in DSP, Bluetooth 5.x connectivity, IP-based audio systems, and wireless synchronization drive performance improvements in modern professional speakers. Manufacturers introduce smarter, self-optimizing loudspeakers featuring real-time room calibration, FIR filtering, and cloud-enabled monitoring. Integration with AV-over-IP ecosystems such as Dante and AES67 supports remote control, multi-zone management, and plug-and-play scalability. Lightweight composite enclosures and energy-efficient amplifiers enhance portability and durability. These innovations reduce setup complexity and support precision tuning, making advanced sound reinforcement accessible to event organizers, rental companies, and fixed-installation projects.

Key Trends & Opportunities

Growing Adoption of Networked and IP-Based Audio Systems

The shift toward IP-driven audio infrastructures presents major opportunities as venues migrate from analog setups to centralized, software-defined audio management. Networked speakers enable multi-room synchronization, remote firmware updates, and streamlined routing through protocols like AVB, Dante, and AES67. Demand rises across hospitality, education, and enterprise sectors seeking unified control of distributed audio environments. As smart buildings expand globally, professional speakers integrated into IoT ecosystems offer automation benefits, predictive maintenance, and scalable installation options that reduce long-term operating costs while enhancing acoustic consistency.

- For instance, Bang & Olufsen’s BeoSound Core streaming engine supports high-resolution audio processing up to 192 kHz / 24-bit (via optical connection, rendered at 96kHz/24-bit).

Increasing Popularity of Portable and Battery-Powered Professional Speakers

Rising adoption of mobile entertainment, outdoor events, and pop-up venues elevates demand for portable professional speakers with high-output performance and long battery life. Manufacturers capitalize on this opportunity by introducing rugged, lightweight enclosures, efficient Class-D amplifiers, and swappable lithium-ion battery systems designed for all-day operation. Enhanced wireless range, faster pairing, and multi-speaker linking enable flexible deployment without complex cabling. Growth in recreational audio use, educational outreach events, and community gatherings continues to create new segments where portability, durability, and ease of setup are critical advantages.

- For instance, Harman’s Crown ComTech D Series amplifiers deliver 125 W per channel when all channels are driven equally, while also supporting power sharing of up to 250 W on the 2-channel version and 500 W across any four channels in the 4- or 8-channel versions.

Expanding Use of Smart Features and AI-Enhanced Audio Optimization

AI-enabled audio processing emerges as a key opportunity as manufacturers incorporate auto-tuning, ambient noise adaptation, and intelligent feedback suppression into professional speakers. These features support consistent sound performance across dynamic environments, reducing dependency on skilled sound engineers. Cloud-connected monitoring platforms allow predictive diagnostics and remote troubleshooting, improving operational uptime for rental fleets and fixed installations. Advancements in sensor-based acoustic mapping create new value for large venues seeking to automate system calibration and optimize sound coverage, enhancing user experience and reducing setup times.

Key Challenges

High Initial Investment and Maintenance Costs

Professional-grade speakers, especially line-array systems and DSP-equipped models, involve significant upfront expenditure and ongoing maintenance requirements. Smaller event companies, educational institutions, and community venues often face budget constraints that delay upgrades or system expansion. Costs rise further with the need for compatible amplifiers, mixers, network hardware, and skilled installation services. Frequent outdoor usage also increases wear and necessitates weatherproofing, component replacements, and tuning adjustments. These financial barriers limit adoption among price-sensitive segments and push buyers toward rental models instead of ownership.

Technical Complexity and Skilled Labor Shortage

Deploying advanced professional audio systems requires trained technicians capable of managing DSP configurations, acoustic modeling, network routing, and multi-zone system calibration. Many regions face shortages of certified audio engineers, leading to inconsistent sound performance and increased reliance on automated tools. Integrating IP-based audio ecosystems further adds complexity, requiring expertise in networking, firmware management, and digital signal workflows. For event organizers and small venues, the lack of skilled labor can result in operational delays, suboptimal sound quality, and increased risk of system errors during live events.

Regional Analysis

North America

North America leads the Professional Speakers Market with roughly 34% share, supported by high adoption across live entertainment, corporate AV systems, and large-scale sports venues. Strong investments in touring-grade line-array systems, hybrid-event infrastructure, and networked audio solutions drive continuous upgrades. The U.S. dominates regional demand due to extensive music festivals, broadcast studios, and commercial installations requiring advanced DSP-enabled speakers. Growth accelerates as enterprises modernize conference environments with IP-based audio and integrated communication platforms. Expansion in rental and staging services further contributes to steady demand for durable, portable, and high-output speaker systems.

Europe

Europe holds nearly 28% market share, driven by strong demand from cultural venues, stadiums, performing arts centers, and corporate meeting environments. Countries such as Germany, the U.K., France, and Italy invest in advanced sound reinforcement technologies to support theatrical productions, sports events, and large-scale exhibitions. The region benefits from established professional audio manufacturing hubs and stringent acoustic performance standards that encourage adoption of premium DSP-driven speakers. Growth is reinforced by expanding tourism-related events and increasing government investment in modernizing public infrastructure, including convention centers, educational institutions, and municipal auditoriums requiring high-quality audio.

Asia-Pacific

Asia-Pacific accounts for approximately 30% share, making it one of the fastest-growing regions due to rapid urbanization, expanding entertainment industries, and rising investments in commercial infrastructure. China, Japan, India, and South Korea drive large-scale deployments of professional speakers across malls, stadiums, banquet halls, broadcast studios, and educational campuses. Growth strengthens as regional event-management industries expand and demand rises for portable speakers supporting weddings, corporate gatherings, and community events. Increasing adoption of networked audio systems and the expansion of smart cities accelerate installation of multi-zone speaker systems across transportation hubs and public venues.

Latin America

Latin America holds close to 5% market share, influenced by growing entertainment activities, music festivals, and sports events across Brazil, Mexico, Argentina, and Chile. Rising investments in hospitality, tourism, and corporate facilities support demand for compact PA systems and cost-effective DSP-enabled speakers. Local event-production companies increasingly adopt portable and weather-resistant models for outdoor use. Economic constraints slow large-scale upgrades, but adoption grows steadily within auditoriums, worship venues, and educational institutions. Expansion of regional e-commerce platforms also improves product accessibility, enabling broader penetration of mid-range professional speaker brands.

Middle East & Africa

The Middle East & Africa region represents around 3% market share, with demand driven by rising construction of hotels, convention centers, mosques, and entertainment complexes. The UAE, Saudi Arabia, and South Africa lead adoption as large-scale events, exhibitions, and cultural festivals expand. Premium professional speakers gain traction in luxury hospitality venues and upscale retail environments requiring enhanced audio experiences. Growth remains gradual due to budget limitations in several African nations, but infrastructural development and increased investment in tourism, sports, and public gatherings support steady long-term demand for durable, high-output speaker systems.

Market Segmentations:

By Type:

By Technology:

- Analog active speakers

- Digital Signal Processing (DSP)

By Distribution Channel:

- Online

- Electronics stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Professional Speakers Market features a strong mix of global audio leaders such as Klipsch Audio Technologies, Sony Corporation, Bose Corporation, Masimo (Bowers & Wilkins), Bang & Olufsen, Harman International, KEF International, Yamaha Corporation, Pioneer Corporation, and Sennheiser electronic SE & Co. KG. The Professional Speakers Market is defined by rapid technological evolution, strong product differentiation, and a growing focus on high-performance audio solutions tailored for diverse applications. Manufacturers compete by enhancing acoustic precision, expanding DSP capabilities, and introducing wireless multi-speaker ecosystems that simplify setup and improve scalability for live events, corporate environments, and commercial installations. The shift toward IP-based audio infrastructure intensifies innovation around network compatibility, remote monitoring, and automated room calibration. Companies also emphasize lightweight materials, energy-efficient amplifiers, and rugged enclosures to meet portability and durability needs. Design aesthetics, smart features, and seamless ecosystem integration further shape competitive positioning as brands target both professional and premium consumer segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Klipsch Audio Technologies

- Sony Corporation

- Bose Corporation

- Masimo (Bowers & Wilkins)

- Bang & Olufsen

- Harman International

- KEF International

- Yamaha Corporation

- Pioneer Corporation

- Sennheiser electronic SE & Co. KG

Recent Developments

- In May 2024, Bose Corporation released a new product in the Bluetooth speaker category. The SoundLink Max has an excellent old aux input and is a technologically advanced Bluetooth speaker with a 20-hour long battery life and AptX Adaptive codec support for higher-bitrate streaming.

- In April 2024, Sony Corporation announced the launch of a new series of Bluetooth headphones and speakers, the ULT POWER SOUND series-designed for young customers. These speakers and headphones offer powerful bass and an enhanced audio experience.

- In February 2024, Skyhigh Security announced the addition of managed & professional IT services to its Altitude Partner Program. With these professional services offered, companies can complete their product development and resell SkyHigh Security solutions.

- In August 2023, Creative Technology announced a strategic partnership with xMEMS Labs, bringing in a new era of audio excellence for users worldwide by incorporating xMEMS’ cutting-edge Micro-electro-mechanical System (MEMS) solid-state speaker technology into Creative’s True Wireless Stereo (TWS) products

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as live events, concerts, and large venues continue expanding worldwide.

- Demand for DSP-enabled speakers will rise due to the need for precise audio control and automated sound optimization.

- Wireless and networked audio systems will see stronger adoption across professional and commercial installations.

- Portable, battery-powered professional speakers will gain popularity for outdoor and mobile event applications.

- Smart speakers with AI-driven tuning and remote diagnostics will become more common in large-scale deployments.

- Integration with AV-over-IP platforms will accelerate, enabling seamless multi-zone audio management.

- Premium design-focused speakers will grow in demand across luxury hospitality and commercial spaces.

- Rental and staging companies will increasingly upgrade to lightweight, durable, and weather-resistant models.

- Corporate digitization will drive expansion of advanced audio systems in boardrooms and hybrid meeting environments.

- Emerging markets will contribute more significantly as entertainment infrastructure and event ecosystems expand.